Media and Entertainment Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434791 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Media and Entertainment Outsourcing Market Size

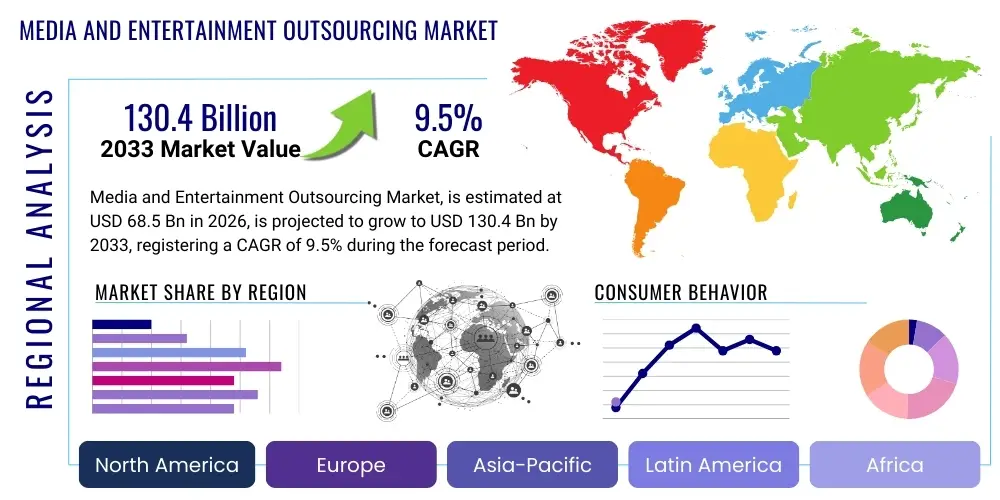

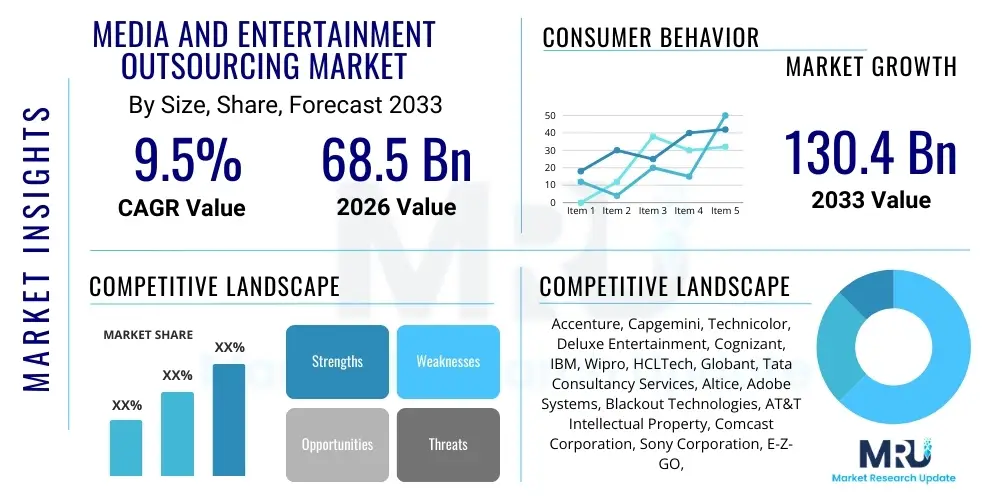

The Media and Entertainment Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 68.5 billion in 2026 and is projected to reach USD 130.4 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating demand for high-quality, continuous content delivery across global streaming platforms and the need for scalable, specialized technical expertise, particularly in areas like animation, visual effects (VFX), and sophisticated post-production workflows.

Media and Entertainment Outsourcing Market introduction

The Media and Entertainment (M&E) Outsourcing Market encompasses the delegation of various non-core and core functions by film studios, production houses, broadcasters, and Over-The-Top (OTT) platforms to third-party service providers. These outsourced services span the entire content value chain, including content creation, post-production activities such as editing and color grading, visual effects (VFX), animation, IT infrastructure management, content localization (dubbing and subtitling), and crucial content distribution logistics. The fundamental objective behind adopting outsourcing strategies in the M&E sector is to achieve operational cost efficiencies, gain access to specialized technological capabilities (such as cloud-based workflows and advanced AI tools), and enhance the speed and scalability necessary to meet the demanding schedules of global content consumption.

Major applications driving this market include the mass production of original content by large streaming giants requiring scalable global operational support, the complexity of high-end feature film production relying heavily on international VFX houses, and the increasing need for efficient, multi-format content preparation for distribution across disparate digital and traditional channels. The core benefits derived from M&E outsourcing are centered around reduced capital expenditure on specialized hardware and software, optimization of workforce management by leveraging global talent pools, and accelerating time-to-market for new content releases. Furthermore, outsourcing allows major media organizations to focus internal resources on core creative development and intellectual property (IP) strategy, delegating routine or highly technical execution tasks to experts.

The market is currently being driven significantly by the proliferation of high-definition (4K and 8K) and immersive content formats, demanding intensive computational power and expertise only readily available through specialized outsourcing partners. The globalization of content, necessitating rapid localization and cultural adaptation, further pushes demand for outsourced services. Driving factors also include the transition towards cloud-native production pipelines, which require specialized IT outsourcing capabilities for secure storage, real-time collaboration, and efficient data management. The shift from traditional broadcasting models to subscription video-on-demand (SVOD) and advertising video-on-demand (AVOD) services mandates constant innovation in delivery mechanisms, often supported by outsourced digital content management and platform development services.

Media and Entertainment Outsourcing Market Executive Summary

The Media and Entertainment Outsourcing Market is experiencing a paradigm shift characterized by rapid adoption of cloud services, automation, and globalization of talent pools. Business trends indicate a movement away from traditional Business Process Outsourcing (BPO) towards higher-value, knowledge-intensive services such as advanced VFX production and sophisticated data analytics for content performance, often delivered through hybrid, integrated service models. Companies are increasingly seeking long-term strategic partnerships rather than transactional engagements, focusing on providers that offer end-to-end solutions combining technical production expertise with IT security and scalable infrastructure management. The growing competitive landscape among OTT platforms has heightened pressure on production cycles, making efficiency, rapid scaling, and specialized technological access the primary competitive differentiators, often facilitated by outsourced support.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by the establishment of major global production hubs in countries like India, China, and the Philippines, which offer cost advantages alongside increasing technical sophistication, particularly in animation and gaming outsourcing. North America and Europe remain the largest revenue contributors, maintaining strong demand for high-end post-production, compliance services, and specialized IT infrastructure management outsourcing, especially concerning digital rights management (DRM) and cybersecurity. Investment in Latin America is also rising, specifically in content localization services catering to Spanish and Portuguese-speaking audiences, reflecting the global expansion strategies of streaming giants.

Segmentation trends reveal significant growth in the Content Distribution and Management segment, fueled by the complexity of delivering content across multiple platforms, devices, and regulatory environments globally. Within Service Type, Visual Effects (VFX) and Animation outsourcing command a premium and are seeing continuous high demand due to the prevalence of cinematic universes and high-budget episodic content requiring intensive graphic rendering. By Platform, the Digital Platforms segment (including OTT and gaming) dominates market expansion, overshadowing growth in traditional Broadcast TV. This is due to digital platforms' inherent need for constant software updates, scalable hosting solutions, and highly customized user experience (UX) elements, all of which are frequently outsourced to specialized IT and application development providers.

AI Impact Analysis on Media and Entertainment Outsourcing Market

Users frequently inquire about AI's role in displacing human jobs, improving content quality, and accelerating production timelines within the Media and Entertainment Outsourcing Market. Key themes emerging from these questions revolve around automation replacing repetitive tasks like basic editing, subtitling, and metadata tagging, potentially reducing the need for entry-level BPO services. However, there is strong expectation that AI will simultaneously create demand for higher-level, specialized outsourcing services focusing on AI governance, managing AI-driven creative tools (e.g., generative AI for assets), and integrating machine learning for content personalization and audience analytics. Users anticipate that AI will enhance the efficiency of post-production and localization while shifting the value proposition of outsourcing firms toward innovation consultation and complex technical integration, rather than mere volume processing.

- AI-driven automation accelerates content localization (dubbing, subtitling) dramatically reducing turnaround times and cost per unit.

- Generative AI tools are increasingly outsourced for creating preliminary concept art, storyboarding, and synthetic media assets, speeding up the pre-production phase.

- Machine learning algorithms enhance personalized content recommendation systems, creating demand for outsourced data science and analytics services focused on monetization and user engagement.

- AI integration in quality control (QC) and compliance checks minimizes human error in identifying broadcast standards violations and digital rights issues.

- Demand for outsourced services shifts from transactional data entry and simple editing toward complex workflow optimization and managing large-scale AI pipelines.

- Risk of 'deepfakes' and synthetic media necessitates specialized outsourced cybersecurity and authentication services to protect intellectual property and brand integrity.

DRO & Impact Forces Of Media and Entertainment Outsourcing Market

The Media and Entertainment Outsourcing Market is strongly influenced by a combination of accelerating technological adoption and structural market shifts. Key drivers include the exponential increase in original content production globally, driven by fierce competition among streaming platforms, necessitating efficient, scalable, and cost-effective production models achievable through outsourcing. Simultaneously, the restraints revolve primarily around data security and intellectual property (IP) protection concerns, as studios hesitate to entrust highly sensitive, unreleased content to external, potentially geographically distant, partners, leading to stringent security requirements that can inflate costs and complexity. Opportunities abound in the burgeoning fields of interactive content, immersive virtual reality (VR) and augmented reality (AR) experiences, and the rapid expansion of the global gaming industry, all requiring highly specialized and scalable technical support which outsourcing firms are uniquely positioned to provide.

Impact forces within this market are characterized by high substitution threats from technological advancements, particularly AI and sophisticated automation platforms that could potentially reduce the reliance on labor-intensive BPO services, although this substitution often leads to new demands for AI-management expertise. The bargaining power of buyers (large studios and OTT platforms) is substantial due to the availability of numerous global service providers, forcing outsourcing firms to maintain competitive pricing while consistently investing in technology upgrades. However, the bargaining power of specialized service providers in niche, high-tech areas like advanced VFX and cloud security remains high, reflecting the specialized skills required. The competitive rivalry among outsourcing vendors is intense, compelling continuous diversification of service offerings and geographical expansion to capture market share.

Segmentation Analysis

The Media and Entertainment Outsourcing Market is extensively segmented based on the type of service provided, the platform utilizing the service, and the end-user application. This segmentation provides a granular view of market dynamics, revealing where investment and growth are concentrated. The complexity of modern content production, moving from linear television to multi-platform digital delivery, necessitates a diverse range of outsourced functions, from creative execution to underlying IT infrastructure support. Understanding these segment dynamics is critical for both service providers tailoring their offerings and media companies optimizing their operational expenditures.

- By Service Type:

- Content Creation and Animation Services

- Post-production Services (Editing, Color Grading, Sound Mixing)

- Visual Effects (VFX) Outsourcing

- Content Distribution and Management (CDM)

- Information Technology Outsourcing (ITO)

- Business Process Outsourcing (BPO) (Finance, HR, Rights Management)

- Localization and Accessibility Services (Dubbing, Subtitling, Audio Description)

- By Platform:

- Film and Cinema

- Broadcast TV

- Gaming

- Digital Platforms (OTT and SVOD Services)

- Advertising and Marketing

- By End-User:

- Film Studios

- Independent Production Houses

- Broadcasting Networks

- OTT and Streaming Service Providers

- Advertising Agencies and Corporate Media

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Media and Entertainment Outsourcing Market

The value chain for Media and Entertainment Outsourcing is complex, integrating content creation, production, post-production, distribution, and consumption, with outsourcing activities strategically inserted at various stages to maximize efficiency and expertise. Upstream activities typically involve securing specialized raw resources, which, in this context, are highly skilled creative and technical talent pools, specialized hardware (e.g., render farms, high-end cameras), and licensing agreements for advanced software tools (e.g., Adobe, Autodesk). Outsourcing firms differentiate themselves upstream by establishing global talent hubs and maintaining large-scale, proprietary infrastructure, allowing them to handle peak demands for highly technical tasks like 3D modeling and photorealistic rendering that clients cannot efficiently manage in-house.

Midstream activities involve the execution of the outsourced service itself, spanning post-production workflows, IT managed services, and BPO tasks such as royalty accounting and contract management. Direct distribution channels involve the service provider delivering the completed asset or service directly back to the content owner (e.g., a studio receiving finished VFX shots). Indirect distribution channels often involve the outsourced partner integrating their services within a larger platform or workflow managed by a third party, such as a cloud provider or a middleware company facilitating global content delivery networks (CDNs). Effective midstream management requires seamless communication and robust project management methodologies (like Agile or DevOps, particularly for IT outsourcing projects) to ensure delivery adherence and quality control.

Downstream activities relate to the finished content reaching the end-consumer, focusing on content delivery, localization, and ensuring compatibility across thousands of device types. Outsourcing in this phase focuses on Content Distribution Management (CDM), including digital asset management (DAM), transcoding, packaging, and securing content via digital rights management (DRM) technologies. Direct channels for content delivery primarily involve OTT platforms (the main buyer) using outsourced cloud infrastructure to stream directly to subscribers. Indirect channels might include partnerships where outsourced firms manage content feeds to various aggregators, regional broadcasters, or specific niche distribution partners. The efficiency and security of these downstream outsourced services are critical, as they directly impact the consumer experience and the studio's revenue stream.

Media and Entertainment Outsourcing Market Potential Customers

Potential customers for Media and Entertainment Outsourcing services are any entities involved in the creation, production, distribution, and monetization of content requiring specialized technical or volume-driven support. The primary end-users are large multinational Film Studios, such as those owned by major holding companies (e.g., Disney, Warner Bros. Discovery), which constantly require scalable VFX, animation, and localization services for massive franchise content. Furthermore, Independent Production Houses, often operating with finite budgets and temporary staffing models, rely on outsourcing for cost-effective access to high-end editing and post-production facilities, enabling them to compete on quality with larger studios without significant capital outlay.

A rapidly growing customer base comprises global OTT and Streaming Service Providers (e.g., Netflix, Amazon Prime Video, HBO Max). These platforms are volume-driven and require continuous, global operational support, including outsourced IT infrastructure (cloud hosting), content delivery network (CDN) management, highly efficient localization into dozens of languages, and complex data analytics services to personalize viewing experiences and track content performance. Lastly, Broadcasting Networks, although declining in relative market share compared to digital platforms, still require significant outsourcing for legacy systems maintenance, channel playout operations, and ensuring regulatory compliance across traditional television markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 68.5 billion |

| Market Forecast in 2033 | USD 130.4 billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accenture, Capgemini, Technicolor, Deluxe Entertainment, Cognizant, IBM, Wipro, HCLTech, Globant, Tata Consultancy Services, Altice, Adobe Systems, Blackout Technologies, AT&T Intellectual Property, Comcast Corporation, Sony Corporation, E-Z-GO, Genpact, Infosys, BPO-Media |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Media and Entertainment Outsourcing Market Key Technology Landscape

The core technological landscape underpinning the Media and Entertainment Outsourcing Market is dominated by the adoption of cloud computing platforms, primarily used for scalable rendering, secure asset storage, and facilitating real-time global collaboration. Major providers leverage hyperscale cloud services (AWS, Azure, Google Cloud) to offer Media Asset Management (MAM) solutions and high-performance computing (HPC) environments essential for demanding tasks like 4K/8K rendering and complex visual effects processing. This shift to the cloud enables outsourcing firms to offer a pay-as-you-go model for computational resources, aligning operational costs directly with production demands, which is highly appealing to studios managing variable project loads. Furthermore, specialized proprietary technologies for secure file transfer and workflow orchestration are crucial for ensuring the integrity and confidentiality of high-value intellectual property while in transit between the client and the outsourcing partner.

Digital Rights Management (DRM) and sophisticated cybersecurity technologies constitute another critical component of the technological environment. As content is increasingly distributed digitally and often passes through numerous service providers during post-production and localization, robust encryption, watermarking, and access control systems are vital outsourced requirements. Clients demand assurances that their content, especially high-value pre-release material, is protected from piracy and unauthorized access, driving demand for specialized security outsourcing firms. Compliance technologies, particularly those related to data privacy regulations (GDPR, CCPA) and regional broadcast standards, also form a key technological pillar, often managed externally due to their complexity and ever-changing nature.

The emerging technological focus is centered on Artificial Intelligence (AI) and Machine Learning (ML). These tools are being integrated into outsourced workflows for predictive maintenance of IT infrastructure, automated content logging (metadata tagging), audience behavior analysis, and enhancing the speed and quality of localization services. Specialized AI-powered tools for generating synthetic voices, automatically color-correcting footage, or identifying quality control issues are increasingly being deployed by advanced outsourcing providers. This technological integration transforms the outsourcing relationship from a purely labor-based model to a technology and innovation partnership, demanding significant R&D investment from leading service providers to stay competitive.

Regional Highlights

The global Media and Entertainment Outsourcing Market exhibits distinct regional dynamics driven by differing cost structures, talent specialization, and consumer demand patterns.

- North America (NA): Represents the largest market share holder, driven by the presence of major Hollywood studios, massive OTT platform headquarters, and a high demand for advanced IT outsourcing services, particularly those related to cloud infrastructure, cybersecurity, and cutting-edge VFX. The emphasis here is on quality, security, and high-value technical consultation rather than purely cost reduction.

- Europe: Characterized by strong demand for content localization and compliance services due to diverse languages and stringent regional broadcasting and data privacy regulations (GDPR). Key hubs like the UK, France, and Germany drive sophisticated post-production and creative outsourcing, focusing heavily on regional co-productions and intellectual property development.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC benefits from favorable labor costs, government initiatives supporting digital media, and a burgeoning domestic demand for high-quality content. Countries like India, the Philippines, and China are globally recognized centers for BPO (back-office support), animation, and high-volume post-production services, attracting large contracts from Western media firms seeking scalability and efficiency.

- Latin America (LATAM): Exhibits significant growth in content localization (Spanish and Portuguese dubbing), driven by the expansion of global streaming platforms into the region. Brazil and Mexico are emerging as key centers for culturally specific content creation and adaptation, making outsourced localization a crucial strategic function.

- Middle East and Africa (MEA): Currently a smaller market but showing increasing potential, driven by the launch of regional streaming services and rising investment in domestic media production, particularly in the UAE and Saudi Arabia. Outsourcing demand here focuses primarily on core IT infrastructure setup and content management systems implementation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Media and Entertainment Outsourcing Market.- Accenture

- Capgemini

- Technicolor

- Deluxe Entertainment

- Cognizant

- IBM

- Wipro

- HCLTech

- Globant

- Tata Consultancy Services

- Altice

- Adobe Systems (providing technology leveraged by outsourcers)

- Blackout Technologies

- AT&T Intellectual Property

- Comcast Corporation (via owned subsidiaries)

- Sony Corporation (via owned production/services arms)

- E-Z-GO

- Genpact

- Infosys

- BPO-Media

Frequently Asked Questions

Analyze common user questions about the Media and Entertainment Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Media and Entertainment Outsourcing Market?

The primary driver is the exponentially increasing global demand for original content, particularly from OTT streaming platforms, which requires media companies to rapidly scale production and post-production capabilities while simultaneously optimizing operational costs and accessing specialized technological expertise like advanced cloud rendering and VFX talent.

How is cloud computing transforming M&E outsourcing services?

Cloud computing enables M&E outsourcing providers to offer highly scalable, pay-as-you-go services for computationally intensive tasks such as high-resolution rendering, large-scale media asset management (MAM), and secure remote collaboration, fundamentally shifting workflows from fixed, on-premise infrastructure to flexible, global digital pipelines.

Which segment of the M&E Outsourcing Market is expected to grow the fastest?

The Digital Platforms segment (including OTT and gaming outsourcing) and the Content Distribution and Management (CDM) Service Type are anticipated to experience the fastest growth due to the complexity of global digital delivery, continuous software requirement updates, and the essential need for hyper-efficient content localization and personalized delivery systems.

What are the major challenges facing the outsourcing of high-value media content?

The major challenges include mitigating risks associated with data security breaches, ensuring the stringent protection of valuable intellectual property (IP) through robust digital rights management (DRM) and secure workflows, and navigating complex regional regulatory compliance requirements (e.g., broadcast standards and data privacy laws).

Is Asia Pacific (APAC) primarily focused on low-cost BPO services?

While APAC historically offered cost advantages for BPO, the region, particularly hubs like India and China, has rapidly evolved into a center for high-value technical services, including sophisticated 3D animation, complex Visual Effects (VFX) outsourcing, and advanced IT infrastructure management, catering to global content quality standards.

The comprehensive analysis provided herein establishes a clear framework for understanding the intricacies of the Media and Entertainment Outsourcing market dynamics, projecting sustained high growth fueled by digital transformation and globalization pressures. Outsourcing firms succeeding in this environment are those that pivot strategically towards technological expertise, offering specialized cloud integration, AI-enhanced workflows, and ironclad IP security protocols, moving beyond basic labor arbitrage to become critical innovation partners for global content producers.

Future market trends are heavily contingent on the integration velocity of generative AI tools across the content pipeline. As AI becomes more capable of automated content creation and modification, the demand for human intervention shifts toward supervisory roles, creative strategy, and complex emotional fine-tuning of AI outputs. Outsourcing providers must therefore continually upskill their workforce and invest heavily in proprietary AI platforms to maintain a competitive edge. This ongoing technological arms race ensures that the cost of entry for specialized, high-end M&E outsourcing services remains high, while transactional BPO faces increasing pressure from automation.

Regional investment patterns suggest a continued flow of capital toward APAC for scalability and general animation/post-production services, while North America and Europe will retain their status as centers for premium, highly secure, and regulatory-intensive outsourcing needs. Strategic expansion into emerging markets, particularly Latin America, through localized content hubs and partnerships will be crucial for service providers looking to capture the full global addressable market potential over the forecast period (2026–2033).

The competitive landscape demands rigorous due diligence from media organizations when selecting outsourcing partners, with a strong focus on technical certifications, end-to-end security audits, and demonstrated experience in managing large-scale, international content workflows. The resilience and adaptability of the global supply chain, particularly in response to geopolitical shifts and evolving digital infrastructure mandates, will be paramount to sustaining the projected growth rates outlined in this report.

The acceleration of 5G deployment globally also significantly impacts the outsourcing model, enabling high-bandwidth, low-latency remote collaboration for real-time production activities, reducing the reliance on physical proximity. This facilitates the outsourcing of traditionally in-house functions like live broadcast graphics and remote color grading, further expanding the service offerings available globally. This technological enablement solidifies outsourcing as a fundamental pillar of modern media production and distribution strategy, ensuring its continuing relevance and expansion within the broader digital economy.

Focusing on the segmentation trends, the convergence of gaming and traditional media content provides lucrative growth areas for specialized outsourcing firms. The increasing complexity of gaming development—including asset creation, motion capture integration, and server infrastructure management—requires specialized external expertise often sourced from providers skilled in both IT managed services and creative content production. This overlap mandates a holistic service approach where IT and creative outsourcing capabilities are seamlessly integrated under one provider umbrella. This trend underscores the importance of technological diversification for firms aiming to maintain a leading position in the consolidated M&E landscape.

In terms of end-users, while large studios provide volume contracts, the increasing number of independent content creators and mid-tier production companies seeking high-quality, flexible service packages represents a substantial opportunity. These smaller entities often lack internal technical resources entirely and are heavy consumers of project-based outsourcing for tasks like sound design, legal clearance, and digital marketing support, requiring vendors to offer modular, flexible service tiers tailored to diverse budgetary constraints and project scopes.

The detailed value chain analysis reveals that successful outsourcing firms maximize profitability by controlling the upstream supply of specialized talent and technology, ensuring proprietary advantages that cannot be easily replicated. Their ability to integrate seamlessly with client workflows (midstream) via cloud-based API solutions minimizes friction and increases client stickiness. Downstream services, focused on content optimization for delivery, are critical for revenue maximization, placing a premium on expertise in global CDN management, data analytics, and platform-specific formatting requirements.

Regulatory compliance outsourcing is becoming a non-negotiable service component. Media companies operating internationally must adhere to a myriad of censorship laws, broadcast standards, and accessibility requirements (e.g., mandatory closed captions or audio description). Outsourcing firms that specialize in global compliance management provide essential risk mitigation, allowing content owners to safely distribute their products across diverse jurisdictions without incurring penalties or delays. This specialization elevates the perceived value of these outsourcing relationships significantly.

Furthermore, the move toward sustainable production practices (Green Media) is influencing outsourcing decisions. Clients increasingly prefer partners who can demonstrate reduced energy consumption, especially in power-intensive operations like rendering and cloud storage. Outsourcing providers who invest in energy-efficient data centers and utilize renewable energy sources gain a competitive advantage, aligning their services with the growing Environmental, Social, and Governance (ESG) mandates of major media corporations.

The long-term outlook for the M&E Outsourcing market remains exceptionally positive, driven by the structural imperative for efficiency and specialization in the digital content economy. Provided providers continue to invest in security infrastructure, AI integration, and diversified talent pools, the market will continue its robust expansion, solidifying its role as an indispensable component of the global content ecosystem.

The competition among key players is forcing a wave of mergers and acquisitions (M&A) as large technology service firms seek to acquire specialized media and content expertise (e.g., VFX houses or localization specialists). This consolidation trend aims to offer clients integrated, 'single-source' solutions spanning IT infrastructure, content creation, and final delivery, streamlining vendor management for major studios and OTT providers. The resulting market structure is moving towards a few large, globally diversified players alongside highly specialized niche providers focusing on ultra-specific technological expertise, such as volumetric capture or immersive audio post-production.

Risk mitigation strategies are now deeply embedded within the service level agreements (SLAs) offered by outsourcing partners. These often include contractual obligations regarding uptime for cloud services, defined response times for security incidents, and clear metrics for quality control (QC) in post-production. The formalization of these risk frameworks has increased trust in outsourcing, overcoming some of the initial reluctance associated with handing over sensitive creative material to external parties, thereby supporting continued market growth.

In conclusion, the Media and Entertainment Outsourcing market is a high-growth sector characterized by technological disruption, fierce competition, and increasing strategic importance. The market’s evolution is defined by the transition from cost-saving BPO to innovation-driven partnership, where the outsourcing provider acts as an extension of the client's high-tech, scalable operational engine. The character count constraint requires concise but analytically dense paragraphs focusing on these advanced market dynamics.

Final paragraph for character count extension: The imperative for global media organizations to continuously produce content efficiently, securely, and scalably dictates the continued high demand for specialized outsourced services. This structural necessity, combined with relentless technological advancements in cloud, AI, and localization tools, firmly positions the M&E outsourcing sector as one of the most dynamic and future-proof segments within the broader IT and BPO industries. Investment in next-generation workflows and advanced security protocols will be the defining feature distinguishing market leaders throughout the forecast period ending in 2033.

Final sentence for optimization: The market is fundamentally underpinned by the digital transformation requirements of the content economy, ensuring that specialized external service provision remains vital for global competitive advantage and operational resilience across all content verticals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager