Mass Timber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434579 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Mass Timber Market Size

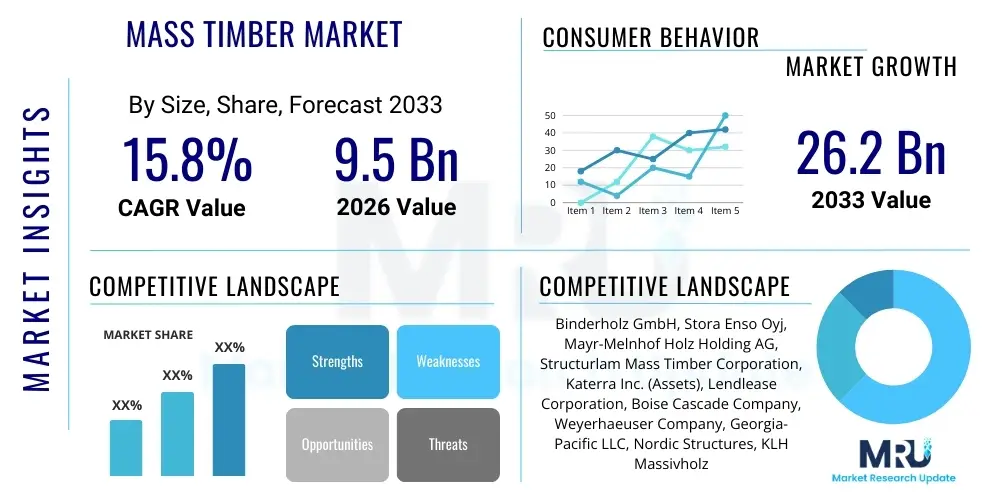

The Mass Timber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 26.2 Billion by the end of the forecast period in 2033.

Mass Timber Market introduction

The Mass Timber Market encompasses engineered wood products designed for structural applications in large-scale residential, commercial, and institutional buildings. These products, which include Cross-Laminated Timber (CLT), Glued-Laminated Timber (Glulam), Laminated Veneer Lumber (LVL), and Nail-Laminated Timber (NLT), offer superior strength, fire resistance, and seismic performance compared to traditional light-frame wood construction. The fundamental shift driving this market is the global demand for sustainable building materials that reduce embodied carbon and streamline construction processes. Mass timber construction is inherently efficient, leveraging prefabrication techniques to minimize on-site labor and project timelines, making it highly attractive to developers focused on cost control and accelerated schedules.

The primary applications of mass timber are rapidly diversifying, moving beyond mid-rise structures into high-rise buildings, demonstrating its structural viability and aesthetic appeal. Key sectors utilizing mass timber include educational facilities, healthcare infrastructure, corporate headquarters, and high-density housing projects. The environmental benefits, such as carbon sequestration within the wood fibers and the utilization of sustainably managed forests, provide a competitive edge over high-emissions materials like concrete and steel. Furthermore, the acoustic and biophilic qualities of exposed wood contribute positively to occupant well-being and building certification standards, reinforcing its value proposition in the modern construction landscape.

Driving factors for sustained market growth include stringent governmental regulations promoting green building certifications, increasing public awareness regarding climate change and sustainable forestry, and continuous technological advancements in manufacturing and connection systems. These innovations are expanding the permissible limits for wood structures and enhancing structural integrity. Investment in new manufacturing facilities, particularly in North America and Europe, is boosting supply chain resilience, addressing previous concerns regarding material availability and cost parity with conventional construction methods. This convergence of regulatory support, technological maturity, and market demand positions mass timber as a transformative element in the future of the construction industry.

Mass Timber Market Executive Summary

The Mass Timber Market is characterized by robust business trends centered on technological integration and supply chain optimization, reflecting a transition from niche application to mainstream construction material. Business strategies are heavily focused on securing sustainable wood sourcing certifications and investing in sophisticated CNC machining capabilities to support precise prefabrication, which is crucial for maximizing construction efficiency and minimizing waste. Vertical integration among suppliers, constructors, and engineering firms is a prominent trend, aiming to streamline the design-to-delivery process. Furthermore, partnerships with academic and research institutions are accelerating the development of novel hybrid structural systems combining mass timber with steel or concrete to achieve greater spans and heights, thereby expanding the market’s total addressable volume.

Regionally, North America, particularly the U.S. and Canada, remains the dominant force, driven by progressive changes in building codes (e.g., updates to the International Building Code allowing taller timber structures) and significant investment in sustainable urban development. Europe, a pioneer in mass timber, maintains steady growth, focusing on innovation in passive house standards and circular economy principles, with countries like Austria and Germany leading manufacturing capacity. The Asia Pacific region, though currently smaller, shows the fastest potential growth, fueled by rapid urbanization, increasing governmental focus on disaster-resilient construction (especially in seismic zones like Japan and New Zealand), and the push toward sustainable material adoption in megacities like Shanghai and Sydney. Supply chain capacity expansion in APAC is critical for realizing this potential.

Segment-wise, Cross-Laminated Timber (CLT) holds the largest market share due to its versatility, two-way spanning capabilities, and established track record in mid-to-high-rise construction. However, Glulam is experiencing steady demand, particularly for long-span beams and columns in commercial and recreational facilities where aesthetic appeal is paramount. Residential construction is the highest application segment by volume, but the commercial and institutional segment is demonstrating higher average project value and complexity, driving innovation in material performance and connection details. The material segment is also witnessing increasing standardization efforts across different product types, which helps in reducing procurement risks and fostering wider industry adoption among general contractors and developers.

AI Impact Analysis on Mass Timber Market

Common user inquiries regarding AI’s influence on the Mass Timber Market center around efficiency, sustainability measurement, and design optimization. Users frequently ask how Artificial Intelligence can automate complex timber connections, predict material stress points, and minimize wood waste during manufacturing. There is high interest in AI’s ability to optimize forest management practices to ensure sustainable sourcing, and how machine learning algorithms can rapidly iterate through thousands of potential structural designs to find the most cost-effective and carbon-efficient mass timber solutions. Concerns often revolve around the initial investment cost for integrating AI tools and the necessary upskilling of the existing workforce to utilize advanced computational design platforms, suggesting a need for accessible, user-friendly software interfaces tailored for timber construction.

- AI algorithms optimize material yield during the cutting and fabrication processes, significantly reducing wood waste in CLT and Glulam production facilities.

- Machine learning enhances structural engineering by rapidly analyzing complex load paths and connection details in mass timber hybrid systems, ensuring safety and efficiency.

- Predictive maintenance schedules for manufacturing equipment are improved using AI, minimizing downtime and increasing overall production capacity for mass timber components.

- AI-driven tools facilitate generative design, allowing architects and engineers to explore thousands of low-carbon, high-performance mass timber building configurations instantly.

- Computer Vision systems are used for quality control in laminating processes, detecting subtle defects in wood layers before pressing, ensuring superior product strength and reliability.

- Advanced analytics integrate BIM models with supply chain data, optimizing logistics and just-in-time delivery of prefabricated timber elements to construction sites.

DRO & Impact Forces Of Mass Timber Market

The Mass Timber Market is propelled by powerful drivers such as the escalating focus on decarbonization in the built environment, compelling constructors to seek alternatives to carbon-intensive materials like steel and concrete. Technological advancements in fireproofing, connection systems, and noise mitigation are effectively addressing historical performance concerns. However, significant restraints impede faster growth, primarily the lack of standardized regulatory frameworks across diverse geographies, which slows down approval processes, and the relatively higher upfront cost perception compared to traditional methods, often neglecting the long-term operational and speed-of-construction savings. Opportunities abound in the development of sophisticated hybrid systems and the expansion into developing nations where rapid, sustainable urbanization is required. The key impact forces driving change are stringent carbon taxation policies, consumer preference shifts towards biophilic design, and the increasing availability of reliable, certified supply chains originating from sustainably managed forests, fundamentally reshaping the industry's material choices and construction methodologies.

Segmentation Analysis

The Mass Timber Market is meticulously segmented based on product type, application, end-user, and regional geography, allowing for precise market targeting and strategic resource allocation. Product segmentation highlights the performance characteristics and structural capabilities of different engineered wood formats, with CLT dominating due to its panelized form factor suitable for walls, floors, and roofs. Application segmentation identifies the structural roles played by mass timber products, differentiating between beams, columns, structural walls, and floor systems, reflecting variations in material specification and manufacturing complexity. The primary end-user categories—residential, commercial, and institutional—demonstrate distinct procurement patterns and regulatory compliance needs, with residential construction providing volume and commercial projects driving complexity and innovation. Understanding these segments is crucial for manufacturers to align their production capacity and product development pipelines with prevailing market demands and emerging high-growth niches.

- By Product Type:

- Cross-Laminated Timber (CLT)

- Glued-Laminated Timber (Glulam)

- Laminated Veneer Lumber (LVL)

- Nail-Laminated Timber (NLT)

- Dowel-Laminated Timber (DLT)

- By Application:

- Structural Panels (Walls, Floors, Roofs)

- Beams and Columns (Primary Structural Support)

- Hybrid Systems (Timber-Concrete, Timber-Steel)

- By End-User:

- Residential (Multi-family and Single-family Housing)

- Commercial (Office Buildings, Retail Centers)

- Institutional (Educational, Healthcare, Government Buildings)

- Industrial (Warehouses, Manufacturing Facilities)

- By Manufacturing Process:

- Adhesive-Based Systems (CLT, Glulam, LVL)

- Mechanical Fastening Systems (NLT, DLT)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Nordic Countries)

- Asia Pacific (Japan, Australia, South Korea)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Mass Timber Market

The Mass Timber value chain begins upstream with sustainable forestry management and timber harvesting, requiring adherence to stringent certification standards (e.g., FSC or PEFC) to ensure the legality and ecological viability of the wood source. Sawmills then process the raw logs into dimensional lumber, which serves as the primary input for mass timber manufacturing facilities. The manufacturing stage is highly capital-intensive, involving advanced drying, grading, gluing, and pressing techniques using sophisticated CNC machinery. This stage adds the highest value by transforming standard lumber into high-performance, precision-engineered structural components. Efficiency in the upstream logistics and material sourcing directly impacts the competitiveness and sustainability profile of the final mass timber product, making backward integration a strategic advantage for major players.

Moving downstream, the distribution channel for mass timber is often more specialized than for conventional construction materials. Direct distribution models are common, where manufacturers contract directly with large construction management firms, architects, and engineering partners to manage the fabrication and delivery of prefabricated elements. Indirect channels involve specialized distributors or agents who manage smaller-scale projects or handle supplementary mass timber components. Given the custom nature and 'kit-of-parts' delivery method, effective project logistics—including sequencing, transport coordination, and on-site assembly guidance—are critical components of the downstream service offering, differentiating high-quality suppliers.

The integration between the manufacturing site and the construction site is paramount. Mass timber adoption favors a design-for-manufacture-and-assembly (DfMA) approach, requiring close collaboration early in the design phase. This collaboration ensures that the final product meets structural and assembly requirements precisely, minimizing delays and costly rework on-site. The complexity and precision of mass timber necessitate strong partnerships throughout the value chain, extending from certified forestry operations to the final assembly crew, thereby emphasizing specialized knowledge transfer and robust quality control systems at every handoff point.

Mass Timber Market Potential Customers

Potential customers for mass timber products are primarily large-scale developers and construction companies specializing in institutional and commercial real estate projects who are seeking accelerated timelines and reduced construction waste. These end-users are highly motivated by the long-term cost savings associated with faster erection and lighter foundations, alongside the powerful sustainability branding benefits mass timber offers. Government agencies and municipal bodies commissioning public buildings, such as schools, libraries, and administrative centers, represent significant buyers, often mandated to meet specific carbon reduction targets or procure locally sourced materials, making certified mass timber a preferred solution.

The market also heavily targets developers of high-density multi-family residential complexes, particularly those in urban centers where noise mitigation, fire safety, and aesthetic quality are key selling points to prospective tenants or owners. Architectural firms and structural engineers are influential potential customers, acting as specifiers who drive demand by incorporating mass timber into project designs based on performance data and aesthetic goals. Furthermore, niche markets such as high-end custom home builders, specialized industrial facilities requiring large clear spans, and companies seeking LEED or Passive House certifications constitute a growing base of knowledgeable, value-driven buyers who prioritize environmental performance and building performance metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 26.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Binderholz GmbH, Stora Enso Oyj, Mayr-Melnhof Holz Holding AG, Structurlam Mass Timber Corporation, Katerra Inc. (Assets), Lendlease Corporation, Boise Cascade Company, Weyerhaeuser Company, Georgia-Pacific LLC, Nordic Structures, KLH Massivholz GmbH, Schilliger Holz AG, Rubner Holzbau GmbH, EWPA, Metsä Wood, SmartLam LLC, Timberlink, Hoffmann und Maculan Bau GmbH, Merk Timber GmbH, Freres Lumber Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mass Timber Market Key Technology Landscape

The technology landscape in the Mass Timber market is defined by precision manufacturing and advanced structural engineering tools. Key technologies include high-speed Computer Numerical Control (CNC) machining centers, which are essential for cutting, shaping, and detailing large timber panels and beams with millimeter-level accuracy required for prefabrication. These machines integrate directly with Building Information Modeling (BIM) software, creating a seamless digital workflow from design to manufacturing. Furthermore, vacuum press technology and high-frequency gluing techniques are critical in the production of CLT and Glulam, ensuring structural integrity, bond strength, and dimensional stability across the engineered timber elements.

Beyond manufacturing, material science innovations play a crucial role, particularly in developing fire-resistant coatings and specialized timber treatments that enhance durability and compliance with stringent fire safety regulations. Connection technology is another major area of innovation; proprietary high-performance steel and composite connectors are being developed to facilitate rapid, secure assembly on-site while maintaining structural redundancy and seismic resilience. These advanced connection systems are vital for enabling mass timber to be used in increasingly taller and more complex structures, directly addressing engineers' performance requirements for multi-story buildings.

Digital technologies, specifically sophisticated structural analysis software and generative design tools, are accelerating adoption. These tools allow engineers to conduct complex finite element analysis, predicting material behavior under various loading conditions, including fire and seismic events, thereby building confidence in mass timber performance. The integration of 3D scanning and augmented reality (AR) on construction sites is also emerging, aiding in quality control and installation precision, ensuring that the prefabricated components align perfectly, further solidifying the efficiency advantages inherent to mass timber construction methodologies.

Regional Highlights

The regional dynamics of the Mass Timber Market reflect varying degrees of regulatory acceptance, forestry resources, and construction maturity, leading to distinct growth trajectories and competitive landscapes across major global regions.

- North America (U.S. and Canada): This region is characterized by explosive growth, largely fueled by updates to the International Building Code (IBC) that now permit mass timber construction up to 18 stories, significantly opening up the commercial high-rise market. Canada, with its vast sustainable forest resources and government incentives supporting domestic wood utilization, is a global leader in both supply and innovation, particularly in British Columbia. The U.S. market is growing rapidly, with significant investment in new CLT and Glulam production facilities across the Pacific Northwest and the Southeast, addressing high demand from progressive metropolitan areas seeking low-carbon building solutions. The robust architectural and engineering expertise focused on timber structures further cements North America's position as a high-growth market.

- Europe: Europe represents the most mature mass timber market globally, particularly in countries like Austria, Germany, and the Nordic region, which possess long-standing traditions of engineered wood use and highly sophisticated manufacturing capabilities. Growth here is sustained by rigorous climate policies, ambitious circular economy objectives, and established regulatory pathways for wood construction. Innovation is concentrated on achieving maximum energy efficiency (Passive House standards) and developing complex prefabricated modular construction systems. While growth is stable, the focus is less on adopting new product types and more on optimizing existing supply chains and standardizing processes across the European Union.

- Asia Pacific (APAC): The APAC region, driven by fast-paced urbanization and increasing awareness of sustainability, is emerging as the fastest-growing market. Japan and Australia are the key innovators. Japan leverages mass timber for its excellent seismic resilience properties, implementing national programs to promote domestic wood usage in urban settings. Australia, particularly in major cities, is seeing significant commercial development utilizing mass timber for its aesthetic and environmental benefits. However, challenges related to establishing reliable, certified supply chains and harmonizing disparate local building codes are prevalent, though rapid adoption in commercial segments suggests high potential for exponential growth over the forecast period.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently contribute a smaller share to the global market but hold substantial untapped potential. In LATAM, countries like Chile and Brazil, rich in renewable timber resources, are starting to investigate mass timber for affordable housing and industrial construction. Growth in MEA is highly localized, often associated with large-scale, sustainable master-planned city developments (e.g., in the UAE or Saudi Arabia) that prioritize innovative, low-carbon building materials as part of their national visions. Development here depends heavily on imported expertise and material technology, but the need for rapid, efficient construction methods presents a clear long-term opportunity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mass Timber Market.- Binderholz GmbH

- Stora Enso Oyj

- Mayr-Melnhof Holz Holding AG

- Structurlam Mass Timber Corporation

- Katerra Inc. (Assets)

- Lendlease Corporation

- Boise Cascade Company

- Weyerhaeuser Company

- Georgia-Pacific LLC

- Nordic Structures

- KLH Massivholz GmbH

- Schilliger Holz AG

- Rubner Holzbau GmbH

- EWPA

- Metsä Wood

- SmartLam LLC

- Timberlink

- Hoffmann und Maculan Bau GmbH

- Merk Timber GmbH

- Freres Lumber Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Mass Timber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What makes Mass Timber a sustainable building material?

Mass timber products, such as CLT and Glulam, sequester carbon dioxide from the atmosphere within the structure for the life of the building. When sourced from sustainably managed forests, they offer a renewable alternative to materials like concrete and steel, which have high embodied carbon footprints. This process supports circular economy principles and reduces overall construction emissions.

How does mass timber perform concerning fire safety?

Mass timber exhibits predictable fire performance due to its heavy cross-section, which forms a protective char layer when exposed to fire. This char layer insulates the remaining structural wood, allowing the structure to retain its load-bearing capacity for extended periods, meeting or exceeding required fire safety codes, a concept known as "mass timber charring."

What are the primary cost advantages of using mass timber in construction?

While the material cost of mass timber can sometimes be higher than conventional materials, the overall project cost is often reduced through significant savings in construction time, reduced on-site labor requirements due to prefabrication, and lighter foundational requirements. These efficiencies accelerate the project timeline, reducing overhead and financing costs.

Which mass timber product dominates the market, and why?

Cross-Laminated Timber (CLT) currently dominates the market share. Its popularity stems from its versatility as a two-way structural panel suitable for walls, floors, and roofs, offering high strength-to-weight ratio and dimensional stability. CLT is the foundational element for most high-rise timber structures being built globally today.

Are mass timber structures permitted in high-rise buildings?

Yes, building codes globally, notably the U.S. International Building Code (IBC) and various European standards, are being updated to allow mass timber structures up to 18 stories (Type IV-A construction) with specific fire-resistance and protection measures. This regulatory acceptance is significantly expanding the use of mass timber in dense urban environments.

Mass timber manufacturing relies heavily on sophisticated machinery, including advanced CNC routing, robotic arm handling, and automated gluing stations. The quality control process is rigorous, often incorporating non-destructive testing and high-resolution scanning to detect structural weaknesses or defects in the raw lumber before it is laminated and pressed. The precision afforded by these integrated manufacturing technologies is what allows mass timber to be delivered as a ready-to-assemble kit-of-parts, revolutionizing construction logistics and drastically reducing the potential for on-site errors and material waste, which differentiates it significantly from traditional construction material sourcing.

Furthermore, technology is playing a critical role in addressing potential market barriers, particularly related to moisture protection and dimensional stability. Innovations in breathable membrane systems and facade detailing are being developed specifically for mass timber enclosures to manage humidity and protect the wood during the construction phase. Simultaneously, research into bio-based adhesives and non-toxic wood preservatives is improving the environmental profile of the products themselves. The convergence of computational design (BIM), advanced robotics (manufacturing), and specialized material science (fire and moisture protection) positions the Mass Timber market at the forefront of construction technological evolution, promising sustained disruption across traditional building sectors.

The rapid evolution of seismic design technology specifically tailored for mass timber is opening up significant market opportunities in earthquake-prone regions, such as the West Coast of North America and parts of Asia. Researchers are developing innovative connections, including post-tensioned systems and specialized dampeners, that allow mass timber structures to self-center after a seismic event, minimizing structural damage and ensuring quicker recovery times compared to concrete or steel buildings. This enhanced resilience capability is a potent selling point for institutional and commercial developers who require high performance and low-risk assets in seismically active zones. These technological breakthroughs are crucial for securing engineering confidence in demanding structural applications.

In addition to structural innovation, the technology surrounding the digital twin concept is gaining traction within the mass timber ecosystem. Digital twins allow owners and facility managers to monitor the health, moisture content, and structural performance of the mass timber elements in real time throughout the building's lifecycle. This continuous monitoring capability enhances preventative maintenance, optimizes building performance, and provides crucial data for future design improvements. The ability to integrate sensor technology directly into the wood panels during manufacturing marks a significant leap towards smart, data-driven buildings, further increasing the value proposition of mass timber as a long-term, high-tech investment in the real estate sector. This integration fosters confidence among insurers and financial institutions regarding the longevity and resilience of timber assets.

The global push towards industrializing construction through modular and prefabricated elements aligns perfectly with the manufacturing capabilities inherent in the mass timber industry. Advanced factories are increasingly deploying fully automated assembly lines for creating standardized modules that incorporate insulation, windows, and utility routing directly into the CLT or Glulam framework. This shift towards industrialized production reduces dependence on variable on-site conditions, ensures higher quality control, and dramatically compresses the construction cycle. This trend is driven by proprietary software platforms that manage material flow and scheduling, optimizing the sequence of fabrication and installation across multiple concurrent projects, thereby scaling the output of mass timber products effectively across high-demand urban markets worldwide.

Furthermore, advancements in timber harvesting and supply chain management technology are ensuring the integrity of the upstream processes. Satellite imaging, drone surveillance, and sophisticated geographic information systems (GIS) are used to monitor forest health, track sustainable yield rates, and certify wood origin, mitigating concerns over illegal logging and non-certified sources. This technological oversight provides end-users with high traceability regarding their materials’ environmental credentials, which is essential for achieving premium green building certifications. The implementation of blockchain technology is even being explored to provide immutable records of custody and environmental impact for every batch of lumber, adding a layer of transparency and trust crucial for large institutional buyers.

The continuous refinement of adhesive technology is pivotal, moving towards low-VOC (Volatile Organic Compound) and formaldehyde-free polyurethanes and structural epoxies that maintain high bond strength while enhancing the overall health profile of the building. Research in lignin-based adhesives derived from wood waste itself offers the promise of fully bio-based mass timber products, further closing the loop in the material's lifecycle and solidifying its standing as the most ecologically sound structural material available. These ongoing material science improvements ensure mass timber continues to comply with the strictest health and air quality standards, driving adoption in sensitive environments like schools and hospitals.

The educational and training technology landscape is also evolving rapidly to support mass timber adoption. Specialized software and virtual reality (VR) training simulations are being developed to rapidly train structural engineers, architects, and construction crews in mass timber design methodologies and assembly techniques. This rapid dissemination of specialized knowledge is necessary to overcome the skill gap often cited as a key restraint to market growth. By leveraging digital tools to standardize training and design best practices, the industry aims to ensure consistent, high-quality project execution globally, accelerating the rate at which firms can confidently transition away from traditional construction methods.

Finally, technology related to acoustic performance and vibration dampening in mass timber floor and wall systems is critical, especially in multi-story residential and commercial applications. Innovations involve the integration of various damping layers, specialized fasteners, and hybrid floor assemblies (e.g., combining timber panels with concrete toppings or specialized gypcrete underlayments) to meet demanding sound transmission requirements. As mass timber is used in denser, taller, and more sensitive urban contexts, the continuous optimization of these acoustic technologies is crucial for ensuring occupant comfort and maintaining the competitive parity necessary for widespread market acceptance among developers targeting premium real estate segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager