Master Alloy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436998 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Master Alloy Market Size

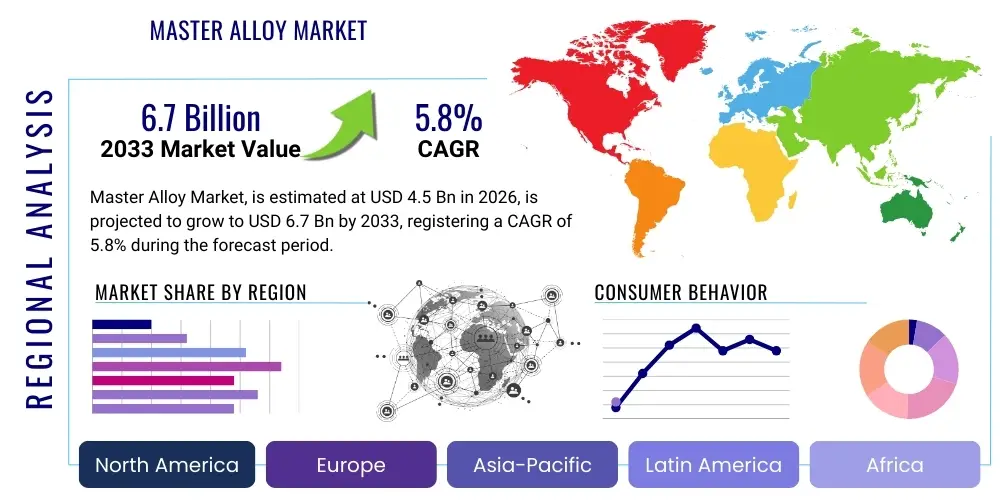

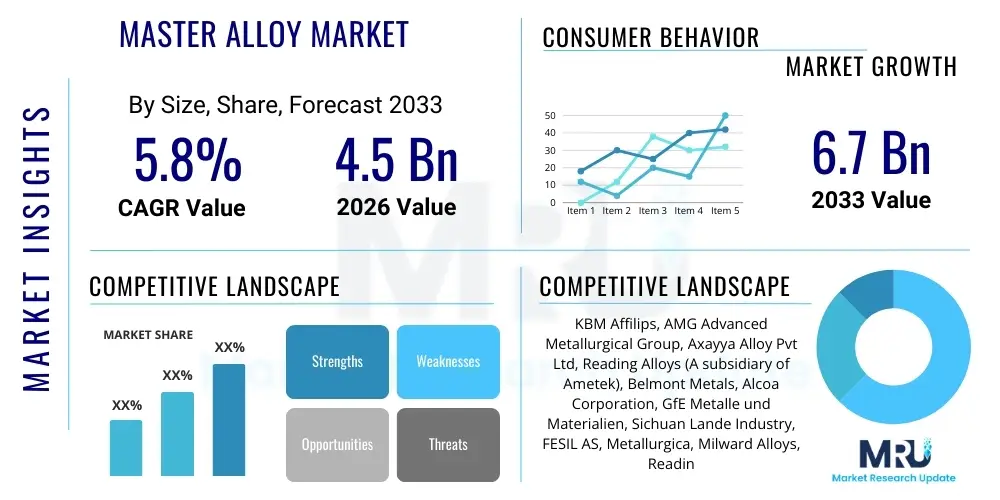

The Master Alloy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Master Alloy Market introduction

Master alloys, often referred to as hardeners, grain refiners, or modifiers, are concentrated mixtures of two or more elements. They are crucial intermediate products used extensively in the production of high-performance metallic components, primarily serving to introduce desired alloying elements into a melt in a controlled and efficient manner. These alloys typically possess a lower melting point than the base metal, facilitating easy dissolution and minimizing oxidation losses during the alloying process. Their composition is meticulously balanced to enhance material properties such as strength, corrosion resistance, castability, and thermal stability in the final product. Key types include aluminum-based, copper-based, and nickel-based master alloys, each tailored for specific industrial applications across diverse sectors.

The primary applications of master alloys span the aerospace and defense, automotive, electronics, and jewelry industries. In aerospace, aluminum-based master alloys (e.g., AlTi, AlSr) are essential for refining grain structures and improving the fatigue life of critical components like turbine blades and structural airframe parts, where weight reduction and high mechanical integrity are paramount. The automotive sector relies on these materials for manufacturing lightweight engine blocks and chassis components, crucial for improving fuel efficiency and meeting stringent emission standards. Furthermore, in electronics, specialized master alloys contribute to the production of solders and conductive materials requiring precise electrical and thermal properties.

Driving factors underpinning market growth include the global push towards lightweight materials in the transportation sector, increased investment in defense and infrastructure projects, and the expanding demand for high-performance alloys in extreme operational environments, such as high-temperature processing and deep-sea exploration. The inherent benefits of using master alloys—including improved metallurgical control, reduced production costs due to faster melt times, and enhanced consistency of the final product—continue to solidify their essential role in modern metallurgy. Regulatory standards enforcing higher material quality and structural reliability further compel manufacturers to integrate sophisticated master alloy solutions into their production streams, ensuring sustained market expansion throughout the forecast period.

- Product Description: Concentrated alloys used to introduce alloying elements, grain refiners, or modifiers into non-ferrous melts (e.g., aluminum, copper) to enhance specific material properties.

- Major Applications: Aerospace, Automotive, Electrical & Electronics, Marine engineering, Jewelry and Minting, and Industrial Manufacturing.

- Benefits: Precise compositional control, energy efficiency through lower melting points, reduced oxidation loss, improved material strength and corrosion resistance.

- Driving Factors: Demand for lightweight automotive and aerospace materials, growth in high-strength defense applications, and technological advancements in casting processes.

Master Alloy Market Executive Summary

The Master Alloy Market is characterized by robust growth, driven primarily by the escalating demand for high-performance, lightweight materials across global manufacturing bases, particularly in Asia Pacific. Business trends indicate a strong focus on strategic mergers and acquisitions among leading producers to consolidate technology and secure raw material supply chains. Manufacturers are increasingly investing in advanced production techniques, such as continuous casting and atomization for powder master alloys, to meet the stringent quality specifications required by sophisticated end-use industries like aerospace and high-end automotive. Furthermore, sustainability pressures are pushing the industry towards the development of cleaner production processes and the use of recycled content, presenting both technological challenges and opportunities for innovation in alloy composition.

Regionally, the Asia Pacific (APAC) market maintains dominance, fueled by massive industrial expansion, rapid urbanization, and significant manufacturing output, especially in China and India. These economies are heavily investing in infrastructure, electronics, and automotive production, necessitating large volumes of high-quality aluminum and copper alloys. North America and Europe, while representing mature markets, exhibit high value growth due to strict regulatory environments demanding ultra-high purity and specialized alloys for critical applications, particularly in defense and precision engineering. The Middle East and Africa (MEA) and Latin America are showing emergent growth, linked to increasing investment in their respective construction, mining, and aerospace repair and overhaul (MRO) sectors, driving localized demand for specific alloy compositions.

Segmentation trends highlight the Aluminum-based master alloys segment as the largest revenue generator, largely due to their indispensable role in grain refinement and modification of aluminum casting alloys used ubiquitously in transportation. However, Nickel-based master alloys, critical for superalloys in extreme temperature environments, are projected to exhibit the fastest growth rate, propelled by expansion in gas turbine technology and high-performance industrial equipment. In terms of form, the ingots and waffles segment remains dominant for large-scale alloying, but the specialized powder master alloy segment is witnessing accelerated adoption, particularly for additive manufacturing (3D printing) applications where fine, spherical powders with precise composition are essential for structural integrity and high resolution.

AI Impact Analysis on Master Alloy Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can optimize the typically high-variability processes involved in master alloy production, focusing on concerns regarding quality control, raw material optimization, and new alloy discovery. Common questions revolve around the integration of AI in predictive modeling for melt quality and process parameter adjustments to reduce energy consumption and defect rates. There is significant interest in utilizing ML algorithms to analyze vast metallurgical data sets, accelerating the discovery and formulation of novel master alloys designed for specific functional requirements, such as ultra-high corrosion resistance or specific thermal expansion coefficients. The core expectation is that AI will transition master alloy manufacturing from a highly empirical, experience-based operation to a data-driven, precision science, thereby enhancing efficiency and shortening the time-to-market for specialized materials.

The application of AI in raw material sourcing and inventory management is fundamentally reshaping cost structures. By analyzing global commodity market trends, supplier performance data, and real-time production schedules, AI systems can optimize purchasing decisions for high-purity inputs like titanium, boron, and strontium, which are essential constituents of critical master alloys. Furthermore, within the production facility, computer vision and deep learning models are being deployed to monitor the casting process in real time. These systems can detect subtle variations in temperature profiles, solidification rates, and impurity distributions far more accurately and rapidly than human operators, allowing for immediate corrective actions, significantly reducing batch failures and ensuring superior product consistency, which is paramount for high-stakes applications like aerospace components.

A longer-term impact of AI lies in its capability to virtually simulate complex alloying reactions and predict the microstructural evolution of the final material. Traditional R&D cycles for new master alloys are time-consuming and resource-intensive, requiring numerous physical experiments. AI-driven materials informatics platforms leverage existing scientific databases and computational thermodynamics to screen thousands of potential alloy compositions simultaneously, identifying promising candidates that meet predefined performance criteria. This accelerated discovery process not only reduces R&D costs but also enables rapid customization of master alloys for emerging technologies, such as advanced battery materials or next-generation superconducting wires, ensuring the master alloy industry remains responsive to cutting-edge technological demands.

- Predictive Quality Control: AI algorithms monitor melt chemistry and casting parameters to predict and prevent defects, ensuring ultra-high purity required by end-users.

- Process Optimization: Machine learning models optimize furnace energy consumption and reduce cycle times by fine-tuning heating and cooling schedules.

- Raw Material Sourcing: AI-driven supply chain management forecasts demand fluctuations and optimizes procurement of expensive, high-purity metal inputs.

- Accelerated R&D: Materials informatics and computational simulation speed up the discovery of novel alloy compositions with superior properties.

- Additive Manufacturing Integration: AI optimizes powder characteristics and process parameters for specialized master alloy powders used in 3D printing.

- Maintenance Forecasting: Predictive maintenance scheduling for critical melting and casting equipment minimizes unplanned downtime, improving overall plant throughput.

DRO & Impact Forces Of Master Alloy Market

The dynamics of the Master Alloy Market are heavily influenced by a combination of powerful drivers, significant restraints, and compelling opportunities that shape investment decisions and strategic planning. A key driver is the relentless pursuit of lightweighting in the transportation industry, particularly in electric vehicles (EVs) and commercial aircraft, where aluminum and magnesium alloys modified by master alloys are crucial for maximizing performance and efficiency. Coupled with this is the escalating global defense expenditure, which necessitates robust, heat-resistant components manufactured from high-purity, nickel-based superalloys. Restraints primarily involve the high capital investment required for technologically advanced production facilities and the volatile pricing and availability of crucial raw materials, such as rare earth elements and specialized metals like strontium or titanium, which directly impact profit margins and supply stability. Opportunities are vast, centered around the rapid proliferation of additive manufacturing (AM), which demands highly specialized, fine-powdered master alloys, and the burgeoning clean energy sector requiring unique materials for efficient power generation and storage technologies.

The fundamental impact forces operating on this market include technological substitution pressure, regulatory compliance demands, and downstream industry growth cycles. Technological advancements in alternative alloying methods or entirely new composite materials pose a long-term threat of substitution, necessitating continuous innovation in master alloy production efficiency and quality. Stringent environmental, health, and safety (EHS) regulations in developed economies impose significant compliance costs, especially concerning emissions and waste management, acting as an implicit barrier to entry for new competitors. However, the sustained and cyclical growth of major end-use sectors—aerospace, automotive, and construction—provides a powerful, recurring demand force. When the automotive cycle is bullish, demand for large volume aluminum-based grain refiners surges, while strategic defense procurement boosts demand for smaller, high-value superalloy additions.

The market also faces external impact forces related to geopolitical stability and global trade dynamics. Disruptions in the supply chains of key alloying elements, particularly those sourced from politically sensitive regions, can severely restrict production capacity and inflate input costs. Furthermore, the capital-intensive nature of master alloy production often limits the speed at which the industry can react to sudden surges in demand, leading to potential supply bottlenecks during periods of high economic expansion. Balancing the need for continuous technological upgrades to meet increasingly complex material requirements against the need for stable, cost-effective production in a volatile raw materials market represents the most significant strategic challenge for market participants navigating this high-precision materials segment. The increasing complexity of modern alloys requires master alloy producers to engage in deeper technical partnerships with end-users to co-develop custom solutions, thereby solidifying long-term contractual stability.

Segmentation Analysis

The Master Alloy Market is comprehensively segmented based on the composition of the base metal (Type), the physical format in which the alloy is delivered (Form), and the ultimate industrial application (Application). This segmentation allows for precise market sizing and strategic targeting, reflecting the varied technological requirements and usage patterns across global industries. The aluminum-based segment currently dominates due to its widespread adoption in transportation and construction, but the high-growth segments, such as nickel and titanium-based alloys, are driving innovation and value expansion. The choice of form—whether ingots, rods, or highly specialized powders—is dictated by the end-user’s melting technology and specific processing needs, especially the rapid uptake of powder forms in additive manufacturing workflows.

- By Type:

- Aluminum-based Master Alloys

- Copper-based Master Alloys

- Nickel-based Master Alloys

- Zinc-based Master Alloys

- Lead-based Master Alloys

- Others (e.g., Titanium-based, Magnesium-based)

- By Form:

- Waffles

- Ingots

- Rods

- Buttons/Tablets

- Powder

- Others (e.g., Cut pieces, shot)

- By Application:

- Aerospace and Defense

- Automotive Industry

- Marine Engineering

- Electrical and Electronics

- Jewelry and Minting

- Industrial Manufacturing and Machinery

- Other applications (e.g., Chemical processing, Medical devices)

Value Chain Analysis For Master Alloy Market

The value chain of the Master Alloy Market commences with the upstream extraction and refining of primary metals and highly specialized alloying elements, such as high-purity silicon, chromium, boron, and rare earth metals. This initial stage is crucial as the purity and consistent quality of these raw materials directly dictate the performance characteristics of the final master alloy. Upstream suppliers must adhere to rigorous quality control standards, often requiring long-term contractual relationships with alloy producers to ensure stable supply and predictable pricing. Geopolitical risks associated with sourcing key elements, such as cobalt or certain rare earth additives, exert significant pressure at this foundational stage, influencing operational costs and supply chain resilience.

The midstream involves the core manufacturing process, where highly sophisticated induction melting, controlled cooling, and casting techniques are employed to combine the primary metal and the alloying elements into the desired master alloy composition (e.g., Al-B, Cu-Mg). This stage requires substantial capital investment in specialized furnace technology, inert atmosphere processing, and advanced analytical instrumentation (like spectrometers) for real-time quality assurance and batch consistency. Manufacturers differentiate themselves here through technological expertise, process yield optimization, and the ability to produce niche, high-specification products, such as ultra-fine atomized powders for 3D printing, which require significantly higher technological input compared to standard ingot production.

Downstream distribution channels typically involve both direct sales and specialized indirect routes. Major consumers, such as large integrated aluminum foundries, aerospace manufacturers, or high-volume automotive suppliers, often engage in direct procurement contracts with master alloy producers to ensure tailor-made products and technical support. Indirect distribution utilizes regional metal distributors and specialized chemical or metallurgical agents who manage inventory, handle smaller batch orders, and provide logistical support to mid-sized casting and fabrication shops. The efficiency of the downstream channel is critical for ensuring just-in-time delivery to end-users whose production schedules are often highly sensitive to material lead times, emphasizing the role of robust logistics and inventory management across the value chain.

Master Alloy Market Potential Customers

Potential customers for master alloys are predominantly large-scale industrial consumers requiring metallurgical modification of their base metal melts to achieve specific mechanical, thermal, or electrical properties in their final components. The largest segment of buyers comprises primary and secondary aluminum producers and foundries supplying the automotive and construction sectors, who consistently require aluminum-based grain refiners (like Al-Ti-B) and modifiers (like Al-Sr) to enhance castability and structural integrity. These customers are highly price-sensitive for standard, high-volume products but demand absolute consistency in performance, making supplier reliability and technical service paramount considerations in purchasing decisions.

Another crucial customer base lies within the aerospace and defense industries, including original equipment manufacturers (OEMs) and their tier-one suppliers. These entities purchase specialized, high-purity master alloys, primarily nickel-based and titanium-based, which are essential for producing superalloys used in turbine blades, jet engine components, and sophisticated defense platforms. For this segment, the criteria shift dramatically from cost to certified quality, traceability, and compliance with rigorous international standards (e.g., AS9100). The purchasing cycle is often long-term and governed by strict qualification processes, favoring suppliers capable of providing extensive documentation and customized alloy development.

The burgeoning electronics and specialized industries segment represents high-growth potential customers. Manufacturers of semiconductor components, high-efficiency electrical conductors, and advanced medical devices require specific copper or zinc-based master alloys to precisely control conductivity, heat dissipation, or biocompatibility. Furthermore, the jewelry and minting industries remain steady customers for precious metal master alloys (e.g., gold and silver alloys) used to adjust hardness, color, and casting properties. These diverse customer groups necessitate that master alloy suppliers maintain a broad portfolio of products, accompanied by deep metallurgical expertise to assist customers in solving complex material science challenges and optimizing their downstream manufacturing processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KBM Affilips, AMG Advanced Metallurgical Group, Axayya Alloy Pvt Ltd, Reading Alloys (A subsidiary of Ametek), Belmont Metals, Alcoa Corporation, GfE Metalle und Materialien, Sichuan Lande Industry, FESIL AS, Metallurgica, Milward Alloys, Reading Alloys, Materion Corporation, China Minmetals Corporation, Dowa Holdings Co., Ltd., Arconic Corporation, Advanced Technology & Materials Co., Ltd. (AT&M), SLM Solutions Group AG, ECKA Granules GmbH, Alumitech Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Master Alloy Market Key Technology Landscape

The key technology landscape in the Master Alloy Market is centered on achieving higher purity, better homogeneity, and innovative forms suitable for advanced manufacturing processes. The fundamental technology relies on precise melting and casting techniques, primarily utilizing vacuum induction melting (VIM) and electro-slag remelting (ESR) for producing high-integrity, contamination-free superalloys and specialized compositions. VIM is critical for preventing oxidation and nitrogen absorption, particularly when processing reactive elements like titanium or zirconium, ensuring that the final alloy meets the rigorous structural performance criteria demanded by aerospace turbine components. Continuous casting technologies are increasingly being implemented to enhance efficiency and reduce production costs for high-volume products like aluminum grain refiners, guaranteeing uniform cross-sectional structure and reduced scrap rates.

In response to the rapid rise of additive manufacturing (AM), atomization technology has emerged as a crucial area of investment. Gas atomization, plasma atomization, and water atomization techniques are used to produce fine, spherical master alloy powders with controlled particle size distribution and minimal porosity. These powders serve as feedstock for laser powder bed fusion (LPBF) and electron beam melting (EBM) processes, enabling the creation of complex, high-performance parts. The successful scaling of master alloy powder production requires significant technological advancements in powder handling and storage to prevent oxidation and ensure particle morphology consistency, which directly impacts the print quality and mechanical properties of the final 3D printed component.

Furthermore, process control and automation technologies are transforming the operational landscape. Advanced sensing systems, often integrated with AI and machine learning platforms, monitor melt composition and temperature profiles in real time, minimizing compositional variations from batch to batch. Spectroscopic analysis techniques, such as X-ray fluorescence (XRF) and inductively coupled plasma mass spectrometry (ICP-MS), are essential for rapid and precise verification of the alloy chemistry, ensuring that trace element specifications are met, especially in ultra-high purity materials. The adoption of smart factory principles, integrating IoT devices across the production floor, is helping manufacturers optimize energy usage, predict equipment failure, and maintain high standards of quality assurance throughout the entire complex manufacturing lifecycle.

Regional Highlights

The global Master Alloy Market exhibits distinct regional dynamics driven by varying levels of industrialization, technological maturity, and governmental focus on key end-use sectors. Asia Pacific (APAC) currently holds the dominant position, characterized by massive manufacturing capacity in automotive, consumer electronics, and infrastructure development, particularly centered in China, Japan, South Korea, and India. The region's immense output of primary aluminum necessitates large volumes of aluminum-based master alloys for grain refinement and modification. Furthermore, rapid urbanization and significant investment in domestic defense capabilities in countries like China and India are creating burgeoning demand for high-performance superalloys. The competitive landscape in APAC is intensifying, with local manufacturers rapidly adopting advanced technologies to challenge the market share of established Western players, often focusing on cost-effective, high-volume production.

North America represents a mature, high-value market, primarily defined by the stringent quality requirements of the aerospace and defense industries, which are concentrated heavily in the United States. The demand here is less focused on volume and more on ultra-high purity, custom-developed master alloys, especially nickel-based and titanium-based ones for turbine engines and advanced weaponry. The region leads in the adoption of master alloy powders for additive manufacturing, supported by significant government and private sector investment in next-generation material science. Regulatory compliance, particularly related to material traceability and environmental impact, drives continuous innovation towards cleaner production processes and sophisticated supply chain management, ensuring that North American suppliers remain at the forefront of quality assurance and technological complexity.

Europe mirrors North America in terms of technological sophistication and high quality demands, with Germany, France, and the UK serving as key hubs for advanced automotive production, aerospace manufacturing, and industrial machinery. European manufacturers prioritize sustainability and circular economy principles, leading to higher demand for master alloys that facilitate the recycling of complex aluminum and copper scrap while maintaining material integrity. The emphasis on developing electric vehicle technology is substantially boosting the requirement for specialized copper and aluminum alloys for battery cooling systems and high-voltage electrical components. The implementation of EU directives on material sourcing and chemical registration further influences regional product specifications and market entry strategies.

Latin America's master alloy consumption is closely tied to its strong domestic automotive production base (especially in Brazil and Mexico) and significant mining and energy infrastructure projects. While the overall market size is smaller than APAC or Europe, steady industrial growth and increasing foreign direct investment in manufacturing facilities are creating consistent demand. The primary need is for standard aluminum and zinc-based alloys. Market expansion is sensitive to regional economic volatility and currency fluctuations, which affect the cost of imported high-purity raw materials. Local producers focus on optimizing logistics and achieving competitive pricing to serve the regional automotive supply chains effectively.

The Middle East and Africa (MEA) region presents a growing, albeit fragmented, market characterized by major infrastructure build-outs, substantial oil and gas investment, and increasing aerospace MRO capabilities, particularly in the UAE and Saudi Arabia. The demand for master alloys in MEA is highly concentrated around construction-grade aluminum alloys and high-temperature alloys needed for energy sector maintenance and expansion. Economic diversification efforts by Gulf Cooperation Council (GCC) countries away from oil dependency are expected to stimulate local manufacturing, increasing the complexity and volume of master alloy requirements over the forecast period. However, logistical challenges and reliance on global suppliers for high-purity materials remain significant factors influencing market development.

- Asia Pacific (APAC): Dominant region driven by large-scale automotive manufacturing, electronics production, and infrastructure investment; high volume consumer of aluminum-based alloys.

- North America: High-value market focused on aerospace, defense, and additive manufacturing; stringent requirements for nickel and titanium superalloys and specialized powders.

- Europe: Mature market emphasizing sustainability, high-end automotive (especially EVs), and specialized industrial machinery; strong demand for complex recycling-compatible alloys.

- Latin America (LATAM): Growth driven by regional automotive production and infrastructure projects; susceptible to economic volatility impacting raw material imports.

- Middle East & Africa (MEA): Emerging growth linked to infrastructure development, energy sector maintenance, and economic diversification efforts; demand focused on construction and high-temperature alloys.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Master Alloy Market.- KBM Affilips

- AMG Advanced Metallurgical Group

- Axayya Alloy Pvt Ltd

- Reading Alloys (A subsidiary of Ametek)

- Belmont Metals

- Alcoa Corporation

- GfE Metalle und Materialien

- Sichuan Lande Industry

- FESIL AS

- Metallurgica

- Milward Alloys

- Reading Alloys

- Materion Corporation

- China Minmetals Corporation

- Dowa Holdings Co., Ltd.

- Arconic Corporation

- Advanced Technology & Materials Co., Ltd. (AT&M)

- SLM Solutions Group AG (Powder segment focus)

- ECKA Granules GmbH

- Alumitech Corporation

Frequently Asked Questions

Analyze common user questions about the Master Alloy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of master alloys in metallurgy and why are they preferred over pure elements?

Master alloys serve three primary functions: grain refinement, modification, and hardening. They are preferred because they possess a lower melting point than the base metal, facilitating rapid and uniform dissolution in the melt, minimizing oxidation losses, and ensuring precise control over the final chemical composition. Using concentrated master alloys improves overall metallurgical efficiency and consistency in the casting process compared to adding pure, often highly reactive, elemental metals.

Which segment of the Master Alloy Market is projected to exhibit the fastest growth rate through 2033?

The Nickel-based Master Alloys segment is anticipated to display the fastest growth rate. This accelerated expansion is largely attributed to the robust demand from the aerospace and industrial gas turbine sectors, which require superalloys capable of enduring extreme temperatures and high mechanical stresses. Additionally, the increasing utilization of these specialized alloys in high-end energy generation and chemical processing environments contributes significantly to their market valuation increase.

How is the rise of Additive Manufacturing (AM) impacting the demand for master alloys?

Additive Manufacturing (3D printing) is fundamentally shifting demand towards high-purity, spherical master alloy powders. AM processes require feedstocks with extremely tight particle size distribution and high flowability. Master alloy manufacturers are investing heavily in advanced atomization technologies (gas and plasma) to produce these specialized powders, enabling the fabrication of complex, high-performance components with superior mechanical properties, driving a new, high-value segment within the master alloy market.

What key strategic factors influence the selection of a master alloy supplier by an aerospace manufacturer?

Aerospace manufacturers prioritize certified quality, absolute traceability, and consistency above cost. Key factors include adherence to strict global aerospace standards (e.g., AS9100), the supplier’s ability to provide ultra-high purity materials with minimal trace element contamination, extensive testing documentation, and proven logistical reliability to ensure just-in-time delivery for critical component manufacturing programs. Technical partnership for customized alloy development is also highly valued.

What role does the Asia Pacific region play in the global Master Alloy Market outlook?

Asia Pacific (APAC) is the largest and most dominant region in the global Master Alloy Market, primarily due to its expansive manufacturing base across automotive, electronics, and construction sectors. High levels of industrial output in economies such as China and India drive immense volumetric demand, particularly for aluminum and copper-based alloys. APAC manufacturers are increasingly focused on process efficiency and competitive pricing, establishing the region as the epicenter for high-volume master alloy production and consumption globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Master Alloy Market Size Report By Type (Aluminium-based Master Alloy, Copper-based Master Alloy, Others), By Application (Transportation, Building and Construction, Package, Energy, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Master Alloy Market Statistics 2025 Analysis By Application (Transportation, Building and Construction, Package, Energy), By Type (Aluminium-based Master Alloy, Copper-based Master Alloy), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Master Alloy Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Copper-based master alloy, Aluminium-based master alloy, Others), By Application (Transportation, Building and Construction, Package, Energy, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager