MCPA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438729 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

MCPA Market Size

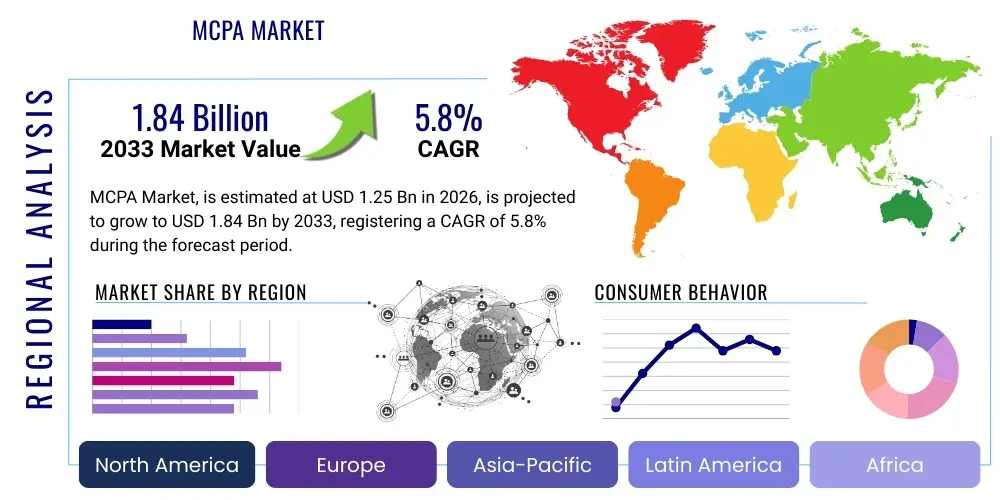

The MCPA Market (2-Methyl-4-chlorophenoxyacetic acid) is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.84 Billion by the end of the forecast period in 2033. This consistent growth is primarily driven by the sustained global demand for selective post-emergence herbicides in cereal and pasture management, coupled with advancements in formulation technology that enhance efficacy and environmental profile.

MCPA Market introduction

The MCPA market centers around 2-Methyl-4-chlorophenoxyacetic acid, a synthetic auxin belonging to the phenoxy herbicide class, which is vital for managing broadleaf weeds across diverse agricultural and non-agricultural settings. Developed in the mid-20th century, MCPA remains one of the most cost-effective and widely used solutions, offering excellent selectivity, making it safe for major crops like wheat, barley, oats, and rice. Its primary function is to disrupt plant hormone balance, leading to uncontrolled growth and eventual plant death, thereby maximizing crop yields and quality. The market encompasses various chemical forms, including the acid, salts (e.g., sodium, potassium, DMA), and esters (e.g., 2-ethylhexyl), each tailored for specific application methods, solubility, and target environments.

Major applications of MCPA predominantly revolve around large-scale commodity agriculture, specifically in the cultivation of cereals and grains across temperate zones, where competitive broadleaf weeds pose a significant threat to productivity. Beyond staple crops, MCPA is extensively applied in pasture and turf management to maintain grass health and aesthetics by eliminating invasive weeds, ensuring quality forage for livestock and pristine sports fields. The inherent benefits of MCPA, such as its proven track record, relatively low mammalian toxicity compared to some alternatives, and adaptability to tank mixtures, solidify its market position despite the growing scrutiny on agrochemicals globally. Furthermore, the ease of integration into existing farming practices and resistance management strategies contributes significantly to its perennial demand.

Driving factors for market expansion include the increasing global population necessitating higher food production, leading to intensified agricultural practices and greater dependence on effective crop protection solutions. Additionally, the proliferation of weed resistance to newer classes of herbicides often forces growers to revert to time-tested chemistries like MCPA as part of a rotational strategy. Regulatory frameworks, while sometimes restrictive, are also stabilizing in key regions, allowing for predictable market operations. The development of advanced, microencapsulated, and low-drift formulations further boosts adoption by enhancing application safety and reducing environmental runoff, thereby sustaining the compound’s relevance in modern sustainable farming systems.

MCPA Market Executive Summary

The MCPA market is experiencing stable but strategic expansion, characterized by a shift towards high-concentration and optimized formulations that meet stringent environmental standards while maintaining economic viability for farmers. Business trends indicate consolidation among major global agrochemical producers who are leveraging their extensive distribution networks and research capabilities to introduce novel adjuvant systems that maximize MCPA efficacy. There is a discernible trend toward integrated pest management (IPM) where MCPA is used rotationally with other herbicide groups to mitigate the widespread issue of weed resistance, securing its long-term utility in the crop protection portfolio. Supply chain resilience, particularly concerning raw material sourcing from Asia Pacific, remains a critical strategic focus for maintaining cost competitiveness globally.

Regionally, the market exhibits bifurcation, with mature markets in North America and Europe focusing intensely on regulatory compliance, precision application technologies, and high-value turf/amenity uses. Conversely, emerging economies in the Asia Pacific (APAC) and Latin America (LATAM) are the primary engines of volume growth, driven by expanding arable land, increased adoption of chemical protection methods, and the push for agricultural self-sufficiency. APAC, particularly China and India, dominates both production capacity and consumption due to vast cereal acreage and favorable climatic conditions for broadleaf weed growth. Regulatory stability in key regional blocks is paramount for investment planning, influencing local production capacities and trade flows.

Segment trends reveal that the Ester and Salt forms of MCPA continue to hold dominance, chosen for their rapid action and varying solubility profiles, respectively, crucial for different weather conditions and crops. Application-wise, the Cereals & Grains segment remains the bedrock of demand, though the Pasture & Forage segment is showing accelerated growth, particularly in regions with significant livestock industries (e.g., Australia, Brazil, and parts of Europe). Formulations are increasingly moving toward high-load emulsifiable concentrates (ECs) and soluble concentrates (SCs) to reduce packaging waste and logistical complexity, aligning with sustainability objectives championed by major agricultural input distributors globally.

AI Impact Analysis on MCPA Market

Common user questions regarding AI's impact on the MCPA market frequently center on how machine learning can enhance the application efficiency of this traditional herbicide, whether AI-driven diagnostics can predict weed resistance patterns, and if automated machinery will require fundamentally new MCPA formulations. Users are concerned about optimizing the timing and dosage of MCPA application to reduce input costs and environmental exposure. The key themes summarized from user inquiries revolve around precision agriculture integration, maximizing the return on investment (ROI) for herbicide use, and leveraging AI for predictive modeling of broadleaf weed outbreaks specific to climatic zones where MCPA is most utilized. Expectations focus on AI transforming MCPA from a broadly applied chemical into a highly targeted solution, potentially extending its lifespan in the face of environmental regulations.

AI's influence is primarily disruptive in the supply chain optimization and application phases. By employing machine learning algorithms to analyze historical weather data, soil composition, satellite imagery, and localized weed pressure maps, AI systems can generate precise variable rate prescriptions (VRTs) for MCPA application. This precision drastically reduces the total volume of MCPA applied per hectare, ensuring that the chemical is only deployed where weed thresholds dictate, thereby cutting down costs for farmers and significantly minimizing environmental runoff and non-target effects. This shift from blanket spraying to targeted spot application demands highly specialized nozzle control and drone or robotic sprayer integration.

Furthermore, AI is instrumental in accelerating the development of new, synergistic MCPA formulations. By simulating chemical interactions and predicting the efficacy and stability of various adjuvant combinations, AI reduces the time and cost associated with laboratory testing. AI models are also being trained to analyze complex genomic data related to weed species, identifying emerging resistance mechanisms faster than conventional field trials, which allows manufacturers and agronomists to proactively recommend effective MCPA-based tank-mix strategies or formulation adjustments, thus preserving the herbicide's effectiveness over time.

- AI-driven Variable Rate Technology (VRT) enables precise, site-specific application of MCPA, reducing overall usage by up to 30%.

- Machine learning models predict optimal timing for MCPA spraying based on micro-climatic conditions and weed growth stage, maximizing kill rates.

- AI optimizes MCPA supply chain logistics, forecasting regional demand peaks and managing inventory levels to minimize waste and ensure product availability during critical seasons.

- Computational chemistry and AI simulations accelerate the development of synergistic MCPA tank mixes and highly stable, low-drift formulations.

- Autonomous spraying systems utilize AI vision and geospatial data for real-time identification of broadleaf weeds, enabling immediate, targeted MCPA deployment.

- AI facilitates faster identification and monitoring of MCPA resistance evolution in weed populations, informing rotational strategies.

DRO & Impact Forces Of MCPA Market

The MCPA market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. Key drivers include the necessity for increased food production globally, which sustains demand for effective selective herbicides like MCPA, particularly in the cereal sector where broadleaf weeds pose a consistent yield threat. The cost-effectiveness of MCPA compared to newer, more expensive chemistries makes it an attractive choice for farmers operating under tight margins, especially in emerging markets. Additionally, its established role in resistance management programs (alternating chemistries) reinforces its market stability. These drivers provide a consistent, foundational demand, ensuring that MCPA remains a staple in crop protection programs worldwide.

Restraints primarily revolve around increasing regulatory pressure and public perception challenges associated with agrochemical use, particularly in the European Union, which mandates rigorous re-registration processes that can limit market access or require costly formulation changes. Furthermore, the persistent evolution of herbicide resistance in targeted broadleaf weeds, while partially mitigated by its use in rotational strategies, constantly threatens MCPA's long-term effectiveness, driving the need for higher application rates or complex tank mixes. The environmental impact concerning potential water contamination or persistence in soil necessitates continuous research and investment into safer, encapsulated formulations, adding to production costs.

Opportunities for growth are largely centered on geographical expansion into under-penetrated agricultural regions in Africa and parts of Asia, where traditional farming methods are rapidly being modernized. Innovation in formulation technology, specifically the development of safer salts, low-odor esters, and microencapsulation technologies, allows the product to meet modern environmental criteria and application efficiencies. Furthermore, integrating MCPA application with precision agriculture technologies, enabled by AI, presents a significant opportunity to increase efficacy while simultaneously reducing total applied volumes, thereby addressing regulatory concerns and enhancing sustainability metrics. The collective impact forces suggest a market that is mature but resilient, pivoting toward technological integration to maintain its competitive edge.

Segmentation Analysis

The MCPA market segmentation provides a comprehensive view of product diversity, end-use applications, and geographical consumption patterns, which are crucial for strategic planning and resource allocation. The market is primarily segmented based on product type (Acid, Salt, Ester), the major application sector (Cereals & Grains, Pastures, Turf & Ornamentals, Others), and formulation (Liquid, Granular). Analysis across these vectors demonstrates how market stakeholders tailor their offerings to meet specific needs—ranging from the high solubility required for aerial application (salts) to the prolonged activity needed in specific soil types (esters). Understanding these segments is key to identifying niche high-growth areas, such as the increasing demand for MCPA in professional turf management.

The segmentation by application highlights the structural reliance of the market on major global cereal production, with wheat and barley cultivation representing the largest consumption base globally. However, the rapidly expanding global livestock industry is accelerating the demand within the Pastures segment, particularly for effective weed control in grazing lands which directly impacts forage quality and animal health. Geographically, segmentation underscores the production concentration in APAC versus the high-value consumption in North America and Europe. Continuous monitoring of these segments allows for agile adjustments to pricing strategies and distribution channel optimization based on regional agricultural cycles and regulatory variances.

- By Product Type:

- MCPA Acid

- MCPA Salts (Sodium, Potassium, Dimethylamine (DMA) Salt)

- MCPA Esters (Isooctyl Ester, 2-Ethylhexyl Ester)

- By Application:

- Cereals and Grains (Wheat, Barley, Oats, Rice)

- Pastures and Forage

- Turf and Amenity Grass

- Non-Crop Applications (Railways, Roadsides, Industrial Sites)

- By Formulation:

- Liquid Formulations (Soluble Concentrates (SC), Emulsifiable Concentrates (EC), Aqueous Solutions)

- Solid/Granular Formulations (Water Dispersible Granules (WDG), Dusts)

Value Chain Analysis For MCPA Market

The value chain for the MCPA market begins with the upstream procurement of essential petrochemical derivatives, such as monochloroacetic acid (MCA) and cresols/phenols, which serve as the primary chemical precursors. The efficiency and stability of this upstream supply directly impact the final product cost and production timelines. Manufacturing typically involves complex organic synthesis—chlorination and subsequent reaction processes—carried out in highly specialized chemical plants, predominantly located in China, India, and parts of Europe. Key strategic challenges in this stage include managing fluctuating raw material prices, ensuring adherence to rigorous manufacturing safety standards, and maintaining high product purity levels suitable for agricultural use. Vertical integration, where major players control both precursor manufacturing and final product formulation, provides significant competitive advantages through cost control.

The midstream segment involves formulation, where the raw MCPA acid is converted into various salts and esters and then mixed with solvents, emulsifiers, and surfactants to create end-use products (like SCs or ECs). Formulation is a critical stage that determines the product's shelf life, biological efficacy, ease of mixing, and environmental profile. Distribution channels form the link between manufacturers and end-users, typically involving a hybrid model: direct sales to large agricultural cooperatives or global distributors, and indirect sales through regional wholesalers, local agrochemical retailers, and farm-level dealers. Robust cold chain management is less critical for MCPA but logistical efficiency and regional inventory stocking based on planting cycles are paramount.

Downstream analysis focuses on the end-user application by farmers, professional applicators, or turf managers. Direct sales channels, often facilitated by agronomist consultation teams employed by major manufacturers, are effective for disseminating best practices, dosage recommendations, and resistance management strategies. Indirect channels, relying on local retail stores, provide broader geographic reach, especially in developing markets. The value chain is characterized by relatively high margins at the formulation and distribution stages, reflecting the intellectual property related to formulation efficacy and the cost of maintaining regulatory compliance across numerous jurisdictions. Efficiency gains are increasingly sought through digital platforms that streamline inventory tracking and connect farmers directly to product information and consultation services.

MCPA Market Potential Customers

Potential customers for the MCPA market are primarily drawn from sectors reliant on effective, selective weed control, forming a diverse base ranging from large-scale commercial farming operations to specialized land management entities. The largest customer segment remains commercial farmers, particularly those engaged in the cultivation of major food crops such as wheat, barley, oats, and rice across extensive acreage in North America, Europe, Australia, and Asia Pacific. These customers prioritize efficacy, broad-spectrum control of target weeds (e.g., thistles, buttercups, mustards), and cost efficiency, favoring standard, proven MCPA salt and ester formulations that integrate easily into their existing spraying programs.

A rapidly expanding customer base includes livestock producers and entities managing large pastures or rangelands. These customers utilize MCPA to eliminate toxic or non-palatable weeds, thereby improving the quality and safety of forage for grazing animals. This segment often requires specific formulations that are less likely to carry over or cause harm to livestock following the prescribed withdrawal period. Furthermore, professional turf management organizations, including golf course maintenance crews, sports facility managers, and landscaping contractors, represent a high-value niche market. These users demand specialized, high-purity, often low-odor MCPA formulations for precise control of broadleaf weeds in sensitive, aesthetic environments.

Finally, governmental agencies and large infrastructure organizations constitute another critical customer segment. These include departments responsible for maintaining public lands, railway corridors, utility right-of-ways, and industrial sites where vegetation control is necessary for safety and operational integrity. These non-crop applications often utilize high-concentration or specialized formulations designed for total or semi-selective vegetation control, demonstrating the versatility of MCPA beyond traditional food production systems. Targeted marketing and distribution strategies must be tailored to the specific regulatory, application, and procurement requirements unique to each of these distinct customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.84 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nufarm Ltd., Adama Agricultural Solutions Ltd., Corteva Agriscience, Bayer AG, Syngenta AG (ChemChina), FMC Corporation, Albaugh LLC, UPL Ltd., Lier Chemical Co., Ltd., Jiangsu Limin Chemical Co., Ltd., Gowan Company, Drexel Chemical Company, Sinon Corporation, Mitsui Chemicals Agro, Inc., Sipcam Oxon S.p.A., Helm AG, Rotam Agrochemical Co., Ltd., Willowood Chemicals Pvt. Ltd., Shandong Hailir Chemical Co., Ltd., Hebei Weiyong Biochemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MCPA Market Key Technology Landscape

The technology landscape within the MCPA market is predominantly focused on advanced formulation chemistry and integration with digital agriculture tools, rather than fundamental molecular innovation, given MCPA is a mature chemical. Key advancements center on improving the physical and biological characteristics of the finished product to enhance efficacy, user safety, and environmental compliance. Microencapsulation technology is gaining prominence, allowing for the slow, controlled release of MCPA, which extends the active period, reduces phytotoxicity risk to crops, and minimizes off-target movement. Similarly, the development of high-load liquid concentrates (SC, EC) is a crucial technological area, enabling manufacturers to reduce packaging volume and logistical costs while providing a product that is easier and safer for the farmer to handle and mix.

A significant technological shift is occurring in adjuvant systems, which are co-formulated with MCPA to maximize penetration into the weed leaf surface and reduce wash-off from rain. Newer, environmentally friendlier surfactants and co-solvents are replacing older, harsher chemicals to meet evolving regulatory requirements, particularly concerning solvent toxicity and volatility. Furthermore, the integration of computational chemistry is accelerating the identification and testing of novel buffer systems that ensure the stability of MCPA in tank mixes with other agrochemicals, addressing the need for complex, multi-functional applications required for modern resistance management programs.

The most transformative technologies are external to the chemical itself but directly impact its deployment: Precision Agriculture and application machinery. This includes sophisticated nozzle technologies (e.g., air induction nozzles) designed to create specific droplet sizes that minimize drift, optimizing MCPA deposition. Moreover, the rise of drone-based and robotic sprayers, integrated with GPS and AI-driven VRT maps, demands highly stable, quick-dissolving, and non-clogging MCPA formulations. This technology landscape drives producers to innovate their physical product characteristics to be compatible with high-tech application hardware, ensuring that MCPA remains relevant in the era of smart farming.

Regional Highlights

Regional dynamics heavily influence the MCPA market, reflecting differences in agricultural practices, crop types, and regulatory environments. North America and Europe, while being mature markets, are characterized by high-value consumption, focused on premium, highly compliant formulations, and significant usage in the professional turf and amenity sector. Europe, especially, faces intense regulatory scrutiny under the REACH framework and the EU’s Farm to Fork strategy, necessitating constant investment in re-registration and the development of formulations with minimal environmental footprints. The US and Canada maintain robust demand driven by large-scale cereal, wheat, and pasture operations, and are early adopters of VRT technology for MCPA application, aiming for efficiency gains and sustainable use.

Asia Pacific (APAC) stands out as the global leader in both production capacity and consumption volume, primarily due to the vast acreage dedicated to cereal crops (especially rice, wheat, and coarse grains) in countries like China, India, and Australia. China and India are major global sourcing hubs for the active ingredient (AI), benefiting from lower manufacturing costs and substantial domestic demand expansion driven by increased farm mechanization and rising use of agrochemicals. This region's growth trajectory is steeper than the global average, fueled by population pressure and the imperative to maximize crop yields, creating an environment where cost-effective herbicides like MCPA are highly favored by small and large farmers alike.

Latin America (LATAM), spearheaded by Brazil and Argentina, represents a significant growth market, driven by the expansion of pastureland for cattle ranching and increased grain production (especially wheat rotation). MCPA demand here is often tied to pasture management and is critical for improving forage quality, supporting the booming regional livestock industry. The Middle East and Africa (MEA) currently hold the smallest market share but offer long-term growth potential. As agricultural modernization progresses in countries like South Africa and parts of North Africa, driven by investments in water management and improved seed varieties, the demand for foundational crop protection products like MCPA is projected to increase steadily, although market fragmentation and political instability can pose challenges to distribution.

- North America: Focus on VRT adoption, high-value turf segment growth, and strict adherence to EPA guidelines; stable growth driven by extensive wheat and pasture acreage.

- Europe: Driven by necessity for compliant, low-impact formulations due to stringent EU regulations; strong emphasis on IPM strategies utilizing MCPA rotationally.

- Asia Pacific (APAC): Highest volume market, acting as the primary global manufacturing base (China, India); rapid consumption growth fueled by intensified cereal production and agricultural modernization.

- Latin America (LATAM): Significant potential, particularly in pasture and forage management linked to the expanding beef industry in Brazil and Argentina.

- Middle East and Africa (MEA): Emerging market characterized by increasing adoption of formalized crop protection programs; growth dependent on infrastructure development and political stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MCPA Market.- Nufarm Ltd.

- Adama Agricultural Solutions Ltd.

- Corteva Agriscience

- Bayer AG

- Syngenta AG (ChemChina)

- FMC Corporation

- Albaugh LLC

- UPL Ltd.

- Lier Chemical Co., Ltd.

- Jiangsu Limin Chemical Co., Ltd.

- Gowan Company

- Drexel Chemical Company

- Sinon Corporation

- Mitsui Chemicals Agro, Inc.

- Sipcam Oxon S.p.A.

- Helm AG

- Rotam Agrochemical Co., Ltd.

- Willowood Chemicals Pvt. Ltd.

- Shandong Hailir Chemical Co., Ltd.

- Hebei Weiyong Biochemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the MCPA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the MCPA Market?

The MCPA Market is projected to grow at a stable CAGR of 5.8% between 2026 and 2033, driven primarily by sustained demand in cereal farming and advancements in application technology, despite regulatory pressures.

Which application segment accounts for the largest share of MCPA consumption globally?

The Cereals and Grains segment, particularly wheat, barley, and oats, dominates MCPA consumption. The selective nature of MCPA makes it essential for broadleaf weed control in these critical commodity crops, ensuring high yield stability.

How is regulatory policy in the European Union impacting MCPA manufacturers?

EU regulatory stringency (e.g., REACH) necessitates continuous investment in complex re-registration processes and the development of advanced, low-risk formulations. This increases operating costs but favors major players capable of ensuring high compliance standards.

What role does Artificial Intelligence (AI) play in optimizing MCPA usage?

AI is crucial for integrating MCPA into precision agriculture systems. It enables Variable Rate Technology (VRT) prescriptions, minimizing dosage where weed pressure is low and maximizing application efficiency to reduce overall environmental impact and farmer costs.

Which region is the leading global producer and consumer of the MCPA active ingredient?

The Asia Pacific (APAC) region, specifically China and India, leads both in the manufacturing capacity of the MCPA active ingredient and in volume consumption, owing to vast agricultural land and cost-competitive production advantages.

What are the primary formulation types of MCPA available in the market?

The market primarily features three product types: MCPA Acid (the base chemical), MCPA Salts (highly soluble, used in aqueous sprays), and MCPA Esters (oil-soluble, effective in aerial applications and under specific climatic conditions).

How does weed resistance affect the long-term viability of MCPA?

Herbicide resistance is a significant restraint. However, MCPA remains viable because its unique mode of action allows it to be used effectively in rotation or tank mixes with newer chemicals, forming a vital tool in overall resistance management strategies.

What are the key drivers sustaining demand for MCPA despite the maturity of the product?

Key drivers include its superior cost-effectiveness compared to alternatives, its proven track record over decades, and the indispensable role it plays in managing broadleaf weeds in globally significant cereal crops, supporting global food security imperatives.

Who are the potential customers for MCPA products beyond traditional farming?

Potential customers include professional turf management companies (golf courses, sports fields), livestock producers managing pastures and forage quality, and governmental agencies responsible for non-crop vegetation control along utility and transport infrastructure.

What is microencapsulation technology and how does it benefit MCPA formulations?

Microencapsulation is a technological advancement that encapsulates the MCPA active ingredient, providing controlled, slow release. This enhances product longevity, reduces volatility, minimizes non-target drift, and improves user safety during handling and application.

What is the significance of the Pasture and Forage segment growth?

The Pasture and Forage segment is growing rapidly, particularly in regions with large livestock industries (e.g., LATAM). MCPA is essential here to remove toxic weeds, improve grass quality, and maximize the efficiency of grazing land.

How does the MCPA value chain begin, and who controls the upstream segment?

The value chain begins with upstream sourcing of petrochemical precursors like monochloroacetic acid (MCA). The segment is often controlled by integrated chemical manufacturers, especially in APAC, who leverage internal production to maintain cost leadership.

What are the primary logistical challenges in distributing MCPA globally?

The main logistical challenges involve managing regional inventory fluctuations based on strict seasonal planting cycles, ensuring timely delivery across vast agricultural regions, and navigating diverse national customs and regulatory requirements for agrochemical trade.

How do the major market players maintain their competitive edge?

Top key players maintain dominance through established global distribution networks, superior technical support and formulation expertise (especially in adjuvant systems), and extensive portfolios that allow for integrated crop management solutions.

What is the difference between direct and indirect distribution channels for MCPA?

Direct channels involve manufacturers selling straight to large cooperatives or commercial farms, often with technical support. Indirect channels utilize wholesalers and local retailers, crucial for reaching smaller, geographically dispersed farms, especially in developing markets.

Why is the MCPA Ester product type often preferred for aerial spraying?

MCPA Esters are oil-soluble and less prone to crystallization in the spray tank, making them highly effective for low-volume aerial applications. Their lower volatility profile, depending on the specific ester, also aids in minimizing drift risk during widespread application.

What are the main non-crop applications of MCPA?

Non-crop applications include controlling invasive vegetation along critical infrastructure such as railway lines, utility corridors, highways, and industrial sites, where robust and cost-effective weed control is essential for safety and maintenance.

How does climate change influence the demand patterns for MCPA?

Changing climate patterns, leading to shifts in weed prevalence and distribution, necessitate more adaptable and diverse weed control chemistries. This often increases the need for robust, foundational herbicides like MCPA as part of a flexible control program.

What is the current market focus regarding MCPA formulation technology?

The focus is on developing high-load, water-based liquid formulations (SCs) and improving solubility and stability for tank mixing. The goal is to maximize the active ingredient concentration while reducing inert ingredients, packaging, and environmental burden.

What segment offers the highest potential for value-added growth in mature MCPA markets?

The Turf and Amenity Grass segment offers the highest value-added growth in mature markets like North America and Europe. This niche demands premium, high-purity, often specialized MCPA formulations suitable for aesthetically sensitive and high-maintenance environments.

How is market consolidation affecting the MCPA competitive landscape?

Consolidation among major agrochemical firms leads to fewer, larger players controlling formulation and distribution. This allows for greater investment in compliance and R&D for advanced formulations, while simultaneously increasing competitive pressure on generic producers.

What specific benefit does MCPA offer over total vegetation control herbicides?

MCPA is a selective herbicide, meaning it effectively kills broadleaf weeds without harming monocot crops like cereals or grasses. This selectivity is the fundamental reason for its widespread use in protecting major agricultural yields.

Why is supply chain resilience a critical strategic objective for MCPA manufacturers?

Raw material sourcing, heavily reliant on a few key regions (primarily APAC), faces volatility. Maintaining supply chain resilience ensures stable access to precursors like MCA, protecting manufacturing margins and guaranteeing product availability during peak planting seasons.

What are the projected growth trends for MCPA usage in the Latin American market?

Growth in LATAM is expected to be above the global average, largely driven by the expansion of pasturelands for the growing beef export market, where MCPA is essential for maintaining high-quality forage and eliminating invasive weeds.

How do farmers ensure the environmental safety when applying MCPA?

Farmers increasingly adopt best management practices, including using low-drift application technologies (e.g., modern nozzles), adhering strictly to recommended buffer zones near water bodies, and utilizing advanced, encapsulated formulations to minimize runoff and volatility.

What is the key determinant for MCPA usage in non-crop applications?

The key determinant is the necessity for effective, long-lasting, and generally cost-effective vegetation control to ensure operational safety and prevent infrastructure damage, particularly in challenging environments like railway ballast and industrial sites.

How is the move towards sustainable agriculture influencing MCPA market strategy?

The push for sustainability drives manufacturers to develop highly targeted, precision-compatible MCPA formulations. The market strategy focuses on promoting MCPA as a tool for reducing overall herbicide application volumes when integrated with VRT and IPM protocols.

What specific challenge does the MCPA acid form present compared to its salts?

MCPA acid has limited solubility in water, requiring conversion to salts (e.g., DMA, potassium) or esters for effective field application. The salts offer high water solubility, making them easier to formulate into concentrates for typical spray operations.

What is the role of governmental agricultural subsidies in influencing MCPA demand?

Government subsidies, particularly in developing economies, often support the procurement of cost-effective crop protection inputs. This financial support directly boosts the purchasing power of farmers, driving higher volume demand for established products like MCPA.

How does the MCPA market respond to competition from newer herbicide classes?

MCPA maintains its competitive edge not by challenging novel herbicides directly, but by positioning itself as a foundational, low-cost component of rotational weed management systems, essential for mitigating resistance developed against newer, singular-mode-of-action products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager