Maternal and Infant Toiletries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432078 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Maternal and Infant Toiletries Market Size

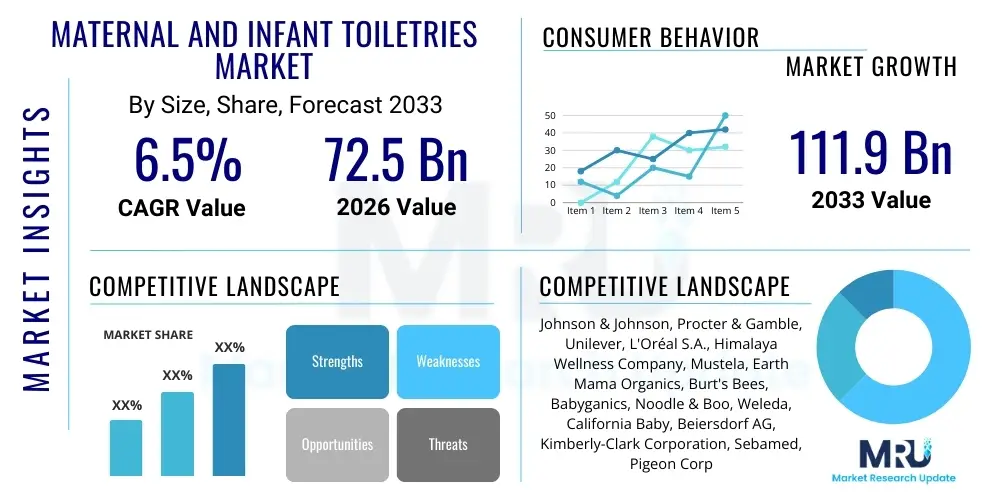

The Maternal and Infant Toiletries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 72.5 Billion in 2026 and is projected to reach USD 111.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by rising global birth rates, particularly in emerging economies, coupled with increasing consumer awareness regarding the need for specialized, safe, and hypoallergenic products tailored for sensitive skin. Furthermore, the burgeoning spending power of millennial parents, who prioritize premium, organic, and natural ingredients, significantly contributes to the high valuation forecast.

Market expansion is also supported by continuous product innovation, focusing on sustainability and enhanced functional performance. Manufacturers are investing heavily in research and development to introduce clinically tested, tear-free formulations and biodegradable packaging solutions, aligning with global environmental sustainability goals. The shift from traditional generic personal care items to specialized maternal and infant lines, often featuring certified organic ingredients and free-from lists (parabens, sulfates, phthalates), is a critical trend bolstering market value. The established preference for branded, dermatologist-recommended products in developed nations also stabilizes growth trajectories.

Geographical dynamics play a pivotal role in market size determination. Asia Pacific, led by populous countries like China and India, represents the fastest-growing region, fueled by rapid urbanization, improving healthcare infrastructure, and the massive scale of its consumer base. North America and Europe, while mature, maintain high per capita spending on premium and luxury maternal and infant care items, focusing intensely on efficacy and ethical sourcing. The overall market size reflects a consistent pattern of premiumization across all product categories, from body wash and shampoo to specialized creams and oils.

Maternal and Infant Toiletries Market introduction

The Maternal and Infant Toiletries Market encompasses a diverse range of specialized personal care and hygiene products designed specifically for expectant and new mothers (maternity care) and infants from newborn to toddler age (infant care). This category includes bathing products, skin care items, hair care solutions, and cleansing wipes, all formulated to meet the high standards of safety, gentleness, and non-toxicity required for these sensitive demographics. Key product descriptions involve items such as tear-free shampoos, hypoallergenic lotions, diaper rash creams, stretch mark oils, and nipple balms, prioritizing mild surfactants, natural extracts, and pH-neutral compositions. Major applications span daily hygiene, moisturizing, preventative skin care, and addressing common dermatological issues specific to pregnancy or infancy. The primary benefits derived from these specialized products include enhanced skin barrier protection, prevention of irritation and allergies, maintenance of optimal skin hydration, and promoting overall health and comfort for both mother and child. Driving factors propelling this market include rising disposable incomes globally, particularly in Asia Pacific, the increased focus on child hygiene and wellness driven by educational initiatives, the expansion of e-commerce platforms facilitating product accessibility, and substantial marketing efforts by key industry players emphasizing clinical safety and natural ingredient sourcing, thereby creating strong consumer confidence and loyalty towards specialized branded products over generic alternatives, sustaining robust demand.

Maternal and Infant Toiletries Market Executive Summary

The Maternal and Infant Toiletries Market is experiencing profound shifts influenced by prevailing business, regional, and segment trends, forecasting robust growth toward USD 111.9 Billion by 2033. Business trends are characterized by fierce competition centered on ingredient transparency, clean beauty formulations, and sustainable packaging initiatives, driving mergers, acquisitions, and strategic partnerships aimed at expanding geographical footprint and diversifying product portfolios with organic or vegan certifications. A significant trend is the direct-to-consumer (D2C) model and rapid penetration of digital commerce, allowing niche brands to compete effectively against established multinationals by offering personalized product recommendations and fostering community engagement. Regionally, the Asia Pacific market is the epicenter of future growth, owing to its massive consumer base, rising middle-class population exhibiting higher purchasing power parity, and changing cultural norms favoring modern, branded child care over traditional methods, whereas North America and Europe maintain dominance in premiumization and technological adoption in formulation safety. Segment trends reveal the skin care category (lotions, creams, oils) dominating market share due to daily usage frequency, but the wipes and diapers category is demonstrating the fastest volume growth, especially innovative biodegradable options; moreover, the natural and organic ingredient segment is universally outperforming conventional synthetic products, reflecting a decisive consumer preference for perceived safety and minimal chemical exposure across all price points.

AI Impact Analysis on Maternal and Infant Toiletries Market

User queries regarding AI's influence in the Maternal and Infant Toiletries sector frequently center on enhanced safety verification, personalized product development, and optimized supply chain management. Consumers and stakeholders are keen to know how AI can guarantee stricter formulation safety, specifically through predictive modeling for allergen identification and toxicity screening, ensuring products meet the stringent requirements for sensitive skin. Another major theme is the potential for hyper-personalization, where AI analyzes individual consumer data (skin type, climate, specific maternal needs) to recommend or even formulate bespoke product combinations, moving beyond generic recommendations. Expectations are high that AI integration will significantly refine inventory forecasting, reduce waste associated with short shelf-life natural products, and streamline logistics, ensuring consistent availability of essential baby care items while simultaneously lowering operational costs, translating to more accessible pricing or higher quality outputs, addressing concerns about the premium cost often associated with certified natural toiletries.

- AI-driven predictive toxicity screening accelerates the identification of potentially harmful ingredients, enhancing product safety and reducing R&D cycles.

- Generative AI models assist in personalized product formulation, tailoring ingredient ratios and functional components based on specific user profiles and climatic data.

- Machine learning algorithms optimize supply chain visibility and demand forecasting, significantly reducing stockouts of high-demand items like wipes and diaper creams.

- AI-powered customer service chatbots provide instant, personalized recommendations for skin concerns, improving consumer engagement and brand loyalty.

- Computer vision systems are used in manufacturing for quality control, detecting minor packaging defects or formulation inconsistencies with high precision.

- AI analyzes consumer feedback and social media trends instantly, allowing brands to rapidly adjust marketing strategies and product claims in real time.

DRO & Impact Forces Of Maternal and Infant Toiletries Market

The Maternal and Infant Toiletries Market is shaped by powerful Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate market direction and profitability. Key drivers include the global increase in the working female population leading to higher disposable income, enabling parents to choose premium, specialized products, and a heightened focus on child health and hygiene standards promulgated by pediatric organizations and educational campaigns. Simultaneously, significant restraints challenge market growth, notably the high cost associated with certified natural, organic, and dermatologically tested ingredients, making these products unaffordable for large segments of the population in developing markets, alongside stringent regulatory approval processes that increase time-to-market and compliance expenses, particularly regarding ingredient claims and safety substantiation. Opportunities for expansion lie predominantly in penetrating untapped rural and semi-urban markets through innovative distribution models, leveraging the growth of e-commerce for direct consumer reach, and focusing heavily on product innovation concerning sustainable packaging and the development of specialized therapeutic lines for conditions like eczema or severe dryness, providing niche market advantages and differentiation. The collective impact forces push the market toward premiumization, regulatory adherence, and digital transformation, compelling established players to innovate sustainably while navigating complex global supply chains and competitive pricing pressures.

The imperative for safety acts as both a driver and a restraint. While heightened parental concern for non-toxic ingredients drives demand for high-end products, the need for rigorous, often slow, clinical testing and certification acts as a significant barrier to entry and market speed. The impact of social media and digital platforms further amplifies these forces; positive endorsements accelerate brand growth (driver), while rapid dissemination of negative reviews or misinformation regarding ingredient safety can immediately restrain sales and necessitate costly remediation efforts. Furthermore, economic stability in key regions influences spending patterns; strong economic indicators encourage purchasing of luxury maternal products, whereas recessions force trade-down behavior towards mid-range or private-label alternatives, illustrating the market's sensitivity to macroeconomic factors.

The overall market trajectory is defined by a continuous cycle of consumer demand for 'cleaner' ingredients met by corporate innovation. This cycle is sustained by external impact forces such as governmental policies promoting health awareness, and infrastructural developments (like improved cold chain logistics for preservative-free formulations). Ultimately, the market benefits from a persistent global focus on preventative wellness and early childhood development, ensuring that demand, despite occasional economic volatility or regulatory headwinds, remains fundamentally strong and oriented towards quality and certified performance, underpinning the market's resilience and long-term valuation growth.

Segmentation Analysis

The Maternal and Infant Toiletries Market is comprehensively segmented based on product type, end-user, distribution channel, and key ingredient composition, allowing for precise market targeting and strategic development. Product segmentation differentiates between daily routine items (body wash, shampoo) and specialized therapeutic products (diaper rash cream, stretch mark removal gel), reflecting varied consumer spending priorities and usage patterns. End-user segmentation distinctly separates maternal products (prenatal/postnatal care) from infant products, acknowledging the unique physiological requirements of each group. Distribution channels highlight the critical shift towards online retailing while acknowledging the persistent importance of traditional pharmacy and specialty stores. Ingredient analysis, crucial for modern consumers, segments products into conventional, natural, and certified organic categories, where the latter two are experiencing rapid expansion due to strong consumer preference for plant-derived and chemical-free formulations, driving overall segment innovation and premium pricing.

- By Product Type:

- Bathing Products (Body Wash, Shampoo, Soap)

- Skin Care Products (Lotions, Moisturizers, Oils, Powders)

- Wipes (Baby Wipes, Face Wipes)

- Hair Care Products (Conditioners, Detanglers)

- Others (Diaper Rash Creams, Stretch Mark Creams, Nipple Balms)

- By End-User:

- Infant (0-3 years)

- Maternal (Prenatal and Postnatal)

- By Ingredient Type:

- Natural and Organic

- Conventional/Synthetic

- By Distribution Channel:

- Online Channels (E-commerce Websites, Company-owned Portals)

- Offline Channels (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Specialty Stores)

Value Chain Analysis For Maternal and Infant Toiletries Market

The value chain for maternal and infant toiletries begins with rigorous upstream analysis focused on the sourcing of high-quality raw materials, a critical stage given the emphasis on natural, organic, and ethically sourced components. Upstream activities involve complex negotiations and quality assurance with suppliers of plant extracts, essential oils, mild surfactants, and natural emollients like Shea butter and coconut oil. Manufacturers must invest heavily in ensuring the purity and sustainability certification of these materials, often requiring detailed traceability systems to satisfy consumer demand for transparency. The integrity of the upstream supply chain directly impacts the final product’s efficacy, safety profile, and marketability, often resulting in higher procurement costs compared to conventional personal care ingredients due to the specialized nature of certification and cultivation required for organic standards.

Midstream processing involves manufacturing, formulation, and packaging. Due to the high sensitivity of the end-users, manufacturing processes must adhere to stringent Good Manufacturing Practices (GMP) and often require specialized, contaminant-free production environments. Downstream analysis focuses on distribution and retailing, which are rapidly evolving. The primary distribution channels are increasingly bifurcated: traditional retail channels, including large hypermarkets and specialized pharmacies, offer consumer trust and immediate accessibility, while e-commerce platforms and Direct-to-Consumer (D2C) models offer unparalleled reach, especially for niche or premium brands. Direct distribution through company-owned online portals or dedicated pediatric clinics provides brands greater control over pricing and customer relationship management, optimizing inventory turnover and reducing reliance on third-party retailers.

Indirect distribution remains essential, primarily through large-scale distributors and wholesalers who manage logistics and inventory for widespread availability across diverse geographical regions. The choice of distribution channel significantly influences market penetration and profitability; for high-volume products like wipes, mass-market indirect channels are crucial, whereas specialized treatment creams often rely on direct engagement or selective distribution through specialized health stores. Overall, the value chain is characterized by a strong focus on certification at every stage—from ingredient sourcing (Ecocert, USDA Organic) to clinical testing and final retail presentation—ensuring consumer confidence and maintaining the high-trust nature essential for products targeting infants and mothers.

Maternal and Infant Toiletries Market Potential Customers

The core potential customers for the Maternal and Infant Toiletries Market are segmented into two primary, yet interconnected, groups: expectant and new mothers (maternal care segment) and caregivers purchasing for infants and toddlers up to three years of age (infant care segment). These end-users are characterized by a high degree of health consciousness, a strong propensity for information gathering via digital and professional channels (pediatricians, parenting blogs), and a non-negotiable demand for product safety and proven efficacy. The modern maternal customer, often a millennial, demonstrates a willingness to spend significantly more on preventative skin care, such as stretch mark prevention oils and labor-preparation perineal balms, prioritizing natural ingredients and clinical endorsement over cost savings. This segment is highly responsive to brand messaging that aligns with wellness, self-care, and ethical sourcing practices.

The infant care segment represents the largest volume market, where purchasing decisions are overwhelmingly driven by the need to prevent common issues like diaper rash, cradle cap, and eczema. Potential buyers here are deeply concerned about chemical exposure, leading to a strong shift towards hypoallergenic, fragrance-free, and paraben-free formulations. Key decision-makers, primarily parents and grandparents, are increasingly influenced by digital reviews and recommendations from trusted social networks and pediatric associations. Furthermore, this consumer base values convenience, which fuels the rapid growth of products like pre-moistened baby wipes and easy-application sunscreen sticks, making accessibility through major e-commerce platforms and large hypermarkets a critical factor in successful market penetration and recurring purchases.

Beyond the immediate household buyers, secondary potential customers include institutional purchasers such as hospitals, neonatal care units, and daycare centers, which require bulk supplies of highly regulated, mild cleansing products. Geographically, potential for high consumption is concentrated in urban and semi-urban areas globally where higher education levels and increased media exposure amplify awareness of specialized maternal and child health needs. The consistent expansion of the global middle class, particularly in Asian markets, continually adds millions of new potential customers who are migrating from traditional or homemade remedies to commercial, branded, and certified toiletries, confirming that demographic shifts remain the foundational driver of customer base growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 72.5 Billion |

| Market Forecast in 2033 | USD 111.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Procter & Gamble, Unilever, L'Oréal S.A., Himalaya Wellness Company, Mustela, Earth Mama Organics, Burt's Bees, Babyganics, Noodle & Boo, Weleda, California Baby, Beiersdorf AG, Kimberly-Clark Corporation, Sebamed, Pigeon Corporation, Artsana Group, Chicco, The Honest Company, Bepanthen (Bayer) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Maternal and Infant Toiletries Market Key Technology Landscape

The key technology landscape in the Maternal and Infant Toiletries Market is characterized by a strong convergence of green chemistry, advanced formulation sciences, and sustainable manufacturing practices, all aimed at maximizing product safety and minimizing environmental impact. Green chemistry principles are paramount, focusing on developing formulations that utilize benign solvents, renewable raw materials, and processes that reduce hazardous substance usage. This involves innovative use of mild, sugar-derived surfactants and plant-based polymers replacing harsh chemical compounds, ensuring that products are ultra-gentle and biodegradable. Furthermore, encapsulation technologies are being employed to stabilize sensitive natural extracts and vitamins, ensuring their efficacy is maintained over the product's shelf life, despite often requiring less synthetic preservation. The technological advancements are fundamentally driven by the need to secure certifications like USDA Organic or Ecocert, which require strict adherence to ingredient purity and processing methods.

Packaging technology represents another pivotal area of innovation. There is a decisive technological shift towards mono-material packaging, post-consumer recycled (PCR) plastics, and bio-plastics derived from sugarcane or cornstarch to address growing consumer concerns about plastic waste. Manufacturers are leveraging advanced injection molding techniques and material science to ensure that these sustainable packaging solutions maintain the integrity and hygiene of the sensitive products contained within, particularly for liquid formulations and wipes. Additionally, traceability technology, often utilizing blockchain or sophisticated QR codes, is increasingly integrated into the packaging, allowing consumers to scan and verify the source of ingredients and the entire product journey, building trust and combating counterfeiting, which is a persistent threat in this high-trust market segment.

Finally, technology is heavily utilized in product testing and safety assurance, moving beyond traditional animal testing to advanced in-vitro and predictive toxicology models. Advanced dermatological testing utilizes specialized equipment to measure subtle changes in skin hydration, pH balance, and transepidermal water loss (TEWL) on sensitive skin models, providing objective data on product efficacy and gentleness. This use of precision instrumentation and simulation software allows for rapid iteration and refinement of product formulations, ensuring compliance with the highest global safety standards (like the EU's strict chemical regulations) while meeting the consumer expectation for clinically proven, yet naturally derived, gentle care solutions for both mother and infant, thereby reinforcing the premium positioning of technologically advanced products.

Regional Highlights

Regional dynamics heavily influence consumption patterns, product preference, and regulatory standards within the Maternal and Infant Toiletries Market. Asia Pacific (APAC) stands out as the highest potential growth region, fueled by massive population size, increasing urbanization, rising disposable income, and a cultural shift towards modern, westernized infant care practices. Countries like China, India, and Southeast Asian nations are driving demand due to high birth rates and increasing parental willingness to invest in branded, safe products. The region focuses heavily on volume sales and accessibility through e-commerce platforms.

North America and Europe represent mature markets characterized by high per capita spending and a strong preference for premium, organic, and certified "clean" label products. Regulatory scrutiny is extremely high here, pushing manufacturers toward constant innovation in terms of sustainability (packaging and sourcing) and complex dermatological testing. These regions set the global benchmarks for ingredient safety and ethical manufacturing practices, leading to higher average selling prices for maternal and infant care lines.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions showing promising growth. LATAM demand is boosted by urbanization and better access to international brands, with a growing focus on sun protection and skin hydration due to climate factors. MEA, particularly the GCC countries, demonstrates high demand for luxury brands and sophisticated packaging, influenced by high discretionary spending. However, logistical challenges and varying regulatory landscapes present operational complexities in these emerging markets, requiring localized distribution strategies for effective penetration.

- Asia Pacific (APAC): Dominates growth due to rising middle-class income, large consumer base, and rapid adoption of digital distribution channels, with a strong focus on hygiene and specialized baby care lines.

- North America: Market leader in innovation and premiumization; strong regulatory environment drives demand for certified organic, non-GMO, and clinically proven products.

- Europe: Characterized by stringent chemical regulations (REACH), emphasizing sustainability, biodegradable ingredients, and high ethical sourcing standards, particularly prevalent in Western European nations.

- Latin America (LATAM): Growing market influenced by increasing internet penetration and modernization of healthcare systems; price sensitivity remains a factor, driving demand for value-for-money bundled products.

- Middle East and Africa (MEA): Emerging luxury segment demand in urban centers, alongside strong needs for basic hygiene products in developing parts of Africa; market growth is often dependent on imported goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Maternal and Infant Toiletries Market.- Johnson & Johnson

- Procter & Gamble

- Unilever

- L'Oréal S.A.

- Himalaya Wellness Company

- Mustela

- Earth Mama Organics

- Burt's Bees

- Babyganics

- Noodle & Boo

- Weleda

- California Baby

- Beiersdorf AG

- Kimberly-Clark Corporation

- Sebamed

- Pigeon Corporation

- Artsana Group

- Chicco

- The Honest Company

- Bepanthen (Bayer)

Frequently Asked Questions

Analyze common user questions about the Maternal and Infant Toiletries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Maternal and Infant Toiletries Market between 2026 and 2033?

The Maternal and Infant Toiletries Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven primarily by rising global awareness of specialized infant care and increasing parental spending power on premium, certified safe products.

Which ingredient type segment is currently dominating market growth and consumer preference?

The Natural and Organic ingredient segment is rapidly dominating market growth and preference. Consumers, particularly millennial parents, prioritize formulations free from harsh chemicals, parabens, and sulfates, leading to significantly higher demand and premium pricing for products holding certifications like USDA Organic or Ecocert, indicating ingredient purity and sustainable sourcing.

How is e-commerce impacting the distribution and accessibility of maternal and infant toiletries?

E-commerce platforms are fundamentally revolutionizing market distribution by providing unparalleled accessibility, especially for niche organic brands and consumers in geographically remote areas. Online channels facilitate the Direct-to-Consumer (D2C) model, allow for personalized subscription services, and offer extensive product information and peer reviews, making digital sales the fastest-growing distribution segment globally.

What are the primary safety concerns driving product innovation in this specialized market?

Primary safety concerns revolve around preventing skin sensitivities, allergies, and minimizing systemic exposure to endocrine disruptors. This drives innovation toward ultra-mild, hypoallergenic formulations, clinically proven tear-free products, and the complete elimination of controversial ingredients such as phthalates, formaldehyde releasers, and harsh fragrances, emphasizing pH-neutral stability for infant skin.

Which geographical region holds the highest potential for future market expansion?

The Asia Pacific (APAC) region holds the highest potential for future market expansion. This growth is underpinned by rapid urbanization, significant improvements in economic standing resulting in greater disposable income allocated to child welfare, and the world’s largest consumer base transitioning quickly toward branded maternal and infant health products.

What role does sustainability play in the purchasing decisions of modern maternal consumers?

Sustainability is a core purchasing determinant for modern maternal consumers. They actively seek products with eco-friendly certifications, recyclable or biodegradable packaging (such as PCR plastics), and ethically sourced ingredients. Brands demonstrating commitments to environmental responsibility and ingredient transparency gain significant competitive advantage and loyalty in this market.

How do stringent regulatory requirements in regions like Europe affect product development?

Stringent regulatory requirements, particularly in Europe (such as adherence to REACH chemical regulations), compel manufacturers to adopt highly rigorous safety testing protocols and reformulate products to eliminate thousands of potentially restricted substances. This elevates product quality and consumer trust but increases research and development costs and time-to-market for new formulations.

Besides traditional products, what specialized categories are experiencing accelerated demand?

Specialized therapeutic categories are experiencing accelerated demand, notably products designed for treating chronic conditions like infant eczema, severe cradle cap, and post-partum skin recovery (e.g., specialized nipple care and intensive stretch mark treatments). These products command premium pricing due to their clinical efficacy and targeted ingredient profiles.

What is the significance of the shift from conventional to plant-based surfactants in infant body wash?

The shift to plant-based surfactants is critical as it drastically reduces the potential for skin and eye irritation in infants. Conventional surfactants can compromise the delicate skin barrier, whereas mild, naturally derived alternatives offer effective cleansing with superior gentleness, aligning with the primary parental demand for non-irritating, tear-free bathing solutions.

How are supply chain technologies, particularly AI, optimizing the delivery of maternal toiletries?

AI-driven supply chain technologies optimize delivery by accurately forecasting volatile consumer demand for essential items like wipes and creams. This predictive capability minimizes inventory risks, ensures optimal stock levels in distribution centers across regions, and streamlines logistics, crucial for maintaining product freshness for sensitive formulations.

What is the key difference between maternal products and general adult toiletries?

Maternal products are formulated specifically to address physiological changes during pregnancy and postpartum, such as stretch mark prevention, nipple sensitivity, and hormonal skin changes. They feature concentrated, highly tested ingredients that are often fragrance-free and verified safe for use during breastfeeding, distinguishing them from standard adult cosmetics.

How does the high cost of organic certification restrain market growth in developing countries?

The high cost associated with attaining and maintaining organic certification translates directly into higher retail prices, acting as a restraint in price-sensitive developing economies. While consumers desire natural products, affordability often forces trade-offs toward more conventional or local, uncertified alternatives, limiting the market penetration of premium international brands.

What demographic group is currently the primary influencer and consumer of premium infant toiletries?

Millennial parents, typically aged 25 to 40, constitute the primary demographic influencing and consuming premium infant toiletries. They possess higher digital literacy, prioritize preventive health, and exhibit greater willingness to invest in branded, research-backed products over less expensive alternatives, often driven by extensive digital research and peer recommendations.

In the value chain, why is upstream analysis of raw materials critical for this market?

Upstream analysis of raw materials is critical because the purity, source traceability, and sustainable certification of ingredients (especially natural extracts and oils) determine the final product's safety claim and premium market positioning. Any compromise at this stage directly affects consumer trust and regulatory compliance in a market where safety is non-negotiable.

What are the future opportunities regarding specialized pediatric dermatological care lines?

Future opportunities lie in developing highly specialized pediatric dermatological care lines that offer clinically proven relief for common, chronic infant skin conditions such as severe atopic dermatitis (eczema) and persistent cradle cap. These therapeutic lines offer high profit margins and meet a persistent, underserved medical need, requiring significant investment in clinical testing and professional endorsement.

How do technological advancements in packaging improve the shelf life of preservative-free formulations?

Technological advancements in packaging, such as airless pump systems and opaque, multi-layer barrier materials, significantly reduce product exposure to oxygen and light. This protection is vital for maintaining the stability and efficacy of sensitive, preservative-free natural ingredients, thereby extending the required shelf life without compromising the clean label claim.

Which offline distribution channel maintains significant importance despite the rise of e-commerce?

Pharmacies and drug stores maintain significant importance in the offline distribution channel. Consumers trust these locations for health-related purchases, and these stores often stock dermatologist-recommended and specialized, clinical-grade maternal and infant toiletries, leveraging the trust associated with healthcare professionals.

What macroeconomic factors positively influence the market size forecast?

Key positive macroeconomic factors include sustained global growth in discretionary household income, stable employment rates, and increasing investment in healthcare infrastructure, all of which enhance parents' capacity and willingness to purchase higher-priced, specialized maternal and infant care products over the forecast period.

In North America, what specific certifications are highly sought after by consumers?

In North America, highly sought-after certifications include USDA Organic, Non-GMO Project Verified, Leaping Bunny (cruelty-free), and Dermatologist Tested or Pediatrician Recommended seals, reflecting consumer demand for ingredient transparency, ethical sourcing, and rigorous safety verification.

How is competition intensifying among major key players and niche brands?

Competition is intensifying as niche brands utilize D2C models and social media marketing to rapidly gain market share by focusing exclusively on organic, ethical, and highly specialized product lines, forcing major multinational players (like J&J and P&G) to innovate rapidly, acquire smaller specialized brands, and revamp their legacy product formulations to meet "clean label" standards.

What is the significance of pH balance in infant skin care products?

Maintaining a neutral or slightly acidic pH (around 5.5) in infant skin care products is highly significant. This balance supports the natural skin barrier function, prevents the proliferation of harmful bacteria, and minimizes irritation, which is crucial for the undeveloped and highly sensitive nature of infant skin.

How do clinical trials contribute to the successful launch of a new maternal toiletries product?

Clinical trials are mandatory for establishing credibility and consumer confidence. They provide objective, scientific evidence validating claims such as "hypoallergenic," "stretch mark reduction," or "24-hour hydration," allowing brands to charge a premium and gain endorsements from healthcare providers, which is vital for market penetration.

Why is product traceability important for maternal and infant products?

Product traceability, often enhanced by blockchain technology, is important to assure consumers of the authenticity and safety of the ingredients used. In a market frequently targeted by counterfeiters, full transparency from raw material sourcing to retail shelves guarantees product integrity and prevents potential health risks associated with fake toiletries.

What is the impact of rising birth rates in emerging economies on the market outlook?

Rising birth rates, particularly in densely populated emerging economies in APAC and LATAM, provide a massive and continuous influx of new consumers into the market. This demographic factor ensures sustained volume growth and acts as a fundamental long-term driver for overall market expansion and investment.

How are companies addressing the need for fragrance in sensitive skin products?

Companies are addressing the need for fragrance while maintaining safety by either offering entirely fragrance-free lines or utilizing natural essential oils and highly purified, allergen-free fragrance compounds in minimal concentrations. The focus is strictly on safety, ensuring that any scent does not contain known irritants or respiratory sensitizers, often verified through clinical testing.

What is the role of pediatricians and dermatologists in market influence?

Pediatricians and dermatologists hold enormous influence as professional gatekeepers. Their recommendations directly guide parental purchasing decisions, particularly for therapeutic or specialized products addressing severe skin conditions. Brands actively seek clinical testing and endorsement to leverage this critical source of consumer trust and authority.

In the context of the supply chain, what challenges are specific to natural and organic ingredients?

Specific challenges related to natural and organic ingredients include volatility in raw material pricing due to agricultural factors, shorter shelf lives requiring specialized cold chain logistics, and the complexity of ensuring consistent quality and purity across varied harvest seasons and geographical sourcing locations, necessitating rigorous supplier audits.

How are brands utilizing social media platforms to target new parents?

Brands utilize social media by creating engaging, educational content focused on parenting tips, product usage demonstrations, and collaborations with key parenting influencers. This approach builds community, fosters brand loyalty, and provides targeted advertising for personalized product recommendations based on life stage (prenatal, newborn, toddler).

What types of innovative packaging are favored for baby wipes to enhance consumer experience?

Innovative packaging for baby wipes favors features that enhance convenience and hygiene, such as improved one-touch dispensing systems, moisture-locking resealable lids to prevent drying, and the use of sustainable, plant-based nonwoven materials that are flushable or highly biodegradable, addressing both user convenience and environmental concerns.

What are the key differences in product focus between the infant and maternal segments?

The infant segment primarily focuses on basic hygiene, moisturizing, and therapeutic barrier protection (diaper rash, sensitive skin), prioritizing gentleness and tear-free formulations. Conversely, the maternal segment focuses on preventative and restorative cosmetic care, such as stretch mark reduction, firming, and nipple care, addressing specific pregnancy and postpartum skin conditions.

How does the market respond to concerns regarding microplastics in toiletries?

The market actively responds to microplastic concerns by eliminating synthetic polymer microbeads and seeking biodegradable alternatives, such as natural exfoliants (jojoba beads or fruit seeds) and plant-derived thickening agents. Manufacturers prioritize formulations that ensure no solid plastic particles are used, aligning with strict environmental legislation and clean beauty standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager