Medical Device CDMO Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434648 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Medical Device CDMO Market Size

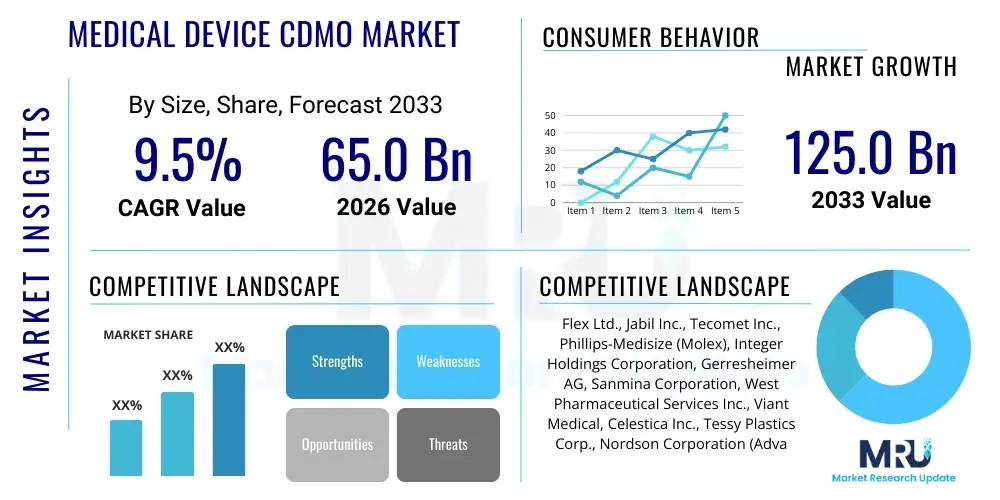

The Medical Device CDMO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 65.0 Billion in 2026 and is projected to reach USD 125.0 Billion by the end of the forecast period in 2033.

Medical Device CDMO Market introduction

The Medical Device Contract Development and Manufacturing Organization (CDMO) Market encompasses specialized external partners offering comprehensive services ranging from initial concept design and development to final high-volume manufacturing, assembly, and packaging of medical devices. This market serves original equipment manufacturers (OEMs) who seek to outsource non-core competencies or leverage external expertise and advanced infrastructure to accelerate product timelines, manage regulatory complexities, and reduce operational costs. The shift toward outsourcing is driven by increasing regulatory scrutiny (e.g., MDR in Europe, stringent FDA requirements), the rising complexity of devices (particularly connected, implantable, and diagnostic technologies), and the intense pressure on OEMs to maintain capital efficiency and focus resources on core intellectual property creation and market strategy. CDMOs offer crucial flexibility, scalability, and access to specialized technical platforms that would be prohibitively expensive for individual OEMs to maintain internally, positioning them as essential strategic partners in the modern medical technology ecosystem.

Key products within this sector span a broad range, including complex electronic components, minimally invasive surgical tools, sophisticated diagnostic imaging systems, and combination products incorporating drug delivery mechanisms. Major applications include cardiology, orthopedic, neurology, diabetes care, and general surgery. The principal benefit of utilizing CDMOs lies in optimized time-to-market, enhanced quality control due to certified facilities, and risk mitigation related to supply chain disruptions and technological obsolescence. Furthermore, CDMOs facilitate seamless integration of advanced manufacturing techniques, such as additive manufacturing (3D printing) and smart manufacturing practices (Industry 4.0), ensuring that devices are produced using state-of-the-art processes that meet the highest standards of precision and compliance.

Driving factors propelling market expansion include the global aging population, which necessitates greater demand for chronic disease management devices; increased venture capital funding flowing into smaller medical technology startups that inherently rely on outsourcing; and the growing focus on personalized medicine requiring highly flexible and low-volume manufacturing capabilities. Additionally, the continuous innovation cycle in areas like robotics, remote monitoring, and complex interventional devices demands specialized engineering skills often possessed by leading CDMOs. The consolidation of CDMOs, leading to larger, more geographically diverse entities, further simplifies the supply chain management for global OEMs, cementing the CDMO model as a foundational element of the global medical device manufacturing landscape.

Medical Device CDMO Market Executive Summary

The Medical Device CDMO market is experiencing robust growth fueled by strategic partnerships and a profound shift toward full-service outsourcing models. Business trends indicate strong merger and acquisition activity among CDMOs seeking to expand their technological capabilities, particularly in areas like advanced materials processing, sophisticated electronics integration, and specialized sterilization services. OEMs are increasingly prioritizing CDMOs that offer end-to-end solutions, from design inputs through to regulatory submission and post-market surveillance support, moving away from fragmented, transactional manufacturing agreements. Investment in automated manufacturing processes, driven by the desire for improved yield and reduced human error, is a defining business imperative for market leaders. Furthermore, resilience and redundancy in the supply chain, emphasized following recent global disruptions, are now critical differentiators when OEMs select strategic partners.

Regionally, North America remains the dominant market due to a high concentration of leading medical device OEMs, robust regulatory infrastructure, and substantial investment in R&D, particularly in biotech and complex implantable devices. However, the Asia Pacific region is demonstrating the highest growth trajectory, primarily driven by lower operating costs, expanding domestic healthcare markets in countries like China and India, and increasing manufacturing quality standards that are attracting global outsourcing mandates. Europe maintains significant strength, underpinned by Germany, Ireland, and Switzerland, focusing on high-precision engineering and compliance with the highly complex Medical Device Regulation (MDR). The competitive advantage globally is shifting toward CDMOs that can navigate disparate regional regulatory frameworks efficiently and offer localized manufacturing solutions to minimize logistical footprints.

Segmentation trends highlight the increasing prominence of complex device categories, particularly diagnostic and imaging systems, and cardiovascular devices, which require high-tolerance manufacturing and specialized quality assurance protocols. The services segment shows the fastest evolution, moving beyond simple component fabrication to encompass specialized engineering services, including risk analysis, verification/validation testing, and regulatory documentation management. Small to Mid-Sized Enterprises (SMEs) are emerging as the fastest-growing customer segment, as they lack the internal infrastructure and capital necessary to bring innovative devices to market without extensive external support. Conversely, large OEMs are using CDMOs for strategic capacity expansion and accessing niche technological expertise that complements their internal core manufacturing capabilities.

AI Impact Analysis on Medical Device CDMO Market

Common user questions regarding AI's influence in the Medical Device CDMO market center around efficiency gains, enhanced quality control, and the integration of AI-enabled devices into the manufacturing process. Users frequently inquire about how AI can optimize complex production scheduling (e.g., managing low-volume, high-mix production lines), improve predictive maintenance to minimize downtime, and accelerate design iteration cycles through simulation and generative design tools. A significant theme is the expected paradigm shift from reactive quality checks to proactive, real-time defect detection using machine vision and deep learning algorithms. Furthermore, the market anticipates AI's role in streamlining regulatory compliance documentation by automatically analyzing and summarizing large volumes of quality data, addressing key concerns about the cost and complexity of modern medical device production and ensuring consistent regulatory adherence across global operations.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming the operational landscape of Medical Device CDMOs, moving manufacturing floors toward smart, autonomous environments. AI algorithms are being deployed in crucial areas such as supply chain predictive analytics, allowing CDMOs to forecast material requirements with unprecedented accuracy, thereby mitigating risks associated with component shortages or fluctuating market demands. In the realm of quality assurance, AI-powered systems are capable of analyzing data from complex sensor arrays in real-time during assembly processes, identifying minute variations or defects that human inspection or traditional statistical process control methods might miss. This proactive quality approach not only enhances product reliability but also significantly reduces material wastage and rework costs, directly impacting the profitability and competitiveness of the CDMO.

Moreover, AI is playing a critical role in the R&D and design phase, offering CDMOs a competitive edge by accelerating the development cycle for their OEM partners. Generative design tools, guided by AI, can rapidly explore thousands of viable device configurations based on performance, material, and manufacturability constraints, resulting in optimized designs that are inherently easier and more cost-effective to produce. This capability is particularly valuable for complex geometries found in orthopedic implants or highly miniaturized components. The adoption of AI also extends to optimizing facility layouts and workflow management, ensuring optimal resource allocation and throughput maximization in highly regulated cleanroom environments. However, the implementation requires substantial investment in data infrastructure and specialized data science talent, presenting an adoption barrier for smaller market participants.

- AI-Driven Predictive Maintenance: Minimizing unplanned equipment downtime and optimizing operational throughput.

- Generative Design Optimization: Accelerating the design and prototyping of complex device geometries.

- Real-Time Quality Control (Machine Vision): Implementing instantaneous defect detection in high-speed assembly lines.

- Supply Chain Forecasting: Utilizing ML models for accurate prediction of material needs and logistics planning.

- Automated Regulatory Documentation: Streamlining data analysis for quicker compliance reports and audits.

- Enhanced Robotics Programming: Improving the dexterity and precision of robotic systems using learning algorithms.

DRO & Impact Forces Of Medical Device CDMO Market

The Medical Device CDMO market is driven primarily by the escalating complexity of medical technology, regulatory harmonization efforts requiring specialized expertise, and the persistent pressure on OEMs to reduce capital expenditures by outsourcing manufacturing assets. Restraints include significant regulatory barriers to entry, particularly in specialized fields like combination products, and intense pricing pressure from OEMs seeking cost efficiencies, which compresses CDMO profit margins. Opportunities are vast, focused on specialized technological niches such as connected health devices (IoT), micro-electromechanical systems (MEMS) production, and penetrating emerging markets where local manufacturing expertise is scarce. The core impact forces shaping this market include stringent quality mandates (MDR/FDA), rapid technological obsolescence necessitating continuous capital upgrades, and critical skilled labor shortages in high-precision engineering and compliance roles.

The increasing need for speed and scale is a significant driver. Startups and mid-sized device companies, often focused solely on innovation and clinical validation, depend entirely on CDMOs for manufacturing capabilities, particularly those requiring cleanroom facilities or sterile processing expertise. Furthermore, large OEMs utilize CDMOs not just for capacity but also for strategic diversification of their supply base to ensure resiliency against geopolitical and natural disaster risks. The regulatory environment acts as a dual-edged sword: while it is a restraint due to the cost of compliance, it simultaneously drives market demand for CDMOs, as smaller OEMs often lack the internal resources and knowledge base required to navigate complex global standards, making external regulatory expertise indispensable.

Impact forces are heavily centered on geopolitical dynamics and economic volatility. Tariffs, trade disputes, and regional manufacturing incentives (e.g., reshoring initiatives) directly influence where CDMOs choose to locate or expand their facilities. Technological advancement, particularly the shift toward Industry 4.0 principles (smart factories, interconnected systems), mandates continuous heavy capital investment by CDMOs to remain competitive. This high investment requirement reinforces the barrier to entry but also strengthens the position of established, well-capitalized market leaders. The ability of a CDMO to integrate seamlessly into an OEM's Quality Management System (QMS) and provide transparent, auditable supply chain data represents a critical competitive advantage and a powerful impact force in vendor selection.

Segmentation Analysis

The Medical Device CDMO market is segmented based on device type, service, and end-user, reflecting the diverse requirements of the medical technology industry. Analyzing these segments provides crucial insights into specialized growth areas and investment priorities within the outsourcing landscape. Key segments such as Class II and Class III devices command substantial revenue due to their complexity and higher regulatory burden, necessitating sophisticated manufacturing processes. The service segmentation reveals a continuous shift from pure manufacturing toward comprehensive design and engineering services, indicating a strategic preference for CDMOs capable of providing full product lifecycle management. Understanding these segments is vital for anticipating technological investment needs and geographical expansion strategies for both CDMOs and their OEM partners.

The classification by services—ranging from pure manufacturing to specialized testing and regulatory affairs—is critical because it determines the value addition potential of the CDMO. While raw material procurement and component fabrication are necessary, the highest margin and strategic value are found in specialized services such as sterilization management, complex assembly, and intellectual property protection consulting. The trend toward vertically integrated CDMOs, which consolidate multiple service offerings under one roof, is addressing OEM demand for supply chain simplification and risk consolidation. Furthermore, the end-user segmentation, distinguishing between large OEMs and small-to-mid-sized enterprises (SMEs), demonstrates differing service needs, with SMEs requiring more extensive design and regulatory support, whereas large OEMs primarily seek scalable capacity and expertise in niche manufacturing technologies.

- By Device Type:

- Class I Devices

- Class II Devices

- Class III Devices

- Combination Products

- In-vitro Diagnostics (IVD)

- By Service:

- Design and Development Services

- Device Manufacturing

- Molding and Machining

- Extrusion

- Assembly

- Welding and Fabrication

- Testing and Regulatory Services

- Packaging and Sterilization Services

- Finished Goods Assembly

- By End-User:

- Large Medical Device Companies (OEMs)

- Small and Medium-sized Enterprises (SMEs)

- By Application:

- Cardiology

- Orthopedics

- Neurology

- General Surgery

- Drug Delivery Devices

- Diagnostics and Imaging

Value Chain Analysis For Medical Device CDMO Market

The value chain for the Medical Device CDMO market begins with upstream activities focused on raw material sourcing and specialized component providers. Upstream analysis involves assessing the suppliers of high-grade biocompatible polymers, specialized metals (e.g., titanium, stainless steel), and complex electronic components (sensors, microprocessors). Strong partnerships with tier-one material suppliers are critical, as material quality directly impacts device safety and regulatory compliance. CDMOs must exercise rigorous supplier qualification and audit processes to ensure traceability and material integrity, especially concerning rare earth elements and conflict minerals. The pricing stability and geopolitical risks associated with these raw material inputs significantly influence the final manufacturing cost and lead times for medical devices.

The core of the value chain is the manufacturing and development stage, where CDMOs execute their primary functions, including design engineering, prototyping, process validation, and high-volume manufacturing. This midstream phase involves complex capital assets, such as advanced CNC machines, cleanroom infrastructure (ISO Class 7 and 8), and sophisticated quality management systems (QMS compliant with ISO 13485). Value addition here is primarily driven by technological expertise, automation, and the ability to manage the regulatory documentation required for global market entry. Distribution channels for the CDMO market are primarily indirect, relying on the CDMO acting as a specialized manufacturer selling finished or semi-finished goods directly to the OEM. The OEM then manages the direct distribution, sales, and marketing to hospitals, clinics, and end-users.

Downstream analysis focuses on packaging, sterilization, logistics, and post-market services. Sterilization (e.g., EtO, gamma, E-beam) is often outsourced to specialized third-party vendors, although integrated CDMOs may offer this in-house. The final distribution is handled by logistics partners specialized in handling high-value, temperature-sensitive, and regulated medical products. Direct engagement in the CDMO market typically occurs during the initial contract negotiation phase between the OEM and the CDMO executive teams. Indirect interactions are numerous, involving sub-suppliers, logistics providers, external regulatory consultants, and technology platform providers. The efficiency and regulatory rigor applied across the entire value chain determine the final cost and quality of the medical device, making supply chain resilience and transparency paramount for CDMO success.

Medical Device CDMO Market Potential Customers

The primary customer base for the Medical Device CDMO market includes a wide spectrum of Original Equipment Manufacturers (OEMs), ranging from Fortune 500 pharmaceutical and medical technology giants to early-stage, venture-backed medical technology startups. Large, established OEMs (e.g., Medtronic, Johnson & Johnson, Abbott) are major buyers, seeking CDMO partnerships for strategic capacity management, geographical expansion into new regulated territories, and accessing niche technological capabilities (such as complex micro-assembly or specialized coatings) that complement their mass-production internal facilities. These large entities value CDMOs that can offer risk sharing, redundant manufacturing sites, and deep expertise in global regulatory documentation, particularly concerning Class III implantable devices.

Small and Medium-sized Enterprises (SMEs) and medical technology startups represent the fastest-growing segment of potential customers. These entities often possess disruptive intellectual property but lack the significant capital required to establish certified manufacturing infrastructure, cleanrooms, or the extensive regulatory affairs teams necessary for commercialization. For SMEs, CDMOs function as an essential lifeline, providing comprehensive design-to-launch services, including early-stage prototyping, clinical trial device manufacturing, and navigating initial FDA or CE Mark approvals. The reliance of this segment on CDMOs for full product lifecycle support ensures a consistent demand for integrated service models, differentiating the CDMO role from a simple contract manufacturer.

Furthermore, non-traditional buyers are emerging, including academic research institutions and specialized venture capital firms that manage a portfolio of device startups. These groups require CDMO services for pilot runs and limited production of highly specialized research tools or diagnostic platforms. The decision criteria for all potential customers heavily revolve around the CDMO's track record in quality compliance (zero recall history), technological specialization (e.g., expertise in catheter fabrication, diagnostics optics), and financial stability, ensuring long-term supply continuity. The evolving needs of these diverse customer segments necessitate CDMO specialization across various device complexities and service depth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 125.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flex Ltd., Jabil Inc., Tecomet Inc., Phillips-Medisize (Molex), Integer Holdings Corporation, Gerresheimer AG, Sanmina Corporation, West Pharmaceutical Services Inc., Viant Medical, Celestica Inc., Tessy Plastics Corp., Nordson Corporation (Advanced Technology), Benchmark Electronics Inc., Nolato AB, Creganna Medical (TE Connectivity), BD (Becton, Dickinson and Company), Teleflex Incorporated, Zeus Company Inc., Dyamed Biotech, Accellent Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Device CDMO Market Key Technology Landscape

The technological landscape of the Medical Device CDMO market is undergoing rapid evolution, heavily influenced by the principles of Industry 4.0 and the pursuit of miniaturization and connectivity in devices. Additive manufacturing (3D printing) stands out as a foundational technology, enabling CDMOs to rapidly prototype complex geometries, produce patient-specific implants (personalized medicine), and streamline tool production, offering agility that traditional subtractive manufacturing methods cannot match. Furthermore, precision machining technologies, particularly five-axis CNC milling and advanced laser processing, remain critical for producing high-tolerance components used in surgical robotics and implantable devices. The integration of advanced robotics and collaborative robots (cobots) across the assembly lines is increasing, addressing labor shortages while ensuring precise, repeatable processes essential for medical device quality.

Another crucial technological development is the expansion of micro-manufacturing capabilities, necessary for producing intricate components for micro-electromechanical systems (MEMS), complex catheters, and drug delivery platforms. This involves specialized processes like micro-molding, precision extrusion, and advanced surface treatment technologies (e.g., plasma treatment, specialized coatings) to enhance biocompatibility and functional performance. Data management and cybersecurity platforms are equally critical technological investments. As more devices become connected (IoT integration), CDMOs must implement robust, validated systems to manage and secure the vast amounts of manufacturing and quality data generated, ensuring compliance with data integrity regulations (e.g., 21 CFR Part 11) and protecting sensitive OEM intellectual property.

The future of the CDMO technology landscape centers on digital transformation and simulation. CDMOs are increasingly using Digital Twins—virtual representations of their manufacturing lines—to simulate process changes, predict outcomes, and optimize efficiency before physical implementation, significantly reducing validation time and cost. Furthermore, specialized cleanroom technology, including automated particulate monitoring and controlled environments for aseptic manufacturing, continues to be a core requirement, driven by stricter global sterilization and contamination control standards. The successful CDMO will be characterized by its capacity to integrate these diverse, high-tech platforms—from materials science to AI-powered quality monitoring—into a seamless, validated manufacturing workflow that meets rigorous regulatory and quality demands.

Regional Highlights

- North America: This region holds the largest market share, characterized by high R&D expenditure, early adoption of advanced medical technologies (e.g., surgical robotics, complex diagnostics), and a favorable investment environment for MedTech startups. The presence of major pharmaceutical and device OEMs drives substantial outsourcing demand, particularly for complex Class III and high-value niche manufacturing services. Compliance with FDA regulations requires CDMOs operating here to maintain extremely high standards of quality management and documentation.

- Europe: The European market is the second-largest, driven by Germany, Ireland, and Switzerland, which are hubs for high-precision engineering and manufacturing. The implementation of the new Medical Device Regulation (MDR) has intensified the regulatory burden on OEMs, thereby increasing reliance on CDMOs for compliance expertise and specialized testing. Demand is strong for orthopedic, cardiovascular, and high-quality diagnostic devices.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising healthcare expenditure, a rapidly expanding middle class, and government initiatives promoting local medical device manufacturing (e.g., 'Make in India' and Chinese strategic plans). Countries like China, India, and Singapore are emerging as global manufacturing centers, attracting significant foreign direct investment. CDMOs are leveraging lower labor costs and establishing regional hubs to serve both multinational OEMs and burgeoning local device companies, particularly focusing on high-volume disposables and Class II devices.

- Latin America (LATAM): Growth in LATAM is steady, driven primarily by Mexico and Brazil, which serve as regional manufacturing bases due to proximity to the North American market and favorable trade agreements. The market is primarily focused on serving domestic demand for essential medical consumables and leveraging manufacturing efficiencies for export, though regulatory harmonization across the diverse countries remains a challenge.

- Middle East and Africa (MEA): This region is an emerging market, driven by significant government investment in modernizing healthcare infrastructure, particularly in the UAE and Saudi Arabia. While currently smaller, the demand for locally accessible, high-quality manufacturing services is growing, reducing reliance on long-distance imports, particularly in specialized areas like diagnostics and critical care consumables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Device CDMO Market.- Flex Ltd.

- Jabil Inc.

- Tecomet Inc.

- Phillips-Medisize (Molex)

- Integer Holdings Corporation

- Gerresheimer AG

- Sanmina Corporation

- West Pharmaceutical Services Inc.

- Viant Medical

- Celestica Inc.

- Tessy Plastics Corp.

- Nordson Corporation (Advanced Technology)

- Benchmark Electronics Inc.

- Nolato AB

- Creganna Medical (TE Connectivity)

- BD (Becton, Dickinson and Company)

- Teleflex Incorporated

- Zeus Company Inc.

- Dyamed Biotech

- Accellent Inc.

Frequently Asked Questions

Analyze common user questions about the Medical Device CDMO market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Medical Device CDMO market?

The primary driver is the accelerating complexity of modern medical devices (e.g., connected health, miniaturization, combination products) which necessitates specialized manufacturing expertise and large capital investments that OEMs prefer to outsource. Additionally, stringent global regulatory requirements (like the EU MDR) push smaller device manufacturers to rely on expert CDMO partners for compliance and validation services, accelerating outsourcing penetration.

How does the shift to Industry 4.0 affect Medical Device CDMO operations?

Industry 4.0 profoundly impacts CDMOs by enabling smart manufacturing through AI, IoT, and advanced automation. This results in highly flexible production lines, superior quality control via real-time monitoring and predictive maintenance, and enhanced traceability of components, all crucial for meeting the demanding quality and cost expectations of OEMs.

Which geographic region demonstrates the highest potential for future CDMO market expansion?

The Asia Pacific (APAC) region is projected to exhibit the highest future growth potential. This is driven by rapid expansion of local healthcare infrastructure, increasing manufacturing sophistication, lower operational costs attracting global outsourcing mandates, and governments actively supporting the local production of medical devices to serve large regional populations.

What are the greatest risks associated with relying on a Medical Device CDMO?

The greatest risks primarily involve maintaining control over Intellectual Property (IP) and ensuring supply chain resilience. OEMs face risks related to potential breaches of confidentiality during development and manufacturing, alongside the crucial need for the CDMO to maintain continuous compliance and capacity to avoid critical supply disruptions, especially for life-sustaining devices.

What is the role of Additive Manufacturing (3D Printing) in the CDMO market?

Additive Manufacturing is integral to the CDMO market, particularly for rapid prototyping and the production of complex, patient-specific orthopedic implants and surgical tools. It allows for geometrical freedom, material reduction, and quicker design iteration cycles, enabling CDMOs to offer highly specialized and personalized manufacturing services to their clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager