Masonry Saws Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431812 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Masonry Saws Market Size

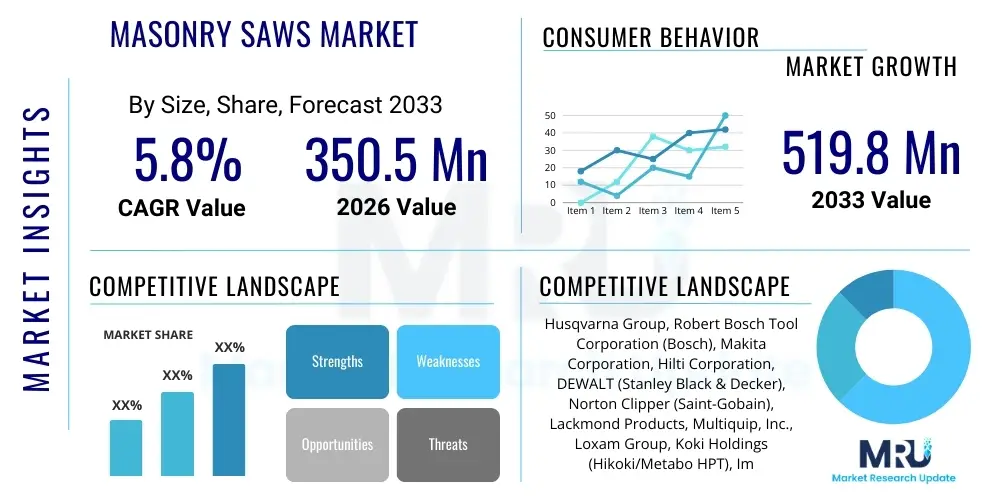

The Masonry Saws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 519.8 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by robust global infrastructure development initiatives, increased urbanization, and a sustained demand for durable, efficient, and high-precision cutting tools required in modern construction practices, particularly for materials like brick, block, stone, and tile. The market expansion is also contingent upon the continued adoption of advanced abrasive technologies, specifically high-performance diamond blades that enhance cutting speed and prolong tool life, contributing significantly to overall operational efficiency on construction sites across both developed and emerging economies.

Masonry Saws Market introduction

The Masonry Saws Market encompasses specialized heavy-duty cutting equipment designed for precise and rapid segmentation of various mineral-based construction materials, including concrete blocks, natural stone, pavers, bricks, and ceramic tiles. These robust machines are essential tools in the construction and renovation sectors, enabling contractors and masons to achieve complex cuts, angles, and shapes required for structural integrity and aesthetic finishing. The product range includes diverse models such as block saws, designed for large materials, and tile saws, optimized for finer, delicate ceramic and porcelain applications. The core functionality relies on powerful motors, durable frames, and, crucially, sophisticated blade systems, predominantly utilizing diamond-impregnated technology for superior hardness and cutting efficiency across different material densities. The continuous innovation in portability, dust control systems (wet cutting), and enhanced safety features defines the competitive landscape of this specialized tooling market.

Major applications of masonry saws span residential, commercial, and large-scale infrastructural projects. In residential construction, they are indispensable for foundation work, patio installation, and interior tiling. For commercial buildings and infrastructure, these saws facilitate the precise placement of structural components and ensure compliance with stringent building codes requiring highly accurate material preparation. The primary benefits driving market adoption include significantly improved cutting accuracy compared to manual methods, superior speed of operation, and reduced labor costs. Furthermore, modern masonry saws are engineered to handle the extremely hard, engineered materials increasingly utilized in contemporary architecture, materials that standard abrasive saws cannot process effectively.

Driving factors for the market include rapid global urbanization leading to extensive construction activity, governmental focus on modernizing aging infrastructure (e.g., roads, bridges, public works), and a growing emphasis on efficient project completion timelines. The need for tools that minimize dust exposure and comply with environmental health and safety regulations, particularly in North America and Europe, further accelerates the demand for advanced wet-cutting masonry saw models. Technological advancements focusing on battery-powered flexibility, reduced noise emission, and integrated digital monitoring systems are pivotal in maintaining market momentum and addressing the evolving needs of professional construction crews seeking high productivity tools.

Masonry Saws Market Executive Summary

The Masonry Saws Market is characterized by steady, infrastructure-driven growth, underpinned by technological shifts towards increased automation, enhanced dust suppression, and superior portability. Business trends indicate a strong move towards professional-grade equipment that offers maximum durability and precision, driven by large-scale commercial and civil engineering projects globally. Key manufacturers are focusing on integrating smart features, such as optimized electronic controls and real-time performance diagnostics, into their high-end models to differentiate their offerings and capture premium market segments. Furthermore, the rising cost of skilled labor necessitates the adoption of high-efficiency machinery that minimizes setup time and maximizes material yield, positioning advanced masonry saws as crucial capital expenditure for construction firms seeking competitive advantages.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market segment, fueled by massive government investment in urban development, housing, and transportation networks, particularly in China, India, and Southeast Asian nations. North America and Europe remain mature markets, driven primarily by replacement cycles, stringent safety standards, and sophisticated demand for specialized, environmentally compliant equipment, such as low-emission, battery-operated units suitable for dense urban environments and sensitive renovation work. The Middle East and Africa (MEA) exhibit promising growth linked to large-scale vision projects and diversification efforts away from oil economies, requiring significant construction material processing capability. Investment in local assembly and distribution networks within these emerging regions is a crucial strategic focus for global market leaders.

Segment trends highlight the dominance of electrically powered saws due to their lower maintenance requirements and suitability for enclosed job sites, although gasoline/diesel models retain their essential role in remote, heavy-duty infrastructure applications where power access is limited. In terms of product type, large block saws and advanced tile saws are experiencing robust demand. Block saws are integral to large civil construction, while sophisticated tile saws, often featuring laser guides and optimized water management, are increasingly required to handle the complex and highly brittle nature of large format porcelain and engineered stone tiles now favored in contemporary architecture. The rental segment is also gaining traction, particularly among smaller contractors who prefer operational flexibility over large upfront capital investment.

AI Impact Analysis on Masonry Saws Market

User queries regarding AI's impact on masonry saws primarily revolve around questions concerning automated cutting processes, predictive maintenance schedules, and the potential for integrating computer vision into job site planning. Users are keen to understand if AI can enhance the precision of complex geometric cuts, minimize material waste, and streamline inventory management by predicting material consumption rates. There is significant concern about how AI-driven tools might affect the skill requirements for masons and the initial cost burden of adopting such sophisticated, connected equipment. The summarized consensus indicates an expectation that AI will transition masonry saws from purely mechanical tools to highly optimized, semi-autonomous cutting systems, focusing on data-driven operational efficiency, safety enhancement, and robotic assistance in repetitive or hazardous tasks, rather than replacing the core cutting mechanism itself.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration, temperature, and usage patterns to forecast component failure (e.g., motor or blade wear), scheduling maintenance proactively, thereby minimizing costly downtime.

- Optimized Cutting Patterns: Integration of machine learning to analyze 3D models or blueprints, automatically generating the most efficient cutting sequence for blocks or tiles, drastically reducing material wastage and improving speed.

- Robotic/Semi-Autonomous Operation: AI-guided systems facilitate repetitive, high-volume cutting tasks (e.g., standard block dimensions) with minimal human intervention, improving consistency and reducing physical strain on operators.

- Improved Safety Monitoring: AI computer vision systems monitor the cutting zone in real time, detecting unsafe operator behavior or blade jamming immediately, triggering automatic shutdowns faster than human reaction time.

- Inventory and Material Tracking: Linking saw usage data to inventory management systems via AI, providing precise material consumption rates and automatically reordering standard blocks or specialty tiles before stock depletion.

DRO & Impact Forces Of Masonry Saws Market

The Masonry Saws Market dynamics are propelled by significant drivers, chief among them being the sustained global boom in infrastructure spending and urbanization, which necessitates large volumes of cut masonry materials. Restraints include the high initial capital expenditure for advanced, professional-grade machinery, coupled with increasing governmental regulation regarding dust and noise pollution on construction sites, pressuring manufacturers to invest heavily in specialized containment and wet-cutting technologies. Opportunities for growth are abundant, particularly through the penetration of emerging markets where construction practices are rapidly modernizing, and the integration of battery-powered systems offers operational flexibility in challenging environments. The interplay between these factors creates a competitive, yet expanding market landscape where technological differentiation is key to sustainable market share.

The impact forces influencing this market relate strongly to economic cycles and regulatory environments. Economic stability directly correlates with construction spending, thereby influencing demand for new equipment. Technological change acts as a positive force, as innovation in blade materials and cutting efficiency continually replaces older, less efficient models. Environmental regulations, particularly those surrounding crystalline silica exposure, necessitate continuous product redesign and investment in superior water and slurry management systems, impacting manufacturing costs but ultimately driving market towards safer, compliant equipment. Furthermore, the availability and cost of raw materials (like diamond abrasives) used in blade production exert indirect but significant pressure on the final product cost and market pricing strategies.

Another crucial impact force is the evolving preference of end-users for mobility and power flexibility. The shift toward battery-powered, cordless tools, while currently challenging to implement for the highest power requirements of large block saws, represents a major transformative force, promising quieter operation and eliminating trip hazards from cords. Manufacturers failing to adapt their portfolio to include increasingly powerful and reliable cordless alternatives risk losing ground to agile competitors. Lastly, the rental market's increasing penetration acts as an impactful force, democratizing access to high-end, specialized saws for smaller firms, requiring manufacturers to develop durable, low-maintenance equipment optimized for rental fleet usage and rapid return on investment for rental operators.

Segmentation Analysis

The Masonry Saws Market is meticulously segmented based on product type, power source, and end-use application, providing a granular view of demand distribution and target market characteristics. The segmentation by product type (Table Top, Walk Behind, Block, Tile) reflects the scale and precision requirements of different job tasks, dictating the necessary motor power and cutting depth. Power source segmentation is vital, contrasting the high-power, remote capabilities of gasoline/diesel units with the lower-emission, quiet operation of electric saws favored in urban indoor settings. Application segmentation differentiates demand derived from large-scale infrastructure projects versus highly specialized residential renovation work, allowing market participants to tailor their product development and marketing strategies effectively to specific end-user needs and purchasing priorities.

- By Type:

- Table Top Saws (Portable, smaller capacity, high precision for pavers and small blocks)

- Walk Behind Saws (Larger, robust, used for flat work like sidewalks and trenches)

- Tile Saws (Specialized for ceramic, porcelain, and natural stone tiles, often including sliding tables and laser guides)

- Block Saws (Heavy-duty, high power, designed for large concrete and stone blocks)

- By Application:

- Commercial Construction (Office buildings, retail spaces, industrial facilities)

- Residential Construction (New homes, multi-family units, detached housing)

- Infrastructure Projects (Roads, bridges, tunnels, public utilities)

- Renovation & Repair (Remodeling, restoration, upgrade of existing structures)

- By Power Source:

- Electric (Standard, three-phase, battery-powered)

- Gasoline/Diesel (High power, maximum portability for remote sites)

- Hydraulic (Specialized, robust systems, often integrated into larger machinery)

Value Chain Analysis For Masonry Saws Market

The value chain for the Masonry Saws Market begins with upstream activities focusing on raw material procurement, primarily sourcing high-grade steel for frames and components, specialized polymers for housing, and crucial inputs like synthetic diamonds, cobalt, and tungsten carbide for manufacturing high-performance blades. Research and development activities, particularly those focused on enhancing motor efficiency, integrating better dust and water management systems, and improving operator ergonomics, are critical upstream contributors that establish product quality and technological differentiation. Key manufacturers often maintain tight control over the blade production process, as the blade’s performance is the single most critical factor determining the saw’s effectiveness and overall market appeal, necessitating specialized metallurgical and abrasive technology expertise. Efficient supply chain management ensuring stable access to diamond composite materials, which are subject to global commodity price fluctuations, is essential for maintaining cost predictability in the manufacturing phase.

The downstream analysis focuses heavily on distribution and post-sales support. Masonry saws, due to their capital expenditure nature and specialized function, utilize a dual distribution model. Direct distribution is common for large, institutional buyers, government contracts, and major rental fleet operators, allowing manufacturers to maintain close relationships and offer tailored servicing packages. Indirect channels, utilizing independent dealers, specialized industrial equipment distributors, and major hardware retailers, are essential for reaching small to medium-sized contractors and individual masons. The importance of robust post-sales support, including parts availability, specialized maintenance services, and operator training, cannot be overstated, as the longevity and performance of these tools directly impact construction project timelines and profitability for the end-user.

The primary distribution channel remains specialized industrial and construction equipment dealers who can provide technical expertise, demonstrate product capabilities, and offer financing options. The rental market acts as a potent indirect channel, particularly for very large or specialized saws that contractors only need for specific project phases. E-commerce, while growing for ancillary products and accessories (like blades and maintenance kits), plays a less dominant role in the initial sale of heavy machinery due to the need for physical inspection and logistical complexity. Effective channel management requires balancing margins for dealers with competitive pricing, ensuring that the necessary technical support infrastructure is in place to maintain the perceived value and reliability of the high-investment equipment over its long operational life.

Masonry Saws Market Potential Customers

The primary customers for the Masonry Saws Market are professional entities engaged in the construction, infrastructure development, and specialized renovation sectors. These buyers, typically characterized by high volume material processing needs and strict regulatory adherence, include large general contractors responsible for executing major commercial and civil projects, specialized masonry and hardscape subcontractors, and tile installation professionals. Their purchasing decisions are critically influenced by factors such as the machine's durability, cutting precision, compliance with site safety standards (especially dust control), and overall total cost of ownership (TCO) calculated through efficiency gains and maintenance frequency. Furthermore, government agencies responsible for public works often constitute large, high-volume purchasers, particularly for robust walk-behind models used in road and utility construction projects requiring long-term reliability and standardized fleet management.

Another significant customer segment comprises industrial equipment rental companies, which purchase large volumes of versatile, ruggedized masonry saws specifically designed for fleet usage. These companies prioritize ease of maintenance, robust construction to withstand diverse operator use, and high utilization rates. The rental sector serves a broad base of smaller, independent contractors and DIY enthusiasts undertaking temporary or smaller-scale projects who find renting more economically viable than outright purchase. This segment demands equipment that is intuitively operable and built to endure heavy, intermittent use with minimal technical complexity, driving manufacturers to design specialized "rental-ready" models focusing on maximized uptime and simplified serviceability protocols to ensure rapid turnaround between rentals.

Beyond traditional construction, potential customers include specialized stone fabricators, landscape designers, and monument restoration firms that require precise cutting of natural stone and historical materials. These customers often demand specialized saws, such as high-precision tile saws or robust block saws capable of handling irregularly shaped or particularly dense geological materials. The demand in this niche segment is driven by the need for aesthetic quality and highly precise tolerances, leading to the preference for premium machines equipped with advanced features like laser guidance, sophisticated water cooling, and highly adjustable cutting heads, justifying a higher investment cost based on the specialized outcome required for high-end bespoke projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 519.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Husqvarna Group, Robert Bosch Tool Corporation (Bosch), Makita Corporation, Hilti Corporation, DEWALT (Stanley Black & Decker), Norton Clipper (Saint-Gobain), Lackmond Products, Multiquip, Inc., Loxam Group, Koki Holdings (Hikoki/Metabo HPT), Imer Group, Wacker Neuson, ICS (Blount International), Felker (Lincoln Electric), Tyrolit Group, Masterpac, Pearl Abrasive Co., GÖLZ GmbH, EDCO - Equipment Development Company, Inc., C.P. Italia S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Masonry Saws Market Key Technology Landscape

The technological evolution in the Masonry Saws Market is centered on enhancing performance, safety, and environmental compliance. Diamond abrasive technology remains the foundational element, with constant research focused on optimizing the matrix bond of diamond segments to achieve superior life and faster cutting speeds across varied materials, including ultra-hard porcelain and reinforced concrete. Advanced materials engineering is also crucial in manufacturing lighter, more durable frames (often utilizing aluminum alloys) that enhance portability without compromising structural rigidity and vibration dampening, thereby improving operator comfort and cutting accuracy. Furthermore, the integration of high-efficiency brushless DC motors in electric and battery-powered models maximizes power output while minimizing heat generation and maintenance needs, representing a significant technological step forward in achieving reliable, high-power cordless cutting solutions for professional use.

A critical area of technological focus is the management of construction dust, particularly crystalline silica, which is subject to rigorous regulatory control worldwide. Modern masonry saws extensively utilize wet-cutting systems, employing sophisticated pumps and water catchment trays to suppress airborne dust. Innovation here includes advanced slurry management systems that facilitate easier disposal and recycling of water, reducing both environmental impact and setup/cleanup time. Additionally, for dry-cutting applications where wet methods are impractical, manufacturers are developing integrated vacuum attachment ports and specialized shrouds that achieve higher dust capture rates, ensuring compliance with OSHA and European health and safety directives, which is a powerful driver for equipment replacement cycles.

Digital integration and automation are increasingly influencing the technology landscape. Many premium models now incorporate features such as laser guidance systems for precise cutting line visualization, digital displays for real-time monitoring of motor load and blade depth, and electronic soft-start mechanisms to prolong motor and transmission life. Future technology hinges on the implementation of sensor technology for monitoring blade RPM and vibration, allowing for real-time adjustments that optimize cutting performance and warn operators of potential mechanical issues. This shift towards 'smart' saws, which collect and report operational data, aligns the masonry saw market with broader trends in digital construction, facilitating better fleet management and operational reporting for large construction firms and rental companies globally, enhancing overall job site efficiency through data-driven performance management.

Regional Highlights

The global Masonry Saws Market exhibits varied growth profiles across different geographical regions, primarily correlated with the pace of infrastructure development, regulatory standards, and local construction traditions. North America and Europe, while mature, represent critical markets characterized by high demand for specialized, safety-compliant, and high-efficiency equipment, largely driven by large-scale renovation, stringent OSHA regulations, and the adoption of premium, often battery-powered, tools. Asia Pacific (APAC) stands out as the primary growth engine due to unprecedented levels of urbanization, vast governmental investments in public infrastructure (high-speed rail, ports, residential complexes), and rapid industrialization, leading to massive consumption of masonry materials and subsequent demand for robust cutting tools. Latin America and the Middle East & Africa (MEA) present emerging opportunities, where increasing construction sophistication and growing adoption of formal construction methods are transitioning demand away from rudimentary tools toward professional-grade masonry saws.

- Asia Pacific (APAC): Dominates market growth due to expansive infrastructure projects in China, India, and Southeast Asia. High volume, lower-cost manufacturing presence also influences competitive pricing across the globe.

- North America: Mature market focused on replacement cycles, high safety standards (silica dust control), and demand for premium, high-precision tools and the rapid uptake of powerful cordless and electric models for compliance and convenience.

- Europe: Driven by strict environmental and noise regulations, leading to strong demand for specialized wet-cutting systems and efficient, quiet electric saws, especially in densely populated urban renovation projects across Germany, France, and the UK.

- Latin America (LATAM): Exhibits solid, steady growth linked to housing initiatives and improving economic conditions fostering capital expenditure in construction tools. Price sensitivity remains a key factor in procurement decisions.

- Middle East & Africa (MEA): Growth is tied to major governmental diversification and construction projects (e.g., Saudi Vision 2030), generating significant demand for heavy-duty block saws capable of processing large volumes of local stone and concrete in challenging, often arid, environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Masonry Saws Market.- Husqvarna Group

- Robert Bosch Tool Corporation (Bosch)

- Makita Corporation

- Hilti Corporation

- DEWALT (Stanley Black & Decker)

- Norton Clipper (Saint-Gobain)

- Lackmond Products

- Multiquip, Inc.

- Loxam Group

- Koki Holdings (Hikoki/Metabo HPT)

- Imer Group

- Wacker Neuson

- ICS (Blount International)

- Felker (Lincoln Electric)

- Tyrolit Group

- Masterpac

- Pearl Abrasive Co.

- GÖLZ GmbH

- EDCO - Equipment Development Company, Inc.

- C.P. Italia S.p.A.

Frequently Asked Questions

Analyze common user questions about the Masonry Saws market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Masonry Saws Market between 2026 and 2033?

The Masonry Saws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven by global infrastructure spending and urbanization trends.

Which power source segment dominates the Masonry Saws Market?

Electric masonry saws currently hold a dominant share, preferred for their lower emissions, reduced noise, and suitability for indoor and urban construction sites, though gasoline/diesel models remain essential for remote and high-power infrastructure applications.

How are new regulations affecting the technology of masonry saws?

New health and safety regulations, particularly those targeting crystalline silica dust exposure, mandate advanced dust control. This accelerates the adoption of wet-cutting systems, sophisticated shrouds, and integrated vacuum technologies in modern saw designs.

Which geographical region is expected to show the highest market growth?

The Asia Pacific (APAC) region is projected to exhibit the highest market growth, fueled by substantial government investments in urban development, housing, and critical transportation infrastructure across key countries like China and India.

What technological innovations are defining the future of masonry saws?

Future innovations are defined by the integration of AI for predictive maintenance and automated cutting patterns, alongside the development of more powerful and reliable battery-operated saws, aiming to maximize portability, safety, and operational efficiency on job sites.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager