Medical Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433062 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Medical Diagnostics Market Size

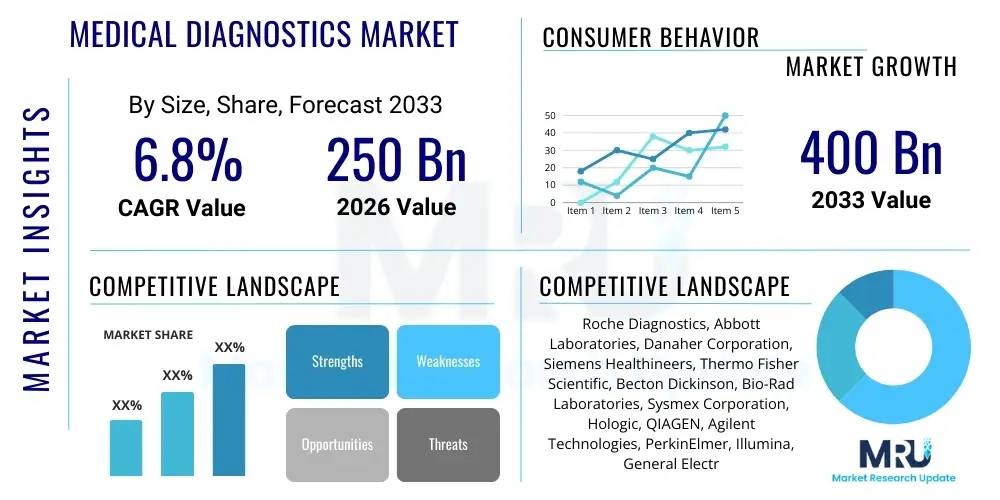

The Medical Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 250 Billion in 2026 and is projected to reach USD 400 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating prevalence of chronic and infectious diseases globally, coupled with significant advancements in technological innovation, particularly in molecular diagnostics and point-of-care testing (POCT). The shift towards preventative healthcare models and personalized medicine also necessitates continuous investment in accurate and rapid diagnostic tools, fueling revenue growth across all geographic segments. Furthermore, the increasing geriatric population, which inherently requires more intensive diagnostic screening and disease management, acts as a pivotal demographic driver.

Medical Diagnostics Market introduction

The Medical Diagnostics Market encompasses a broad spectrum of technologies, products, and services used to identify, monitor, or predict diseases and medical conditions. This includes complex laboratory instrumentation, specialized reagents, sophisticated imaging systems, and integrated software solutions designed to analyze biological samples (blood, urine, tissues). Key product descriptions range from highly sensitive immunoassay analyzers used for hormonal and cardiac markers to advanced PCR systems essential for nucleic acid detection in infectious disease testing and oncology. Major applications span critical areas such as infectious disease management (including viral, bacterial, and parasitic identification), chronic disease monitoring (diabetes, cardiovascular diseases, kidney disorders), prenatal screening, and precise cancer staging and management.

The core benefit of timely and accurate medical diagnostics lies in enabling early intervention, improving patient outcomes, and significantly reducing overall healthcare costs by preventing disease progression. Rapid diagnostics, especially those facilitating decentralized testing like POCT, improve efficiency and accessibility, particularly in remote or resource-limited settings. Driving factors include government initiatives promoting early disease detection, substantial funding for life sciences research leading to novel biomarker discovery, and the transition from traditional centralized laboratory testing to more distributed, rapid, and patient-centric diagnostic platforms. The ongoing integration of digital health solutions, such as Laboratory Information Management Systems (LIMS) and AI-powered analytical tools, further enhances the utility and market penetration of diagnostic products.

Moreover, the increasing demand for tailored treatments inherent in the precision medicine paradigm directly elevates the importance of complex diagnostic tests, such as companion diagnostics. These specialized tests are mandatory for determining which patients are most likely to respond to specific targeted therapies, particularly in cancer treatment. The market’s dynamism is also reflected in the continuous innovation surrounding minimally invasive diagnostic procedures and the emergence of liquid biopsy techniques, which offer less burdensome alternatives to traditional tissue biopsies, thereby improving patient compliance and accelerating diagnostic workflows. This confluence of technological refinement and shifting clinical needs firmly establishes the medical diagnostics sector as indispensable to modern healthcare delivery worldwide.

Medical Diagnostics Market Executive Summary

The Medical Diagnostics Market is characterized by robust growth, primarily driven by rapid technological convergence, increasing incidence of chronic diseases, and a global shift toward decentralized diagnostic workflows. Business trends highlight intense competitive rivalry, focusing heavily on mergers and acquisitions (M&A) among major players to consolidate technology portfolios, particularly in the high-growth molecular diagnostics space. Companies are investing heavily in automation and standardization to address labor shortages in clinical laboratories and improve throughput. Key trends include the proliferation of home-based testing solutions, the integration of telehealth with diagnostic services, and the establishment of stringent regulatory frameworks globally, necessitating high investment in clinical validation and quality assurance to maintain market access and consumer trust.

Regionally, North America continues to dominate the market share due to sophisticated healthcare infrastructure, high healthcare expenditure, and the early adoption of advanced diagnostic technologies like next-generation sequencing (NGS) and digital pathology. However, Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by significant improvements in healthcare access, rising disposable incomes, and increasing awareness of preventative diagnostics in populous nations like China and India. European markets maintain stable growth, underpinned by universal healthcare systems and a strong emphasis on infectious disease surveillance and cancer screening programs. Emerging markets in Latin America and MEA are seeing growth driven by investments in laboratory infrastructure modernization and increased access to affordable basic diagnostic services.

Segment trends reveal that Molecular Diagnostics is the fastest-growing segment, propelled by the urgent need for fast and accurate identification of pathogens and the essential role of genetic testing in personalized medicine. Within the technology segment, Immunodiagnostics retains the largest revenue share, largely due to its foundational role in clinical chemistry, blood banking, and hormone testing, supported by continuous advancements in assay sensitivity. Among end-users, hospitals and clinical laboratories remain the primary consumers, but the fastest expansion is observed in the Point-of-Care Testing (POCT) settings, which includes pharmacies, physician office laboratories, and patient homes. This shift reflects a broader healthcare strategy emphasizing convenience, rapid results delivery, and immediate clinical decision-making across diverse healthcare settings.

AI Impact Analysis on Medical Diagnostics Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) in Medical Diagnostics frequently center on the potential for diagnostic error reduction, the efficiency of processing large medical datasets (imaging, genomic, clinical chemistry results), and the practical timeline for widespread clinical adoption. Users often question how AI will specifically enhance diagnostic specialties like pathology and radiology, where image recognition is paramount, and express concerns regarding data privacy, regulatory hurdles for AI-driven devices, and the eventual impact on the role of human lab professionals and clinicians. The overarching expectation is that AI will dramatically accelerate the detection of subtle disease patterns, improve predictive capabilities for disease progression, and facilitate the customization of treatment protocols. The key themes summarized include improved accuracy and speed, integration challenges with existing LIMS systems, ethical concerns related to algorithmic bias, and the necessity of robust governmental guidance for AI-powered diagnostics to ensure patient safety and clinical reliability.

AI's integration into the medical diagnostics workflow promises to revolutionize data analysis and interpretation. Specifically, machine learning algorithms are being employed to automate the screening and analysis of high-volume samples, such as digital pathology slides and multiplexed genetic test results, significantly reducing the turnaround time and variability associated with manual review. This technological shift is moving diagnostic processes from reactive analysis to proactive pattern recognition, allowing clinicians to identify potential diseases in early, often asymptomatic stages. Furthermore, AI platforms are instrumental in correlating diverse data types—from laboratory parameters to lifestyle metrics and genetic information—to construct more comprehensive patient risk profiles, thereby advancing the realization of predictive and preventative medicine. The development of clinical decision support systems (CDSS) powered by AI also assists less specialized healthcare workers in making preliminary diagnostic assessments in remote locations, democratizing access to complex diagnostic expertise and reducing unnecessary referrals.

However, the successful implementation of AI hinges on the availability of large, high-quality, and ethically sourced training datasets. Data governance and interoperability between different healthcare systems remain significant technical hurdles that must be addressed to unlock the full potential of AI tools. Regulatory bodies, such as the FDA and EMA, are actively developing frameworks for the approval and monitoring of Software as a Medical Device (SaMD) driven by AI, demanding rigorous validation studies to demonstrate both efficacy and lack of unintended bias. As AI assumes more complex interpretive roles, the market must ensure adequate professional training to maintain a workforce capable of effectively interacting with and overseeing these sophisticated systems, guaranteeing that human oversight remains the crucial final layer of diagnostic certainty and ethical accountability.

- Enhanced pattern recognition in pathology and radiology images, improving detection sensitivity for subtle anomalies.

- Automation of high-throughput genomic data analysis, accelerating the identification of disease-associated mutations.

- Development of sophisticated Clinical Decision Support Systems (CDSS) for guiding less specialized practitioners.

- Optimization of laboratory workflows and resource allocation through predictive analytics, reducing operational costs.

- Creation of personalized diagnostic algorithms that integrate multi-omic data (genomic, proteomic, metabolomic).

- Facilitation of remote diagnostics and telehealth consultations through AI-powered image and data interpretation tools.

- Reduction of inter- and intra-observer variability in manual diagnostic procedures, leading to standardized results.

DRO & Impact Forces Of Medical Diagnostics Market

The Medical Diagnostics Market is profoundly shaped by a powerful interplay of Driving forces, Restraints, and Opportunities (DRO), which collectively determine market trajectory and competitive landscape. The principal drivers include the rapidly increasing global incidence of chronic diseases, such as cardiovascular disorders, cancer, and diabetes, which necessitate frequent and precise diagnostic monitoring. Further impetus comes from continuous technological innovation, especially the miniaturization of testing equipment and the development of highly specific and multiplexed assays. Restraints primarily involve the high capital investment required for adopting advanced diagnostic platforms, particularly NGS equipment, and the complexity of regulatory approval processes which can significantly delay the launch of novel diagnostic tests. Furthermore, the issue of reimbursement policies, which often lag behind technological advancements, sometimes limits the commercial viability and widespread adoption of newer, more expensive tests.

Opportunities for growth are vast, particularly in leveraging the shift towards precision medicine, which demands companion diagnostics and specialized genetic tests for treatment selection. The ongoing trend of decentralization, pushing diagnostics from large centralized labs to Point-of-Care (POC) settings, presents a massive market opportunity for developers of portable and rapid testing kits. Moreover, emerging markets, characterized by improving healthcare infrastructure and expanding government coverage, offer significant untapped potential for both basic and advanced diagnostic products. The increasing focus on preventative health and wellness screening, especially post-pandemic, has also created demand for at-home testing solutions and accessible molecular diagnostic platforms.

Impact forces governing the market include technological change, competitive intensity, and stringent regulatory environments. Technological impact is characterized by continuous disruption through molecular testing, digital pathology, and the integration of AI, which raises the bar for accuracy and speed. Competitive intensity is high, with large multinational corporations constantly vying for market share through strategic acquisitions and exclusive patent rights, leading to price pressure in mature segments like clinical chemistry. Finally, the regulatory environment acts as a significant force, compelling companies to adhere to evolving standards (e.g., IVDR in Europe), ensuring that products are safe, reliable, and clinically validated across diverse populations, which ultimately protects consumers but increases research and development costs for market participants.

Segmentation Analysis

The Medical Diagnostics Market is extensively segmented based on Product Type, Technology, Application, and End-User, reflecting the diversity and complexity of diagnostic procedures globally. Understanding these segments is crucial for strategic market positioning, as each segment possesses unique growth drivers and competitive dynamics. Product segmentation covers the full spectrum of necessary components, ranging from high-cost, automated instruments and large-scale analyzers to recurring revenue streams generated by reagents, consumables, and specialized software packages for data management and analysis. Technology segmentation illustrates the fundamental methods employed, highlighting the shift from traditional techniques like clinical chemistry and basic hematology toward advanced molecular and immunological approaches. This granular segmentation allows market stakeholders to identify specialized niches and capitalize on areas experiencing rapid clinical adoption, such as personalized medicine and high-throughput screening.

- Product Type:

- Instruments (Analyzers, Scanners, Readers)

- Reagents and Kits (Assays, Controls, Calibrators)

- Software and Services (LIMS, Data Analytics Platforms)

- Technology:

- Immunodiagnostics (ELISA, Chemiluminescence, Fluoroimmunoassay)

- Clinical Chemistry

- Molecular Diagnostics (PCR, Isothermal Nucleic Acid Amplification, NGS)

- Hematology

- Microbiology

- Tissue Diagnostics/Histology

- Application:

- Infectious Diseases (COVID-19, HIV, Hepatitis, TB)

- Oncology/Cancer Diagnostics

- Cardiology and Metabolic Disorders

- Diabetes Management

- Nephrology

- Autoimmune Diseases

- End-User:

- Hospitals and Clinics

- Diagnostic Laboratories (Reference Labs and Independent Labs)

- Point-of-Care Testing (POCT) Centers

- Academic and Research Institutes

Value Chain Analysis For Medical Diagnostics Market

The Medical Diagnostics Value Chain is complex and spans from raw material sourcing and technological development (upstream) through manufacturing and distribution to clinical deployment and usage (downstream). Upstream analysis involves highly specialized suppliers providing critical components such as purified antibodies, engineered enzymes, nucleic acid probes, and optical sensors. These suppliers must adhere to extremely high quality and purity standards, as the performance of the final diagnostic test is directly dependent on these raw materials. R&D activities at this stage focus on biomarker discovery, assay design, and developing patented chemical formulations that confer specificity and sensitivity. Control over upstream intellectual property is a major competitive advantage, often secured by integrating R&D teams closely with academic and biotech partners.

The midstream process involves the large-scale manufacturing and assembly of sophisticated instruments and the mass production of standardized reagent kits under stringent Quality Management Systems (QMS). Major diagnostic companies (OEMs) dominate this phase, leveraging automation and global manufacturing footprints to achieve economies of scale. Distribution channels are highly varied: direct sales forces are typically used for high-value capital equipment (instruments) and strategic laboratory accounts, providing installation, training, and long-term service contracts. Indirect channels utilize specialized distributors and third-party logistics providers (3PLs) for the efficient delivery of reagents and consumables, particularly to decentralized labs and international markets. The robustness of the cold chain logistics is paramount for temperature-sensitive reagents.

Downstream analysis focuses on the end-users—hospitals, large reference laboratories, and POCT centers—where the diagnostic service is ultimately delivered to the patient. Key downstream activities include test ordering, sample collection, analysis, interpretation, and subsequent integration of results into electronic health records (EHRs). The relationship between diagnostic companies and major laboratory networks often involves long-term contracts and bundled deals for equipment, reagents, and service, locking in customers and guaranteeing stable revenue streams. The adoption of Laboratory Information Management Systems (LIMS) and digital connectivity is essential downstream to ensure seamless communication, compliance with clinical standards, and efficient integration into the overall patient care pathway.

Medical Diagnostics Market Potential Customers

The primary end-users or buyers of medical diagnostic products are structured into distinct organizational categories, each possessing unique purchasing dynamics, volume requirements, and technology preferences. Large hospital networks and integrated healthcare systems represent the largest single customer segment; they require a comprehensive portfolio of instruments and reagents to cover emergency diagnostics, specialized surgery support, and chronic disease management. Their purchasing decisions are often centralized, prioritizing high-throughput automation, seamless integration with existing IT infrastructure, and comprehensive service agreements that guarantee maximum uptime for critical equipment. These organizations are critical buyers of high-cost capital equipment, particularly sophisticated chemistry, immunoassay, and hematology analyzers.

Diagnostic laboratories, encompassing both independent clinical labs (reference labs) and smaller specialty testing centers, constitute the second major customer base. Reference labs, such as Quest Diagnostics or LabCorp, specialize in high-volume, complex, and esoteric testing (like genomics and advanced toxicology), demanding cutting-edge molecular diagnostics and robust automation to maintain competitive pricing and fast turnaround times. Smaller independent labs focus more on core chemistry and routine testing, seeking reliable, cost-effective solutions that require minimal maintenance. The increasing popularity of decentralized POCT centers and rapid testing facilities also highlights a growing customer segment that prioritizes ease of use, speed, and portability over maximal throughput, focusing on rapid cartridge-based systems and compact instrumentation for near-patient testing scenarios.

Additionally, academic and government research institutes are key potential customers, particularly for specialized molecular and tissue diagnostics products. These institutions are heavy buyers of advanced technologies like Next-Generation Sequencing (NGS) platforms, mass spectrometry systems, and high-resolution microscopy tools, primarily utilizing them for basic research, clinical trials, and epidemiological studies rather than routine patient care. Their purchasing decisions are often grant-funded, focusing on the technological capability and scientific versatility of the equipment. Finally, public health agencies and blood banks represent specialized segments that require tailored diagnostic solutions, specifically those for surveillance testing, screening large populations for infectious diseases, and ensuring the safety and compatibility of blood products, demanding instruments and reagents meeting strict government regulatory approval.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Billion |

| Market Forecast in 2033 | USD 400 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Abbott Laboratories, Danaher Corporation, Siemens Healthineers, Thermo Fisher Scientific, Becton Dickinson, Bio-Rad Laboratories, Sysmex Corporation, Hologic, QIAGEN, Agilent Technologies, PerkinElmer, Illumina, General Electric (GE) Healthcare, Philips Healthcare, bioMérieux, FujiFilm, Eiken Chemical, Ortho Clinical Diagnostics, Sekisui Diagnostics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Diagnostics Market Key Technology Landscape

The technology landscape of the Medical Diagnostics Market is experiencing rapid transformation, driven by a convergence of biology, engineering, and data science. A foundational technology remains Clinical Chemistry, which provides routine, high-volume testing for analytes like glucose, electrolytes, and liver function markers, often integrated into large, automated platforms. However, the most significant transformative growth is being realized through Molecular Diagnostics (MDx). MDx, which includes Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), and gene chips, is crucial for identifying genetic predispositions, infectious pathogens (viral load measurement), and characterizing complex cancers. NGS, in particular, has become indispensable for comprehensive genomic profiling and liquid biopsy applications, moving diagnosis from single-marker detection to multi-target analysis, enabling true precision medicine.

Another crucial technology segment is Immunodiagnostics, which relies on the highly specific binding of antibodies to antigens. Advancements in immunoassays, particularly the shift from standard ELISA to sophisticated platforms like Chemiluminescence Immunoassay (CLIA) and bead-based multiplex assays, have dramatically improved assay sensitivity and specificity, making them the gold standard for hormone testing, cardiac markers, and specific infectious disease screening. Complementary to these lab-based systems, Point-of-Care Testing (POCT) technologies are fundamentally changing patient access. POCT focuses on developing miniaturized, often cartridge-based devices that deliver accurate results rapidly outside the central laboratory environment, facilitated by microfluidics and robust connectivity, allowing healthcare providers immediate diagnostic information at the patient’s bedside or in community clinics.

Digitalization further underpins the technological evolution, integrating advanced techniques such as Digital Pathology and Artificial Intelligence (AI). Digital pathology involves scanning traditional tissue slides into high-resolution digital images, enabling remote consultation and AI-assisted analysis for faster, more standardized diagnosis of tissue samples. AI algorithms are increasingly applied across the entire technological spectrum—from improving the signal-to-noise ratio in molecular testing data to automating the interpretation of complex hematology results—ensuring higher diagnostic reliability and efficiency. This holistic integration of advanced instrumentation, sensitive biochemical assays, and powerful computational analysis characterizes the cutting edge of the modern diagnostic technology landscape, continuously pushing the boundaries of what is clinically detectable and manageable.

Regional Highlights

Regional dynamics in the Medical Diagnostics Market are highly diversified, reflecting varying levels of healthcare expenditure, regulatory maturity, and disease burden across different continents. North America, specifically the United States, commands the largest market share globally. This dominance is attributed to early adoption of high-cost technologies, extensive research and development activities, highly favorable reimbursement policies, and the presence of numerous key industry players. The region's focus on personalized medicine and robust investment in genetic sequencing and cancer screening programs continue to drive high value growth. Furthermore, the strong integration of Electronic Health Records (EHRs) and advanced Laboratory Information Management Systems (LIMS) accelerates the adoption cycle for sophisticated diagnostic tools.

Europe represents the second-largest market, characterized by advanced public healthcare systems and strong regulatory oversight, particularly with the implementation of the In Vitro Diagnostic Regulation (IVDR), which standardizes product quality and safety across member states. Key drivers include government-funded population screening programs for cancer and cardiovascular diseases, alongside high awareness regarding infectious disease surveillance. Major growth pockets are found in Germany, France, and the UK, which maintain high expenditure on advanced molecular testing and automation solutions to cope with aging populations and increasing pressure on laboratory capacity.

Asia Pacific (APAC) is forecast to be the fastest-growing region during the forecast period. This rapid expansion is fueled by massive demographic shifts, rising disposable incomes leading to greater private healthcare spending, and significant investments in modernizing healthcare infrastructure across high-growth economies like China, India, and South Korea. While basic diagnostic services drive volume growth in rural areas, the burgeoning prevalence of chronic diseases and government initiatives aimed at improving diagnostic accessibility are catalyzing the adoption of advanced technologies, especially in molecular diagnostics and POCT, creating substantial opportunities for international manufacturers.

- North America: Dominates due to technological leadership, high healthcare spending, and substantial market presence of major diagnostic corporations; focus on genetic testing and precision oncology.

- Europe: Stable growth driven by universal healthcare coverage, stringent regulatory harmonization (IVDR), and strong investment in automated centralized laboratory systems.

- Asia Pacific (APAC): Highest CAGR fueled by infrastructure development, expanding medical tourism, increasing chronic disease burden, and rising demand for decentralized diagnostics in large population centers.

- Latin America (LATAM): Growth spurred by improving economic conditions, increased access to basic diagnostic services, and rising government efforts to control infectious diseases.

- Middle East and Africa (MEA): Emerging market growth focused on developing core laboratory capabilities, addressing high infectious disease prevalence, and significant government investment in high-end medical facilities (e.g., GCC countries).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Diagnostics Market.- Roche Diagnostics

- Abbott Laboratories

- Danaher Corporation (Beckman Coulter, Cepheid)

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- Becton Dickinson and Company (BD)

- Bio-Rad Laboratories

- Sysmex Corporation

- Hologic, Inc.

- QIAGEN N.V.

- Agilent Technologies

- PerkinElmer, Inc.

- Illumina, Inc.

- General Electric (GE) Healthcare

- Philips Healthcare

- bioMérieux SA

- FujiFilm Holdings Corporation

- Eiken Chemical Co., Ltd.

- Ortho Clinical Diagnostics (Part of QuidelOrtho)

- Sekisui Diagnostics

Frequently Asked Questions

Analyze common user questions about the Medical Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological trends driving growth in the Medical Diagnostics Market?

The market growth is primarily driven by the increasing adoption of Molecular Diagnostics (MDx), particularly Next-Generation Sequencing (NGS) and advanced PCR techniques essential for precision medicine. Other key trends include the rapid expansion of Point-of-Care Testing (POCT) solutions for decentralized diagnosis, and the integration of Artificial Intelligence (AI) to enhance data analysis, improve image interpretation in pathology, and increase overall diagnostic speed and accuracy.

How does the shift towards personalized medicine impact demand for diagnostic products?

Personalized medicine fundamentally increases the demand for highly specific and complex diagnostic products, most notably companion diagnostics. These tests are necessary to identify specific biomarkers or genetic profiles in patients, ensuring that targeted therapies, particularly in oncology, are administered only to those likely to benefit. This shift requires sophisticated molecular and genetic testing platforms and drives revenue in the high-value reagents segment.

Which market segment is expected to show the fastest growth rate through 2033?

The Molecular Diagnostics segment is projected to achieve the highest Compound Annual Growth Rate (CAGR) due to its critical role in infectious disease outbreaks, genetic screening, and cancer detection. The increasing prevalence of complex diseases requiring genomic analysis and the continuous development of novel nucleic acid amplification techniques are the primary accelerators for this segment’s superior market performance.

What are the main challenges facing manufacturers operating in the Medical Diagnostics Market?

Key challenges include navigating stringent and evolving global regulatory pathways, such as the European IVDR, which necessitate higher investment in clinical validation. Manufacturers also face pressure regarding the high capital cost of advanced instrumentation, which can limit adoption in budget-constrained settings, and ongoing reimbursement uncertainties that affect the commercial viability of novel, highly specialized diagnostic tests.

Why is the Asia Pacific region becoming increasingly important for the Medical Diagnostics Market?

The Asia Pacific (APAC) region is crucial due to its vast, underserved population base, rapid expansion of healthcare infrastructure, and rising incidence of both infectious and chronic diseases. Economic growth is increasing healthcare spending capabilities, while government initiatives focus on improving diagnostic accessibility and technology adoption, making APAC the primary driver of market volume growth and future technology implementation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager