Mast Head Amplifiers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432368 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mast Head Amplifiers Market Size

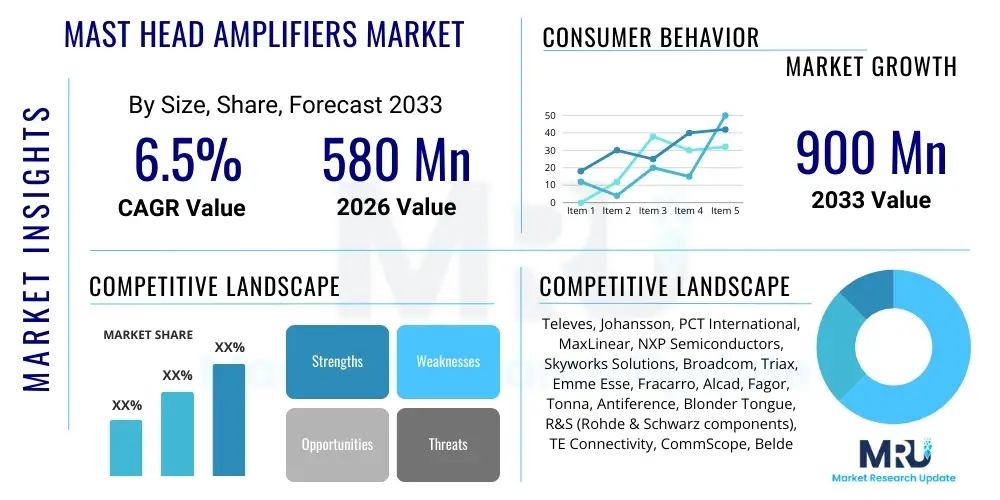

The Mast Head Amplifiers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $900 Million by the end of the forecast period in 2033.

Mast Head Amplifiers Market introduction

The Mast Head Amplifiers (MHA) Market encompasses devices crucial for improving the quality and reliability of received signals in television broadcasting, satellite communication, and specialized terrestrial wireless applications. MHAs are low-noise amplifiers strategically placed close to the receiving antenna (the "mast head") to boost weak signals immediately, thereby increasing the signal-to-noise ratio (SNR) before the signal travels down long coaxial cables, where attenuation and noise introduction are significant challenges. These devices are essential components in Digital Video Broadcasting (DVB) systems, specifically DVB-T/T2 (terrestrial) and DVB-S/S2 (satellite), ensuring effective signal reception in fringe areas or environments burdened by electromagnetic interference. The fundamental product characteristic is the combination of high gain and extremely low noise figures, which are prerequisites for maintaining signal integrity in weak signal environments. Continuous advancements in semiconductor technology, particularly in Gallium Nitride (GaN) and Gallium Arsenide (GaAs) components, are driving the development of more efficient and wider bandwidth MHAs capable of handling multi-band frequency ranges, crucial for modern complex telecommunication infrastructures.

Major applications for Mast Head Amplifiers span professional broadcasting infrastructure, residential and commercial Multi-Dwelling Units (MDUs), maritime communication systems, and remote telemetry applications where signal degradation over distance is a primary concern. The benefits derived from utilizing MHAs are manifold, including extended reception range, reduced pixilation or dropout in digital signals, enhanced throughput in data transmission, and lower reliance on expensive, high-power receiving equipment located indoors. Furthermore, MHAs play a critical role in mitigating interference from 4G/5G mobile networks that operate near TV broadcast frequencies, often incorporating advanced filtering capabilities to reject unwanted signals, thereby protecting the desired frequency spectrum. This filtering capability is becoming increasingly complex due to spectrum reallocation initiatives globally, necessitating highly selective and adaptable amplifier solutions tailored to specific regional regulatory environments and frequency allocations.

The market growth is primarily driven by the ongoing global transition from analog to digital television broadcasting, which necessitates reliable signal acquisition, as digital signals are highly sensitive to noise and loss. Another significant driving factor is the rapid urbanization and the proliferation of complex MDU architectures requiring sophisticated signal distribution networks where centralized mast head amplification simplifies installation and maintenance. Additionally, the increasing demand for high-definition (HD) and ultra-high-definition (UHD) content requires robust signal delivery, further boosting the adoption of high-performance, low-noise MHAs. The integration of smart home technologies and IoT devices often relies on existing aerial infrastructure, creating secondary demand for reliable signal amplification to support integrated services. Regulatory pushes mandating minimum standards for broadcasting quality also contribute substantially to market expansion across developing economies.

Mast Head Amplifiers Market Executive Summary

The Mast Head Amplifiers (MHA) market is poised for steady expansion, fueled by structural business trends centered on digitalization and spectrum consolidation. Key business trends indicate a shift towards modular and software-defined amplifiers that can adapt to changing frequency allocations and standards (e.g., DVB-T2, ISDB-T). Manufacturers are prioritizing products with enhanced filtering capabilities, particularly against encroaching 5G signals (C-band and sub-6GHz), which is leading to higher average selling prices for premium, highly selective MHA units. The market is also seeing increased merger and acquisition activity among niche component providers and large communication equipment manufacturers, aimed at consolidating intellectual property related to low-noise, high-linearity amplification technologies. The supply chain stability, however, remains a persistent challenge, particularly concerning the sourcing of specialized RF semiconductor components, which affects production lead times and cost structures globally, urging companies to implement dual-sourcing strategies.

Regional trends highlight that Asia Pacific (APAC) remains the fastest-growing region, driven by massive infrastructure investments in digital terrestrial television (DTT) in countries like India, Indonesia, and Vietnam, often supported by government mandates for digital migration. North America and Europe, characterized by highly mature satellite and cable infrastructure, show steady demand focused primarily on replacement cycles and upgrades to handle higher bandwidth requirements (e.g., Ultra HD transmission). Europe's market dynamics are particularly influenced by the regulatory environment established by the European Telecommunications Standards Institute (ETSI) and ongoing efforts to reallocate the 700 MHz band, necessitating widespread upgrade of filtering capabilities within installed MHA bases. Conversely, regions in Latin America and the Middle East and Africa (MEA) exhibit strong growth potential due to ongoing foundational infrastructure rollouts and increasing household penetration of television services, prioritizing cost-effective and robust solutions suitable for harsh climatic conditions.

Segment trends reveal that the DVB-T/T2 segment, focusing on terrestrial reception, dominates the volume metrics due to widespread household usage, while the Satellite Communication segment commands higher value due to stringent technical requirements and professional applications (e.g., VSAT networks and professional broadcast uplink systems). In terms of component type, those based on advanced semiconductor materials like GaN are experiencing accelerated uptake, specifically in professional applications where superior power handling and efficiency are non-negotiable. Furthermore, there is a distinct trend towards intelligent MHAs equipped with remote monitoring and diagnostic capabilities (IoT integration), allowing network operators to manage and troubleshoot signal distribution networks proactively, reducing operational expenditure and minimizing service disruptions, appealing greatly to large MDU operators and telecommunication service providers.

AI Impact Analysis on Mast Head Amplifiers Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can be integrated into traditional RF components like Mast Head Amplifiers, specifically focusing on automatic optimization, fault prediction, and dynamic interference mitigation. Key themes revolve around the possibility of AI-driven adaptive filtering systems that can automatically identify and nullify transient interference sources (e.g., pulsed radar, intermittent 5G noise) without manual operator intervention. Users also express concerns and expectations regarding enhanced energy efficiency; they anticipate AI algorithms could manage amplifier gain stages dynamically based on real-time signal conditions, thus minimizing power consumption during periods of low signal fluctuation. The synthesis of these common questions suggests a strong market expectation for the evolution of MHAs from static signal boosters to intelligent, self-managing nodes within a broader communication network infrastructure, optimizing performance parameters like linearity, noise figure, and power consumption continuously throughout the operational lifecycle. This shift is essential for complex smart-city and large-scale MDU deployments where network integrity relies on proactive management rather than reactive maintenance.

- AI-Driven Adaptive Gain Control: Utilizes ML algorithms to optimize amplifier gain automatically in response to fluctuating input signal levels, preventing saturation or excessive noise introduction, ensuring optimal linearity and power efficiency.

- Predictive Maintenance and Diagnostics: AI monitors operational parameters (temperature, voltage, output linearity) to predict component failure or degradation before catastrophic outages occur, significantly improving network uptime and reducing truck rolls.

- Dynamic Interference Cancellation: ML models are trained to recognize patterns of transient or broadband interference (e.g., 5G sidelobes, atmospheric noise) and dynamically adjust filtering profiles in real-time to suppress unwanted signals without compromising the desired signal bandwidth.

- Automated Spectrum Management: AI assists in the quick recalibration of multi-band MHAs following governmental spectrum reallocation events, allowing for instant adaptation to new frequency band plans across large installed bases.

- Optimized Power Consumption: Algorithms learn signal flow characteristics and adjust bias points and standby modes to conserve energy when maximum performance is not required, crucial for green communication initiatives.

DRO & Impact Forces Of Mast Head Amplifiers Market

The Mast Head Amplifiers market is shaped by significant forces spanning technological necessity and regulatory pressures. The primary drivers include the mandatory global digital switchover (DSO), which demands noise-immune reception, and the ever-increasing consumer expectation for high-quality video content (4K/8K), requiring higher signal integrity. Restraints primarily involve the saturation of traditional terrestrial television markets in developed economies and the substantial cost associated with upgrading large, existing infrastructure networks, particularly when migrating to active, intelligent MHA solutions. Furthermore, the complexity of integrating MHAs with existing antiquated cabling and distribution systems poses a technical restraint. Opportunities are emerging from the rapid expansion of VSAT (Very Small Aperture Terminal) networks in remote regions, the growth of integrated communication systems for smart buildings (MDU/SMATV), and the necessity for robust, specialized MHA units capable of functioning reliably in mission-critical environments like maritime and aerospace communications, often requiring customized solutions with extreme environmental tolerance. These factors converge to create a market environment where technological differentiation and specialized niche applications are key to sustaining growth.

The impact forces are high, particularly concerning regulatory changes related to frequency spectrum utilization. When government agencies reallocate bands (e.g., selling the 700 MHz band previously used by DTT to mobile operators), it instantly renders existing, non-filtered MHAs obsolete or prone to interference, necessitating large-scale replacement cycles. This regulatory force creates mandatory demand spikes, offsetting the market maturity in traditional segments. Competition from alternative content delivery methods, such as Over-The-Top (OTT) streaming services delivered via fiber or 5G broadband, exerts a moderating pressure, limiting the growth rate of standard terrestrial TV reception equipment. However, the symbiotic relationship between terrestrial and broadband, where terrestrial acts as a reliable backup or primary source in bandwidth-constrained areas, keeps the demand for high-performance MHAs stable. Technological advancements in low-power, high-linearity RFICs act as a powerful enabling force, constantly reducing the size and cost of MHAs while improving their performance metrics, making them more accessible for mass market adoption.

The long-term success in this market hinges on manufacturers' ability to anticipate and respond to these external forces. For instance, the market’s reliance on advanced semiconductor fabrication processes means that geopolitical stability and supply chain resilience directly impact profitability and market share. Companies that invest in robust, field-upgradeable MHA designs that incorporate software-defined functionality or interchangeable filters are better positioned to weather rapid regulatory and technological shifts. The high barrier to entry regarding RF expertise and low-noise design capabilities acts as a protective force for established players, ensuring that new entrants must possess specialized knowledge in high-frequency engineering to compete effectively in the professional and consumer grades of the market. Ultimately, the continuous pressure to maintain signal quality in an increasingly congested RF environment solidifies the essential role of the Mast Head Amplifier.

Segmentation Analysis

The Mast Head Amplifiers market is segmented primarily based on the application (terrestrial, satellite, cable), the technology used (GaN, GaAs, Silicon), and the component type (single-band, multi-band, filtered). The application segmentation dictates the required frequency range and power handling, with terrestrial applications requiring coverage typically up to 860 MHz, while satellite applications require C-band, Ku-band, or Ka-band support, operating in the GHz range. The technology segment highlights a crucial performance differentiator, where advanced materials like GaN offer superior linearity and efficiency for high-power, professional applications, contrasting with more cost-effective silicon-based solutions suitable for mass-market residential use. The shift towards highly selective, filtered MHAs is the most dynamic trend, driven by the need to operate reliably in shared spectrum environments increasingly congested by mobile services.

- By Type:

- Single-Band Amplifiers

- Multi-Band Amplifiers

- Wideband Amplifiers

- By Application:

- Digital Terrestrial Television (DTT) (DVB-T/T2, ATSC, ISDB-T)

- Satellite Communication (DVB-S/S2, VSAT)

- Cable Television (CATV/DOCSIS)

- Professional Broadcasting and Test Equipment

- By Frequency Range:

- UHF/VHF (Below 1 GHz)

- L-Band/S-Band (1 GHz to 4 GHz)

- C-Band and Above (4 GHz+)

- By Technology:

- Silicon-based Amplifiers

- Gallium Arsenide (GaAs) Amplifiers

- Gallium Nitride (GaN) Amplifiers

Value Chain Analysis For Mast Head Amplifiers Market

The value chain for Mast Head Amplifiers begins with upstream analysis, focusing heavily on the specialized component suppliers. The most critical upstream inputs are RF semiconductor chips, including Low-Noise Amplifiers (LNAs), transistors (GaAs or GaN FETs), filters, and specialized passive components such as inductors and capacitors capable of operating reliably at high frequencies. Key material suppliers are highly specialized global firms that control proprietary intellectual property regarding compound semiconductor manufacturing, particularly concerning achieving ultra-low noise figures and high linearity. The stability and cost of these raw materials and specialized components significantly influence the final product cost and performance, creating a strong dependency on technological leaders in the RF IC manufacturing sector. Furthermore, the specialized PCB fabrication required to minimize noise and impedance mismatches at high frequencies forms another crucial layer of the upstream chain, demanding precision engineering and stringent quality control.

Moving downstream, the distribution channel for MHAs bifurcates into direct and indirect paths. Direct distribution primarily targets large professional system integrators, telecommunication carriers, and major broadcasting entities that require bulk orders, customized solutions, and direct technical support. This channel is characterized by high contract values and long sales cycles. The indirect channel dominates the consumer and small commercial segment, relying heavily on specialized electronic wholesalers, electrical distributors, and retail hardware stores, particularly for standard DVB-T/T2 residential units. Installers and authorized dealers often serve as crucial intermediaries, acting as trusted advisors to end-users and influencing purchasing decisions based on product reliability and ease of installation. Effective logistics management is paramount in the indirect channel to ensure timely delivery of high-volume, standardized products to a vast network of resellers across diverse geographic locations, minimizing stockouts and maintaining competitive pricing strategies.

The post-sale value chain components, including installation, maintenance, and technical support, are increasingly becoming integrated differentiators. Given the complexity of spectrum interference, technical support services often require highly specialized RF testing and calibration expertise. The trend towards smart, connected MHAs (with remote diagnostics) aims to shift the post-sale value from physical site visits (truck rolls) to remote monitoring and software-based troubleshooting, thereby optimizing operational expenditure for large network operators. Moreover, waste management and regulatory compliance for electronic components (WEEE directives in Europe) also form part of the reverse logistics and value chain, pushing manufacturers toward designing modular and easily recyclable products. Overall, successful value chain management hinges on maintaining high-quality upstream sourcing coupled with efficient and technically supported downstream distribution tailored to the specific application domain.

Mast Head Amplifiers Market Potential Customers

The Mast Head Amplifiers market serves a wide array of end-users who rely on robust and interference-free signal reception for broadcasting, communication, and data acquisition. The primary customer segment includes professional system integrators and installers specializing in large-scale signal distribution networks, such as those found in Multi-Dwelling Units (MDUs), hotels, hospitals, and educational campuses. These customers require high-reliability, commercial-grade MHAs capable of handling multiple input sources (SMATV systems) and distributing clean signals across complex, multi-point architectures. Their purchasing decisions are driven by system longevity, scalability, the availability of centralized remote management features, and compliance with local building codes and broadcasting standards. The demand from this sector is stable and growing, particularly in urban areas experiencing high-density development, necessitating centralized signal reception solutions that are more efficient than individual antenna installations.

Another major segment consists of telecommunication carriers and Over-the-Air (OTA) broadcasters. Broadcasters utilize professional MHAs as critical components in their monitoring and terrestrial transmission equipment, ensuring the quality of the signal fed into their distribution chain or used for performance monitoring. Telecommunication companies, particularly those offering satellite TV services (DTH providers) or operating niche wireless links (e.g., backhaul systems), rely on high-linearity, highly filtered MHAs to maintain service quality and minimize interference. These enterprise-level customers purchase based on rigorous technical specifications, including extremely low noise figures, high out-of-band rejection capabilities, and proven Mean Time Between Failures (MTBF) statistics, often requiring customized MHAs built to withstand demanding outdoor environmental conditions and operate continuously under high-power loads.

Finally, the residential consumer market represents a substantial volume segment, particularly for DVB-T/T2 reception enhancement. Individual homeowners and small installers purchase these devices to overcome poor reception in fringe areas or to amplify signals for distribution across multiple televisions within a single home. While individual unit prices are lower, the sheer volume makes this a critical segment. Their purchasing criteria are centered on ease of installation ("plug-and-play" functionality), cost-effectiveness, and verifiable improvement in reception quality, often influenced by readily available consumer reviews and local installer recommendations. The growing adoption of smart antenna systems, which often include integrated MHAs and advanced filtering to combat mobile interference, continues to drive replacement and upgrade cycles in this widespread but highly fragmented segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $900 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Televes, Johansson, PCT International, MaxLinear, NXP Semiconductors, Skyworks Solutions, Broadcom, Triax, Emme Esse, Fracarro, Alcad, Fagor, Tonna, Antiference, Blonder Tongue, R&S (Rohde & Schwarz components), TE Connectivity, CommScope, Belden, Hirschmann Multimedia |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mast Head Amplifiers Market Key Technology Landscape

The technological landscape of the Mast Head Amplifiers market is defined by continuous innovation in semiconductor materials, digital processing, and filtering techniques, all aimed at achieving higher linearity and lower noise figures across broader bandwidths. A core technological trend is the increasing adoption of compound semiconductors, particularly Gallium Arsenide (GaAs) and Gallium Nitride (GaN). GaAs technology is widely used due to its excellent high-frequency performance and low noise characteristics, making it ideal for the critical first-stage LNA (Low-Noise Amplifier) within the mast head unit. However, GaN is rapidly gaining traction, especially in professional and high-power applications, because it offers superior power density and thermal stability compared to both Silicon and GaAs, allowing for the creation of smaller, more efficient, and robust amplifier modules capable of handling higher signal levels without distortion. The choice between these materials heavily influences the power consumption, size, and ultimate cost-effectiveness of the MHA unit for its intended application.

Another crucial area of technological advancement involves smart filtering and interference mitigation. With the increasing spectral congestion, particularly the shared use of formerly dedicated broadcast bands by 4G and 5G cellular services, MHAs now require highly sophisticated internal filters, often implemented as Surface Acoustic Wave (SAW) or Bulk Acoustic Wave (BAW) filters for high selectivity. Beyond fixed filtering, manufacturers are integrating digital signal processing (DSP) capabilities into higher-end MHAs to enable adaptive equalization and programmable filtering. These "smart" MHAs can dynamically adjust their response characteristics to minimize localized, time-varying interference, offering a significant performance edge over traditional passive filters. This move towards software-defined amplification simplifies field adjustments and future-proofs the equipment against subsequent spectrum reallocations, providing long-term operational advantages to service providers.

Furthermore, power efficiency and remote management are driving technological design choices. Modern MHAs are engineered to operate with minimal power consumption, often utilizing DC power passed up the coaxial cable (phantom power) from a centralized power supply located indoors. Improvements in bias circuitry and efficiency optimization in the RF stages ensure that the devices remain cool and reliable, even when mounted in environmentally challenging locations. The integration of IoT capabilities, such as Ethernet connectivity or Zigbee/Bluetooth interfaces, allows network operators to remotely monitor crucial performance metrics (e.g., gain, noise figure, temperature, output level) and perform diagnostics without physical intervention. This capability is paramount for large-scale cable and DTT network operators, facilitating proactive maintenance, quicker fault identification, and significant reduction in maintenance costs, transforming the MHA from a simple component into an intelligent network node.

Regional Highlights

The global Mast Head Amplifiers market exhibits heterogeneous growth patterns influenced by varying levels of digital infrastructure maturity, regulatory timelines for digital switchover, and consumer preferences for content delivery mechanisms. North America and Europe represent mature markets characterized by stable replacement demand and technological upgrades. In North America, demand is heavily focused on specialized MHAs for professional satellite communications (VSAT, DTH) and high-quality CATV head-ends, driven by the need to support massive bandwidth consumption for UHD content and complex MDU systems. European growth is stimulated primarily by mandatory upgrades following the 700 MHz band clearance, forcing the replacement of millions of terrestrial MHAs with new units featuring LTE/5G suppression filters, a regulatory mandate that ensures sustained capital expenditure in the terrestrial segment. Both regions prioritize performance, emphasizing low-noise figures and high linearity.

Asia Pacific (APAC) stands out as the engine of growth, demonstrating the highest projected CAGR. This surge is attributed to the ongoing, large-scale deployment of Digital Terrestrial Television (DTT) infrastructure across populous nations such as India, Indonesia, and China. Government initiatives promoting access to free-to-air digital broadcasting, coupled with rapidly increasing household penetration of television sets, create massive volume demand for cost-effective, multi-band MHAs. Moreover, the vast geographical distances and often challenging signal environments in rural APAC areas necessitate the use of high-gain MHAs to ensure reliable reception. Manufacturers operating in APAC focus on solutions that balance high performance with robust environmental protection and competitive pricing, suitable for high-volume consumer markets.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets offering significant long-term opportunities. LATAM’s growth is fueled by the continuing migration to digital standards like ISDB-T, driving foundational infrastructure build-out. MEA is witnessing strong adoption due to expanding rural electrification and increasing access to communication services, making terrestrial and satellite reception crucial links. In MEA, environmental robustness—withstanding extreme temperatures and dust—is a non-negotiable requirement for MHA deployments. While current market sizes in these regions are smaller compared to developed economies, the high growth potential stems from rapid urbanization, demographic expansion, and foundational investment in basic communication infrastructure, indicating a strong future demand for reliable signal amplification components necessary for establishing stable broadcast networks.

- North America: Focus on advanced CATV and high-frequency satellite (Ku/Ka-band) MHAs; driven by high-bandwidth demands and professional applications.

- Europe: Driven by regulatory mandates (700 MHz band clearance); strong replacement demand for 5G-filtered DVB-T2 MHAs.

- Asia Pacific (APAC): Highest volume growth due to extensive DTT rollout; focus on cost-effective, multi-standard compatible MHAs for rapidly expanding consumer base.

- Latin America: Moderate growth fueled by digital migration projects (ISDB-T); localized demand for robust terrestrial reception devices.

- Middle East & Africa (MEA): Strong future potential driven by new infrastructure deployment and satellite communication expansion in remote areas; demanding high environmental durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mast Head Amplifiers Market.- Televes

- Johansson

- PCT International

- MaxLinear

- NXP Semiconductors

- Skyworks Solutions

- Broadcom

- Triax

- Emme Esse

- Fracarro

- Alcad

- Fagor

- Tonna

- Antiference

- Blonder Tongue

- Rohde & Schwarz (Components Division)

- TE Connectivity

- CommScope

- Belden

- Hirschmann Multimedia

Frequently Asked Questions

Analyze common user questions about the Mast Head Amplifiers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Mast Head Amplifier and how does it differ from a standard signal booster?

The primary function of a Mast Head Amplifier (MHA) is to amplify weak RF signals immediately at the antenna (the 'mast head') before significant attenuation and noise degradation occur in the long coaxial cable run. This early amplification is crucial because it significantly improves the overall system's Signal-to-Noise Ratio (SNR). Unlike a standard indoor signal booster, which amplifies the signal along with any accumulated noise, the MHA maximizes the signal quality at the point of origin, ensuring cleaner signal delivery for digital reception systems like DVB-T2 and DVB-S2, resulting in clearer picture quality and reliable channel locking, even in fringe reception areas.

How is 5G rollout impacting the demand and technological requirements for Mast Head Amplifiers?

The 5G rollout, particularly the use of repurposed UHF and C-band frequencies (e.g., 700 MHz band), is fundamentally driving the demand for specialized MHAs equipped with high-performance filtering. 5G signals often operate close to or within traditional TV broadcast bands, causing severe interference (known as LTE/5G ingress noise). Therefore, modern MHAs must incorporate advanced, high-selectivity filtering technology (like SAW or ceramic filters) to reject these powerful mobile signals while allowing the desired TV signals to pass cleanly. This technological necessity has fueled a significant replacement and upgrade cycle across mature markets, forcing consumers and network operators to invest in MHAs capable of robust 5G interference suppression, directly impacting market value and product complexity.

What are the key technical specifications customers should prioritize when selecting a Mast Head Amplifier?

When selecting a Mast Head Amplifier, customers should prioritize three key technical specifications: Noise Figure (NF), Gain, and Linearity/Output Level. The Noise Figure, measured in decibels (dB), should be as low as possible (typically 1 dB or less for high-end units) because it indicates how much noise the amplifier itself adds to the signal, directly influencing the final SNR. Gain (dB) must be sufficient to overcome cable losses but not so high that it overloads the receiving equipment (high output level). High Linearity ensures that the amplifier does not introduce distortion (Intermodulation Products) when handling multiple channels simultaneously. Additionally, the amplifier’s built-in Filtering Capabilities for out-of-band signals (e.g., 5G/LTE) are now considered critical specifications.

Which segment of the Mast Head Amplifiers market is showing the highest growth potential?

The segment showing the highest growth potential is the Digital Terrestrial Television (DTT) application segment, particularly within the Asia Pacific (APAC) and emerging markets. This growth is volumetrically driven by government mandates for digital switchover and the expansion of DTT networks to provide free-to-air television access to rapidly growing populations. Technologically, the highest value growth potential resides in smart, GaN-based, Multi-band Amplifiers integrated with IoT capabilities. These advanced units, utilized in large professional SMATV systems and critical infrastructure, offer remote diagnostics and superior thermal performance, justifying a higher price point and leading to robust revenue expansion in developed markets seeking optimized operational efficiency and superior long-term reliability.

How do semiconductor material choices like GaAs versus GaN influence Mast Head Amplifier performance?

The choice between Gallium Arsenide (GaAs) and Gallium Nitride (GaN) significantly influences MHA performance characteristics, particularly related to power handling and efficiency. GaAs MHAs are favored for their inherently low noise characteristics and high electron mobility, making them excellent choices for low-noise applications, often used in the LNA input stage where noise figure is paramount. Conversely, GaN technology offers superior power density and thermal stability, enabling the creation of amplifiers that can handle much higher signal power levels without overheating or introducing distortion. GaN is increasingly adopted in high-power output stages and professional broadcasting environments where robustness, high linearity, and thermal resilience under continuous heavy load are essential requirements, justifying the typically higher manufacturing cost associated with GaN substrates and fabrication processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager