Medical Fabrics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436168 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Medical Fabrics Market Size

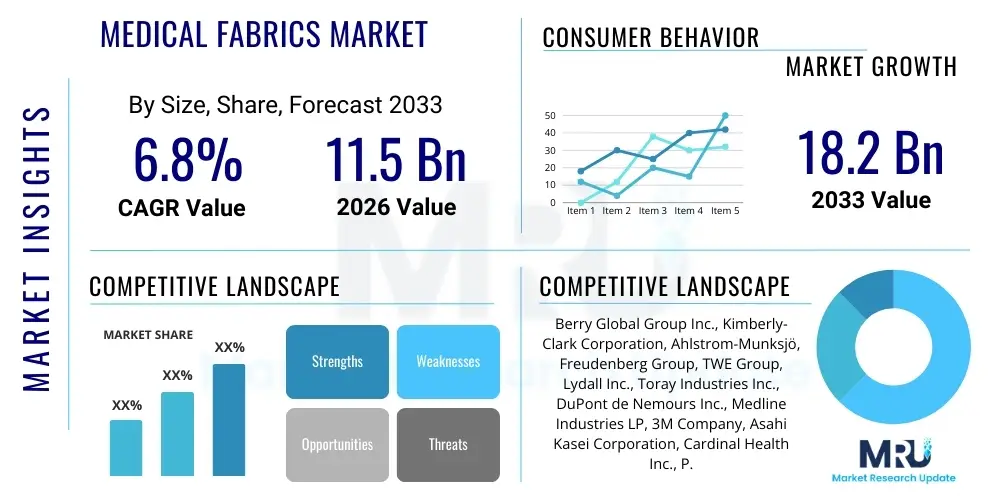

The Medical Fabrics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033.

Medical Fabrics Market Introduction

The Medical Fabrics Market encompasses a diverse range of textile materials specifically engineered and manufactured for use in healthcare, hygiene, and surgical applications. These specialized fabrics are crucial components in protective gear, surgical dressings, implants, non-implantable materials, and sanitation products. The core characteristic of medical fabrics is their functionality, which often includes properties such as anti-microbial resistance, liquid repellency, breathability, biocompatibility, sterilization compatibility, and mechanical strength. The demand for these materials is intrinsically linked to global healthcare expenditure, aging populations, and the persistent need for infection control in clinical environments, making them indispensable to modern medicine. The materials utilized span both natural fibers like cotton and advanced synthetic polymers such as polypropylene, polyester, and composites, selected based on the specific end-use requirements, whether for single-use disposables or durable medical textiles.

Product descriptions within this market vary significantly, ranging from highly porous woven gauzes used in wound care to dense, fluid-impermeable non-woven materials utilized in operating room gowns and drapes. Major applications include surgical textiles (gowns, masks, caps), wound care products (bandages, specialized dressings), hygiene products (adult incontinence products, wipes), and advanced medical device components (vascular grafts, sutures, implantable scaffolds). The primary benefits derived from using specialized medical fabrics include enhanced patient safety through reduced cross-contamination, superior barrier protection for medical professionals, and improved recovery outcomes through engineered material interaction with biological systems. The trend toward high-performance disposable products, especially non-woven fabrics, is a significant driver, offering a cost-effective solution for stringent hygiene standards and high-volume clinical needs across hospitals and ambulatory settings.

Driving factors propelling the expansion of the Medical Fabrics Market include the escalating global prevalence of Hospital-Acquired Infections (HAIs), which mandates the increased use of disposable protective apparel. Furthermore, continuous technological advancements in fiber science and polymer chemistry enable the creation of fabrics with advanced functionalities, such as self-cleaning or drug-eluting properties, boosting their integration into complex medical procedures. Demographic shifts, particularly the global increase in geriatric populations requiring long-term care and frequent medical interventions, necessitate a consistent supply of hygiene and surgical textiles. Lastly, robust regulatory frameworks emphasizing patient and practitioner safety, especially in developed economies, ensure sustained demand for certified, high-quality medical fabric products, cementing their critical role in the healthcare supply chain.

Medical Fabrics Market Executive Summary

The Medical Fabrics Market is experiencing robust growth driven primarily by structural shifts in global healthcare delivery and stringent infection control protocols. Business trends indicate a strong focus on sustainability and biodegradability, pushing manufacturers to develop bio-based polymers and recyclable non-woven structures, mitigating environmental concerns associated with high volumes of disposable medical waste. Furthermore, consolidation among major textile producers and medical device manufacturers is leading to vertically integrated supply chains, improving efficiency and quality control from raw material sourcing to final product assembly. Investment in advanced manufacturing techniques, such as electrospinning for nano-fiber creation and sophisticated coating technologies, is enhancing product performance, particularly in complex wound care and implantable devices, representing a key competitive advantage in the current business landscape.

Regionally, North America and Europe remain the dominant markets due to high healthcare spending, advanced medical infrastructure, and established regulatory mandates favoring high-quality textiles. However, the Asia Pacific region is poised for the fastest growth, propelled by rapidly expanding healthcare access, increasing governmental focus on public health standards, and massive manufacturing capabilities in countries like China and India. Regional trends also highlight localized production strategies; Western manufacturers are increasingly establishing facilities closer to major consumption centers in APAC and Latin America to minimize logistical costs and navigate complex trade barriers, ensuring a more resilient global supply network. This geographical diversification is critical for maintaining supply chain stability, especially given fluctuating material costs and geopolitical trade dynamics.

Segmentation trends reveal that Non-woven fabrics dominate the market, attributed to their cost-effectiveness, superior barrier properties, and suitability for single-use applications like face masks, surgical drapes, and sterilization wraps. Application-wise, hygiene products and surgical/protective apparel constitute the largest segments, maintaining stable growth due to universal usage requirements in clinical settings. The most dynamic growth segment is advanced wound care, driven by the increasing complexity of chronic wounds and the development of smart, interactive fabrics capable of monitoring healing progress or delivering therapeutic agents. Material preference is shifting towards lighter, yet more durable synthetic polymers like high-density polypropylene, which offers an optimal balance of cost, barrier efficacy, and disposability, aligning with the industry's focus on both performance and operational efficiency.

AI Impact Analysis on Medical Fabrics Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Medical Fabrics Market typically revolve around three core themes: operational efficiency, material innovation, and personalized medicine integration. Common questions include how AI can optimize textile manufacturing processes, predict material performance under various clinical stresses, and whether AI-driven diagnostics will influence the composition or functionality of future fabrics, particularly in smart wearables and advanced dressings. Users are keen to understand the shift from traditional R&D to AI-accelerated material discovery, seeking confirmation on whether machine learning algorithms can rapidly identify novel polymer combinations or coating technologies that offer enhanced antimicrobial resistance or biocompatibility. Concerns often focus on the required investment in data infrastructure and the specialized expertise needed to deploy AI tools effectively within textile production facilities, signaling a strong user expectation for tangible operational improvements and disruptive innovation.

The implementation of AI and Machine Learning (ML) in the medical fabric lifecycle is primarily focused on enhancing quality control and accelerating the R&D pipeline. In manufacturing, computer vision systems powered by AI are deployed for real-time defect detection in non-woven production lines, ensuring zero tolerance for contamination or structural flaws in critical barrier products like surgical drapes. This precision dramatically reduces waste and improves overall product reliability, which is paramount in medical applications. Furthermore, AI models are used to simulate complex fiber interactions and predict the fluid dynamics of fabrics, optimizing properties such as hydrostatic pressure resistance and air permeability before physical prototypes are manufactured, cutting down development time and cost significantly.

Beyond manufacturing optimization, AI is set to revolutionize material design for advanced medical applications. Machine learning algorithms analyze vast datasets of patient physiology and material performance data to suggest optimal fabric architectures for specific implantable devices, such as scaffolds for tissue engineering or biodegradable stents. For smart fabrics, AI processes sensor data embedded within the textile (e.g., monitoring temperature, moisture, or heart rate) to provide predictive analytics on patient health or wound status. This integration transforms passive fabrics into active, diagnostic tools, moving the market toward highly customized, data-driven medical textile solutions that promise superior clinical outcomes and proactive patient monitoring capabilities.

- AI optimizes supply chain logistics, predicting demand fluctuations for disposable fabrics based on disease outbreak models.

- Machine learning enhances quality assurance through automated, real-time detection of microscopic fabric defects in sterile products.

- AI accelerates the discovery of novel antimicrobial polymer coatings and biocompatible textile compositions.

- Predictive modeling simulates material durability and performance for implantable fabrics, reducing physical testing cycles.

- Integration of AI-driven sensor data enables the development of smart fabrics for continuous, personalized patient monitoring.

DRO & Impact Forces Of Medical Fabrics Market

The dynamics of the Medical Fabrics Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine its trajectory. The primary driver is the undeniable growth in global healthcare expenditure, coupled with increasingly stringent regulatory standards, particularly concerning infection prevention. This is reinforced by the demographic imperative of an aging global population, requiring persistent medical interventions and long-term care products, significantly boosting demand for hygiene and specialized wound care textiles. Furthermore, continuous innovation in fiber technology, leading to high-performance, multi-functional fabrics—such as those with advanced moisture management or targeted drug delivery capabilities—creates new avenues for market expansion across diverse clinical specialties. These forces generate strong, sustained momentum, prioritizing safety, efficacy, and performance in all medical textile procurement decisions.

Despite the strong demand, the market faces significant restraints. The volatility and increasing cost of raw materials, particularly petrochemical derivatives used in synthetic fibers like polypropylene and polyester, pose substantial challenges to manufacturers' profit margins. Moreover, the extensive environmental impact of disposable medical textiles, which constitute a large proportion of clinical waste, necessitates high investment in sustainable alternatives and recycling infrastructure, imposing cost burdens. Stringent regulatory approval processes, especially for Class III implantable fabrics, require extensive testing and validation, often leading to prolonged time-to-market and high research costs. These economic and environmental pressures require strategic maneuvers from market players to maintain competitive pricing while ensuring compliance and sustainability goals are met.

Opportunities within the Medical Fabrics Market are abundant, primarily revolving around technological penetration and emerging market expansion. The development of biodegradable and compostable non-woven materials, replacing conventional synthetics, represents a major sustainability opportunity that aligns with consumer and institutional pressures for green procurement. Secondly, the integration of smart functionalities, including biosensors and microelectronics into wearable textiles for remote patient monitoring (Telemedicine), opens up entirely new high-value segments outside traditional hospital settings. Finally, penetrating underserved healthcare markets in developing regions through scalable, cost-effective manufacturing solutions presents a massive growth trajectory. The convergence of material science, digital health, and environmental consciousness defines the next wave of opportunity, rewarding companies that successfully bridge these technological and social demands.

Segmentation Analysis

The Medical Fabrics Market is fundamentally segmented based on the material used, the fabrication technique (type), the specific application area, and the end-use facility. This detailed segmentation allows stakeholders to analyze market performance across various dimensions, reflecting the diverse and highly specialized nature of medical textile requirements. Non-woven fabrics dominate the market structure, primarily due to their cost-efficiency and superior barrier protection, making them ideal for high-volume disposable products crucial for infection control. Conversely, woven and knitted fabrics retain significant shares in high-durability segments like reusable surgical drapes and complex implantable devices, where mechanical strength and specific porosity are critical performance metrics. Understanding these segment dynamics is essential for strategic market positioning and resource allocation, enabling manufacturers to tailor production capabilities to specific clinical demands and regulatory compliance levels.

Key application segments underscore the functional diversity of medical fabrics. Surgical and Protective Apparel remains the cornerstone segment, driven by global infection control mandates and continuous clinical usage. However, the fastest growth is typically observed in niche segments such as Advanced Wound Care and Medical Device Components, fueled by technological breakthroughs leading to better patient outcomes and reduced recovery times. The choice of material—whether natural fibers like cotton for comfort and absorption, or synthetic polymers like polyester and polyurethane for strength and specific chemical resistance—directly dictates the suitability of the fabric for its intended medical purpose. Furthermore, the end-user segmentation clearly reflects procurement volumes and demand patterns, with Hospitals and Clinics being the primary consumers, followed by Ambulatory Surgical Centers (ASCs) and specialized wound care centers, each having unique requirements regarding fabric volume, sterilization methods, and regulatory adherence.

- Type:

- Woven Fabrics

- Non-Woven Fabrics

- Knitted Fabrics

- Material:

- Polypropylene (PP)

- Polyester

- Cotton

- Viscose

- Polyamide

- Other Synthetics (e.g., Polyurethane, PTFE)

- Application:

- Surgical & Protective Apparel (Gowns, Masks, Drapes)

- Wound Care (Gauzes, Bandages, Advanced Dressings)

- Hygiene Products (Incontinence Products, Wipes)

- Implantable Goods (Vascular Grafts, Hernia Meshes)

- Extracorporeal Devices (Dialysis Filters, Blood Oxygenators)

- Sterilization Packaging

- End-Use:

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Specialized Care Centers

Value Chain Analysis For Medical Fabrics Market

The Value Chain for the Medical Fabrics Market begins with the Upstream Analysis, which focuses on the procurement and processing of raw materials. This stage is dominated by large petrochemical companies supplying polymer resins (Polypropylene, Polyester chips) and natural fiber producers (cotton). Fluctuations in oil prices and agricultural yields directly impact the cost structure of the finished medical fabrics. Key activities at this stage include polymerization, fiber extrusion, and the initial chemical treatments required to give fibers specific properties like enhanced hydrophobicity or antimicrobial characteristics. Efficiency in this upstream segment is crucial, as the quality and cost of the primary feedstock dictate the profitability and technical capabilities of subsequent manufacturing stages. Strategic long-term contracts with resin suppliers are common for stability.

Midstream activities involve the conversion of raw fibers into specialized medical fabrics, which include processes like weaving, knitting, and significantly, non-woven production (e.g., spunbond, meltblown, or spunlace). This stage encompasses sophisticated textile engineering, where manufacturers apply high-tech finishes, coatings (such as plasma treatments or silver ion depositions), and sterilization techniques. The integration of advanced machinery and adherence to strict Good Manufacturing Practices (GMP) are critical here. Manufacturers differentiate themselves through proprietary techniques that enhance barrier protection, breathability, and comfort—features highly valued by healthcare end-users. Certification and compliance with international standards (e.g., ISO, FDA) are non-negotiable bottlenecks in this conversion phase.

The Downstream Analysis addresses distribution and final consumption. Medical fabrics, whether as rolls of material or finished goods (e.g., surgical packs), move through various Distribution Channels. Direct distribution involves large fabric manufacturers selling directly to major hospital groups or Original Equipment Manufacturers (OEMs) who assemble medical devices. Indirect distribution relies heavily on specialized medical distributors and wholesalers who manage inventory, sterilization logistics, and last-mile delivery to clinics and smaller healthcare facilities. E-commerce platforms are increasingly utilized for smaller volume supplies and specialized items. The final consumers, the hospitals and clinics, prioritize reliability, consistent quality, ease of sterilization, and bulk purchasing agreements, making strong distributor networks essential for market penetration and sustained revenue generation.

Medical Fabrics Market Potential Customers

The primary customers and end-users of medical fabrics are institutions operating within the healthcare ecosystem that require textiles for patient care, protection, and operational hygiene. Hospitals, particularly large multi-specialty and academic medical centers, represent the largest volume buyers, consuming massive quantities of surgical apparel, wound care dressings, bedding, and sterilization wraps daily. Their procurement decisions are heavily influenced by stringent infection control policies, cost-effectiveness of disposable products, and vendor reliability. Given the critical nature of their usage, hospitals demand fabrics with certified barrier protection and robust supply chain resilience, often engaging in long-term contracts with established manufacturers or distributors to ensure consistent stock availability, especially during health crises.

Ambulatory Surgical Centers (ASCs) and specialized clinics, including dermatological and plastic surgery centers, form another significant customer base. While their individual purchasing volumes are smaller than major hospitals, the collective growth of ASCs globally, driven by the shift towards outpatient procedures, creates a rising demand stream for specific surgical drapes, patient covers, and procedural kits. These smaller facilities often prioritize convenience and pre-packaged sterilization solutions. Furthermore, the burgeoning home healthcare sector and long-term care facilities are increasingly important buyers, particularly for hygiene products such as adult incontinence briefs and specialized patient transfer linens, focusing on absorbency, skin compatibility, and durability, thereby expanding the customer landscape beyond traditional institutional settings.

Medical Device Original Equipment Manufacturers (OEMs) constitute highly technical potential customers for advanced medical fabrics. These manufacturers procure highly specialized fabrics (e.g., PTFE, ePTFE, sophisticated polymers) as raw materials for creating implantable devices like vascular grafts, artificial ligaments, cardiac patches, and complex filtration membranes used in extracorporeal devices (e.g., dialysis). For OEMs, the key purchasing criteria revolve around material biocompatibility, structural integrity, regulatory compliance (e.g., FDA Class II/III), and consistency of proprietary specifications. This segment demands collaborative R&D efforts between the fabric supplier and the OEM to ensure the textile meets the precise requirements for integration into the finished medical product, making it a high-value, high-barrier-to-entry customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berry Global Group Inc., Kimberly-Clark Corporation, Ahlstrom-Munksjö, Freudenberg Group, TWE Group, Lydall Inc., Toray Industries Inc., DuPont de Nemours Inc., Medline Industries LP, 3M Company, Asahi Kasei Corporation, Cardinal Health Inc., P. H. Glatfelter Company, Getinge AB, Elkem ASA, Texhong Textile Group Limited, Lohmann & Rauscher GmbH & Co. KG, Sioen Industries NV, Hollingsworth & Vose Company, Sandel Medical Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Fabrics Market Key Technology Landscape

The technological landscape of the Medical Fabrics Market is rapidly evolving, moving beyond simple barrier textiles toward highly functional, intelligent materials. A primary technological focus is on enhancing the performance of non-woven fabrics through advanced polymer treatments and composite layering. Techniques such as Spunbond-Meltblown-Spunbond (SMS) lamination remain standard for achieving high barrier efficacy in surgical gowns, but new developments involve electrospinning to create nano-fiber structures. Electrospun nano-fibers offer superior filtration capabilities and ultra-high surface areas, making them ideal for highly sensitive applications like advanced wound scaffolds and high-efficiency particulate air (HEPA) filtration masks, promising unprecedented levels of protection and biological interaction at the cellular level.

Another crucial technological development involves surface modification and functional coatings designed to impart active properties to the fabric. Plasma technology is widely utilized to alter the surface energy of polymer fibers, enabling permanent changes to hydrophobicity (liquid repellency) or hydrophilicity (absorption) without compromising breathability or comfort. Furthermore, the integration of antimicrobial agents, often encapsulated silver ions or quaternary ammonium compounds, directly into the fiber matrix or surface coating ensures sustained infection control. Research and development efforts are also heavily invested in creating self-cleaning and self-sterilizing fabrics that release localized therapeutic agents upon contact with moisture or biological indicators, thereby enhancing the therapeutic scope of textile materials in clinical settings and long-term care environments.

The emergence of smart textiles marks a significant paradigm shift. This technology integrates micro-sensors, conductive polymers, and miniature electronic components directly into the fabric structure. These smart fabrics are capable of real-time monitoring of physiological parameters, such as heart rate, body temperature, respiration rate, and wound exudate composition. This shift is particularly impactful in remote patient monitoring and chronic disease management. While integrating electronics presents challenges related to washability, sterilization, and cost, ongoing research is focused on flexible, bio-integrated electronics that maintain durability and biocompatibility, pushing medical fabrics into the realm of advanced diagnostic tools and personalized continuous health monitoring systems.

Regional Highlights

Regional dynamics are critical to understanding the distribution and growth potential of the Medical Fabrics Market, influenced heavily by healthcare infrastructure maturity, regulatory environments, and demographic profiles. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to high per capita healthcare spending, the presence of major industry players and advanced research facilities, and stringent regulatory requirements enforced by bodies like the FDA, which mandate the use of high-specification, certified medical textiles. The region’s focus on advanced wound care technologies and sophisticated single-use protective apparel ensures sustained, high-value demand, often setting global standards for material performance and clinical safety protocols.

Europe represents the second-largest market, characterized by mature healthcare systems (e.g., the NHS in the UK, centralized systems in Germany and France) and strong emphasis on sustainability. European demand is driven by high infection control awareness and a growing geriatric population. Key market trends in this region include a strong push towards eco-friendly and bio-based medical fabrics, often accelerated by EU directives aimed at reducing plastic waste. Countries like Germany and France lead in the adoption of innovative textile manufacturing processes, particularly in technical textiles for surgical implants and reusable, high-durability apparel, balancing environmental responsibility with uncompromising clinical quality standards.

Asia Pacific (APAC) is projected to be the fastest-growing region over the forecast period. This rapid expansion is fueled by massive infrastructure development in healthcare across developing nations (China, India, Southeast Asia), increasing public health awareness, and rising disposable incomes leading to greater access to medical services. While cost-sensitivity remains a factor, the sheer scale of the population and the establishment of large-scale manufacturing hubs make APAC both a significant consumer and a dominant global producer of medical fabrics, especially generic non-woven disposables. Growth here is further supported by government initiatives aimed at improving primary healthcare and enhancing preparedness for potential pandemic events, requiring extensive inventories of protective textiles.

- North America: Market leader due to high healthcare expenditure, stringent FDA regulations, and adoption of advanced non-woven technologies.

- Europe: High growth rate driven by strong regulatory focus on infection control and significant market demand for sustainable, biodegradable medical fabrics.

- Asia Pacific (APAC): Fastest-growing region, powered by expanding healthcare access, large population base, and rapid infrastructural investments in countries like China and India.

- Latin America (LATAM): Emerging market characterized by increasing healthcare privatization and growing demand for basic hygiene and surgical textiles; constrained slightly by economic volatility.

- Middle East and Africa (MEA): Growth driven by medical tourism, significant infrastructure projects (e.g., GCC nations), and rising awareness of infection control standards, particularly in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Fabrics Market.- Berry Global Group Inc.

- Kimberly-Clark Corporation

- Ahlstrom-Munksjö

- Freudenberg Group

- TWE Group

- Lydall Inc.

- Toray Industries Inc.

- DuPont de Nemours Inc.

- Medline Industries LP

- 3M Company

- Asahi Kasei Corporation

- Cardinal Health Inc.

- P. H. Glatfelter Company

- Getinge AB

- Elkem ASA

- Texhong Textile Group Limited

- Lohmann & Rauscher GmbH & Co. KG

- Sioen Industries NV

- Hollingsworth & Vose Company

- Sandel Medical Industries

Frequently Asked Questions

What is the primary factor driving demand for disposable medical fabrics?

The primary driver is the stringent global mandate for infection control, particularly in preventing Hospital-Acquired Infections (HAIs). Disposable non-woven fabrics offer superior, consistent barrier protection and eliminate cross-contamination risks associated with reusable textiles, making them indispensable in surgical and high-risk environments.

How is sustainability impacting the development of new medical fabrics?

Sustainability is profoundly influencing product development, leading to increased investment in biodegradable polymers, bio-based fibers, and advanced recycling technologies for synthetic medical textiles. Manufacturers are focusing on reducing the environmental footprint of single-use products while maintaining critical safety performance standards.

Which type of medical fabric holds the largest market share?

Non-woven fabrics hold the largest market share due to their versatility, low manufacturing cost, high barrier efficacy, and suitability for mass-produced disposable applications such as surgical masks, gowns, drapes, and sterilization packaging essential for high-volume clinical operations.

What role do smart textiles play in the Medical Fabrics Market?

Smart textiles integrate micro-sensors and conductive fibers into clothing and wound dressings to enable continuous, real-time monitoring of patient vital signs (e.g., heart rate, temperature) or wound healing status. This technology transforms passive fabrics into active diagnostic tools, driving growth in telemedicine and remote patient care.

Which geographical region exhibits the highest growth potential in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential, fueled by rapidly expanding healthcare infrastructure investments, rising disposable incomes leading to greater access to medical care, and increasing governmental emphasis on public health and hygiene standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager