Mass Transfer Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431879 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Mass Transfer Equipment Market Size

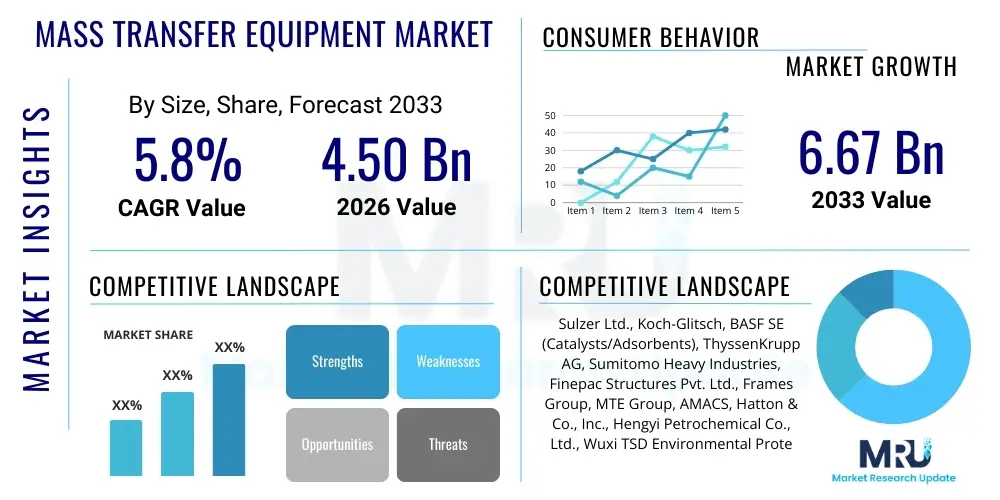

The Mass Transfer Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.50 Billion in 2026 and is projected to reach USD 6.67 Billion by the end of the forecast period in 2033.

Mass Transfer Equipment Market introduction

Mass Transfer Equipment (MTE) constitutes a critical component within chemical process industries, serving as the backbone for separation processes such as distillation, absorption, stripping, and extraction. These operations are fundamental to achieving product purity and separation efficiency across sectors ranging from petrochemicals and oil refining to pharmaceuticals and specialty chemicals manufacturing. The equipment, encompassing distillation columns, solvent extractors, structured and random packing, trays (like sieve, valve, and bubble cap), and column internals, is designed to facilitate the intimate contact between two phases (liquid-gas, liquid-liquid) to allow for the movement of components from one phase to another.

The core functionality of MTE lies in optimizing the surface area available for mass exchange while minimizing pressure drop and energy consumption. Modern mass transfer solutions are increasingly focused on achieving higher theoretical plate numbers within compact column dimensions, addressing the industry's continuous need for enhanced throughput and reduced operational costs. The shift towards sustainable chemical processing and the stringent regulatory environment regarding solvent recovery and emissions control further propel the demand for high-efficiency mass transfer systems, particularly in large-scale separation tasks crucial for hydrocarbon processing.

Major applications of mass transfer equipment include the purification of crude oil fractions, removal of acid gases from natural gas streams, production of high-purity solvents, and complex separations in the food and beverage industry. The primary benefits derived from advanced MTE installation include significant energy savings due to lower reflux ratios, improved product quality through finer separation capability, and increased plant capacity without major physical footprint expansion. These technological advantages, coupled with global expansion in refining capacity and the burgeoning adoption of carbon capture and storage (CCUS) technologies—which heavily rely on absorption/stripping processes—are the primary factors driving market growth.

Mass Transfer Equipment Market Executive Summary

The global Mass Transfer Equipment market exhibits robust growth driven primarily by ongoing industrial modernization efforts, particularly within the Asia Pacific region, which is witnessing massive capital investment in new chemical and petrochemical complexes. Business trends indicate a strong preference for high-performance column internals and structured packing materials over traditional trays, owing to their superior efficiency, lower pressure drop characteristics, and capacity to handle fouling streams. Key market players are focusing on advanced material science, utilizing exotic alloys and high-performance plastics to address corrosive environments and high-temperature operations, thereby extending equipment lifespan and reliability.

Segment trends reveal that the separation columns and column internals category holds a dominant market share, reflecting their pivotal role in core industrial processes. Within the equipment type, structured packing is the fastest-growing sub-segment, driven by its application in revamping existing units to boost efficiency and capacity, a more cost-effective strategy than building entirely new facilities. Furthermore, the oil and gas sector remains the largest end-user, though the specialty chemicals and pharmaceuticals segments are accelerating their adoption of bespoke, small-scale, high-purity separation equipment, offering specialized revenue streams for niche manufacturers.

Regionally, Asia Pacific (APAC) leads the market in terms of consumption and production capacity expansion, fueled by robust economic development in China, India, and Southeast Asian countries. North America and Europe, while slower in new capacity additions, maintain significant market value through high-value replacement, maintenance, and the adoption of cutting-edge, energy-efficient MTE solutions aligned with stringent environmental mandates. These mature markets are pivotal for the development and adoption of novel technologies, particularly those related to reducing volatile organic compound (VOC) emissions and improving overall process sustainability, ensuring a diversified and resilient global market structure.

AI Impact Analysis on Mass Transfer Equipment Market

User inquiries regarding AI's impact on Mass Transfer Equipment frequently center on themes of predictive maintenance, process optimization, and the accelerated design cycle for new packing geometries. Users seek clarity on how Machine Learning (ML) can analyze complex process variables—such as temperature, pressure, flow rates, and composition data—to predict potential fouling or flooding within separation columns, thus preventing unscheduled downtime. Furthermore, there is significant interest in leveraging AI-driven Computational Fluid Dynamics (CFD) and molecular dynamics simulations to rapidly iterate on and optimize the design of high-efficiency column internals and packing materials, moving beyond traditional empirical testing methods. Expectations are high that AI will transform MTE operation from reactive troubleshooting to proactive, model-based control, significantly enhancing yield, safety, and energy efficiency, particularly in highly non-linear separation processes like azeotropic or extractive distillation.

The integration of digital twins, powered by advanced AI algorithms, is emerging as a critical tool for operators. These virtual models simulate the precise hydrodynamic and mass transfer behaviors inside columns under various operating conditions, allowing engineers to test optimization strategies without risking physical plant stability. This shift minimizes the dependence on expensive pilot plant testing and drastically reduces the time-to-market for novel MTE designs. AI-based pattern recognition also enhances quality control during the manufacturing of high-precision structured packing, ensuring uniform surface characteristics and geometric accuracy, which are paramount for performance consistency.

Consequently, the application of AI is moving MTE from a purely mechanical domain towards a cyber-physical system. It addresses long-standing challenges like optimizing energy intensity, which is critical for distillation processes that consume vast amounts of utility power. By dynamically adjusting parameters based on real-time data analysis, AI algorithms can maintain operation closer to the theoretical efficiency limit, maximizing throughput while minimizing the steam or reboiler duty required. This convergence of chemical engineering expertise with data science expertise is defining the next generation of highly efficient, autonomous separation plants.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, differential pressure) to anticipate fouling, corrosion, or mechanical failures in column internals, minimizing unexpected shutdowns.

- Real-Time Process Optimization: ML models dynamically adjust reflux ratios, steam flow, and flow distribution to maintain peak separation efficiency and reduce energy consumption based on fluctuating feed compositions.

- Accelerated Design and Simulation: Utilizing AI-driven CFD to simulate the performance of new tray geometries or packing structures, drastically reducing physical prototyping costs and time.

- Fault Detection and Diagnostics: Rapid identification of operational anomalies, such as flooding or weeping, allowing for instantaneous corrective action and improved process stability.

- Digital Twin Implementation: Creation of high-fidelity virtual models of distillation and absorption columns for scenario testing, operator training, and lifetime performance prediction.

- Supply Chain and Inventory Optimization: AI models predicting demand for specific MTE components (e.g., replacement trays or packing) to ensure optimal stocking levels and rapid deployment during maintenance periods.

- Energy Intensity Reduction: Deployment of reinforcement learning to fine-tune energy input across heating and cooling utilities to achieve target purity with minimal energy expenditure.

DRO & Impact Forces Of Mass Transfer Equipment Market

The Mass Transfer Equipment market is shaped by significant driving forces, critical restraints, and substantial opportunities that collectively determine its growth trajectory and competitive landscape. The primary drivers include the escalating global demand for high-purity fuels, specialty chemicals, and pharmaceutical intermediates, all necessitating advanced separation technologies. Furthermore, the stringent regulatory mandates concerning industrial emissions and the push for greater energy efficiency in chemical plants compel operators to replace older, less efficient equipment with modern, high-performance structured packing and superior tray designs. These modern solutions offer lower pressure drops and significantly reduced utility costs, making them essential for sustainable operations.

However, the market faces notable restraints, chiefly the substantial capital expenditure and complexity associated with designing, manufacturing, and installing large-scale mass transfer columns. Projects are often highly customized, requiring specialized engineering expertise, which can limit the speed of adoption, particularly in smaller facilities. Moreover, the cyclical nature of end-user industries like Oil & Gas and Petrochemicals means that market demand for new installations can fluctuate significantly with global commodity prices and capital investment cycles, creating instability for MTE manufacturers. The vulnerability of packing materials and trays to fouling and plugging in dirty or polymerization-prone streams also remains a persistent operational challenge.

Opportunities for growth are concentrated in emerging fields such as Carbon Capture, Utilization, and Storage (CCUS), where advanced absorption and stripping columns are essential for large-scale CO2 removal. The expansion of bio-refineries and the production of bio-fuels and bio-plastics also present a fertile ground for MTE application, requiring highly selective and efficient separation processes. Furthermore, market participants focusing on digital integration, offering AI-enhanced diagnostic services, and designing modular MTE units for rapid deployment in decentralized process environments are poised to capture significant market share. The continuous pursuit of process intensification, seeking to perform multiple chemical operations within a single piece of equipment, drives innovation in compact MTE designs.

Segmentation Analysis

The Mass Transfer Equipment market is comprehensively segmented based on product type, material of construction, application, and end-user industry, providing a granular view of demand dynamics across various industrial ecosystems. The product segmentation is crucial, differentiating between the core internal components that define the separation efficiency—namely, packing, trays, and column internals (distributors, supports, liquid collectors). The choice between these segments is driven by factors such as required throughput, tolerance to fouling, allowable pressure drop, and the complexity of the chemical system being processed. High-efficiency packing, particularly structured packing, is increasingly preferred for revamp projects requiring capacity increase, while trays remain the standard for high-throughput, large-diameter columns in basic refining operations.

Material segmentation, including metals (stainless steel, exotic alloys), ceramics, and plastics (PTFE, PFA), reflects the need to withstand diverse chemical environments, temperatures, and pressures. The selection of the appropriate material is paramount to ensure equipment longevity and prevent corrosion or erosion that could compromise separation performance. Stainless steel dominates due to its mechanical strength and cost-effectiveness in standard chemical processes, but the rise of highly corrosive processes necessitates greater adoption of expensive, high-nickel alloys or non-metallic materials, especially in specialized chemical production and environmental applications like flue gas scrubbing.

Application and end-user segmentation clearly highlight the market's reliance on capital-intensive sectors. Petrochemicals and Oil & Gas remain the most significant consumers due to the scale and complexity of refining and bulk chemical synthesis. However, the fastest growth is often observed in the fine chemicals, pharmaceutical, and water treatment sectors, where customized, high-precision MTE is required to achieve ultra-high purity specifications. This segmentation analysis provides manufacturers with targeted insights into where technological investment and sales efforts should be concentrated, balancing the volume demand from bulk commodity production with the high-margin opportunities in specialty applications.

- By Product Type:

- Trays (Sieve Trays, Valve Trays, Bubble Cap Trays, Dual Flow Trays)

- Packing (Structured Packing, Random Packing)

- Column Internals (Liquid Distributors, Support Plates, Redistributors, Anti-swirl Devices)

- Columns/Shells (Distillation Columns, Absorption Columns, Stripping Columns)

- By Material of Construction:

- Metals (Stainless Steel, Carbon Steel, Exotic Alloys)

- Plastics (PP, PE, PTFE, FRP)

- Ceramics

- Other Materials (Graphite, Activated Carbon)

- By Application:

- Distillation

- Absorption

- Stripping

- Extraction

- Desorption

- By End-User Industry:

- Oil and Gas

- Chemicals and Petrochemicals

- Pharmaceuticals

- Food and Beverages

- Water and Wastewater Treatment

- Pulp and Paper

Value Chain Analysis For Mass Transfer Equipment Market

The value chain for the Mass Transfer Equipment market begins with the upstream supply of specialized raw materials, primarily metals (high-grade stainless steel, titanium, nickel alloys) and advanced polymers/ceramics. This upstream segment is highly dependent on global commodity prices and the stability of mining and metallurgy industries. MTE manufacturers require rigorous quality control over incoming materials, as the operational integrity of the separation column hinges on the corrosion resistance and mechanical strength of the trays, packing, and shell components. A stable and reliable supply of specialized alloys, often sourced from highly concentrated global suppliers, is critical for meeting project timelines and ensuring performance guarantees.

The manufacturing stage involves complex processes, including precision stamping, weaving, forming (for structured packing), and welding of large column sections. This stage is capital-intensive and requires specialized tooling and highly skilled labor for fabrication and quality assurance. Key manufacturers often maintain extensive intellectual property regarding proprietary tray designs, packing geometries, and simulation software. Distribution channels are varied: direct sales are common for large, customized capital projects managed by Engineering, Procurement, and Construction (EPC) firms, while indirect channels, involving authorized distributors and agents, handle smaller replacement parts and standard MTE components for maintenance, repair, and overhaul (MRO).

Downstream analysis focuses on the installation, commissioning, and long-term maintenance services provided directly to end-users (e.g., refineries, chemical plants). EPC contractors play an intermediary role, integrating MTE into overall plant designs. Post-installation services, including troubleshooting, efficiency audits, and replacement of internals (revamping projects), form a crucial high-margin service segment. The success of the downstream activities heavily relies on the application engineering support provided by MTE vendors, ensuring the equipment meets the specific fluid dynamics and chemical reaction characteristics of the client's process, thereby completing a value chain characterized by high technical expertise and stringent performance requirements.

Mass Transfer Equipment Market Potential Customers

The potential customer base for Mass Transfer Equipment is highly concentrated in heavy industrial sectors where chemical and physical separation are essential processes for product refinement and quality control. The primary buyers are large, integrated energy and chemical corporations that own and operate refineries, petrochemical complexes, and bulk chemical manufacturing facilities. These companies purchase MTE either for new plant construction (greenfield projects) or, more frequently, for the capacity expansion and modernization of existing operational units (brownfield or revamp projects).

Engineering, Procurement, and Construction (EPC) companies represent another critical customer segment. EPC firms act as intermediaries, procuring MTE packages on behalf of the ultimate asset owner as part of a larger project contract. The specifications, technical design, and vendor selection are often heavily influenced by the EPC contractor’s experience and standardized material choices, making them a key gatekeeper in the procurement process. Furthermore, specialty chemical and fine chemical producers, particularly those dealing with high-value products like specialized polymers, advanced intermediates, and active pharmaceutical ingredients (APIs), constitute a growing customer group, prioritizing separation selectivity and purity over sheer volume.

Finally, governmental and municipal entities, through their investment in water and wastewater treatment plants and environmental control systems (e.g., flue gas desulfurization units), also serve as significant, albeit slower, customers. These buyers often require robust, corrosion-resistant MTE such as scrubbers and absorbers. The need for continuous maintenance and periodic upgrades ensures that even in mature industrial regions, there is a consistent, recurring demand for replacement trays, packing, and column internal components, driven by maintenance schedules and the necessity to adopt newer, more energy-efficient designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.50 Billion |

| Market Forecast in 2033 | USD 6.67 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sulzer Ltd., Koch-Glitsch, BASF SE (Catalysts/Adsorbents), ThyssenKrupp AG, Sumitomo Heavy Industries, Finepac Structures Pvt. Ltd., Frames Group, MTE Group, AMACS, Hatton & Co., Inc., Hengyi Petrochemical Co., Ltd., Wuxi TSD Environmental Protection Equipment Co., Ltd., Munters Group, Hebei Hengyi Petrochemical Equipment Co., Ltd., Tianjin University-Mass Transfer Equipment Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mass Transfer Equipment Market Key Technology Landscape

The technological landscape of the Mass Transfer Equipment market is characterized by continuous innovation focused on maximizing interfacial area, minimizing pressure drop, and improving resistance to chemical and thermal degradation. A central area of technological development is the refinement of structured packing geometry. Manufacturers are utilizing advanced computational fluid dynamics (CFD) simulations to develop novel crimping patterns and surface enhancements that improve liquid spreading and gas-liquid contact efficiency. The shift from standard metallic packing to high-performance ceramic and specialized polymer packing addresses the need for greater corrosion resistance and lighter weight in highly aggressive chemical environments, such as those found in acid gas removal or aggressive solvent recovery systems.

Another pivotal technological advancement involves the design of high-capacity trays, such as high-performance valve trays and specialized jet trays, engineered to handle significantly higher vapor and liquid loads than conventional designs while maintaining high separation efficiency. These advanced trays often incorporate proprietary downcomer designs and deck hole arrangements to mitigate weeping and jet flooding, thereby allowing operators to increase plant throughput dramatically during revamp projects. The integration of advanced flow distributors and redistributors within packed columns is equally vital, ensuring uniform liquid wetting across the packed bed surface, which is essential for realizing the full efficiency potential of high-specification packing materials.

Furthermore, digital technologies are rapidly transforming the operational landscape. The adoption of smart column internals equipped with wireless sensors for real-time monitoring of temperature, pressure profiles, and liquid holdup is increasing. This data feeds into predictive maintenance systems and advanced process control (APC) strategies, enabling precise, dynamic control of the separation process. The utilization of 3D printing (Additive Manufacturing) is also being explored, particularly for prototyping complex column internals or producing bespoke, highly optimized distributors and small-scale packing elements tailored for niche or laboratory-scale separations, marking a significant step toward manufacturing flexibility and customization in the MTE sector.

Regional Highlights

- North America (USA, Canada, Mexico): North America represents a mature yet dynamic market segment, characterized by high investment in refinery modernization and capacity upgrades, particularly following recent regulatory shifts favoring cleaner fuel standards. The focus here is less on new construction and more on brownfield projects where high-efficiency structured packing and advanced trays are utilized to increase existing column throughput and reduce energy intensity. The significant presence of natural gas processing and LNG liquefaction facilities drives substantial demand for large-scale acid gas removal and cryogenic separation MTE, often incorporating highly specialized materials to handle sour gas and ultra-low temperature conditions.

- Europe (Germany, UK, France, Italy): The European market is heavily influenced by stringent environmental regulations (e.g., REACH) and a strong commitment to decarbonization and sustainability. Demand for MTE is robust in the specialty chemicals, pharmaceutical, and environmental sectors, especially for solvent recovery, VOC abatement, and advanced wastewater treatment. Innovation is paramount in this region, with strong uptake of ceramic and specialized plastic packing materials for corrosive scrubbing applications and a pioneering role in the development of MTE for Carbon Capture and Storage (CCS) projects. The market is highly competitive, emphasizing efficiency, durability, and a low total cost of ownership.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is the fastest-growing and largest regional market, driven by massive capital expenditure in new petrochemical complexes, refineries, and chemical manufacturing hubs, particularly in China and India. Rapid industrialization and urbanization fuel an insatiable demand for commodity chemicals, polymers, and fuels, necessitating large volumes of mass transfer equipment. While cost sensitivity is a factor, the rapid adoption of advanced technologies, often in collaboration with Western firms, is evident as countries strive for world-class operational efficiency. Expansion in LNG infrastructure and the increasing complexity of local refineries further solidify APAC's dominance in terms of new installed capacity.

- Latin America (Brazil, Argentina): This region’s market growth is moderate and cyclical, largely dependent on investment in the domestic oil and gas sector and agricultural chemicals (fertilizers). Brazil, with its large bio-fuel (ethanol) industry, is a specialized segment requiring high-efficiency distillation equipment. Economic volatility and political instability can occasionally restrain major capital projects, yet the underlying need for maintenance and targeted refinery upgrades provides a steady, if unpredictable, demand for MTE replacement parts and engineering services.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, Qatar): MEA is a critical market driven by massive investments in downstream integration, aiming to shift from purely crude oil export to refined products and petrochemical derivatives. Countries in the GCC are building large, complex refining and chemical conversion facilities, creating high demand for large-diameter distillation columns and associated high-throughput MTE. Projects often prioritize robust, high-specification equipment capable of operating reliably in harsh desert environments and handling high-sulfur crude feedstocks. Investment in desalination plants also contributes significantly to the regional demand for specialized membrane and mass transfer components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mass Transfer Equipment Market.- Sulzer Ltd.

- Koch-Glitsch

- BASF SE (Catalysts/Adsorbents)

- ThyssenKrupp AG

- Sumitomo Heavy Industries

- Finepac Structures Pvt. Ltd.

- Frames Group

- MTE Group

- AMACS

- Hatton & Co., Inc.

- Hebei Hengyi Petrochemical Equipment Co., Ltd.

- Wuxi TSD Environmental Protection Equipment Co., Ltd.

- Munters Group

- Ningbo Yixing Petrochemical Equipment Co., Ltd.

- Tianjin University-Mass Transfer Equipment Co.

- C. R. Daniels, Inc.

- Lantec Products, Inc.

- Dalian Huading Separation Equipment Co., Ltd.

- Beijing Zehua Chemical Engineering Co., Ltd.

- Dutco Group

Frequently Asked Questions

Analyze common user questions about the Mass Transfer Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between structured and random packing, and which dominates the Mass Transfer Equipment market?

Structured packing consists of geometrically defined elements (sheets or corrugated materials) providing high surface area and very low pressure drop, ideal for vacuum distillation and revamps. Random packing (e.g., rings, saddles) is dumped randomly into the column. Structured packing is gaining dominance, particularly for high-efficiency and high-capacity applications, due to its superior performance characteristics and lower energy consumption compared to random packing and traditional trays.

Which end-user industry is the largest consumer of Mass Transfer Equipment?

The Oil and Gas and Petrochemicals industries remain the largest consumers of Mass Transfer Equipment globally. These sectors require large-scale, high-throughput separation columns for crude oil distillation, gas sweetening, natural gas liquids recovery, and bulk chemical production, driving significant demand for trays and specialized column internals.

How is energy efficiency driving innovation in the Mass Transfer Equipment sector?

Energy efficiency is a primary driver, as separation processes (especially distillation) are energy-intensive. Innovation focuses on designing MTE with lower pressure drop characteristics, such as high-performance structured packing and energy-efficient tray designs, which allow plants to reduce steam consumption and operational costs significantly, meeting strict environmental and economic mandates.

What are the key technical challenges facing the operation of mass transfer columns?

Key challenges include column fouling (build-up of solids or polymers), which reduces efficiency and throughput; hydrodynamic instabilities like flooding (excessive vapor/liquid holdup); and weeping (liquid draining through tray perforations). Addressing these requires robust design, advanced materials, and sophisticated real-time monitoring systems, often utilizing AI and digital twin technology for prediction and prevention.

What are the primary growth opportunities related to new MTE applications?

Major growth opportunities lie in the expanding field of Carbon Capture, Utilization, and Storage (CCUS), which relies heavily on absorption and stripping technology. Additionally, the development of sustainable bio-fuel production and advanced recycling processes for plastics are driving specialized demand for bespoke, high-selectivity mass transfer systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager