Medical Cold Plasma Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432585 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Medical Cold Plasma Market Size

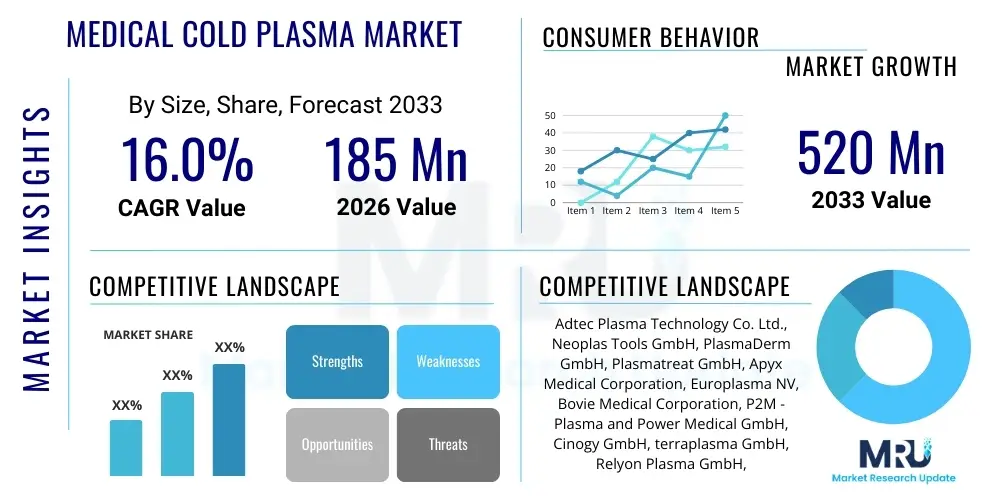

The Medical Cold Plasma Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.0% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $520 Million USD by the end of the forecast period in 2033. This substantial expansion is driven by the growing clinical acceptance of cold plasma technology in advanced wound care and dermatology, offering non-thermal, minimally invasive solutions that enhance tissue regeneration and sterilization.

Medical Cold Plasma Market introduction

The Medical Cold Plasma Market encompasses devices and consumables utilizing low-temperature atmospheric pressure plasma (LTAPP) for therapeutic and sterilization applications across various medical fields. Cold plasma, often described as the fourth state of matter, involves partially ionized gas containing highly reactive species such as reactive oxygen species (ROS) and reactive nitrogen species (RNS), electrons, and UV radiation, all maintained at near room temperature. This unique composition allows for direct application to human tissue without causing thermal damage, thereby revolutionizing fields like wound management, dermatological treatments, and surgical sterilization. Key applications include chronic wound disinfection, promoting epithelialization, treating skin conditions like acne and psoriasis, and providing effective localized sterilization for medical tools and surfaces. The inherent benefits, such as rapid action, broad-spectrum antimicrobial efficacy, and low risk of resistance development, position cold plasma as a critical innovation in modern medicine.

Driving factors propelling market growth include the rising incidence of chronic diseases, particularly diabetic foot ulcers and pressure ulcers, which require sophisticated wound healing technologies. Furthermore, increasing awareness among clinicians regarding the superior antimicrobial properties of cold plasma compared to traditional antibiotics, coupled with escalating concerns over antimicrobial resistance (AMR), significantly boosts adoption. Technological advancements, leading to smaller, more portable, and cost-effective cold plasma devices, are expanding the use beyond specialized hospital settings into outpatient clinics and potentially home healthcare. The therapeutic efficiency in treating drug-resistant infections and facilitating faster recovery times without significant side effects cement cold plasma’s role as a transformative medical tool.

Medical Cold Plasma Market Executive Summary

The Medical Cold Plasma Market is characterized by robust growth, primarily fueled by strong clinical evidence supporting its efficacy in chronic wound care and the increasing prevalence of antibiotic-resistant infections globally. Business trends indicate a focus on strategic collaborations between academic research institutions and commercial manufacturers to accelerate device development and secure regulatory approvals, particularly in North America and Europe. Key market players are concentrating on product miniaturization and developing specialized applicators tailored for specific medical disciplines, such as dentistry and oncology, diversifying the application portfolio beyond traditional dermatology and wound healing. Investment is heavily directed towards enhancing plasma delivery systems to ensure consistent dosage and treatment uniformity, addressing one of the primary technical challenges in widespread adoption.

Regionally, North America maintains market dominance due to high healthcare expenditure, established clinical infrastructure, and early adoption of advanced medical technologies. However, the Asia Pacific region is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR), driven by improving healthcare access, large patient pools suffering from diabetes-related complications, and increasing governmental support for advanced medical device manufacturing in countries like China and India. Europe also holds a significant share, supported by stringent regulatory frameworks ensuring high product quality and continuous innovation originating from German and Swiss research clusters specializing in plasma physics and medical engineering. Regional growth disparities are influenced by reimbursement policies and the speed of technology acceptance by national health services.

Segment trends highlight the Application segment, particularly chronic wound treatment, as the most lucrative, commanding the largest revenue share owing to the high unmet need and the critical success rates demonstrated by cold plasma in non-healing wounds. Within the Technology segment, the Direct Cold Plasma systems, offering focused, high-intensity treatment, dominate the market, although Indirect Cold Plasma systems are gaining traction for treating sensitive tissues and achieving sterilization in confined areas. End-user analysis shows that Hospitals and Specialty Clinics remain the primary revenue generators, driven by the volume of surgical procedures and complex wound management cases, while Ambulatory Surgical Centers (ASCs) represent a high-growth segment due to the shift towards outpatient care models.

AI Impact Analysis on Medical Cold Plasma Market

User inquiries regarding AI's influence on the Medical Cold Plasma Market primarily revolve around optimizing treatment parameters, predicting patient responses, and automating device operation. Users frequently question how AI can ensure precise plasma dosage delivery, minimize side effects, and integrate cold plasma treatment pathways into standardized clinical protocols. The key themes underscore the expectation that AI and Machine Learning (ML) algorithms will move cold plasma therapy from empirical application to highly personalized medicine. Concerns center on the regulatory hurdles for AI-integrated devices and the need for large, high-quality clinical datasets specific to cold plasma outcomes to train reliable models. Overall, the expectation is that AI will significantly enhance the efficacy, safety, and operational efficiency of cold plasma devices, transforming them into smart, predictive therapeutic tools capable of dynamic treatment modification based on real-time tissue feedback.

- AI-driven optimization of plasma parameters (e.g., gas flow, power, duration) based on wound type and patient characteristics, ensuring targeted efficacy.

- Predictive analytics for determining treatment outcomes and identifying patients most likely to benefit from cold plasma therapy for chronic wounds.

- Integration of real-time image analysis (using computer vision) to assess wound status, measure healing progression, and automatically adjust device settings.

- Automation of quality control and calibration processes within cold plasma systems, improving device reliability and minimizing human error during clinical use.

- Development of AI-powered diagnostic tools that classify microbial bioburden severity before and after cold plasma application, aiding in personalized infection control strategies.

- Enhanced clinical trial design and data processing for cold plasma technologies through ML models, accelerating regulatory approval pathways.

DRO & Impact Forces Of Medical Cold Plasma Market

The market dynamics for Medical Cold Plasma are primarily propelled by the urgent global requirement for advanced, non-thermal sterilization and wound care solutions, counterbalanced by technological hurdles related to standardization and high initial investment costs. The primary drivers include the escalating global burden of chronic wounds, particularly those complicated by drug-resistant bacteria, alongside supportive clinical studies validating cold plasma’s superior germicidal efficacy. Restraints center on the lack of standardized clinical guidelines across different geographies, limited long-term data regarding tissue interaction, and the capital intensiveness of acquiring and maintaining complex plasma generation equipment. Opportunities lie in diversifying applications into precision oncology (targeting cancer cells selectively), advanced dental procedures, and the integration of plasma systems into robotic surgery. These forces combine to create a high-growth market trajectory, contingent on overcoming regulatory inertia and achieving greater cost-efficiency in device production.

Drivers: The rapid increase in geriatric populations susceptible to chronic conditions such as diabetes and vascular insufficiency significantly drives the need for effective wound management tools. Furthermore, the undeniable rise of antimicrobial resistance (AMR) is pushing healthcare providers toward non-antibiotic treatments, making cold plasma a highly attractive alternative for sterilizing infected tissues and medical devices. Continuous investment in research and development has led to generation two and three devices that are more user-friendly, smaller, and capable of generating plasma under normal atmospheric pressure, increasing accessibility and utility in diverse clinical settings. Regulatory bodies are increasingly acknowledging the therapeutic potential, streamlining approval processes for well-validated devices.

Restraints: A significant impediment to broader market acceptance is the variability in plasma output depending on the device design, gas mixture, power source, and environmental conditions (humidity, temperature), which complicates the standardization of treatment protocols and comparison of clinical outcomes. Moreover, the high initial capital outlay for cold plasma systems, coupled with specific training requirements for medical personnel, particularly limits adoption in developing regions or smaller clinical practices. Uncertainty surrounding favorable reimbursement coverage for these novel procedures in several major markets creates a financial barrier for patients and clinics, slowing down widespread commercial penetration.

Opportunities: The market stands to benefit immensely from expanding into novel therapeutic areas where targeted cell ablation or tissue regeneration is required, such as non-melanoma skin cancer treatment and orthopedic implant surface modification for enhanced biocompatibility and infection prevention. Developing integrated, disposable cartridges for handheld systems could drastically reduce operational complexity and cross-contamination risks, opening up vast opportunities in emergency medicine and remote healthcare. Furthermore, strategic partnerships aimed at generating conclusive, multi-center clinical data will be pivotal in influencing regulatory bodies and securing broader insurance coverage, validating the long-term economic benefits of cold plasma therapy.

Impact Forces: The overarching impact force is technological substitution pressure, where cold plasma competes against established wound care methods (e.g., negative pressure wound therapy, advanced dressings) and traditional sterilization techniques (autoclaves, chemical sterilization). Regulatory scrutiny serves as a critical force, where rigorous demonstration of safety and efficacy is mandatory for market entry, especially concerning potential long-term genetic effects or tissue damage. Market growth is intensely sensitive to clinical adoption rates, which in turn are driven by published evidence and key opinion leader advocacy. The convergence of physics, engineering, and medical sciences in this domain ensures continuous technological innovation acts as a sustained upward force on market valuation.

Segmentation Analysis

The Medical Cold Plasma Market is comprehensively segmented based on its technological characteristics, application areas, and end-user uptake, reflecting the diversity of clinical needs and device designs. Analysis of these segments is crucial for strategic market positioning, demonstrating how specific device types are optimized for particular medical procedures. The Application segment dominates the landscape, driven by the massive patient pool requiring advanced wound and dermatological care. Geographic segmentation highlights the different maturity levels of the technology across regions, with established markets focusing on advanced procedural integration and emerging markets concentrating on fundamental infection control applications.

- By Application:

- Wound Healing (Chronic wounds, acute wounds, burns)

- Dermatology (Acne, Psoriasis, Eczema, Anti-aging, Skin rejuvenation)

- Sterilization and Disinfection (Surface sterilization, medical device sterilization)

- Cosmetic Applications (Aesthetic procedures)

- Oncology (Targeted tumor cell ablation, adjunctive therapy)

- Coagulation and Hemostasis

- Dental Applications (Periodontitis, root canal sterilization)

- By Technology:

- Direct Cold Plasma (DCP) Systems (Handheld, atmospheric pressure plasma jets)

- Indirect Cold Plasma (ICP) Systems (Remote delivery, plasma-activated media)

- By End-User:

- Hospitals and Clinics (Primary market segment due to infrastructure and volume)

- Ambulatory Surgical Centers (ASCs)

- Research and Academic Institutes (Focus on R&D and clinical trials)

- Specialty Dermatological Centers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Medical Cold Plasma Market

The value chain for the Medical Cold Plasma Market begins with the upstream activities centered on specialized material sourcing and core technology development. Upstream involves sourcing specialized noble gases (like Argon or Helium), high-precision power supplies, and advanced dielectric barrier discharge (DBD) components. The key value generation at this stage is research and intellectual property surrounding plasma jet physics and biological interaction modeling. Midstream activities involve the design, manufacturing, and rigorous testing of the plasma devices, requiring specialized engineering expertise in non-thermal plasma generation and miniaturization. Strict adherence to ISO and medical device regulatory standards (FDA, CE) adds significant value. Downstream activities focus on complex distribution channels, which typically include specialized medical device distributors, direct sales forces targeting key hospital groups, and focused training programs for clinical staff to ensure correct usage and maximize efficacy. The direct channel is preferred for large-scale hospital system sales where extensive training and maintenance contracts are required, while indirect channels leverage regional distributors to penetrate smaller clinics and ASCs efficiently.

The distribution network for these devices requires technical competence, as installation and maintenance are often complex. Direct sales enable manufacturers to maintain control over branding and clinical support, which is critical for a nascent technology where user confidence is paramount. Conversely, utilizing indirect regional distributors allows for rapid geographic expansion without massive capital expenditure, particularly useful in fragmented markets like APAC. Effective value delivery is crucially dependent on robust after-sales support, including software updates for AI-integrated systems and routine calibration to maintain plasma consistency. Partnerships with logistics providers specializing in high-value, sensitive medical equipment are essential to minimize supply chain risks and ensure timely delivery of consumables and replacement parts.

Medical Cold Plasma Market Potential Customers

The primary customers for Medical Cold Plasma devices are institutions that manage high volumes of surgical procedures, chronic disease patients, and infectious cases requiring advanced sterilization and tissue regeneration capabilities. Hospitals, particularly large university and trauma centers, are the most significant end-users due to their need for versatile, high-throughput sterilization equipment and their specialized clinics focusing on vascular surgery, dermatology, and infectious disease management. These institutions purchase systems based on clinical outcomes data, total cost of ownership, ease of integration into existing surgical suites, and the technology's capacity to address antibiotic-resistant organisms effectively. The decision-making unit often includes wound care specialists, infection control officers, and procurement committees focused on long-term capital investments.

Ambulatory Surgical Centers (ASCs) and specialized dermatological clinics represent a rapidly growing customer base, driven by the increasing shift towards outpatient settings for minor surgeries, cosmetic procedures, and specialized chronic wound care. ASCs prioritize smaller, portable, and less resource-intensive cold plasma devices that offer rapid turnaround and effective sterilization for high-volume minor procedures, valuing efficiency and minimal environmental footprint. Research and academic institutions, including clinical trial centers, constitute another vital customer segment, purchasing these systems primarily for investigational purposes, focusing on optimizing plasma delivery for novel applications like oncology or gene therapy delivery, thereby driving future technological advancements and validation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $520 Million USD |

| Growth Rate | 16.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adtec Plasma Technology Co. Ltd., Neoplas Tools GmbH, PlasmaDerm GmbH, Plasmatreat GmbH, Apyx Medical Corporation, Europlasma NV, Bovie Medical Corporation, P2M - Plasma and Power Medical GmbH, Cinogy GmbH, terraplasma GmbH, Relyon Plasma GmbH, Starkstrom-Gerätebau GmbH, Wacker Chemie AG, TTP plc, IonMed Ltd., Cold Plasma Medical Technologies, HPL Technologies, Zimek Medical, US Medical Innovations, K.H. Wirsam Elektrotechnik GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Cold Plasma Market Key Technology Landscape

The technological landscape of the Medical Cold Plasma Market is defined by continuous evolution towards enhanced stability, portability, and precise control over reactive species generation. The core technologies primarily revolve around Dielectric Barrier Discharge (DBD) systems and Atmospheric Pressure Plasma Jet (APPJ) configurations. DBD systems are favored for large-area surface treatment and sterilization due to their uniformity, while APPJs offer highly focused, localized plasma streams critical for surgical precision and specific wound targeting. Recent innovations focus heavily on microplasma sources and flexible plasma delivery systems that can conform to irregular wound surfaces or internal body cavities, significantly expanding the scope of minimally invasive surgical applications. There is a strong movement towards utilizing ambient air or nitrogen/oxygen mixtures rather than expensive noble gases, drastically reducing operational costs and enhancing feasibility for wider clinical adoption, particularly in resource-constrained environments.

A major advancement involves integrating sophisticated sensor technology and feedback loops into cold plasma devices. These smart systems monitor critical parameters such as temperature, electron density, and UV emission in real-time, allowing the device to dynamically adjust the power and gas flow to maintain optimal therapeutic effect while ensuring tissue safety. This intelligent control is crucial for securing regulatory clearance and building clinical trust. Furthermore, researchers are exploring the use of plasma-activated liquids (PALS) and plasma-activated water (PAW) as a non-invasive method for delivering reactive species to difficult-to-reach areas, representing a shift toward indirect treatment modalities that are less dependent on direct electrical coupling to the tissue. This innovative approach promises enhanced safety and easier integration into existing liquid-based medical procedures.

The pursuit of miniaturization has resulted in the development of handheld, battery-operated devices that significantly increase the versatility of cold plasma therapy, making it accessible in outpatient clinics, specialized wound care centers, and even potentially for professional home use under strict medical supervision. Manufacturers are also improving the lifespan and reliability of the internal components, particularly the high-voltage power supplies, which are central to consistent plasma generation. Ongoing research into optimizing the gas mixture—including the introduction of trace elements—to selectively generate specific Reactive Oxygen Species (ROS) or Reactive Nitrogen Species (RNS) is key to unlocking highly specialized applications, such as enhanced penetration for biofilm disruption or precise modulation of cellular signaling pathways for accelerated regeneration.

Regional Highlights

- North America: North America, particularly the United States, commands the largest market share owing to its robust healthcare infrastructure, high prevalence of diabetes-related chronic wounds, and substantial research funding allocated to advanced medical technologies. Favorable reimbursement policies for advanced wound therapies and the presence of major key market players drive early adoption. The region is characterized by high demand for cutting-edge, FDA-approved devices and a strong focus on clinical validation and standardization, positioning it as the primary innovation hub for cold plasma applications in oncology and sophisticated dermatology.

- Europe: Europe represents a mature market, driven significantly by rigorous research output from countries like Germany and Switzerland, which are global leaders in plasma technology and medical engineering. The European market benefits from established quality standards (CE Mark) and proactive government initiatives aimed at combating antimicrobial resistance (AMR), facilitating the clinical acceptance of cold plasma for sterilization and infection control. Market growth is robust, focused primarily on wound care and advanced cosmetic procedures, but regulatory fragmentation across different member states can pose minor distribution challenges.

- Asia Pacific (APAC): The APAC region is anticipated to be the fastest-growing market, driven by rapidly improving healthcare expenditure, increasing awareness of advanced treatments, and a massive patient demographic, especially for infectious diseases and diabetic foot ulcers in countries like China and India. Government policies aimed at localizing medical device manufacturing and favorable regulatory environments for new technologies contribute to aggressive market penetration. The opportunity here lies in producing cost-effective, high-volume devices suitable for large, tiered hospital systems.

- Latin America: The Latin American market exhibits moderate growth, constrained by economic volatility and comparatively lower healthcare technology budgets. However, growing medical tourism and the expansion of private healthcare facilities in countries like Brazil and Mexico are creating specific demand pockets for high-end cold plasma devices in specialized clinics, particularly for aesthetic and specialized surgical applications. Market entry typically requires strong partnerships with local distributors to navigate complex import tariffs and regulatory requirements.

- Middle East and Africa (MEA): The MEA region is emerging, with demand concentrated in the GCC countries (Saudi Arabia, UAE) due to high per capita income and advanced healthcare infrastructure in urban centers. Adoption is primarily focused on high-end hospital systems utilizing cold plasma for surgical instrument sterilization and critical wound management, often driven by international purchasing guidelines. The expansion into African markets is slow but holds significant long-term potential for basic infection control applications, contingent upon the availability of affordable, robust devices requiring minimal maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Cold Plasma Market.- Adtec Plasma Technology Co. Ltd.

- Neoplas Tools GmbH

- PlasmaDerm GmbH

- Plasmatreat GmbH

- Apyx Medical Corporation

- Europlasma NV

- Bovie Medical Corporation

- P2M - Plasma and Power Medical GmbH

- Cinogy GmbH

- terraplasma GmbH

- Relyon Plasma GmbH

- Starkstrom-Gerätebau GmbH

- Wacker Chemie AG

- TTP plc

- IonMed Ltd.

- Cold Plasma Medical Technologies

- HPL Technologies

- Zimek Medical

- US Medical Innovations

- K.H. Wirsam Elektrotechnik GmbH

Frequently Asked Questions

Analyze common user questions about the Medical Cold Plasma market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Medical Cold Plasma and how does it promote wound healing?

Medical Cold Plasma (MCP) is a partially ionized gas maintained at near room temperature (non-thermal). It accelerates wound healing by delivering reactive species (like ROS and RNS) directly to the tissue, which effectively sterilizes the wound site, disrupts bacterial biofilms, stimulates microcirculation, and promotes cellular proliferation and angiogenesis without causing thermal damage to surrounding healthy tissue.

Is cold plasma therapy safe for clinical use, and are there any significant side effects?

Yes, cold plasma therapy is generally considered safe for clinical use when delivered via medically certified devices, as it operates at temperatures below 40 degrees Celsius, avoiding tissue burning. Side effects are typically minimal, transient, and may include mild redness or temporary tingling at the application site. Extensive research confirms its high safety profile when applied to skin, mucosal membranes, and wounds.

How does the cost of cold plasma systems compare to traditional wound care technologies?

The initial acquisition cost of cold plasma systems is generally higher than traditional methods like standard dressings or simple chemical antiseptics, representing a significant capital expenditure. However, the long-term cost-effectiveness is enhanced by reducing treatment time, minimizing the need for expensive antibiotics (especially for drug-resistant infections), and lowering overall hospitalization days associated with chronic wounds.

What are the primary regulatory challenges faced by manufacturers in the Cold Plasma Market?

Primary challenges include the lack of globally harmonized standards for plasma device performance and output parameters, as the exact composition of the plasma stream can vary significantly between devices. Manufacturers must provide rigorous, reproducible clinical data demonstrating both efficacy and long-term safety to satisfy stringent regulatory bodies like the FDA and CE Mark authorities, particularly concerning the biological interaction mechanisms.

What key technological advancements are driving the future growth of cold plasma applications?

Future growth is being driven by the miniaturization of plasma generators for portable, handheld use; the integration of smart sensors and AI to ensure precise, individualized dosing; and the shift towards plasma-activated liquid technologies (PAW/PALS) for non-contact treatment of deep or internal infections, opening pathways for applications in areas like endoscopy and neurosurgery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager