Mechanical test equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432614 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Mechanical test equipment Market Size

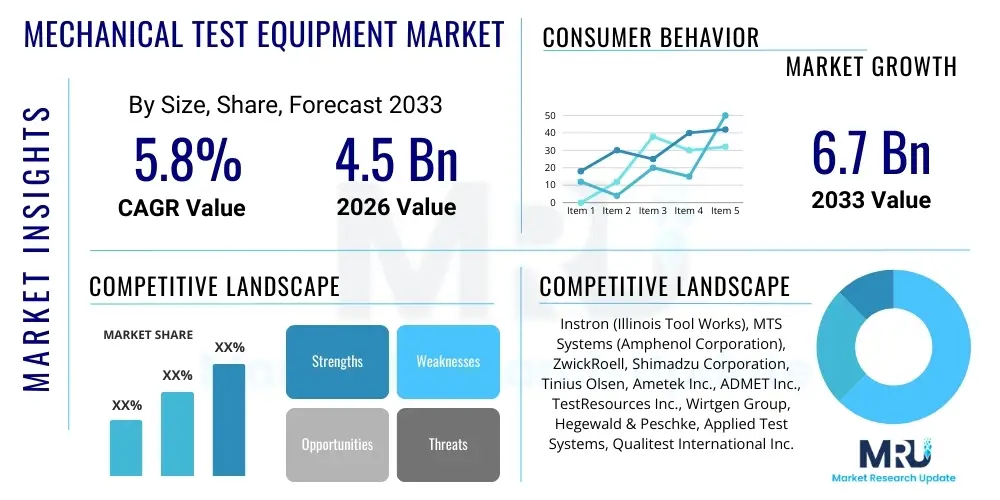

The Mechanical test equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Mechanical test equipment Market introduction

The Mechanical Test Equipment market encompasses a wide array of specialized instruments and systems designed to measure, analyze, and validate the physical properties, strength, durability, and performance of materials, components, and finished products under various mechanical stresses, including tension, compression, fatigue, impact, hardness, and torsion. This critical equipment ensures quality control, adherence to global regulatory standards (such as ASTM, ISO, and JIS), and facilitates research and development across highly regulated sectors. Key products include Universal Testing Machines (UTMs), Hardness Testers, and specialized fatigue testing systems, which are foundational tools in materials science and engineering disciplines worldwide, providing quantifiable data essential for design validation and failure prevention.

The primary applications of mechanical testing equipment span highly demanding industries such as automotive, aerospace and defense, construction, metals and manufacturing, and medical devices, where material integrity and structural reliability are paramount safety concerns. The benefits derived from utilizing this equipment are substantial, including enhanced product reliability, reduced time-to-market for new materials, minimization of warranty claims, and significant cost savings through optimized material usage and preventative design iteration. Furthermore, the rigorous testing regimes mandated by international standardization bodies drive continuous investment in advanced, higher-precision testing apparatus capable of replicating complex real-world loading scenarios.

Market growth is predominantly driven by the global surge in research and development activities focused on advanced materials, such as composites, high-strength alloys, and lightweight polymers, particularly within the electric vehicle (EV) and sustainable infrastructure sectors. Increasing regulatory requirements demanding higher safety and performance standards, coupled with the ongoing industrial push towards automation and precision manufacturing (Industry 4.0), further catalyze the demand for sophisticated, digitally integrated mechanical testing solutions that offer higher throughput and traceability.

Mechanical test equipment Market Executive Summary

The Mechanical Test Equipment market is currently undergoing a significant technological transformation, moving swiftly from traditional analog systems toward integrated digital and automated testing platforms. Key business trends indicate a strong focus on modular designs and software integration, allowing equipment manufacturers to offer scalable solutions capable of handling diverse testing protocols, essential for meeting the rapidly evolving demands of materials science. Regionally, the Asia Pacific (APAC) market, driven primarily by robust growth in automotive manufacturing (especially EVs) and infrastructure projects in China and India, is emerging as the fastest-growing geographical segment, challenging the historically dominant markets of North America and Europe. Meanwhile, regulatory standardization efforts continue to reinforce market stability globally, ensuring sustained demand for certified and traceable testing apparatus.

Segment trends reveal that the Universal Testing Machine (UTM) category remains the largest segment by revenue, attributed to its versatility across a multitude of materials and testing types. However, specialized segments such as fatigue and impact testing equipment are exhibiting higher growth rates, fueled by the development of critical components for aerospace and high-performance automotive applications where extreme durability is required. The primary end-user segment experiencing the most vigorous expansion is the automotive sector, driven by stringent safety regulations regarding vehicle crashworthiness and the need to test novel battery materials and lightweight structural components essential for EV range optimization. Service providers offering outsourced testing and calibration are also gaining traction, particularly among smaller enterprises unable to bear the high capital expenditure associated with proprietary equipment ownership.

Strategic acquisitions focusing on software and sensor technology providers are common among major players aiming to integrate Artificial Intelligence (AI) and Internet of Things (IoT) capabilities into their product offerings, enhancing predictive maintenance and data analytical features. This digitalization is paramount for maintaining competitive advantage, allowing users to move from simple material failure detection to comprehensive lifecycle prediction and simulation. The overall market outlook remains positive, underpinned by continuous global investment in infrastructure, R&D, and the pervasive need for quality assurance across all engineering disciplines.

AI Impact Analysis on Mechanical test equipment Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Mechanical Test Equipment market center on two major themes: efficiency and complexity. Users frequently ask how AI can reduce the duration and cost of testing, particularly in highly iterative R&D cycles involving composite materials. There is significant interest in AI's capacity to analyze the vast datasets generated during high-cycle fatigue tests, identifying subtle patterns indicative of material degradation that might be missed by conventional statistical methods. Key concerns revolve around data security, the reliability of AI-driven predictive failure models, and the necessary expertise required to implement and validate these complex algorithms within a traditionally mechanical engineering environment. Users are anticipating AI not just as a data processing tool, but as a system supervisor capable of autonomous test sequence generation and optimization.

AI's primary influence is transforming mechanical testing from a reactive measurement process into a proactive predictive science. Machine learning algorithms are being employed to optimize test parameters in real-time, reducing unnecessary test iterations and conserving expensive material samples. By correlating raw sensor data (strain, temperature, acoustic emissions) with final failure modes, AI models significantly enhance the precision of material characterization, accelerating the development of new alloys and polymers. Furthermore, AI contributes substantially to laboratory automation, allowing test rigs to self-calibrate, diagnose potential system faults, and manage complex test scheduling autonomously, drastically improving laboratory throughput and minimizing human error in setup and data logging procedures.

The integration of AI also addresses the growing complexity inherent in testing advanced, multi-phase materials, where performance often depends on subtle interactions between constituent elements. AI-powered digital twins allow engineers to simulate test outcomes based on limited physical testing, enabling cost-effective virtual prototyping. This shift towards predictive analytics and autonomous operation is redefining the skillset required in testing laboratories, pushing demand for engineers proficient in data science and machine learning alongside traditional materials engineering expertise, signaling a profound structural change in market service provision.

- AI enables real-time optimization of testing parameters, reducing overall testing cycle time by automating decision processes.

- Predictive maintenance algorithms utilize sensor data to forecast equipment failure, maximizing uptime and reducing unplanned maintenance costs for testing machinery.

- Machine Learning (ML) models analyze complex, high-dimensional datasets from fatigue and creep tests to predict material lifespan and failure points with higher accuracy than traditional statistical methods.

- AI facilitates the creation and validation of material digital twins, enabling extensive virtual testing and reducing reliance on costly physical prototypes.

- Autonomous test sequencing and reporting through AI integration enhance laboratory efficiency and ensure high data integrity and traceability required for regulatory compliance.

DRO & Impact Forces Of Mechanical test equipment Market

The Mechanical Test Equipment market dynamics are fundamentally shaped by a powerful interplay of regulatory enforcement, technological progress, and economic considerations. The primary drivers stem from increasingly stringent global quality and safety standards imposed by bodies like ISO, ASTM International, and specialized industry regulators, compelling manufacturers across automotive, aerospace, and medical device sectors to invest continuously in state-of-the-art testing systems. Concurrently, the burgeoning global focus on R&D for advanced, often brittle or sensitive, materials—crucial for high-efficiency components in aerospace and electric vehicles—demands specialized, high-precision testing apparatus capable of complex, multi-axial loading, thereby sustaining market demand significantly. The rapid pace of industrial digitalization and the push for Industry 4.0 integration further acts as a major driver, compelling users to upgrade to smart, networked testing solutions.

Despite robust demand, the market faces significant restraints, chiefly the extremely high initial capital expenditure required for acquiring advanced mechanical testing systems, particularly fatigue and large-scale structural testing machines. This cost barrier often limits adoption, especially among small and medium-sized enterprises (SMEs) in emerging economies, forcing them to rely on outsourced services. Furthermore, the complexity of modern testing equipment necessitates highly specialized technical personnel for operation, calibration, and data interpretation, leading to ongoing operational expenses and a skills gap challenge in many regions. The long calibration and maintenance cycles associated with high-precision equipment also contribute to operational downtime, impacting laboratory efficiency.

Opportunities for growth are concentrated in the integration of IoT, Cloud Computing, and AI, which facilitate remote monitoring, enhanced data analysis, and predictive calibration services, adding significant value and potentially offsetting high operational costs over time. The transition toward non-destructive testing (NDT) methodologies offers lucrative avenues for market expansion, complementing traditional destructive mechanical tests. The strongest impact forces currently driving market evolution are regulatory mandate and technological convergence—regulations establish the floor for required testing, while digitalization elevates the ceiling for achievable precision and efficiency, fundamentally reshaping competitive strategies and investment priorities across the industry value chain, pushing innovation toward more automated and integrated testing solutions.

Segmentation Analysis

The Mechanical Test Equipment market segmentation is crucial for understanding specific areas of growth and competitive focus, primarily categorized by the type of equipment, the material being tested, the testing mode, and the application industry. This layered structure provides granular insights into demand patterns, revealing that growth is often disproportionately high in segments supporting novel technological advancements, such as testing equipment for composite materials used in wind energy and aerospace. Analyzing these segments helps stakeholders tailor product development and market strategies to align with the fastest-growing industrial requirements, especially those driven by sustainability mandates and regulatory safety protocols.

Key equipment segments, including Universal Testing Machines (UTMs) and Hardness Testers, constitute the foundation of the market due to their broad applicability, while specialized categories like Impact Testers and Fatigue Testing Systems represent high-value, high-growth niche markets essential for component durability and certification in critical applications. Furthermore, the segmentation by end-user industries highlights the automotive sector's dominance, followed closely by the aerospace and defense sector, both of which require continuous, high-volume testing to comply with evolving performance and safety standards, making them critical investment targets for equipment manufacturers globally.

The transition toward modular equipment designs and integrated software platforms is influencing how segments are defined, moving the focus from hardware capability alone to the comprehensive data analysis and automation packages included. Manufacturers are increasingly differentiating themselves based on software interoperability and remote diagnostics capabilities, especially crucial in geographically dispersed research networks and industrial complexes. This shift suggests a future where segment value is increasingly tied to digital service provision rather than merely the physical testing apparatus itself.

- By Equipment Type:

- Universal Testing Machines (UTM)

- Hardness Testing Equipment (Rockwell, Brinell, Vickers, Knoop)

- Impact Testing Equipment (Charpy, Izod)

- Fatigue Testing Systems (High-cycle, Low-cycle, Thermo-mechanical)

- Torsion Testing Machines

- Vibration and Environmental Test Equipment

- By Application/End-User:

- Automotive & Transportation (including EV components and crash safety)

- Aerospace & Defense (structural integrity, engine components)

- Metals & Manufacturing (quality control, material grading)

- Construction & Infrastructure (concrete, rebar, structural components)

- Education & Research Institutions

- Healthcare & Medical Devices (biomaterials, implants)

- By Testing Mode:

- Destructive Testing (DT)

- Non-Destructive Testing (NDT) (though often a separate market, NDT complements mechanical testing extensively)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Mechanical test equipment Market

The value chain for mechanical test equipment starts with specialized upstream activities encompassing raw material sourcing (high-grade steel, complex sensors, and precision components) and highly technical R&D focused on advanced measurement physics, robotics, and software engineering. Original Equipment Manufacturers (OEMs) then engage in complex design and manufacturing, often requiring cleanroom conditions and rigorous internal calibration protocols to ensure the accuracy and reliability of the finished machinery. The integration of proprietary software platforms and data acquisition systems is a major value-adding step at this stage, differentiating premium providers based on usability and analytical depth, moving beyond simple hardware assembly.

The downstream segment involves highly specialized distribution channels. Due to the high-value and technical nature of the equipment, direct sales through highly trained, technically proficient sales engineers are common, ensuring that the customer receives tailored advice on installation and application-specific calibration. Indirect distribution utilizes local representatives, particularly for standardized products or in geographically dispersed emerging markets, though these partners usually require extensive training from the OEM. A critical part of the downstream value addition is the post-sales service, which includes mandated annual calibration, routine maintenance, and software updates, often representing a significant recurring revenue stream for manufacturers and specialized service providers.

The efficiency of the distribution channel is paramount, as customers often require immediate availability of spare parts and rapid technical support to minimize testing downtime. The trend towards integrated digital services, including remote diagnostics and cloud-based calibration checks, is streamlining the service aspect, potentially reducing the reliance on purely physical service visits. Overall, the value chain is characterized by high technical expertise at every stage, with increasing emphasis being placed on the software and service components that ensure compliance and maximize the operational lifespan and data utility of the expensive capital equipment.

Mechanical test equipment Market Potential Customers

The primary customers and end-users of mechanical test equipment are large-scale industrial manufacturers, specialized research and material testing laboratories, and government defense/transportation agencies that require stringent quality assurance and material validation. In the automotive sector, customers range from OEMs producing entire vehicles to Tier 1 and Tier 2 suppliers specializing in engine parts, chassis components, and new battery modules, all requiring extensive fatigue, tensile, and impact testing to meet safety certifications. Similarly, in the aerospace sector, manufacturers of airframes, jet engines, and critical structural components are mandatory users, often requiring highly customized, large-capacity testing rigs for multi-axial load simulations under extreme environmental conditions.

Beyond these heavy industries, academic and governmental research institutions represent a stable customer base, purchasing equipment primarily for fundamental materials science research, educational purposes, and the development of international standards. The construction and infrastructure sector, including concrete and steel manufacturers, requires robust equipment like compression and flexural testers to ensure structural integrity and compliance with building codes. Furthermore, the burgeoning medical device industry, particularly manufacturers of orthopedic implants and surgical instruments, utilizes advanced micro-mechanical testers to validate the durability and biocompatibility of specialized materials under simulated physiological conditions, reflecting a niche but high-growth customer segment.

A growing category of potential customers includes independent third-party testing houses and certification bodies. These organizations offer specialized testing services on a contractual basis, acting as crucial intermediaries for smaller companies or those needing independent verification. Their business model relies heavily on maintaining a portfolio of the latest, most accurate, and compliant testing machinery, making them key purchasers of cutting-edge technology, particularly automated and high-throughput systems that enhance their service delivery efficiency and credibility in a competitive outsourcing environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Instron (Illinois Tool Works), MTS Systems (Amphenol Corporation), ZwickRoell, Shimadzu Corporation, Tinius Olsen, Ametek Inc., ADMET Inc., TestResources Inc., Wirtgen Group, Hegewald & Peschke, Applied Test Systems, Qualitest International Inc., Fine Test Corporation, Torontech Group International, MATEST S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mechanical test equipment Market Key Technology Landscape

The technological landscape of the mechanical test equipment market is defined by advanced sensor integration, digitalization, and automation, moving traditional mechanical systems towards sophisticated mechatronic platforms. High-resolution, multi-axis sensors, including digital extensometers, load cells, and high-speed data acquisition systems, are critical for capturing extremely subtle material behavior under dynamic loading conditions, essential for characterizing advanced composites and nanomaterials. The convergence of mechanical components with sophisticated electrical control systems allows for precise, repeatable testing cycles and significantly reduces measurement uncertainty, driving innovation in areas like high-frequency fatigue testing and fracture mechanics analysis.

A major focus is placed on the implementation of Industry 4.0 principles, primarily through the integration of the Internet of Things (IoT) and cloud connectivity. This allows mechanical testing machines to communicate securely, sharing real-time data across decentralized organizational structures and facilitating remote monitoring, diagnostics, and calibration. This cloud-based approach not only improves operational efficiency but is also crucial for traceability and audit trails, satisfying stringent regulatory requirements in sectors like aerospace. Furthermore, advanced software solutions incorporating Material Data Management Systems (MDMS) are becoming standard, enabling seamless organization, retrieval, and analysis of vast testing datasets, essential for collaborative global R&D efforts.

The adoption of simulation and modeling technologies, particularly Digital Twins, is rapidly changing the application of physical testing. A digital twin of a material or component allows engineers to correlate physical test results with predictive virtual models, reducing the overall dependence on exhaustive, time-consuming physical tests. Robotics and advanced automation systems, including automated specimen handling and optical measurement systems, are also increasingly deployed to enhance throughput, particularly in routine quality control environments, minimizing human intervention and maximizing the utilization rate of expensive testing rigs, thereby future-proofing the technology against labor cost increases and precision requirements.

Regional Highlights

The global Mechanical Test Equipment market exhibits distinct growth patterns influenced by regional industrial maturity, regulatory environments, and investment levels in R&D and infrastructure. North America and Europe, historically the largest markets, maintain strong positions due to the presence of key industry leaders in aerospace, defense, and high-tech manufacturing, coupled with extremely rigorous regulatory frameworks (FAA, EASA, EU safety standards) that mandate continuous, high-precision testing. These regions lead in the adoption of advanced, high-cost equipment such as specialized fatigue testers and complex dynamic simulation systems, driven by sustained expenditure in materials science research and the transition to complex lightweight structures.

The Asia Pacific (APAC) region is projected to be the engine of future market expansion, exhibiting the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is underpinned by massive government investments in infrastructure development, burgeoning domestic automotive production (especially in China and India), and the aggressive expansion of electronics and general manufacturing sectors. Local manufacturers in APAC are increasingly shifting from basic quality control to advanced R&D, necessitating investment in sophisticated mechanical testing laboratories. The region’s focus on electric vehicle (EV) battery and component testing represents a particularly significant demand driver.

Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller market shares but offer significant long-term potential. LATAM growth is primarily linked to infrastructure projects and the automotive assembly sector, demanding basic to medium-complexity testing equipment. MEA, particularly the Gulf Cooperation Council (GCC) nations, shows growth tied to massive construction projects, oil and gas infrastructure expansion, and nascent domestic manufacturing initiatives, driving demand for materials testers (e.g., concrete compression testers, pipeline material fatigue analysis) that comply with international quality benchmarks.

- Asia Pacific (APAC): Characterized by high growth, driven by massive investments in infrastructure (China, India), robust expansion of the automotive sector (especially EV components), and increasing regulatory compliance enforcement in local manufacturing bases.

- North America: A mature market focused on high-technology, custom equipment for aerospace and defense, characterized by high spending on R&D and rapid adoption of AI-integrated testing solutions and advanced material characterization techniques.

- Europe: Strong demand driven by stringent EU safety and environmental regulations, particularly in the automotive and medical device sectors; emphasis on standardization and digitalization (Industry 4.0) of testing workflows.

- Latin America (LATAM): Growth tied to recovering construction and mining sectors, requiring reliable and rugged testing equipment for basic material strength and quality control, often relying on global imports.

- Middle East and Africa (MEA): Demand is localized and concentrated around major infrastructure projects, oil and gas industry components, and defense spending, prioritizing equipment that ensures critical material reliability in extreme environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mechanical test equipment Market.- Instron (Illinois Tool Works)

- MTS Systems (Amphenol Corporation)

- ZwickRoell

- Shimadzu Corporation

- Tinius Olsen

- Ametek Inc.

- Sintech (MTS Systems)

- ADMET Inc.

- TestResources Inc.

- Wirtgen Group (Controls Testing Equipment)

- Hegewald & Peschke

- Applied Test Systems (ATS)

- Qualitest International Inc.

- Fine Test Corporation

- Torontech Group International

- Matest S.p.A.

- Laizhou Lai Hua Test Instrument Co., Ltd.

- Sakae Testing Machine Co., Ltd.

- Doli Elektronik GmbH

- Saraswathi Engineers

Frequently Asked Questions

Analyze common user questions about the Mechanical test equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Mechanical Test Equipment Market?

Market growth is primarily driven by increasingly strict global safety and quality regulations (ASTM, ISO), coupled with substantial global investment in R&D for advanced materials like composites and high-strength alloys, particularly within the automotive and aerospace industries.

How is Industry 4.0 impacting mechanical testing methodologies?

Industry 4.0 facilitates the integration of IoT sensors, cloud connectivity, and AI into testing equipment, enabling higher automation, remote monitoring, predictive maintenance, and sophisticated real-time data analysis, significantly improving throughput and data traceability.

Which geographical region exhibits the fastest market expansion for this equipment?

The Asia Pacific (APAC) region, spearheaded by China and India, is the fastest-growing market due to rapid industrialization, large-scale infrastructure spending, and robust growth in automotive manufacturing, particularly the electric vehicle component testing segment.

What is the most significant restraint challenging market growth?

The most significant restraint is the high initial capital expenditure required to purchase advanced, high-precision mechanical testing systems, which poses a considerable financial barrier for smaller enterprises and mandates higher operational costs for technical labor.

What role do Universal Testing Machines (UTM) play in the overall market?

UTMs represent the foundational and largest equipment segment by revenue due to their versatility in performing essential tension, compression, and flexural tests on a vast range of materials (metals, polymers, composites), making them indispensable across nearly all end-user industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager