Meat Poultry and Seafood Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434500 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Meat Poultry and Seafood Packaging Market Size

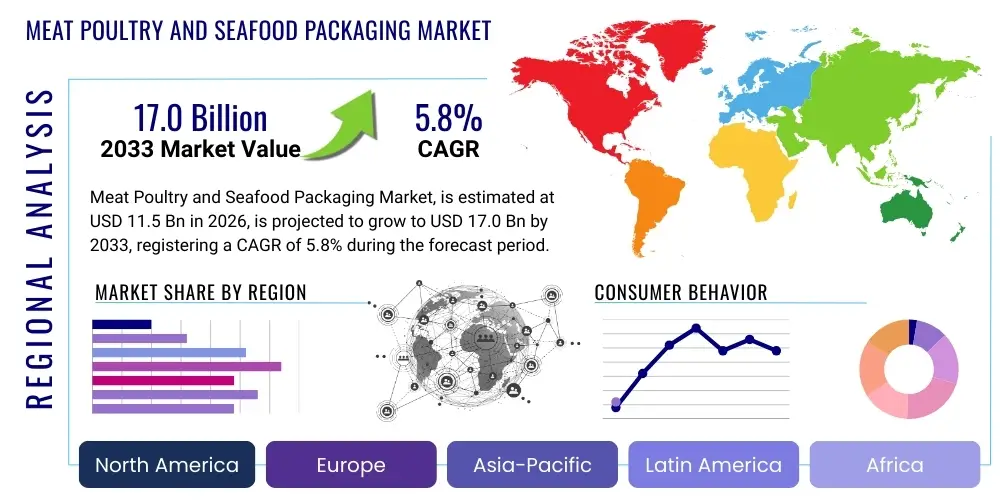

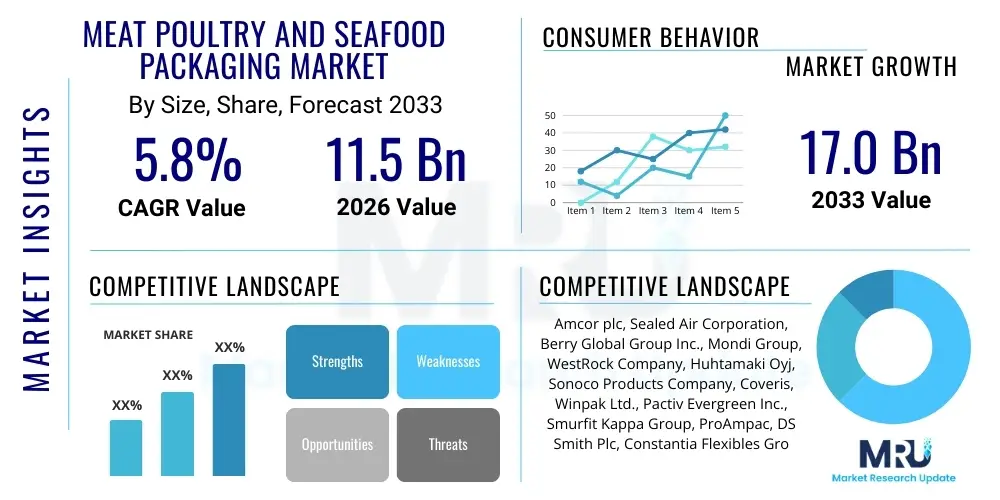

The Meat Poultry and Seafood Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $11.5 Billion in 2026 and is projected to reach $17.0 Billion by the end of the forecast period in 2033.

Meat Poultry and Seafood Packaging Market introduction

The Meat, Poultry, and Seafood (MPS) Packaging Market encompasses specialized packaging solutions designed to preserve the freshness, extend the shelf life, maintain the nutritional integrity, and ensure the safety of perishable protein products throughout the supply chain. These packaging formats are critical components in minimizing food waste and meeting stringent global regulatory standards concerning food safety and hygiene. Products range from vacuum skin packaging (VSP), modified atmosphere packaging (MAP), and flexible films to rigid trays, pouches, and sustainable materials, each tailored to the specific respiration rates and preservation requirements of different protein types, whether raw, processed, or ready-to-eat. The primary objective is to create an optimal barrier against oxygen, moisture, and microbial contamination, thereby sustaining product quality from processing plant to consumer.

Major applications of MPS packaging span across retail settings, food service operations, and institutional distribution. In the retail sector, aesthetic appeal and consumer convenience are paramount, driving the demand for attractive, easy-to-open, and portion-controlled packaging. For food service, large-format, robust, and often resealable packaging is preferred to maintain bulk product quality. The intrinsic benefits of advanced MPS packaging include significant reduction in spoilage, enhanced product visibility, and improved traceability through integrated labeling technologies. Furthermore, the evolution of packaging materials towards biodegradability and recyclability is reshaping the industry landscape, driven by escalating consumer demand for environmental responsibility and governmental mandates across developed economies seeking circular economy solutions.

Driving factors propelling market expansion include the burgeoning global population, resulting in increased demand for packaged and convenient protein sources, especially in rapidly urbanizing regions. Shifting consumer lifestyles necessitate grab-and-go and ready-to-cook meals, favoring packaging technologies that simplify preparation and handling. Moreover, advancements in barrier technology, such as active and intelligent packaging systems incorporating scavengers and indicators, are significantly contributing to shelf-life extension and safety assurance. The rigorous implementation of cold chain logistics, supported by reliable packaging that can withstand temperature fluctuations and physical handling, further reinforces market growth by enabling wider distribution channels for highly sensitive products like seafood and fresh poultry, ensuring that international trade of these commodities continues to thrive despite geographical challenges and complex logistical networks.

Meat Poultry and Seafood Packaging Market Executive Summary

The global Meat Poultry and Seafood Packaging Market is experiencing robust growth, primarily fueled by fundamental shifts in consumer purchasing behavior towards greater convenience, coupled with stringent food safety regulations mandating higher barrier protection. Key business trends highlight a decisive move toward sustainable and eco-friendly packaging alternatives, including bio-based plastics and compostable films, as major industry players commit to minimizing their environmental footprint. Consolidation and strategic partnerships among packaging manufacturers and material science firms are common, aiming to accelerate the commercialization of novel active and intelligent packaging solutions, thus creating a highly competitive landscape focused on innovation, cost efficiency, and supply chain resilience, particularly in response to volatile raw material pricing and increasing energy costs inherent in production processes.

Regional trends indicate that Asia Pacific (APAC) is poised to exhibit the highest growth rate, driven by significant urbanization, rising disposable incomes leading to increased protein consumption, and the rapid expansion of organized retail chains in countries like China and India. North America and Europe, characterized by mature markets, are focusing heavily on packaging optimization, waste reduction, and the adoption of advanced Modified Atmosphere Packaging (MAP) and Vacuum Skin Packaging (VSP) systems to meet high consumer expectations for product freshness and transparency. Regulatory pressures in Europe, specifically pertaining to plastic waste and recycling targets, are compelling rapid innovation in material substitution and redesigning packaging for mono-material recyclability, setting precedents that emerging markets are increasingly starting to follow in their own policy development regarding environmental protection and resource management.

Segment trends underscore the dominance of flexible packaging materials due to their cost-effectiveness, versatility, and superior barrier properties necessary for perishable goods, though the growth of semi-rigid and rigid formats is maintained by the demand for aesthetically pleasing and protective packaging, particularly for premium cuts of meat and delicate seafood. By technology, MAP remains the most prevalent method for extending shelf life, but VSP is gaining traction for its ability to enhance product presentation and significantly reduce purge. The ready-to-eat and processed meat segments are particularly driving innovation in lidding films and microwavable tray technology, catering directly to the busy, time-constrained consumer seeking efficient meal solutions that do not compromise on safety or quality, thereby continuously pushing the boundaries of material science integration.

AI Impact Analysis on Meat Poultry and Seafood Packaging Market

Common user questions regarding AI's impact on the MPS packaging market revolve around optimizing supply chain efficiency, predicting demand fluctuations, enhancing food safety monitoring, and enabling smart factories. Users are particularly keen on understanding how AI can integrate with existing packaging lines to reduce material waste, improve quality control processes through computer vision systems, and personalize packaging designs based on predictive consumer analytics. Key concerns include the initial capital investment required for AI implementation, data privacy issues associated with collecting extensive operational data, and the need for a skilled workforce capable of managing and maintaining sophisticated AI-driven systems. The core expectation is that AI will transform packaging from a static protective shell into a dynamic, intelligent component of the food safety and distribution ecosystem, leading to measurable improvements in operational sustainability and overall product integrity throughout the distribution network, particularly concerning rapid identification of defective seals or inadequate temperature control.

- AI-powered predictive maintenance optimizes packaging line uptime, reducing unplanned material wastage.

- Computer vision systems enhance quality control, instantaneously detecting sealing defects or mislabeling with high precision.

- Machine learning algorithms forecast perishable product demand, minimizing over-packaging and inventory surplus.

- AI-driven robotics improves high-speed, contamination-free handling and packing of raw protein products.

- Intelligent packaging, utilizing sensors monitored by AI, provides real-time freshness and temperature tracking across the cold chain.

- Optimizing material usage and cutting patterns through AI modeling leads to significant cost savings and sustainability benefits.

- Data analytics generated by AI inform personalized and targeted packaging strategies for specific demographics or regional preferences.

DRO & Impact Forces Of Meat Poultry and Seafood Packaging Market

The market dynamics are defined by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include rising global consumption of packaged protein, the imperative for extended shelf life to facilitate long-distance distribution and export, and strict regulatory enforcement concerning foodborne illness prevention, demanding high-integrity packaging barriers. Opportunities primarily center on the burgeoning demand for sustainable, biodegradable, and recyclable packaging materials, along with the integration of smart technologies (IoT, RFID) to enhance traceability and consumer engagement, offering avenues for premiumization and technological differentiation among competitive product offerings. These forces collectively shape the competitive strategy, pushing manufacturers towards continuous process optimization and material innovation to capture market share effectively.

Restraints significantly affecting market growth include the volatile pricing of petrochemical-derived raw materials, particularly plastics, which directly impacts production costs and profitability margins across the entire supply chain, making accurate cost forecasting challenging. Moreover, the increasing public pressure and subsequent legislative restrictions on single-use plastics in several key geographical markets, such as the European Union, necessitate extensive, capital-intensive redesigns of established packaging formats, requiring significant investment in research and development for viable alternatives. Regulatory harmonization challenges across different nations regarding permissible food contact materials and recycling infrastructure also complicate international market expansion for standardized packaging solutions, forcing localized production or material sourcing strategies.

The primary impact force driving market innovation is the convergence of sustainability demands and functional preservation requirements. Packaging must not only be environmentally benign (recyclable, compostable, or bio-based) but must also deliver superior barrier performance to maintain the integrity of highly perishable products like fresh fish and delicate poultry. This simultaneous demand for eco-friendliness and high performance is pushing rapid advancements in co-extruded films and specialized coatings that minimize material usage while maximizing preservation efficacy. Secondary impact forces include consumer preference for transparency and convenience, leading to the rise of clear packaging and resealable features, ensuring that packaging remains a crucial differentiator at the point of sale in increasingly crowded retail environments.

Segmentation Analysis

The Meat Poultry and Seafood Packaging Market is analyzed based on Material, Application, Packaging Type, and Technology, providing a granular view of market dynamics and growth potential across various product categories. Materials primarily include plastic (polyethylene, polypropylene, PVC), paperboard, metal, and glass, with plastics holding a dominant share due to their versatility and cost-effectiveness, although sustainable materials are the fastest-growing subsegment. Packaging types range from flexible options like bags and pouches, which offer low material usage, to rigid trays and containers favored for premium products needing structural protection. Analyzing these segments helps stakeholders understand shifting consumer preferences and regulatory impacts across the value chain, focusing investments on high-growth areas such as Vacuum Skin Packaging (VSP) for enhanced meat display and the use of Modified Atmosphere Packaging (MAP) for extended shelf-life requirements.

- By Material:

- Plastics (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET))

- Paperboard/Fiberboard

- Metal (Aluminum, Steel)

- Glass

- Bio-based and Sustainable Materials

- By Application:

- Meat (Red Meat, Processed Meat)

- Poultry

- Seafood (Fish, Shellfish)

- By Packaging Type:

- Flexible Packaging (Films, Bags, Pouches)

- Semi-Rigid Packaging (Trays, Containers)

- Rigid Packaging (Cans, Boxes)

- By Technology:

- Modified Atmosphere Packaging (MAP)

- Vacuum Packaging (VP)

- Vacuum Skin Packaging (VSP)

- Active and Intelligent Packaging

- Barrier Packaging

Value Chain Analysis For Meat Poultry and Seafood Packaging Market

The value chain for MPS packaging begins with upstream activities, involving raw material suppliers primarily providing polymers (resins), pulp and paper, and aluminum/steel. This stage is crucial as the quality and volatility of raw material pricing directly impact the profitability of packaging converters. Material science innovation occurs heavily at this stage, focusing on developing high-barrier, multi-layer films and sustainable alternatives like bio-plastics or recycled content polymers (PCR), driven by stringent regulatory compliance and the demand for enhanced product protection. Efficient sourcing and stable contracts with petrochemical and material suppliers are fundamental to mitigate supply chain risk and ensure consistent production quality, particularly for specialized food-grade materials that require specific certifications.

Midstream activities encompass the conversion process, where raw materials are transformed into finished packaging products such as trays, films, and pouches using processes like extrusion, thermoforming, printing, and sealing. Packaging manufacturers invest heavily in advanced machinery (e.g., high-speed MAP sealers, VSP machines) to optimize production efficiency and ensure precise barrier layer integration. Downstream analysis focuses on the distribution channels, which are typically divided into direct and indirect routes. Direct sales often involve large, integrated meat and poultry processors who purchase customized packaging solutions directly from manufacturers. Indirect distribution utilizes specialized packaging distributors who cater to smaller processors, regional butchers, and independent seafood operators, providing localized inventory and technical support for equipment installation and material compatibility.

The final consumption stage involves the meat, poultry, and seafood processing plants, followed by distribution to retail, foodservice, and institutional sectors. Packaging performance throughout the cold chain is paramount, making reliable logistics and inventory management critical. The shift towards e-commerce and direct-to-consumer models is increasingly influencing packaging design, favoring robust, temperature-stable, and aesthetically appealing secondary packaging that ensures product integrity upon arrival. Successful value chain management relies on strong collaboration between packaging suppliers, equipment manufacturers, and food processors to rapidly implement technological advancements and meet evolving consumer safety and sustainability expectations, ensuring maximum operational efficiency from polymer pellet to packaged product.

Meat Poultry and Seafood Packaging Market Potential Customers

The primary end-users and buyers of MPS packaging are highly diverse, spanning the entire food production and distribution ecosystem. Large multinational food processing corporations, such as Tyson Foods, JBS, and major seafood distributors, represent the core customer base, demanding high volumes of standardized, cost-effective packaging, often negotiating long-term, custom supply agreements for complex solutions like high-speed MAP rollstock and large-format vacuum bags. These major processors prioritize packaging reliability, integration with automated packing lines, and compliance with global export standards, requiring suppliers capable of large-scale, consistent material delivery and technical support across multiple international facilities.

A significant segment of potential customers includes regional and local meat and seafood processors, independent butchers, and artisanal food producers. These smaller entities often rely on packaging distributors for lower volume orders, seeking flexible and convenient solutions like pre-formed trays and stand-up pouches that allow for localized branding and flexibility in product batch sizes. Their purchasing decisions are often influenced by ease of use, minimum order quantities, and immediate availability, with a growing emphasis on sustainable packaging options that appeal to local consumer preferences for environmentally responsible sourcing and packaging integrity. The food service sector, encompassing restaurants, hotels, and institutional caterers, also represents a critical customer segment, typically demanding durable, large-capacity packaging designed for back-of-house storage and high-volume preparation.

The evolving retail landscape, specifically the rapid growth of e-commerce platforms and meal kit delivery services, is creating a distinct customer profile requiring specialized packaging. These companies need solutions that are robust enough to withstand complex logistics and multiple handling points, maintain optimal temperature control during transit, and offer superior aesthetic presentation for the final customer delivery. This customer group drives demand for insulated packaging, robust secondary packaging, and integrated traceability features (e.g., QR codes) that link the consumer directly to provenance information and expiration data, thereby elevating the technological requirements placed upon packaging material suppliers to ensure product quality consistency throughout the last-mile delivery network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $11.5 Billion |

| Market Forecast in 2033 | $17.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Sealed Air Corporation, Berry Global Group Inc., Mondi Group, WestRock Company, Huhtamaki Oyj, Sonoco Products Company, Coveris, Winpak Ltd., Pactiv Evergreen Inc., Smurfit Kappa Group, ProAmpac, DS Smith Plc, Constantia Flexibles Group GmbH, Flair Flexible Packaging, Praxair Technology Inc., DuPont de Nemours Inc., Schur Flexibles Group, Klöckner Pentaplast, Silgan Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Meat Poultry and Seafood Packaging Market Key Technology Landscape

The technological landscape in the Meat Poultry and Seafood Packaging Market is defined by continuous innovation focused on optimizing preservation, minimizing environmental impact, and enhancing consumer safety and convenience. Modified Atmosphere Packaging (MAP) remains a cornerstone technology, utilizing precise gas mixtures (typically nitrogen, carbon dioxide, and oxygen) to slow down oxidation and microbial growth, thereby significantly extending the chilled shelf life of fresh products. Advancements in MAP focus on developing high-barrier films with improved gas retention properties and specialized equipment that ensures accurate and consistent gas flushing during the sealing process. Furthermore, the adoption of proprietary film structures allows for tailored permeability rates that optimize the internal package environment specific to the metabolic requirements of various protein types, from dark red meats to white poultry and sensitive fish fillets, ensuring color stability and texture preservation.

Vacuum Skin Packaging (VSP) has emerged as a high-growth technology, particularly for premium cuts of meat and seafood, driven by its ability to tightly seal the product without creating air pockets, resulting in a visually appealing, "second skin" effect that enhances product presentation and minimizes purge (liquid leakage). VSP technology relies on advanced thermoforming and sealing equipment coupled with highly elastic and puncture-resistant films. Another area of significant technological investment is Active Packaging, which involves incorporating specialized components into the packaging structure to actively maintain or improve product quality. Examples include oxygen scavengers embedded in the film to absorb residual oxygen, moisture absorbers to prevent condensation, and antimicrobial agents designed to inhibit pathogen growth directly on the product surface, providing an extra layer of protection against spoilage that traditional barrier packaging cannot fully achieve.

Intelligent Packaging represents the future trajectory, utilizing indicators and sensors to provide real-time information about product freshness and handling history. Time-Temperature Indicators (TTIs) change color based on cumulative temperature abuse, offering clear visual signals to supply chain handlers and consumers regarding potential spoilage. Moreover, the integration of Near-Field Communication (NFC) and Radio-Frequency Identification (RFID) tags is enhancing supply chain traceability, allowing processors and retailers to monitor the product's journey from origin to store shelf digitally. The overarching trend across all these technologies is material simplification—developing multi-functional, mono-material structures that retain the necessary barrier performance while drastically improving end-of-life recyclability, aligning functional requirements with global circular economy goals and reducing reliance on complex, non-recyclable multi-layer laminates.

Regional Highlights

- North America: This region is characterized by high consumption of packaged protein and a mature market focusing on advanced packaging technologies like VSP and MAP. The U.S. and Canada prioritize convenience, driving demand for ready-to-cook and sustainable, rigid tray solutions. Regulatory emphasis on food traceability and safety stimulates the adoption of intelligent packaging systems.

- Europe: Driven by strict environmental regulations, particularly the EU’s Plastics Strategy, Europe leads the shift toward recyclable and compostable packaging materials. The focus is intensely on reducing plastic weight and increasing recycled content (PCR), particularly in countries like Germany and the UK. MAP technology is highly utilized for processed meats, while VSP is expanding in the premium seafood segment.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rising middle-class disposable income, rapid urbanization, and the modernization of retail infrastructure. Countries like China, India, and Japan exhibit huge demand for extended shelf-life solutions to manage complex internal distribution networks. Flexible packaging dominates due to cost-efficiency, but advanced barrier films are quickly being adopted to meet increasing food safety standards.

- Latin America (LATAM): Growth in LATAM, particularly in Brazil and Mexico, is robust, driven by increasing meat and poultry production and export activities. The market primarily utilizes cost-effective flexible and vacuum packaging solutions. Sustainability concerns are emerging but are secondary to cost and functional preservation requirements in many local markets.

- Middle East and Africa (MEA): This region shows steady growth, boosted by high food imports and the need for reliable, long shelf-life packaging to combat climatic challenges and logistical complexities. Investment in robust barrier packaging and cold chain infrastructure is crucial, with flexible and semi-rigid plastics being the prevalent material choices for meat and poultry products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Meat Poultry and Seafood Packaging Market.- Amcor plc

- Sealed Air Corporation

- Berry Global Group Inc.

- Mondi Group

- WestRock Company

- Huhtamaki Oyj

- Sonoco Products Company

- Coveris

- Winpak Ltd.

- Pactiv Evergreen Inc.

- Smurfit Kappa Group

- ProAmpac

- DS Smith Plc

- Constantia Flexibles Group GmbH

- Flair Flexible Packaging

- Praxair Technology Inc.

- DuPont de Nemours Inc.

- Schur Flexibles Group

- Klöckner Pentaplast

- Silgan Holdings Inc.

Frequently Asked Questions

Analyze common user questions about the Meat Poultry and Seafood Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are shaping the future of Meat Poultry and Seafood packaging?

The future of MPS packaging is dominated by sustainability initiatives, specifically the shift toward mono-material structures, high-recycled content (PCR), and compostable films. Additionally, the increasing integration of active and intelligent packaging technologies, such as oxygen scavengers and time-temperature indicators, is crucial for enhanced food safety and extended shelf life across global supply chains.

How does Modified Atmosphere Packaging (MAP) technology extend the shelf life of perishable proteins?

MAP extends shelf life by replacing the ambient air within the package with a carefully controlled mixture of gases (typically CO2, N2, and sometimes O2). This gas balance inhibits the growth of spoilage microorganisms and slows down enzymatic degradation and oxidation, preserving the product's color, flavor, and texture for significantly longer than conventional packaging methods.

What are the primary material challenges facing the packaging industry today?

The primary material challenges include mitigating the volatility of virgin plastic resin prices and meeting aggressive regulatory and consumer demands for packaging recyclability. Developing high-barrier, multi-layer films that maintain product integrity yet are easily separable or composed of a single polymer type for efficient recycling poses a complex technical hurdle for material scientists and converters.

Which geographical region is expected to demonstrate the highest growth in MPS packaging?

The Asia Pacific (APAC) region is projected to register the highest growth rate. This accelerated expansion is driven by rapidly expanding organized retail sectors, increasing household income enabling higher packaged protein consumption, and essential infrastructural development necessary to support effective cold chain logistics and food distribution networks across highly populated urban centers.

How do Vacuum Skin Packaging (VSP) solutions benefit the marketing of meat and seafood?

VSP provides a taut, clear, 'second skin' around the product, offering a premium, three-dimensional presentation that maximizes shelf appeal and product visibility, while simultaneously eliminating air pockets and minimizing fluid purge. This superior presentation, coupled with outstanding barrier protection, significantly enhances brand perception and reduces spoilage, making it ideal for high-value cuts.

This extensive market insights report delves deeply into the complexities and driving forces within the Meat Poultry and Seafood Packaging Market, offering a comprehensive analysis of technological advancements, regional dynamics, and sustainability pressures that define the current landscape. The market, poised for significant expansion, is underpinned by the urgent global necessity for food safety and the efficient distribution of perishable protein products. Key areas of focus, including the shift towards bio-based materials and the integration of artificial intelligence for operational efficiency and quality control, illustrate the rapid transformation occurring across the entire value chain. The detailed segmentation analysis provides granularity on material choices, applications, and preservation technologies such as Modified Atmosphere Packaging (MAP) and Vacuum Skin Packaging (VSP), which are critical for maximizing product shelf life and maintaining consumer trust. Furthermore, the evaluation of key market restraints, such as raw material price volatility and rigorous environmental regulations, provides strategic context for stakeholders navigating this highly competitive environment. The geographical highlights pinpoint where the most intensive growth and regulatory innovation are taking place, guiding investment decisions toward high-potential markets like Asia Pacific. The structured format ensures optimal readability and search engine indexing, providing immediate, actionable insights for market analysts, industry leaders, and potential investors seeking definitive data on the future trajectory of protein packaging solutions worldwide, encompassing advanced barrier films, thermoformed trays, and the transition to circular economy packaging models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager