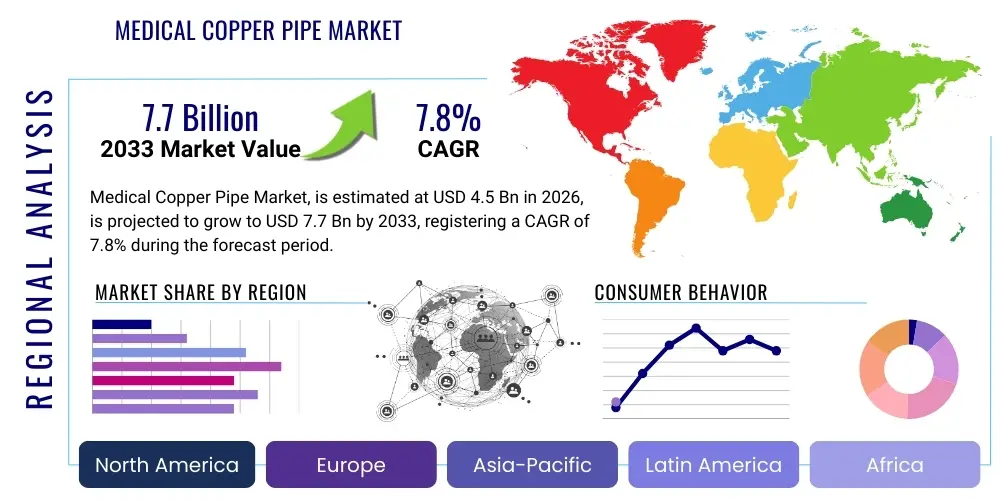

Medical Copper Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435289 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Medical Copper Pipe Market Size

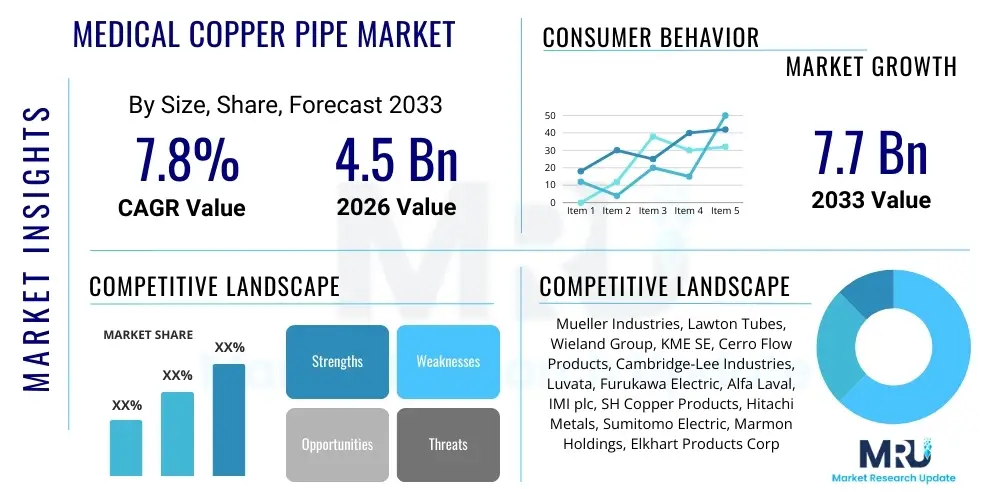

The Medical Copper Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Medical Copper Pipe Market introduction

The Medical Copper Pipe Market encompasses the manufacturing, distribution, and utilization of high-purity copper tubing specifically designed for critical healthcare applications, primarily focusing on the conveyance of medical gases, vacuum systems, and anesthetic gas scavenging systems (AGSS) within hospitals and medical facilities. These pipes must adhere to stringent national and international standards, such as ASTM B819 (for seamless copper tube for medical gas systems) and European standards like EN 13348, ensuring reliability, cleanliness, and non-toxicity crucial for patient safety. Copper is the material of choice due to its inherent antimicrobial properties, corrosion resistance, high tensile strength, and ease of installation (brazing), making it essential for robust medical infrastructure.

The primary product description centers on types K, L, and M, with K and L being predominant in medical applications due to their wall thickness and pressure rating capabilities. K-type tubing is typically utilized for underground installations or high-pressure systems, while L-type is most commonly used for interior runs and standard medical gas supply lines. These pipes are characterized by specialized cleaning processes—often referred to as "oxygen service cleaned"—to remove any residue, oil, or particulate matter that could contaminate the medical gases being transported, which are frequently life-supporting substances like oxygen, nitrous oxide, and medical air.

Major applications include integrating these pipes into new hospital construction projects, renovation of existing healthcare facilities, and specialized laboratory environments requiring ultra-pure gas delivery. The key driving factors for market growth include the global expansion of healthcare infrastructure, especially in developing economies, increasing regulatory mandates regarding medical gas system safety, and the rising prevalence of chronic respiratory diseases necessitating reliable oxygen delivery systems. The benefits derived from using medical-grade copper pipe—longevity, safety, and bacteriostatic properties—solidify its position as an indispensable component of modern medical engineering infrastructure.

Medical Copper Pipe Market Executive Summary

The Medical Copper Pipe Market is poised for substantial growth, driven primarily by favorable business trends surrounding global infrastructure investment and technological advancements in installation techniques. Business trends indicate a shift towards pre-fabricated and pre-cleaned copper tube assemblies, reducing on-site contamination risks and speeding up construction timelines, thereby increasing project efficiency and minimizing facility downtime. Furthermore, stringent quality control measures implemented by regulatory bodies (such as the FDA, ISO, and regional health organizations) ensure sustained demand for certified, high-quality copper products, mitigating the adoption of lower-grade alternatives and reinforcing market stability.

Regional trends highlight that North America and Europe remain mature markets, focused on infrastructure upgrades and adherence to complex compliance standards, representing stable demand for high-specification products. Conversely, the Asia Pacific region, particularly countries like China and India, presents the fastest-growing market opportunity due to massive investments in expanding public and private healthcare facilities to cater to burgeoning populations and improving economic standards. This demographic shift necessitates widespread build-out of medical gas supply networks, creating immediate and long-term demand for copper piping systems. The Middle East and Africa also show promising growth, spurred by government initiatives to modernize healthcare services and establish medical tourism hubs.

Segment trends confirm that the Hospital Infrastructure segment, specifically related to centralized medical gas supply systems, dominates the market share. However, the Ambulatory Surgical Centers (ASCs) segment is exhibiting accelerated growth, reflecting the global trend of shifting procedures from inpatient hospital settings to outpatient facilities, which still require highly reliable, specialized medical gas piping. Segmentation by pipe type shows continuous, strong demand for K-Type and L-Type tubing due to their established use and compliance, while specialized products focusing on antimicrobial coatings or enhanced purity standards are gaining traction, reflecting the industry's focus on infection control and patient safety protocols.

AI Impact Analysis on Medical Copper Pipe Market

Common user questions regarding AI's impact on the Medical Copper Pipe Market primarily revolve around how advanced analytics can optimize supply chain logistics, predict raw material price volatility (copper), and enhance quality assurance during manufacturing and installation. Users are keenly interested in whether AI-driven predictive maintenance systems can monitor the integrity and performance of installed medical gas pipelines over time, thereby reducing catastrophic failure risks. Key themes summarized from user queries include expectations for AI to minimize waste in production through optimized cutting and material usage, improve traceability of piping components from manufacturer to installation site, and potentially aid in the design phase of complex medical gas manifold systems, ensuring compliance and efficiency. While AI does not directly affect the copper pipe material properties, its influence is profound in optimizing the associated operational and logistical facets of the industry, enhancing safety and cost-efficiency.

- AI-driven Predictive Analytics: Used for forecasting copper raw material price fluctuations, enabling strategic procurement and inventory management to mitigate supply chain risk.

- Manufacturing Optimization: AI algorithms optimize cutting patterns and production schedules, minimizing material waste and energy consumption during the pipe manufacturing process.

- Quality Assurance (QA) Enhancement: Machine learning models analyze non-destructive testing data (e.g., ultrasonic testing) to detect microscopic defects in piping before installation, ensuring regulatory compliance.

- Installation Management: AI tools assist in complex piping layout design for hospital architecture, ensuring optimal flow dynamics and adherence to strict safety codes like NFPA 99.

- Supply Chain Traceability: Integration of AI with blockchain technology to create immutable records tracing each pipe segment from the smelter to the installation point in the hospital, crucial for liability and audits.

- Smart Infrastructure Monitoring: Future integration of sensors with AI monitoring systems to track pressure, flow rates, and potential micro-leaks in medical gas systems proactively, enhancing patient safety.

DRO & Impact Forces Of Medical Copper Pipe Market

The dynamics of the Medical Copper Pipe Market are shaped significantly by a complex interplay of internal and external forces categorized as Drivers, Restraints, and Opportunities (DRO). Key drivers include the mandatory requirement for copper in medical gas systems dictated by international safety standards (such as ISO 7396-1 and NFPA 99), which compels healthcare providers globally to invest in certified copper infrastructure. This regulatory push is amplified by rapid demographic shifts, specifically the aging global population and the corresponding increase in surgical procedures and reliance on supportive medical gases, demanding expansion and modernization of existing healthcare facilities across all major regions. Furthermore, the inherent antimicrobial efficacy of copper surfaces, a critical feature highlighted post-pandemic, increasingly drives demand in infection-sensitive environments, strengthening its market position against potential substitutes.

Conversely, the market faces considerable restraints, primarily the volatile and historically high price of raw copper, which directly impacts manufacturing costs and project budgeting for healthcare construction. This price instability can lead to procurement delays or force project managers to seek cost-saving measures, though strict medical requirements limit material substitution. Another significant restraint is the stringent requirement for highly skilled labor for proper installation and brazing of medical copper pipes, especially in developing regions where specialized training for compliance with standards like ASTM B819 is scarce. Incorrect installation risks system failure and contamination, making labor skill a crucial bottleneck.

Opportunities for market expansion are abundant, particularly within emerging economies characterized by substantial government spending on public health infrastructure build-outs and the growth of private healthcare investment. The adoption of advanced, pre-cleaned, and pre-insulated copper systems offers an opportunity for manufacturers to add value, reduce installation time, and meet increasingly demanding cleanliness standards. Furthermore, the growing trend toward sustainable and 'green' building codes in healthcare encourages the use of highly recyclable materials like copper. The key impact forces driving the market trajectory are governmental health expenditure policies, which directly fund infrastructure, and the continuous evolution of infection control protocols, which mandate the highest material quality and system integrity.

Segmentation Analysis

The Medical Copper Pipe Market is rigorously segmented based on product characteristics, primarily Type and Application, and further analyzed by the End-User purchasing the materials. This segmentation helps stakeholders understand the diverse demand landscape within the medical sector. Segmentation by Type distinguishes between the varying wall thicknesses and pressure ratings required for different installation environments and medical applications. L-Type and K-Type tubing dominate consumption due to their suitability for standard and high-pressure medical gas distribution systems. Application segmentation highlights the overarching demand areas, with dedicated hospital infrastructure being the central consumer, but with increasing fragmentation into specialized areas like dental surgeries and ambulatory centers. Analyzing these segments provides a clear pathway for strategic marketing and product development targeted toward specific regulatory and functional requirements.

- Type

- K-Type Copper Pipe (Heavy Wall, High Pressure)

- L-Type Copper Pipe (Medium Wall, Standard Pressure)

- M-Type Copper Pipe (Thin Wall, Less Common in Critical Applications)

- ACR (Air Conditioning and Refrigeration) Grade (Used in ancillary cooling units)

- Application

- Medical Gas Supply Systems (Oxygen, Nitrous Oxide, Air, CO2)

- Vacuum Systems and Suction

- Anesthetic Gas Scavenging Systems (AGSS)

- Laboratory Gas Piping (High Purity)

- End-User

- Hospitals (Public and Private)

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers and Laboratories

- Dental Clinics and Veterinary Hospitals

Value Chain Analysis For Medical Copper Pipe Market

The value chain for the Medical Copper Pipe Market begins with the upstream segment, centered on the mining and refinement of copper ore. This stage is dominated by large, multinational mining corporations and smelting facilities that produce high-purity copper cathodes. Price volatility in the commodities market profoundly influences this upstream cost structure. Following refinement, specialized copper mill producers process the raw material into seamless tubes, adhering strictly to medical-grade cleanliness standards (oil-free and particulate-free interior surfaces as per ASTM B819 or equivalent). This manufacturing phase is capital-intensive, requiring advanced drawing and annealing technologies to ensure uniformity and structural integrity crucial for high-pressure medical environments.

The downstream segment involves complex distribution and installation networks. Distribution is characterized by both direct sales from major pipe manufacturers to large hospital construction projects and indirect sales through specialized medical gas equipment distributors and large plumbing wholesale houses. These distributors often maintain stock of pre-cleaned, capped, and properly labeled tubing to comply with immediate project needs and regulatory requirements. The final crucial step in the value chain is the installation, typically carried out by certified medical gas installers or licensed mechanical contractors who specialize in high-integrity brazing techniques, ensuring zero leakage and system purity, which requires strict adherence to regional medical facility codes.

Direct distribution channels are generally preferred for large-scale, complex hospital projects where manufacturers can offer technical support and specific supply chain guarantees. Indirect distribution, leveraging wholesale and specialized gas equipment dealers, caters effectively to smaller clinics, renovations, and maintenance demand. The efficiency and reliability of the value chain are heavily contingent upon strict quality checkpoints at every stage, from material sourcing to final system commissioning, ensuring the safety and long-term performance of the medical gas infrastructure, which directly affects patient care outcomes and regulatory compliance adherence.

Medical Copper Pipe Market Potential Customers

The primary consumers and end-users of medical copper piping are institutions involved in providing clinical care, diagnostics, and surgical interventions where the reliable delivery of medical gases is essential for patient life support and procedural functionality. Hospitals, both public and privately funded, represent the largest and most consistently growing customer segment, driven by continuous expansion, replacement of aging infrastructure, and modernization efforts aimed at achieving higher safety standards (e.g., transitioning from older manifolds to centralized, fully redundant systems). These entities require bulk quantities of high-purity L and K-type copper tubing, often procured through large engineering, procurement, and construction (EPC) firms managing hospital build-outs.

A rapidly expanding customer base includes Ambulatory Surgical Centers (ASCs) and specialized outpatient facilities. As healthcare systems globally shift towards cost-effective outpatient care, ASCs are requiring smaller, yet equally compliant, medical gas systems. Although the volume per site is lower than a large hospital, the proliferation of ASCs worldwide creates a significant collective demand. Furthermore, diagnostic laboratories, especially those conducting advanced testing that requires specialized, high-ppurity laboratory gases (such as gas chromatography, mass spectrometry), are critical niche buyers, often requiring specialized, smaller diameter copper tubing for precision delivery.

Finally, governmental health authorities and military medical facilities are substantial long-term customers, frequently initiating large-scale national infrastructure projects or maintaining mobile field hospitals that require rugged, reliable, and compliant gas delivery systems. The buying decision for all these end-users is heavily influenced not just by cost, but primarily by product certification, proven reliability, traceability, and the manufacturer’s capacity to supply materials that meet stringent local and international medical piping codes, making compliance assurance a key differentiator for suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mueller Industries, Lawton Tubes, Wieland Group, KME SE, Cerro Flow Products, Cambridge-Lee Industries, Luvata, Furukawa Electric, Alfa Laval, IMI plc, SH Copper Products, Hitachi Metals, Sumitomo Electric, Marmon Holdings, Elkhart Products Corporation, Kembla Copper, MetTube, Golden Dragon Precise Copper Tube Group, Jintian Copper, Aurubis AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Copper Pipe Market Key Technology Landscape

The core technology surrounding medical copper pipes remains the production of seamless, deoxidized high-phosphorus (DHP) copper tubing (C12200 grade), which provides the optimal balance of corrosion resistance, strength, and malleability required for brazed gas systems. However, the key technological advancements in this market focus primarily on the refinement of manufacturing processes to achieve ultra-high internal cleanliness and enhanced pipe integrity, going beyond standard industrial requirements. Manufacturers increasingly utilize automated, high-pressure flushing systems with inert gases (such as nitrogen) during the final stages of production to ensure the internal surfaces meet stringent "oxygen service clean" specifications, thereby eliminating contaminants that could react with high-purity medical gases.

Another crucial technological area is the development of advanced brazing techniques and fittings designed specifically for medical systems. While traditional brazing using silver alloys remains standard, there is increasing adoption of mechanically jointed systems in less critical areas, though brazing is mandated for high-pressure medical oxygen lines. Furthermore, manufacturers are investing in specialized capping and packaging technologies, utilizing hermetically sealed, nitrogen-pressurized packaging to maintain internal pipe cleanliness from the factory floor until the moment of installation at the job site. This packaging technology is vital for regulatory compliance and reducing the labor required for on-site re-cleaning procedures.

Innovation also extends to pipe surface treatments. While copper is inherently antimicrobial, research is ongoing into applying specific surface modifications or incorporating anti-biofilm coatings, further leveraging copper's ability to resist microbial colonization in humid medical environments. Finally, non-destructive testing (NDT) methodologies, including eddy current testing and advanced ultrasonic inspection, are standard technologies employed to verify the absence of microscopic fissures or defects in the pipe wall before certification. The collective aim of these technologies is to ensure zero risk of material failure or gas contamination throughout the lifecycle of the medical gas system.

Regional Highlights

- North America: This region holds a significant market share, characterized by mature healthcare infrastructure, extremely stringent regulatory frameworks (e.g., NFPA 99 standards in the U.S.), and a high average healthcare expenditure. Demand is consistently high, driven primarily by hospital renovation projects, expansion of Ambulatory Surgical Centers (ASCs), and replacement cycles for aging copper infrastructure dating back decades. The market here demands the highest quality, certified K-type and L-type piping, favoring suppliers with robust compliance certifications and established distribution networks.

- Europe: Europe represents a strong, stable market, guided by EU directives and specific national standards (like HTM 02-01 in the UK). Western Europe focuses on sophisticated infrastructure modernization and integrating smart hospital technologies. Central and Eastern Europe present high growth potential due to ongoing structural reforms and investment aimed at aligning public health standards with Western European norms. Germany, France, and the UK are the primary consumers, prioritizing environmental sustainability alongside technical performance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This exponential growth is fueled by massive demographic pressure, rising middle-class disposable income, and large-scale government programs aimed at universal healthcare coverage (e.g., in China, India, and Southeast Asia). The demand here is driven by large new hospital construction projects, requiring bulk supply of standard-compliant medical copper pipes, often balancing cost-effectiveness with regulatory adherence.

- Latin America (LATAM): The LATAM market is showing steady, moderate growth, propelled by private sector investment in specialized clinics and hospitals in countries like Brazil and Mexico. Economic volatility can sometimes restrain large public sector projects, but the increasing requirement for reliable gas systems in private facilities ensures continuous demand. Standardization efforts across the continent are improving, increasing the preference for internationally certified piping products.

- Middle East and Africa (MEA): Growth in the MEA region is segmented. The GCC (Gulf Cooperation Council) nations are major investors, focusing on creating world-class medical tourism hubs, necessitating premium, high-spec medical infrastructure and imported piping solutions. The African continent, particularly South Africa and high-growth markets like Nigeria, offers substantial long-term opportunity as basic healthcare infrastructure expands, though logistical challenges and varying regulatory landscapes remain factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Copper Pipe Market.- Mueller Industries

- Lawton Tubes

- Wieland Group

- KME SE

- Cerro Flow Products

- Cambridge-Lee Industries

- Luvata

- Furukawa Electric

- Alfa Laval

- IMI plc

- SH Copper Products

- Hitachi Metals

- Sumitomo Electric

- Marmon Holdings

- Elkhart Products Corporation

- Kembla Copper

- MetTube

- Golden Dragon Precise Copper Tube Group

- Jintian Copper

- Aurubis AG

Frequently Asked Questions

Analyze common user questions about the Medical Copper Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary standards governing medical copper pipe cleanliness and use?

The critical standards include ASTM B819 in North America, specifying seamless copper tube for medical gas systems, which mandates internal cleanliness for oxygen service. Globally, ISO 7396-1 defines requirements for medical gas pipeline systems, while regional standards like NFPA 99 (Health Care Facilities Code) in the US regulate the installation and performance of these systems.

Why is copper pipe preferred over plastic or stainless steel for medical gas applications?

Copper is preferred due to its inherent antimicrobial (bacteriostatic) properties, excellent corrosion resistance, high structural integrity under pressure, and proven reliability. Regulatory codes mandate copper or specific alloys due to these safety benefits, ensuring non-reactivity and system purity critical for life-supporting gases.

What is the difference between Type K and Type L medical copper tubing?

The distinction lies in wall thickness. K-Type tubing has the thickest wall, offering the highest pressure rating, and is often used underground or in heavy-duty applications. L-Type has a thinner wall but is the most common choice for general interior medical gas distribution runs due to its balance of strength, cost, and pressure capability.

How does copper price volatility affect the Medical Copper Pipe Market?

Copper price volatility directly impacts the manufacturing cost and, consequently, the final procurement cost for healthcare facility projects. High volatility can lead to project delays or budget re-evaluation, although demand remains largely inelastic due to mandatory material requirements for medical safety compliance.

Which regional market shows the highest growth potential for medical copper pipes?

The Asia Pacific (APAC) region exhibits the highest growth potential, driven by significant governmental and private investments in expanding foundational healthcare infrastructure to support large and aging populations, particularly in rapidly developing economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager