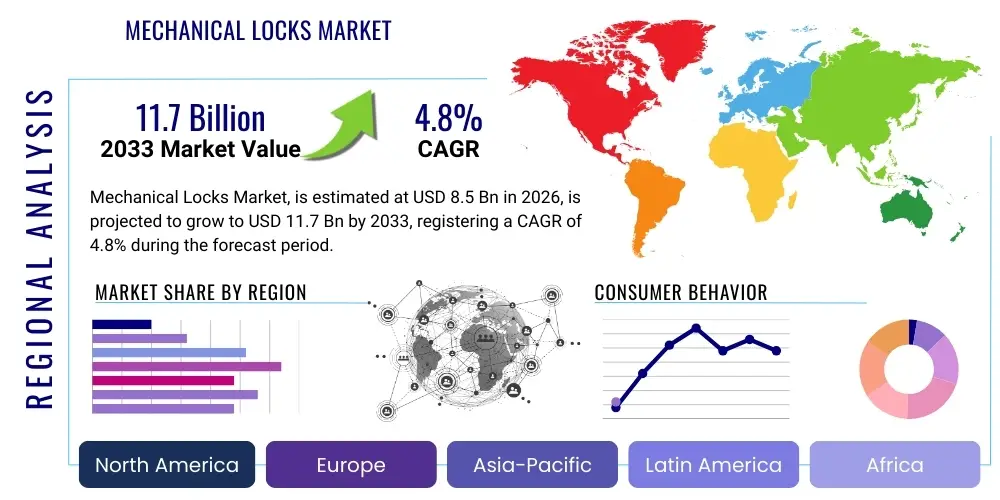

Mechanical Locks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438531 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Mechanical Locks Market Size

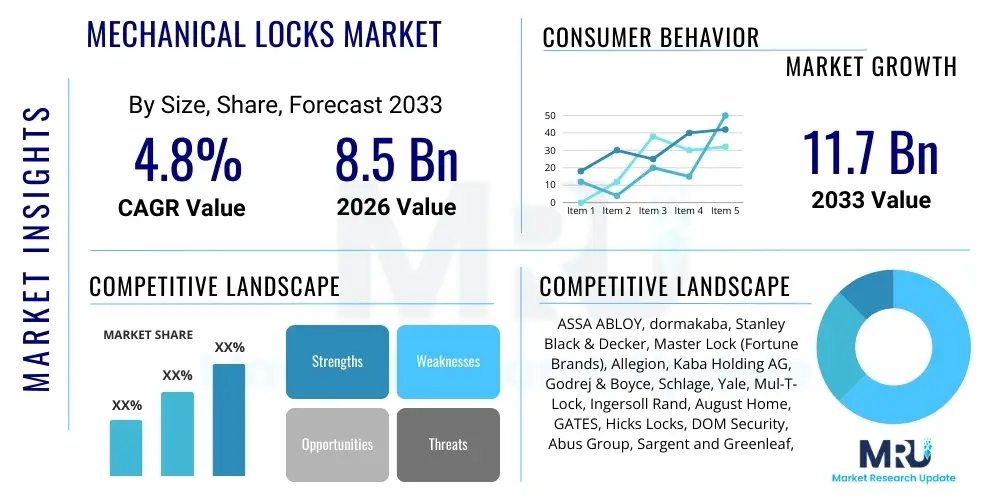

The Mechanical Locks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 11.7 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by sustained construction activities globally, particularly in emerging economies, alongside the persistent need for basic, reliable security solutions that mechanical locks provide. While electronic security systems are gaining traction, the cost-effectiveness, durability, and lack of dependency on power sources ensure the foundational relevance of mechanical locking mechanisms across various sectors, including residential, commercial, and automotive applications.

Mechanical Locks Market introduction

The Mechanical Locks Market encompasses a wide array of devices designed to secure doors, cabinets, vehicles, and other enclosures through purely physical mechanisms, typically involving keys, tumblers, and bolts. Products range from basic padlocks and simple cylinder locks to complex mortise and rim lock assemblies utilized in high-security residential and commercial structures. These traditional security solutions rely on intricate mechanical arrangements to prevent unauthorized access, offering a time-tested, fundamental layer of protection critical for asset and personnel safety. The market’s resilience stems from its universal applicability and the intrinsic reliability of mechanical components under diverse environmental conditions.

Major applications of mechanical locks span the residential sector, where they form the primary barrier for homes and apartments; the commercial sector, including securing office buildings, retail establishments, and educational institutions; the industrial sector, used for securing storage facilities and equipment; and the automotive industry, where they are integral to ignition and door locking systems. The continuous global infrastructure development and urbanization trends are consistently driving demand for high-quality, durable mechanical locking systems that meet stringent international safety standards. Furthermore, renovation and retrofitting projects in established markets contribute significantly to product replacement cycles and upgrades, focusing on enhanced pick resistance and material strength.

The core benefits of mechanical locks include their inherent simplicity, low maintenance requirements, resistance to electronic hacking, and longevity. Driving factors for market growth include increasing global awareness regarding property security, strict building codes mandating minimum security standards, and the steady rise in disposable income in developing nations, allowing consumers to invest in better security hardware. Conversely, challenges such as the rising popularity of smart and electronic locks require manufacturers to innovate within the mechanical domain, focusing on hybrid solutions and advanced materials to maintain competitive edge, ensuring that mechanical reliability remains paramount while integrating modern features like master key systems and complex key control protocols.

Mechanical Locks Market Executive Summary

The Mechanical Locks Market demonstrates steady growth, characterized by innovation focused on material durability, anti-picking technology, and integration capabilities, rather than radical technological disruption. Business trends indicate a bifurcation in product offerings: a high-volume segment focused on cost-effective, standardized solutions for new construction in emerging markets, and a premium segment emphasizing high-security, custom-engineered mechanical locks (e.g., high-precision cylinder systems) tailored for critical infrastructure and luxury residential projects in developed economies. Consolidation among major players is also a significant trend, aiming to achieve economies of scale and integrate supply chains globally, allowing them to offer comprehensive security portfolios that include both mechanical and electronic hardware. Furthermore, sustainability is becoming a key factor, with manufacturers exploring environmentally friendly materials and production processes to meet evolving regulatory and consumer demands.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure expansion, rapid urbanization, and significant growth in the residential construction sector across China, India, and Southeast Asian nations. North America and Europe, while mature markets, maintain high demand for replacement and upgrade cycles, focusing heavily on specialized, certification-compliant locks that meet strict insurance requirements and fire safety regulations. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, fueled by government investments in large-scale commercial and mixed-use developments, necessitating robust and scalable mechanical security deployments. Regional regulatory variations regarding lock grading (e.g., ANSI/BHMA in North America, CEN in Europe) heavily influence product design and procurement strategies.

Segment trends reveal that the Residential application segment continues to dominate in terms of volume, primarily driven by mass housing projects. However, the Commercial and Industrial segments are exhibiting higher value growth due to the demand for heavy-duty, restricted access, and master keying solutions. By product type, Mortise locks and high-security Padlocks are experiencing notable growth, favored for their enhanced structural integrity and resistance to forced entry. Material innovation is focused on advanced alloys and specialized coatings that improve weather resistance and reduce wear, extending the lifespan and reliability of the locking mechanism under rigorous operational conditions. The continuous demand for reliable key control systems reinforces the market position of mechanical systems over purely electronic alternatives in specific high-traffic environments where power failure is a critical concern.

AI Impact Analysis on Mechanical Locks Market

Common user questions regarding the impact of Artificial Intelligence on the mechanical locks market typically revolve around themes of obsolescence, integration feasibility, and the potential for enhanced security through hybrid systems. Users frequently inquire if AI and smart technology will render traditional mechanical locks obsolete, or how mechanical reliability can be combined with AI-driven monitoring and access management features. Key concerns focus on balancing the foolproof simplicity of a mechanical system with the predictive and adaptive capabilities of AI, specifically in areas like proactive maintenance notifications, analyzing forced entry attempts, and optimizing key management logistics in large institutional settings. Users seek confirmation that the core mechanical functionality, particularly in critical security areas, will remain operational even during electronic system failures or cyberattacks, pushing manufacturers toward developing robust, failsafe mechanical components that can interface securely with smart platforms.

While mechanical locks themselves do not integrate AI, the market ecosystem surrounding them is profoundly influenced by AI-driven technologies. AI plays a critical role in the manufacturing process, optimizing production lines, improving precision engineering, and enhancing quality control measures through automated defect detection, thereby increasing the reliability and consistency of the mechanical products. Furthermore, in the security landscape, AI is essential for predictive threat analysis and access pattern recognition within integrated security platforms. These platforms manage key control, monitoring mechanical lock usage data (e.g., frequency of use, anomalies in lock activity via associated sensors), allowing facility managers to identify potential security breaches or maintenance needs long before mechanical failure occurs, ultimately extending the effective life and security profile of the mechanical hardware.

The primary influence of AI lies in optimizing the security architecture where mechanical locks serve as the final physical barrier. AI tools analyze massive datasets generated by peripheral devices—such as sensors detecting vibrations or proximity devices confirming key usage—to validate the integrity of the mechanical lock system. This synthesis of physical security and intelligent monitoring elevates the perceived security value of traditional locks. For example, in high-security environments, AI algorithms can flag anomalous key usage times or excessive wear patterns on locking mechanisms, triggering immediate human inspection or scheduled maintenance, thus shifting the security paradigm from reactive replacement to proactive preservation and reliability enhancement. This technological convergence ensures that mechanical locks remain relevant by being an integral component of a sophisticated, AI-managed security framework.

- AI drives precision manufacturing and quality control for mechanical components, reducing defects and enhancing durability.

- AI analyzes usage patterns and sensor data in hybrid systems to predict mechanical failures or unauthorized tampering attempts.

- AI optimizes key control logistics, especially in large master key systems, enhancing operational efficiency and accountability.

- AI-driven threat intelligence helps tailor mechanical lock design standards for resilience against evolving physical attack methods.

- AI facilitates the development of self-diagnosing mechanical lock systems when combined with integrated low-power sensors.

DRO & Impact Forces Of Mechanical Locks Market

The Mechanical Locks Market is shaped by a complex interplay of drivers, restraints, and opportunities, all influenced by dynamic impact forces derived from technology evolution and regulatory shifts. Major drivers include the robust expansion of global construction and infrastructure projects, particularly in Asian and African markets, creating consistently high demand for fundamental security hardware. The intrinsic durability, reliability, and low operational cost of mechanical locks compared to electronic alternatives ensure their sustained adoption in environments where power access is unreliable or budgets are constrained. Furthermore, stringent global safety regulations and building codes, which often mandate specific mechanical lock standards for fire exits and emergency access points, provide a non-negotiable floor for market demand.

Restraints primarily revolve around the competitive threat posed by advanced electronic and smart lock systems, which offer enhanced features like remote access, keyless entry, and audit trail capabilities, often preferred in modern smart buildings and high-end residential installations. Another significant restraint is the vulnerability of mechanical locks to physical manipulation techniques, such as lock picking and bumping, leading to continuous investment demands in anti-picking technological refinement, which can increase manufacturing complexity and cost. Furthermore, market fragmentation and the proliferation of low-quality, inexpensive knock-offs, particularly in emerging markets, exert downward pressure on pricing and complicate the establishment of reliable security standards among end-users.

Opportunities for growth are significant, centering on the development of hybrid locking systems that merge the reliable security of mechanical locks with the connectivity and monitoring features of electronics, offering a best-of-both-worlds solution, particularly in commercial and institutional settings. Expanding into specialized security applications, such as high-security safe locks, industrial equipment protection, and sophisticated master key architecture for corporate campuses, represents high-value growth avenues. The growing focus on key control solutions, including patented keyway systems that prevent unauthorized key duplication, offers premiumization opportunities for manufacturers. Impact forces, such as rapid urbanization and increased global security consciousness following geopolitical instabilities, consistently accelerate the need for reliable physical access control, bolstering the market's long-term stability and demand across all regional segments.

Segmentation Analysis

The Mechanical Locks Market is extensively segmented based on criteria such as product type, material, and diverse end-user applications, allowing for precise targeting of specific security and functionality needs across the global economy. Understanding these segmentations is critical for market participants to tailor their innovation, distribution, and pricing strategies. The foundational segmentation by type, including door locks, padlocks, and specialty locks, reflects the varied security requirements inherent in different physical assets. Door locks, dominating the volume segment, are further broken down into highly specialized sub-types like mortise, cylinder, and rim locks, each offering distinct levels of physical security and aesthetic integration suitable for diverse architectural styles and regulatory requirements in residential and commercial buildings globally.

Material segmentation is paramount, as the durability and security rating of a mechanical lock are directly tied to the materials used in its construction. Brass, stainless steel, and zinc alloys are the most common materials, offering varying degrees of resistance to corrosion, temperature, and physical attack. Stainless steel locks, for instance, are heavily favored in industrial and coastal environments due to their superior resistance to rust and harsh weather conditions, commanding a higher price point than zinc alloy counterparts typically used in lower-security, internal applications. The choice of material often dictates the product's lifespan and its compliance with stringent international standards such as European Norms (EN) or ANSI/BHMA specifications, influencing purchasing decisions across the mature European and North American markets.

Application segmentation reveals the varying security criticality levels across end-user sectors. While the Residential sector drives volume, focused primarily on ease of use and aesthetic integration, the Commercial and Industrial sectors require much higher security grades, specialized access control mechanisms (like grand master key systems), and rugged construction to withstand heavy usage and potential security threats. Within the Commercial segment, institutions like banks, hospitals, and schools require highly regulated, specialized mechanical locks compliant with fire safety and accessibility standards. This comprehensive segmentation framework allows manufacturers to address the niche requirements of each sector, ensuring that solutions provided—whether it is a heavy-duty padlock for a logistics container or a precision mortise lock for a bank vault—are optimized for their specific security function.

- By Type:

- Door Locks (Cylinder Locks, Mortise Locks, Rim Locks, Tubular Locks)

- Padlocks (Keyed Padlocks, Combination Padlocks, High-Security Padlocks)

- Cabinet Locks (Cam Locks, Drawer Locks)

- Vehicle Locks (Ignition Locks, Door/Boot Locks)

- By Material:

- Brass

- Stainless Steel

- Zinc Alloy

- Aluminum

- Others (e.g., Bronze, Specialized Alloys)

- By Application:

- Residential

- Commercial (Office Buildings, Retail, Hospitality, Healthcare, Education)

- Industrial

- Automotive

- By Security Grade:

- Standard Security

- High Security

Value Chain Analysis For Mechanical Locks Market

The value chain for the Mechanical Locks Market commences with upstream activities focused on raw material sourcing and precision component manufacturing, representing the foundational stage where material quality and metallurgical processes are paramount. Key raw materials, primarily brass, steel, and zinc, are sourced globally, and fluctuations in commodity prices directly impact the cost of goods sold. Specialized component manufacturing involves high-precision casting, machining, and stamping of complex parts like cylinders, keys, and tumblers, requiring specialized machinery and highly skilled labor to meet tight tolerances necessary for reliable function and high security. Manufacturers often engage in vertical integration for critical components, especially those related to proprietary keyways and cylinder mechanisms, to protect intellectual property and ensure supply chain integrity.

Midstream activities involve the assembly, finishing, and distribution of the final lock products. Assembly involves combining hundreds of small, precision-machined parts into the final lock body, followed by surface treatments such as plating, polishing, or coating to enhance corrosion resistance and aesthetic appeal. Quality assurance and testing (e.g., cyclical testing, endurance testing, resistance to picking) are crucial midstream steps to ensure compliance with international security standards (e.g., EN 1303, ANSI/BHMA). Distribution channels are highly diverse and complex, encompassing both direct sales to large Original Equipment Manufacturers (OEMs), particularly in the automotive and high-volume housing construction segments, and indirect sales through extensive networks of specialized distributors, wholesalers, and hardware retailers.

Downstream activities focus on reaching the end-user market through installation, aftermarket services, and maintenance. Indirect distribution channels, such as wholesale distributors and large home improvement retail chains (e.g., Home Depot, Lowe's), dominate the residential and small commercial segments, providing broad geographical reach. Specialized security distributors and locksmiths play a vital role in the high-security commercial and institutional segments, offering expertise in complex master keying systems and professional installation services. The after-sales market, including key duplication services and replacement parts, forms a substantial revenue stream, ensuring the longevity of the installed mechanical base. Direct channels often involve specialized project sales teams that interface directly with large contractors, architects, and security consultants to specify custom mechanical security solutions for major commercial or governmental projects, emphasizing robust training and technical support.

Mechanical Locks Market Potential Customers

The primary customers in the Mechanical Locks Market span diverse sectors, united by the common need for physical access control and asset protection. The Residential segment represents the largest volume market, driven by homeowners and property developers who require durable, easy-to-use locking solutions for doors, windows, and cabinets. Purchasing criteria in this segment prioritize cost-effectiveness, aesthetic compatibility, and basic security assurance, often relying on mass-market retail channels for acquisition. The sustained global population growth and ongoing housing construction boom ensure this segment remains a stable cornerstone of market demand, though it is the most susceptible to penetration by consumer-focused smart lock alternatives.

The Commercial and Institutional sectors constitute the highest-value segment, characterized by stringent security requirements, complex access structures (e.g., master key hierarchies), and high usage frequency demanding robust, heavy-duty hardware. Customers include facility managers of corporate offices, healthcare facilities (hospitals), educational institutions (universities, schools), and retail environments. These buyers prioritize high-grade certification, proven resilience against physical attacks, and the ability to integrate mechanical locks seamlessly into larger security protocols. Procurement decisions here are often driven by regulatory compliance, insurance requirements, and consultation with specialized security experts, making the sales cycle longer but offering higher margins and loyalty for manufacturers specializing in professional-grade hardware and sophisticated key control systems.

The Industrial and Infrastructure sectors represent another crucial potential customer base, requiring specialized, weather-resistant, and tamper-proof mechanical locks for protecting critical assets, remote sites, and supply chain logistics. Customers include transportation companies (trucking, rail), utility providers (power plants, water facilities), military and defense establishments, and the construction industry (securing equipment and storage containers). For these users, heavy-duty padlocks, industrial cabinet locks, and specialized key systems resistant to extreme environmental conditions are essential. Furthermore, Original Equipment Manufacturers (OEMs) in the automotive industry remain indispensable customers, integrating thousands of mechanical ignition and door lock sets into new vehicle production annually, requiring high precision, mass customization, and adherence to automotive safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 11.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, dormakaba, Stanley Black & Decker, Master Lock (Fortune Brands), Allegion, Kaba Holding AG, Godrej & Boyce, Schlage, Yale, Mul-T-Lock, Ingersoll Rand, August Home, GATES, Hicks Locks, DOM Security, Abus Group, Sargent and Greenleaf, VingCard Elsafe, Lowe & Fletcher, Shenzhen Speedup. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mechanical Locks Market Key Technology Landscape

The technology landscape in the Mechanical Locks Market, while inherently traditional, is characterized by continuous refinement aimed at improving fundamental security characteristics, specifically focusing on cylinder mechanism design, material science, and key control systems. Core mechanical innovations center on anti-picking, anti-bumping, and drill-resistant features. Manufacturers utilize highly complex cylinder mechanisms, such as dimple key systems, magnetic pins, and telescopic pin configurations, to significantly increase the difficulty and time required for unauthorized manipulation, moving beyond traditional pin-tumbler designs. Material technology advancements include the use of hardened steel inserts and ceramic components within the cylinder core to resist aggressive physical attacks like drilling or sawing, thereby enhancing the overall resilience and security grading of the lock product.

A crucial technological differentiator is the implementation of proprietary, patented keyway systems, which form the basis of effective key control. These technologies are intellectual property protected and legally restrict the unauthorized duplication of keys, ensuring that only licensed dealers and authorized personnel can produce copies. This is vital for commercial and institutional applications where stringent key management is essential for security compliance and liability mitigation. Furthermore, the technology extends to master key systems architecture, involving sophisticated mechanical planning to allow a hierarchical structure of keys (e.g., grand master, master, sub-master, and individual keys) to operate specific groups of locks efficiently without compromising the security of individual cylinders, offering complex operational flexibility for large facilities management.

Beyond the core cylinder and key technology, significant efforts are dedicated to lock body and bolt design, focusing on structural integrity and compliance with fire safety regulations. Mortise locks, for instance, utilize advanced gear mechanisms and heavy-duty components to ensure smooth, durable operation and compliance with high cycle-count endurance tests. The emergence of hybrid mechanical-electronic technology represents the most significant ongoing evolution, where mechanical cylinders are equipped with electronic readers or chips (like RFID or NFC) that retain the mechanical fail-safe while integrating into a digital access control system. This technological merger addresses the modern demand for audit trails and time-limited access while guaranteeing reliable physical access in the event of system failure, solidifying the mechanical lock's role in the increasingly digitized security environment.

Regional Highlights

The Mechanical Locks Market exhibits highly distinct dynamics across major geographical regions, influenced by localized construction cycles, regulatory environments, and prevailing security consciousness levels. North America and Europe represent mature markets characterized by stable replacement demand, stringent security standards, and a strong preference for certified high-quality, durable products. In these regions, growth is driven primarily by regulatory mandates (e.g., fire safety codes, ADA compliance) and the transition towards specialized, technologically sophisticated mechanical systems like patented key control architectures and high-end mortise locks. European markets specifically demand locks meeting CEN standards, placing a premium on certified resistance to picking and forced entry, contributing to higher average selling prices compared to regions focused on volume.

Asia Pacific (APAC) stands as the fastest-growing market globally, fueled by unprecedented rates of urbanization and massive investments in both residential and commercial infrastructure, particularly in rapidly developing economies such as China, India, and Indonesia. The sheer volume of new construction projects ensures consistently high demand for mechanical locking hardware, often favoring cost-effective, standard-grade cylinder and padlock solutions for mass housing and entry-level commercial applications. While price sensitivity is higher in parts of APAC, there is a burgeoning segment demanding high-security mechanical systems due to rising affluence and heightened security concerns, driving localized manufacturing improvements and the import of premium products from international suppliers. The diverse local standards across APAC countries necessitate highly adaptable product strategies from multinational manufacturers.

Latin America (LATAM) and the Middle East and Africa (MEA) offer substantial long-term growth potential, driven by ongoing economic development and large-scale government and private sector projects, including hospitality, retail, and mixed-use developments. In MEA, major construction hubs like the UAE and Saudi Arabia are investing heavily in modern infrastructure, demanding high-quality mechanical locks that can withstand harsh climatic conditions and meet robust international security criteria. LATAM markets are recovering, showing steady demand for reliable mechanical solutions for both residential security and industrial asset protection. These regions prioritize robust, straightforward mechanical locks that offer immediate, visible security protection, often in environments where maintenance infrastructure for complex electronic systems may be less established, thus favoring the inherent reliability of mechanical hardware.

- Asia Pacific (APAC): Highest growth rate fueled by new construction, mass urbanization, and increasing consumer spending on security hardware in China, India, and Southeast Asia.

- North America: Mature market focused on replacement cycles, high-security systems, and compliance with strict standards like ANSI/BHMA; strong demand for patented key control systems.

- Europe: Stable demand driven by highly stringent EU and national regulations (CEN standards) pertaining to fire safety, accessibility, and resistance classification; strong focus on precision-engineered mortise locks.

- Latin America (LATAM): Growing market segment driven by heightened security awareness and commercial construction revival, prioritizing robust, reliable, and cost-efficient mechanical solutions.

- Middle East and Africa (MEA): High demand from large infrastructure and hospitality projects; focus on durable locks capable of resisting extreme temperatures and requiring minimal maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mechanical Locks Market.- ASSA ABLOY

- dormakaba

- Stanley Black & Decker

- Master Lock (Fortune Brands)

- Allegion

- Godrej & Boyce

- Schlage

- Yale

- Mul-T-Lock

- Abus Group

- Ingersoll Rand

- DOM Security

- Sargent and Greenleaf

- VingCard Elsafe

- Lowe & Fletcher

- Shenzhen Speedup

- Hicks Locks

- August Home (Subsidiary focusing on hybrid solutions)

- GATES

- Walsall Locks

Frequently Asked Questions

Analyze common user questions about the Mechanical Locks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Mechanical Locks Market between 2026 and 2033?

The Mechanical Locks Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, driven by construction growth and fundamental security needs globally.

How do high-security mechanical locks differ from standard mechanical locks?

High-security mechanical locks employ proprietary technology such as patented keyways, complex cylinder mechanisms (e.g., multi-row pins, telescopic tumblers), and hardened material inserts to provide superior resistance against picking, bumping, drilling, and unauthorized key duplication, often meeting stringent CEN or ANSI Grade 1 certifications.

Which application segment drives the highest market value in the mechanical locks sector?

The Commercial and Institutional application segments typically drive the highest market value. This is due to the mandatory requirement for advanced, heavy-duty, certified security solutions, intricate master key systems, and compliance with stringent commercial building codes, resulting in higher average selling prices per unit.

What is the primary impact of electronic smart locks on the traditional mechanical lock market?

Electronic smart locks primarily exert competitive pressure by offering enhanced features like remote access and audit trails. However, they simultaneously foster innovation in the mechanical sector, leading to the development of robust hybrid systems that retain the mechanical fail-safe while integrating digital monitoring capabilities, ensuring mechanical reliability remains essential.

What role does the Asia Pacific region play in the global Mechanical Locks Market expansion?

Asia Pacific (APAC) is the largest and fastest-growing regional market, driven by rapid urbanization, significant residential and commercial construction booms, and increasing infrastructure investments across countries like China and India, generating substantial volume demand for both standard and specialized mechanical locking hardware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager