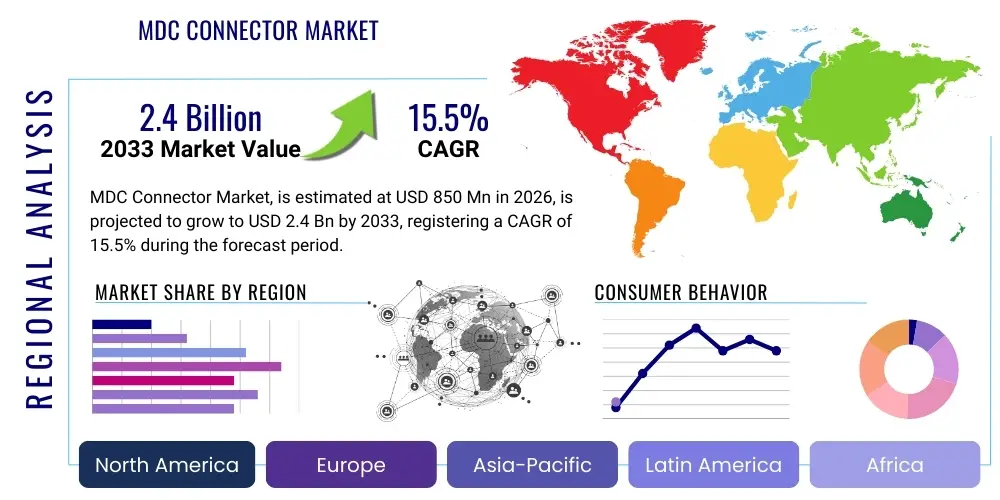

MDC Connector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437380 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

MDC Connector Market Size

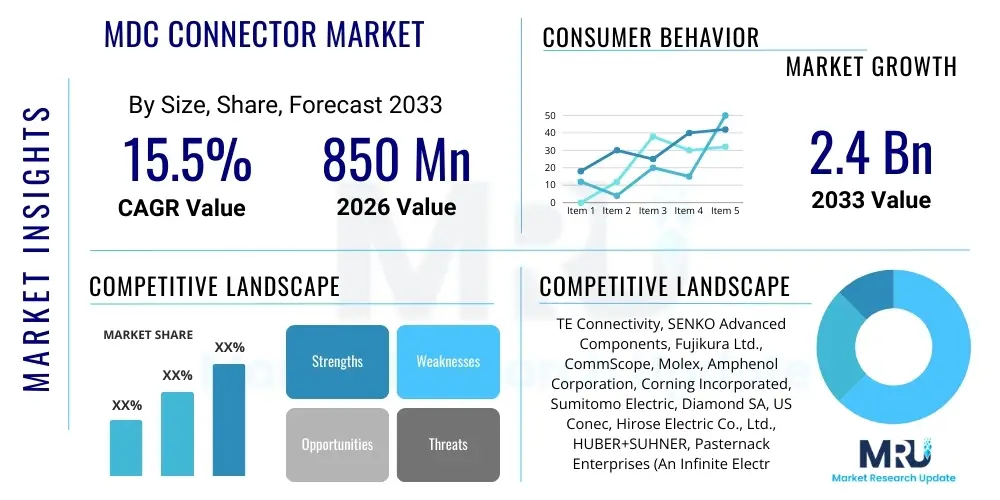

The MDC Connector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. This robust expansion is fueled by the unprecedented demand for high-density, small-form-factor connectivity solutions across various high-bandwidth applications, particularly in hyperscale data centers and advanced telecommunication infrastructure. The market is estimated at USD 850 million in 2026 and is projected to reach USD 2.4 billion by the end of the forecast period in 2033, reflecting a crucial shift in industry standards towards miniaturization and superior performance required for 400G and 800G Ethernet deployments. This growth trajectory highlights the industry's commitment to optimizing space utilization within complex networking environments while maintaining rigorous performance criteria regarding insertion loss and return loss.

MDC Connector Market introduction

The MDC Connector Market, centered on Miniature Dual Connection technology, encompasses specialized fiber optic connectors designed to offer exceptionally high port density and superior optical performance within extremely limited spaces. The fundamental product concept revolves around miniaturizing traditional duplex LC connectors, providing comparable or superior reliability while occupying significantly less footprint, typically reducing the space requirement by 60% or more compared to conventional designs. These connectors feature a robust push-pull mechanism, enabling secure and easy handling in high-density patch panels and active equipment interfaces, crucial characteristics when dealing with tens of thousands of connections in modern hyperscale environments. The high fiber count accommodated within a small form factor makes MDC connectors indispensable for transceivers (such as QSFP-DD and OSFP interfaces) that demand ultra-compact and highly reliable interconnectivity.

Major applications driving the widespread adoption of MDC connectors span high-speed data transmission within core network infrastructure, cloud computing environments, and enterprise storage networks. Specifically, these connectors are foundational in high-density switch-to-switch aggregation, server farm connectivity, and fiber-to-the-desktop (FTTD) implementations where space is a critical constraint. The inherent benefits of MDC technology include maximized panel space utilization, significant reduction in cable management complexity, enhanced airflow (due to less cable bulk), and standardized compatibility with emerging transceiver formats requiring multi-fiber connectivity. Furthermore, their secure locking mechanism minimizes the risk of accidental disconnection in vibrational or high-traffic environments, ensuring operational stability and network uptime.

The primary driving factors propelling this market include the global expansion of hyperscale and edge data centers necessitated by the surge in data consumption, the ongoing rollout of 5G and 6G telecommunication networks which require denser fiber infrastructure backhaul, and the continuous industry drive towards higher data rates (400G, 800G, and beyond). Regulatory pushes for energy efficiency and reduced operational expenditure (OpEx) also favor MDC adoption, as their high density contributes directly to optimized hardware utilization and decreased physical footprint, leading to lower cooling and real estate costs. Manufacturers are continuously innovating the termination processes and materials science of the ferrules to further reduce insertion loss, ensuring that the connectors can reliably support the stringent performance demands of next-generation optical transmission standards.

MDC Connector Market Executive Summary

The MDC Connector Market Executive Summary reveals a landscape dominated by rapid technological evolution and concentrated investment in critical infrastructure. Business trends indicate a strong move toward strategic partnerships between connector manufacturers and transceiver developers to ensure immediate compatibility with next-generation optical modules, accelerating the standardization process. Furthermore, key market players are focusing heavily on vertical integration, controlling both the component manufacturing (ferrules, alignment sleeves) and the final assembly of complex multi-fiber cable assemblies, thereby gaining a competitive edge through quality control and reduced time-to-market. The competitive environment is characterized by intense focus on patented latching mechanisms and superior optical alignment techniques, crucial differentiators in a market valuing reliability and ease of installation above all else. Adoption rates are showing a clear correlation with investment cycles in AI and machine learning infrastructure, which inherently require the highest possible density connectivity.

Regionally, the Asia Pacific (APAC) region is poised to maintain its lead in market share, primarily driven by the colossal data center construction boom in countries like China, India, and Japan, coupled with its status as a global manufacturing hub for electronic and optical components. However, North America continues to be the primary engine for innovation and early adoption, housing the majority of hyperscale cloud providers who dictate the technical specifications and deployment standards for high-density interconnects like the MDC. Europe is demonstrating steady, sustained growth, largely influenced by stringent regulatory requirements pertaining to data sovereignty and the need to modernize legacy telecom infrastructure, favoring high-performance, space-saving solutions. The rapid digitization in emerging economies, particularly in Southeast Asia and Latin America, represents significant untapped market opportunity, contingent upon localized infrastructure investment and standardization efforts.

Segment trends highlight the increasing dominance of the Duplex MDC configuration due to its versatility and direct application in high-speed transceiver breakouts and patch panel aggregation. Regarding fiber count, while 4-fiber (4F) and 8-fiber (8F) assemblies currently hold a substantial share, the 12-fiber (12F) and higher-count variants are projected to witness the fastest growth, directly correlating with the transition to 400G and 800G systems which require enhanced parallel optics capabilities. Application-wise, the Data Center segment, encompassing both hyperscale and co-location facilities, remains the indisputable largest consumer, though the Industrial and Military/Aerospace segments are seeing accelerating demand for ruggedized and environmentally sealed MDC derivatives, driven by the need for high-bandwidth connectivity in harsh operating conditions such as factory floors and tactical field deployments. This segmentation dynamic underscores the connector’s adaptability beyond core networking into specialized, mission-critical applications.

AI Impact Analysis on MDC Connector Market

Common user questions regarding AI's impact on the MDC Connector Market typically center around three key themes: bandwidth scalability, thermal management within high-density racks, and the longevity of current MDC form factors in future AI architectures. Users frequently query whether existing MDC standards can support the anticipated terabit-level data flows required for interconnected AI clusters and large language model (LLM) training. They are concerned about the ability of these miniature connectors to dissipate heat effectively when integrated into ultra-hot QSFP-DD/OSFP transceivers running intensive AI workloads. Furthermore, questions arise concerning the resilience of fiber optic connectivity against electromagnetic interference (EMI) often associated with dense, high-power compute racks, seeking assurance that the optical integrity provided by MDC remains absolute. The aggregate analysis of these inquiries indicates a market expectation that AI will not just drive incremental demand, but fundamentally accelerate the need for next-generation, ultra-low-loss, and thermally optimized MDC variants.

The key thematic summary confirms that AI’s influence is primarily disruptive, demanding higher density and lower latency than traditional data center loads. The requirements imposed by training large AI models—massive GPU cluster interconnects and extremely rapid data movement—translate directly into a non-negotiable requirement for physical connectivity that maximizes port capacity per rack unit while minimizing signal propagation delay and insertion loss. Consequently, MDC connectors are positioned as a core enabling technology because they inherently meet the density mandate. However, the operational reality of AI workloads, which generate significant heat, forces manufacturers to rapidly innovate materials science, focusing on polymers and housing designs that improve thermal conductivity and stability under continuous high load. This push for thermal optimization and reliability at scale represents the immediate and most critical design challenge posed by the AI boom.

The long-term expectations suggest that AI adoption will necessitate broader standardization efforts specific to AI/ML interconnectivity, potentially leading to specialized MDC derivatives optimized for high-power optical modules (co-packaged optics) and near-chip connectivity. The increased velocity of data processing driven by AI requires network operators to eliminate all potential performance bottlenecks, reinforcing the value proposition of MDC’s low-profile and exceptional optical performance. Failure to adopt high-density solutions like MDC would severely limit the computational power that can be housed in a single rack, making the MDC form factor a de facto standard for future high-performance computing (HPC) and AI clusters. This impact transcends merely unit sales; it dictates the architectural foundation of next-generation digital infrastructure globally.

- AI-driven workloads mandate ultra-high-density cabling, making MDC essential for maximizing rack compute capacity.

- Accelerated demand for 400G and 800G infrastructure directly linked to AI cluster growth requires MDC compatibility with new transceivers.

- Thermal management concerns in high-power AI racks necessitate MDC variants using advanced, heat-resistant housing materials.

- AI deployments increase focus on ultra-low insertion loss connectors to maintain signal integrity over expanded link lengths.

- MDC enables complex fiber breakout configurations necessary for connecting thousands of GPUs in interconnected AI fabric networks.

DRO & Impact Forces Of MDC Connector Market

The MDC Connector Market is shaped by a powerful interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. The primary driver is the exponentially increasing global demand for data bandwidth, fueled by cloud services, video streaming, and the rapid deployment of AI and machine learning infrastructure, all of which require unprecedented levels of network density in data centers. Restraints largely center on the technical complexities associated with field termination and the initial higher unit cost compared to traditional LC connectors, alongside concerns regarding the specialized tooling and training required for maintenance personnel to handle these intricate, miniaturized components effectively. Opportunities are abundant in the emerging fields of Edge Computing, Industrial IoT (IIoT), and Passive Optical Networks (PON), which necessitate compact, reliable optical interconnects in non-traditional environments. The collective impact forces reflect the industry's accelerating move toward Co-Packaged Optics (CPO) and higher levels of integration, potentially rendering external physical connectors less relevant for ultra-short, on-board distances, yet simultaneously increasing their necessity for inter-shelf and chassis-to-chassis connectivity.

A detailed examination of the Drivers reveals that the migration from 100G to 400G and 800G optical networking mandates a proportional increase in fiber density per port, a requirement perfectly addressed by the MDC's compact design. This technological transition pushes system architects away from bulkier connectors. Furthermore, regulatory standards promoting green data centers inherently favor solutions that reduce physical footprint and improve thermal efficiency, positioning the MDC as a key component in sustainable infrastructure strategies. However, the Restraints are significant hurdles; the small size that provides the density advantage also introduces challenges related to connector cleaning and inspection, which are critical procedures in maintaining optical performance. A microscopic dust particle can severely degrade the performance of these miniature ferrules, requiring specialized training and precise handling protocols that increase operational complexity and potential downtime if mishandled. Overcoming the perception of complexity through improved tooling and standardized installation training is essential for mass market penetration beyond the hyperscale giants.

The inherent Opportunities in the MDC market are tied to diversification into harsh-environment applications. The development of ruggedized MDC variants, designed for industrial, military, and outdoor telecommunication shelters, opens entirely new vertical markets where space efficiency and environmental resilience are prioritized equally. Furthermore, the advent of standardized transceivers featuring multiple MDC interfaces (e.g., in advanced OSFP modules) creates a clear roadmap for widespread adoption across all tiers of data center operators, including enterprise facilities that are currently evaluating upgrades. The overarching Impact Forces, particularly the convergence of hardware and software-defined networking, exert pressure on connector manufacturers to innovate rapidly, not only on the physical design but also on compatibility with automated fiber management systems. The speed at which new standards are adopted or rejected by major technology consortia acts as a critical external force determining the market's direction, emphasizing the necessity for interoperability and consensus among key industry players to maintain the MDC's relevance in the next decade of fiber optic advancement.

Segmentation Analysis

The MDC Connector Market is strategically segmented based on crucial operational and technical attributes, allowing for granular analysis of demand patterns across different application environments and technical requirements. Key segmentation categories include the Type of Connector (e.g., Duplex, Simplex), the Fiber Count supported by the connector assembly (ranging from 2-fiber up to 16-fiber or more), and the ultimate Application or End-User industry, which dictates environmental specifications and performance thresholds. This segmentation framework assists manufacturers in tailoring product specifications—such as ferrule material, housing robustness, and latching mechanisms—to meet the distinct, stringent demands of sectors like Telecom, which prioritize long-term reliability and environmental sealing, versus Data Centers, which focus primarily on maximizing port density and minimizing insertion loss for multi-mode and single-mode systems within controlled climates. Understanding these differentiated demands is fundamental to effective product development and market penetration strategies within the evolving connectivity landscape.

- By Type

- Duplex MDC (Standard)

- Simplex MDC

- MDC Array Connectors (High Fiber Count)

- By Fiber Type

- Single-Mode Fiber (SMF)

- Multi-Mode Fiber (MMF)

- By Fiber Count

- 2-Fiber

- 4-Fiber

- 8-Fiber

- 12-Fiber

- 16-Fiber and Above

- By Application

- Data Centers (Hyperscale, Co-location, Enterprise)

- Telecommunications (Central Offices, FTTx, 5G Backhaul)

- High-Performance Computing (HPC) and AI Clusters

- Industrial & Military/Aerospace (Ruggedized Connectors)

- Broadcasting and Pro AV

Value Chain Analysis For MDC Connector Market

The Value Chain for the MDC Connector Market is characterized by a high degree of technical specialization and dependency on precision engineering across all tiers. The upstream segment is dominated by highly specialized material suppliers providing critical components such as high-precision ceramic ferrules, specialized polymer housing materials that must withstand high temperatures and ensure dimensional stability, and high-purity glass fiber necessary for the cable itself. The quality and uniformity of these upstream components directly dictate the optical performance (low insertion loss) of the final connector product. Key challenges in this stage include maintaining stringent manufacturing tolerances in the nanometer range for ferrule concentricity, which is crucial for perfect fiber alignment within the miniaturized form factor. Suppliers capable of providing consistent, high-quality materials at scale hold significant leverage within the value chain, as any deviation in material specification compromises the connector's ability to support 400G and 800G transmission rates.

The midstream involves the core manufacturing and assembly of the MDC connectors, typically undertaken by large, established connectivity solution providers. This stage involves sophisticated processes such as injection molding for housing, precision grinding and polishing of the ferrules, and highly automated assembly of the internal spring mechanisms and latching components. Distribution channels are varied but can generally be categorized into direct and indirect routes. Direct sales are predominant for large-volume customers, specifically hyperscale data center operators and Tier 1 telecom carriers, where customized cable assembly lengths and specific performance testing requirements necessitate direct manufacturer engagement and support. This direct channel facilitates rapid feedback loops concerning product performance and potential improvements, crucial for staying ahead of rapid transceiver technology shifts.

Indirect distribution relies heavily on global distributors, specialized electrical/optical wholesalers, and authorized system integrators who service smaller enterprise data centers, industrial clients, and general network installers. These partners provide inventory management, localized technical support, and the necessary integration services required to deploy MDC connectors within diverse existing network infrastructures. The downstream segment consists of the end-users: primarily Hyperscale Cloud Providers, Telecommunication Equipment Manufacturers (TEMs), and government/defense agencies. The trend toward pre-terminated fiber optic cable assemblies has significantly influenced the downstream, shifting installation complexity from the field to the factory, thereby increasing the value captured by midstream assemblers who offer plug-and-play solutions. Successful navigation of the value chain requires expertise not only in component engineering but also in global logistics and specialized technical training to support the intricate installation and maintenance demands of the MDC connector.

MDC Connector Market Potential Customers

The primary potential customers for MDC Connectors are those entities that face severe constraints on rack space and thermal management while simultaneously requiring maximum fiber density and future-proof bandwidth capability. This includes, first and foremost, Hyperscale Cloud Providers such as Amazon Web Services (AWS), Google Cloud, and Microsoft Azure. These entities operate data centers housing millions of servers, where every inch of rack space and every fraction of a decibel in insertion loss translates into massive operational costs or performance gains. Their demand is characterized by high volume, stringent specification adherence, and a continuous requirement for the latest, highest-density connectivity solutions to support internal fabric upgrades from 100G/200G to 400G/800G networks. Their purchasing power and technical requirements often set the precedent for the entire market, compelling manufacturers to adhere to extremely tight manufacturing tolerances.

Secondly, Major Telecommunication Operators, particularly those involved in 5G core network deployments and FTTx expansion, constitute a significant customer base. In centralized radio access networks (C-RANs) and central offices, space efficiency is critical, and the MDC connector’s compact design allows for greater fiber management within dense aggregation points and distribution frames. Telcos prioritize ruggedized versions and long-term environmental stability, as their deployments often reside in less controlled environments than typical data centers. The focus here is on durability, reliability over decades, and compatibility with standardized optical distribution frames (ODFs). Their procurement processes often involve long qualification cycles, prioritizing suppliers with established track records and comprehensive service support capabilities.

Finally, Enterprise Data Centers, especially those in finance, high-frequency trading, and specialized scientific research/HPC facilities, represent a rapidly growing segment. While their volume demand is lower than hyperscale providers, their need for extremely low latency and high-speed links between clustered servers (e.g., in a high-performance trading environment) makes the MDC connector highly attractive. Furthermore, system integrators and equipment manufacturers specializing in networking hardware (switches, routers, and optical transport gear) are indirect but critical customers, as they integrate the MDC connector directly into their chassis and transceivers, driving consumption upstream. The expansion of Industrial IoT and smart factory initiatives also creates niche potential customers requiring small, robust MDC solutions for localized, high-speed machine-to-machine communication.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, SENKO Advanced Components, Fujikura Ltd., CommScope, Molex, Amphenol Corporation, Corning Incorporated, Sumitomo Electric, Diamond SA, US Conec, Hirose Electric Co., Ltd., HUBER+SUHNER, Pasternack Enterprises (An Infinite Electronics Brand), Panduit, EXFO, AFL Global (Fujikura), Optical Cable Corporation (OCC), Belden Inc., Leviton Manufacturing Co., Inc., Clearfield, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MDC Connector Market Key Technology Landscape

The technological landscape of the MDC Connector Market is fundamentally driven by advancements in precision engineering, focusing on achieving stable, ultra-low insertion loss (UL-IL) performance in a miniature footprint. A cornerstone technology is the adoption of advanced ceramic or composite ferrules, which are meticulously manufactured to ensure sub-micron concentricity and dimensional accuracy, essential for perfect physical contact (PC) or angled physical contact (APC) termination. The successful deployment of MDC connectors is heavily reliant on the mechanism that ensures precise fiber alignment and consistent spring pressure, compensating for potential fiber misalignment that increases rapidly when dealing with smaller components. Innovations in automated fiber polishing and inspection systems are equally crucial, as manual methods struggle to meet the quality assurance requirements imposed by 400G and 800G applications where the power budget for loss is extremely tight. Manufacturers are increasingly utilizing specialized polymer compounds for the connector housing, selected for their dimensional stability across a wide temperature range and resistance to chemical degradation, extending the lifespan and reliability of the connectivity solution in variable data center conditions.

Another critical technological development involves the continuous refinement of the push-pull boot and latching mechanism. Since MDC connectors are designed for dense environments, the latching mechanism must be operable using minimal finger access or specialized tools, ensuring secure connection and easy disconnection without disturbing adjacent ports. Recent advancements focus on making these latching systems more intuitive and robust, often incorporating visual or tactile feedback to confirm secure mating. Furthermore, key players are investing heavily in research related to expanded beam technology for future high-fiber-count arrays, potentially reducing the reliance on physical contact termination in extremely harsh or dirty environments. While traditional MDC remains physical contact, the industry is exploring modularity and hybridization, integrating elements of expanded beam technology to improve durability and ease of cleaning, especially for field-deployed tactical units or industrial applications where optical connectivity integrity is constantly challenged by environmental factors.

The integration of MDC technology into cutting-edge transceiver form factors, such as QSFP-DD and OSFP, represents a vital aspect of the technological landscape. Connector manufacturers must collaborate closely with optical module designers to ensure that the MDC footprint and mechanical interfaces are seamlessly integrated, supporting the complex breakout configurations required for parallel optics (e.g., breaking out a 400G link into multiple 100G lanes using multiple MDC duplex pairs). The technological challenge here is maintaining thermal integrity. As transceivers become more powerful and hotter, the connector interface must be designed not only for optical performance but also for thermal resilience, ensuring that temperature fluctuations do not cause component expansion or contraction that could lead to intermittent signal loss. Future developments are likely to focus on passive thermal management solutions integrated directly into the MDC housing design, further cementing its role as a necessary enabler for next-generation, high-speed, and high-density optical fabrics within AI and HPC environments.

Regional Highlights

Regional dynamics play a crucial role in shaping the MDC Connector Market, dictated primarily by investment levels in digital infrastructure, technological adoption rates, and local manufacturing capabilities. North America, encompassing the United States and Canada, remains the leader in technological innovation and early market adoption, primarily driven by the presence of the world’s largest hyperscale cloud providers (CSPs) and leading technology research institutions. These CSPs consistently push the boundaries of density and speed, creating sustained, high-volume demand for premium, low-loss MDC connectors compatible with the latest 400G and 800G transceiver standards. The region’s focus is predominantly on high-performance, single-mode fiber connectivity and immediate deployment of standardized MDC solutions within massive, centralized data hubs. The competitive environment is characterized by intense focus on patented design features and rapid fulfillment capabilities to meet the aggressive deployment schedules of cloud giants.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, securing its position as the largest market by volume. This exponential growth is fueled by massive infrastructure projects, including government-led initiatives to expand internet penetration, the rapid build-out of 5G networks, and extraordinary investment in localized hyperscale and co-location data centers across nations such as China, India, and Southeast Asian countries. APAC also serves as the global manufacturing core for many fiber optic components, leading to competitive pricing and robust supply chains within the region. While North America drives innovation in specification, APAC drives volume production and implementation at scale. Local manufacturers are increasingly gaining market share by optimizing cost structures and providing customized solutions tailored to regional network architectures, often focusing on multi-mode and single-mode variants for both data center and FTTx applications.

Europe demonstrates stable growth, mandated by ongoing efforts to modernize telecommunications networks and comply with stringent data privacy regulations, which necessitates localized data processing and storage capacity. Countries in Western Europe, particularly the UK, Germany, and France, are upgrading enterprise and carrier-neutral data centers, leading to steady demand for space-efficient solutions like the MDC. The Middle East and Africa (MEA) and Latin America regions, while currently possessing smaller market shares, represent significant untapped potential. Growth in these regions is strongly linked to foreign direct investment in core digital infrastructure, particularly submarine cable landings and the subsequent development of large-scale terrestrial data centers. As data consumption and digitization efforts accelerate in these emerging economies, the need for high-density, reliable connectivity solutions like the MDC will escalate dramatically, focusing initially on robust, high-fiber-count cable assemblies for regional network backbones.

- North America: Dominant in innovation; driven by hyperscale cloud providers and early adoption of 400G/800G standards.

- Asia Pacific (APAC): Largest volume market; fueled by rapid 5G deployment, massive data center construction, and strong local manufacturing base (China, Japan, India).

- Europe: Stable, sustained growth driven by telecom modernization, enterprise data center upgrades, and strict regulatory compliance needs.

- MEA and Latin America: High-potential emerging markets; growth dependent on core digital infrastructure investment and urbanization trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MDC Connector Market.- SENKO Advanced Components

- TE Connectivity

- Fujikura Ltd.

- CommScope

- Molex (A Subsidiary of Koch Industries)

- Amphenol Corporation

- Corning Incorporated

- Sumitomo Electric Lightwave (SEL)

- Diamond SA

- US Conec

- Hirose Electric Co., Ltd.

- HUBER+SUHNER

- Pasternack Enterprises (An Infinite Electronics Brand)

- Panduit

- EXFO

- AFL Global (Fujikura)

- Optical Cable Corporation (OCC)

- Belden Inc.

- Leviton Manufacturing Co., Inc.

- Clearfield, Inc.

Frequently Asked Questions

Analyze common user questions about the MDC Connector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific advantages do MDC connectors offer over traditional LC duplex connectors?

MDC connectors provide significantly higher density, typically reducing the panel space required by 60% to 70% compared to LC connectors. This miniaturization is crucial for maximizing port count in transceivers like QSFP-DD and OSFP, which are essential for 400G and 800G parallel optic systems in modern hyperscale data centers. They also feature a robust push-pull latching mechanism optimized for blind mating and easy access in high-density environments.

How is the adoption of AI and machine learning impacting the demand for MDC connectors?

AI adoption is accelerating demand by necessitating extremely dense, low-latency fabric interconnects for GPU clusters. MDC connectors are critical enablers because they allow data center operators to pack the maximum number of fiber links into switch ports and patch panels, supporting the massive bandwidth requirements and complex breakout architectures inherent in advanced AI and HPC systems.

What are the primary technical challenges associated with deploying and maintaining MDC connectors?

The primary challenges stem from the miniature form factor, requiring highly specialized tooling for precise field termination and rigorous cleaning procedures. Due to the tight tolerances and small fiber cores, MDC connectors are highly sensitive to dust and debris, demanding superior cleanliness protocols and specialized inspection equipment during both installation and maintenance to ensure ultra-low insertion loss performance.

Which regional market is exhibiting the fastest growth rate for MDC connector adoption?

The Asia Pacific (APAC) region is forecast to experience the fastest growth, primarily driven by massive government and private sector investment in new data center construction and the widespread deployment of 5G infrastructure across key economies like China, India, and Southeast Asia. This region capitalizes on its position as a global manufacturing hub and its escalating demand for digital services.

Are MDC connectors compatible with emerging Co-Packaged Optics (CPO) architectures?

While CPO technology aims to reduce traditional external interfaces, MDC connectors remain essential for chassis-to-chassis and board-to-panel connectivity, especially as the fiber count required to break out CPO interfaces remains high. Manufacturers are developing advanced MDC designs that offer improved thermal stability and low-loss performance specifically to interface with high-power CPO modules, ensuring their continued relevance in future optical systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager