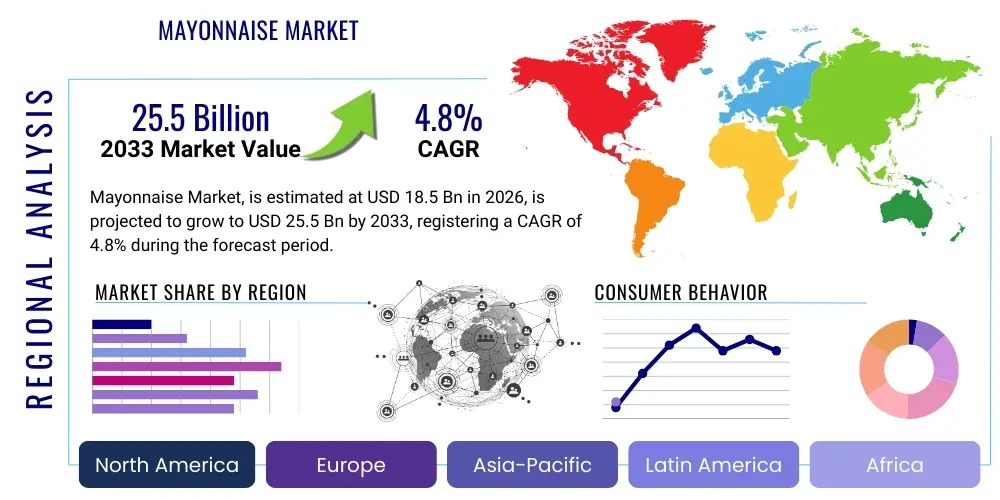

Mayonnaise Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436952 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Mayonnaise Market Size

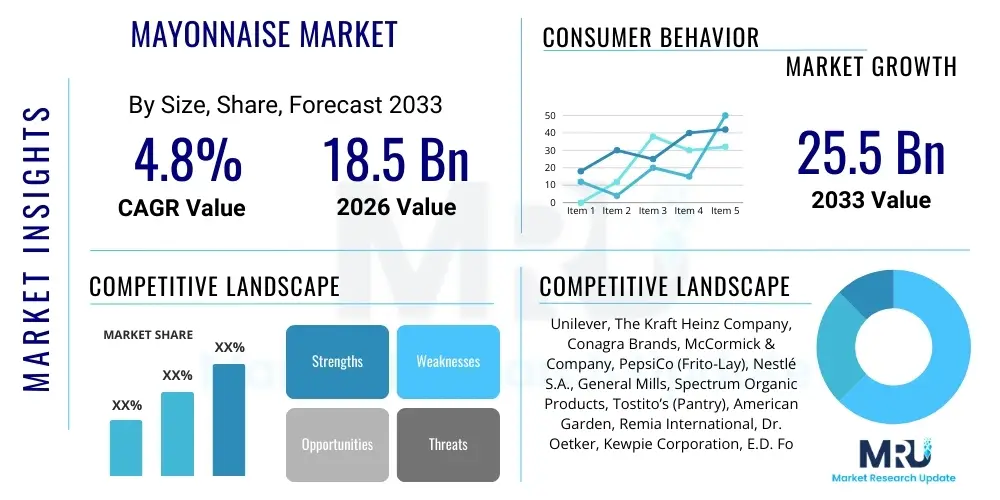

The Mayonnaise Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. This robust expansion is fueled by evolving consumer tastes, the increasing popularity of global cuisine requiring diverse condiments, and strategic product innovation focused on health and specialty diets. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.5 Billion by the end of the forecast period in 2033, demonstrating stable demand across both developed and emerging economies.

The consistent upward trajectory of the market size reflects strong penetration in the food service industry, where mayonnaise is a staple ingredient for sandwiches, salads, and prepared foods. Furthermore, household consumption remains high, driven by the perceived convenience and versatility of the product. Manufacturers are investing heavily in capacity expansion and optimization of supply chain logistics to meet this escalating global demand, particularly in regions like Asia Pacific and Latin America, which offer significant untapped potential for market growth and volume sales.

Market expansion is also intrinsically linked to demographic shifts, urbanization, and rising disposable incomes globally. As consumers adopt Westernized dietary habits and seek convenience in meal preparation, the demand for pre-packaged condiments like mayonnaise increases. This growth is compounded by the strategic marketing efforts of key players, who utilize digital platforms and strategic partnerships to enhance brand visibility and product accessibility across diverse retail channels, ensuring sustained market value appreciation throughout the forecast period.

Mayonnaise Market introduction

The Mayonnaise Market encompasses the global trade and consumption of mayonnaise, a thick, creamy condiment traditionally made from oil, egg yolk, and an acid, such as vinegar or lemon juice. This emulsion is widely recognized for its versatility, serving as a staple ingredient, a dipping sauce, and a binding agent in numerous culinary applications, ranging from sandwiches and burgers to salads and specific prepared food products. The market has diversified significantly beyond the traditional full-fat variant to include low-fat, vegan (eggless), organic, and flavored alternatives, catering to a broad spectrum of dietary preferences and health consciousness.

Major applications of mayonnaise span the household consumption segment, where it is used daily for meal enhancement, and the expansive food service sector, including restaurants, fast-food chains, and catering services, which rely on bulk volumes for operational efficiency. Key benefits driving its adoption include flavor enhancement, texture improvement, and convenience. The product offers a rich mouthfeel and binds ingredients effectively, making it indispensable in modern culinary practices globally. Its long shelf life, particularly in industrial formulations, further secures its position as a favored condiment in the packaged food industry.

The market is primarily driven by the increasing demand for ready-to-eat and processed foods, the rapid proliferation of fast-food culture across emerging economies, and persistent innovation in flavor profiles and ingredient sourcing. Consumers’ heightened awareness regarding health and sustainability has spurred manufacturers to introduce plant-based and clean-label options, mitigating traditional restraints associated with high-fat content. These factors collectively contribute to a dynamic and expansive market landscape, poised for consistent growth bolstered by continuous product evolution and strategic market penetration.

Mayonnaise Market Executive Summary

The Mayonnaise Market Executive Summary highlights a period of sustained innovation and strategic market segmentation, driven primarily by evolving consumer health trends and increased demand for convenience. Current business trends indicate a strong shift toward sustainable packaging, clean-label ingredients, and the proliferation of specialty mayonnaise variants, such as those infused with exotic spices or functional ingredients like probiotics. Key market players are actively pursuing mergers, acquisitions, and strategic partnerships to strengthen their supply chains, optimize production costs, and penetrate high-growth regional markets, emphasizing volume sales in developing economies and premiumization in mature markets.

Regionally, the market exhibits divergent growth patterns. North America and Europe remain mature markets characterized by high per capita consumption but are seeing growth concentrated in the premium, organic, and vegan segments. Conversely, the Asia Pacific (APAC) region, particularly India and China, is emerging as the primary growth engine, fueled by rapid urbanization, Western influence on dietary habits, and the expansion of organized retail infrastructure. Latin America also shows promising growth potential, driven by robust demand in the food service sector and rising household income levels, stimulating competition and local production capacity.

Segment trends underscore the dominance of the institutional/food service segment in volume terms, while the retail segment experiences higher revenue growth driven by premium products. In terms of product type, the shift from traditional to low-fat and, critically, vegan/eggless mayonnaise is the most defining trend. Distribution channels are increasingly leveraging e-commerce platforms, offering manufacturers a direct line to consumers and enabling targeted marketing of niche and specialty products, thereby disrupting traditional supermarket dominance and improving overall market accessibility and competitive intensity.

AI Impact Analysis on Mayonnaise Market

Analysis of common user questions regarding AI's impact on the Mayonnaise Market reveals primary concerns centered around supply chain predictability, quality control, ingredient traceability, and personalized flavor development. Users frequently query how AI-driven predictive analytics can optimize raw material sourcing (especially eggs and oil, which face volatile price fluctuations), reduce waste in manufacturing, and enhance food safety standards across the processing line. Furthermore, there is significant user interest in AI's role in consumer preference modeling—how algorithms can analyze vast datasets of consumer feedback, social media trends, and purchase patterns to rapidly develop and launch novel mayonnaise flavors that perfectly match hyper-localized demand and evolving dietary requirements, such as low-sodium or high-protein variants.

AI technologies are fundamentally altering the operational efficiency of mayonnaise production. Machine learning models are deployed to monitor ingredient inputs in real-time, ensuring optimal emulsification stability and consistency, which is crucial for product quality and shelf life. AI-powered inventory management systems predict demand fluctuations with greater accuracy than traditional methods, drastically reducing spoilage risks and ensuring the timely distribution of perishable ingredients and finished goods. This application of AI enhances overall resource utilization and contributes significantly to minimizing the carbon footprint associated with large-scale food manufacturing operations, addressing growing user concerns about sustainability and operational transparency.

In the consumer-facing domain, AI is instrumental in personalizing the marketing mix. Generative AI is being used to create tailored advertising content based on individual demographic data and purchase histories, optimizing ad spending and improving conversion rates for niche products like organic or gourmet mayonnaise. Moreover, AI-driven chatbots and customer service interfaces are providing instantaneous, detailed product information, including complex nutritional breakdowns and recipe suggestions, thereby enhancing brand loyalty and consumer engagement, setting a new standard for interactive food brand relationships.

- AI optimizes ingredient sourcing and mitigates price volatility risk through predictive analytics.

- Machine learning enhances real-time quality control, ensuring optimal emulsion stability and product consistency.

- AI-driven demand forecasting significantly improves inventory management, reducing waste and spoilage rates.

- Generative AI facilitates rapid flavor innovation by analyzing consumer trends and predicting successful new product formulations.

- AI personalizes marketing and consumer outreach, optimizing digital advertising campaigns for specialized mayonnaise segments.

- Robotics and automation, guided by AI, increase the speed and efficiency of high-volume manufacturing lines.

DRO & Impact Forces Of Mayonnaise Market

The dynamics of the Mayonnaise Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary impact forces. A critical driver is the surging global demand for convenience foods and the widespread adoption of Western dietary practices, particularly in developing economies, which inherently increases the usage frequency of condiments. Opportunities are predominantly centered around the premiumization trend, focusing on organic, non-GMO, and plant-based formulations, appealing to the health-conscious consumer base. However, the market faces significant restraints, primarily revolving around the volatility of key raw material prices (eggs and edible oils), regulatory challenges related to food safety and labeling, and persistent consumer perception regarding the high caloric density of traditional mayonnaise.

The positive impact forces are heavily weighted toward demographic shifts and innovation. The rising middle class in regions like APAC and Latin America translates directly into higher disposable incomes and greater expenditure on processed and packaged foods, sustaining volume growth. Technological advances in emulsion science allow manufacturers to create healthier formulations, such as those with omega-3 fatty acids or natural preservatives, effectively transforming a traditional product into a functional food item. These innovations mitigate the historical restraint of health concerns and expand the potential user base by capturing segments previously deterred by high-fat content.

Conversely, the negative impact forces, especially fluctuating commodity prices, pose continuous challenges to manufacturers' profit margins and pricing strategies. Economic downturns or geopolitical instabilities can severely impact the cost structure, requiring sophisticated hedging and procurement strategies. Overcoming these restraints necessitates strategic investment in vertical integration and the establishment of long-term supply agreements. The most significant opportunity remains the aggressive penetration of untapped rural and semi-urban markets in Asia and Africa through localized flavor adaptation and the use of affordable, single-serve packaging formats, capitalizing on the increasing demand for packaged food accessibility.

Segmentation Analysis

The Mayonnaise Market is highly fragmented and analyzed based on several dimensions including product type, packaging format, distribution channel, and end-use application. This comprehensive segmentation allows market participants to tailor their offerings to specific consumer needs and strategic retail environments. The diversification across product types—ranging from standard full-fat to specialized low-fat and vegan variants—reflects the industry's response to divergent dietary trends and heightened health consciousness among global consumers. Understanding these segments is crucial for accurate forecasting and identifying high-potential market niches that require specialized marketing efforts or localized production strategies.

Analysis of the distribution channel segmentation reveals the importance of traditional brick-and-mortar retail (supermarkets/hypermarkets) for volume sales, while the rapid expansion of the e-commerce segment is reshaping consumer purchasing habits, particularly for gourmet and niche mayonnaise products. End-use segmentation clearly distinguishes the robust, high-volume requirements of the food service industry (restaurants, catering) from the smaller, more varied purchase patterns of the household sector. Successful companies often adopt a dual-channel strategy, ensuring bulk supply for industrial clients while simultaneously maintaining strong brand visibility and personalized packaging options for retail consumers, optimizing both efficiency and profitability across the supply chain.

- Product Type

- Real/Regular Mayonnaise

- Low-Fat/Diet Mayonnaise

- Vegan/Eggless Mayonnaise (Plant-Based)

- Organic Mayonnaise

- Flavored Mayonnaise (e.g., Chipotle, Garlic Aioli)

- Packaging Format

- Jars (Glass/Plastic)

- Bottles (Squeeze/Dispenser)

- Pouches and Sachets (Single-Serve)

- Bulk Containers (Industrial/Food Service)

- Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Specialty Stores

- End-Use Application

- Household

- Food Service (Hotels, Restaurants, Cafes)

- Industrial Processing (Prepared Foods, Salad Dressings)

Value Chain Analysis For Mayonnaise Market

The Value Chain Analysis for the Mayonnaise Market begins with upstream activities involving the sourcing of primary raw materials: edible oils (soybean, rapeseed, sunflower), eggs (or plant-based substitutes for vegan variants), and acidic components (vinegar, lemon juice). This upstream segment is highly sensitive to commodity price volatility and geopolitical factors, necessitating robust procurement and risk management strategies by manufacturers. Quality assurance at this stage is paramount, especially regarding egg safety and the purity of oils, often involving advanced testing and certified supply chains to comply with stringent international food standards and ensure the final product's stability and shelf life.

The core manufacturing process involves high-shear blending and emulsification, transforming raw ingredients into a stable, semi-solid emulsion. This midstream phase utilizes advanced industrial machinery and requires precise control over temperature and blending speed to maintain product consistency across large batches. Downstream activities encompass packaging, which is critical for product preservation, shelf appeal, and distribution efficiency, involving various formats from large bulk containers for institutional clients to smaller, shelf-stable jars and flexible pouches for retail consumers. Sustainability initiatives are increasingly impacting packaging choices, favoring recyclable or bio-degradable materials to meet environmental mandates.

Distribution is segmented into direct and indirect channels. Direct distribution involves sales to large industrial food processors or major institutional clients through dedicated sales teams and logistics networks, emphasizing volume and reliability. Indirect distribution leverages established wholesalers, distributors, and vast retail networks (supermarkets, convenience stores), requiring substantial slotting fees and strong trade marketing support. The emergence of e-commerce has created a hybrid direct-to-consumer channel, allowing brands to bypass traditional retail intermediaries for specialty or high-margin products, thereby optimizing margin potential and enhancing brand control over the final consumer experience, though it requires specialized cold chain logistics for certain high-perishability variants.

Mayonnaise Market Potential Customers

The Mayonnaise Market serves a diverse array of potential customers, broadly categorized into three major end-user groups: households, food service establishments, and industrial food processors. Households represent a foundational consumer segment, where purchasing decisions are driven by brand recognition, price sensitivity, and specific dietary needs (e.g., organic or low-fat choices). This segment requires convenient packaging formats and strong retail presence, making brand loyalty and targeted consumer advertising key determinants of market share success among this large, heterogeneous group of buyers who use mayonnaise as a versatile cooking ingredient and condiment.

The Food Service sector—encompassing restaurants, quick-service restaurants (QSRs), catering companies, hotels, and institutional cafeterias—is a critical, high-volume customer segment. These buyers prioritize cost-effectiveness, consistency in quality, and availability in bulk packaging formats (e.g., gallon jars or large industrial pouches) suitable for high-throughput operations. Demand here is often tied directly to the growth of the overall hospitality and dining out industry, and suppliers must meet strict safety certifications and logistical requirements to maintain supply contracts with major national and international chains.

Industrial food processors, including manufacturers of prepared foods, ready-to-eat meals, processed salads, and specialized sauces and dressings, constitute the third major segment. These customers require customized ingredient formulations that meet specific performance criteria, such as heat stability or enhanced shelf life when mixed with other components. Their purchase volumes are extremely large, making technical support, guaranteed supply contracts, and competitive industrial pricing the primary decision factors. Suppliers often engage in co-development to create bespoke mayonnaise bases perfectly integrated into the client's complex manufacturing workflows and final product specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, The Kraft Heinz Company, Conagra Brands, McCormick & Company, PepsiCo (Frito-Lay), Nestlé S.A., General Mills, Spectrum Organic Products, Tostito’s (Pantry), American Garden, Remia International, Dr. Oetker, Kewpie Corporation, E.D. Foods, C.B.S. International, Hain Celestial Group, Bunge Limited, Ventura Foods, Del Monte Foods, Stonewall Kitchen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mayonnaise Market Key Technology Landscape

The technological landscape of the Mayonnaise Market is fundamentally focused on achieving stable, scalable emulsification, ensuring product safety, and extending shelf life while accommodating modern dietary requirements like reduced fat or plant-based formulations. The core technology revolves around high-pressure homogenization and high-shear mixers, essential for creating the fine, stable oil-in-water emulsion that defines mayonnaise texture and prevents phase separation during storage and transport. Advanced mixing technologies now integrate in-line sensors and automated control systems to monitor viscosity, particle size distribution, and pH levels in real-time, significantly reducing batch variation and enhancing operational predictability in large-scale manufacturing environments.

Crucially, the industry relies on sophisticated preservation technologies. While traditional methods involve acidification using vinegar or lemon juice, modern manufacturing employs clean-label preservation systems, including natural antimicrobials and high-pressure processing (HPP). HPP is a non-thermal method that neutralizes pathogens and spoilage microorganisms, allowing manufacturers to reduce or eliminate chemical additives while maintaining the fresh flavor profile and extending the refrigerated shelf life of premium, less processed mayonnaise variants, a key selling point for health-conscious consumers. This technology addresses the challenge of microbial stability, especially in formulations with reduced acid content or novel plant-based ingredients.

Furthermore, technology is playing an increasing role in ingredient substitution and novel formulation development. Companies are utilizing proprietary encapsulation techniques to introduce functional ingredients, such as omega-3 oils, without compromising the creamy texture or incurring off-flavors. Biotechnology and fermentation processes are being explored to produce sustainable, high-quality egg substitutes or novel emulsifying agents derived from plant proteins (like chickpea or potato protein), allowing the production of vegan mayonnaise that closely mimics the sensory properties of traditional egg-based products. This technological shift is paramount for capitalizing on the rapid growth within the plant-based food segment and maintaining market relevance in a consumer landscape increasingly prioritizing sustainable and ethical sourcing.

Regional Highlights

Regional dynamics significantly influence the global mayonnaise market structure, dictated by local culinary traditions, economic maturity, and retail infrastructure development. North America, characterized by high disposable income and established fast-food culture, represents a high-value market where growth is concentrated in the premium, gourmet, and specialty segments (e.g., organic, paleo, or aioli variants). The U.S. and Canada remain crucial centers for product innovation and the rapid adoption of health-focused alternatives, with intense competition driving continuous marketing expenditure.

Europe mirrors North America in maturity, with Western European nations showing stable consumption and a strong preference for high-quality, regionally distinct mayonnaise types (such as Belgian mayonnaise or French aioli). Regulatory emphasis on clean labeling and animal welfare standards profoundly impacts ingredient sourcing and formulation in this region. Conversely, Eastern Europe is experiencing faster consumption growth due to rising affluence and the integration of convenience foods into local diets. Manufacturers must navigate complex regulatory environments across the European Union while adapting flavor profiles to meet diverse national tastes.

The Asia Pacific (APAC) region stands out as the highest-growth market globally. This expansion is driven by population density, rapid urbanization, rising disposable incomes, and the increasing influence of Western dining trends, especially in countries like China, India, and Southeast Asia. The local market often prefers unique, sweeter, or savory variants tailored to local palate requirements, such as Kewpie’s distinct flavor profile. Market penetration often relies on the expansion of cold chain logistics and investment in modern retail formats. The Middle East and Africa (MEA) region also presents significant opportunities, fueled by population growth and strong demand in the food service sector, requiring suppliers to focus on shelf-stable, high-quality products suitable for varying climatic conditions and cultural dietary norms.

- North America: Market stability with high per capita consumption; focus on premium, organic, and keto/paleo-friendly variants. Dominated by large multinational food conglomerates.

- Europe: Mature market with diverse national preferences; strong demand for clean-label, non-GMO, and sustainable ingredient sourcing. Significant regulatory impact on production.

- Asia Pacific (APAC): Highest growth potential; driven by urbanization, fast-food proliferation, and Westernization of diets. High demand for localized flavor adaptations and convenient packaging.

- Latin America: Consistent growth fueled by expanding middle-class populations and strong food service demand. Increasing interest in low-cost and versatile bulk options.

- Middle East and Africa (MEA): Growth tied to tourism, urbanization, and the rise of organized retail. Emphasis on product stability under high temperatures and adherence to Halal certification standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mayonnaise Market, analyzing their product portfolios, geographical presence, recent strategic developments, and competitive positioning.- Unilever

- The Kraft Heinz Company

- Conagra Brands

- McCormick & Company

- PepsiCo (Frito-Lay)

- Nestlé S.A.

- General Mills

- Spectrum Organic Products

- Tostito’s (Pantry)

- American Garden

- Remia International

- Dr. Oetker

- Kewpie Corporation

- E.D. Foods

- C.B.S. International

- Hain Celestial Group

- Bunge Limited

- Ventura Foods

- Del Monte Foods

- Stonewall Kitchen

Frequently Asked Questions

Analyze common user questions about the Mayonnaise market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Vegan Mayonnaise segment?

The primary factor driving the growth of the Vegan Mayonnaise segment is the increased consumer adoption of plant-based diets, driven by concerns over animal welfare, health benefits (e.g., cholesterol reduction), and environmental sustainability, encouraging manufacturers to develop high-quality, eggless alternatives using substitutes like pea or potato protein.

How do fluctuating raw material prices impact the Mayonnaise Market?

Fluctuating global prices for key raw materials, specifically edible oils (like soybean and sunflower oil) and eggs, directly impact manufacturers' cost of goods sold. This volatility often forces companies to adjust consumer pricing or compress profit margins, requiring sophisticated hedging strategies and optimized procurement processes to maintain stability.

Which geographical region exhibits the fastest growth rate for mayonnaise consumption?

The Asia Pacific (APAC) region, particularly emerging economies like India and China, currently exhibits the fastest growth rate for mayonnaise consumption, spurred by rapid urbanization, Western dietary influence, and the expansion of modern retail and fast-food chains.

What role does technology play in improving mayonnaise shelf life and safety?

Technology plays a critical role through advanced homogenization techniques, ensuring stable emulsions, and through preservation methods like High-Pressure Processing (HPP). HPP significantly extends product shelf life and enhances food safety by eliminating pathogens without relying heavily on artificial preservatives or high heat, preserving flavor and quality.

What are the most significant consumer trends influencing product innovation in this market?

The most significant consumer trends are the demand for clean-label ingredients (minimal artificial additives), the push for reduced fat and sugar content, and the desire for specialized functional variants, such as organic, non-GMO, and mayonnaise infused with healthy fats like avocado oil or functional ingredients like added fiber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Egg-free Mayonnaise Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Salad Dressings & Mayonnaise Market Size Report By Type (Mayonnaise, Sauces, Oil-based Dressings, Other Types), By Application (Off-Trade, Hypermarkets/Supermarkets, Convenience Stores, Specialty Retailers, Online Retail Stores, Other Distribution Channels, On-Trade), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Salad Dressings and Mayonnaise Market Size Report By Type (Salad Dressings, Mayonnaise), By Application (Daily Use, Food Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Vegan Mayonnaise Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Glass Jars Packaging, Plastic Containers Packaging, Pouches Packaging), By Application (Retail Stores, Online Sales, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Salad Dressings and Mayonnaise Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Salad Dressings, Mayonnaise), By Application (B2C, B2B), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager