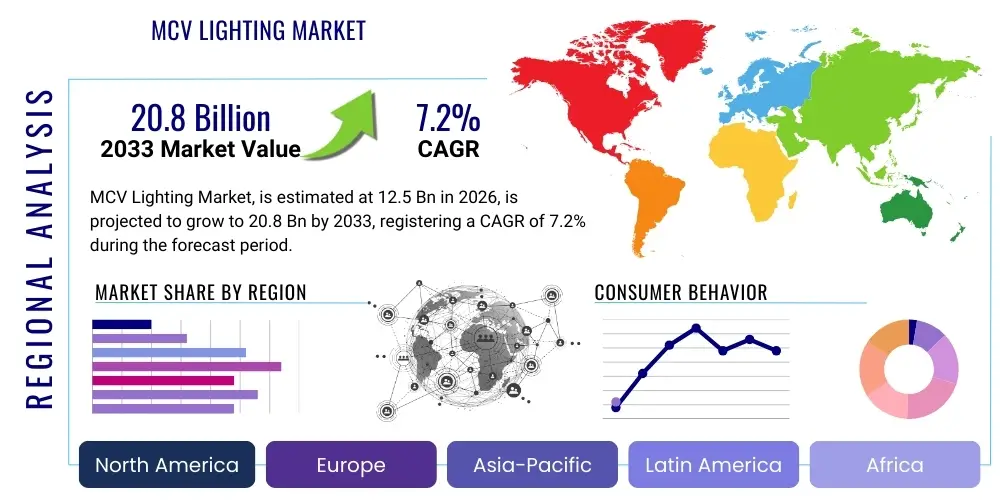

MCV Lighting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439269 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

MCV Lighting Market Size

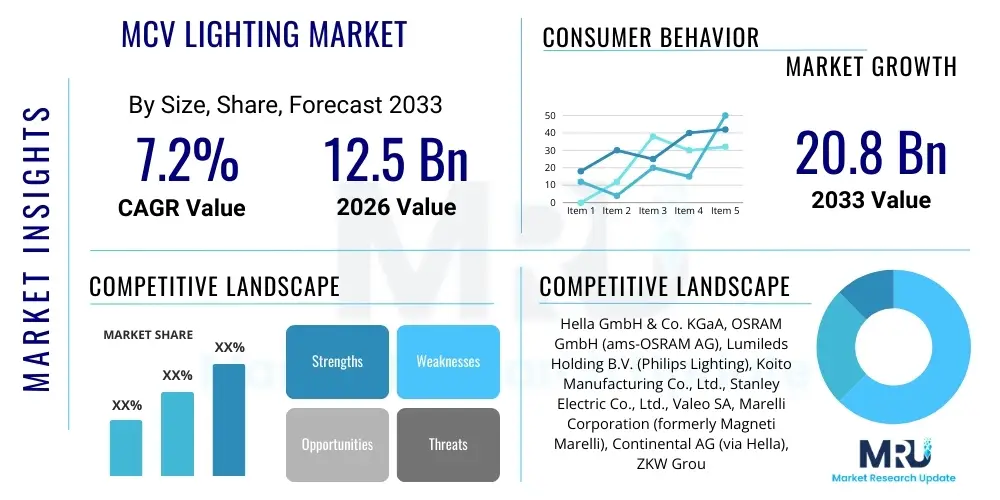

The MCV Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 20.8 Billion by the end of the forecast period in 2033.

MCV Lighting Market introduction

The Medium Commercial Vehicle (MCV) Lighting Market encompasses the design, manufacturing, and distribution of illumination systems specifically for commercial vehicles ranging from medium-duty trucks to various types of buses and coaches. These lighting systems are critical for operational safety, driver visibility, and regulatory compliance, integrating advanced technologies to enhance performance and efficiency. Key products include headlights, tail lights, fog lights, interior cabin lighting, and specialized signaling units, all engineered to withstand the demanding conditions of commercial vehicle operation.

Major applications of MCV lighting extend across freight transportation, public transit, logistics, and specialized service vehicles, where reliable and high-performance illumination is paramount. The benefits derived from advanced MCV lighting solutions include improved road safety through enhanced visibility, reduced driver fatigue, lower energy consumption, and extended product lifespans. Furthermore, modern lighting systems contribute to vehicle aesthetics and brand identity, playing an increasingly important role in vehicle design.

Driving factors for market growth include stringent global safety regulations mandating advanced lighting features, the increasing adoption of LED technology due to its efficiency and durability, and the rising demand for commercial vehicles globally, particularly in emerging economies. Technological advancements such as adaptive lighting systems and smart lighting solutions that integrate with vehicle communication networks are also significant market accelerators, promising greater efficiency and functional capabilities for MCV fleets.

MCV Lighting Market Executive Summary

The MCV Lighting Market is experiencing robust growth driven by technological innovation and evolving regulatory landscapes. Business trends indicate a strong shift towards LED-based solutions, driven by their superior energy efficiency, longer lifespan, and design flexibility, leading to higher adoption rates in both OEM and aftermarket segments. Manufacturers are also focusing on integrated lighting solutions that incorporate advanced driver-assistance systems (ADAS) to improve overall vehicle safety and operational intelligence. Strategic partnerships and mergers among key players are common, aimed at expanding product portfolios and geographical reach, while investment in research and development for smart lighting systems is accelerating.

Regionally, the market exhibits diverse growth patterns. Asia Pacific, particularly countries like China and India, is poised for significant expansion due to rapid industrialization, increasing freight transportation, and growing public transit infrastructure. North America and Europe, characterized by stringent safety regulations and a strong emphasis on fuel efficiency and emissions reduction, are also witnessing steady growth, primarily through the adoption of premium and technologically advanced lighting systems. Latin America, the Middle East, and Africa are emerging as promising markets, driven by urbanization and infrastructure development, which are boosting demand for new commercial vehicles equipped with modern lighting solutions.

Segmentation trends highlight the dominance of LED technology across various product types, from headlights to interior lighting. Adaptive and smart lighting systems are gaining traction, especially in higher-end commercial vehicles, offering features like automatic beam adjustment and enhanced visibility in diverse conditions. The OEM channel continues to hold the largest market share, but the aftermarket is also growing, fueled by replacement demand, upgrades, and customization trends, particularly for fleet operators seeking to enhance vehicle safety and operational costs through more durable and efficient lighting components.

AI Impact Analysis on MCV Lighting Market

Users frequently inquire about how Artificial Intelligence will revolutionize safety and efficiency in MCV lighting, questioning the practical implementation of AI in adaptive lighting, predictive maintenance, and autonomous vehicle integration. Key concerns revolve around the cost-effectiveness of AI-powered systems, their reliability in harsh commercial environments, and the necessary regulatory frameworks to support their widespread adoption. Expectations are high for AI to enable more intuitive, responsive, and ultimately safer lighting solutions that can anticipate road conditions and driver needs, while also contributing to the efficiency of fleet operations through smart data utilization and predictive capabilities.

- AI-powered adaptive lighting systems can dynamically adjust beam patterns and intensity based on real-time environmental conditions, traffic, and vehicle speed, significantly enhancing visibility and reducing glare for oncoming drivers.

- Predictive maintenance for lighting components leveraging AI analytics can forecast potential failures, optimizing maintenance schedules and reducing unexpected downtime for commercial vehicles, thereby improving fleet operational efficiency.

- Integration with autonomous driving systems allows MCV lighting to communicate vehicle intent to pedestrians and other vehicles through dynamic light projections and patterns, crucial for safe navigation in complex environments.

- AI-driven sensor fusion can combine data from cameras, radar, and lidar with lighting controls to identify hazards more effectively, such as pedestrians or animals, and illuminate them preemptively.

- Personalized interior lighting experiences are possible, where AI adjusts cabin illumination based on driver preferences, time of day, or fatigue levels, enhancing driver comfort and alertness during long hauls.

- Optimized energy consumption: AI algorithms can manage power distribution to lighting systems, ensuring lights operate at optimal levels for visibility while minimizing energy drain, particularly beneficial for electric MCVs.

- Enhanced security features: AI can be integrated with security systems to use exterior lighting for perimeter alerts or to deter theft by activating specific light patterns or intensities.

- Fleet management insights: Data collected from smart lighting systems can be analyzed by AI to provide insights into route conditions, driver behavior, and vehicle health, aiding in more informed fleet management decisions.

DRO & Impact Forces Of MCV Lighting Market

The MCV Lighting Market is significantly shaped by a confluence of driving factors, restraints, opportunities, and their collective impact. Key drivers include increasingly stringent global safety regulations that mandate advanced lighting technologies, such as improved headlight performance and active signaling systems, compelling manufacturers to innovate. The continuous technological evolution, particularly the shift towards LED and intelligent lighting solutions, offers superior efficiency, durability, and enhanced visibility, which are highly valued in the commercial vehicle sector. Furthermore, the burgeoning growth of e-commerce and logistics industries globally is fueling the demand for MCVs, consequently boosting the market for their lighting systems. These drivers collectively push for greater adoption of sophisticated and reliable lighting components.

However, the market also faces notable restraints. High initial investment costs associated with advanced LED and smart lighting systems can be a deterrent for smaller fleet operators or in price-sensitive markets, despite long-term operational savings. The complexity of integrating these sophisticated lighting systems with existing vehicle electronics and control units poses technical challenges for OEMs and aftermarket installers. Additionally, fluctuating raw material prices, particularly for components used in LED manufacturing and electronic controls, can impact production costs and overall market stability. These restraints necessitate innovative financing models and streamlined integration processes to ensure broader market accessibility.

Opportunities for growth are abundant within this dynamic landscape. The development of connected and autonomous commercial vehicles presents a substantial opportunity for innovative lighting solutions that communicate vehicle intent and enhance perception capabilities for AI systems. Emerging markets, with their rapid urbanization and infrastructure development, offer untapped potential for expansion as demand for new MCVs rises. Furthermore, the growing focus on sustainable transportation and electrification of commercial fleets opens avenues for ultra-efficient and lightweight lighting solutions, aligning with environmental goals and operational cost reductions. The aftermarket segment also offers significant opportunities for upgrades and retrofitting existing fleets with advanced lighting technologies, extending the lifecycle and enhancing the performance of older vehicles.

Segmentation Analysis

The MCV Lighting market is comprehensively segmented to provide granular insights into its diverse components and drivers. These segmentations allow for a detailed analysis of product types, technologies, sales channels, and applications, revealing the intricate dynamics influencing market trends and consumer preferences across various commercial vehicle categories. Understanding these segments is crucial for stakeholders to identify growth areas, tailor product offerings, and devise effective market strategies.

- By Vehicle Type: This segment categorizes lighting solutions based on the specific medium commercial vehicle they are designed for, acknowledging the varying requirements and regulatory standards across different vehicle classes.

- Medium-Duty Trucks (Class 4-6)

- Heavy-Duty Trucks (Class 7-8)

- Buses (City, Intercity, School)

- Coaches (Tourist, Long-distance)

- Specialty & Utility Vehicles (e.g., municipal vehicles, construction support)

- By Product Type: This segmentation focuses on the specific lighting components within MCVs, each serving distinct functional and safety purposes.

- Headlights (LED, Halogen, Xenon, Adaptive Front-lighting Systems - AFS)

- Tail Lights (LED, Incandescent, OLED)

- Fog Lights (LED, Halogen)

- Turn Signals & Side Marker Lights

- Daytime Running Lights (DRL)

- Interior Lighting (Cabin, Dashboard, Cargo Area, Task Lighting)

- Warning & Emergency Lights (e.g., strobe lights, beacon lights)

- Auxiliary & Work Lights (e.g., spotlights, floodlights)

- Brake Lights & Reverse Lights

- License Plate Lights

- By Technology: This segment differentiates the market based on the illumination technology utilized, highlighting the shift towards more advanced and efficient solutions.

- LED Lighting Systems

- Halogen Lighting Systems

- Xenon (HID) Lighting Systems

- Adaptive Front-lighting Systems (AFS)

- Smart Lighting & Connectivity Solutions (e.g., IoT integration, communication via light)

- Laser Lighting (Emerging Technology)

- OLED Lighting (Emerging Technology)

- By Sales Channel: This segmentation analyzes how lighting products reach the end-user, distinguishing between initial installation and subsequent replacements or upgrades.

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement, Customization, Upgrades)

- By Application: This segment categorizes lighting based on its primary function within the commercial vehicle.

- General Illumination (Headlights, Interior Lights)

- Signaling & Communication (Turn Signals, Brake Lights)

- Safety & Visibility Enhancement (Fog Lights, DRL, Warning Lights)

- Aesthetic & Brand Differentiation (Design elements, customizable lighting)

Value Chain Analysis For MCV Lighting Market

The value chain for the MCV Lighting Market initiates with upstream activities involving raw material procurement and component manufacturing. This phase includes the sourcing of semiconductors, plastics, metals, glass, and electronic components essential for creating complex lighting modules. Key suppliers in this stage are specialized in optics, LED chips, drivers, and housing materials. Efficient upstream management is critical for controlling costs, ensuring quality, and maintaining a stable supply chain amidst global fluctuations in material availability and pricing. Suppliers' technological capabilities directly influence the innovation potential of the final lighting products.

Midstream activities encompass the core manufacturing processes, where raw materials and components are assembled into finished lighting systems. This involves sophisticated processes such as injection molding for lenses and housings, circuit board assembly for LED drivers, and precise optical alignment. OEMs and Tier 1 suppliers conduct rigorous quality control and testing to ensure compliance with automotive standards and regulatory requirements. Research and development also play a significant role here, focusing on improving light output, energy efficiency, durability, and integrating new functionalities like adaptive lighting or smart connectivity.

Downstream activities involve the distribution and sales of MCV lighting products. The primary distribution channels are Original Equipment Manufacturers (OEMs) and the aftermarket. OEMs directly integrate lighting systems into new medium commercial vehicles on the assembly line, often through long-term supply contracts with Tier 1 lighting manufacturers. The aftermarket channel serves replacement demand, upgrades, and customization, reaching end-users through authorized dealers, independent garages, and specialized retailers. Direct sales can occur for large fleet operators, while indirect channels leverage a network of distributors and wholesalers. Effective downstream management, including logistics, inventory control, and customer support, is crucial for market penetration and customer satisfaction, ensuring that high-quality lighting solutions are readily available and properly installed for the demanding commercial vehicle sector.

MCV Lighting Market Potential Customers

The primary potential customers and end-users of MCV lighting products are diverse, reflecting the broad application spectrum of medium commercial vehicles. These include major automotive original equipment manufacturers (OEMs) specializing in trucks and buses, who procure lighting systems for integration into their new vehicle models. These OEMs represent the largest customer base, driving demand for innovative and compliant lighting solutions that meet their specific design, performance, and regulatory specifications. Their purchasing decisions are heavily influenced by factors such as reliability, cost-effectiveness, technological advancement, and long-term supplier relationships.

Another significant customer segment comprises commercial fleet operators, ranging from large logistics companies and public transportation authorities to independent trucking businesses and specialized service providers. These operators are primarily interested in aftermarket lighting solutions for vehicle maintenance, repair, and upgrades. Their purchasing criteria often prioritize durability, energy efficiency, ease of installation, and total cost of ownership (TCO) to minimize downtime and operational expenses. Enhancements in safety and driver comfort through improved lighting are also key motivators for these end-users, seeking solutions that can withstand rigorous daily use.

Additionally, independent workshops, garages, and spare part retailers constitute a crucial part of the customer landscape, serving as intermediaries for individual vehicle owners and smaller fleet operators needing replacement or upgrade parts. These customers look for readily available, high-quality, and competitively priced lighting components. Government entities and municipal service providers, such as fire departments, police forces, and public works departments, also represent a segment of potential customers, requiring specialized and robust lighting solutions for their medium commercial vehicles to ensure visibility and operational safety in various demanding environments. The continuous evolution of vehicle technology and regulatory changes means that these customers are always looking for next-generation lighting solutions that offer superior performance and compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 20.8 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella GmbH & Co. KGaA, OSRAM GmbH (ams-OSRAM AG), Lumileds Holding B.V. (Philips Lighting), Koito Manufacturing Co., Ltd., Stanley Electric Co., Ltd., Valeo SA, Marelli Corporation (formerly Magneti Marelli), Continental AG (via Hella), ZKW Group GmbH, Varroc Lighting Systems, Ichikoh Industries, Ltd., North American Lighting, Inc. (NAL), Truck-Lite Co., LLC, Grote Industries, Peterson Manufacturing Company, Ecco Safety Group (ESG), Optronics International, Vision X Lighting, Federal-Mogul LLC (Tenneco Inc.), TYC Brother Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MCV Lighting Market Key Technology Landscape

The MCV Lighting Market is experiencing a rapid technological evolution, with a primary focus on enhancing efficiency, durability, and safety. Light Emitting Diode (LED) technology remains at the forefront, dominating both exterior and interior lighting applications due to its superior energy efficiency, longer lifespan, compact size, and design flexibility compared to traditional halogen or Xenon (HID) lamps. The reduced power consumption of LEDs is particularly beneficial for commercial vehicles, contributing to lower fuel costs and reduced emissions, while their robustness withstands the vibration and harsh conditions inherent in MCV operations. This transition to LED is a significant driver for innovation, enabling new design possibilities and functional integrations.

Beyond basic LED implementation, the market is increasingly adopting Adaptive Front-lighting Systems (AFS) and other smart lighting solutions. AFS uses sensors to detect steering angle, vehicle speed, and weather conditions to automatically adjust headlight beam direction and intensity, improving visibility around curves and in adverse weather without dazzling oncoming drivers. Further advancements include matrix LED technology, allowing individual LEDs within a headlight to be controlled independently, creating precise light patterns to selectively illuminate areas and actively block light from specific zones. This level of control significantly enhances safety by providing optimal illumination exactly where needed.

The integration of lighting with Advanced Driver-Assistance Systems (ADAS) and vehicle communication networks is also a pivotal technological trend. Smart lighting systems can interface with onboard sensors and navigation data to provide predictive lighting, illuminating potential hazards before the driver can visually perceive them. Moreover, some emerging technologies like laser lighting, while still niche due to cost, offer extremely long beam ranges for specialized applications. The focus is increasingly on connected lighting systems that can communicate with other vehicles and infrastructure (V2X communication), enhancing overall road safety and preparing for the era of autonomous commercial vehicles by utilizing lighting as a communication interface for vehicle intent and warnings.

Regional Highlights

- North America: This region is characterized by a mature commercial vehicle market and stringent safety regulations. Key countries like the United States and Canada are early adopters of advanced lighting technologies, including LED and adaptive systems, driven by a strong emphasis on fleet efficiency and driver safety. The presence of major truck and bus manufacturers also fuels OEM demand.

- Europe: Europe is at the forefront of implementing advanced vehicle safety standards and emission regulations, which directly impact lighting technology development. Countries such as Germany, France, and the UK demonstrate high demand for premium and technologically sophisticated MCV lighting solutions, including smart and connected lighting, driven by innovation and a push towards greener transportation.

- Asia Pacific (APAC): APAC represents the fastest-growing market for MCV lighting, propelled by rapid industrialization, urbanization, and expanding logistics and transportation sectors in countries like China, India, and Japan. While price sensitivity is a factor, the sheer volume of commercial vehicle production and the increasing adoption of modern safety features are driving substantial market expansion and technological upgrades.

- Latin America: Countries like Brazil and Mexico are emerging as significant markets due to infrastructure development and economic growth, leading to increased demand for medium commercial vehicles. The market here is growing, with a rising preference for durable and cost-effective lighting solutions, and a gradual shift towards more energy-efficient technologies.

- Middle East and Africa (MEA): This region is experiencing steady growth in the commercial vehicle sector, particularly in GCC countries and South Africa, driven by construction projects and diversifying economies. The demand for MCV lighting is primarily focused on robust and reliable solutions capable of performing in challenging environmental conditions, with a gradual uptake of advanced LED technologies for efficiency and longevity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MCV Lighting Market.- Hella GmbH & Co. KGaA: A global automotive supplier specializing in lighting technology and electronics for commercial vehicles, offering a wide range of LED headlamps, rear lamps, and work lights.

- OSRAM GmbH (ams-OSRAM AG): A leading global high-tech company with a focus on optical solutions, providing advanced LED and laser components for automotive lighting applications, including MCVs.

- Lumileds Holding B.V. (Philips Lighting): A prominent manufacturer of LED lighting solutions for the automotive industry, known for its high-performance and innovative LED components used in MCV headlights and other applications.

- Koito Manufacturing Co., Ltd.: A leading Japanese manufacturer of automotive lighting equipment, supplying a comprehensive range of exterior lighting products, including advanced LED systems, for various commercial vehicles.

- Stanley Electric Co., Ltd.: A Japanese company specializing in automotive lighting and electronic components, offering a broad portfolio of LED-based headlamps, rear lamps, and interior lighting solutions for commercial vehicles.

- Valeo SA: A global automotive supplier and partner to automakers worldwide, providing innovative lighting systems, including LED and smart lighting solutions, for improved safety and design in MCVs.

- Marelli Corporation (formerly Magneti Marelli): A global independent supplier to the automotive industry, offering comprehensive lighting systems and components, with expertise in advanced LED technology for commercial vehicle applications.

- Continental AG (via Hella): A major German automotive parts manufacturing company, with its lighting segment (now largely through its stake in Hella) providing innovative lighting solutions and electronics for commercial vehicles.

- ZKW Group GmbH: An Austrian specialist in premium lighting and electronic systems for the automotive industry, known for its high-tech headlamps and fog lamps, with significant offerings for commercial vehicles.

- Varroc Lighting Systems: A global automotive tier-one supplier of exterior lighting systems, offering a full range of advanced LED and conventional lighting products for trucks and buses.

- Ichikoh Industries, Ltd.: A Japanese automotive lighting manufacturer known for its high-quality headlamps, rear lamps, and signaling lights, serving a wide array of commercial vehicle OEMs.

- North American Lighting, Inc. (NAL): A premier automotive lighting company in North America, manufacturing a comprehensive range of exterior lighting products for commercial vehicle applications.

- Truck-Lite Co., LLC: A leading global manufacturer of heavy-duty lighting, mirrors, and wiring harnesses for the commercial vehicle industry, specializing in LED lighting solutions.

- Grote Industries: A well-established manufacturer of vehicle lighting and safety systems for the commercial vehicle industry, offering a wide array of LED lamps, reflectors, and electrical components.

- Peterson Manufacturing Company: A US-based manufacturer of vehicle safety lighting and accessories, providing robust and durable lighting solutions for medium and heavy-duty trucks and trailers.

- Ecco Safety Group (ESG): A global leader in vehicle lighting and audible warning equipment, offering specialized warning lights, backup alarms, and work lights for commercial and emergency vehicles.

- Optronics International: A major manufacturer and supplier of heavy-duty truck and trailer lighting products, known for its innovative LED lighting solutions.

- Vision X Lighting: A global manufacturer of advanced LED lighting products, offering high-performance auxiliary and work lights designed for the demanding conditions of commercial vehicles.

- Federal-Mogul LLC (Tenneco Inc.): Provides various automotive components, including lighting solutions and related parts for the commercial vehicle aftermarket.

- TYC Brother Industrial Co., Ltd.: A Taiwanese manufacturer specializing in automotive lighting products for the aftermarket, offering a broad selection of replacement lamps for commercial vehicles.

Frequently Asked Questions

What is the primary driving factor for the growth of the MCV Lighting Market?

The primary driving factor for the growth of the MCV Lighting Market is the increasing stringency of global safety regulations for commercial vehicles. These regulations mandate enhanced visibility and advanced lighting features, compelling manufacturers to adopt innovative technologies like LEDs and adaptive lighting systems to meet compliance and improve overall road safety.

How is LED technology impacting the MCV Lighting Market?

LED technology is profoundly impacting the MCV Lighting Market by offering superior energy efficiency, extended lifespan, and greater design flexibility compared to traditional lighting. This leads to reduced operational costs for fleet operators, lower maintenance, and the enablement of advanced functionalities like adaptive and smart lighting systems, driving widespread adoption in both OEM and aftermarket segments.

What role do smart lighting systems play in MCV applications?

Smart lighting systems in MCV applications play a crucial role in enhancing safety and operational efficiency. They utilize sensors and data to dynamically adjust light patterns, intensity, and direction based on real-time conditions, vehicle speed, and steering angle. These systems can integrate with ADAS and autonomous driving features, improving visibility, reducing driver fatigue, and communicating vehicle intent to other road users.

Which geographical region is projected to experience the fastest growth in the MCV Lighting Market?

The Asia Pacific (APAC) region is projected to experience the fastest growth in the MCV Lighting Market. This acceleration is driven by rapid industrialization, increasing urbanization, significant expansion in the logistics and transportation sectors, and growing commercial vehicle production, particularly in populous countries like China and India.

What are the main challenges faced by the MCV Lighting Market?

The main challenges faced by the MCV Lighting Market include the high initial investment costs associated with advanced LED and smart lighting systems, which can deter smaller fleet operators. Additionally, the technical complexity of integrating these sophisticated systems with existing vehicle architectures and the fluctuations in raw material prices pose significant hurdles for manufacturers and impact market stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager