Material Testing Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437191 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Material Testing Machines Market Size

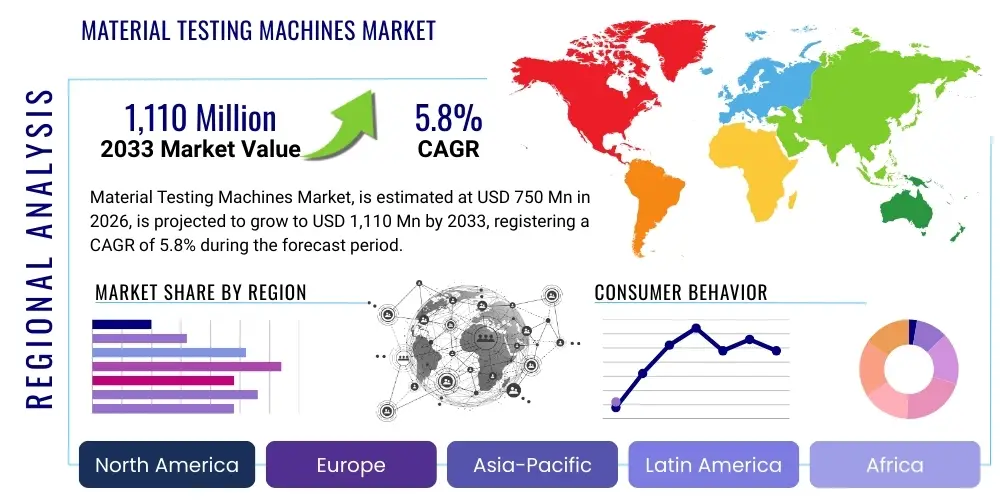

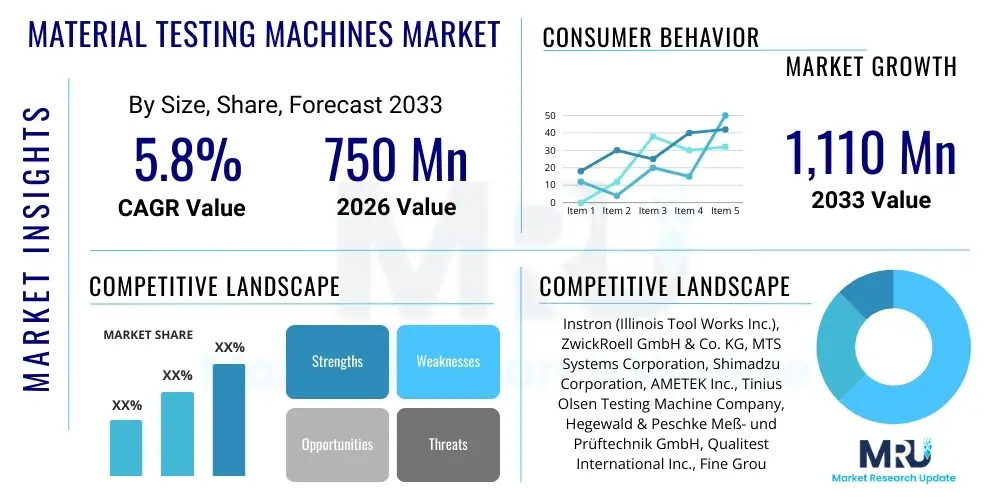

The Material Testing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 750 million in 2026 and is projected to reach USD 1,110 million by the end of the forecast period in 2033.

Material Testing Machines Market introduction

The Material Testing Machines Market encompasses specialized equipment designed to evaluate the physical, mechanical, and structural properties of raw materials, components, and finished products. These machines are fundamental to quality assurance, product development, and regulatory compliance across virtually all manufacturing and construction sectors. They determine crucial characteristics such as tensile strength, compression resistance, hardness, fatigue limit, impact resistance, and creep behavior, ensuring that materials meet specified standards for safety, durability, and performance. The reliability of industrial processes and consumer goods is intrinsically linked to the precision and accuracy offered by modern testing equipment, driving their continuous adoption globally.

The core product portfolio includes Universal Testing Machines (UTMs), which are versatile instruments capable of performing tensile, compression, and flexural tests; specialized machines like hardness testers (Rockwell, Vickers, Brinell), impact testers (Charpy and Izod), and dynamic fatigue testers are also critical components. Major applications span the automotive industry, where lightweighting materials require rigorous testing; aerospace, demanding extreme precision for high-performance alloys; construction, verifying concrete and steel integrity; and medical devices, ensuring biocompatibility and mechanical longevity. The ability of these machines to provide quantifiable data on material failure modes and behavioral response under stress makes them indispensable tools in engineering and research & development.

Key benefits derived from using advanced material testing machines include enhanced product quality, reduced failure rates, compliance with stringent international standards (such as ISO, ASTM, and DIN), and significant cost savings associated with avoiding material defects early in the production cycle. Driving factors for market growth include the global infrastructure boom, increasing focus on lightweight yet robust materials in electric vehicle and aerospace manufacturing, and the stringent regulatory environment requiring certified material performance. Furthermore, the integration of automation, software-driven controls, and non-destructive testing (NDT) capabilities is expanding the market's addressable opportunities.

Material Testing Machines Market Executive Summary

The Material Testing Machines Market is experiencing robust growth fueled by intensifying demand for precision engineering and compliance across high-value sectors such as aerospace and automotive. Business trends indicate a strong shift towards highly automated, digital testing solutions capable of remote monitoring and AI-driven data analysis, moving away from purely manual operations. Key players are focusing on modular designs for Universal Testing Machines (UTMs) to cater to diverse testing requirements and integrating advanced sensor technology for superior data fidelity. Moreover, the growing emphasis on sustainable and recycled materials necessitates novel testing methods to certify their structural integrity, creating opportunities for specialized equipment development. Supply chain optimization, particularly the integration of testing processes directly onto the production line (in-line testing), is a dominant operational strategy being pursued by market leaders to enhance efficiency and throughput.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily driven by massive infrastructure investments, rapid urbanization, and the establishment of large-scale manufacturing hubs in countries like China and India. North America and Europe maintain leading positions in terms of technology adoption, characterized by high spending on R&D and strict regulatory mandates requiring advanced dynamic and fatigue testing equipment for complex projects. The demand in Latin America and the Middle East & Africa (MEA) is accelerating, largely influenced by rising oil & gas investments and diversification efforts requiring certified construction and material standards. This regional dynamism ensures a geographically dispersed revenue growth trajectory, necessitating tailored market penetration strategies based on local industrial requirements and regulatory landscapes.

Segmentation analysis confirms that Universal Testing Machines (UTMs) dominate the market revenue share due to their versatile application profile, while impact testing machines are projected to exhibit the highest growth rate, reflecting the increased need to assess material resilience in crash and high-stress scenarios, particularly within the electric vehicle battery housing and aerospace sectors. Application-wise, the automotive segment remains the largest end-user, but the medical devices sector is experiencing substantial acceleration driven by the development of novel implants and surgical tools demanding ultra-precise mechanical property validation. The shift toward software and automation components as high-value add-ons rather than mere hardware sales is fundamentally transforming segment revenue streams and increasing the profitability margins associated with ongoing maintenance and software licensing.

AI Impact Analysis on Material Testing Machines Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Material Testing Machines Market revolve heavily around how AI can enhance efficiency, reduce human error, and accelerate the development cycle. Users frequently ask about the capabilities of AI in predictive maintenance for testing equipment, the potential for AI algorithms to interpret complex test results automatically (such as identifying subtle fracture patterns or inconsistencies), and whether AI integration can minimize the sheer volume of physical tests required through high-fidelity simulations. There is significant interest in AI's role in optimizing test protocols, dynamically adjusting load settings based on real-time material response, and ensuring testing conformity across diverse global facilities. The overarching themes reflect a user desire for higher throughput, superior data analysis, and a move towards 'smart testing' environments that reduce material wastage and accelerate time-to-market for new products. Concerns often center on data security, the validation process for AI-derived results, and the requisite workforce upskilling needed to manage these sophisticated systems.

The integration of Artificial Intelligence is poised to fundamentally revolutionize the material testing landscape, transitioning the industry from descriptive data reporting to prescriptive action and predictive modeling. AI algorithms are increasingly being deployed to analyze vast datasets generated during mechanical testing, allowing for the rapid identification of subtle anomalies or correlations that human analysts might miss. This capability significantly improves the quality assurance process, enabling proactive adjustments to manufacturing parameters or material composition before extensive defects occur. Furthermore, AI powers predictive maintenance strategies for the testing machinery itself, optimizing operational uptime and scheduling necessary calibration or repairs based on sensor data analysis, thereby minimizing costly unplanned downtime and maximizing asset utilization throughout the laboratory infrastructure.

Beyond data analysis and maintenance, AI is critical in optimizing the testing parameters and methodologies. Machine learning models can be trained on historical test data and material characteristics to suggest optimal load speeds, temperature profiles, and cycling protocols to achieve desired results more efficiently, reducing the time spent on iterative physical testing. For instance, in fatigue testing, AI can predict the remaining useful life (RUL) of a material sample with higher accuracy after only a fraction of the test cycles are completed, drastically cutting down testing time while maintaining data reliability. This shift towards AI-driven optimization is crucial for industries like aerospace and defense, where the cost and time associated with traditional long-duration tests are extremely prohibitive, marking AI as a core strategic enabler for future material science innovation.

- AI-driven predictive analytics for identifying material failure modes.

- Optimization of testing protocols, reducing iterative physical trials and speeding up R&D cycles.

- Enhanced quality control through automated detection of subtle defects and data anomalies.

- Predictive maintenance planning for testing machinery, maximizing operational uptime.

- Automated generation of conformity reports and regulatory compliance documentation.

- Simulation-assisted testing, reducing the need for destructive physical testing volumes.

DRO & Impact Forces Of Material Testing Machines Market

The Material Testing Machines Market is significantly influenced by a dynamic interplay of Drivers, Restraints, Opportunities, and macro-environmental forces. A primary driver is the accelerating global focus on quality assurance and regulatory compliance, particularly in high-risk sectors such as nuclear, aerospace, and medical devices, where material failure can have catastrophic consequences. This regulatory pressure mandates the use of certified, high-precision testing equipment. Concurrently, technological advancements, including the adoption of sensor fusion, IoT integration, and sophisticated software for test control and data acquisition, are enhancing machine capabilities, driving the replacement cycle for older analog equipment and fueling investment in new, digitized platforms. These factors collectively push the market forward, ensuring a continuous demand for advanced testing solutions that adhere to evolving international standards like ASTM and ISO.

Restraints primarily involve the substantial initial capital expenditure required for sophisticated testing machines, such as dynamic fatigue testers or high-capacity Universal Testing Machines (UTMs), which can deter smaller enterprises or developing economies from immediate adoption. Furthermore, the complexity of operating and maintaining highly specialized equipment necessitates a skilled workforce, and the shortage of trained personnel capable of advanced test methodology setup and data interpretation poses a significant operational restraint. Economically, global manufacturing slowdowns or unexpected shifts in infrastructure spending can also temporarily curb demand, particularly for large, construction-focused testing machines. Overcoming these restraints requires manufacturers to offer flexible financing models and comprehensive training programs.

Opportunities abound, particularly in the realm of non-destructive testing (NDT), which allows for the integrity assessment of finished components without causing damage, a crucial requirement in high-value manufacturing. The rapid growth of the electric vehicle (EV) industry presents a lucrative opportunity, demanding specialized testing equipment for battery materials, lightweight body structures, and complex composite materials requiring accurate thermal and mechanical performance validation. Furthermore, the shift towards modular, interconnected, and cloud-enabled testing systems offers manufacturers a pathway to recurring revenue through software-as-a-service (SaaS) models and specialized calibration contracts. The intensifying focus on material sustainability and the testing of bio-based or recycled materials also opens entirely new market verticals for specialized testing machines. Impact forces such as governmental standardization bodies, global trade policies affecting material sourcing, and rapid industrial digitalization heavily shape the competitive landscape and technological investment priorities.

Segmentation Analysis

The Material Testing Machines Market segmentation is crucial for understanding the diverse needs and purchasing patterns across different industrial landscapes. The market is primarily segmented based on machine type, testing type, application (end-use industry), and geographic region. Analyzing these segments helps stakeholders tailor their product offerings, sales strategies, and R&D investments. The structure is heavily weighted towards mechanical testing devices, which form the bedrock of quality control in manufacturing. Technological differentiation, particularly between destructive and non-destructive methods, further refines the market categories, reflecting varied needs from basic tensile strength checks to complex structural integrity assessments of high-value components.

- By Type:

- Universal Testing Machines (UTM)

- Hardness Testing Machines (Rockwell, Brinell, Vickers, Knoop)

- Impact Testing Machines (Charpy and Izod)

- Fatigue Testing Machines (Dynamic and Static)

- Torque Testing Machines

- Creep and Stress Rupture Testing Machines

- Corrosion Testing Machines

- Non-Destructive Testing (NDT) Equipment (Ultrasonic, Eddy Current, Radiography)

- By Testing Type:

- Destructive Testing (DT)

- Non-Destructive Testing (NDT)

- By Application (End-use Industry):

- Automotive and Transportation

- Aerospace and Defense

- Construction and Infrastructure (Cement, Concrete, Aggregates)

- Metals and Metallurgy

- Plastics and Polymers

- Textiles and Composites

- Medical Devices and Healthcare

- Education and Research & Development (R&D)

- Energy (Oil & Gas, Power Generation)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (MEA) (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Material Testing Machines Market

The Value Chain for the Material Testing Machines Market begins with upstream activities focusing on the procurement of highly specialized components, including precision sensors (load cells, extensometers), advanced hydraulic and electromechanical systems, sophisticated control electronics, and industrial-grade software. Key upstream challenges involve maintaining high-quality standards for these complex components, as the accuracy of the final testing machine directly relies on the precision of its sub-systems. Manufacturers often forge long-term partnerships with specialized sensor providers and software developers to ensure proprietary technological advantages and component reliability. Effective upstream management is critical for minimizing manufacturing lead times and ensuring competitive pricing for the final product, given the high fixed costs associated with calibration and certification of base components.

Midstream activities involve the design, assembly, calibration, and final certification of the testing equipment. This stage is dominated by core Original Equipment Manufacturers (OEMs) who integrate the procured components, develop proprietary control software, and rigorously calibrate the machines to meet international standards (ISO/IEC 17025 accreditation is highly valued here). Manufacturing processes are characterized by high complexity, demanding skilled technical labor and clean room environments for sensor integration. Downstream activities focus heavily on installation, training, and robust after-sales support. Given the mission-critical nature of these machines in quality control labs, reliable technical service, prompt spare part availability, and continuous software updates constitute a major revenue stream and competitive differentiator for market players. Lifecycle support services often extend beyond hardware maintenance to include compliance consulting and methodology optimization.

Distribution channels for material testing machines are complex, often utilizing both direct and indirect sales models. Direct sales are predominantly employed for high-value, customized systems, such as large fatigue testers or specialized aerospace testing rigs, where detailed technical consultation and direct client interaction are necessary. This approach allows OEMs to maintain better control over pricing and customer relationships. Indirect channels, involving authorized distributors, technical representatives, and specialized sales agents, are more common for standardized products like desktop hardness testers or mid-range UTMs. These indirect channels are particularly effective in penetrating geographically diverse and emerging markets. The choice of channel is heavily influenced by the required level of technical support and customization needed for the specific machine type, with service contracts and ongoing calibration services forming an inseparable part of the overall distribution package.

Material Testing Machines Market Potential Customers

The potential customers for Material Testing Machines span a wide spectrum of industries and institutions whose operations are intrinsically linked to material performance, safety, and compliance. The primary end-users are manufacturers across various sectors, ranging from automotive and aerospace to packaging and consumer electronics, all requiring rigorous verification of raw materials and finished components. These buyers, highly focused on mitigating failure risk and ensuring product longevity, invest in these machines as essential capital equipment for in-house quality control labs. Their purchasing decisions are driven by production volume, the complexity of materials used (e.g., composites versus standard metals), and mandatory industry certifications (e.g., FAA approval in aerospace or FDA clearance in medical devices).

Another significant customer segment includes independent commercial testing laboratories and government regulatory bodies. Commercial labs offer third-party certification and testing services, catering to companies that lack the internal resources or specialized equipment for specific tests. Government agencies and standardization organizations (like NIST, national metrology institutes) use these machines to set and verify national and international standards, ensuring trade fairness and public safety. These customers demand the highest levels of accuracy, traceability, and compliance with strict calibration protocols (often requiring specific accreditations like ISO/IEC 17025), prioritizing machine robustness and software documentation capabilities over initial cost.

Finally, the academic and research community represents a vital customer segment. Universities, polytechnic institutions, and dedicated R&D centers globally require advanced testing machines to conduct fundamental research into novel materials (such as nanotechnology-enabled composites, bio-materials, and smart alloys) and to train future engineers and material scientists. These buyers often seek versatile, modular systems—especially Universal Testing Machines (UTMs) with comprehensive software interfaces—that can accommodate a wide range of academic projects. Their purchasing cycle is often dictated by grant funding availability, and they frequently prioritize integration with existing laboratory equipment and advanced data visualization tools for educational purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 million |

| Market Forecast in 2033 | USD 1,110 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Instron (Illinois Tool Works Inc.), ZwickRoell GmbH & Co. KG, MTS Systems Corporation, Shimadzu Corporation, AMETEK Inc., Tinius Olsen Testing Machine Company, Hegewald & Peschke Meß- und Prüftechnik GmbH, Qualitest International Inc., Fine Group, S.A.E.C. Ltd., Hung Ta Instrument Co., Ltd., Testometric Company Ltd., NDT Systems Inc., ADMET Inc., Torontek Group, Galdabini S.p.A., Cooper Technology, Mitutoyo Corporation, Mahr GmbH, Starrett Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Material Testing Machines Market Key Technology Landscape

The technological landscape of the Material Testing Machines Market is rapidly evolving, driven primarily by the need for higher precision, increased automation, and seamless data integration. A foundational technology shift involves the pervasive replacement of older hydraulic and mechanical systems with advanced servo-electric and servo-hydraulic actuation systems. Servo-electric systems offer superior control, higher energy efficiency, and better repeatability, which are critical for precision applications like biomedical testing and micro-material characterization. Simultaneously, the sensors used in these machines—specifically load cells, strain gauges, and extensometers—are transitioning towards digital architectures, offering better signal-to-noise ratios, inherent calibration memory, and enhanced resistance to electromagnetic interference, thereby improving the overall fidelity of the acquired test data.

The increasing importance of connectivity and software is another major technological trend. Modern material testing machines are IoT-enabled, facilitating remote diagnostics, real-time data monitoring, and centralized management of testing fleets across geographically dispersed facilities. Software platforms are becoming highly sophisticated, incorporating user-friendly interfaces, advanced data visualization tools, and modules dedicated to compliance reporting based on various standards (ASTM, ISO, etc.). Furthermore, the convergence of destructive testing (DT) with non-destructive testing (NDT) techniques, often within the same testing environment, allows for a more holistic material assessment. For instance, combining mechanical loading with ultrasonic or eddy current inspection provides deeper insight into material behavior under stress before catastrophic failure, enhancing predictive modeling capabilities.

Advanced computational technologies, particularly Artificial Intelligence (AI) and Machine Learning (ML), are moving beyond the conceptual stage into practical implementation. AI is leveraged for optimizing test parameters, automating the interpretation of complex results (e.g., fatigue crack initiation and propagation analysis), and performing predictive maintenance on the machines. Furthermore, the rising demand for testing complex materials, such as carbon fiber reinforced polymers (CFRP) and new metal matrix composites, necessitates specialized technologies like high-frequency dynamic testing rigs and environmental chambers capable of simulating extreme temperature or corrosive conditions. Thermal imaging and digital image correlation (DIC) are also increasingly integrated to analyze surface deformation and thermal stress distribution non-contactively, significantly expanding the scope and accuracy of material performance evaluation.

Regional Highlights

Regional dynamics play a crucial role in shaping the Material Testing Machines Market, reflecting varied levels of industrialization, regulatory stringency, and R&D investment across the globe. Asia Pacific (APAC) currently dominates the market in terms of volume and is expected to exhibit the highest CAGR during the forecast period. This growth is underpinned by massive government initiatives in infrastructure development (road, rail, bridges), rapid expansion of the domestic automotive and consumer electronics manufacturing sectors, and substantial investments in specialized testing laboratories in countries like China, India, and South Korea. These regions are focused on acquiring cost-effective, high-throughput machines to support high-volume production quality control. Compliance with export standards is also driving the necessity for internationally certified testing equipment.

North America and Europe represent mature markets characterized by high adoption rates of advanced, technologically sophisticated equipment. These regions lead in the demand for dynamic and specialized testing machines, particularly in the aerospace, defense, and medical device sectors, which require stringent fatigue and fracture mechanics testing. The market here is driven by the replacement of legacy systems with IoT-enabled, automated solutions and substantial expenditure on R&D for next-generation materials, especially those related to sustainable energy production and electric vehicle technology. Regulatory frameworks in the EU and the US mandate continuous investment in cutting-edge, calibrated equipment to maintain certifications and competitive advantage, favoring premium, high-accuracy vendors.

Latin America and the Middle East & Africa (MEA) are emerging markets showing significant potential. Growth in MEA, particularly in the GCC countries, is linked to ambitious diversification strategies away from oil dependence, focusing on construction, logistics, and establishing regional manufacturing hubs, thus increasing the need for certified material integrity checks, especially for construction materials and pipelines. Latin American growth, led by Brazil and Mexico, is fueled by recovering automotive production and ongoing investments in energy infrastructure. While price sensitivity remains a factor in these regions, the emphasis on establishing reliable quality assurance processes in line with international partners is accelerating the uptake of standardized Universal Testing Machines and essential NDT equipment.

- Asia Pacific (APAC): Key growth engine driven by manufacturing expansion (China, India), infrastructure projects, and increasing focus on domestic quality standards. High demand for cost-efficient UTMs and NDT solutions.

- North America: Leading market for advanced, high-precision, and dynamic testing equipment; strong drivers from aerospace, defense, and medical devices sectors; high R&D spending promoting AI integration.

- Europe: Characterized by stringent quality and environmental standards (e.g., EU regulations); significant demand for fatigue testing and complex material characterization, particularly in the automotive (EV) and energy industries.

- Middle East & Africa (MEA): Emerging market growth fueled by infrastructural diversification projects and investments in oil & gas pipeline integrity assessment, leading to demand for specialized NDT and construction material testers.

- Latin America: Market stability linked to automotive sector recovery and raw material extraction industries; focusing on acquiring reliable equipment to meet international export quality benchmarks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Material Testing Machines Market.- Instron (Illinois Tool Works Inc.)

- ZwickRoell GmbH & Co. KG

- MTS Systems Corporation

- Shimadzu Corporation

- AMETEK Inc.

- Tinius Olsen Testing Machine Company

- Hegewald & Peschke Meß- und Prüftechnik GmbH

- Qualitest International Inc.

- Fine Group, S.A.E.C. Ltd.

- Hung Ta Instrument Co., Ltd.

- Testometric Company Ltd.

- NDT Systems Inc.

- ADMET Inc.

- Torontek Group

- Galdabini S.p.A.

- Cooper Technology

- Mitutoyo Corporation

- Mahr GmbH

- Starrett Company

- Elmendorf Testing Equipment

Frequently Asked Questions

Analyze common user questions about the Material Testing Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Universal Testing Machines (UTMs)?

The primary driver for Universal Testing Machines (UTMs) is their versatility and indispensability across diverse industries, allowing for comprehensive destructive testing (tensile, compression, flexural) on a wide range of materials (metals, plastics, composites) essential for universal quality control and regulatory compliance checks mandated by standards like ASTM and ISO.

How is Non-Destructive Testing (NDT) impacting the Material Testing Machines Market?

NDT is significantly expanding the market by allowing manufacturers to assess the structural integrity and internal characteristics of high-value finished components without causing damage. This is critical in aerospace and automotive sectors, driving demand for specialized NDT equipment such as ultrasonic, eddy current, and radiographic testing machines integrated with mechanical testers for real-time analysis.

Which application segment holds the largest share in the Material Testing Machines Market?

The automotive and transportation sector currently holds the largest market share. This dominance is due to stringent safety regulations, the trend towards lightweighting (using advanced composites and high-strength steels), and the immense R&D required for electric vehicle components, particularly battery housing and structural parts that demand intensive mechanical and fatigue testing.

What role does automation play in the evolution of material testing equipment?

Automation is crucial for enhancing testing throughput, ensuring repeatability, and reducing human error. Modern machines incorporate robotic sample handling, automated calibration routines, and software-driven test sequencing, enabling 24/7 operation and seamless integration of testing results directly into enterprise resource planning (ERP) systems for efficient quality management.

What are the key technological challenges facing material testing equipment manufacturers?

Key challenges include developing equipment capable of handling ultra-complex, multi-phase materials (like advanced composites and bio-materials), ensuring high-speed data acquisition for dynamic testing, integrating AI for reliable result interpretation, and meeting the increasingly tight tolerance requirements mandated by next-generation manufacturing processes, all while adhering to global calibration traceability standards.

What types of sensors are critical for the accuracy of modern material testing machines?

Modern material testing machines rely heavily on high-precision digital load cells, which measure force; advanced optical or video extensometers, which accurately measure strain without contacting the sample; and sophisticated displacement transducers. These sensors, often integrated with temperature and humidity probes, ensure accurate data acquisition for mechanical properties under various environmental conditions.

How do global regulatory standards influence the purchasing decisions for testing machines?

Global standards, such as those set by ASTM International, ISO, and national bodies (DIN, BS), directly dictate the technical specifications and mandatory features of testing equipment. Companies must purchase machines that are rigorously calibrated and certified to perform tests precisely according to these standards, making compliance a non-negotiable factor in procurement and favoring OEMs offering full traceability and accredited calibration services.

Why is the medical device sector a rapidly growing segment for material testing?

The medical device sector is accelerating due to the rapid innovation in implants, prosthetics, and surgical tools, all of which require rigorous testing for biocompatibility, fatigue resistance (especially for long-term implants), and ultra-precise mechanical behavior validation. Testing for micro-materials and bio-resorbable polymers demands highly specialized, low-force, high-accuracy testing systems.

What is the impact of Industry 4.0 principles on material testing laboratories?

Industry 4.0 principles drive the integration of testing labs into the broader digital manufacturing ecosystem. This involves deploying IoT sensors for real-time machine performance monitoring, utilizing cloud-based data storage for centralized analysis, and employing AI/ML for prescriptive quality control, effectively creating 'smart labs' that enhance operational efficiency and predictive capability across the production chain.

How does the demand for lightweight materials affect the market for testing machines?

The push for lightweighting, particularly in aerospace and automotive industries (driven by fuel efficiency and EV range extension), increases demand for advanced testing equipment suitable for composites (CFRPs, GFRPs) and specialized alloys. These materials require complex fatigue, impact, and interlaminar shear strength testing, driving investment in biaxial and multi-axis testing systems that simulate real-world stress states.

What distinguishes static fatigue testing from dynamic fatigue testing?

Static fatigue testing (creep testing) assesses how a material behaves under a constant load over a long period, typically at elevated temperatures, relevant for components in power generation or high-temperature piping. Dynamic fatigue testing applies cyclical, varying loads, simulating real-world wear and tear (e.g., aircraft wing flapping), crucial for determining the material's lifespan and endurance limit under repeated stress.

What is the role of Digital Image Correlation (DIC) technology in material testing?

DIC is a non-contact optical measurement technique that uses high-resolution cameras to track surface deformation and strain patterns on materials under load. It provides full-field, three-dimensional displacement and strain data, offering much richer insights than traditional single-point strain gauges, particularly valuable for composite materials and fracture mechanics studies.

Why is software integration increasingly important for material testing machine vendors?

Software integration is crucial because it provides the interface for sophisticated test control, data acquisition, analysis, and reporting. Vendors leverage proprietary software to offer advanced features like automated compliance checking, custom test protocol creation, and secure data archival, transforming the machine from a piece of hardware into a comprehensive, managed testing solution with recurring revenue potential through updates and licenses.

What market opportunities exist related to sustainable and recycled materials?

The increasing global emphasis on sustainability necessitates specialized testing protocols for recycled polymers, bio-based materials, and construction waste derivatives. This creates opportunities for testing equipment manufacturers to develop new fixtures and methodologies that accurately assess the long-term durability, mechanical stability, and batch consistency of these emerging sustainable materials.

How does the high capital cost of testing machines restrain market growth?

The high capital investment required for advanced testing systems (e.g., servo-hydraulic fatigue testers) restricts adoption, particularly among Small and Medium Enterprises (SMEs) and academic institutions with limited budgets. This restraint is often mitigated by vendors offering leasing options, modular systems that allow for staged investment, or promoting third-party testing services as an alternative to outright purchase.

What is the main driver for the adoption of hardness testing machines?

The primary driver is the necessity for rapid, non-destructive assessment of material surface quality, wear resistance, and heat treatment effectiveness in production lines. Hardness testing (such as Rockwell and Vickers methods) is a quick and essential metric for determining the quality control and consistency of manufactured components like gears, shafts, and metal tooling.

In the Value Chain, what are the critical components sourced during upstream activities?

Upstream activities focus on sourcing high-precision components vital for accuracy, including high-capacity, traceable load cells, specialized hydraulic or electro-mechanical actuators, precision linear motion guides, and sophisticated, industrial-grade control electronics and data acquisition cards, all of which require rigorous quality checks.

How is the aerospace industry's demand for certification influencing the equipment market?

The aerospace industry demands exceptionally high standards for material certification (e.g., failure analysis, lifetime prediction), driving demand for highly customized, ultra-reliable fatigue, fracture mechanics, and elevated-temperature testing systems. Equipment must be calibrated to the highest degree of traceability and often requires specific aerospace-related software modules for data reporting.

What is the estimated Compound Annual Growth Rate (CAGR) for the Material Testing Machines Market?

The Material Testing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% over the forecast period spanning from 2026 to 2033, driven by increasing industrialization and regulatory pressure across key manufacturing regions, particularly Asia Pacific.

What are the typical after-sales services offered by OEMs in this market?

After-sales services are a crucial revenue stream, typically encompassing accredited calibration services (essential for compliance), preventative and predictive maintenance contracts (often leveraging IoT data), repair and spare parts supply, software updates and training, and technical consulting on complex testing methodologies and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager