Maternity Intimate Wear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435977 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Maternity Intimate Wear Market Size

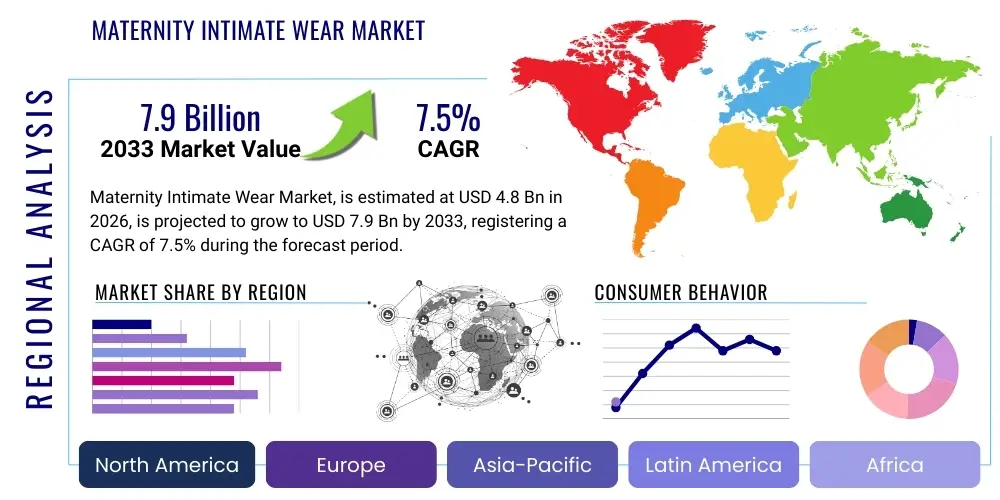

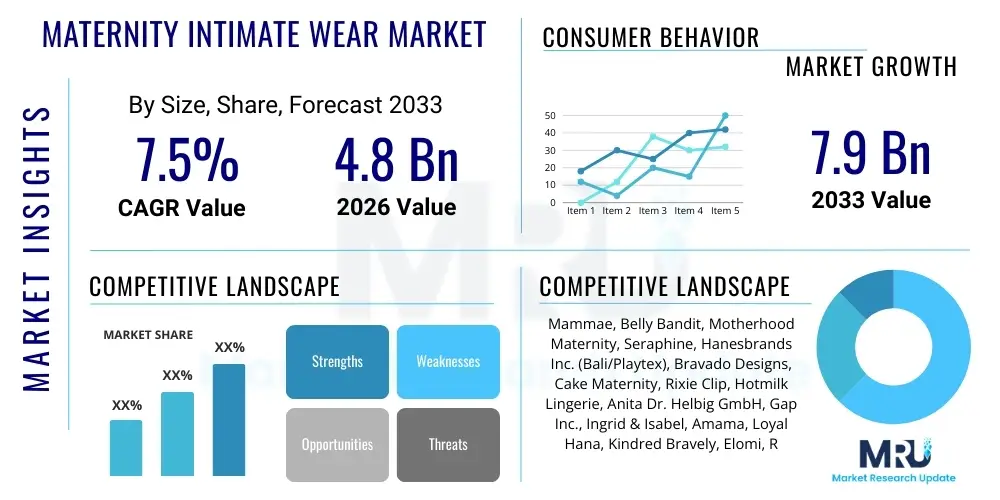

The Maternity Intimate Wear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Maternity Intimate Wear Market introduction

The Maternity Intimate Wear Market encompasses specialized apparel designed to provide comfort, support, and functionality for women during pregnancy and the postnatal period, including breastfeeding. These products are crucial as a woman's body undergoes significant physiological changes, requiring garments that adapt to fluctuating body sizes, offer gentle support to the breasts and abdomen, and prioritize skin sensitivity. Key products include maternity and nursing bras, supportive panties, belly bands, and specialized sleepwear designed with expandable fabrics and easy-access features for feeding.

Major applications of maternity intimate wear are centered on enhancing maternal health, ensuring comfort during sleep, and facilitating the breastfeeding process efficiently and discreetly. The design innovation focuses heavily on seamless technology, moisture-wicking fabrics, and adjustable closures to accommodate rapid size changes without compromising aesthetics or hygiene. Furthermore, the increasing awareness regarding the long-term benefits of proper support, particularly for breast health and posture during gestation, significantly drives consumer adoption across developed and emerging economies.

Driving factors for this market include rising global birth rates, increasing disposable income among working women who prioritize specialized comfort items, and the widespread influence of e-commerce platforms that offer discreet and expansive purchasing options. Benefits of using high-quality maternity intimate wear range from reducing back pain and mitigating stretch marks through effective support, to improving breastfeeding convenience and promoting overall maternal wellness and confidence throughout the challenging stages of motherhood. The market is evolving rapidly, moving beyond basic functionality towards incorporating sustainable materials and aesthetic appeal, treating maternity wear as a fashion statement rather than a purely utilitarian requirement.

Maternity Intimate Wear Market Executive Summary

The global Maternity Intimate Wear Market is characterized by robust growth, primarily fueled by shifting consumer preferences toward specialized comfort and functional aesthetics, coupled with the increasing penetration of online retail channels. Business trends show a distinct move toward sustainable and organic fabric sourcing, responding to heightened consumer demand for eco-friendly and hypoallergenic products. Startups specializing in Direct-to-Consumer (DTC) models are disrupting traditional retail by offering highly customized sizing tools and personalized shopping experiences, thus capturing significant market share by addressing specific niche requirements that mainstream retailers often overlook. Technological integration, particularly in material science resulting in four-way stretch and temperature-regulating fabrics, remains a critical competitive differentiator among leading manufacturers.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the fastest growth, driven by large population bases, rising affluence, and increasing healthcare awareness regarding maternal wellness. North America and Europe, while mature markets, continue to lead in innovation, focusing on luxury, technologically advanced products such as smart intimate wear integrated with subtle health monitoring capabilities. Regulatory emphasis on product safety and labeling, particularly concerning chemicals and dyes used in sensitive garments, is becoming more pronounced globally, affecting manufacturing processes and supply chain compliance across all major regions, pushing manufacturers toward safer, certified materials.

Segmentation trends highlight that the Maternity and Nursing Bra segment retains the dominant market share due to its essential nature and daily requirement for support and feeding access. However, the specialized supportive wear (e.g., shapewear and belly bands designed for post-partum recovery) is exhibiting the highest growth trajectory, reflecting the consumer trend of extending specialized care into the postnatal phase. Distribution channels are undergoing a profound transformation, with online sales surpassing traditional brick-and-mortar outlets. E-commerce platforms offer unparalleled convenience, product diversity, and the ability to compare intricate sizing charts and review specialized features, which is highly valued by pregnant consumers facing mobility limitations or seeking discreet purchases.

AI Impact Analysis on Maternity Intimate Wear Market

Users frequently inquire about how AI can solve the persistent problem of fluctuating sizing during pregnancy and the post-partum period, asking about personalized recommendations and fit predictions based on body change trajectories. Common themes also revolve around AI’s ability to streamline inventory management for manufacturers dealing with diverse and unpredictable demand cycles across various sizes and trimesters, and how virtual try-on technologies enhance the online purchasing experience. The key consumer expectation is that AI will move maternity shopping from a high-risk, trial-and-error process to a precise, comfortable, and personalized experience, ensuring functional and supportive garments fit perfectly at every stage of the pregnancy journey. Manufacturers are primarily concerned with utilizing AI for predictive trend analysis, reducing waste associated with overstocking specific sizes, and optimizing supply chain logistics specific to seasonal demand shifts in specialized apparel.

- AI-Powered Sizing Predictors: Algorithms analyze pre-pregnancy data, current trimester, and growth rates to suggest optimal sizes, minimizing returns and enhancing fit accuracy for fluctuating body shapes.

- Generative Design Optimization: AI assists designers in creating modular and adaptable garment structures that conform better to changing maternal silhouettes, improving comfort and longevity.

- Virtual Try-On (VTO) Technology: Uses AR and AI to map garments onto customer bodies via mobile devices, simulating drape and fit, thereby replicating the in-store experience online.

- Supply Chain and Inventory Forecasting: Machine learning models predict demand spikes for specific product types (e.g., sleeping bras vs. daytime nursing bras) based on regional birth rate data and seasonal consumer behavior.

- Personalized Marketing and Recommendation Engines: AI targets expectant mothers with highly relevant product bundles and education on optimal support based on their specific stage of pregnancy and lifestyle requirements.

- Customer Service Automation: Chatbots powered by natural language processing (NLP) handle common inquiries regarding washing instructions, sizing exchanges, and material properties, offering instant support 24/7.

DRO & Impact Forces Of Maternity Intimate Wear Market

The dynamics of the Maternity Intimate Wear Market are governed by a complex interplay of internal growth catalysts and external constraining factors, alongside long-term strategic opportunities that define the market trajectory. Drivers include the increasing global focus on maternal wellness and proactive health management, leading pregnant women to invest in specialized functional wear that minimizes discomfort and supports physiological changes. Restraints largely center on the premium pricing associated with specialized materials (such as seamless, microbial-resistant, or organic fabrics) and the transient usage nature of the products, which can lead to consumer hesitancy, especially in price-sensitive emerging markets. Opportunities exist in product diversification, moving into specialized post-surgical recovery wear and smart intimate apparel integrated with biometrics, positioning the market at the intersection of fashion, technology, and healthcare.

The primary impact force driving demand stems from evolving societal norms where discussing and investing in maternity comfort and recovery is increasingly normalized and encouraged, particularly through social media and influencer culture. This cultural shift translates directly into increased demand for fashionable, yet highly functional, intimate wear that allows women to maintain their personal style throughout pregnancy. Conversely, the impact force related to supply chain volatility, particularly concerning the sourcing of sustainable and certified organic materials, poses a significant constraint, often increasing production costs and lead times. The competitive landscape is intensely influenced by the rapid introduction of innovative features like one-handed clasp operation for nursing bras and integrated cooling technologies, which become instant expectations among informed consumers, putting pressure on traditional brands to continually refresh their product lines.

The combination of demographic shifts—specifically, delayed childbearing leading to higher disposable income per pregnancy—and advancements in material science creates a strong upward impetus for market expansion. However, the market remains vulnerable to economic downturns, as specialized intimate wear, despite its benefits, is often considered a non-essential luxury item by budget-conscious segments. Strategic opportunities for sustained growth include leveraging tele-health platforms and partnerships with maternity clinics to provide medically recommended apparel, ensuring continuous customer acquisition via trusted professional endorsements, and solidifying the necessity of high-quality intimate support for long-term health benefits.

Segmentation Analysis

The Maternity Intimate Wear Market is meticulously segmented based on product type, material composition, and distribution channels, reflecting the diverse needs and purchasing behaviors of expectant and new mothers globally. Product segmentation remains critical, distinguishing between essential daily wear like bras and panties, and more specialized supportive garments such as belly bands and shapewear designed for targeted relief or recovery. Material segmentation underscores the increasing consumer preference for natural, breathable, and sensitive skin-friendly options, with organic cotton and bamboo emerging as key growth areas, juxtaposed against high-performance synthetic blends offering superior stretch and durability. Distribution segmentation clearly highlights the structural shift toward e-commerce, which offers the privacy, extensive selection, and detailed sizing information that this specific consumer group demands for a comfortable shopping experience.

- By Product Type:

- Maternity & Nursing Bras

- Maternity Panties (Over-the-bump, Under-the-bump)

- Maternity Sleepwear & Loungewear

- Belly Bands and Support Garments

- Postnatal and Recovery Wear

- By Material:

- Natural Fabrics (Cotton, Organic Cotton, Bamboo)

- Synthetic Fabrics (Nylon, Spandex, Polyester Blends)

- Blended Fabrics (Cotton-Lycra Mixes, Microfiber)

- By Distribution Channel:

- Online Retail (E-commerce Websites, Company-Owned Sites)

- Offline Retail (Specialty Stores, Department Stores, Pharmacy/Drug Stores)

Value Chain Analysis For Maternity Intimate Wear Market

The value chain for the Maternity Intimate Wear Market begins with specialized upstream material procurement, focusing heavily on sourcing innovative textiles that offer high elasticity, breathability, and non-allergenic properties, such as Tencel, organic Pima cotton, and sophisticated microfibers designed for seamless knitting. This stage often involves stringent certifications (e.g., Oeko-Tex Standard 100) due to the sensitivity of the end-user. Manufacturing processes prioritize ergonomic design, emphasizing seamless construction and adjustable features to ensure comfort and adaptability throughout trimesters. The midstream involves careful warehousing and inventory management, critical because demand is often size-specific and time-sensitive.

Downstream analysis focuses on effective marketing that educates consumers on the health benefits of specialized support, moving beyond purely aesthetic considerations. Distribution channels are bifurcated into direct and indirect routes. Direct distribution, primarily through dedicated brand e-commerce sites, offers higher margins, greater control over brand messaging, and crucial direct consumer feedback for product iteration. This model allows brands to manage complex sizing requirements more effectively through personalized virtual fitting tools and proprietary recommendation engines, ensuring higher customer satisfaction and lower return rates.

Indirect distribution involves sales through multi-brand specialty maternity stores, large department stores, and mass-market pharmacies, capitalizing on the foot traffic and established reputation of these traditional retail partners. While these channels offer broad accessibility, they often dilute brand control and require robust logistics for inventory stocking across various sizes and product adaptations. The increasing reliance on online marketplaces (like Amazon or specialized mommy-focused platforms) further complicates the distribution landscape, demanding sophisticated digital marketing and fulfillment capabilities to maintain visibility and competitive pricing. The efficiency of the final stage, customer service and post-sale follow-up, is paramount for securing brand loyalty in this highly personal market segment.

Maternity Intimate Wear Market Potential Customers

The primary end-users and buyers in the Maternity Intimate Wear Market are pregnant women, new mothers who are breastfeeding, and women in the immediate post-partum recovery phase. These consumers are typically highly discerning, prioritizing function, comfort, and material quality over price, especially when the product directly impacts their health and daily comfort. A significant subset of potential customers includes first-time mothers who often rely heavily on recommendations from healthcare professionals, maternity specialists, or trusted online parenting communities to guide their purchasing decisions, making educational content and expert endorsements critical components of the marketing strategy.

Secondary buyers often include partners, family members, and friends purchasing these items as gifts, although the primary user remains the expectant mother herself, who dictates the specific brand and product requirements based on her personal physiological needs and style preferences. Demographic analysis reveals a growing segment of professional women aged 30–45 who have higher disposable incomes and are willing to invest in premium, high-tech intimate wear that supports their active lifestyles during pregnancy. This segment demands products that blend medical-grade support with high fashion, often seeking seamless technology and specialized anti-microbial treatments to ensure hygiene and discretion.

Geographically, customers in developed economies like North America and Western Europe demonstrate high brand loyalty and are early adopters of innovative materials and smart features, such as integrated sensors for temperature regulation. In rapidly developing markets across Asia, the potential customer base is expanding rapidly, driven by urbanization and improved access to digital information, leading to increased demand for affordable yet comfortable and functional maternity essentials. Manufacturers must tailor their product offerings and distribution strategies to meet the contrasting price sensitivity and feature expectations across these distinct global customer profiles, ensuring that educational resources on product use and benefits are widely available to maximize penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mammae, Belly Bandit, Motherhood Maternity, Seraphine, Hanesbrands Inc. (Bali/Playtex), Bravado Designs, Cake Maternity, Rixie Clip, Hotmilk Lingerie, Anita Dr. Helbig GmbH, Gap Inc., Ingrid & Isabel, Amama, Loyal Hana, Kindred Bravely, Elomi, Royce Lingerie, Leading Lady, Bella Materna, La Leche League International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Maternity Intimate Wear Market Key Technology Landscape

The technological landscape of the Maternity Intimate Wear Market is heavily dominated by advancements in textile engineering, specifically focusing on creating garments that offer superior adaptability and comfort without restrictive structural elements. Seamless knitting technology, which utilizes circular knitting machines to produce garments without side seams, is paramount, minimizing skin irritation and providing a smooth, flexible fit that accommodates rapid body changes. Furthermore, the integration of high-performance elastane and microfiber blends, often treated with moisture-wicking and antimicrobial finishes, ensures that the apparel remains hygienic, dry, and comfortable, addressing the common issues of increased perspiration and sensitivity experienced during pregnancy.

Smart textile innovations are emerging as a significant trend, although still nascent. These involve embedding subtle, non-invasive technology into intimate wear, such as temperature-regulating fibers (phase change materials) or soft integrated sensors designed to monitor basic vital signs, offering an advanced layer of care. While full-scale implementation is pending regulatory and cost feasibility, the foundational research is driving innovation in adjustable technology, including specialized hardware like magnetic or simplified clasp systems for one-handed nursing access, significantly improving the practicality of the products for new mothers, which is a major technological advancement in the usability of nursing bras.

Beyond material science, technology also permeates the retail and design phases. Computer-Aided Design (CAD) and 3D body scanning are increasingly used to map out the physiological changes of the pregnant female body, allowing designers to create patterns that offer targeted support and optimal compression zones without sacrificing flexibility. This precision in design, coupled with data analytics from AI-powered fitting tools, is defining the next generation of intimate wear, ensuring the shift from generic sizing scales to a more personalized, engineered fit that aligns perfectly with the medical and comfort requirements of the expectant mother at every stage.

Regional Highlights

Regional dynamics play a crucial role in shaping the Maternity Intimate Wear Market, driven by disparate birth rates, income levels, and cultural attitudes toward maternal health and specialized apparel spending. North America, led by the U.S. and Canada, represents a highly sophisticated market characterized by high consumer awareness, strong purchasing power, and a dominant presence of specialized maternity retailers and robust e-commerce infrastructure. Consumers here prioritize innovation, demanding products that blend sustainable sourcing with cutting-edge technology like enhanced seamless construction and post-partum recovery compression wear. Marketing is effective when emphasizing the intersection of wellness and convenient online purchasing.

Europe stands out for its strong emphasis on quality, ethical sourcing, and environmental sustainability. Western European countries, particularly the UK, Germany, and France, show a high affinity for premium brands that use certified organic materials (e.g., GOTS certified cotton) and prioritize durable, long-lasting garments. Regulatory standards concerning textile safety are stringent, influencing product development toward hypoallergenic and chemical-free options. The market is mature, leading to steady, quality-focused growth, often seen in boutique specialty stores and established high-end department stores that curate luxury maternity lines.

Asia Pacific (APAC) is projected to be the fastest-growing region globally. This expansive growth is attributable to large populations in countries like China and India, rapidly increasing disposable incomes, and the swift adoption of Western healthcare and consumer trends regarding maternal care specialization. While price sensitivity remains a factor in certain sub-regions, the demand for functional nursing bras and supportive wear is surging, heavily driven by mobile commerce and local specialty brands that offer high value at competitive price points. The cultural importance of post-partum recovery (often referred to as 'sitting the month' or related traditions) also boosts demand for specialized recovery garments and thermal sleepwear, contributing significantly to market volume.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging opportunities. In LATAM, market growth is primarily concentrated in urban centers, fueled by increasing awareness campaigns and the penetration of international brands through online platforms, though brand consciousness is still developing. In MEA, the market is highly segmented, with wealthy Gulf nations showing demand for luxury and imported international brands, while other African regions focus on affordability and basic functional wear. E-commerce is crucial for market penetration in both LATAM and MEA due to the scattered nature of specialized physical retail outlets, making digital visibility essential for brand success in these diverse geographies.

- North America: Market leader in technology adoption and premium segment spending; high penetration of DTC brands; demand focused on seamless, adaptive technology.

- Europe: Strong focus on sustainability, organic fabrics (GOTS certification), and ethical manufacturing; mature market driving slow, stable, high-value growth.

- Asia Pacific (APAC): Highest growth rate globally; driven by rising middle class, urbanization, and rapid e-commerce expansion; strong demand for functional, affordable nursing products.

- Latin America (LATAM): Emerging market concentrated in Brazil and Mexico; growth tied to increased health awareness and international brand accessibility via online channels.

- Middle East and Africa (MEA): Varied market; demand for luxury brands in the GCC region; focus on basic functional wear and hygiene products in broader African markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Maternity Intimate Wear Market.- Mammae

- Belly Bandit

- Motherhood Maternity

- Seraphine

- Hanesbrands Inc. (Bali/Playtex)

- Bravado Designs

- Cake Maternity

- Rixie Clip

- Hotmilk Lingerie

- Anita Dr. Helbig GmbH

- Gap Inc.

- Ingrid & Isabel

- Amama

- Loyal Hana

- Kindred Bravely

- Elomi

- Royce Lingerie

- Leading Lady

- Bella Materna

- La Leche League International

- Lululemon Athletica (Expanding into post-partum wear)

- ASOS Plc (Maternity line)

- Triumph International

- Under Armour (Specialized support wear)

Frequently Asked Questions

Analyze common user questions about the Maternity Intimate Wear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Maternity Intimate Wear Market?

The primary driving factor is the increasing global focus on maternal health and comfort, coupled with rising disposable incomes allowing women to invest in specialized, high-quality supportive garments and the widespread convenience of e-commerce platforms for discreet purchasing.

Which product segment holds the largest share in the Maternity Intimate Wear Market?

The Maternity and Nursing Bra segment holds the largest market share due to its essential nature for daily support during pregnancy and its vital role in facilitating convenient, comfortable breastfeeding post-partum, driving high necessity-based replacement demand.

How is technology influencing the design of maternity intimate wear?

Technology is significantly influencing design through seamless knitting for enhanced comfort, the use of high-performance moisture-wicking and anti-microbial fabrics, and the development of specialized hardware like one-handed nursing clasps, improving both fit and functionality.

What role does sustainability play in maternity intimate wear purchasing decisions?

Sustainability plays a critical role, particularly in mature markets like Europe, where consumers increasingly prefer intimate wear made from certified organic, eco-friendly materials such as organic cotton or bamboo, reflecting concerns over skin sensitivity and environmental impact.

Which geographical region is expected to experience the fastest market growth?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, primarily fueled by rising affluence, increasing population density, greater urbanization, and the rapid expansion of digital retail channels accessing large, previously underserved consumer bases.

What are the key differences between maternity bras and regular bras?

Maternity bras are designed with increased elasticity and larger cups/bands to accommodate fluctuating breast size, feature wider straps for enhanced support, and often incorporate seamless, wire-free designs to minimize discomfort and pressure points compared to structured regular bras.

When should an expectant mother begin purchasing maternity intimate wear?

Most experts recommend that expectant mothers begin transitioning to maternity intimate wear, particularly bras, during the first trimester or as soon as their current undergarments begin to feel restrictive, typically around 4–6 months when significant breast and ribcage expansion occurs.

What are the benefits of using post-partum support garments or belly bands?

Post-partum support garments aid in abdominal muscle recovery, provide gentle compression to the pelvic area, help stabilize the back and core, and may improve posture, facilitating comfort and support during the healing period after childbirth.

How do direct-to-consumer (DTC) brands affect the market competition?

DTC brands intensify market competition by offering highly specialized products, leveraging AI for better fit recommendations, maintaining higher profit margins through reduced intermediaries, and building strong, direct relationships with consumers through digital and social media engagement.

What is the most significant restraint challenging market expansion in developing regions?

The most significant restraint is the higher price point of specialized intimate wear compared to conventional garments, coupled with lower consumer awareness regarding the medical and comfort benefits of specialized support, leading to cost-conscious purchasing behaviors.

Are there specialized fabrics used to manage temperature regulation in maternity intimate wear?

Yes, specialized fabrics include microfibers treated with wicking properties and increasingly, Phase Change Materials (PCMs) that are subtly integrated into the textile structure to absorb and release heat, helping to regulate body temperature and mitigate discomfort associated with hormonal changes.

Why is the fitting accuracy of maternity intimate wear crucial?

Accurate fitting is crucial not just for comfort but for health, as poorly fitting bras can lead to blocked milk ducts during lactation, mastitis, and unnecessary back or shoulder pain, making customized or adaptable sizing an absolute necessity for optimal maternal health outcomes.

How do maternity intimate wear brands utilize digital marketing effectively?

Brands utilize digital marketing by creating targeted educational content across platforms like Instagram and Pinterest, focusing on product function, sizing guides, and the physiological needs of pregnant women, often partnering with mommy bloggers and wellness influencers for authenticity and reach.

What is the typical lifespan expected for high-quality maternity and nursing bras?

While highly dependent on care, high-quality maternity and nursing bras are designed to last throughout the entire pregnancy and breastfeeding duration (typically 12–18 months), needing to maintain elasticity and support despite frequent washing and significant size changes.

In the material segmentation, which fabric is showing rapid growth due to comfort and eco-friendliness?

Bamboo fiber is showing rapid growth, prized for its exceptional softness, inherent antimicrobial properties, high breathability, and sustainable sourcing profile, making it a premium choice for intimate wear aimed at highly sensitive skin.

What distinguishes nursing sleepwear from regular sleepwear?

Nursing sleepwear incorporates hidden access panels, drop-down cups, or specific elastic necklines designed to allow quick, discreet, and comfortable nighttime breastfeeding access without requiring the mother to fully undress, prioritizing convenience during late-night feedings.

How do manufacturers ensure product safety in materials used for maternity wear?

Manufacturers often adhere to strict material safety certifications like Oeko-Tex Standard 100, which guarantees that textiles are free from harmful substances, dyes, and chemicals, ensuring the garment is safe for prolonged contact with sensitive skin.

What is the impact of AI on inventory management within the maternity intimate wear sector?

AI significantly optimizes inventory management by analyzing variable demand across different sizes and trimesters, improving forecast accuracy, and reducing overstocking of slow-moving items, which is critical in a market defined by fluctuating consumer needs.

Why are specialty stores still important despite the growth of online retail?

Specialty stores remain important because they offer personalized, professional fitting services and expert advice, which is highly valued by first-time mothers who require guidance in navigating the complex sizing and functional requirements of maternity intimate wear.

How is the Maternity Intimate Wear Market addressing the demand for adaptive fashion?

The market addresses adaptive fashion through modular designs, adjustable closures, and four-way stretch fabrics that seamlessly accommodate changes in bust and abdominal circumference, ensuring the garment remains functional and supportive across multiple stages of the maternal cycle.

What are the typical end-user preferences in terms of color and aesthetics?

While functional considerations remain paramount, modern end-users show a preference for neutral tones (nude, black, white) for versatility, alongside subtle pastel shades and soft lace trims, reflecting a shift towards intimate wear that is both supportive and aesthetically pleasing.

How does the average consumer seek information about purchasing maternity intimate wear?

The average consumer increasingly seeks information through online forums, parenting blogs, influencer reviews on platforms like YouTube and Instagram, and direct consultation with healthcare providers, making digital presence and authentic testimonials crucial for brand visibility.

What is the major challenge for brands in penetrating the Latin American market?

The major challenge in the Latin American market is navigating high import duties and complex regional logistics, combined with varying levels of consumer purchasing power and limited specialized retail infrastructure outside of key metropolitan hubs.

How are companies using segmentation to develop new products?

Companies use detailed segmentation to identify niche needs, such as developing products specifically for plus-size maternity needs, intimate wear for mothers returning to high-impact exercise post-partum, or specialized garments catering to C-section recovery, ensuring targeted product lines.

What is the definition of seamless technology in this market?

Seamless technology refers to garments knitted in one continuous piece, typically on circular looms, which eliminates stiff seams and reduces chafing, resulting in a smooth, stretchable, and pressure-free fit that is ideal for sensitive pregnant skin.

Why is the concept of 'comfort' paramount in maternity intimate wear marketing?

'Comfort' is paramount because pregnancy involves significant physical discomfort and sensitive skin; marketing emphasizes specialized fabrics and ergonomic design features that promise immediate relief and adaptiveness, positioning the product as essential for maternal wellness rather than just apparel.

What is the significance of the shift from offline to online distribution channels?

The shift to online distribution provides expectant mothers with greater convenience, privacy, access to a wider range of specialty sizing, and detailed product information (reviews, sizing charts), overcoming mobility issues and enhancing the shopping experience.

How do international brands adapt products for the Asian market?

International brands adapt for the Asian market by adjusting sizing to fit regional body types, incorporating designs that align with local cultural preferences (e.g., higher coverage or specific post-partum garment styles), and focusing on high-value, functional essentials.

What is the difference between an over-the-bump and an under-the-bump maternity panty?

Over-the-bump panties feature high waistlines with elastic panels designed to provide gentle support and coverage over the abdomen, whereas under-the-bump styles sit low beneath the belly, appealing to users who prefer minimal compression or find high-waist styles uncomfortable.

What long-term opportunity exists for manufacturers in smart maternity apparel?

The long-term opportunity lies in integrating non-invasive bio-monitoring features (like subtle heart rate or movement tracking) into intimate wear, establishing the product as a bridge between fashion, comfort, and proactive digital maternal health management.

How does competitive pricing impact premium brands in this segment?

Competitive pricing pressures premium brands to justify their higher cost through rigorous certification (e.g., GOTS, Oeko-Tex), advanced technology integration (e.g., seamless 3D knitting), and superior longevity/durability, emphasizing value over sheer affordability.

What are the key material characteristics consumers look for in maternity intimate wear?

Consumers primarily seek high stretch capacity, excellent breathability, moisture-wicking properties, extreme softness (hypoallergenic qualities), and retention of shape after prolonged wear and washing, ensuring long-lasting comfort and functional support.

Why are post-partum recovery garments considered a high-growth segment?

This segment is high-growth because there is an increasing recognition of the need for specialized garments that aid physical recovery (both vaginal and C-section deliveries), stabilize core muscles, and manage swelling in the critical first six weeks post-delivery, extending the consumer lifecycle of intimate wear.

What are the implications of delayed childbearing on market demand?

Delayed childbearing typically means the consumer has higher accumulated disposable income, leading to increased demand for premium, luxury, and technologically advanced intimate wear, prioritizing quality and sophisticated features over basic functionality.

What is the role of key opinion leaders (KOLs) in promoting maternity intimate wear?

KOLs, such as respected parenting influencers and certified lactation consultants, validate product efficacy, share authentic fit experiences, and educate followers on the importance of proper support, significantly driving brand recognition and trusted purchasing decisions.

How do regulatory requirements influence the manufacturing of maternity intimate wear?

Regulatory requirements, particularly concerning the safety of materials (dyes, heavy metals) that contact the skin, mandate stringent testing and certification processes, pushing manufacturers towards ethical sourcing and transparent supply chains, particularly in Europe and North America.

What is the upstream challenge in material procurement for sustainable maternity wear?

The upstream challenge involves securing a consistent and cost-effective supply of certified organic or recycled fibers that meet both the high performance requirements (stretch, durability) and the strict certification standards required for sensitive skin contact.

How does the rise of 'athleisure' affect the maternity intimate wear category?

The 'athleisure' trend pushes maternity wear toward functional versatility, leading to the development of supportive bras and leggings that transition seamlessly from prenatal workouts or yoga sessions to everyday casual wear, blending support with modern athletic style.

What specific feature distinguishes a true nursing bra from a generic maternity bra?

A true nursing bra features specific, easily operable clasps or access panels on the cups designed to allow quick, convenient drop-down access for feeding, which is the primary functional difference compared to a simple, supportive maternity bra without feeding capability.

In the regional analysis, why is North America considered a trendsetter for product innovation?

North America is a trendsetter due to its high concentration of specialized startups, robust venture capital investment in consumer wellness technology, and a consumer base that readily adopts high-cost innovative solutions like specialized post-partum recovery compression technologies and virtual fitting tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager