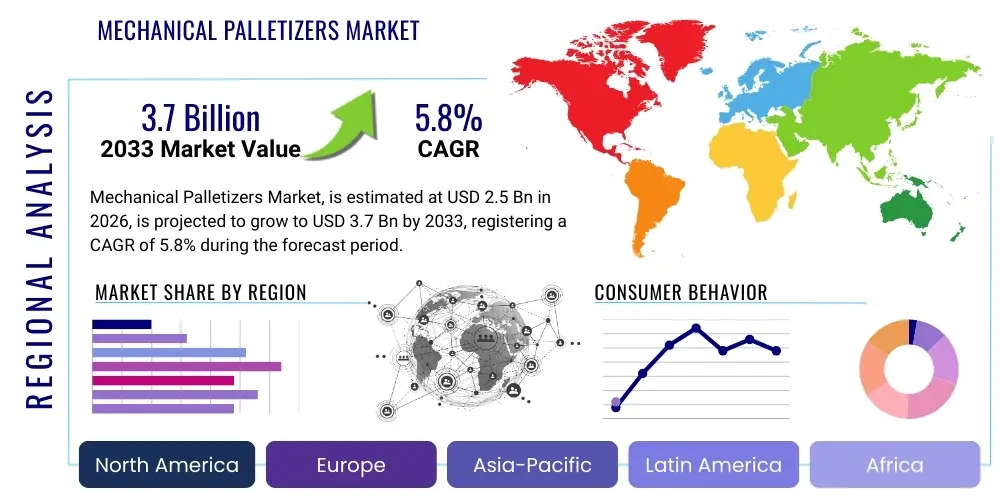

Mechanical Palletizers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437096 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mechanical Palletizers Market Size

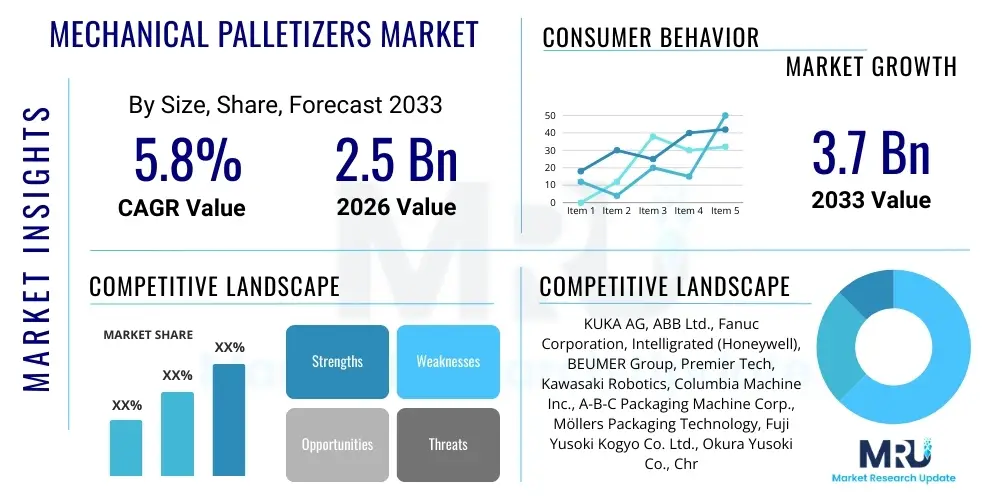

The Mechanical Palletizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.7 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by the increasing global emphasis on automation within end-of-line packaging processes across high-volume manufacturing sectors, particularly in fast-moving consumer goods (FMCG) and e-commerce fulfillment centers. Mechanical palletizers offer superior throughput and reliability compared to manual operations, making them critical investments for companies aiming to optimize operational efficiency and reduce labor-related costs.

Mechanical Palletizers Market introduction

The Mechanical Palletizers Market encompasses equipment designed for automatically stacking cases, bags, or other packaged products onto a pallet in a predetermined pattern for shipping or storage. These systems are integral components of automated material handling and end-of-line packaging infrastructure. Mechanical palletizers primarily use conventional methods, often involving layer-by-layer accumulation, transfer plates, or high-level infeed systems, contrasting with articulated robotic systems that use arms and grippers. The core product category includes high-level infeed, low-level infeed, and hybrid systems, each tailored to specific throughput requirements, product fragility, and facility layout constraints. The fundamental benefit of these machines lies in their ability to handle heavy loads consistently, ensuring structural integrity of unit loads, minimizing product damage during transport, and dramatically enhancing production line speeds.

Major applications of mechanical palletizers span critical industries such as Food and Beverage (bottles, cartons, crates), Pharmaceuticals (cases of medication), Chemicals (sacks, drums), and especially the massive Consumer Goods sector, where efficient supply chain logistics are paramount. The market growth is primarily driven by escalating global demand for packaged goods, coupled with rising labor costs and a persistent focus on improving workplace safety by automating repetitive and ergonomically challenging tasks. Furthermore, the push towards greater supply chain visibility and traceability necessitates standardized, uniformly stacked pallets, which mechanical systems reliably provide.

Key technological advancements driving the current market include enhanced layer forming capabilities, quick changeover features to accommodate diverse Stock Keeping Units (SKUs), and the integration of sophisticated diagnostics using Programmable Logic Controllers (PLCs). The reliability, speed, and proven longevity of conventional mechanical palletizers maintain their competitive edge, particularly in high-volume, uniform-product environments where throughput maximization is the ultimate business objective. These systems are often the workhorses of large distribution facilities, providing a robust solution for continuous 24/7 operation with minimal downtime requirements when compared to more complex articulated robotic counterparts in certain applications.

Mechanical Palletizers Market Executive Summary

The Mechanical Palletizers Market is experiencing significant acceleration driven by global industrial automation initiatives, particularly across Asia Pacific and North America. Key business trends include the strong adoption of high-level palletizers in sectors requiring immense speed, such as beverage canning and bottling, alongside the rising demand for hybrid systems that blend the speed of conventional mechanisms with the flexibility of robotics. Companies are increasingly investing in modular mechanical palletizers that allow for easy scalability and integration into existing production lines without extensive retooling. The crucial competitive differentiator is evolving toward energy efficiency, reduced maintenance footprint, and superior uptime reliability, compelling manufacturers to utilize advanced servo drive technology and preventative maintenance software.

Regionally, Asia Pacific is projected to lead market expansion, fueled by massive infrastructure development in manufacturing and the rapid growth of the retail and e-commerce logistics sectors in countries like China, India, and Southeast Asia. North America and Europe, characterized by high labor costs, maintain strong demand for fully automatic systems as they prioritize operational cost reduction and adherence to stringent workplace safety standards. These mature markets are also key centers for innovation, focusing on smart factory integration (Industry 4.0), demanding palletizers with seamless enterprise resource planning (ERP) system connectivity for real-time inventory and production management.

Segment trends reveal a sustained dominance of fully automatic mechanical palletizers, reflecting the industry's pervasive shift away from manual processes. Within end-user segments, the Food & Beverage sector remains the largest consumer, driven by the sheer volume and variety of packaged products requiring stable unit loads. Furthermore, there is a pronounced shift within the technology type segment towards conventional, non-robotic systems for handling non-uniform packaging sizes, although the line between fully mechanical and hybrid (combining conventional layer depositing with robotic end effectors) solutions is becoming increasingly blurred as manufacturers seek optimal performance metrics combining speed and versatility. The demand for systems optimized for compact footprints in urbanized or retrofitted facilities also heavily influences segment growth.

AI Impact Analysis on Mechanical Palletizers Market

Common user questions regarding AI’s impact on mechanical palletizers typically revolve around predictive maintenance schedules, optimizing complex stacking patterns (mixed SKUs), and improving machine vision system accuracy for quality control. Users often inquire how AI algorithms can reduce unplanned downtime by analyzing vibration, temperature, and current consumption data in real-time, moving maintenance from scheduled to condition-based. Another significant theme is the role of machine learning in adapting layer patterns instantaneously when product dimensions or case counts change, thereby maximizing pallet stability and minimizing packaging waste without requiring manual reprogramming. Concerns also frequently emerge regarding the necessity of retrofitting older, non-connected mechanical systems and the associated costs of integrating AI-enabled software layers into established infrastructure.

The integration of Artificial Intelligence (AI) into the mechanical palletizers market is primarily focused on enhancing operational intelligence and predictive capabilities rather than replacing the core mechanical function. AI algorithms analyze vast datasets generated by machine sensors (such as throughput rates, motor load, alignment deviations, and cycle times) to identify anomalies and forecast potential failures well before they impact production. This shift enables manufacturers to achieve unparalleled levels of uptime reliability and optimize Mean Time Between Failure (MTBF). Moreover, AI-driven vision systems are revolutionizing quality control, ensuring that every layer formation meets precise specifications, detecting damaged cases or misalignment instantly, and preventing unstable pallets from entering the supply chain.

Furthermore, AI plays a crucial role in dynamic optimization, particularly important in e-commerce fulfillment where mixed-SKU palletizing (rainbow pallets) is common. Traditional mechanical systems struggle with highly variable layer configurations, but AI algorithms can process complex constraints—such as weight distribution, product fragility, and stacking sequence—to generate the most stable and space-efficient stacking patterns on the fly. This capability significantly elevates the value proposition of modern mechanical palletizers, enabling them to handle the complexity typically reserved for collaborative robotics while maintaining high conventional speed, thus driving strategic market adoption in logistics and distribution centers.

- Enhanced Predictive Maintenance: AI models analyze sensor data (vibration, thermal signatures) to anticipate mechanical component failure, minimizing costly unplanned downtime.

- Dynamic Pattern Optimization: Machine learning algorithms generate optimal, stable stacking patterns instantly for mixed-SKU pallets, crucial for e-commerce logistics.

- Improved Quality Control: AI-driven machine vision systems ensure precise case orientation, integrity verification, and layer alignment, drastically reducing error rates.

- Energy Efficiency Optimization: AI fine-tunes motor movements and cycle timing to reduce energy consumption based on real-time operational requirements and load profiles.

- Autonomous Fault Diagnosis: Systems can self-diagnose root causes of operational stoppages and suggest precise corrective actions to maintenance staff, speeding up recovery time.

DRO & Impact Forces Of Mechanical Palletizers Market

The Mechanical Palletizers Market is strongly propelled by the relentless drive for end-of-line automation across global manufacturing sectors and significant upward pressure from soaring labor costs, especially in developed economies. However, market expansion is constrained by the substantial initial capital investment required for high-throughput, integrated mechanical systems and the requirement for highly skilled technical personnel to maintain complex automated equipment. Opportunities are abundant in the development of modular, flexible, and compact palletizing solutions tailored for Small and Medium Enterprises (SMEs) and for integrating these systems with advanced Industry 4.0 technologies. The market is fundamentally impacted by the powerful force of cost reduction imperatives, pushing manufacturers toward reliable, high-speed solutions, while regulatory standards concerning occupational health and safety act as a supplementary driver, making automation essential to mitigate manual handling risks.

Drivers include the accelerating demand for packaged goods globally, necessitating faster and more efficient end-of-line processes. Furthermore, the structural shortage of labor willing to perform repetitive, heavy lifting tasks in logistics environments is forcing immediate investment in automation. The inherent speed advantage of conventional high-level mechanical palletizers over some robotic counterparts in uniform high-volume applications ensures their continued relevance and market dominance in specific niches, such as beverage bottling and cement bagging. Technological maturity and proven reliability also contribute significantly, as many manufacturers prefer the known maintenance schedule and operational longevity of conventional machinery.

Restraints are primarily linked to the high implementation cost of integrated systems, making market entry challenging for smaller manufacturers. Additionally, mechanical systems, particularly older generations, often lack the versatility to handle frequently changing product types or dimensions, which is a growing necessity in customized production environments. The primary opportunity lies in developing hybrid mechanical-robotic systems that combine the speed of mechanical layer formation with the flexibility of robotic handling and gripping. Another crucial opportunity involves retrofitting and upgrading existing mechanical lines with modern control systems (PLCs) and connectivity features to integrate them into smart factory ecosystems, extending their lifecycle and enhancing data collection capabilities.

The market faces several impact forces. Firstly, the force of technological substitution from advanced robotic palletizers capable of handling infinite stacking patterns poses a long-term challenge, pushing mechanical manufacturers to innovate in speed and modularity. Secondly, competitive pricing pressure, particularly from Asian manufacturers, forces incumbents to focus on features like total cost of ownership (TCO) and advanced service contracts rather than just initial purchase price. The standardization imperative for safer, more stable unit loads (driven by supply chain partners) acts as a powerful accelerating force, guaranteeing that high-quality, precise palletizing remains a non-negotiable requirement for global trade compliance.

Segmentation Analysis

The Mechanical Palletizers Market is segmented based on the operational mechanism (Type), the level of human intervention (Operation), and the industries utilizing the equipment (End-User). The segmentation provides critical insights into purchasing behaviors, technology preferences, and application-specific demands across the global market. Understanding these segments is crucial for manufacturers in tailoring their product offerings, whether focusing on high-speed, dedicated low-level systems for food packaging or highly robust, high-level systems for heavy-duty industrial applications like chemicals or construction materials. The dominance of the fully automatic operation segment underscores the pervasive industrial trend towards minimizing human involvement in high-risk, high-repetitive tasks.

Segmentation by Type distinguishes systems based on how products are introduced and processed. Low-level palletizers are typically favored for slower lines or when floor-level loading is preferred, offering ease of access and maintenance. High-level palletizers, conversely, are designed for maximum speed and throughput, introducing product layers from above, often necessitating a substantial vertical footprint but delivering superior performance metrics in demanding environments. Meanwhile, hybrid systems are gaining traction by incorporating elements of mechanical speed with robotic flexibility, serving as an intermediate solution for lines with moderate product variability. This detailed breakdown allows market participants to precisely target industries based on their specific throughput and physical constraints.

The End-User segment analysis highlights the massive impact of the Food & Beverage industry, which constantly demands faster, safer, and cleaner palletizing solutions due to stringent hygiene standards and immense volume requirements. However, segments like Pharmaceuticals are driving demand for highly validated, precision-engineered mechanical systems that minimize product agitation and ensure strict traceability during case handling. The strategic allocation of resources and marketing efforts is heavily dependent on the growth trajectories and automation maturity levels within each of these distinct end-user categories, with e-commerce fulfillment centers becoming an increasingly critical sub-segment due to their unique demands for mixed-SKU handling and expedited logistics.

- By Type:

- Low-Level Palletizers (Floor Level Infeed)

- High-Level Palletizers (Overhead Infeed)

- Hybrid Palletizers (Mechanical Core with Robotic Elements)

- By Operation:

- Semi-Automatic Palletizers

- Automatic Palletizers (Fully Automated Systems)

- By End-User Industry:

- Food & Beverage (F&B)

- Pharmaceuticals and Healthcare

- Chemicals and Petrochemicals

- Consumer Goods (Non-Durable)

- Building & Construction Materials

- Others (Automotive components, Electronics)

Value Chain Analysis For Mechanical Palletizers Market

The value chain for the Mechanical Palletizers Market begins with the Upstream Analysis, which focuses heavily on the procurement of high-quality raw materials and critical components. This includes specialized steel and aluminum alloys for structural integrity, advanced servo motors, precision gearboxes, complex sensor arrays, sophisticated PLC controllers, and proprietary software licenses. Suppliers specializing in motion control technology and industrial automation components hold significant leverage within this segment, as the performance and longevity of the palletizer are directly dependent on the quality and integration of these electrical and electronic subsystems. Sourcing dependable, long-life components is critical for minimizing the Total Cost of Ownership (TCO) for the end-user, thereby influencing supplier selection and pricing strategies.

Midstream activities involve the design, manufacturing, assembly, integration, and rigorous testing of the mechanical systems. Leading manufacturers invest heavily in R&D to develop proprietary layer forming technologies, enhance structural rigidity, and reduce the physical footprint of their machines while increasing throughput speed. Manufacturing complexity arises from the necessity of custom engineering solutions to match diverse product types (e.g., bags, boxes, trays, bottles) and stacking requirements. The integration phase is crucial, ensuring the palletizer communicates effectively with upstream conveyors, wrappers, and downstream warehouse management systems (WMS). Quality control during assembly, particularly concerning alignment and motion accuracy, determines the machine's long-term operational effectiveness.

Downstream analysis encompasses Distribution Channels, installation, training, and critical after-sales support. Distribution typically involves a mix of Direct Sales Channels for large, custom projects and Indirect Channels utilizing system integrators, authorized distributors, and local agents who provide regional sales support and localized maintenance services. Post-installation support—including preventative maintenance contracts, spare parts inventory management, and remote diagnostics—is a major revenue stream and a key competitive factor. The primary Potential Customers (End-Users) are large-scale manufacturers and global logistics providers who seek high reliability, speed, and integrated solutions to manage massive throughput volumes efficiently.

Mechanical Palletizers Market Potential Customers

The primary customers for mechanical palletizers are high-volume manufacturing and logistics companies that require consistent, high-speed end-of-line packaging automation to manage extensive product flows. End-User/Buyers typically include major players in the Food & Beverage sector, such as large breweries, soft drink manufacturers, and canned goods producers, where the throughput rate and uniform product size make conventional mechanical palletizers the optimal choice. These customers prioritize machine speed, uptime, and the ability to maintain continuous operation across multiple shifts to meet aggressive production quotas. Their procurement decisions are often driven by Return on Investment (ROI) calculations based on labor savings and increased efficiency.

Another significant customer base resides in the Consumer Goods (Non-Durable) industry, including companies producing cleaning supplies, personal care products, and household items. Due to the increasing variety of packaging formats (SKUs), these buyers are increasingly seeking hybrid or highly flexible mechanical systems capable of fast changeovers, minimizing downtime when switching between product lines. The chemical and petrochemical industries, dealing with heavy and often hazardous materials like sacks of fertilizers or cement, are also key buyers, demanding extremely robust, high-payload mechanical systems that adhere to strict safety protocols for handling heavy loads. In this segment, the emphasis is placed on durability, safety features, and reliability under extreme operational conditions.

Furthermore, major distribution centers and third-party logistics (3PL) providers are rapidly emerging as high-potential customers, particularly those handling fulfillment for large e-commerce retailers. While traditional mechanical palletizers might be less common in highly dynamic mixed-load environments compared to robotics, dedicated 3PLs often employ mechanical systems for high-volume, uniform inbound processes or for creating standard mixed-SKU loads for specific retail chains. The purchasing decision in this sector is influenced by the system’s ability to integrate seamlessly with existing WMS/WES software, ensuring fluid data exchange and maximized warehouse efficiency, thus making IT integration capabilities a primary purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KUKA AG, ABB Ltd., Fanuc Corporation, Intelligrated (Honeywell), BEUMER Group, Premier Tech, Kawasaki Robotics, Columbia Machine Inc., A-B-C Packaging Machine Corp., Möllers Packaging Technology, Fuji Yusoki Kogyo Co. Ltd., Okura Yusoki Co., Christiaens Agro Systems, CIMATEC, Concetti S.p.A., Langen Packaging, Brenton (A Syntegon Brand), Masipack. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mechanical Palletizers Market Key Technology Landscape

The core technology in the mechanical palletizers market revolves around highly specialized material handling and controlled motion systems designed for optimal speed and precision layer deposition. A significant technological advancement is the widespread adoption of high-efficiency Servo Drive Systems coupled with advanced Programmable Logic Controllers (PLCs). Servo motors provide the necessary rapid, precise, and repeatable motion control required for high-speed layer forming, dramatically improving cycle times while minimizing energy consumption compared to older hydraulic or pneumatic systems. Modern PLCs integrate sophisticated diagnostic and networking capabilities, allowing real-time monitoring of operational parameters and enabling seamless integration with facility-wide Supervisory Control and Data Acquisition (SCADA) systems.

Layer forming technology remains the key differentiator. Conventional mechanical palletizers employ complex mechanisms such as pushers, sweep arms, apron plates, and slip-sheet insertion devices to manipulate product cases into precise layers before deposition. Recent innovations focus on soft handling techniques, crucial for fragile products, utilizing specialized product squaring and accumulation zones designed to minimize impact and prevent case damage. Furthermore, the integration of 3D Machine Vision Systems is becoming standard, offering immediate verification of case alignment, orientation, and product count before the layer is transferred onto the pallet, thereby ensuring compliance with stacking patterns and enhancing overall quality assurance.

The increasing relevance of Industry 4.0 principles is driving the integration of mechanical palletizers into the broader smart factory ecosystem. Key technologies here include IoT sensors embedded within the machine structure to collect performance data, cloud-based data analytics platforms for predictive maintenance, and standardized communication protocols (like OPC UA) for enterprise connectivity. This technological shift transforms the palletizer from an isolated machine into a networked asset, providing actionable insights into operational bottlenecks, resource utilization, and overall equipment effectiveness (OEE). The trend towards modular design also represents a technical advancement, facilitating quicker assembly, easier expansion, and flexibility in adapting the system layout to evolving manufacturing needs.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand for mechanical palletizers, influenced by local labor costs, the maturity of manufacturing infrastructure, and regulatory environments.

- Asia Pacific (APAC): Dominates the market growth trajectory due to rapid industrialization, massive investments in logistics infrastructure (driven by e-commerce), and the proliferation of low-cost manufacturing bases. Countries like China and India are experiencing a massive shift from semi-automatic to fully automatic, high-speed mechanical palletizers to manage unprecedented volumes of packaged goods, particularly in the food and consumer electronics sectors.

- North America: Characterized by high labor costs and stringent occupational safety standards, leading to extremely high demand for fully automatic, high-throughput mechanical systems. The focus here is on integration complexity, maximum uptime, and incorporating advanced diagnostic tools and remote monitoring capabilities to minimize the total cost of ownership (TCO) across large-scale distribution centers.

- Europe: A mature market focused heavily on precision engineering, energy efficiency, and adherence to strict EU safety and environmental regulations. Demand is strong for modular, compact mechanical palletizers suitable for retrofitting existing, often constrained, production spaces. Germany, France, and Italy are hubs for innovation in sustainable and efficient palletizing solutions.

- Latin America: Exhibits moderate growth, driven primarily by the modernization of food and beverage processing plants in Brazil and Mexico. The market often favors more robust, lower-technology conventional mechanical palletizers due to budget constraints and varying levels of technical maintenance expertise, though sophisticated systems are increasingly adopted in export-focused facilities.

- Middle East and Africa (MEA): Still an emerging market, with pockets of significant investment driven by infrastructure projects and the expansion of packaged food manufacturing in Gulf Cooperation Council (GCC) countries. Demand is specifically high for heavy-duty systems suited for construction materials, petrochemicals, and bottled water production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mechanical Palletizers Market.- KUKA AG

- ABB Ltd.

- Fanuc Corporation

- Intelligrated (Honeywell)

- BEUMER Group

- Premier Tech

- Kawasaki Robotics

- Columbia Machine Inc.

- A-B-C Packaging Machine Corp.

- Möllers Packaging Technology

- Fuji Yusoki Kogyo Co. Ltd.

- Okura Yusoki Co.

- Christiaens Agro Systems

- CIMATEC

- Concetti S.p.A.

- Langen Packaging

- Brenton (A Syntegon Brand)

- Masipack

Frequently Asked Questions

Analyze common user questions about the Mechanical Palletizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between low-level and high-level mechanical palletizers?

Low-level palletizers introduce products at floor level, offering easier access and maintenance, typically suited for slower or moderate throughput lines. High-level palletizers introduce products from an elevated position, providing faster cycle times and throughput, ideal for high-volume operations like beverage bottling.

How does automation impact the ROI of installing a mechanical palletizer?

Automation significantly boosts ROI by reducing reliance on manual labor, minimizing workplace injuries (lowering insurance costs), ensuring consistent pallet quality, and achieving higher production throughput rates (cases per minute), often leading to payback periods of 18 to 36 months depending on utilization.

Are robotic palletizers replacing conventional mechanical palletizers?

Robotic palletizers are gaining share in mixed-SKU, high-flexibility applications. However, conventional mechanical palletizers remain dominant and preferred for extremely high-speed, uniform product lines (like beer or soft drinks) because they often provide higher cases-per-minute throughput and lower operational complexity in dedicated applications.

What key factors should manufacturers consider when selecting a palletizer type?

Key factors include the required throughput speed (cases/bags per minute), the physical footprint available in the facility, the variety and fragility of the products being handled (SKU variability), the maximum payload requirement, and the integration compatibility with existing upstream conveyors and Warehouse Management Systems (WMS).

What role does Industry 4.0 play in modern mechanical palletizer technology?

Industry 4.0 integration allows modern mechanical palletizers to use embedded IoT sensors and connectivity features to provide real-time performance data, enabling advanced predictive maintenance, remote diagnostics, integration with ERP/SCADA systems, and optimization of Overall Equipment Effectiveness (OEE).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager