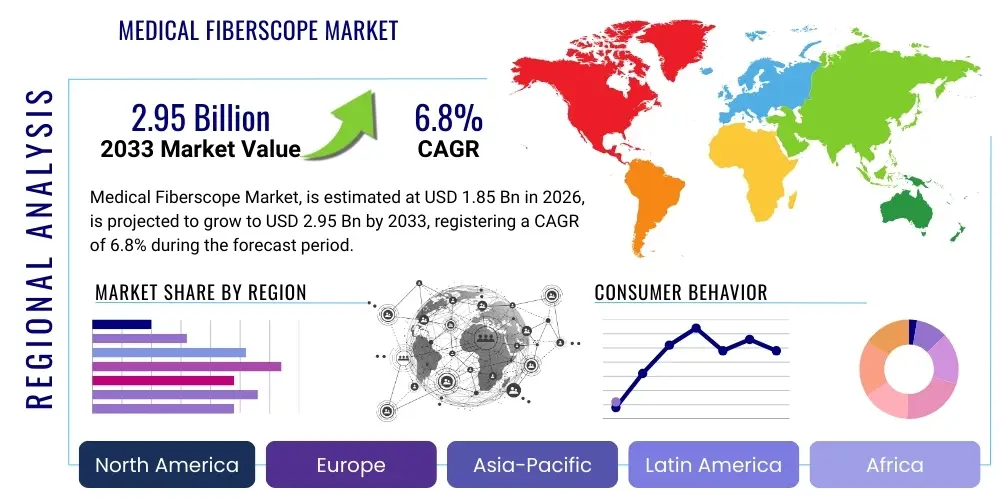

Medical Fiberscope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435253 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Medical Fiberscope Market Size

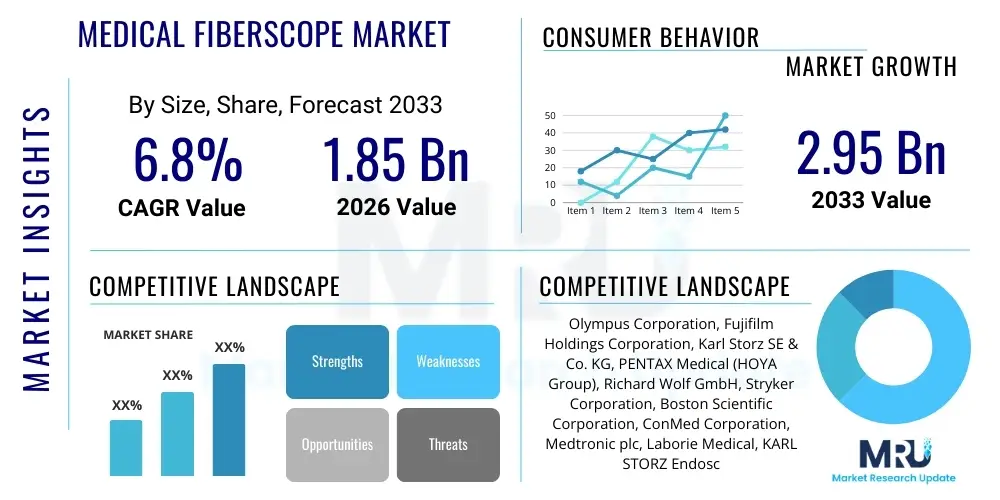

The Medical Fiberscope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Medical Fiberscope Market introduction

The Medical Fiberscope Market encompasses the global trade and utilization of optical instruments employing coherent fiber bundles to transmit images from inside the human body to an external observer or camera system. These devices are fundamentally crucial in minimally invasive procedures, diagnostic imaging, and therapeutic interventions across various medical specialties, including gastroenterology, pulmonology, urology, and orthopedics. Modern fiberscopes, while increasingly being challenged by digital video endoscopes, maintain a significant market presence due to their robust construction, cost-effectiveness, and flexibility in specific, highly maneuverable applications, especially in resource-constrained settings or for legacy equipment requirements.

The core product description revolves around a bundle of thousands of tiny, flexible glass fibers. Light is transmitted to the target area via an illumination fiber bundle, and the returning image is captured and relayed through the image-transmitting fibers. Major applications span procedures like colonoscopy, gastroscopy, bronchoscopy, and laryngoscopy, facilitating the direct visualization of internal organs and cavities. The inherent benefit of fiberscopes lies in their ability to navigate complex anatomical structures with minimal patient trauma, offering superior visualization compared to traditional open surgery, which leads to shorter hospital stays and quicker recovery times.

Driving factors propelling market expansion include the global increase in the incidence of chronic diseases, particularly gastrointestinal and pulmonary disorders, necessitating enhanced diagnostic capabilities. Furthermore, the rising adoption of minimally invasive surgical techniques across both developed and developing economies significantly fuels demand. Technological advancements, such as improved light guides, enhanced fiber resolution, and integration with supplementary imaging modalities, also contribute to the sustained relevance and growth of the medical fiberscope segment, despite the parallel development of high-definition video endoscopy systems.

Medical Fiberscope Market Executive Summary

The Medical Fiberscope Market exhibits sustained expansion, driven primarily by favorable demographic trends, particularly the aging global population which requires frequent diagnostic screening for conditions like colorectal and lung cancer. Business trends indicate a strategic shift by leading manufacturers towards hybrid systems that integrate the optical reliability of fiber bundles with advanced digital processing capabilities, aiming to bridge the gap between traditional fiberscopes and cutting-edge video endoscopy. Furthermore, robust competitive activity focuses on maintenance contracts and refurbishment services for installed equipment bases, particularly in hospitals and ambulatory surgical centers (ASCs) seeking cost-effective visualization solutions. Key mergers and acquisitions often center on securing specialized flexible scope technologies and expanding geographical distribution networks in high-growth APAC regions.

Regionally, North America and Europe currently dominate the market due to established healthcare infrastructure, high awareness regarding preventive screening, and substantial healthcare expenditure. However, the Asia Pacific region is forecast to demonstrate the highest growth rate, fueled by rapid infrastructural development, increasing access to advanced medical devices, and significant unmet clinical needs in populous countries like China and India. Government initiatives promoting early diagnosis and improvements in insurance coverage are pivotal in accelerating market penetration across these emerging economies. These regional trends underscore a dual market structure: high-value innovation in mature markets and volume-driven adoption in emerging markets.

Segment trends reveal that the application segment is heavily influenced by gastrointestinal procedures, which utilize fiberscopes extensively for initial screening and basic therapeutic interventions. Within the end-user segment, Hospitals remain the largest segment due to the sheer volume of complex procedures requiring comprehensive imaging suites. However, Ambulatory Surgical Centers (ASCs) are rapidly growing, driven by the shift towards outpatient settings for simpler, routine endoscopic procedures, placing a premium on durable, portable, and easily sterilizable fiberscope models. The ongoing need for reliable, albeit less costly, visualization tools ensures that fiberscopes maintain their niche alongside high-definition video counterparts.

AI Impact Analysis on Medical Fiberscope Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Medical Fiberscope Market frequently center on whether AI will render the underlying fiberoptic technology obsolete or if it will primarily serve as an advanced augmentation layer. Key themes emerging from these questions involve the potential for AI algorithms to enhance diagnostic yield, specifically concerning the automatic detection and classification of subtle lesions such as polyps or early-stage cancerous growths that might be missed by the human eye viewing the fiberscope image. Concerns also revolve around the integration feasibility, data latency issues when processing images streamed from fiberscopes (which typically have lower intrinsic resolution than high-end digital scopes), and the regulatory pathways required for AI-powered diagnostic tools used in conjunction with these traditional devices. Users expect AI to improve workflow efficiency, reduce procedure time, and standardize the quality of endoscopic reporting, thereby extending the clinical utility of the existing fiberscope installed base.

AI's primary influence is moving the fiberscope beyond a simple visualization tool into an intelligent diagnostic assistant. By processing the live optical data transmitted through the fiber bundle, AI systems can perform real-time pattern recognition, alerting endoscopists to regions of interest that require focused attention or biopsy. This integration is crucial for maximizing the effectiveness of less expensive or older fiberscope models, providing them with enhanced capabilities previously restricted to high-end digital systems. Furthermore, AI contributes significantly to procedural quality metrics, such as ensuring proper withdrawal times during colonoscopy and documenting mucosal visualization coverage, thereby optimizing patient outcomes and reducing inter-operator variability.

The implementation of AI models for predictive maintenance and scope handling is also gaining traction. Fiberscopes, being delicate instruments, frequently suffer damage during insertion, use, or reprocessing. AI-driven monitoring systems can analyze usage patterns, flag potential equipment misuse, and predict component failure, leading to proactive maintenance schedules. This predictive capability significantly reduces downtime and lowers the total cost of ownership for healthcare facilities utilizing extensive inventories of fiberscopes. Ultimately, AI enhances the longevity and diagnostic precision of fiberscope technology rather than replacing it, solidifying its role as a necessary, affordable tool in comprehensive endoscopic care.

- Real-time lesion detection and characterization for improved diagnostic accuracy.

- Enhanced image quality processing and chromatic aberration correction from fiberoptic bundles.

- AI-guided navigation and procedural assistance for less experienced operators.

- Automated documentation and quality assessment metrics (e.g., adequate mucosa inspection).

- Predictive maintenance and analysis of fiberscope integrity and usage patterns.

DRO & Impact Forces Of Medical Fiberscope Market

The dynamics of the Medical Fiberscope Market are shaped by a complex interplay of growth drivers, inherent restraints, and emerging opportunities, all modulated by powerful external impact forces such as regulatory shifts and technological competition. A primary driver is the rising global demand for minimally invasive surgery (MIS) driven by improved patient outcomes, coupled with the increasing prevalence of age-related and lifestyle diseases requiring regular endoscopic surveillance. Simultaneously, the market is restrained by the inherent limitations of fiberoptic technology, specifically the lower resolution and reduced image brightness compared to state-of-the-art video endoscopy, alongside ongoing concerns regarding the effective and standardized reprocessing and sterilization of highly flexible insertion tubes, which pose an infection risk if protocols are breached.

Opportunities for growth are predominantly found in the development of disposable fiberscope solutions, addressing the sterilization concerns and potentially lowering the barrier to entry for smaller clinics and ASCs. Furthermore, integrating fiberscopes with advanced visualization technologies, such as Narrow Band Imaging (NBI) or autofluorescence, offers competitive differentiation, enhancing the diagnostic sensitivity of these devices for early cancer detection. Impact forces, such as stringent regulatory approvals from bodies like the FDA and EMA concerning device safety and reprocessing efficacy, compel manufacturers to invest heavily in robust design validation and post-market surveillance. The intense technological competition from superior digital CMOS/CCD-based endoscopes continually pressures fiberscope manufacturers to reduce costs or specialize in niche applications where extreme flexibility is paramount.

Another crucial impact force is the fluctuating healthcare reimbursement landscape globally. In regions where cost containment is a major imperative, the relatively lower upfront capital cost of fiberscopes compared to full video endoscopy towers makes them an attractive procurement option, particularly in developing markets and public health systems. Conversely, in highly capitalized private systems, the emphasis on absolute image quality for complex therapeutic procedures often favors digital systems, pushing fiberscopes into a supporting or backup role. Navigating this cost-benefit equilibrium while addressing the persistent challenge of device fragility and repair cycles forms the core strategic challenge for market participants.

Segmentation Analysis

The Medical Fiberscope Market is comprehensively segmented based on technology type, clinical application, and primary end-user base, providing a granular view of demand distribution and competitive strongholds. Understanding these segments is crucial for strategic planning, as distinct purchasing criteria and utilization patterns exist across the varied categories. For instance, while hospitals require a broad portfolio covering multiple applications, specialized diagnostic centers may focus intensely on high-throughput gastrointestinal scopes. The evolution of segmentation is heavily influenced by technological migration, where specific procedural demands often dictate the continued relevance of traditional fiberscope designs over newer, digital alternatives, particularly where cost constraints or extreme maneuverability requirements are dominant factors.

Segmentation by Type, involving flexible and rigid fiberscopes, highlights the functional differences. Flexible fiberscopes dominate the overall market due to their suitability for non-linear anatomical pathways (e.g., GI tract, respiratory tract) and are essential for both diagnostic and interventional procedures. Rigid fiberscopes, although limited in maneuverability, are critical in specific surgical domains such as laparoscopy or arthroscopy, providing superior image stability and channel rigidity for instrument passage. However, in many areas, the rigid fiberscope segment is increasingly overlapped or replaced by rigid digital endoscopes, making technological innovation within the flexible segment particularly vital for market sustainment.

Application segmentation illustrates where the primary volume demand originates. Gastroenterology remains the largest application segment, driven by global screening guidelines for colorectal cancer and the high prevalence of peptic ulcers and reflux diseases. Pulmonology (bronchoscopy) also constitutes a significant segment, especially following the increased focus on respiratory health post-pandemic. The diverse requirements across applications, from the diameter and length of the insertion tube to the size of the working channel, dictate the manufacturing specifications and differentiation strategies employed by major fiberscope providers globally.

- By Type: Flexible Fiberscopes, Rigid Fiberscopes

- By Application: Bronchoscopy, Gastroscopy, Colonoscopy, Laryngoscopy, Ureteroscopy, Others (Cystoscopy, Otoscopy)

- By End-User: Hospitals, Ambulatory Surgical Centers (ASCs), Diagnostic Centers, Specialty Clinics

Value Chain Analysis For Medical Fiberscope Market

The value chain for the Medical Fiberscope Market begins with the upstream procurement and processing of highly specialized materials, primarily consisting of high-purity glass or quartz for the fiber bundles, high-grade polymers for the insertion tube sheathing, and precision metal alloys for the instrument heads and control bodies. Upstream analysis focuses heavily on the technological sophistication required to draw and bundle thousands of coherent fibers, a process dominated by specialized optical component suppliers often operating under strict proprietary agreements with major endoscope manufacturers. Quality control at this stage is paramount, as defects in fiber alignment directly translate to reduced image resolution and fidelity, impacting the final medical device's performance and clinical acceptance.

The midstream phase involves manufacturing, assembly, and testing, where large, multinational corporations integrate the supplied optical components with illumination systems, irrigation/suction channels, and ergonomic control sections. Distribution channels constitute a critical link in the value chain, determining market access and reach. Distribution is primarily managed through a blend of direct sales forces for major hospital systems in high-revenue territories (ensuring deep product expertise and maintenance support) and indirect channels utilizing authorized distributors or third-party logistics providers for smaller clinics and geographical areas where establishing a dedicated presence is uneconomical. The choice between direct and indirect distribution often hinges on the complexity of the product and the required level of technical support and post-sales service.

Downstream analysis centers on the end-users—hospitals, ASCs, and diagnostic centers—where the fiberscopes are utilized and subsequently subjected to rigorous reprocessing protocols. This segment of the value chain includes not only the surgical and diagnostic use but also the critical repair and maintenance ecosystem. Given the fragility and high cost of fiberscope repair, post-sales service revenue forms a significant component of the total market value. Efficiency in the repair cycle, including rapid turnaround times and certification of repaired devices, provides a strong competitive advantage. Furthermore, the downstream interaction involves continuous feedback loops with clinicians regarding design improvements and ergonomic refinements, driving iterative product development.

Medical Fiberscope Market Potential Customers

The primary consumers and end-users of medical fiberscopes are institutions heavily engaged in diagnostic, screening, and therapeutic endoscopic procedures. Hospitals, particularly large tertiary and quaternary care centers, represent the largest and most valuable customer segment. These institutions require diverse inventories of fiberscopes across multiple departments (Gastroenterology, Pulmonology, Urology, etc.), demand high-end features, and require comprehensive service contracts due to continuous, high-volume usage. Their purchasing decisions are often centralized and driven by a balance of clinical needs, budgetary constraints, and long-term total cost of ownership, including repair and reprocessing costs.

Ambulatory Surgical Centers (ASCs) constitute a rapidly expanding customer base, driven by the shift of lower-risk, routine endoscopic procedures from inpatient hospital settings to outpatient environments. ASCs prioritize fiberscope models that offer enhanced portability, reliability, and cost-effectiveness. Their purchasing decisions are highly sensitive to initial capital outlay and efficiency metrics, often favoring robust, perhaps less feature-rich, fiberscopes that minimize downtime and simplify sterilization processes. ASCs often target specific, high-volume procedures, necessitating specialized equipment tailored to those specific clinical needs, such as dedicated colonoscopes and gastroscopes.

Diagnostic Centers and Specialty Clinics form the third major customer segment. These entities focus on specific therapeutic areas, such as oncology screening or respiratory diagnostics. Their procurement decisions are often influenced by the need for integration with specialized imaging modalities and external data systems for reporting and patient management. Government-run public health centers and military hospitals globally also represent a significant customer group, prioritizing durability and affordability, often leading to bulk purchases of standard fiberscope models suitable for basic diagnostic screening across large populations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Fujifilm Holdings Corporation, Karl Storz SE & Co. KG, PENTAX Medical (HOYA Group), Richard Wolf GmbH, Stryker Corporation, Boston Scientific Corporation, ConMed Corporation, Medtronic plc, Laborie Medical, KARL STORZ Endoscopy-America, Inc., GIMMI GmbH, Optomic S.A., Schindler Endoskopie Technologie GmbH, Huger Medical Instrument Co., Ltd., Shenyang PuKang Medical Instrument Co., Ltd., AOHUA Endoscopy, Jinshan Science & Technology, SonoScape Medical Corporation, ProSurg, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Fiberscope Market Key Technology Landscape

The technology landscape of the Medical Fiberscope Market is characterized by continuous refinement of core fiberoptic components and strategic integration of complementary digital and mechanical systems to enhance performance and durability. While the fundamental principle of image transmission via coherent glass fiber bundles remains constant, significant technological investments focus on improving the quality and density of these bundles. Advances in fiber drawing techniques allow for smaller diameter fibers, increasing the packing density within the same scope size, thereby boosting the effective pixel count and image resolution, helping fiberscopes better compete with digital solutions. Furthermore, specialized optical coatings and improved lens systems at the distal tip are deployed to minimize light loss and chromatic aberration, ensuring clearer visualization of mucosal details.

Illumination technology constitutes another crucial area of innovation. Traditional halogen or incandescent lamps have largely been replaced by high-intensity Light Emitting Diode (LED) or Xenon light sources. These modern light sources provide superior brightness, extended lifespan, and, crucially, enable advanced imaging modes such as Narrow Band Imaging (NBI) or similar spectral enhancement techniques, even when utilizing a fiberoptic light guide. NBI, for instance, uses specific wavelengths to highlight mucosal capillaries and surface structures, aiding in the early identification of pre-cancerous and cancerous lesions. This integration of spectral imaging capabilities significantly extends the diagnostic utility of fiberscopes, maintaining their relevance in high-stakes clinical settings.

Beyond the optical and illumination systems, materials science plays a vital role in enhancing the physical attributes of the fiberscopes. The development of advanced, more durable, and biocompatible polymers for the insertion tube sheathing improves resistance to wear, tear, and the harsh chemical and thermal stresses associated with high-level disinfection and sterilization processes. Mechanically, the angulation system—allowing the distal tip to be manipulated by the operator—is continuously optimized for increased precision, torque stability, and sustained resilience over repeated use cycles. The development of miniaturized working channels also allows for the integration of increasingly sophisticated micro-instruments, blurring the line between diagnostic and therapeutic fiberscope capabilities.

Regional Highlights

The regional dynamics of the Medical Fiberscope Market are segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA), each presenting unique growth patterns and technological adoption levels.

- North America: This region, encompassing the United States and Canada, holds the largest market share due to high healthcare expenditure, established screening programs (especially for colorectal cancer), and rapid adoption of advanced endoscopic techniques. The market here is mature, characterized by high demand for maintenance, scope upgrades, and a growing emphasis on disposable scopes to mitigate infection risks, driving premium pricing and service contract demand.

- Europe: Western European countries, including Germany, the UK, and France, represent a substantial market driven by universal healthcare coverage and comprehensive reimbursement for endoscopic procedures. While technologically advanced, European procurement often focuses heavily on value-for-money and regulatory compliance (CE marking), maintaining a balance between high-end digital systems and reliable, cost-effective fiberscopes for routine diagnostics.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by massive infrastructure investment in healthcare across emerging economies like China, India, and Southeast Asia. The sheer volume of patients, coupled with increasing disposable income and growing health insurance penetration, drives high demand for affordable and durable diagnostic equipment, making standard fiberscopes highly relevant for initial procurement phases in public and private hospitals.

- Latin America: This region presents moderate growth, challenged by economic volatility and uneven distribution of advanced healthcare facilities. Market penetration is concentrated in major urban centers (e.g., Brazil, Mexico), where demand is strong for versatile, moderately priced fiberscopes that offer reliability and can withstand variable reprocessing environments.

- Middle East and Africa (MEA): Growth is steady, primarily concentrated in the Gulf Cooperation Council (GCC) countries benefiting from high oil revenues and ambitious healthcare transformation projects. The demand is often polarized, with luxurious private hospitals seeking the latest technology, while public sectors in Africa prioritize essential, robust fiberscopes for infectious disease surveillance and basic diagnostics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Fiberscope Market.- Olympus Corporation

- Fujifilm Holdings Corporation

- Karl Storz SE & Co. KG

- PENTAX Medical (HOYA Group)

- Richard Wolf GmbH

- Stryker Corporation

- Boston Scientific Corporation

- ConMed Corporation

- Medtronic plc

- Laborie Medical

- KARL STORZ Endoscopy-America, Inc.

- GIMMI GmbH

- Optomic S.A.

- Schindler Endoskopie Technologie GmbH

- Huger Medical Instrument Co., Ltd.

- Shenyang PuKang Medical Instrument Co., Ltd.

- AOHUA Endoscopy

- Jinshan Science & Technology

- SonoScape Medical Corporation

- ProSurg, Inc.

Frequently Asked Questions

Analyze common user questions about the Medical Fiberscope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a fiberscope and a video endoscope?

A fiberscope transmits the image using bundles of coherent glass fibers directly to the eyepiece. A video endoscope (or videoscope) uses a miniaturized digital sensor (CCD or CMOS) at the distal tip to capture the image, which is then digitized and displayed on a monitor. Fiberscopes are generally more durable and less expensive upfront, while videoscopes offer superior resolution and advanced digital processing capabilities.

What are the key drivers for the sustained growth of the Medical Fiberscope Market despite digital competition?

The sustained growth is driven by the fiberscope's cost-effectiveness, robustness, suitability for extreme maneuverability in complex anatomies, and high demand in emerging economies with budget constraints. They also remain essential backup systems in developed markets and are highly valued for their reliable mechanical performance in certain therapeutic niches.

How significant is the impact of cross-contamination risk on fiberscope market trends?

The risk of cross-contamination associated with complex reprocessing protocols is highly significant. This concern has led to increased regulatory scrutiny, driving innovation towards improved, automated reprocessing systems and accelerating the development and adoption of single-use (disposable) fiberscopes, which eliminate the reprocessing challenge entirely, particularly in high-risk procedures.

Which application segment holds the largest share in the fiberscope market?

The Gastroenterology segment, including diagnostic and therapeutic gastroscopy and colonoscopy procedures, currently holds the largest share of the Medical Fiberscope Market. This dominance is attributed to global screening initiatives and the high prevalence of gastrointestinal disorders requiring regular endoscopic examination.

What role does AI play in extending the lifespan and utility of medical fiberscopes?

AI extends the utility of fiberscopes by integrating real-time image analysis, compensating for lower inherent resolution, and automatically highlighting suspicious lesions for the operator. Furthermore, AI systems are crucial in monitoring scope usage and predicting maintenance needs, thereby lowering repair costs and increasing the operational lifespan of the fiberoptic equipment fleet.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager