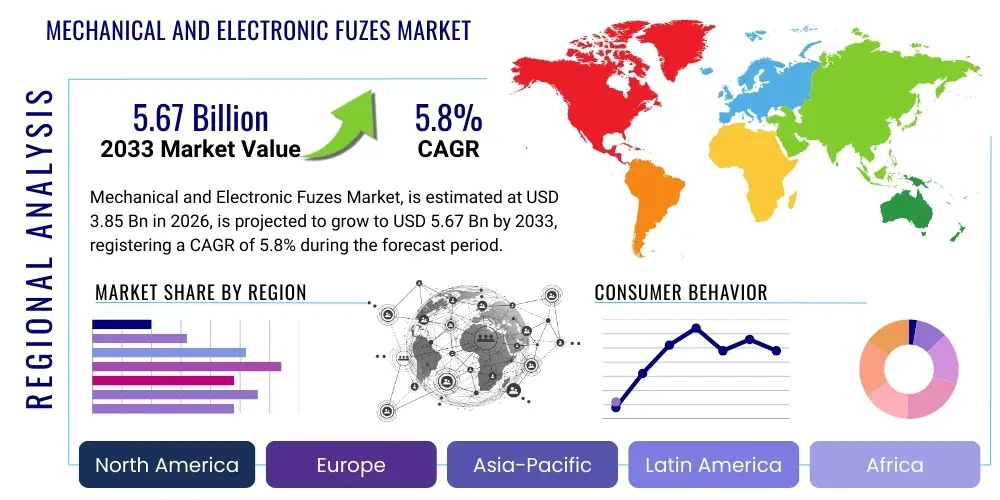

Mechanical and Electronic Fuzes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438363 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Mechanical and Electronic Fuzes Market Size

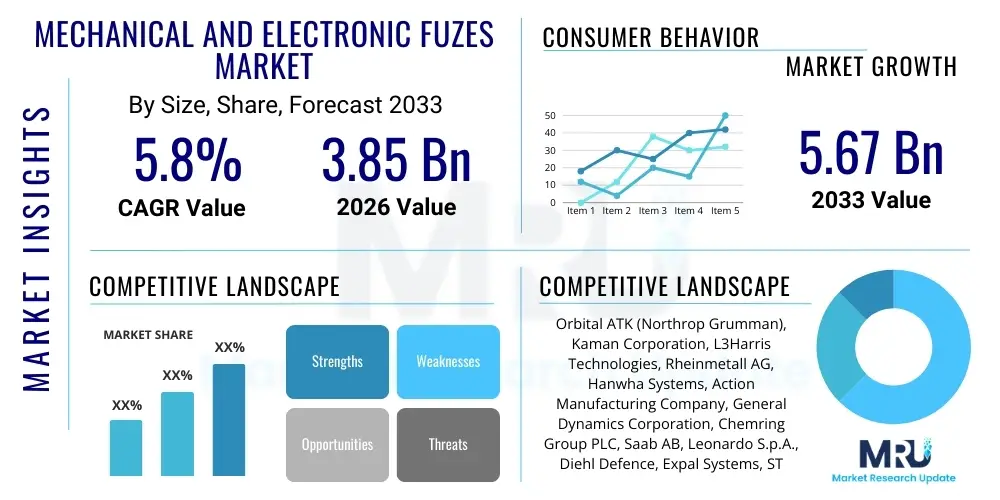

The Mechanical and Electronic Fuzes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 5.67 Billion by the end of the forecast period in 2033.

Mechanical and Electronic Fuzes Market introduction

The Mechanical and Electronic Fuzes Market encompasses devices critical for the safe and reliable function of ordnance, including artillery shells, mortar rounds, missiles, and specialized munitions. These components initiate the detonation sequence at a specific time, proximity, or impact point, adhering strictly to global safety protocols. Mechanical fuzes utilize clockwork or pyrotechnic delays, known for their robustness and reliability in diverse environments, while modern electronic fuzes incorporate sophisticated digital logic, highly accurate timing circuits, and advanced Safety & Arming (S&A) mechanisms, providing superior precision and programmability required for smart munitions.

Major applications of these fuzes are predominantly centered within the defense sector, driven by global military modernization programs and the need to replace aging stockpiles with highly accurate, low-collateral-damage munitions. Electronic fuzes, in particular, enable features such as setting precise burst height, terminal trajectory adjustments, and multiple detonation modes (e.g., impact, delayed impact, airburst), significantly enhancing the effectiveness of artillery and missile systems. The shift towards network-centric warfare and guided weapon systems is accelerating the demand for programmable and digitally integrated electronic fuzes.

Key driving factors include increasing geopolitical instability necessitating robust defense readiness, coupled with continuous technological advancements aimed at miniaturization, enhanced reliability, and greater resistance to electromagnetic interference (EMI). The core benefit provided by these products is ensuring that munitions remain safe during storage, handling, and transport, arming only milliseconds before intended use, thus minimizing the risk of accidental detonation and maximizing operational safety for military personnel.

Mechanical and Electronic Fuzes Market Executive Summary

The Mechanical and Electronic Fuzes Market is characterized by intense technological innovation, driven by shifting geopolitical landscapes and elevated global defense spending, particularly in the Asia Pacific and Middle East regions. Key business trends include the consolidation of major defense contractors and specialized fuzing manufacturers focusing on developing modular, multi-option fuzes compatible with a wide array of existing and next-generation munitions platforms. There is a notable industry shift from purely mechanical designs toward high-precision electronic fuzes, which offer superior performance characteristics, including programmability and integration with fire control systems, despite their higher manufacturing complexity and cost. Safety regulations remain paramount, mandating substantial investment in robust Safety & Arming (S&A) devices.

Regionally, North America and Europe maintain dominance due to established, high-tech defense industries and continuous research and development in sophisticated ordnance. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by significant military modernization efforts in countries like China, India, and South Korea, aimed at countering regional threats and achieving technological parity with Western powers. The Middle East also represents a critical high-demand market, driven by persistent internal conflicts and the need for advanced guided weapon systems requiring state-of-the-art electronic fuzing technology. These regional dynamics dictate specific product demands, with advanced nations prioritizing programmable electronic fuzes while emerging markets maintain a substantial requirement for cost-effective mechanical and basic time fuzes.

Segment trends confirm the rapid adoption of programmable electronic fuzing systems, which are displacing traditional purely mechanical systems across all major ordnance types, including artillery and mortar ammunition. Within the technology segment, Micro-Electro-Mechanical Systems (MEMS) fuzes are emerging as a transformative technology, offering unparalleled miniaturization, reduced power consumption, and enhanced shock resistance, opening new possibilities for small-diameter munitions. Application growth remains robust across missile and rocket systems, where the reliability and precision offered by electronic and proximity fuzes are indispensable for ensuring high probability of kill (Pk) against maneuvering targets.

AI Impact Analysis on Mechanical and Electronic Fuzes Market

User inquiries regarding AI's impact on the fuzes market commonly revolve around questions concerning autonomous targeting integration, enhanced safety diagnostics, and the potential for AI-driven manufacturing optimization. Users are particularly interested in how Artificial Intelligence can improve the decision-making capabilities of smart fuzes, enabling them to select optimal detonation parameters (e.g., timing, burst height, fragmentation pattern) in real-time based on target identification and environmental data transmitted from the munition’s sensors or external command link. Concerns also focus on the reliability and cyber resilience of AI-integrated components, given the critical safety role of fuzes. The consensus is that AI will initially be utilized for sophisticated data processing and predictive maintenance in manufacturing, followed by integration into highly advanced, network-enabled fuzes to elevate lethality and reliability.

- AI algorithms enable real-time selection of optimal fuzing modes (impact, proximity, airburst) based on sensor data and target type identification.

- Predictive maintenance analytics, powered by AI, optimize the production and storage lifecycle of fuzes, minimizing defects and improving shelf life reliability.

- AI enhances the cyber security of electronic fuzing software, protecting programmable components from adversarial electronic warfare and hacking attempts.

- Machine learning models are utilized in R&D to simulate extreme shock environments and optimize mechanical design for increased robustness and miniaturization.

- Automated quality control systems employing computer vision and AI significantly speed up inspection processes during high-volume manufacturing of sensitive electronic components.

DRO & Impact Forces Of Mechanical and Electronic Fuzes Market

The market is fundamentally driven by the relentless global push toward military modernization and the replacement of older conventional ordnance with smart, precision-guided munitions. This shift necessitates high-reliability electronic fuzes capable of integrating seamlessly with command and control systems (C2) and offering superior performance over traditional systems. Geopolitical tensions and active conflict zones sustain a high demand for advanced defense capabilities, compelling governments worldwide to maintain and upgrade their strategic weapon stockpiles, directly translating into increased procurement contracts for fuzing technology. Furthermore, advancements in Micro-Electro-Mechanical Systems (MEMS) technology are creating opportunities for developing highly compact, shock-resistant electronic fuzes at potentially lower costs in the long term, serving as a significant market accelerant.

However, the sector faces significant restraints, primarily stemming from the extremely stringent regulatory frameworks governing the design, testing, and certification of fuzes. The necessity for zero-failure safety standards (specifically concerning the Safety & Arming device) results in protracted, high-cost research and development cycles and necessitates long lead times for market entry, posing barriers for smaller innovators. Another major constraint is the complexity and sensitivity of the supply chain for critical electronic components used in advanced fuzes, many of which are specialized military-grade items subject to export controls and geopolitical volatility, potentially disrupting production schedules and increasing manufacturing costs.

Significant market opportunities reside in the development of multi-option and modular fuzes that can be rapidly adapted for use across different munition calibers and roles, simplifying logistics and reducing inventory complexity for armed forces. The increasing global focus on Counter-Unmanned Aerial Systems (C-UAS) and missile defense presents a niche for highly responsive proximity fuzes designed to engage small, fast-moving targets. The primary impact forces influencing this market are technology obsolescence, which necessitates continuous investment in digital and sensor technology upgrades, and the enduring pressure from regulatory bodies to achieve ever-higher levels of safety and reliability, ensuring that innovation always prioritizes fail-safe operation before enhanced lethality.

Segmentation Analysis

The Mechanical and Electronic Fuzes Market is intricately segmented based on technology type, application, and geographical region, reflecting the diverse requirements of modern military ordnance. The segmentation by Type is critical, differentiating between legacy mechanical fuzes, which prioritize reliability and cost-effectiveness, and sophisticated electronic fuzes, which offer programmability, accuracy, and multiple functioning modes. Application segmentation highlights the primary end-uses, ranging from high-volume artillery shells to highly specialized and expensive missile guidance systems, each requiring tailored fuzing solutions to meet specific kinetic and functional requirements. Understanding these segments is vital for manufacturers to align R&D investment with current and projected military modernization priorities worldwide.

The electronic fuzes segment is anticipated to witness the fastest growth due to the global trend toward precision warfare and the decommissioning of older, less accurate ammunition. Within applications, the missile and rocket segment demands the most advanced proximity and radar-enabled fuzes, incorporating complex algorithms for target engagement. Geographically, while North America and Europe dominate in terms of market value due to advanced defense procurement budgets, the Asia Pacific region is expected to generate the highest incremental growth opportunities due to massive ongoing military expansion and indigenous defense capability development programs. The interplay between these segments defines the competitive landscape, pushing manufacturers toward developing dual-mode or multi-sensor fuzes that maximize adaptability and operational efficiency for end-users.

- By Type:

- Mechanical Fuzes (Point Detonating, Base Detonating)

- Electronic Fuzes (Programmable, Non-Programmable)

- Proximity Fuzes (Radar, Laser)

- Time Fuzes (Mechanical Time, Electronic Time)

- Impact Fuzes (Super-Quick, Delayed)

- By Application:

- Artillery Shells (105mm, 155mm, etc.)

- Mortar Ammunition (60mm, 81mm, 120mm)

- Missiles and Rockets (Tactical Missiles, Anti-Tank Missiles)

- Bombs (Air-Delivered Bombs, Gravity Bombs)

- Specialized Ordnance (Naval Munitions, Practice Rounds)

- By Technology:

- Micro-Electro-Mechanical Systems (MEMS) Fuzes

- Digital Signal Processing (DSP)

- Safety & Arming (S&A) Mechanisms

- Batteries and Power Sources (Thermal, Capacitor-Based)

- By Region:

- North America (U.S., Canada)

- Europe (UK, France, Germany, Russia)

- Asia Pacific (China, India, South Korea, Japan)

- Latin America (Brazil, Mexico)

- Middle East and Africa (Israel, UAE, Saudi Arabia)

Value Chain Analysis For Mechanical and Electronic Fuzes Market

The value chain for the Mechanical and Electronic Fuzes Market is highly specialized and tightly controlled, beginning with the upstream procurement of raw materials and sophisticated electronic components. Upstream activities involve acquiring high-grade specialty metals (for casings and mechanical components), microprocessors, sensors (for proximity fuzes), and specialized batteries (often thermal or capacitor-based) designed to withstand high G-forces and extreme temperatures. Due to the high-reliability and military-grade nature required, component suppliers often operate under strict defense contracts and security clearances, making this stage crucial for overall product performance and quality assurance.

Midstream activities encompass the highly precise manufacturing, assembly, and rigorous testing of the fuzes. Manufacturing involves complex processes like micro-machining for mechanical parts and highly controlled clean-room assembly for electronic circuits and MEMS components. The integration of the Safety & Arming (S&A) mechanism is the most critical step, requiring specialized facilities and stringent quality control protocols to ensure zero-risk of premature arming. Downstream activities involve distribution, which is predominantly direct, managed through government-to-government contracts or long-term agreements between prime defense contractors and national defense ministries. Indirect distribution channels are minimal, largely restricted to the servicing of legacy systems or components through authorized defense technology suppliers.

The distribution channel is characterized by exclusivity and government oversight. Direct sales are the dominant model, where manufacturers deliver certified fuzes directly to national ordnance depots or to major prime contractors (like Lockheed Martin or Raytheon) for integration into larger weapon systems. The regulatory burden throughout the value chain is substantial, with strict adherence required to national and international munitions regulations (e.g., ITAR, export control). The profitability margins are generally high for highly specialized electronic fuzes, reflecting the substantial R&D investment and high barriers to entry, whereas mechanical fuzes face stronger price competition and often rely on high-volume production efficiencies.

Mechanical and Electronic Fuzes Market Potential Customers

The primary customers for the Mechanical and Electronic Fuzes Market are national defense organizations, armed forces, and government ordnance procurement agencies worldwide. These entities procure fuzes for their standing army, naval, and air force arsenals, driven by ongoing operational needs, training requirements, and stockpile maintenance. Defense ministries act as the ultimate end-user/buyer, often defining highly specific technical specifications and safety parameters that manufacturers must meet, leading to customized production runs and long-term procurement agreements rather than off-the-shelf purchases.

A second major customer segment includes large defense prime contractors (OEMs) specializing in complete weapon systems, such as missiles, rockets, and artillery platforms. These contractors integrate fuzing systems purchased from specialized component manufacturers into their final products. For instance, a missile manufacturer will source a highly reliable electronic proximity fuze from a specialized supplier, integrating it into the guidance section of a surface-to-air missile. This segment demands fuzes that are easily integrated, standardized, and compatible with complex fire control and targeting systems.

Furthermore, allied nations and multinational military alliances (like NATO) often harmonize their fuzing standards and procurement, creating opportunities for large-volume standardized contracts. Additionally, specific government-approved ordnance refurbishing and maintenance facilities, which maintain existing stockpiles, require replacement fuzes and specialized components. The demand profile is highly inelastic, tied directly to geopolitical stability and long-term defense planning cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 5.67 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orbital ATK (Northrop Grumman), Kaman Corporation, L3Harris Technologies, Rheinmetall AG, Hanwha Systems, Action Manufacturing Company, General Dynamics Corporation, Chemring Group PLC, Saab AB, Leonardo S.p.A., Diehl Defence, Expal Systems, ST Engineering, Nexter Group (KNDS), BAE Systems, Thales Group, Reshef Technologies, Advanced Ordnance Solutions, ZVS Holding, ENSER Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mechanical and Electronic Fuzes Market Key Technology Landscape

The technology landscape within the fuzes market is rapidly evolving, driven by the shift towards programmable and highly secure systems. Traditional mechanical fuzes rely on robust, precision-machined components like clockwork timers and spring-driven escapements, technologies that have seen incremental improvements in materials science for greater shock tolerance. However, the leading edge of innovation is dominated by advanced electronic fuzing systems incorporating Digital Signal Processing (DSP) chips and sophisticated microprocessors, enabling complex trajectory calculations and highly accurate time and proximity sensing, essential for modern airburst capabilities and engaging moving targets with high precision.

A transformative technology is the integration of Micro-Electro-Mechanical Systems (MEMS) into fuzes, replacing bulkier, discrete electronic components. MEMS technology allows for the fabrication of highly reliable, miniaturized sensors, accelerometers, and safety and arming (S&A) mechanisms on silicon chips. This miniaturization is crucial for the development of smaller, smarter munitions and offers improved resistance to extreme environmental factors like high G-forces experienced during launch. The use of MEMS significantly reduces the volume and weight of the fuze while often improving its safety features by enabling multi-redundancy S&A systems that are extremely resistant to accidental arming.

Furthermore, power source technology is critical, particularly the development of high-reliability, long-life thermal batteries and capacitor-based systems that provide instantaneous power upon munition launch, ensuring the electronic circuits are ready for activation and arming sequence execution within milliseconds. Research also focuses heavily on secure programming interfaces that allow ground personnel to set detonation parameters digitally just moments before firing, utilizing standardized communication protocols to integrate the munition seamlessly with the platform's fire control system, optimizing terminal effects based on the specific threat environment and maximizing operational flexibility.

Regional Highlights

- North America: North America, particularly the United States, represents the largest market share in terms of value, driven by massive defense spending and continuous technological supremacy requirements. The U.S. Department of Defense maintains the highest standards for electronic fuzing and is a primary driver in the adoption of next-generation technologies like MEMS fuzes and highly advanced digital S&A mechanisms. U.S. manufacturers dominate the high-end electronic fuze segment, focusing heavily on R&D for guided munitions, missile defense, and standardized modular fuzes that comply with stringent military specifications (MIL-SPEC). The region’s focus is on replacing mechanical and older electronic systems with highly programmable, network-enabled systems.

- Europe: Europe holds a significant market share, characterized by diverse national procurement policies and a strong indigenous defense industrial base (led by countries like the UK, France, and Germany). The market growth is fueled by collaborative European defense initiatives and the necessity to maintain advanced capabilities in response to renewed geopolitical tensions, particularly in Eastern Europe. The European market shows a strong demand for sophisticated artillery fuzes that enable precise airburst capabilities for use against entrenched positions and light armored vehicles. Compliance with NATO standards and interoperability are key procurement criteria, favoring suppliers who can provide highly reliable, multi-role electronic fuzing solutions across allied forces.

- Asia Pacific (APAC): The APAC region is poised for the fastest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is primarily attributed to rapidly escalating defense budgets in nations such as China, India, South Korea, and Japan, fueled by maritime and territorial disputes and the desire for indigenous technological self-reliance. While there is substantial demand for high-volume, cost-effective mechanical fuzes for massive conventional stockpiles, there is a concurrent, high-priority investment in acquiring and developing advanced electronic and smart proximity fuzes for new missile systems and precision-guided rockets. This region is critical for new market entrants due to the scale of modernization projects currently underway.

- Middle East and Africa (MEA): The MEA region is characterized by high demand driven by persistent internal and regional conflicts, leading to steady procurement of conventional and guided ordnance from international suppliers. Nations like Israel, Saudi Arabia, and the UAE are significant importers and, in some cases, producers of specialized munitions. The demand centers heavily on proven, combat-tested electronic fuzes for air-delivered bombs and tactical missile systems. Reliability and effectiveness in harsh desert environments are crucial requirements, often favoring suppliers who can demonstrate robust performance under extreme temperature fluctuations and dusty conditions, maintaining a preference for established, reliable technology alongside new precision acquisitions.

- Latin America: The Latin American market represents a smaller, yet stable, segment focused primarily on maintaining existing stockpiles and undertaking limited modernization programs. Demand is generally weighted toward cost-effective, high-reliability mechanical and basic electronic fuzes for light and medium artillery and mortar systems. Procurement cycles are often tied to governmental budget limitations and economic stability. Local manufacturing capabilities are slowly emerging, often through technological transfers and joint ventures with European or North American defense firms, aimed at securing domestic supply for foundational ordnance components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mechanical and Electronic Fuzes Market.- Northrop Grumman Corporation (via Orbital ATK)

- Kaman Corporation

- L3Harris Technologies

- Rheinmetall AG

- Hanwha Systems Co. Ltd.

- Action Manufacturing Company

- General Dynamics Corporation

- Chemring Group PLC

- Saab AB

- Leonardo S.p.A.

- Diehl Defence GmbH & Co. KG

- Expal Systems (Maxam Group)

- ST Engineering

- Nexter Group (KNDS)

- BAE Systems plc

- Thales Group

- Reshef Technologies Ltd.

- Advanced Ordnance Solutions LLC

- ZVS Holding a.s.

- ENSER Corporation

Frequently Asked Questions

Analyze common user questions about the Mechanical and Electronic Fuzes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and electronic fuzes?

Mechanical fuzes rely on physical mechanisms like clockwork or pyrotechnic delays for detonation timing, prioritizing ruggedness and simplicity. Electronic fuzes use sophisticated digital circuits and microprocessors for precise, programmable timing and multi-option functionality, offering significantly higher accuracy and safety standards required for modern smart munitions.

How does MEMS technology impact the future of fuzing?

Micro-Electro-Mechanical Systems (MEMS) revolutionize fuzing by enabling extreme miniaturization and high shock resistance. MEMS technology integrates sensors and safety mechanisms onto tiny silicon chips, reducing the size and weight of fuzes while enhancing their reliability and allowing for advanced features in small-diameter ordnance.

Which segment of the fuzes market is experiencing the fastest growth?

The electronic and programmable fuzes segment is experiencing the fastest growth, primarily driven by global military modernization programs focused on acquiring precision-guided munitions (PGMs) and implementing highly accurate airburst capabilities across artillery and mortar platforms.

What are the main regulatory challenges facing fuze manufacturers?

The main challenges involve extremely stringent safety and certification requirements, particularly concerning the Safety & Arming (S&A) device, which necessitates lengthy and costly testing cycles to ensure zero risk of accidental detonation and compliance with international armament treaties and military standards.

Which geographical region leads the market in terms of technological adoption?

North America, led by the United States, currently leads in technological adoption and market value due to substantial defense R&D budgets and a persistent focus on integrating cutting-edge digital, sensor, and MEMS technologies into their next-generation ordnance procurement programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager