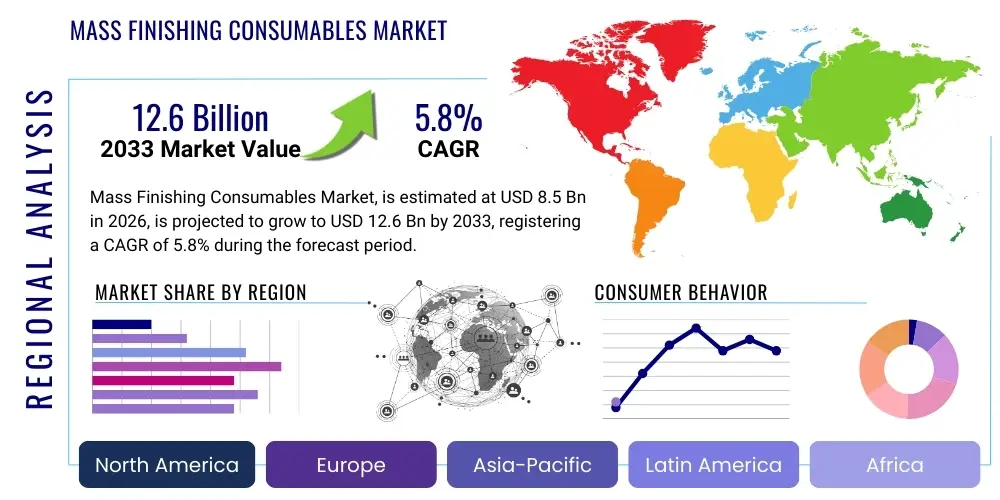

Mass Finishing Consumables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438626 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mass Finishing Consumables Market Size

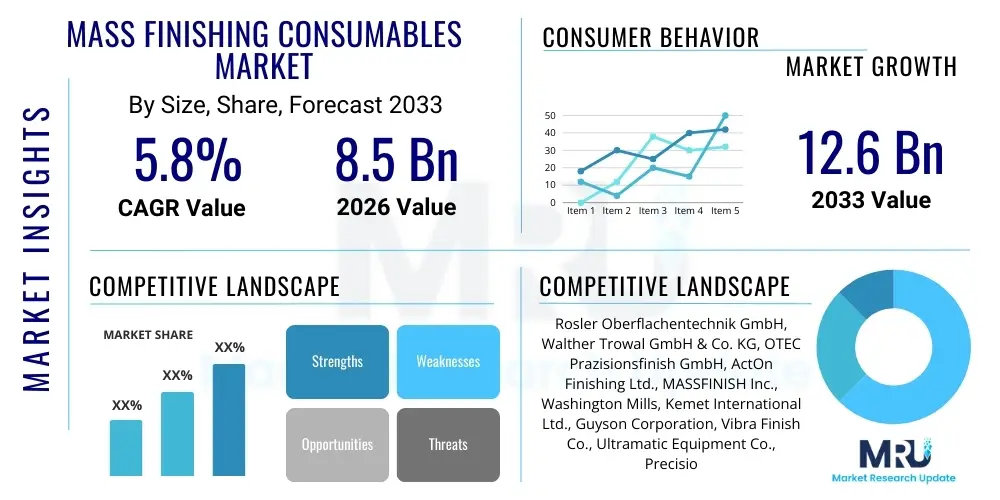

The Mass Finishing Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Mass Finishing Consumables Market introduction

The Mass Finishing Consumables Market encompasses a critical range of industrial supplies essential for surface preparation and refinement across numerous manufacturing sectors. Mass finishing, often referred to as vibratory or barrel finishing, is a sophisticated process utilized to deburr, clean, polish, radius, and burnish components efficiently and uniformly in bulk quantities. The core products driving this market include abrasive media (such as ceramic, plastic, steel, and organic variants), specialized chemical compounds (detergents, anti-corrosion agents, brighteners), and auxiliary components necessary to facilitate precision surface engineering. These consumables are not merely operational necessities but are integral to achieving the stringent quality and aesthetic requirements demanded by modern industries, offering significant advantages in processing time and cost reduction compared to manual finishing techniques.

The applications of mass finishing consumables are expansive, spanning high-precision industries like aerospace and medical devices, volume manufacturing sectors such as automotive and general machinery, and consumer goods production including jewelry and electronics. In automotive manufacturing, for example, these consumables are vital for smoothing transmission components and engine parts, directly impacting performance and longevity. The fundamental benefits driving market adoption include enhanced surface integrity, improved fatigue resistance of finished parts, and the ability to process geometrically complex parts effectively. Furthermore, the automation compatibility inherent in mass finishing systems allows manufacturers to scale production while maintaining consistent quality standards, a critical factor in competitive global markets.

Key driving factors propelling the expansion of this market include the relentless global focus on manufacturing quality and precision, particularly in emerging economies where industrial production is rapidly escalating. Regulatory demands in sectors like medical and aerospace necessitate extremely high standards of surface finish, thereby increasing the reliance on high-performance ceramic and plastic media. Moreover, the increasing adoption of lightweight materials, such as specialized aluminum alloys and advanced composites, in transportation sectors requires tailored finishing solutions, thereby stimulating innovation and demand for specialized chemical compounds and non-abrasive media types tailored to sensitive materials. This synergy of high-volume demand and stringent quality requirements firmly establishes the consumables market as an indispensable segment of the industrial supply chain.

Mass Finishing Consumables Market Executive Summary

The global Mass Finishing Consumables Market is experiencing robust expansion, fundamentally driven by sustained growth in the automotive, aerospace, and general industrial sectors, coupled with technological advancements in media formulation. Business trends indicate a significant shift towards environmentally benign and sustainable consumables, particularly water-based compounds and biodegradable media, driven by stringent global environmental regulations and corporate sustainability initiatives. Manufacturers are increasingly focusing on developing application-specific, precision media—such as high-density ceramic media for aggressive material removal and optimized plastic media for delicate polishing—to cater to complex part geometries emerging from additive manufacturing (3D printing). Furthermore, market consolidation among key media producers and compound suppliers is enhancing the global reach and optimizing supply chain efficiencies, allowing for better service delivery to multinational corporations.

Regionally, the Asia Pacific (APAC) market stands out as the primary growth engine, fueled by the massive expansion of manufacturing hubs, particularly in China, India, and Southeast Asian nations. The rapidly industrializing environment in APAC, coupled with increasing foreign direct investment in electronics and automotive assembly, dictates a growing need for efficient surface finishing solutions. North America and Europe, while mature, demonstrate stable growth, primarily anchored by stringent quality standards in high-value sectors like medical devices and aerospace maintenance, repair, and overhaul (MRO). These regions are leading the adoption of advanced automation in finishing processes, which in turn necessitates high-consistency and high-performance consumables to maximize machine uptime and quality output.

Segment trends highlight the dominance of abrasive media, especially ceramic media, which remains crucial for heavy-duty deburring and cutting applications. However, the chemical compounds segment is exhibiting the fastest growth rate, propelled by the demand for specialized, non-foaming, and waste-minimizing solutions that improve both the finishing process and post-treatment waste management. In terms of end-use, the automotive segment retains the largest market share due to the sheer volume of parts requiring finishing, while the medical device sector is demonstrating accelerated consumption growth, driven by the need for exceptionally smooth and sterile surfaces on implants and surgical tools. This segmentation shift emphasizes the market's trajectory towards higher precision and specialized consumable formulations over generalized products.

AI Impact Analysis on Mass Finishing Consumables Market

Analysis of user inquiries concerning Artificial Intelligence (AI) and the Mass Finishing Consumables Market reveals several critical themes centered on process optimization, predictive maintenance, and quality control integration. Users frequently question how AI can lead to "smart" finishing processes that minimize media waste, how machine learning can predict the optimal compound-to-media ratio for specific alloys, and what the long-term impact will be on the demand for traditional consumables versus specialized, AI-informed formulations. Key expectations include the use of AI-driven vision systems for real-time quality inspection post-finishing, and algorithms that can adjust processing parameters (vibration amplitude, time, water flow) dynamically based on the observed wear rate of the consumables. The overarching concern is balancing the capital investment in smart finishing machinery against the anticipated savings realized through optimized consumable usage and reduced rework, driving interest in data-driven process standardization.

- AI-Enhanced Process Optimization: Utilization of machine learning algorithms to analyze historical process data, optimizing media load, compound concentration, and processing duration, leading to reduced consumable consumption and waste generation.

- Predictive Consumable Replenishment: Implementation of sensors and AI models to monitor media wear and compound depletion in real-time, accurately predicting replacement cycles and minimizing unplanned downtime.

- Surface Quality Control (AEO Focus): AI-powered vision systems performing 100% automated inspection of finished parts, identifying micron-level defects and ensuring strict compliance with industry standards, thereby validating the performance of premium consumables.

- Custom Formulation Development: AI assisting R&D teams in simulating and predicting the performance characteristics of new abrasive media and chemical compounds against novel materials (e.g., aerospace superalloys, advanced polymers), accelerating product development cycles.

- Energy Efficiency Management: Machine learning adjusting machine parameters (like amplitude and frequency) to achieve the desired finish using the least possible energy and processing time, extending the effective life of mass finishing consumables.

- Digital Twin Simulation: Creating virtual representations of the mass finishing process to test various consumable combinations and part geometries before physical production, minimizing trial-and-error costs associated with expensive custom media.

DRO & Impact Forces Of Mass Finishing Consumables Market

The dynamics of the Mass Finishing Consumables Market are governed by a complex interaction of Drivers, Restraints, and Opportunities, which collectively determine the growth trajectory and competitive landscape. The primary drivers include the stringent quality standards mandated by high-precision industries such as aerospace and medical technology, necessitating repeatable and high-quality surface finishes achievable only through high-performance consumables. Simultaneously, the global push towards automation in manufacturing, especially in high-volume sectors like automotive and consumer electronics, increases the dependence on consistent and high-efficiency finishing processes. Opportunities are largely centered around the development of specialized, sustainable, and biodegradable consumables that align with global environmental regulations, alongside the integration of smart manufacturing principles (Industry 4.0) that allow for optimized consumption and inventory management, thereby creating significant added value for end-users.

However, the market faces several notable restraints that temper its potential growth rate. One significant constraint is the high upfront capital investment required for modern mass finishing equipment, which can deter small and medium-sized enterprises (SMEs) from adopting these processes, especially in developing regions. Furthermore, the volatility in the prices of raw materials, such as specialized resins, ceramic precursors, and chemical additives, poses a continuous challenge to profitability and consistent pricing for consumable manufacturers. Additionally, the increasing complexity of materials used in modern manufacturing—including lightweight composites and highly sensitive alloys—requires constant research and development, necessitating specialized knowledge and often leading to slower adoption rates as end-users test and validate new finishing protocols.

The impact forces influencing the market are multifaceted, stemming from technological evolution, regulatory environment, and competitive intensity. Porter's Five Forces analysis indicates moderate to high bargaining power of buyers, especially large automotive and general manufacturing OEMs, who purchase large volumes and often demand customized solutions and price concessions. The threat of substitutes is low, as few alternatives offer the cost-effectiveness and scalability of mass finishing for high-volume parts. Technological shifts towards dry finishing and super finishing techniques represent marginal competitive threats but also drive innovation within the consumables space, pushing manufacturers to develop ultra-precise polishing media and specialized dry tumbling compounds to maintain market relevance and capture high-value applications. The net effect of these forces is a market characterized by continuous innovation aimed at reducing environmental impact and maximizing processing efficiency.

Segmentation Analysis

The Mass Finishing Consumables Market is extensively segmented based on the type of consumable material, the functional purpose, and the specific end-user industry, reflecting the diverse requirements of modern manufacturing environments. Segmentation by product type—Abrasive Media and Chemical Compounds—is fundamental, where media is responsible for mechanical action (cutting, deburring) and compounds ensure cleanliness, corrosion protection, and enhancement of the surface finish. Within abrasive media, further divisions include ceramic, plastic, steel, and organic options, each tailored for different material hardness and required finish quality. This layered segmentation allows manufacturers and suppliers to address niche applications, such as high-gloss polishing of jewelry with organic media or aggressive stock removal of hardened steel components using high-density ceramic formulations, ensuring product portfolios are optimized for performance across the industrial spectrum.

- By Product Type:

- Abrasive Media

- Ceramic Media (High density, Medium density)

- Plastic Media (Polyester, Urea)

- Steel Media (Stainless steel, Carbon steel)

- Organic/Natural Media (Wood, Walnut shell, Corn cob)

- Chemical Compounds

- Detergents and Cleaners

- Burnishing and Polishing Compounds

- Rust Inhibitors and Anti-Corrosion Agents

- Descaling Compounds

- By Function:

- Deburring

- Cleaning and Degreasing

- Polishing and Burnishing

- Radius Forming

- By End-User Industry:

- Automotive and Transportation (Engine parts, Transmission components)

- Aerospace and Defense (Turbine blades, Structural components)

- Medical Devices and Implants (Surgical tools, Orthopedic implants)

- Jewelry and Precious Metals

- Machinery and Equipment Manufacturing

- Consumer Goods and Electronics

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Mass Finishing Consumables Market

The value chain for the Mass Finishing Consumables Market commences with the intensive upstream sourcing of raw materials, which is crucial for defining the ultimate performance and cost structure of the final product. For abrasive media, this involves procuring high-purity minerals such as aluminum oxide, silicon carbide, specialized polymer resins, and various steel alloys. For chemical compounds, key inputs include surfactants, sequestering agents, corrosion inhibitors, and alkaline builders. Maintaining rigorous quality control at this initial stage is paramount, as the particle size distribution, purity, and consistency of these raw ingredients directly impact the finishing efficiency and lifespan of the consumables. Strong, reliable partnerships with certified raw material suppliers mitigate supply chain risks and ensure the stability required for consistent product manufacturing.

Midstream activities involve sophisticated manufacturing processes, including sintering for ceramic media, injection molding for plastic media, and specialized blending or batch processing for chemical compounds. These processes require significant technological expertise and specialized machinery to achieve the desired shape, density, and chemical formulation. Post-manufacturing, the distribution channel acts as the vital link to the diverse end-user base. Distribution is typically hybrid, utilizing direct sales channels for large, strategically important original equipment manufacturers (OEMs) who require specialized technical consultation and bespoke consumable mixes. Simultaneously, indirect distribution channels, comprising specialized industrial distributors, regional agents, and e-commerce platforms, serve the broader market of smaller job shops and general manufacturing enterprises, optimizing reach and inventory management.

The downstream segment is heavily focused on application support, customer relationship management, and ancillary services, which significantly enhance the perceived value of the consumables. This includes providing technical consultation, conducting process optimization trials at customer sites, and offering training on media selection and compound usage. Furthermore, the market increasingly involves end-of-life management services, particularly the development of media recycling programs and the safe disposal or treatment of spent chemical compounds, addressing growing environmental responsibilities. Effective engagement at this downstream level ensures that the consumables perform optimally within the customer's specific finishing machinery, maximizing the overall return on investment and fostering long-term customer loyalty in a competitive environment.

Mass Finishing Consumables Market Potential Customers

Potential customers for Mass Finishing Consumables span virtually all industries that require precision surface modification, with a strong concentration in sectors characterized by high-volume production and stringent quality mandates. The automotive industry represents the largest buyer segment, consuming vast quantities of media and compounds for components like gears, shafts, fasteners, and engine components where stress relief and wear reduction are critical performance metrics. Similarly, the aerospace and defense sectors, though lower in volume, demand extremely high-value, specialized consumables—often custom-formulated—for finishing critical flight components such as turbine blades, hydraulic parts, and structural elements where surface integrity directly correlates with safety and operational lifespan.

Beyond the core transportation segments, manufacturers of medical devices constitute a rapidly growing customer base. This sector requires ultra-smooth, polished, and often passivated surfaces for implants, surgical instruments, and orthopedic components to ensure biocompatibility and reduce friction. These applications typically demand high-purity, non-contaminating ceramic and plastic media, alongside specific chemical compounds designed for cleanliness and subsequent sterilization processes. General machinery and heavy equipment manufacturers, involved in producing industrial tools, bearings, and complex machine parts, form a robust segment relying on mass finishing for deburring and radiusing before assembly.

A further essential customer group includes jewelry manufacturers and producers of high-end consumer electronics (e.g., casings, connectors, internal components). These industries prioritize aesthetic finish, high gloss, and removal of fine imperfections. They frequently utilize non-abrasive steel media or organic media with specialized polishing compounds to achieve mirror finishes without dimensional loss. The diversity of these end-users underscores the necessity for consumable suppliers to maintain a broad portfolio, offering solutions ranging from aggressive ceramic cutting media to delicate burnishing agents, catering to the varied material substrates and finishing requirements across the global manufacturing ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rosler Oberflachentechnik GmbH, Walther Trowal GmbH & Co. KG, OTEC Prazisionsfinish GmbH, ActOn Finishing Ltd., MASSFINISH Inc., Washington Mills, Kemet International Ltd., Guyson Corporation, Vibra Finish Co., Ultramatic Equipment Co., Precision Finishing Inc., Allied High Tech Products Inc., Polymagnet S.A., CEE-BEE Industrial, Ems-Tronic GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mass Finishing Consumables Market Key Technology Landscape

The technological landscape of the Mass Finishing Consumables Market is characterized by continuous material science innovation aimed at improving efficiency, reducing processing time, and catering to advanced material requirements. A key trend involves the development of high-performance ceramic and plastic media with enhanced wear resistance and optimized geometric shapes. Advanced manufacturing techniques, such as precision sintering and specialized polymer compounding, allow manufacturers to create media that maintain their form and cutting capability longer, minimizing media replacement rates. Furthermore, the increasing adoption of specialized vibratory and centrifugal high-speed finishing machines demands consumables capable of withstanding higher G-forces and accelerated processing environments, leading to the creation of ultra-dense and low-porosity media that maximize surface contact efficiency.

Another crucial technological advancement lies in the formulation of chemical compounds. Modern compounds are increasingly shifting from solvent-based to water-based, biodegradable, and non-foaming solutions. The focus is on multi-functional compounds that can simultaneously clean, inhibit rust, and enhance burnishing action, reducing the number of processing steps required. A significant development is the integration of specialized compounds designed for use with sophisticated closed-loop recycling systems, facilitating the separation of media from sludge and metal fines, which significantly reduces the environmental footprint and operational costs associated with wastewater treatment. This emphasis on process sustainability is a major driver of R&D investment in chemical formulations.

The future technology landscape is heavily influenced by the principles of Industry 4.0. This includes the integration of advanced sensor technology within finishing machines to monitor crucial parameters such as compound concentration, media level, and liquid pH in real-time. This real-time data flow enables precision dosing and proactive adjustments, ensuring consistent finishing quality and maximizing the operational life of the consumables. Moreover, the increasing adoption of Additive Manufacturing (AM) or 3D printing across industries necessitates the development of specialized finishing techniques and corresponding consumables tailored to remove support structures and refine the often rough surface textures inherent in 3D-printed parts, driving demand for precision micro-abrasive media and specialized polishing pastes.

Regional Highlights

The Asia Pacific (APAC) region dominates the Mass Finishing Consumables Market, exhibiting the highest growth rate globally due to its position as the world's leading manufacturing hub. Countries such as China, India, Japan, and South Korea are experiencing explosive growth in automotive, electronics, and general machinery production, which directly fuels the demand for high-volume and cost-effective deburring and finishing solutions. Massive government investment in infrastructure and industrial capacity expansion further accelerates the adoption of mass finishing techniques. Consequently, APAC manufacturers are not only significant consumers of standard ceramic and plastic media but are also increasingly adopting advanced, domestically manufactured consumables to achieve export quality standards, particularly in the fields of high-precision components for smartphones and electric vehicle (EV) parts.

North America and Europe represent mature, high-value markets where growth is characterized less by volume and more by the demand for highly specialized and regulated consumables. In North America, the aerospace, medical device, and precision component sectors are primary drivers. These industries prioritize compliance, traceability, and certified performance, leading to strong demand for premium, consistent consumables and high-purity chemical compounds. European markets, particularly Germany and Italy, are leaders in manufacturing sophisticated machinery and high-end automotive components. Strict environmental regulations in the European Union (EU) are strongly pushing the consumption trend toward eco-friendly, REACH-compliant chemical compounds and easily recyclable or biodegradable abrasive media, incentivizing manufacturers to invest heavily in sustainable product lines.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are projected to show steady growth influenced by regional industrialization and diversification efforts. In MEA, investments in the aerospace MRO sector and expansion of regional automotive assembly plants, particularly in Turkey and South Africa, are creating nascent yet reliable markets for finishing consumables. Latin American growth, led by countries like Brazil and Mexico, is closely tied to their established automotive manufacturing industries and increasing internal demand for consumer goods. These regions often rely on imported advanced consumables, but local manufacturing hubs are beginning to emerge, creating opportunities for localized production and distribution efficiencies in the medium to long term, supported by increasing adoption of efficient surface finishing to meet global export standards.

- Asia Pacific (APAC): Dominant market share and fastest CAGR, driven by mass production in automotive and electronics sectors in China and India.

- North America: High-value market focused on aerospace, defense, and medical devices, prioritizing specialized, high-performance, and compliant consumables.

- Europe: Stable growth fueled by high-precision machinery and automotive manufacturing; strong regulatory push towards sustainable and environmentally friendly consumables (e.g., biodegradable compounds).

- Latin America (LAMEA): Emerging potential, driven by automotive industry expansion in Mexico and Brazil; increasing demand for general machinery consumables.

- Middle East and Africa (MEA): Growth tied to localized MRO services, infrastructure projects, and developing industrial bases, seeking cost-effective and reliable finishing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mass Finishing Consumables Market.- Rosler Oberflachentechnik GmbH

- Walther Trowal GmbH & Co. KG

- OTEC Prazisionsfinish GmbH

- ActOn Finishing Ltd.

- MASSFINISH Inc.

- Washington Mills

- Kemet International Ltd.

- Guyson Corporation

- Vibra Finish Co.

- Ultramatic Equipment Co.

- Precision Finishing Inc.

- Allied High Tech Products Inc.

- Polymagnet S.A.

- CEE-BEE Industrial

- Ems-Tronic GmbH

- Harper Corporation of America

- R&R Industries Inc.

- Moorhouse Engineering Co. Ltd.

- Dreher GmbH

Frequently Asked Questions

Analyze common user questions about the Mass Finishing Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between ceramic and plastic media?

Ceramic media, made from abrasive minerals like aluminum oxide, is dense and used for aggressive deburring, cutting, and rapid material removal, suitable for hard metals. Plastic media, typically urea or polyester resin-based, is lighter and softer, used for gentler finishing, polishing, and pre-plating processes, ideal for softer metals and delicate components.

How is the Mass Finishing Consumables Market addressing sustainability and environmental concerns?

The market is focusing on sustainable solutions through the development of biodegradable chemical compounds (replacing harmful solvents), optimizing media geometry for extended lifespan, and implementing closed-loop systems to recycle water and abrasive sludge, thereby minimizing industrial waste output.

Which end-user segment drives the highest demand for mass finishing consumables?

The Automotive and Transportation sector is the dominant end-user segment, driving the highest volume of demand for consumables due to the extensive need for surface finishing on transmission components, engine parts, and fasteners to ensure durability and operational performance.

What role does Industry 4.0 play in the future of consumable utilization?

Industry 4.0 integration, specifically using AI and sensor technology, optimizes consumable utilization by enabling real-time process monitoring, predictive maintenance for media replacement, and automated precision dosing of chemical compounds, leading to significant material savings and quality consistency.

What is the key technological factor affecting consumable selection for additive manufacturing (3D printed) parts?

The primary factor is the requirement for specialized, often micro-abrasive, consumables and highly tailored processes to effectively remove complex support structures and significantly improve the typically rough surface finish characteristic of 3D-printed metal and plastic components without compromising dimensional accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager