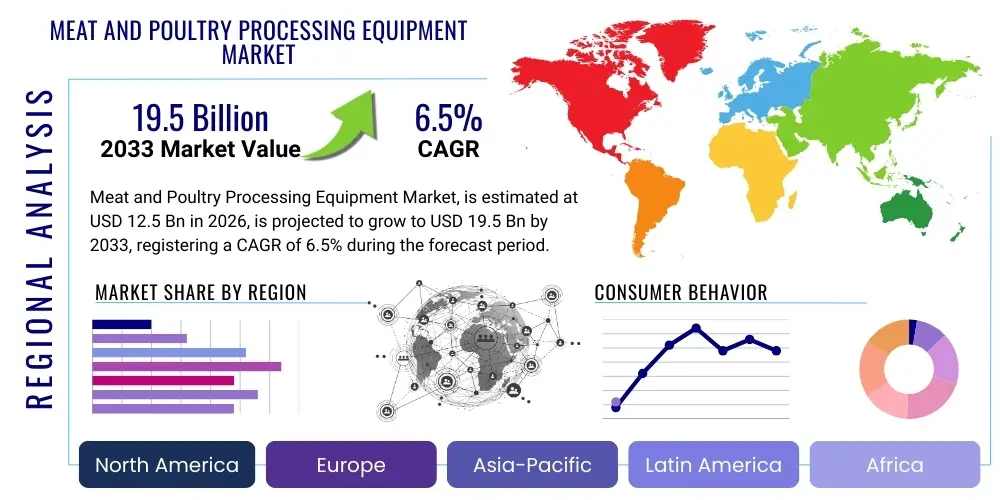

Meat and Poultry Processing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439008 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Meat and Poultry Processing Equipment Market Size

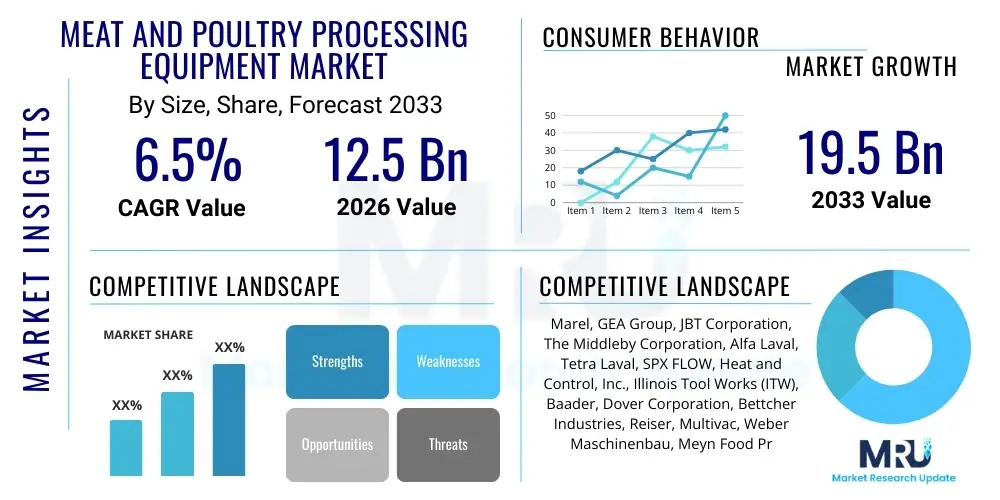

The Meat and Poultry Processing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033.

Meat and Poultry Processing Equipment Market introduction

The Meat and Poultry Processing Equipment Market encompasses machinery used across the entire supply chain, from slaughtering and primary processing (such as deboning and skinning) to secondary processing (further processing like curing, smoking, and forming) and final packaging. These advanced systems are crucial for maintaining food safety, increasing operational efficiency, ensuring product consistency, and meeting stringent global hygiene standards. The equipment includes slicers, dicers, grinders, mixers, tenderizers, injectors, battering and breading machines, thermal processing units, and high-speed packaging lines. Major applications span industrial meat plants, poultry farms, seafood processing centers, and smaller commercial butcheries requiring automated or semi-automated operations. The primary benefits derived from these technologies include enhanced yields, reduced labor costs, minimization of cross-contamination risks, extended shelf life for products, and compliance with complex regulatory frameworks such as HACCP and FDA guidelines. The market is fundamentally driven by rising global demand for protein, shifting consumer preferences towards processed and ready-to-eat (RTE) meat products, and the persistent need for automation to manage soaring production volumes efficiently.

Meat and Poultry Processing Equipment Market Executive Summary

The global Meat and Poultry Processing Equipment Market is experiencing robust expansion, characterized by significant investment in automation, digitalization, and hygienic design across key geographical regions. Business trends indicate a strong move toward integrated systems and modular equipment that offer flexibility and scalability, allowing processors to quickly adapt to diverse product demands and regulatory changes. Manufacturers are heavily focusing on developing solutions that optimize resource utilization, particularly water and energy, addressing sustainability concerns pervasive in the food industry. Regionally, Asia Pacific is anticipated to exhibit the fastest growth, fueled by rapid urbanization, increasing per capita meat consumption, and substantial government investments aimed at modernizing aging food infrastructure and enhancing local production capabilities. Concurrently, North America and Europe remain mature markets, emphasizing retrofitting existing facilities with smart technologies, robotics, and advanced inspection systems to uphold strict quality control. Segment-wise, the further processing equipment category, including complex forming and thermal treatment machinery, is witnessing heightened demand due to the increasing popularity of value-added, convenience food items globally. Packaging equipment, especially vacuum and modified atmosphere packaging (MAP) solutions, also remains a critical segment driven by the necessity to extend product freshness and ensure traceability.

AI Impact Analysis on Meat and Poultry Processing Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the meat and poultry processing sector frequently revolve around how AI can enhance yield optimization, predictive maintenance capabilities, and improve real-time quality assurance processes. Common concerns include the cost of implementation, the availability of skilled labor to manage AI-driven systems, and the accuracy and robustness of deep learning models when dealing with natural variances in raw meat products. Users also seek information on AI's role in advanced sorting, grading, and portion control, specifically asking if AI-vision systems can surpass traditional human-based inspection methods in speed and precision, thereby minimizing waste and maximizing product consistency across large production batches.

AI integration is rapidly transforming the operational efficiency and quality control aspects of the meat and and poultry processing industry, moving the sector toward fully autonomous processing lines. AI-powered vision systems are deployed for real-time defect detection, foreign material identification, and sophisticated grading based on visual characteristics such as marbling, color, and texture, ensuring products meet premium quality standards without slowing down high-throughput production lines. Furthermore, machine learning algorithms are utilized in optimization software, analyzing data from upstream and downstream processes to dynamically adjust equipment settings, predict optimal cutting paths for maximizing yield from specific carcasses, and minimize throughput bottlenecks.

Beyond quality and yield, AI plays a pivotal role in enabling predictive maintenance (PdM) for expensive processing machinery. By analyzing sensor data related to vibration, temperature, and energy consumption, AI models can accurately forecast potential equipment failures, allowing maintenance teams to intervene proactively before critical breakdowns occur, significantly reducing unplanned downtime and associated costs. This proactive approach not only extends the lifecycle of complex equipment, such as deboning robots and high-speed slicers, but also contributes to maintaining the strict sanitation cycles required in food processing, ensuring operational compliance and continuous output. The adoption curve for sophisticated AI solutions, however, remains steeper in developed markets where labor costs are high and investment capital is more readily available for integrating advanced analytics platforms.

- Enhanced Yield Optimization: AI algorithms analyze carcass composition and adjust cutting equipment (e.g., robotic arms) in real-time to maximize high-value cuts.

- Predictive Maintenance: Machine learning models monitor equipment health data (vibration, temperature) to predict failure points, minimizing costly downtime.

- Automated Quality Control: AI vision systems perform instantaneous sorting and grading of products based on color, size, and defect detection, ensuring consistent quality.

- Supply Chain Traceability: AI tracks and records product movement through the entire processing chain, enhancing transparency and rapid recall management.

- Hygiene Monitoring: AI-enabled sensors monitor sanitation status and cleaning efficacy, ensuring adherence to stringent food safety protocols (HACCP).

DRO & Impact Forces Of Meat and Poultry Processing Equipment Market

The dynamics of the Meat and Poultry Processing Equipment Market are driven by several powerful forces, primarily centered on global protein demand, regulatory pressures, and the necessity for technological advancement to counteract rising operational costs. The primary driver is the exponentially increasing global demand for meat, particularly poultry and processed products, fueled by population growth, urbanization, and rising disposable incomes in emerging economies. This persistent demand necessitates higher throughput capacity, driving investments in faster, more efficient, and larger-scale processing equipment. Simultaneously, increasingly strict governmental regulations pertaining to food safety, sanitation, and worker welfare (especially ergonomic requirements) compel processors to upgrade to modern equipment that is easier to clean, minimizes human contact with raw product, and incorporates advanced safety features, thereby making compliance a continuous driver for equipment renewal.

However, the market growth faces substantial restraints, most notably the high initial capital investment required for state-of-the-art automated processing lines, which can be prohibitive for small and medium-sized enterprises (SMEs), particularly in developing regions. Another critical restraint is the complexity of integrating diverse equipment from multiple vendors into a seamless, high-speed production line, often requiring sophisticated software and specialized technical expertise, which presents challenges given the persistent shortage of skilled maintenance personnel trained in industrial automation and IoT technologies within the food sector. Furthermore, the volatility in raw material prices, such as stainless steel and specialized components, coupled with fluctuating energy costs, can negatively impact the manufacturing margins of equipment providers and delay investment decisions by end-users.

Opportunities within the sector are vast, particularly through the development of flexible processing equipment capable of handling multiple types of proteins or varying product specifications (e.g., customizable forming machines), catering to the growing market for hybrid and plant-based meat alternatives that utilize similar processing machinery. The shift towards sustainable and ethical food production offers significant scope for equipment manufacturers specializing in waste reduction systems, efficient water usage technologies, and equipment designed for sustainable sourcing practices. Impact forces such as technological innovation (IoT, robotics, AI), demographic shifts leading to increased demand for convenience foods, and global trade dynamics heavily influence procurement decisions. The immediate impact forces currently revolve around supply chain resilience, post-pandemic recovery strategies, and the urgent adoption of advanced hygiene standards to mitigate future biological risks throughout the processing environment.

Segmentation Analysis

The Meat and Poultry Processing Equipment Market is fundamentally segmented based on the type of equipment used, the specific meat processed, the operational capacity (automation level), and the application stage within the processing workflow. This segmentation provides a granular view of market dynamics, revealing that the demand structure varies significantly between primary processing sectors, such as slaughtering and deboning, and secondary processing sectors focused on creating high-value, ready-to-eat products. Equipment segmentation is critical as it reflects specialized needs, from precision cutting equipment utilizing scanning technology to complex thermal processing units requiring stringent temperature control and validation. The ongoing trend toward high-speed, fully integrated processing lines drives the growth of automatic operation segments, offering higher efficiency and reduced reliance on manual labor.

The application segmentation highlights where investment priority lies; for instance, further processing equipment, encompassing forming, coating, and frying lines, is growing fastest due to changing consumer lifestyles demanding convenience foods like nuggets, patties, and deli meats. Conversely, the primary processing segment requires robust, heavy-duty machinery built for high volume and durability. Geographical segmentation reveals contrasting growth drivers: mature markets prioritize efficiency upgrades and digital integration, while emerging markets focus on installing base capacity to meet escalating domestic consumption. Understanding these segments is paramount for equipment manufacturers to tailor their product offerings, whether focusing on sophisticated robotic deboning for large poultry processors or modular, hygienic stuffing and packaging solutions for medium-sized meat producers specializing in cured products.

Within the equipment spectrum, packaging machinery, including vacuum sealers, thermoforming equipment, and tray sealers, represents a continuously expanding area, vital for extending shelf life and ensuring product integrity during distribution. Furthermore, the demand for sophisticated inspection systems, which include X-ray, metal detection, and vision inspection equipment, often categorized under quality control equipment, is integrated across all processing stages to minimize contamination risks and ensure final product safety. These segments collectively illustrate a market moving away from standalone machines towards interconnected, data-driven processing ecosystems designed for optimal resource utilization and maximum food safety compliance.

- By Equipment Type:

- Cutting, Slicing, Dicing, and Grinding Equipment

- Blending and Mixing Equipment

- Tenderizing and Massaging Equipment

- Stuffing and Forming Equipment

- Coating, Battering, and Breading Equipment

- Thermal Processing Equipment (Ovens, Smokers, Cookers)

- Deboning and Skinning Equipment

- Packaging Equipment (Vacuum, MAP, Thermoforming)

- Inspection and Quality Control Systems (X-ray, Metal Detectors)

- By Meat Type:

- Pork Processing Equipment

- Poultry Processing Equipment

- Beef Processing Equipment

- Seafood Processing Equipment

- By Operation:

- Automatic

- Semi-Automatic

- Manual

- By Application:

- Slaughtering and Dressing

- Primary Processing

- Secondary Processing (Further Processing)

- Packaging and Logistics

Value Chain Analysis For Meat and Poultry Processing Equipment Market

The value chain for the Meat and Poultry Processing Equipment Market begins with upstream activities involving the sourcing of highly specialized raw materials, primarily high-grade, corrosion-resistant stainless steel, precision motors, advanced sensor components, and complex automation software modules. Suppliers of these core components, particularly those providing industrial robotics and specialized hygienic bearings, hold significant influence over equipment manufacturing costs and the final product's reliability and sanitation features. Equipment manufacturers then engage in design, assembly, and rigorous testing, focusing heavily on hygienic design (e.g., sloped surfaces, seamless welding, easy disassembly for cleaning) to meet international food safety standards (NSF, EHEDG). The ability to integrate software for data analytics and connectivity (IoT capabilities) is increasingly a defining characteristic of successful upstream operations.

Downstream activities center on distribution, installation, and comprehensive after-sales service, which often represents a substantial revenue stream for key players. Direct sales channels are common for large, customized, or complex integrated lines, where manufacturers work closely with major processors to design bespoke plant layouts and processing solutions. Conversely, indirect channels, utilizing specialized local distributors and authorized agents, are crucial for reaching smaller processors and managing replacement parts and standardized equipment sales across fragmented regional markets. Effective downstream logistics require certified technicians capable of complex installation and rapid response maintenance, especially since downtime in a meat processing plant results in significant financial losses, making service level agreements (SLAs) a critical competitive differentiator.

The distribution channel landscape is highly specialized, requiring partners with expertise in cold chain logistics management and an intricate understanding of regional food safety regulations. Direct channels allow for greater control over customer relationships and implementation quality, often utilized by market leaders like Marel and GEA for major projects. Indirect channels, relying on well-established regional distributors, help penetrate markets where a localized presence and cultural understanding are necessary for sales execution and service delivery. The success of equipment deployment is highly contingent on the quality of technical training provided to end-users, ensuring operators can maximize the efficiency and longevity of sophisticated machinery while maintaining strict sanitation protocols.

Meat and Poultry Processing Equipment Market Potential Customers

The primary end-users, or buyers, of meat and poultry processing equipment are large-scale industrial meat packers and processors who operate integrated facilities handling high volumes of raw material, spanning slaughter, deboning, cutting, and packaging operations. These organizations, often multinational corporations, represent the largest potential customers due to their continuous need for capacity expansion, equipment modernization, and integration of high-speed automation solutions, such as robotic deboning systems and automated portion control slicers. Their purchasing decisions are critically driven by factors such as equipment throughput, reliability, yield optimization capabilities, and compliance with the most stringent global food safety audits, necessitating continuous investment in the latest hygienic design standards and inspection technologies.

A second substantial customer segment includes specialized further processors—companies that focus exclusively on producing value-added products like ready-to-eat meals, cured meats, sausages, and prepared frozen poultry products. These customers drive demand specifically for secondary processing equipment, including injectors, tumblers, forming machines, coating lines (battering/breading), and complex thermal processing ovens. Their procurement emphasis is placed on versatility and efficiency in product formulation, requiring equipment that can quickly switch between different product recipes and maintain consistency under high-volume demand conditions, reflecting the fast-paced innovation in the convenience food sector.

Furthermore, smaller commercial butcheries, regional slaughterhouses, and specialized food service providers represent a significant market for semi-automatic and modular equipment solutions. While their individual purchasing power is lower, their collective need for reliable, easy-to-operate machinery designed for medium throughput constitutes a vital market segment, typically serviced through indirect distribution channels. Government and institutional bodies, such as military food supply centers or large national institutional caterers, also periodically act as customers when establishing or upgrading centralized food production facilities, primarily seeking equipment optimized for durability, long service life, and adherence to specific institutional dietary and safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marel, GEA Group, JBT Corporation, The Middleby Corporation, Alfa Laval, Tetra Laval, SPX FLOW, Heat and Control, Inc., Illinois Tool Works (ITW), Baader, Dover Corporation, Bettcher Industries, Reiser, Multivac, Weber Maschinenbau, Meyn Food Processing Technology, Provisur Technologies, SFK LEBLANC, Scanvaegt Systems, PSS Svidník. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Meat and Poultry Processing Equipment Market Key Technology Landscape

The technological landscape of the Meat and Poultry Processing Equipment Market is fundamentally shifting towards sophisticated digital integration, robotics, and advanced material science to achieve higher efficiency and unmatched hygienic standards. The central technological push involves the adoption of Industrial Internet of Things (IIoT) sensors and connectivity across all processing machinery. This integration allows for real-time monitoring of machine performance, temperature, flow rates, and sanitation parameters, feeding crucial operational data into centralized manufacturing execution systems (MES) and enterprise resource planning (ERP) platforms. This data-driven approach enables processors to move from reactive maintenance schedules to highly efficient, condition-based predictive maintenance, maximizing equipment uptime and reducing catastrophic failures.

Robotics and advanced automation are defining the next generation of meat and poultry processing lines, particularly in high-risk or high-precision tasks such as primary cutting, deboning, and intricate packaging. Robotic systems, often guided by high-resolution 3D vision systems and powered by AI, are replacing manual labor in tasks requiring high dexterity and repetitive precision, leading to superior yield consistency and a significant reduction in the risk of human-related contamination. Specialized technologies like high-pressure processing (HPP) equipment, while mainly post-packaging, are also seeing increased adoption, offering chemical-free pathogen reduction and shelf-life extension, which necessitates compatible, durable packaging machinery designed to withstand extreme pressure environments.

Furthermore, innovations in inspection and sorting technologies, such as advanced X-ray inspection systems with dual-energy capabilities and hyperspectral imaging, are becoming standard features across high-throughput lines. These systems are significantly better at detecting foreign materials (bone fragments, metal, plastic) and assessing product quality parameters compared to previous generations, reinforcing food safety measures across the supply chain. Alongside these functional advancements, the utilization of hygienic materials and Clean-in-Place (CIP) design principles, which facilitate automated, validated cleaning cycles with minimal human intervention, underscore the ongoing commitment of manufacturers to deliver equipment that not only processes efficiently but also adheres rigorously to the evolving demands of global sanitation regulations.

Regional Highlights

- Asia Pacific (APAC): APAC is forecasted to be the fastest-growing market, primarily due to rising disposable incomes, rapid urbanization, and subsequent shifts in dietary patterns favoring processed meat and poultry products. Countries like China and India are undertaking large-scale modernization of their domestic food production infrastructure to meet massive consumption needs and enhance export capabilities. The investment focus here is on installing new base capacity, automating processing lines to improve yield, and adopting international standards for food safety and traceability, making it a critical region for equipment manufacturers targeting greenfield projects and significant capacity expansion.

- North America: North America represents a mature but highly advanced market characterized by high labor costs and stringent regulatory oversight (USDA, FDA). The regional focus is heavily skewed towards integrating advanced automation (robotics, AI-vision systems) to reduce operational expenditures and maximize efficiency on existing high-throughput lines. Key demand drivers include replacing legacy equipment with smart, IIoT-enabled machinery for predictive maintenance, and sophisticated portion control equipment necessary for optimizing high-value cuts and catering to the prepared food segment.

- Europe: The European market is highly regulated, prioritizing equipment with superior hygienic design (EHEDG compliance), sustainability features, and traceability capabilities. While growth rates are steady, the market is driven by technological upgrades, particularly in thermal processing and advanced packaging (MAP, skin packaging) to meet complex consumer demands for organic and sustainably sourced products. Western European countries lead in adopting advanced deboning and slicing technologies, focusing on energy and water efficiency throughout the production cycle.

- Latin America (LATAM): LATAM is a significant market, particularly Brazil and Argentina, owing to their status as major global exporters of beef and poultry. Market growth is driven by the need to upgrade facilities to meet international export standards, resulting in demand for reliable primary processing and cold storage equipment. Investment decisions are highly sensitive to global commodity prices, but the long-term trend favors automation to enhance competitiveness and maintain quality assurance during international transport.

- Middle East and Africa (MEA): The MEA region is witnessing growth driven by increased population and government efforts to achieve food security and reduce reliance on imports. Investment is concentrated in establishing modern poultry and red meat processing facilities, often requiring turnkey solutions. Demand centers on basic processing equipment, packaging machinery to manage hot climates, and strict adherence to Halal standards, necessitating specialized equipment verification and certification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Meat and Poultry Processing Equipment Market.- Marel

- GEA Group

- JBT Corporation

- The Middleby Corporation

- Alfa Laval

- Tetra Laval

- SPX FLOW

- Heat and Control, Inc.

- Illinois Tool Works (ITW)

- Baader

- Dover Corporation

- Bettcher Industries

- Reiser

- Multivac

- Weber Maschinenbau

- Meyn Food Processing Technology

- Provisur Technologies

- SFK LEBLANC

- Scanvaegt Systems

- PSS Svidník

Frequently Asked Questions

Analyze common user questions about the Meat and Poultry Processing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for automated meat and poultry processing equipment?

The primary drivers are the necessity to mitigate rising labor costs, the need to increase production throughput to meet soaring global protein demand, and adherence to increasingly stringent food safety and hygiene regulations (like HACCP), which require minimized human contact and validated cleaning cycles achieved through automated systems.

How does the integration of IoT and AI benefit equipment maintenance in this industry?

IoT sensors and AI algorithms enable predictive maintenance (PdM) by analyzing equipment performance data in real-time (vibration, temperature). This allows processors to accurately forecast potential component failures, scheduling maintenance proactively, thereby drastically reducing unplanned downtime and optimizing the operational lifespan of high-capital machinery.

Which equipment segment is experiencing the fastest growth in the market?

The further processing equipment segment (including forming, coating, and thermal processing machinery) is witnessing the fastest growth, driven by shifting consumer preferences globally towards convenience, ready-to-eat (RTE), and value-added meat and poultry products, which require complex secondary processing steps.

What major challenges restrict market entry for smaller meat processors regarding new equipment adoption?

The main restriction is the exceptionally high initial capital investment required for automated and advanced processing lines. Furthermore, smaller processors often lack the specialized technical expertise and infrastructure necessary to integrate and maintain complex, digitally connected machinery, favoring modular or semi-automatic solutions instead.

What role does hygienic design play in modern meat processing equipment?

Hygienic design, emphasized by standards like EHEDG, is critical; it ensures equipment surfaces are easy to clean, minimize harborage points for bacteria, and withstand rigorous Clean-in-Place (CIP) procedures. This design priority is mandatory for mitigating cross-contamination risks and ensuring product safety in high-risk food environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager