MBE Effusion Cells Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432036 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

MBE Effusion Cells Market Size

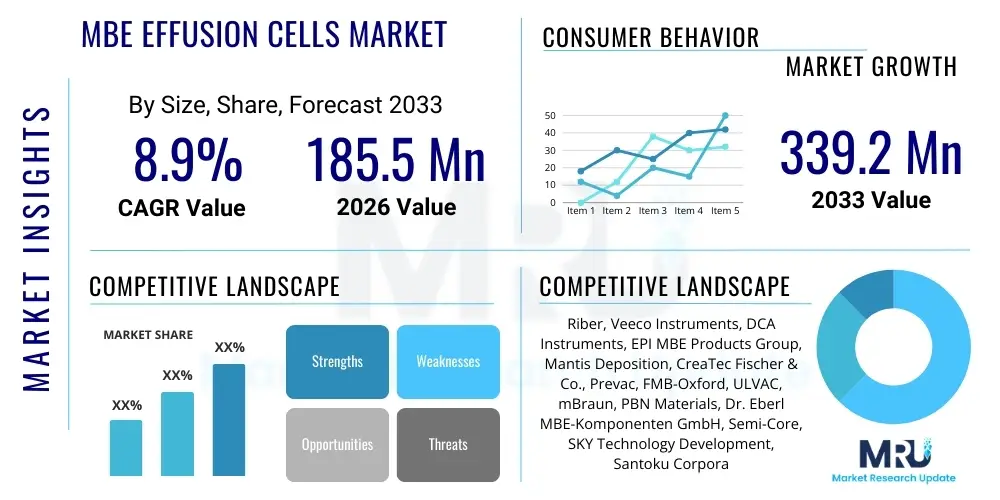

The MBE Effusion Cells Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 339.2 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for advanced compound semiconductors, crucial components in high-performance computing, 5G infrastructure, and sophisticated optoelectronic devices. The inherent precision and material quality achievable through Molecular Beam Epitaxy (MBE) systems, reliant on high-performance effusion cells, positions this market for consistent and accelerated growth over the next decade.

MBE Effusion Cells Market introduction

Molecular Beam Epitaxy (MBE) effusion cells are critical subsystems within ultra-high vacuum deposition equipment, responsible for generating highly pure, stable, and flux-controlled atomic beams of source materials onto a substrate. These cells operate under extreme vacuum conditions and high temperatures, ensuring the precise deposition needed for growing thin films of crystalline materials, predominantly compound semiconductors like Gallium Nitride (GaN), Indium Phosphide (InP), and Gallium Arsenide (GaAs). The accuracy of the effusion cell flux directly dictates the stoichiometry, purity, and crystal structure of the resulting epitaxial layer, which forms the core functional element of advanced electronic and photonic devices.

The primary applications of MBE effusion cells span across several high-technology industries. Major utilization areas include the fabrication of high-electron-mobility transistors (HEMTs) used in radio frequency applications and 5G base stations, manufacturing of laser diodes and LEDs for consumer electronics and data center interconnects, and the development of sophisticated sensors and solar cells. Furthermore, MBE technology, underpinned by reliable effusion cells, is indispensable in cutting-edge academic and industrial research focusing on novel material systems such as topological insulators, 2D materials (e.g., graphene), and materials vital for quantum computing components.

The market growth is largely driven by the pervasive need for device miniaturization and performance enhancement, demanding superior material quality that conventional growth methods often cannot match. Key benefits of high-quality effusion cells include unparalleled flux stability, excellent temperature uniformity, minimal cross-contamination, and extended operational lifetimes, which directly translate into higher yields and better device characteristics for manufacturers. Driving factors include the massive investment influx into the global semiconductor fabrication sector, especially in APAC, coupled with the relentless technological push towards higher frequencies, greater power efficiency, and photonics integration in modern communication systems.

MBE Effusion Cells Market Executive Summary

The MBE Effusion Cells market is characterized by robust business trends centered on technological refinement, moving toward larger capacity cells and systems capable of handling larger wafer sizes (e.g., 6-inch and 8-inch substrates) to improve cost-efficiency in production. There is a discernible trend toward developing advanced cell materials, such as Pyrolytic Boron Nitride (PBN) and Tantalum, which offer enhanced purity and temperature stability, crucial for depositing complex multi-element compounds. Furthermore, manufacturers are focusing on integrating smart features and advanced monitoring systems into effusion cells to enable real-time flux correction and predictive maintenance, addressing the historically high maintenance burden of UHV equipment.

Regionally, the Asia Pacific (APAC) region dominates the market, fueled by large-scale government investments in domestic semiconductor manufacturing capacities, particularly in China, South Korea, and Taiwan. APAC serves as the primary hub for mass production utilizing MBE technology. North America and Europe, while smaller in market size, maintain critical importance due to their leading roles in fundamental Material Science research, Quantum Technology development, and specialized defense applications, driving demand for high-end, customized, and ultra-high-purity effusion cells. The geographical expansion of new R&D facilities necessitates localized support for complex MBE systems, influencing supply chain strategies.

Segmentation trends highlight the increasing prominence of high-temperature effusion cells capable of reaching over 1400°C, necessary for growing GaN and related wide-bandgap materials, which are critical for high-power electronics. By application, the demand originating from the LED/Laser Diode segment remains strong, but the fastest growth is observed in the advanced transistor and quantum computing segments, which require stringent flux control and ultra-low defect rates. Material purity is also a key competitive segment, with manufacturers prioritizing PBN crucible-based systems due to their superior chemical inertness and reduced contamination risk compared to conventional materials.

AI Impact Analysis on MBE Effusion Cells Market

The analysis of common user questions regarding AI's impact on MBE effusion cells reveals significant interest in three core areas: the automation of complex growth recipes, predictive diagnostics for cell component failure, and optimization of material flux stability. Users frequently inquire about how AI algorithms can interpret real-time sensor data (such as thermocouple readings, RHEED patterns, and flux monitoring data) to automatically adjust cell heater power and shutter operation, thereby maintaining perfect stoichiometry during prolonged growth runs. Concerns often revolve around the reliability of AI models in ultra-sensitive UHV environments and the integration challenges with legacy MBE systems. Expectations are high that AI can substantially reduce the trial-and-error approach currently dominating MBE research, leading to faster development cycles and higher production yields by ensuring unprecedented flux uniformity and stability.

- AI enables real-time flux optimization by analyzing deposition data and automatically adjusting effusion cell temperatures, minimizing material waste.

- Predictive Maintenance (PdM) algorithms monitor heater resistance and thermocouple drift, forecasting imminent cell component failure and scheduling proactive replacement.

- Automated growth recipe generation utilizes machine learning to correlate source material flux settings with desired epitaxial layer properties, accelerating materials discovery.

- Improved process control through AI minimizes variations in atomic layer thicknesses, significantly enhancing device performance consistency.

- Data analytics platforms aggregate operational data from multiple cells and systems, providing actionable insights into optimal operating parameters for various compound materials.

DRO & Impact Forces Of MBE Effusion Cells Market

The market for MBE effusion cells is propelled by powerful drivers, countered by inherent restraints, and balanced by significant long-term opportunities, all shaping the competitive landscape through various impact forces. A primary driver is the exponentially increasing global requirement for high-efficiency and high-speed electronic components, particularly compound semiconductors utilized in advanced wireless communication (5G/6G), electric vehicles, and high-performance data processing units. This demand necessitates the atomic-level precision that only MBE systems, equipped with high-performance effusion cells, can reliably deliver. Additionally, increasing R&D activities globally in quantum technologies and advanced material science further accelerate the adoption of these specialized deposition tools.

Conversely, the market faces stringent restraints primarily related to the extremely high initial capital investment required for MBE systems and their associated effusion cells, making the technology inaccessible to smaller research entities or startups. Furthermore, the operational complexity and high maintenance costs associated with maintaining ultra-high vacuum environments and handling specialized, often toxic, source materials pose significant barriers. The limited lifespan of crucibles and heating elements under extreme temperature cycling also constitutes a recurring cost and operational bottleneck, restraining faster deployment in large-scale manufacturing environments.

Opportunities for market expansion are abundant in the development of next-generation materials like ultrawide bandgap semiconductors (e.g., Aluminum Nitride, Boron Nitride) and specialized materials required for spintronics and quantum computing, all of which depend heavily on customized, ultra-pure effusion sources. Technological advancements focusing on automation, integration of advanced diagnostic tools, and the development of modular, quick-swap cell designs represent crucial opportunities to lower the total cost of ownership and enhance system uptime. The impact forces are characterized by stringent quality standards demanded by end-users (especially defense and aerospace) and the rapid pace of technological obsolescence in the semiconductor industry, compelling continuous innovation in effusion cell design to handle new source materials and achieve higher temperature stability.

Segmentation Analysis

The MBE Effusion Cells Market is broadly segmented based on key functional and application characteristics, providing a detailed view of demand dynamics across various technological niches. Primary segmentation criteria include the Type of Effusion Cell, the Material Used for the Crucible, and the End-Use Application. Understanding these segments is crucial for manufacturers to tailor their product offerings, whether focusing on high-volume production cells or specialized research-grade sources. The market diversity reflects the wide range of materials and complex structures that MBE systems are engineered to produce, from simple binary alloys to intricate quaternary compounds.

- By Type:

- Standard Effusion Cells (Low Temperature)

- High-Temperature Effusion Cells (Up to 1400°C)

- Valve Cracker Cells (For precise flux control of volatile materials)

- Sublimation Sources (For solid sources like Carbon or Silicon)

- Dopant Cells

- By Crucible Material:

- Pyrolytic Boron Nitride (PBN)

- Tantalum

- Graphite

- Quartz

- By Application:

- Optoelectronics (LEDs, Laser Diodes, Photodetectors)

- High-Frequency & Power Electronics (HEMTs, RF components)

- Research & Development (Academic and Industrial Labs)

- Advanced Quantum Materials and Sensors

Value Chain Analysis For MBE Effusion Cells Market

The value chain for the MBE Effusion Cells Market begins with the upstream suppliers who provide specialized high-purity raw materials, including refractory metals (Tantalum, Molybdenum), high-purity ceramic components (PBN), and the semiconductor source materials themselves (Ga, As, In, N). The quality and purity of these materials are paramount, as even trace contaminants can compromise the epitaxial growth process. Upstream specialization focuses on producing PBN crucibles and high-stability heater filaments capable of enduring repeated high-temperature cycles in UHV environments, requiring highly specialized manufacturing capabilities.

The midstream involves the core manufacturing process, where companies design, fabricate, and assemble the complex effusion cells, integrating heaters, thermocouples, shutters, and mounting flanges. This stage is characterized by intense intellectual property concentration related to thermal management design, flux monitoring systems, and vacuum compatibility. The distribution channel is crucial; due to the technical complexity and high cost, the distribution is typically direct from the manufacturer to the end-user (academic institution, R&D lab, or semiconductor fab). Indirect distribution is rare but might involve specialized high-tech equipment distributors who also provide integration and maintenance services.

The downstream analysis focuses on the end-users—semiconductor manufacturers, defense contractors, and specialized research institutions—who utilize these cells within complete MBE systems to produce high-value epitaxial wafers. Customer feedback is critical, driving continuous innovation in flux stability and source capacity. Potential customers are heavily influenced by reputation and proven reliability in achieving specific material growth parameters. Aftermarket services, including refurbishment, component replacement (e.g., PBN liners), and calibration support, form a significant part of the total market value, ensuring the long-term operational viability of the effusion cells.

MBE Effusion Cells Market Potential Customers

Potential customers for MBE Effusion Cells are highly specialized entities demanding ultra-pure material deposition for advanced device fabrication. These customers fall broadly into three categories: large-scale commercial semiconductor fabrication facilities (fabs), specialized defense and aerospace contractors, and global academic and industrial research laboratories. Semiconductor fabs focusing on compound materials (III-V, II-VI) are the largest volume buyers, particularly those manufacturing high-brightness LEDs, high-power radio frequency devices (RFICs), and advanced photonics components essential for high-speed data transmission and 5G infrastructure. Their purchasing decisions are primarily driven by throughput, long-term stability, and low defect rates.

Defense and aerospace clients constitute a niche segment demanding the highest level of material purity and reliability for mission-critical applications such as infrared detectors, advanced military communication systems, and satellite solar cells. These customers often require highly customized effusion cells tailored for esoteric source materials or specific geometric constraints. Finally, university labs and national research institutes are consistent buyers, driving demand for flexible, multi-pocket MBE systems equipped with various cell types (standard, cracker, dopant) to explore novel materials like topological insulators, complex oxide films, and materials for early-stage quantum computing research. These research customers prioritize flexibility and excellent technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 339.2 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Riber, Veeco Instruments, DCA Instruments, EPI MBE Products Group, Mantis Deposition, CreaTec Fischer & Co., Prevac, FMB-Oxford, ULVAC, mBraun, PBN Materials, Dr. Eberl MBE-Komponenten GmbH, Semi-Core, SKY Technology Development, Santoku Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MBE Effusion Cells Market Key Technology Landscape

The technological landscape of MBE effusion cells is continuously evolving, driven by the need to achieve higher purity, greater flux stability, and broader material compatibility. A pivotal development has been the refinement of Pyrolytic Boron Nitride (PBN) components. PBN, favored for its extreme thermal stability, chemical inertness, and ultra-high purity, is the material of choice for crucibles, allowing MBE processes to deposit highly reactive or corrosive source materials without contamination. Recent innovations in PBN manufacturing focus on reducing porosity and improving thermal conductivity uniformity across the crucible wall, which is essential for minimizing temperature gradients and ensuring highly stable atomic fluxes over long deposition times.

Another crucial area of innovation is the development of advanced source types, particularly Valve Cracker Cells and Plasma Source Cells. Valve Cracker Cells are designed to thermally decompose larger molecular species (like As4 or P4) into highly reactive atomic species (As2 or P2) just before deposition. The use of integrated valves allows for rapid, precise, and highly repeatable control over the flux rate, offering superior control compared to traditional shutter mechanisms. Plasma Source Cells, particularly RF plasma sources, are critical for incorporating elements like nitrogen and oxygen into the crystal structure (e.g., GaN). Technological advancements here focus on maximizing plasma density and minimizing ion damage to the growing surface through optimized magnetic confinement and aperture design, yielding superior material quality for wide bandgap applications.

Furthermore, the integration of sophisticated monitoring and control systems is transforming the usability and reliability of effusion cells. Real-time flux monitoring techniques, such as Atomic Absorption Spectroscopy (AAS) or Beam Flux Monitors, are increasingly integrated to provide direct measurement of the beam intensity, allowing for immediate feedback and correction of the cell temperature or shutter position. This move towards 'smart' cells, utilizing high-precision thermocouples (like W-Re type) and advanced PID controllers, ensures that material growth remains within the tightest specifications required for fabricating complex heterostructures and quantum wells, positioning the technology at the forefront of semiconductor innovation and reliability improvement.

Regional Highlights

Regional dynamics play a vital role in shaping the MBE Effusion Cells Market, reflecting differences in semiconductor manufacturing capacity, R&D intensity, and government strategic investment focus. Asia Pacific (APAC) dominates the global market both in terms of consumption volume and production capacity. This supremacy is attributable to the concentration of major semiconductor manufacturing powerhouses in South Korea, Taiwan, and Japan, coupled with substantial, state-driven investment in China aimed at achieving self-sufficiency in compound semiconductors, particularly for 5G and military applications. The strong demand for high-brightness LEDs and vertical-cavity surface-emitting lasers (VCSELs) in APAC sustains a high operational demand for robust, high-throughput effusion cells and related consumables.

North America maintains a leading position in advanced materials research and development, particularly in emerging fields like quantum computing, spintronics, and highly specialized defense electronics. While manufacturing volume is lower compared to APAC, the demand for specialized, high-precision, research-grade effusion cells and unique source material capability is extremely high. US-based research institutions and companies drive innovation in customized cell design and complex multi-source systems. Similarly, Europe, particularly Germany and the UK, serves as a hub for academic excellence in material science and photonics, leading to steady demand for highly specialized MBE components for academic and governmental research projects, focusing heavily on II-VI and III-V materials for advanced sensors and energy applications.

Latin America and the Middle East & Africa (MEA) currently represent nascent but potentially fast-growing markets. Growth in MEA is often driven by defense-related investments and nascent academic initiatives in applied physics and renewable energy research, requiring specialized deposition tools. Latin America sees limited, localized growth primarily linked to academic research centers. However, global supply chain expansions and strategic governmental efforts to diversify semiconductor production outside traditional hubs could stimulate future growth in these regions, making localized service and technical support increasingly important factors for market players entering these developing territories.

- Asia Pacific (APAC): Market volume leader due to dominant semiconductor manufacturing base (Taiwan, South Korea, China); strong demand for optoelectronics (LEDs, VCSELs) and 5G components.

- North America: Center for high-value R&D, quantum technology development, and specialized defense applications; focuses on custom, ultra-high-purity effusion cells and complex systems.

- Europe: Key region for fundamental material science research and photonics innovation (Germany, UK); stable demand for academic and specialized industrial research systems.

- Middle East & Africa (MEA): Emerging market driven by strategic defense investments and initial academic programs focusing on specialized materials.

- Latin America: Small but growing R&D segment focused on university-level material science and physics research, primarily driven by governmental grants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MBE Effusion Cells Market.- Riber

- Veeco Instruments

- DCA Instruments

- EPI MBE Products Group

- CreaTec Fischer & Co.

- Prevac

- FMB-Oxford

- Mantis Deposition

- ULVAC

- mBraun

- Dr. Eberl MBE-Komponenten GmbH

- PBN Materials (Crucible Supplier)

- Semi-Core

- SKY Technology Development

- Santoku Corporation (Source Material Supplier)

- LayTec AG (Monitoring Solutions Provider)

- Fuji Film Corporation (Partially related)

- Showa Denko K.K. (Related Source Materials)

- Hitachi High-Tech Corporation (System Integration)

- MBE-Komponenten (Custom solutions)

Frequently Asked Questions

Analyze common user questions about the MBE Effusion Cells market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the demand for High-Temperature MBE Effusion Cells?

The primary driver is the increasing fabrication of Gallium Nitride (GaN) and related wide-bandgap semiconductors, essential for high-power electronics, 5G base stations, and high-efficiency lighting. These materials require deposition temperatures often exceeding 1200°C, necessitating specialized high-temperature PBN or Tantalum-based effusion cells for stable flux delivery.

How does crucible material selection affect the performance of an MBE effusion cell?

Crucible material selection critically influences material purity and stability. Pyrolytic Boron Nitride (PBN) is preferred for its chemical inertness and ultra-high purity, minimizing contamination of the epitaxial layer, crucial for high-performance devices. Tantalum or Graphite are often used for specific high-vapor-pressure elements or specialized processes where PBN is chemically incompatible.

What is the role of Valve Cracker Cells in modern Molecular Beam Epitaxy systems?

Valve Cracker Cells (VCCs) are used to precisely control the flux and species of volatile source materials like Arsenic or Phosphorous. VCCs crack molecular species into more reactive dimers (e.g., As4 into As2), offering superior shutter-free flux regulation and enabling sharper heterointerfaces required for advanced quantum structures and quantum well lasers.

Which geographical region dominates the MBE Effusion Cells Market, and why?

The Asia Pacific (APAC) region dominates the market due to its high concentration of large-scale semiconductor manufacturing facilities in countries like China, South Korea, and Taiwan, which utilize MBE technology extensively for the production of advanced optoelectronics and radio frequency components.

How is AI expected to enhance the operational lifespan and reliability of effusion cells?

AI impacts reliability through Predictive Maintenance (PdM) models, which analyze real-time sensor data (thermocouple readings, heater current) to detect subtle drifts or anomalies. This allows operators to accurately predict the remaining useful life of critical components like heaters and crucibles, scheduling proactive maintenance before catastrophic failure occurs, thereby maximizing system uptime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager