Medical Audiometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433776 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Medical Audiometers Market Size

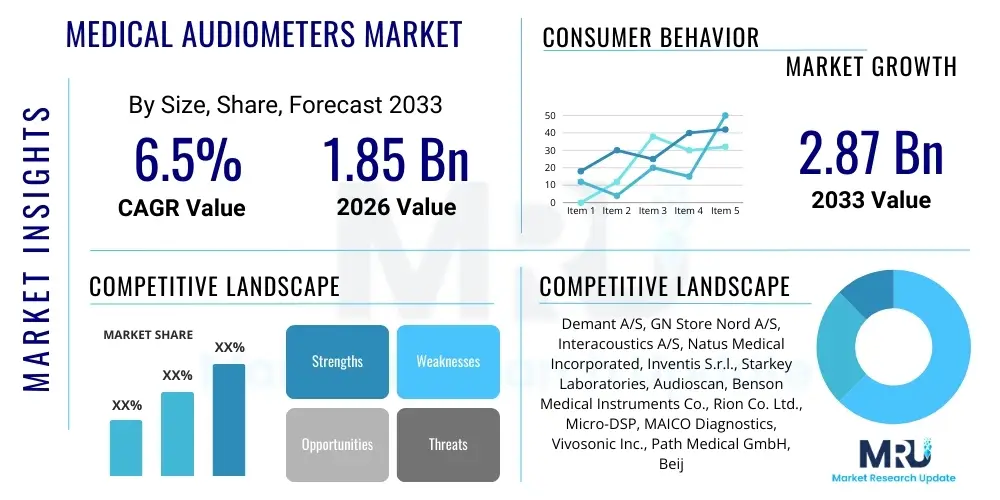

The Medical Audiometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

Medical Audiometers Market introduction

The Medical Audiometers Market encompasses the equipment utilized by healthcare professionals to measure hearing acuity and diagnose hearing loss across various patient populations, ranging from neonates to geriatric individuals. These sophisticated diagnostic instruments, essential within audiology clinics, hospitals, and specialized ENT centers, function by generating calibrated pure tones and speech signals across specific frequencies and intensities. The core purpose is to determine the patient's hearing threshold, thereby classifying the type and severity of hearing impairment, which is critical for subsequent intervention planning, such as hearing aid fitting or cochlear implantation candidacy. Modern audiometers are evolving from basic pure-tone devices to include advanced functionalities like immittance testing, otoacoustic emissions (OAE), and auditory brainstem response (ABR) testing, providing comprehensive diagnostic capabilities in a single unit. This integration of multiple testing modalities enhances clinical workflow efficiency and diagnostic accuracy.

The primary applications of medical audiometers include routine screening, comprehensive clinical diagnosis, occupational health evaluations, and monitoring of ototoxic medication effects. Key market driving factors include the substantial global increase in the geriatric population, which inherently experiences higher rates of age-related hearing loss (presbycusis), and the implementation of mandatory universal newborn hearing screening programs in developed and rapidly developing nations. Furthermore, rising awareness campaigns regarding the socio-economic burden of untreated hearing loss are propelling higher adoption rates of diagnostic tools. The benefits derived from timely and accurate diagnosis using these devices are manifold, including improved quality of life, enhanced communication skills, and mitigated risks associated with developmental delays in children.

Product innovation focuses intensively on portability, digital integration, and user-friendliness. Handheld and tablet-based audiometers, often leveraging wireless connectivity, are gaining traction, especially in remote or underserved geographical areas where traditional stationary equipment is impractical. The shift towards tele-audiology, facilitated by digital audiometers capable of remote data transmission and expert consultation, is a significant trend reshaping market dynamics. These advancements are critical for overcoming barriers to access, making high-quality audiological diagnostics available outside conventional clinical settings, thereby driving market growth through expanded utility and geographical reach. Reliability and calibration stability remain paramount requirements for market acceptance.

Medical Audiometers Market Executive Summary

The Medical Audiometers Market is undergoing substantial transformation, driven primarily by technological convergence and demographic shifts. Business trends indicate a strong move toward consolidated diagnostic platforms that offer multiple testing capabilities, such as combined audiometry and tympanometry systems, reducing equipment footprint and enhancing clinical utility. Key manufacturers are focusing on mergers, acquisitions, and strategic partnerships to expand their product portfolios, particularly in software development for remote calibration and data management, aligning with the rising demand for digitized health records and interconnected medical devices. Investment in R&D is heavily skewed towards creating highly accurate, objective screening devices suitable for non-specialist use, decentralizing the initial diagnostic process from specialized centers to primary care settings and community health programs. The competitive landscape is characterized by innovation in portable devices, which are essential for increasing testing capacity outside traditional clinical environments.

Regionally, North America and Europe currently dominate the market, primarily due to well-established healthcare infrastructure, high healthcare expenditure, and stringent regulations mandating early hearing intervention, particularly for newborns and school-age children. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This rapid expansion in APAC is fueled by the vast, underserved patient pool, growing middle-class income leading to increased affordability of advanced diagnostics, and governmental initiatives in countries like China and India aimed at establishing robust public health audiology programs. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a lower base, largely attributed to increasing awareness and expanding access to basic healthcare services and diagnostic equipment donations or subsidies.

Segment trends reveal that the Portable/Handheld segment is experiencing faster adoption compared to the traditional Standalone/Clinical audiometers, reflecting the need for flexible diagnostic solutions. Diagnostic audiometers maintain the largest revenue share due to their comprehensive testing capabilities required for definitive diagnosis and treatment planning. Among end-users, hospitals and specialized clinics remain the primary consumers, although non-traditional settings like retail hearing aid dispensers and independent telemedicine providers are rapidly emerging as significant purchasing entities. The push toward preventative healthcare and the integration of hearing health into broader wellness strategies further strengthens the outlook for the entire segmentation landscape, ensuring sustained demand for both screening and diagnostic models.

AI Impact Analysis on Medical Audiometers Market

User inquiries frequently revolve around how Artificial Intelligence (AI) can enhance diagnostic accuracy, streamline testing protocols, and facilitate remote audiology services, particularly concerning the interpretation of complex audiometric data and the personalization of hearing device settings. Users are keen to understand if AI integration can lower operational costs, reduce reliance on highly specialized personnel, and improve diagnostic throughput. Key concerns often address data privacy, regulatory hurdles for AI-driven diagnostics, and the potential for AI algorithms to introduce biases or errors if not trained on diverse datasets. The consensus expectation is that AI will primarily serve as a powerful clinical decision support tool, augmenting, rather than replacing, human audiologists, especially in refining difficult-to-test populations’ results and managing large-scale screening data.

- AI algorithms enable objective interpretation of complex audiogram patterns, aiding in differential diagnosis between sensorineural and conductive hearing losses.

- Machine learning models optimize calibration processes for audiometers, predicting necessary adjustments and reducing maintenance downtime.

- AI facilitates automated noise reduction in testing environments, ensuring high-fidelity results even in non-soundproof settings, enhancing flexibility.

- Deep learning aids in the analysis of Auditory Brainstem Response (ABR) and Otoacoustic Emissions (OAE) data, accelerating testing time and improving signal detection accuracy.

- Predictive analytics can forecast equipment failure, enabling proactive maintenance (predictive maintenance) and minimizing service disruptions.

- Natural Language Processing (NLP) is used to synthesize patient reported outcomes (PROs) and integrate them efficiently with objective audiometric data for holistic patient profiles.

- AI powers personalized recommendation engines for hearing aid prescription and tuning, based on individual audiometric profiles and lifestyle data.

- Tele-audiology platforms use AI for preliminary triage and remote data quality checks, ensuring viable remote testing sessions.

DRO & Impact Forces Of Medical Audiometers Market

The market trajectory is significantly shaped by a confluence of influential factors: robust drivers pushing demand, critical restraints limiting growth, emerging opportunities for technological expansion, and overriding impact forces that dictate regulatory and structural shifts. Key drivers include the universal trend of population aging, which directly correlates with the rising incidence of presbycusis, alongside successful global advocacy efforts for early diagnosis of pediatric hearing impairment, exemplified by the widespread adoption of mandatory newborn hearing screening. Furthermore, the increasing burden of noise-induced hearing loss (NIHL) in occupational and recreational settings necessitates widespread diagnostic and monitoring capabilities using advanced audiometric devices. These drivers ensure a consistent and expanding baseline demand for both screening and clinical-grade equipment.

Conversely, significant restraints hinder optimal market penetration. The primary constraint is the substantial capital expenditure required for acquiring highly specialized clinical audiometers and associated accessories, posing a barrier to adoption, particularly in emerging economies with constrained healthcare budgets. Compounding this challenge is the global shortage of trained and certified audiologists and technicians, limiting the effective deployment and utilization of sophisticated equipment in various regions. Additionally, the complex and stringent regulatory approval processes for new audiometer technologies, which must meet rigorous standards for accuracy and safety, often slow down the pace of innovation reaching the consumer market. These restraints require strategic mitigation through cost-effective portable solutions and targeted professional training programs.

Opportunities for exponential market growth lie predominantly in the convergence of digital health technologies with audiology. The expansion of tele-audiology—using remotely operated devices for diagnosis and monitoring—offers a viable solution to access challenges in rural or underserved areas, significantly expanding the addressable market. Furthermore, manufacturers are capitalizing on the development of smart, handheld, and smartphone-integrated audiometers that leverage consumer technology interfaces while maintaining clinical accuracy. The increasing emphasis on preventative hearing healthcare, driven by global organizations, presents avenues for widespread deployment of accessible screening tools in non-traditional healthcare settings, such as pharmacies and community centers. Impact forces, particularly the rapid evolution of digital connectivity standards (5G) and evolving global health policies prioritizing non-communicable disease management, are forcing manufacturers to prioritize seamless connectivity and robust data security protocols.

Segmentation Analysis

The Medical Audiometers Market is meticulously segmented based on Type, Portability, and End-User, reflecting the diverse clinical needs and operational environments globally. Analyzing these segments provides a clear understanding of market preferences and investment patterns, allowing stakeholders to tailor product development and market entry strategies. The segmentation highlights a fundamental dichotomy in the market: the demand for highly accurate, multi-function diagnostic units essential for comprehensive clinical assessment, versus the growing need for simplified, portable screening devices crucial for large-scale public health initiatives and remote services. This division dictates pricing strategies, distribution channels, and technological focuses across different product lines.

By Type, the market is split between Diagnostic Audiometers and Screening Audiometers. Diagnostic models, which include complex pure tone, speech, and high-frequency testing capabilities, constitute the largest revenue segment due to their necessity in definitive medical diagnosis and specialized treatment planning. Screening audiometers, designed for quick, initial checks to identify individuals requiring further evaluation (e.g., newborn screening), are high-volume, lower-cost items, and their market share is growing rapidly due to the expansion of public health programs focused on early detection. Portability segmentation delineates Standalone/Clinical (fixed, high-functionality devices) and Portable/Handheld models, with the latter experiencing accelerated growth driven by the need for flexibility and outreach programs.

The End-User segment is dominated by Hospitals and Specialty Clinics, reflecting where the majority of high-tier clinical diagnoses are performed. However, emerging segments like Diagnostic Centers and Research Institutes are increasingly important. Diagnostic centers leverage these devices for comprehensive patient testing independent of large hospital systems, while research institutes drive demand for highly specialized audiometers used in clinical trials and auditory science research. Understanding the specific procurement needs, volume requirements, and budget constraints of each end-user category is crucial for effective market penetration and sustaining competitive advantage in this specialized medical device market.

- By Type:

- Diagnostic Audiometers

- Screening Audiometers

- By Portability:

- Standalone/Clinical Audiometers

- Portable/Handheld Audiometers

- By End-User:

- Hospitals

- Specialty Clinics

- Diagnostic Centers

- Research Institutes

- Academic Institutions

Value Chain Analysis For Medical Audiometers Market

The value chain for the Medical Audiometers Market begins with crucial upstream activities, encompassing the meticulous sourcing of highly specialized electronic components, acoustic transducers, microprocessors, and sophisticated sensor technology. Manufacturers must maintain stringent control over the supply of these calibrated components to ensure the accuracy and reliability of the final audiometric device, which is paramount in diagnostics. Research and Development (R&D) forms a significant early component, focusing on software development for signal processing, AI integration, and user interface design. Strong relationships with component suppliers are necessary to manage costs and ensure compliance with medical device standards such as ISO 13485. Innovation in material science for durable, anti-microbial casings and lightweight construction for portable units is also centered in this upstream phase.

The midstream phase involves the core manufacturing, assembly, and rigorous quality assurance processes. Assembly requires specialized cleanroom facilities and highly trained technical personnel for the precise calibration of frequency and intensity outputs, a non-negotiable step in producing accurate medical measurement tools. Post-manufacturing activities focus on packaging, regulatory filing (e.g., FDA clearance, CE marking), and inventory management. The downstream activities concentrate on reaching the end-users. Distribution channels are predominantly indirect, relying on specialized medical device distributors, value-added resellers (VARs), and regional sales agents who possess expertise in audiology equipment installation, calibration, and after-sales service. Direct sales channels are typically reserved for large-scale institutional tenders, government contracts, or key opinion leader (KOL) accounts where direct manufacturer support is mandated.

The selection of distribution channels heavily impacts market reach and customer perception. Indirect distributors often provide critical support functions, including localized technical training and rapid maintenance response, which are essential for clinical devices. This network structure ensures deeper penetration into regional markets where local regulatory knowledge is required. Post-sales service, including periodic re-calibration services mandated by clinical guidelines, represents a significant recurring revenue stream and a vital aspect of the downstream value delivery. Efficient logistics, inventory optimization, and robust technical support are critical for sustaining device uptime and ensuring high customer satisfaction in the highly sensitive clinical environment.

Medical Audiometers Market Potential Customers

The primary end-users and potential buyers of medical audiometers are institutions and practitioners dedicated to hearing health assessment and intervention. Hospitals, particularly those with dedicated Ear, Nose, and Throat (ENT) departments, pediatric units, and intensive care nurseries (for mandatory newborn screening), represent the largest traditional customer segment due to their high patient volumes and need for comprehensive diagnostic capabilities. These large facilities typically procure high-end, stationary clinical audiometers equipped with advanced features like high-frequency testing and integrated impedance screening. Purchasing decisions here are often driven by budget cycles, capital procurement committees, and the need for standardized, high-volume testing solutions that integrate seamlessly with existing hospital electronic health record (EHR) systems.

Specialty audiology clinics and independent private practices form a rapidly growing customer base. These clinics require versatile equipment, often favoring both clinical-grade diagnostic units and highly portable models for outreach or home visits. For these smaller entities, factors such as equipment footprint, ease of use, reliability, and lifetime cost of ownership are critical purchasing considerations. Furthermore, the rise of specialized industrial audiology services, catering to companies mandated to perform regular occupational noise exposure screenings, creates demand for rugged, high-throughput screening audiometers suitable for mobile testing units and harsh industrial environments. These buyers prioritize devices with robust data management and reporting features necessary for regulatory compliance.

Emerging potential customers include specialized diagnostic centers and academic research institutions. Diagnostic centers often act as referral hubs, needing sophisticated equipment to perform specialized tests such as Auditory Steady-State Response (ASSR) and electrocochleography, requiring highly specific, research-grade audiometers. Educational and research facilities drive demand for technologically advanced models for training new audiologists and conducting clinical trials related to auditory pathophysiology or new therapeutic interventions. Lastly, public health organizations and governmental bodies purchasing equipment for mass screening campaigns—such as school screening programs—represent bulk buyers focusing on acquiring durable, cost-effective, and easy-to-operate screening audiometers suitable for non-specialist use, prioritizing wide-scale deployment and minimal maintenance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Demant A/S, GN Store Nord A/S, Interacoustics A/S, Natus Medical Incorporated, Inventis S.r.l., Starkey Laboratories, Audioscan, Benson Medical Instruments Co., Rion Co. Ltd., Micro-DSP, MAICO Diagnostics, Vivosonic Inc., Path Medical GmbH, Beijing Bejing-Beier Electronic Co. Ltd., Entomed A/S, Tremetrics, MedRx, Inc., Intelligent Hearing Systems (IHS), Echo Instruments, Sivantos Group (now part of WS Audiology). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Audiometers Market Key Technology Landscape

The current technology landscape in the medical audiometers market is characterized by a significant transition from purely analog or basic digital systems to sophisticated, networked diagnostic platforms. A key technological focus is on enhancing objective testing methods, moving beyond purely behavioral responses which can be challenging, especially in pediatric or non-cooperative patient populations. This involves integrating highly sensitive technologies such as transient evoked otoacoustic emissions (TEOAE), distortion product otoacoustic emissions (DPOAE), and automated Auditory Brainstem Response (AABR) systems directly into audiometric units. These objective measures provide crucial data on inner ear function and auditory pathway integrity without requiring patient participation, significantly improving the quality of newborn and screening programs. Furthermore, high-frequency audiometry (beyond 8 kHz) is becoming standard in clinical models to detect early signs of ototoxicity or specialized hearing loss patterns, driving demand for specialized transducers and calibration routines.

Connectivity and software functionality represent the second major technological pillar. Modern audiometers are designed with integrated Wi-Fi or Bluetooth capabilities, facilitating seamless data export to Electronic Health Records (EHRs) and reducing manual transcription errors. Advanced software platforms now incorporate sophisticated patient management databases and remote calibration features, allowing manufacturers to diagnose and adjust equipment settings remotely, minimizing downtime and maintenance costs for end-users. This push towards connectivity is crucial for enabling the wider deployment of tele-audiology services, where remote specialists can control or monitor testing performed by local technicians. Cybersecurity remains a critical technology area, ensuring the protection of sensitive patient health information (PHI) transmitted and stored through these networked devices, requiring adherence to standards like HIPAA and GDPR.

The third area of intensive development is miniaturization and portability, driven by the need for accessibility. Handheld and tablet-based audiometers, often leveraging the processing power and user interfaces of consumer-grade devices (like tablets or smartphones), are becoming clinically validated alternatives to bulky, standalone units for screening and basic diagnostic tasks. These devices utilize cloud-based computing for data storage and complex algorithm execution, making them lightweight and cost-effective. Furthermore, biofeedback technology and gamified interfaces are being developed to improve patient engagement and reliability during behavioral tests, particularly with children. These user-centric design innovations are crucial for expanding the use of audiometry outside specialized audiology practices into primary care and community settings, thereby expanding market reach.

Regional Highlights

- North America: This region holds a leading market share, primarily driven by high per capita healthcare spending, widespread adoption of advanced diagnostic technologies, and mandatory universal screening programs for infants. The presence of major market players and sophisticated research infrastructure supports continuous innovation. Key countries like the United States exhibit high demand for integrated diagnostic platforms and are early adopters of AI-driven clinical decision support systems. Regulatory standards, particularly those established by the FDA, influence global product development benchmarks.

- Europe: Europe represents a mature market characterized by robust public healthcare systems (like the NHS in the UK and centralized systems in Germany and France) that prioritize standardized hearing care. Growth is steady, fueled by an aging population and high awareness regarding occupational hearing loss. The region is a pioneer in tele-audiology implementation, particularly in Scandinavian countries, aiming to bridge access gaps in sparsely populated areas. The market emphasizes adherence to strict CE regulatory standards for medical devices and prefers reliable, long-lifecycle equipment.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by massive, underserved populations and rapid economic development in countries such as China, India, and South Korea. Government initiatives focusing on improving healthcare access and establishing national screening programs (especially for newborns and the elderly) are key growth accelerators. While the market is price-sensitive, there is a strong emerging demand for affordable, portable audiometers suitable for mass deployment in rural health camps, driving localized manufacturing and distribution partnerships.

- Latin America (LATAM): Growth in LATAM is moderately paced, highly dependent on governmental investment in public health infrastructure and economic stability. Countries like Brazil and Mexico are leading regional adoption, often importing established technologies from North America and Europe. The market faces challenges related to infrastructure unevenness and fluctuating healthcare budgets, making robust and easy-to-maintain equipment a priority for public sector buyers. Private clinics are increasingly adopting advanced diagnostic equipment as health insurance coverage expands.

- Middle East and Africa (MEA): This region exhibits diverse growth patterns. The Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) possess high-end healthcare facilities driving demand for premium, technologically advanced clinical units. In contrast, many African nations focus heavily on basic, durable screening audiometers for public health outreach programs, often reliant on international aid or NGO support. Infrastructure development and improving access to specialized training are key prerequisites for sustained market growth in the wider African sub-region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Audiometers Market.- Demant A/S

- GN Store Nord A/S

- Interacoustics A/S

- Natus Medical Incorporated

- Inventis S.r.l.

- Starkey Laboratories

- Audioscan

- Benson Medical Instruments Co.

- Rion Co. Ltd.

- Micro-DSP

- MAICO Diagnostics

- Vivosonic Inc.

- Path Medical GmbH

- Beijing Bejing-Beier Electronic Co. Ltd.

- Entomed A/S

- Tremetrics

- MedRx, Inc.

- Intelligent Hearing Systems (IHS)

- Echo Instruments

- Sivantos Group (now part of WS Audiology)

Frequently Asked Questions

Analyze common user questions about the Medical Audiometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between screening and diagnostic audiometers?

Screening audiometers are designed for quick, binary (pass/refer) evaluations across a limited frequency range to identify potential hearing loss, typically used by nurses or technicians. Diagnostic audiometers are sophisticated clinical instruments used by audiologists to determine the precise threshold, type, and severity of hearing loss across the entire audible spectrum, including specialized tests like speech audiometry and tympanometry, necessary for treatment planning.

How is tele-audiology influencing market demand for audiometers?

Tele-audiology is driving demand for advanced portable and remotely controllable audiometers equipped with secure connectivity features. It enables diagnostic testing to be performed in remote or rural settings, minimizing travel for patients and expanding the service reach of specialists, thereby overcoming geographical barriers and accelerating the adoption of connected diagnostic devices.

Which end-user segment is contributing most significantly to market revenue?

Hospitals and Specialized Clinics currently contribute the largest market revenue share. These facilities require high-end diagnostic audiometers and peripheral equipment for comprehensive clinical assessments, high patient throughput, and complex cases requiring multi-modal testing capabilities like ABR and OAE, ensuring sustained procurement of premium devices.

What role does AI play in improving the accuracy of audiometric testing?

AI enhances accuracy by automating the interpretation of objective test data (like ABR waveforms), minimizing human variability, and providing clinical decision support for complex audiogram analysis. It also helps refine calibration stability and manages noise interference in sub-optimal testing environments, leading to more reliable diagnostic results.

What are the key technological advancements shaping the future of medical audiometers?

Key technological advancements include the integration of high-frequency testing, miniaturization into portable, smartphone-compatible units, incorporation of robust data security and cloud connectivity for EHR integration, and the application of machine learning for personalized hearing aid programming and predictive equipment maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Medical Audiometers (Diagnostic Audiometer) Market Size Report By Type (Stand-alone Audiometer, Hybrid Audiometer, PC-Based Audiometer), By Application (Diagnose, Screening, Clinical), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Medical Audiometers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stand-alone Audiometer, Hybrid Audiometer, PC-Based Audiometer), By Application (Diagnose, Screening, Clinical), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager