MBS Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435705 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

MBS Resin Market Size

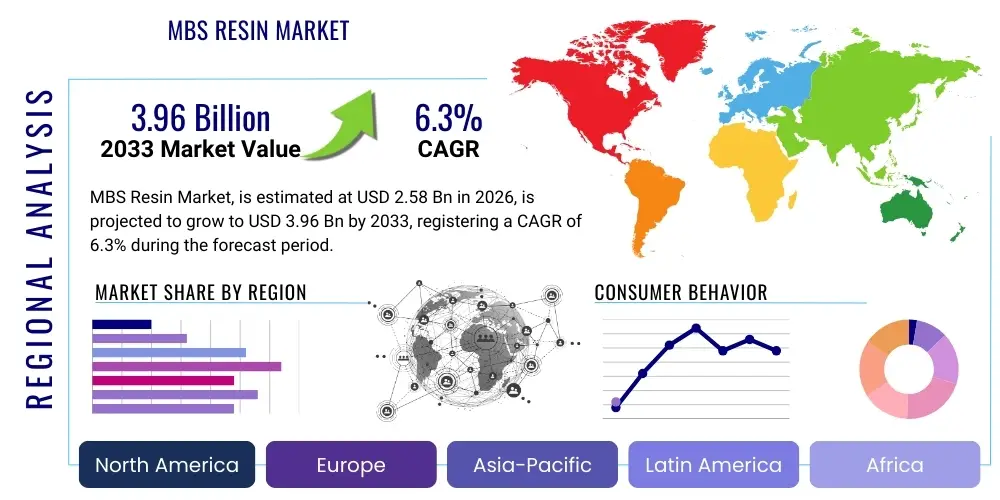

The MBS Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 2.58 Billion in 2026 and is projected to reach USD 3.96 Billion by the end of the forecast period in 2033.

MBS Resin Market introduction

MBS (Methyl Methacrylate-Butadiene-Styrene) resin serves primarily as a crucial impact modifier, predominantly utilized to enhance the durability and toughness of rigid Polyvinyl Chloride (PVC) products. This specialty polymer is designed to impart superior low-temperature impact strength and excellent clarity, especially vital for applications requiring transparency, such as transparent PVC sheets and films used in packaging and construction. Its unique chemical structure, derived from the emulsion polymerization of methyl methacrylate, butadiene, and styrene, allows it to significantly improve the mechanical properties of otherwise brittle PVC materials without compromising weatherability or processability, positioning it as a preferred additive across various industrial sectors.

The major applications of MBS resin span across construction, packaging, and medical sectors. In the construction industry, MBS is essential for producing resilient PVC pipes, fittings, window profiles, and siding, offering increased resistance to physical shock and wear, thereby extending product lifespan. Within the packaging industry, high-clarity MBS modified PVC films are crucial for pharmaceutical blister packaging and food containers, providing transparency coupled with necessary protective impact resistance. The core benefits derived from using MBS include improved processing efficiency of PVC compounds, enhanced aesthetic appeal due to better clarity, and crucially, compliance with stringent safety standards regarding impact performance in consumer and industrial goods, fueling its consistent demand growth globally.

Driving factors for the MBS resin market include the global expansion of the construction industry, particularly in emerging economies where infrastructure development is accelerating. Furthermore, the stringent regulatory environment favoring the replacement of less environmentally friendly or hazardous impact modifiers, coupled with the increasing demand for high-performance, durable, and aesthetically superior rigid PVC products, further propels market expansion. The versatility of MBS resin, allowing customization for specific impact and clarity requirements, ensures its continued relevance and market dominance over competing modifiers in high-value PVC applications.

MBS Resin Market Executive Summary

The MBS Resin Market is characterized by robust business trends driven by significant industrial expansion and material substitution requirements. Global business dynamics show a strong shift towards high-performance specialty MBS grades, particularly those offering improved thermal stability and enhanced clarity, catering to premium applications in medical packaging and architectural glazing. Key market players are focusing on expanding production capacity and implementing vertical integration strategies to secure raw material supply (butadiene, styrene, MMA) and optimize operational costs, leading to intensified competitive pricing pressures and a drive towards product differentiation through proprietary compounding technologies.

Regionally, the Asia Pacific (APAC) continues to dominate the market landscape, primarily fueled by the massive growth in the Chinese and Indian construction and industrial manufacturing sectors, which are the largest consumers of PVC pipes and profiles. North America and Europe demonstrate mature market characteristics, focusing on innovation in sustainable MBS variants and compliance with strict environmental regulations, emphasizing high-efficiency, low-VOC (Volatile Organic Compound) formulations. The Middle East and Africa (MEA) region is emerging as a critical growth center, supported by large-scale infrastructural investments and urbanization projects, although currently exhibiting lower consumption volumes compared to APAC.

Segment trends reveal that the 'Pipes and Fittings' application segment maintains the largest market share due to ubiquitous use in water management and sewage systems, demanding high impact resistance and longevity. However, the 'Films and Sheets' segment, particularly for packaging applications, is expected to register the fastest CAGR, stimulated by the growing demand for transparent, durable, and safe packaging solutions in the food and pharmaceutical industries. Furthermore, segmentation based on Grade Type shows an increasing preference for High-Performance MBS resins, as end-users prioritize superior impact modification capabilities in increasingly complex manufacturing processes.

AI Impact Analysis on MBS Resin Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the MBS Resin Market reveals concentrated interest in three primary areas: optimizing complex polymerization processes, enhancing supply chain resilience, and implementing automated quality control. Users frequently inquire about how AI-driven predictive modeling can improve the batch consistency of MBS resin manufacturing, a process historically sensitive to minute variations in temperature, pressure, and monomer feed rates. Additionally, significant concern revolves around leveraging AI and machine learning (ML) algorithms to forecast fluctuations in key raw material prices (Butadiene, MMA, Styrene), thereby mitigating procurement risk and optimizing inventory levels. Expectations center on AI streamlining R&D for developing next-generation MBS modifiers with superior mechanical properties, leading to faster innovation cycles and reduced operational expenditure across the value chain.

- AI-driven Predictive Maintenance: Utilizing sensor data and ML algorithms to forecast equipment failures in polymerization reactors, minimizing unplanned downtime and maximizing asset utilization, leading to more stable production volumes.

- Optimized Batch Consistency: Implementing AI-based process control systems to precisely manage reaction conditions (temperature profiles, mixing speeds), ensuring high uniformity and quality across different MBS resin batches.

- Raw Material Price Forecasting: Employing sophisticated ML models to analyze global petrochemical market trends, geopolitical factors, and demand signals, providing proactive procurement strategies for MMA, Styrene, and Butadiene.

- Automated Quality Inspection: Using computer vision systems integrated with AI for real-time defect detection in finished MBS powder or pellets, improving product purity and reducing manual quality assurance costs.

- Supply Chain Optimization: AI algorithms optimize logistics, warehousing, and transportation routes for global distribution of MBS resins, reducing lead times and minimizing carbon footprint related to shipping.

- Accelerated R&D: Utilizing generative AI and computational chemistry models to simulate and predict the performance characteristics of new MBS co-polymer formulations, significantly cutting down time spent on physical testing and formulation development.

DRO & Impact Forces Of MBS Resin Market

The dynamics of the MBS Resin Market are comprehensively shaped by a combination of key drivers, inherent restraints, and compelling opportunities, all contributing to significant impact forces influencing strategic decision-making. The principal driver is the continuous and aggressive demand for rigid PVC across the global construction sector, especially in high-growth developing economies seeking durable and cost-effective piping and window solutions. This growth is synergistically supported by MBS resin's intrinsic ability to substitute less effective or less compliant impact modifiers like chlorinated polyethylene (CPE) or certain hazardous components, appealing to stricter environmental and safety standards.

However, the market faces notable restraints, chiefly the volatility and high cost of critical raw materials—Methyl Methacrylate (MMA), Butadiene, and Styrene—which are derivatives of the petrochemical industry. These fluctuating costs directly impact the profitability margins of MBS resin manufacturers and introduce pricing instability for end-users. Furthermore, the limited thermal resistance of MBS resin compared to some high-end engineering plastics restricts its applicability in ultra-high-temperature environments. Another significant restraint is the competitive threat posed by alternative impact modifiers, such as acrylic-based modifiers (AIM), which often offer superior weather resistance, sometimes making them preferable for outdoor applications despite MBS's better low-temperature performance.

Opportunities for market expansion are centered around product innovation and geographical penetration. Developing bio-based or partially bio-derived MBS resins presents a substantial opportunity to address sustainability concerns and appeal to environmentally conscious manufacturers and consumers. Moreover, the increasing adoption of PVC in specialized fields like medical devices (e.g., blood bags, medical tubing) and high-clarity food contact materials, where MBS's unique properties are highly valued, offers lucrative niche market expansion. The impact forces acting on the market, particularly the pressure for material lightweighting and superior performance in extreme conditions, compel manufacturers to invest heavily in next-generation high-performance MBS grades, making innovation a critical factor for competitive success.

Segmentation Analysis

The MBS Resin market segmentation provides a granular view of demand distribution across various product types and end-user applications, enabling strategic focus on high-growth segments. The primary methods for segmenting this market involve categorizing by Grade Type, which relates to the specific composition and intended performance characteristics (e.g., standard vs. high-performance), and by Application, reflecting the primary industries utilizing the modified PVC materials. Geographical segmentation remains crucial for understanding regional consumption patterns, heavily influenced by local construction standards and regulatory environments. This structured breakdown allows stakeholders to identify optimal pricing strategies, target marketing efforts, and align production capabilities with evolving industrial needs and consumer demands globally.

- By Grade Type:

- Standard Grade MBS Resin

- High-Performance Grade MBS Resin (High-Impact, High-Clarity)

- By Application:

- Pipes and Fittings

- Sheets and Films (Rigid Packaging, Thermoforming)

- Profiles (Window Frames, Door Panels, Siding)

- Packaging (Food Contact, Medical Blister Packaging)

- Other Applications (Medical Devices, Appliances)

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For MBS Resin Market

The value chain for the MBS Resin market begins with the upstream sourcing of crucial petrochemical raw materials, specifically methyl methacrylate (MMA), butadiene, and styrene monomers. Upstream analysis highlights that the cost and availability of these materials, predominantly derived from crude oil and natural gas processing, dictate a significant portion of the final product cost. Manufacturers of MBS resin, through complex emulsion polymerization processes, convert these monomers into the specialty polymer powder or pellets. Vertical integration is a key strategic decision in the upstream phase, where major players often secure long-term supply agreements or produce their own monomers to mitigate price volatility and ensure a stable operational flow, which is crucial given the complexity of supply chain coordination.

The middle segment of the value chain involves the production, formulation, and compounding of the MBS resin. This stage includes refining the polymer to achieve specific performance characteristics, such as particle size distribution, molecular weight, and rubber content, tailoring the resin for high-impact or high-clarity applications. Distribution channels play a vital role in connecting manufacturers to diverse end-users. Direct sales are common for high-volume customers (large PVC compounders and profile extruders), allowing for specialized technical support and bespoke solutions. Indirect channels, involving global and regional distributors and agents, are essential for reaching smaller fabricators and specialized niche markets, particularly across fragmented regional markets like Southeast Asia and Latin America.

Downstream analysis focuses on the transformation process where MBS resin is compounded with PVC, stabilizers, plasticizers, and other additives to create rigid PVC products. The primary downstream consumers are PVC processors involved in extrusion, injection molding, and calendering to produce pipes, fittings, sheets, films, and profiles. The end-use segments—construction, packaging, and medical—represent the final consumption point. The high demands from the construction sector (driven by infrastructure needs) and the packaging sector (driven by stringent safety requirements) exert considerable pull on the MBS market, making downstream application performance and regulatory compliance critical success factors for the entire value chain.

MBS Resin Market Potential Customers

Potential customers and end-users of MBS resin are concentrated within industries that extensively utilize rigid PVC for manufacturing durable, impact-resistant, and, often, transparent finished goods. The largest customer base resides in the construction and infrastructure sectors, comprising manufacturers of PVC pipes for water and sewage systems, and companies specializing in extruded PVC profiles for windows, doors, and siding, who require modifiers to ensure structural integrity and resistance to mechanical impact during installation and service life. These customers prioritize superior low-temperature impact performance, a characteristic where MBS excels over many alternatives, ensuring product reliability in diverse climatic conditions, making them the primary volume buyers globally.

Another major segment includes manufacturers in the rigid packaging industry, particularly those producing blister packs for pharmaceuticals and high-clarity containers for food contact applications. These customers demand a precise balance of transparency, chemical inertness, and exceptional impact strength to prevent breakage and maintain product visibility and safety. Specialized medical device manufacturers also represent high-value potential customers, utilizing MBS modified PVC for items such as non-blood-contact tubing and certain casing components where biocompatibility, clarity, and resistance to sterilization processes are essential. These customers typically require high-performance, often customized, grades of MBS resin that comply with rigorous regulatory standards such as USP Class VI, emphasizing product quality and consistency over cost.

Furthermore, compounders and resin distributors act as crucial intermediaries, purchasing MBS resin in bulk to create proprietary PVC formulations tailored for specific end-user requirements before supplying to smaller fabricators. These compounders are key strategic partners, as they disseminate the product across various small and medium-sized enterprises (SMEs) involved in appliance parts manufacturing, electrical conduit production, and consumer goods fabrication, ensuring market penetration into fragmented application areas. Targeting these compounders with technical support and consistent supply is vital for maintaining broad market reach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.58 Billion |

| Market Forecast in 2033 | USD 3.96 Billion |

| Growth Rate | 6.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kaneka Corporation, Mitsubishi Chemical Corporation, LG Chem Ltd., Dow Inc., Arkema S.A., Shandong Ruifeng Chemical Co. Ltd., Shandong Rike Chemical Co. Ltd., Denka Company Limited, Wuxi Xingda Polymer Material Co. Ltd., Suzhou Sunplas Chemical Co. Ltd., Novista Group, Kaimeng Additives, Resonac Holdings Corporation (Showa Denko), Jilin Provincial Jinyuan Titanium Dioxide Co. Ltd., Jiangsu Tiandun Group, Polyone (Avient Corporation), Lotte Advanced Materials, Cheil Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MBS Resin Market Key Technology Landscape

The core technology underpinning the production of MBS resin is highly controlled emulsion polymerization, a process critical for creating the unique core-shell structure that defines its impact modification capability. Modern technological advancements focus heavily on optimizing this polymerization technique to achieve precise control over particle size distribution and shell thickness. Manufacturers are employing advanced reactor design and inline monitoring systems utilizing Spectroscopy and other analytical techniques to ensure narrow particle size dispersion. Narrow particle size distribution is essential as it directly correlates with the efficiency of impact modification and the resultant clarity of the final PVC product, especially crucial for transparent sheet and film applications. Continuous improvement in emulsifier and stabilizer chemistry is also a significant technological focus, aiming to enhance the stability of the emulsion during polymerization and improve the dispersibility of the final MBS powder in the PVC matrix.

A second crucial technological area is the development of functionalized or reactive MBS grades. These grades often incorporate specialized co-monomers or surface treatments designed to improve compatibility and interaction with the PVC matrix, leading to superior mechanical property enhancement and reduced processing temperatures. Innovations here include proprietary grafting technologies that ensure the butadiene rubber core is optimally encapsulated by the MMA and styrene shell, maximizing the energy absorption capability of the modifier. Furthermore, compounding and blending technologies are evolving, with end-users seeking highly customized masterbatches that integrate MBS resin with other additives (e.g., stabilizers, lubricants) to streamline the PVC extrusion or injection molding process, requiring MBS manufacturers to ensure their resins are compatible with high-shear mixing environments and diverse compounding formulations.

Sustainability and resource efficiency represent a third critical technological frontier. Research efforts are focused on developing low-VOC (Volatile Organic Compound) production methods and exploring the use of bio-based or recycled feedstocks for the MMA and styrene components to reduce the dependence on fossil-fuel-derived monomers, aligning with global green chemistry initiatives. Moreover, process intensification technologies, such as continuous polymerization instead of traditional batch processes, are being adopted by leading market players to improve energy efficiency, reduce production cycle times, and achieve greater economies of scale. These technological advancements collectively aim to enhance the performance, cost-effectiveness, and environmental profile of MBS resin, ensuring its continued technological superiority in the impact modifier sector.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, led by China and India, represents the largest and fastest-growing market for MBS resin globally. This dominance is attributable to massive investments in residential and commercial construction, coupled with rapid urbanization and industrial growth, driving high demand for PVC pipes, fittings, and profiles. China, in particular, houses major MBS production capacities and is a huge consumer of the resin in domestic applications, maintaining a competitive pricing environment.

- North American Stability and Innovation: The North American market is characterized by high adoption rates of high-performance and specialty MBS grades, particularly in rigorous applications like medical packaging and high-end construction materials. While construction growth is moderate compared to APAC, the emphasis on superior quality, stringent building codes, and material specifications ensures consistent demand for premium MBS modifiers, focusing on clarity and long-term durability.

- European Regulatory Compliance and Sustainability Focus: Europe is a mature market driven by strict adherence to environmental regulations (like REACH). Demand here is concentrated on sustainable formulations and low-migration MBS grades suitable for sensitive applications such as food and water contact materials. Manufacturers in Germany and France are key innovators in developing bio-based MBS alternatives and resins optimized for material recycling efforts.

- Latin America (LATAM) Infrastructure Growth: LATAM, particularly Brazil and Mexico, presents significant growth opportunities, spurred by government-led infrastructure projects and rising demand for affordable, durable housing solutions. The need for robust water management systems drives the PVC pipe and fittings segment, translating into steady, increasing consumption of standard-grade MBS resin throughout the forecast period.

- Middle East & Africa (MEA) Emerging Potential: The MEA region is experiencing accelerated growth due to substantial construction activity related to large-scale real estate and energy projects, particularly in the UAE and Saudi Arabia. The extreme climatic conditions in the region necessitate high-quality PVC products with enhanced physical properties, indirectly boosting the adoption of MBS for improving material toughness in high-stress environments, positioning it as a developing high-potential market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MBS Resin Market.- Kaneka Corporation

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- Dow Inc.

- Arkema S.A.

- Shandong Ruifeng Chemical Co. Ltd.

- Shandong Rike Chemical Co. Ltd.

- Denka Company Limited

- Wuxi Xingda Polymer Material Co. Ltd.

- Suzhou Sunplas Chemical Co. Ltd.

- Novista Group

- Kaimeng Additives

- Resonac Holdings Corporation (Showa Denko)

- Jilin Provincial Jinyuan Titanium Dioxide Co. Ltd.

- Jiangsu Tiandun Group

- Polyone (Avient Corporation)

- Lotte Advanced Materials

- Cheil Industries

- Fine Chemical Co., Ltd.

- Wuhan Huajia Plastic Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the MBS Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is MBS resin primarily used for and how does it compare to other impact modifiers?

MBS resin is predominantly used as a high-efficiency impact modifier for rigid PVC (Polyvinyl Chloride), crucial for enhancing the material's toughness and low-temperature impact strength without sacrificing clarity. Unlike acrylic impact modifiers (AIM), MBS provides superior low-temperature performance, making it preferred for construction applications in colder climates. It is often favored over CPE (Chlorinated Polyethylene) for applications requiring high transparency, such as films and sheets used in specialized packaging due to its unique core-shell rubber structure that optimizes light transmission while absorbing shock effectively. Its primary function is to transform brittle PVC into a highly resilient engineering material suitable for durable goods manufacturing across various sectors.

Which geographical region exhibits the highest growth potential for the MBS Resin Market?

The Asia Pacific (APAC) region, specifically led by emerging economies like China, India, and countries in Southeast Asia, demonstrates the highest growth potential for the MBS resin market. This accelerated growth is fundamentally driven by unprecedented levels of investment in public and private construction projects, infrastructure development, and widespread urbanization, leading to immense demand for rigid PVC products such as pipes, fittings, and window profiles. Furthermore, the expansion of the regional manufacturing and consumer goods sectors fuels the consumption of MBS-modified PVC films for high-volume packaging applications, ensuring APAC's continued market dominance and rapid expansion compared to mature markets in North America and Europe.

What are the main factors restraining the expansion of the MBS Resin Market?

The principal restraint impacting the MBS Resin Market expansion is the inherent volatility in the pricing and supply of key petrochemical raw materials—Methyl Methacrylate (MMA), Butadiene, and Styrene. As these monomers are petroleum derivatives, their costs fluctuate significantly based on crude oil market dynamics and geopolitical instability, directly affecting the operational costs and profitability of MBS manufacturers. Additionally, MBS resin exhibits lower weather resistance and UV stability compared to certain acrylic-based modifiers, which restricts its usage in unpainted exterior applications, creating a persistent market restraint in the long-term outdoor construction segment where superior UV resistance is non-negotiable for product longevity.

How is sustainability affecting product development within the MBS Resin Market?

Sustainability is significantly influencing MBS resin product development by driving innovation towards bio-based and environmentally conscious formulations. Leading manufacturers are investing in research and development to incorporate bio-derived components for monomers like MMA and styrene, aiming to reduce the carbon footprint associated with petrochemical reliance. Furthermore, there is growing demand for MBS grades that enhance the recyclability and material efficiency of the final PVC product, ensuring compliance with circular economy principles and regulations prevalent in regions like Europe. This shift addresses end-user concerns regarding environmental impact and positions specialized MBS grades as preferred additives for green building initiatives and sustainable packaging solutions across the globe.

What are the key application segments driving the current demand for MBS resin?

The current demand for MBS resin is overwhelmingly driven by the Pipes and Fittings segment within the construction and infrastructure industry, which requires high volumes of impact-modified PVC for water, drainage, and utility systems that demand durability and reliability under pressure. Equally important is the Sheets and Films segment, catering to rigid packaging needs, especially in pharmaceutical blister packaging and high-clarity food contact applications, where transparency, shatter resistance, and safety standards are paramount. The synergy between ongoing global infrastructure development and the stringent requirements of the specialized packaging industry ensures that these two application segments remain the primary consumption drivers in the global MBS resin market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager