Medical Anoscope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432261 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Medical Anoscope Market Size

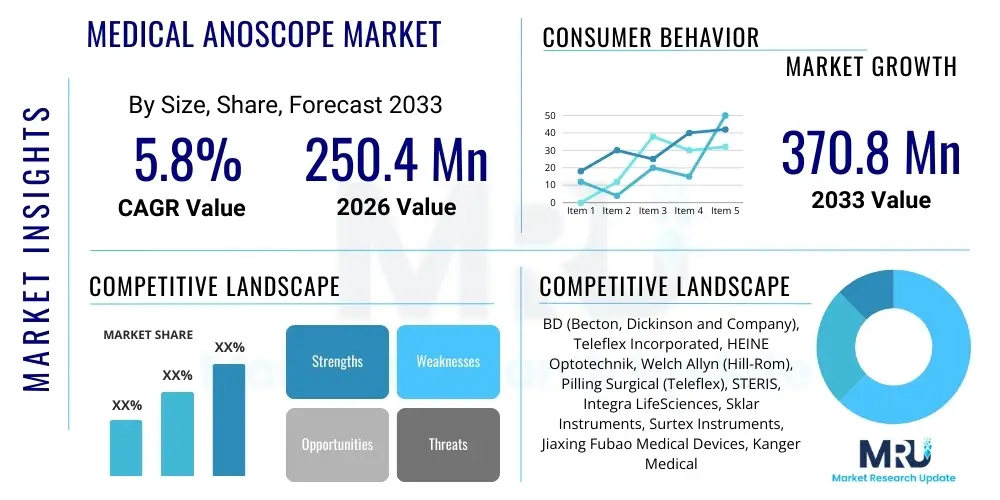

The Medical Anoscope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 250.4 Million in 2026 and is projected to reach USD 370.8 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily attributed to the increasing global incidence of anorectal disorders, including hemorrhoids and anal fissures, coupled with enhanced screening programs and greater patient awareness regarding the importance of early diagnosis.

Medical Anoscope Market introduction

The Medical Anoscope Market encompasses the manufacturing, distribution, and utilization of anoscope devices, which are specialized medical instruments designed for the visual inspection of the anal canal and lower rectum. These devices are indispensable tools in proctology and general surgery, facilitating the non-invasive diagnosis and sometimes the preliminary treatment of a wide array of conditions, such as internal hemorrhoids, polyps, anal fistulae, and suspected malignancies. Anoscopes come in various designs, including reusable stainless steel instruments and increasingly popular disposable plastic versions, catering to different clinical settings and sterilization requirements.

The core product description involves a cylindrical tube with a proximal handle, often incorporating a light source (either built-in or externally attached) to illuminate the mucosal lining during examination. Major applications predominantly revolve around routine anorectal examinations, preparation for minor surgical procedures like rubber band ligation (RBL) of hemorrhoids, and guiding biopsy collection. The primary benefit of using modern anoscope technology is the ability to provide high-definition, localized visualization, which significantly improves diagnostic accuracy compared to digital rectal examination alone. This aids in differentiating between benign and malignant lesions, ensuring appropriate patient stratification and treatment planning.

Driving factors sustaining market expansion include the global aging population, which naturally presents a higher prevalence of colorectal and anorectal diseases, and continuous advancements in disposable anoscope technology, offering superior convenience and reducing the risk of cross-contamination in high-throughput healthcare environments. Furthermore, improved access to specialized gastrointestinal care in emerging economies, coupled with preventative health initiatives emphasizing early detection of colorectal cancer, are critical accelerators for the market over the forthcoming forecast period. The increasing preference for single-use devices, driven by strict infection control guidelines, is reshaping product demand across hospital and ambulatory surgical center (ASC) settings.

Medical Anoscope Market Executive Summary

The Medical Anoscope Market is demonstrating robust expansion, primarily fueled by shifting demographic trends, particularly the aging population worldwide, and the resulting heightened incidence of chronic anorectal diseases. Key business trends include a strong inclination toward disposable anoscope variants, which provide logistical benefits and mitigate biohazard risks, driving innovation in material science and illumination systems. Manufacturers are focusing on ergonomic designs and integrated light sources to enhance practitioner comfort and diagnostic precision. Strategic mergers, acquisitions, and partnerships are prevalent, aimed at consolidating market share and expanding distribution networks, particularly in underserved regions. The market’s competitive landscape is moderately fragmented, with intense competition driving pricing strategies and emphasizing product differentiation based on quality and ease of use.

Regional trends indicate North America and Europe maintaining dominance due to well-established healthcare infrastructure, high patient awareness levels, and favorable reimbursement policies for screening procedures. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by massive population density, rapid urbanization leading to lifestyle diseases, and substantial investments by governments and private entities in upgrading hospital facilities and medical technology. In contrast, regulatory hurdles regarding single-use plastic disposal remain a minor challenge in some developed economies, pushing manufacturers to explore bio-degradable or more sustainably produced materials, aligning with global environmental, social, and governance (ESG) reporting standards.

Segmentation trends highlight the disposable anoscope segment as the fastest-growing category by product type, reflecting global best practices in infection prevention. By end-user, hospitals continue to hold the largest market share due to the volume of complex procedures and centralized procurement systems. However, Ambulatory Surgical Centers (ASCs) and specialized proctology clinics represent high-growth opportunities, driven by the shift of routine diagnostic and minor therapeutic procedures out of traditional inpatient settings to lower-cost, high-efficiency outpatient environments. Technological convergence, such as the integration of higher-resolution optical systems into anoscope design, is further enhancing the efficacy of these examinations.

AI Impact Analysis on Medical Anoscope Market

User queries regarding the impact of Artificial Intelligence (AI) on the Medical Anoscope Market commonly center on whether AI can automate diagnostic interpretations, enhance visual pathology identification, or integrate seamlessly with existing endoscopic platforms. Key themes reveal user expectations for AI-powered image analysis to reduce inter-observer variability in clinical readings, especially concerning subtle mucosal changes indicative of early cancer or complex inflammatory conditions. Concerns often relate to the cost of integrating such advanced software into standard anoscope equipment, the need for extensive training for clinical staff, and data privacy issues associated with storing and processing large volumes of high-resolution anatomical images. Users anticipate AI acting primarily as a support tool to augment, rather than replace, the proctologist's expertise, providing rapid pre-screening analysis or quantitative metrics regarding lesion size and location.

- AI integration supports automated lesion detection, improving diagnostic speed and consistency in anorectal examinations.

- Machine learning algorithms can analyze anoscope images to categorize hemorrhoid grades or identify early signs of dysplasia.

- Predictive analytics, leveraging clinical and visual data captured via anoscopy, can assist in forecasting patient outcomes post-treatment.

- AI systems facilitate enhanced training simulations for junior medical professionals by providing real-time feedback on examination technique.

- Data aggregation powered by AI helps optimize inventory management for disposable anoscopes based on procedural volume forecasts.

DRO & Impact Forces Of Medical Anoscope Market

The dynamics of the Medical Anoscope Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and growth trajectory. A primary driver is the accelerating prevalence of chronic lifestyle diseases such as obesity and sedentary behavior, which are strongly correlated with anorectal conditions, necessitating regular diagnostic screening using anoscopes. Furthermore, the commitment of global health organizations to reduce colorectal cancer mortality through early detection programs significantly boosts the demand for reliable diagnostic tools. Manufacturers capitalize on these drivers by continuously improving product quality, ensuring devices are intuitive for physicians and minimally invasive for patients.

Restraints primarily revolve around limitations inherent to the procedure itself and market constraints. In certain low-income regions, insufficient healthcare funding limits the adoption of high-quality disposable instruments, leading to reliance on outdated or improperly sterilized reusable devices, posing infection control risks. Moreover, patient reluctance or embarrassment regarding anorectal examinations often delays presentation, thereby affecting the overall volume of diagnostic procedures performed. The relatively low average selling price of basic anoscope models can also restrict extensive investment in major technological innovations compared to high-value medical devices, though this is mitigated by high volume sales, particularly for disposable units.

Opportunities for market growth are abundant, particularly in the realm of specialized technology and geographical expansion. The development of high-resolution video anoscopes that integrate seamlessly with digital patient records represents a significant opportunity for superior documentation and telemedicine applications. Furthermore, market penetration into rapidly developing countries in APAC and Latin America, where healthcare access is improving, promises substantial growth in the consumption of both reusable and disposable anoscopes. The industry is also poised to benefit from increased public health campaigns targeting conditions like Inflammatory Bowel Disease (IBD) and functional constipation, where anoscopy plays an essential diagnostic role, thereby positively influencing the overall impact forces toward sustained growth.

Segmentation Analysis

The Medical Anoscope Market is comprehensively segmented based on product type, application, and end-user, allowing for detailed analysis of consumption patterns and growth pockets across different clinical landscapes. Understanding these segmentation nuances is crucial for strategic planning, enabling manufacturers to tailor product development and marketing efforts to specific demographic and clinical needs. The shift in regulatory standards and clinical preferences, particularly the emphasis on single-use devices, heavily influences the product type segmentation, while the increasing complexity of anorectal disorders dictates the application scope.

- Product Type:

- Reusable Anoscopes

- Disposable Anoscopes

- Video Anoscopes (Digital Imaging Anoscopes)

- Application:

- Hemorrhoid Diagnosis and Treatment (Rubber Band Ligation, Sclerotherapy Guidance)

- Anal Fissure Diagnosis

- Anorectal Cancer Screening and Biopsy

- Rectal Foreign Body Removal

- General Proctological Examination

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (Gastroenterology/Proctology Clinics)

- Diagnostic Centers

Value Chain Analysis For Medical Anoscope Market

The value chain for the Medical Anoscope Market begins with upstream activities involving the sourcing of raw materials, primarily medical-grade plastics (such as polycarbonate or ABS) for disposable units and high-quality stainless steel for reusable instruments. Key upstream suppliers include specialized chemical and polymer manufacturers and precision metal fabricators. Cost management at this stage, particularly minimizing material waste and ensuring compliance with biocompatibility standards, is critical, especially given the strict quality requirements for devices intended for internal anatomical examination. Intense focus is placed on sterilization methodologies during manufacturing to meet regulatory mandates, whether the device is supplied sterile (disposable) or designed for repeated high-level disinfection (reusable).

Midstream activities involve core manufacturing, assembly, integration of illumination systems (often LED technology), and packaging. For advanced video anoscopes, this stage also includes the integration of micro-cameras and digital interface components. Downstream analysis focuses heavily on the distribution channel, which is complex due to the varying end-users. Direct distribution is common for large institutional buyers (major hospital networks) through established sales teams, offering tailored procurement contracts and volume discounts. Indirect distribution relies heavily on regional medical device distributors and wholesalers who possess deep localized market knowledge and manage logistics, ensuring timely supply to smaller clinics, ASCs, and independent practitioners.

The distribution network relies on sophisticated logistics to manage the high volume of relatively low-cost items, especially the fast-moving disposable inventory. The efficacy of the indirect channel often determines market penetration in fragmented geographical territories. Crucially, the final link in the value chain involves service and support, especially for reusable or digital video anoscopes, where maintenance, calibration, and software updates are necessary. Effective inventory management throughout the chain is vital to prevent stockouts in emergency settings and minimize obsolescence, directly influencing the final cost to the end-user and ultimately impacting the profitability margins across the entire ecosystem.

Medical Anoscope Market Potential Customers

The primary potential customers and end-users of medical anoscopes are institutional healthcare providers that specialize in gastrointestinal and colorectal health. Hospitals, particularly those with dedicated surgery departments, gastroenterology units, and emergency services, constitute the largest segment. They utilize anoscopes for routine diagnostic workups, emergency hemorrhage assessment, and as an essential component of preparatory steps for various proctological procedures. The requirement for both reusable instruments (for durable use in operating theaters) and disposable units (for infection control in outpatient clinics) makes hospitals the most diversified purchasers.

Ambulatory Surgical Centers (ASCs) represent a rapidly expanding customer base. As healthcare systems globally transition minor diagnostic and interventional procedures to outpatient settings to reduce costs and improve patient throughput, ASCs performing procedures such as hemorrhoid banding and colonoscopy preparation increasingly rely on anoscopes. ASCs typically favor disposable, high-quality instruments due to their streamlined operational models and stringent hygiene protocols, prioritizing rapid turnaround times and minimal sterilization overhead. This preference drives significant volume demand for single-use products, making ASCs high-value targets for manufacturers specializing in disposable lines.

Additionally, specialized proctology clinics and independent physician practices focused on gastroenterology and family medicine are essential end-users. These clinics often serve as the first point of contact for patients experiencing anorectal symptoms. While their procurement volume is smaller than that of hospitals, their large cumulative number across regions ensures sustained, steady demand. Educational and training institutions also serve as niche but vital customers, requiring anoscopes for teaching purposes, including simulators and practical training sessions, ensuring that the next generation of healthcare professionals is proficient in utilizing these fundamental diagnostic tools effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.4 Million |

| Market Forecast in 2033 | USD 370.8 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), Teleflex Incorporated, HEINE Optotechnik, Welch Allyn (Hill-Rom), Pilling Surgical (Teleflex), STERIS, Integra LifeSciences, Sklar Instruments, Surtex Instruments, Jiaxing Fubao Medical Devices, Kanger Medical, GPC Medical, CooperSurgical, SpektroTek Medical, Medline Industries, Eakin Healthcare, Pro-Med Products, V-Care Medical Instruments, MedGyn Products, RZ Medizintechnik |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Anoscope Market Key Technology Landscape

The technological evolution within the Medical Anoscope Market is characterized by a strong focus on enhancing visualization quality, improving ease of use, and ensuring superior infection control. Traditional reusable anoscopes rely on robust construction materials and high-intensity external light sources, often fiber optic, which necessitates regular maintenance and rigorous sterilization procedures. The major technological shift, however, has been the proliferation of disposable plastic anoscopes, designed with integrated, single-use LED lighting systems. These systems eliminate the need for costly sterilization cycles, reduce the risks associated with residual contamination, and significantly improve logistical efficiency in high-volume settings, driving substantial market penetration across all geographies.

The most impactful technological advancement is the emergence of digital or video anoscopy. These advanced devices incorporate miniature cameras and optical magnification systems, allowing for real-time visualization on an external monitor. This technology provides superior magnification, enables simultaneous viewing by clinical teams and students, and critically, facilitates the creation of high-quality digital records for documentation, comparative analysis, and patient education. Video anoscopes are particularly valuable in diagnosing subtle mucosal abnormalities, tracking treatment progress, and providing irrefutable evidence for medicolegal purposes, positioning them as the premium segment of the market, despite their higher initial capital cost.

Further innovation includes ergonomic redesigns aimed at optimizing the geometry of the distal tip to minimize patient discomfort during insertion and examination, along with improvements in the light spectrum used to enhance tissue contrast. Specialized coatings and materials are being explored to ensure instruments remain scratch-resistant and optically clear. Furthermore, the development of integrated biopsy channels and auxiliary ports within the anoscope design allows practitioners to perform minor therapeutic interventions, such as injecting sclerosants or applying topical agents, under direct visualization, thereby consolidating diagnostic and therapeutic workflows and enhancing procedural efficiency in the clinical setting.

Regional Highlights

- North America: Highlight key countries or regions and their market relevance

North America, encompassing the United States and Canada, holds the largest share of the Medical Anoscope Market value. This dominance is underpinned by several critical factors: a highly mature and extensive healthcare infrastructure, substantial expenditure on medical devices, high rates of private health insurance coverage facilitating access to diagnostic procedures, and robust clinical guidelines mandating regular screening for colorectal issues. The United States, in particular, drives significant demand, propelled by a high prevalence of obesity and associated lifestyle diseases contributing to anorectal disorders. The region is characterized by early adoption of advanced technologies, such as video anoscopes and high-grade disposable products, driven by stringent infection control standards and a readiness to invest in efficiency-enhancing tools. Furthermore, the presence of major global market players and strong R&D activities contribute to continuous product innovation and market stability, cementing its leadership position in terms of both consumption and technological advancement.

The operational environment in North America favors Ambulatory Surgical Centers (ASCs) for routine procedures, leading to a strong purchasing volume of single-use anoscopes. Regulatory frameworks enforced by bodies like the FDA ensure high quality but also necessitate detailed compliance, influencing market entry strategies. Market growth in this region is steady and predictable, focused less on volume expansion and more on technological replacement cycles and the integration of digital health solutions, including the adoption of AI-powered diagnostic aids, which enhance the clinical utility of anoscopy procedures and justify premium pricing. Patient awareness campaigns, especially those related to colon cancer screening, consistently drive diagnostic rates, sustaining the demand for standard and specialized anoscope equipment across all clinical settings.

- Europe: Highlight key countries or regions and their market relevance

Europe represents the second-largest regional market, characterized by diverse healthcare funding models across member states, yet maintaining a uniformly high standard of medical care. Western European countries, including Germany, the UK, and France, are major consumers, driven by an aging demographic structure and comprehensive national health services that prioritize preventative medicine and accessible specialist care. Germany, known for its robust medical device manufacturing sector, is a key influencer in both production and technological implementation within the region. The preference in Europe is mixed, with a strong historical reliance on high-quality, reusable stainless steel instruments in certain countries, rapidly transitioning towards disposable options driven by evolving EU directives concerning medical device cleanliness and reprocessing protocols.

The market faces growth from both the East and West. Eastern European countries are undergoing significant healthcare modernization, presenting opportunities for increased adoption of modern diagnostic tools, particularly disposable anoscopes, as they upgrade their infrastructure. Stringent European regulations (MDR) impact the certification and sales of anoscopes, requiring detailed clinical evidence and traceability, which acts as a barrier to entry for smaller manufacturers but assures quality for end-users. Economic stability and established referral systems for gastroenterological disorders ensure a consistent, albeit mature, market for anoscopy products, with future growth closely tied to clinical guidelines promoting increased screening frequency among at-risk populations.

- Asia Pacific (APAC): Highlight key countries or regions and their market relevance

The Asia Pacific region is projected to be the fastest-growing market globally, offering immense potential due to its enormous population base, improving economic conditions, and rapid expansion of healthcare infrastructure. Countries like China, India, and Japan are pivotal to this growth. China and India are characterized by high market volumes driven by immense patient numbers and a burgeoning middle class gaining access to higher quality medical services. Lifestyle changes associated with urbanization are increasing the incidence of anorectal diseases, creating a substantial unmet diagnostic need that anoscopes address effectively.

Investment in public and private hospitals is accelerating across Southeast Asia, which necessitates the procurement of basic and advanced diagnostic equipment, including anoscopes. While price sensitivity remains a factor in rural areas, leading to a higher usage of reusable devices, major urban centers are rapidly adopting disposable and video anoscopy technologies to align with international standards. Japan and South Korea, possessing advanced healthcare systems, serve as crucial innovation hubs within APAC, quickly adopting new digital imaging solutions. Market penetration strategies in APAC must be highly localized, addressing varied procurement processes, local manufacturing capabilities, and diverse regulatory environments to successfully capture the region's high growth potential.

- Latin America: Highlight key countries or regions and their market relevance

The Latin American Medical Anoscope Market is demonstrating moderate but steady growth, led by key economies such as Brazil, Mexico, and Argentina. Market expansion is primarily driven by improvements in public health programs, increased government spending on healthcare infrastructure upgrades, and efforts to standardize clinical procedures. The prevalence of colorectal diseases is rising in line with global urbanization trends and dietary shifts, underpinning the sustained demand for essential diagnostic instruments like anoscopes. Economic volatility and currency fluctuations can occasionally impact procurement budgets, making cost-effectiveness a crucial factor in purchasing decisions, which often favors standardized, reliable reusable instruments or competitively priced disposable versions.

Local manufacturing capacity is generally limited, making the region reliant on imports from North America and Europe, as well as increasingly from APAC manufacturers offering competitive pricing. Opportunities for international vendors exist in establishing strong distribution partnerships and providing effective clinical training to standardize examination protocols. The shift towards outpatient care in major cities is mirroring global trends, gradually increasing the demand for ASCs and specialized clinics, which in turn boosts the consumption of sterile, single-use anoscopes, positioning the region for reliable long-term market expansion.

- Middle East and Africa (MEA): Highlight key countries or regions and their market relevance

The Middle East and Africa (MEA) region presents a fragmented market landscape, with significant growth pockets concentrated in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) due to high healthcare expenditure, sophisticated medical cities, and expatriate healthcare professional populations ensuring adoption of global best practices. These nations display a high adoption rate of premium and digital anoscope technologies, often imported, due to substantial investment in modern hospital facilities. In contrast, the African continent represents a market still heavily constrained by limited healthcare access and lower disposable income, where basic, durable, and cost-effective reusable anoscopes dominate procurement requirements.

Market drivers in MEA include increasing awareness of colorectal health issues and expansion of diagnostic services, especially as non-communicable diseases rise. International aid and collaboration are vital in improving the infrastructure in parts of Africa, slowly increasing the capacity for routine diagnostics. Manufacturers must navigate diverse regulatory regimes and geopolitical stability challenges. The market opportunity lies in establishing strong localized partnerships to manage distribution logistics and offering tiered product strategies that address both the premium, technology-demanding markets in the GCC and the price-sensitive, high-volume needs of developing African nations, focusing on essential diagnostic accessibility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Anoscope Market.- BD (Becton, Dickinson and Company)

- Teleflex Incorporated

- HEINE Optotechnik

- Welch Allyn (Hill-Rom)

- Pilling Surgical (Teleflex)

- STERIS

- Integra LifeSciences

- Sklar Instruments

- Surtex Instruments

- Jiaxing Fubao Medical Devices

- Kanger Medical

- GPC Medical

- CooperSurgical

- SpektroTek Medical

- Medline Industries

- Eakin Healthcare

- Pro-Med Products

- V-Care Medical Instruments

- RZ Medizintechnik

- Rusch (Teleflex Medical)

Frequently Asked Questions

Analyze common user questions about the Medical Anoscope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from reusable to disposable anoscopes?

The transition is primarily driven by rigorous global infection control standards and the imperative to minimize cross-contamination risks associated with inadequate sterilization. Disposable anoscopes offer guaranteed sterility, reduce procedural turnaround time by eliminating reprocessing steps, and minimize the high upfront capital investment and maintenance costs linked to reusable instrument inventories, making them highly favored in fast-paced clinical environments like Ambulatory Surgical Centers (ASCs).

How is video anoscopy impacting diagnostic accuracy in proctology?

Video anoscopy significantly enhances diagnostic accuracy by providing magnified, high-resolution visualization displayed on a monitor, which facilitates detailed identification of subtle mucosal changes, vascular patterns, and early stage lesions. This digital capability allows for superior documentation for medical records, improved team collaboration during procedures, and objective measurement of conditions like hemorrhoid size and prolapse severity.

Which regions offer the highest growth potential for anoscope manufacturers?

The Asia Pacific (APAC) region, particularly China and India, offers the highest growth potential. This is attributed to rapid expansion of healthcare infrastructure, significant government investment in medical facilities, increasing prevalence of lifestyle-related anorectal disorders, and a large, underserved patient population gaining access to specialized diagnostic procedures for the first time.

What are the primary applications of the medical anoscope in clinical practice?

The primary clinical applications include routine diagnostic examination of the anal canal and lower rectum, precise grading and treatment guidance for hemorrhoids (such as rubber band ligation), diagnosis of anal fissures, screening for colorectal polyps and early-stage cancers, and facilitating minimally invasive procedures like targeted biopsies and foreign body removal in the lower GI tract.

What challenges are restraining the market growth for anoscope devices?

Key restraints include patient reluctance and embarrassment, which often delays clinical presentation and procedure volume. Additionally, the relatively lower average selling price of basic devices limits large-scale R&D investment compared to high-end medical technologies, and in certain regions, cost constraints and regulatory challenges regarding the disposal of plastic medical waste pose logistical hurdles for large-scale adoption of disposable products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager