MBE Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434859 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

MBE Systems Market Size

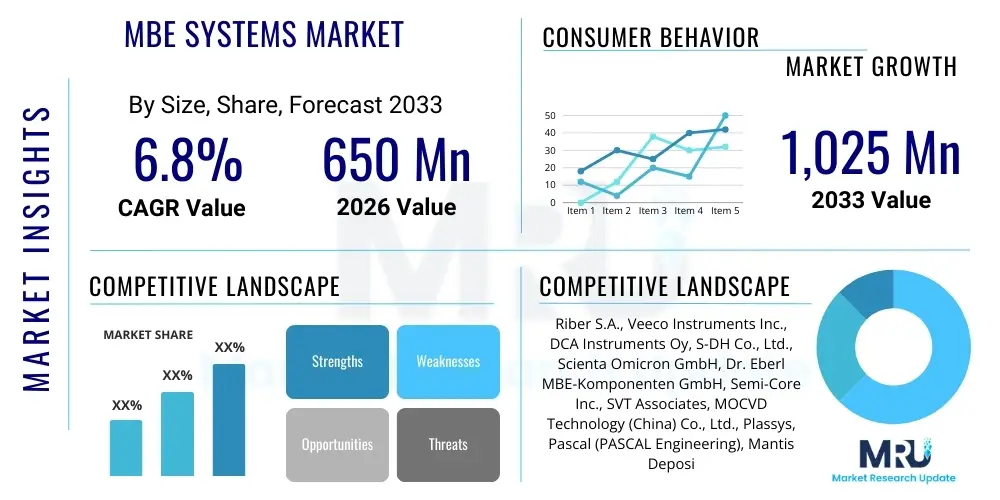

The MBE Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,025 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating global demand for advanced compound semiconductors, essential for high-frequency electronics, next-generation wireless communication infrastructure (5G and 6G), and specialized quantum devices. The unique capability of MBE technology to provide atomic-layer precision and ultra-pure material deposition solidifies its indispensable role in cutting-edge material science and commercial production of sophisticated electronic and photonic components.

MBE Systems Market introduction

The Molecular Beam Epitaxy (MBE) Systems Market encompasses highly sophisticated, ultra-high vacuum (UHV) deposition equipment utilized for growing crystalline thin films with unmatched purity and atomic precision. MBE systems operate by heating source materials in effusion cells, generating molecular or atomic beams that travel through a vacuum to deposit on a heated substrate, enabling epitaxial growth layer by layer. This precise control is crucial for manufacturing advanced devices such as High Electron Mobility Transistors (HEMTs), specialized laser diodes, sophisticated solar cells, and complex quantum structures based predominantly on III-V and II-VI compound semiconductors like Gallium Nitride (GaN), Indium Phosphide (InP), and Gallium Arsenide (GaAs). The product description centers on high-vacuum chambers, substrate manipulators, effusion cells, and in-situ monitoring tools like Reflection High-Energy Electron Diffraction (RHEED).

Major applications of MBE technology span several high-growth sectors, including optoelectronics (e.g., VCSELs for data communication and sensing, LEDs, and photodetectors), wireless communication (power amplifiers and switches for 5G/6G), and emerging fields such as quantum computing and high-efficiency photovoltaic devices. The primary benefits of using MBE over alternative deposition methods like MOCVD (Metal-Organic Chemical Vapor Deposition) include superior control over layer thickness, sharper interfaces, and lower growth temperatures, leading to materials with significantly higher electronic and optical performance characteristics. These advantages make MBE systems critical tools for both academic research institutions exploring novel material physics and industrial manufacturers producing high-performance, specialized compound semiconductor devices.

Driving factors for market expansion include escalating defense spending requiring high-reliability compound semiconductors, rapid technological advancement in consumer electronics demanding faster processors and advanced sensors, and the global push towards commercializing quantum technologies. Furthermore, the increasing complexity of hetero-structure devices, which require multiple materials grown sequentially with near-perfect lattice matching, inherently favors the precision offered by MBE systems. Investment in epitaxial wafer foundries, particularly in Asia Pacific, also contributes significantly to the rising adoption of production-scale MBE equipment, moving the technology beyond niche research applications into mainstream industrial manufacturing processes.

MBE Systems Market Executive Summary

The MBE Systems Market is undergoing a significant transformation driven by pronounced shifts in business trends, accelerated regional focus, and evolving segmentation dynamics. Business trends emphasize system automation and larger substrate capacity, moving MBE from purely research-oriented installations to high-throughput, industrial production environments, particularly for high-volume applications like VCSEL production for 3D sensing and high-power radio frequency devices (RF devices). Strategic alliances between equipment manufacturers and material suppliers are becoming common to optimize material sources and system performance. There is also a strong trend toward integrating sophisticated real-time metrology within MBE systems to ensure stringent quality control and yield optimization, addressing the high capital cost associated with these systems.

Regional trends indicate that the Asia Pacific (APAC) region, led by China, South Korea, and Japan, holds the largest market share and exhibits the fastest growth rate. This dominance is attributable to massive government investment in domestic semiconductor fabrication capabilities, robust consumer electronics manufacturing ecosystems, and aggressive expansion into advanced photonics research. North America and Europe remain crucial hubs for high-end research MBE systems, quantum device development, and defense-related compound semiconductor manufacturing, maintaining leadership in technological innovation and niche high-performance segments. Market competitiveness is intensifying, focusing on service infrastructure and customization capabilities tailored to unique epitaxial requirements across different geographies.

Segmentation trends highlight the increasing revenue contribution from production MBE systems over traditional research systems, reflecting the commercial maturity of compound semiconductor applications. By material type, III-V semiconductors (GaAs, InP, GaN) continue to dominate due to their necessity in high-speed and optoelectronic devices, while the emerging Oxide MBE segment is experiencing accelerated adoption driven by applications in spintronics and novel superconducting materials. The application segment sees robust growth in Data Communication and 3D Sensing driven by the global deployment of fiber optics and advanced consumer interfaces, alongside the long-term potential residing in the specialized Quantum Technology segment, which demands unparalleled material purity and structural control achievable only through MBE.

AI Impact Analysis on MBE Systems Market

User queries regarding AI’s impact on the MBE Systems Market frequently center on themes of process optimization, autonomous control, and predictive maintenance. Users are concerned about how AI can mitigate the complexity and cost associated with manual tuning of epitaxial growth parameters (e.g., flux ratios, substrate temperature, shutter sequences), which currently rely heavily on highly skilled human operators. Key expectations revolve around using machine learning algorithms to analyze RHEED patterns and in-situ monitoring data to achieve "closed-loop" growth control, enabling unprecedented material reproducibility and significantly reducing trial-and-error costs. Furthermore, users are keenly interested in how predictive AI models can forecast equipment failure, minimizing system downtime in highly critical and capital-intensive production environments.

The integration of Artificial Intelligence and Machine Learning (ML) is poised to revolutionize the operational efficiency and material quality achievable within MBE systems. AI algorithms can process vast amounts of data generated by RHEED, pyrometers, and mass spectrometers simultaneously, identifying complex, non-linear correlations between growth parameters and resulting material properties that are invisible to traditional control systems. This capability allows for real-time adjustments to maintain optimal growth conditions, particularly critical during the transition between atomic layers in complex heterostructures, thereby enhancing the homogeneity and yield of epitaxial wafers. The impact of AI fundamentally shifts the focus from manual parameter setting to data-driven process optimization.

Adoption of AI in MBE is accelerating the transition towards "Industry 4.0" manufacturing principles within the semiconductor sector. AI-driven predictive maintenance optimizes service schedules and component replacement cycles, maximizing system uptime, which is vital given the extremely high cost of unscheduled downtime in UHV equipment. Moreover, AI aids in the rapid development of new materials by efficiently exploring vast parameter spaces, significantly cutting down the time required for research and development cycles. This allows researchers and manufacturers to quickly iterate on novel material compositions required for next-generation devices like topological insulators or complex multiferroic materials, ensuring the MBE market remains at the forefront of material science innovation.

- Enhanced Process Control: AI algorithms analyze real-time RHEED and growth rate data to automate flux adjustments, ensuring ultra-precise layer deposition and reproducibility (closed-loop control).

- Predictive Maintenance: Machine learning models forecast potential failures in effusion cells, vacuum pumps, and substrate heaters based on operational telemetry, minimizing unscheduled system downtime.

- Accelerated Material Discovery: AI assists in navigating complex growth parameter spaces for novel materials (e.g., oxides, quantum materials), significantly reducing R&D time and cost.

- Yield Optimization: ML correlates growth conditions with post-growth electrical and optical measurements, enabling automatic compensation for environmental drifts and improving overall wafer yield.

- Data-Driven Calibration: Automated calibration routines using computer vision for RHEED pattern interpretation ensure greater consistency across multiple MBE systems and fabrication facilities.

- Remote Monitoring and Diagnostics: AI-powered platforms allow global service teams to diagnose system issues remotely, speeding up resolution times and improving overall service efficiency.

- Complex Heterostructure Growth: Automation manages the intricate timing of shutters and temperature ramps required for fabricating complex multi-layer structures, reducing human error.

DRO & Impact Forces Of MBE Systems Market

The MBE Systems Market is propelled forward by significant drivers, yet faces substantial restraints, opening key opportunities that collectively determine the impact forces shaping its trajectory. The primary driver is the insatiable global demand for high-performance compound semiconductors used in emerging technologies such as 5G/6G, specialized defense electronics, and advanced optoelectronic sensing applications like LiDAR and 3D sensing. The superior material quality and atomic-level precision inherent to MBE growth are non-negotiable requirements for these demanding applications. However, market expansion is heavily restrained by the extremely high capital investment required for purchasing, installing, and maintaining MBE systems, coupled with the necessity for highly specialized technical expertise to operate the complex ultra-high vacuum equipment and interpret growth diagnostics. These constraints often limit MBE adoption primarily to large research institutions and high-volume, well-funded semiconductor manufacturers.

Opportunities for growth lie significantly in the burgeoning fields of quantum technology and advanced material research, specifically the production of materials like topological insulators, superconducting films, and complex perovskites, where MBE's purity and control are unmatched. Furthermore, the development of hybrid MBE systems integrating features from alternative deposition techniques (e.g., gas source capabilities) expands the range of materials that can be grown efficiently. The market sees strong impact forces from increasing governmental subsidies and strategic initiatives, particularly in APAC and North America, aimed at achieving semiconductor self-sufficiency, driving investment into both research and production MBE infrastructure. Innovations in automation and substrate size expansion also act as positive impact forces, making MBE technology more economically viable for high-volume manufacturing.

The cumulative impact forces dictate a market segment characterized by high value, high precision, and moderate volume compared to mass market silicon processing. While the cost barrier remains a significant restraining force, the increasing performance requirements of next-generation devices (faster switches, higher power outputs, single-photon sensitivity) ensure that MBE remains the technology of choice for specialized, premium-tier wafers. The market dynamic is shifting from pure research tool provision to industrial solution delivery, with manufacturers focusing on improving throughput, system reliability, and integrating AI to overcome operational complexity. This shift ensures sustained high profitability for key players focused on specialized compound semiconductor markets.

Segmentation Analysis

The MBE Systems Market is comprehensively segmented based on three critical axes: System Type, Material Source Type, and Key Application. The System Type segmentation divides the market into Production Systems, which are characterized by high throughput, larger substrate capacities (typically 4-inch, 6-inch, or 8-inch), and enhanced automation, and Research Systems, which prioritize flexibility, material diversity, and specialized experimental configurations, often handling smaller substrates. The Material Source Type differentiates systems based on the nature of the elemental sources used, predominantly focusing on Solid Source MBE (using effusion cells for elemental sources) and Gas Source MBE (using gaseous precursors, especially crucial for nitrogen and phosphorus containing materials). Analyzing these segments reveals the market's trajectory towards industrial optimization while maintaining a strong foundation in exploratory research.

The Application segment is vital for understanding market demand, with major categories including Optoelectronics (e.g., laser diodes, VCSELs, LEDs), Wireless Communication (RF devices, power amplifiers), Photovoltaics (high-efficiency multi-junction solar cells), and Advanced Research (including quantum computing, spintronics, and fundamental material science). The strong growth in data center expansion and 3D sensing has elevated the Optoelectronics application segment. Furthermore, the segmentation by material grown—III-V, II-VI, Silicon/Germanium, and Oxides/Others—allows stakeholders to target specific niches. The III-V group remains the market cornerstone due to its dominance in high-frequency and light-emitting applications. Strategic focus across these segments helps manufacturers align their R&D and manufacturing capabilities with the most financially rewarding end-use markets.

- By System Type:

- Research MBE Systems

- Production MBE Systems (Industrial Scale)

- Cluster Tool MBE Systems

- By Material Grown:

- III-V Semiconductors (e.g., GaAs, InP, GaN)

- II-VI Semiconductors (e.g., ZnSe, CdTe)

- Silicon/Germanium (SiGe)

- Oxides and Complex Materials (e.g., Perovskites, Superconductors)

- By Application:

- Optoelectronics (Lasers, LEDs, Detectors)

- Wireless Communication & RF Devices (HEMTs, PAs)

- Photovoltaics (Multi-junction solar cells)

- Quantum Computing and Advanced Research

- Defense and Aerospace Electronics

- By Material Source Type:

- Solid Source MBE

- Gas Source/Hybrid MBE

Value Chain Analysis For MBE Systems Market

The value chain for the MBE Systems Market begins with upstream activities focused on the specialized suppliers of raw materials and precision components. This includes high-purity elemental source materials (e.g., Gallium, Indium, Aluminum) which must meet stringent purity standards, as well as highly specialized components such as ultra-high vacuum (UHV) pumps, sophisticated substrate heating elements, effusion cell technology, and real-time monitoring instruments like RHEED guns and electron detectors. The upstream complexity and high barrier to entry for these specialized component suppliers significantly influence the final system cost and performance, making supplier qualification a critical step for MBE system manufacturers.

The core of the value chain is occupied by the original equipment manufacturers (OEMs) who design, assemble, calibrate, and test the highly complex MBE systems. This stage involves deep expertise in UHV engineering, control system software development, and epitaxial growth processes. Downstream analysis reveals that the primary users of MBE systems are compound semiconductor foundries (internal or external), specialized device manufacturers, and leading academic or governmental research laboratories. These end-users utilize the MBE systems to produce high-performance epitaxial wafers, which are then processed into final devices (VCSELs, HEMTs, quantum bits) that enter the general electronics supply chain. The strong correlation between system quality and device performance makes robust service and technical support a critical downstream activity.

Distribution channels for MBE systems are highly specific, relying almost entirely on direct sales models due to the high capital cost, complexity, and requirement for extensive pre-sale consultation and post-installation support. Direct distribution ensures that the OEMs maintain complete control over installation, training, and maintenance, leveraging highly specialized engineers. Indirect channels are rarely utilized for the core system but may be involved in the supply of consumable components (e.g., source materials, spare parts) or through partnerships with local representatives in specific geographical regions for initial lead generation and localized service support. Given the customization required for most MBE purchases, the relationship between the manufacturer and the end-user is long-term and consultative.

MBE Systems Market Potential Customers

Potential customers for MBE systems are confined to specific high-technology sectors requiring epitaxial layers with atomic-level precision and material purity that alternative growth techniques cannot match. The primary end-users or buyers of these products are major semiconductor integrated device manufacturers (IDMs) and specialized compound semiconductor foundries (Fabs) focusing on high-speed communications and optoelectronics. These commercial entities utilize production-scale MBE systems to manufacture essential components like VCSEL arrays for 3D sensing applications (used in smartphones and automotive LiDAR), high-power RF devices for 5G base stations, and high-efficiency solar cells for aerospace and satellite applications.

A second major customer segment includes leading academic institutions, university research centers, and national governmental laboratories worldwide. These buyers typically procure research-grade MBE systems, often highly customized, for fundamental physics research, exploring novel material structures, and pioneering next-generation devices such as quantum computers, spintronic devices, and advanced superconducting circuits. These institutions drive the foundational innovation pipeline, creating future commercial demand for production systems. Their purchasing decisions are often influenced by grant funding cycles, strategic governmental science initiatives, and the need for flexible, multi-purpose growth capabilities.

A third, high-value segment is the Defense and Aerospace industry, including governmental defense contractors and military research labs. These customers require ultra-reliable, radiation-hardened compound semiconductors for radar systems, electronic warfare applications, and missile guidance systems. The stringent quality and performance specifications for these devices make MBE the preferred growth method, often necessitating highly secure and proprietary system configurations. Overall, the potential customer base is sophisticated, highly technical, and demands stringent performance guarantees, leading to long sales cycles and a strong reliance on manufacturer reputation and installed base performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,025 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Riber S.A., Veeco Instruments Inc., DCA Instruments Oy, S-DH Co., Ltd., Scienta Omicron GmbH, Dr. Eberl MBE-Komponenten GmbH, Semi-Core Inc., SVT Associates, MOCVD Technology (China) Co., Ltd., Plassys, Pascal (PASCAL Engineering), Mantis Deposition Systems, E-Science Co. Ltd., AET Technologies, Angstrom Engineering Inc., CreaTec Fischer & Co. GmbH, EPI (EpiNova), Suzhou Nano Vacuum Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MBE Systems Market Key Technology Landscape

The core technology utilized in the MBE Systems Market revolves around achieving and maintaining ultra-high vacuum (UHV) environments and precise control over material flux and deposition conditions. Key technological advancements include the evolution of effusion cell technology, moving towards high-capacity, low-spitting, and highly stable sources crucial for high-quality production runs. Effusion cell technology now incorporates active temperature control and advanced crucible designs to handle challenging materials like high-temperature elements and reactive sources. Furthermore, the push for larger substrate sizes (8-inch wafers for GaAs and other compound semiconductors) requires significant redesigns in substrate manipulators and heater uniformity to ensure consistent epitaxial growth across the entire wafer surface, addressing industrial throughput requirements.

A central technological pillar is the advancement in in-situ monitoring and control systems. Techniques like Reflection High-Energy Electron Diffraction (RHEED) remain fundamental for real-time monitoring of surface reconstruction and growth mode determination. However, modern systems integrate sophisticated pyrometry for non-contact temperature measurement, mass spectrometry for residual gas analysis, and optical techniques (e.g., reflectance anisotropy spectroscopy) to provide real-time feedback on layer thickness and composition. The convergence of these advanced sensor technologies facilitates the implementation of AI and machine learning for closed-loop growth control, marking a crucial step towards fully automated and reproducible MBE production, particularly essential for complex quantum structures where a single atomic layer error can render the device useless.

The diversification of MBE applications drives technological segregation. For instance, the Oxide MBE segment utilizes specialized oxygen plasma sources and higher temperature capabilities, often requiring entirely different chamber materials to avoid contamination from reactive species. Conversely, Gas Source MBE, which is vital for phosphide and nitride compounds, relies on sophisticated gas handling systems and high-efficiency crackers to break down precursor molecules, offering higher safety and throughput advantages over traditional solid sources for these specific materials. The overall technological landscape is characterized by increasing modularity, allowing customers to configure specialized cluster tools that combine multiple MBE chambers with various preparation and analysis modules within the same UHV environment, optimizing material transfer and sample purity for advanced research and manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC is the undisputed leader in both consumption and manufacturing capacity, driven primarily by major government initiatives in China, Korea, and Taiwan to establish self-sufficient and world-class semiconductor fabrication ecosystems. The region exhibits the highest demand for production MBE systems, largely due to the massive output requirements for consumer electronics, 3D sensing components (VCSELs), and high-volume RF devices crucial for 5G deployment. Aggressive investment in epitaxial foundries and research labs, coupled with a strong manufacturing base for end-use devices, ensures APAC maintains the highest CAGR during the forecast period.

- North America: North America represents a mature and technologically sophisticated market, serving as a global hub for advanced research, defense, and specialized high-performance computing applications. Demand is heavily concentrated in high-end research MBE systems for quantum material development, fundamental physics studies, and military-grade compound semiconductor manufacturing (e.g., GaN for radar). The presence of major semiconductor IDMs and leading university research centers ensures continuous demand for custom, state-of-the-art MBE technology, emphasizing innovation over volume.

- Europe: Europe maintains a strong foothold in the MBE market, particularly driven by robust academic research programs, public-private partnerships focused on advanced photonics, and governmental support for projects like the European Quantum Flagship. Countries such as Germany, France, and the UK are key markets, focusing on customized research systems and specialized small-scale production for industrial optics, laser systems, and II-VI materials. The region places high emphasis on quality, sustainability, and collaborative development of novel growth techniques.

- Middle East and Africa (MEA): The MEA market is currently small but emerging, with potential growth linked to strategic investment in advanced technology and renewable energy sectors, particularly in the Gulf Cooperation Council (GCC) countries. Current demand is concentrated in governmental research institutions and academic centers establishing foundational capabilities in material science and solar energy research (high-efficiency photovoltaics). Growth is anticipated to accelerate moderately as regional diversification efforts push investments into domestic high-tech manufacturing.

- Latin America: Latin America remains a nascent market for MBE systems, with demand largely restricted to a limited number of high-profile university research groups and national laboratories, primarily focusing on fundamental physics and material science exploration. Market activity is sporadic and highly dependent on government funding cycles and international scientific collaborations. The region generally procures highly flexible, mid-range research systems rather than large-scale industrial production units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MBE Systems Market.- Riber S.A.

- Veeco Instruments Inc.

- DCA Instruments Oy

- S-DH Co., Ltd.

- Scienta Omicron GmbH

- Dr. Eberl MBE-Komponenten GmbH

- Semi-Core Inc.

- SVT Associates

- MOCVD Technology (China) Co., Ltd.

- Plassys

- Pascal (PASCAL Engineering)

- Mantis Deposition Systems

- E-Science Co. Ltd.

- AET Technologies

- Angstrom Engineering Inc.

- CreaTec Fischer & Co. GmbH

- EPI (EpiNova)

- Suzhou Nano Vacuum Technology Co., Ltd.

- Leybold GmbH

- Kurt J. Lesker Company

Frequently Asked Questions

Analyze common user questions about the MBE Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What differentiates MBE systems from MOCVD, and why is MBE preferred for certain applications?

MBE (Molecular Beam Epitaxy) operates in an ultra-high vacuum (UHV) environment and uses elemental sources, enabling unparalleled control over layer thickness (down to a single atom layer) and deposition purity. In contrast, MOCVD (Metal-Organic Chemical Vapor Deposition) operates at higher pressures using gaseous precursors. MBE is preferred for highly demanding applications, such as quantum devices, sophisticated laser diodes (VCSELs), and high-frequency HEMTs, where the highest crystal quality, abrupt interfaces, and ultra-precise composition control are essential, despite MBE's generally lower throughput compared to MOCVD.

What is the primary factor restraining the growth and wider adoption of MBE technology?

The most significant restraint is the extremely high capital cost associated with purchasing, installing, and maintaining MBE systems. These are highly complex, customized UHV tools requiring significant investment not only in the equipment itself but also in specialized infrastructure and continuous operational expertise. This high barrier to entry restricts its use primarily to high-value, niche production environments and major research institutions, limiting penetration into general bulk semiconductor manufacturing sectors.

How is the integration of AI influencing the operational efficiency of industrial MBE production systems?

AI integration is fundamentally enhancing MBE efficiency by enabling automated, closed-loop growth control. Machine learning algorithms analyze real-time data from RHEED and other sensors to dynamically adjust growth parameters (e.g., source fluxes and substrate temperature) during the deposition process. This significantly improves material reproducibility, enhances wafer yield consistency, reduces the dependence on highly experienced operators, and accelerates the development cycles for complex heterostructures.

Which regional market holds the dominant share and exhibits the fastest growth rate for MBE Systems?

The Asia Pacific (APAC) region currently holds the largest market share and is projected to register the fastest growth rate. This dominance is driven by massive investment from nations such as China and South Korea into domestic semiconductor fabrication capabilities, high demand for VCSELs in consumer electronics, and robust governmental support for compound semiconductor manufacturing necessary for 5G and future communication infrastructure development.

What specific materials are driving the current demand within the MBE Systems Market?

Demand is predominantly driven by III-V compound semiconductors, particularly Gallium Arsenide (GaAs), Indium Phosphide (InP), and Gallium Nitride (GaN). These materials are indispensable for high-speed RF devices, power amplifiers, and advanced optoelectronic devices like edge-emitting lasers and VCSELs. There is also increasing, specialized demand for complex materials like Oxides for spintronics and advanced material research crucial for quantum computing applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager