Medical Gas Equipment Belt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434613 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Medical Gas Equipment Belt Market Size

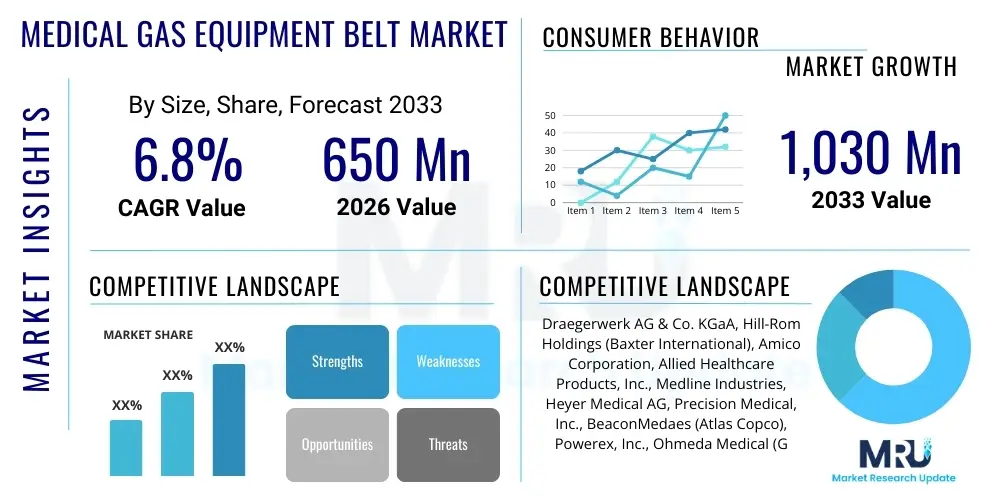

The Medical Gas Equipment Belt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,030 Million by the end of the forecast period in 2033.

Medical Gas Equipment Belt Market introduction

The Medical Gas Equipment Belt Market encompasses the manufacturing, distribution, and utilization of specialized wall-mounted raceway systems, often referred to as 'headwalls' or 'bedhead units,' designed to centralize critical life support infrastructure in healthcare environments, particularly patient rooms and intensive care units (ICUs). These systems integrate essential services such as medical gas outlets (oxygen, medical air, vacuum, nitrous oxide), electrical power sockets, nurse call systems, lighting, data communication ports, and physiological monitoring connections into a single, organized unit. The primary function of the equipment belt is to ensure immediate and reliable access to necessary utilities, thereby enhancing operational efficiency, patient safety, and clinical workflow in acute care settings.

The product, fundamentally a delivery system for utility services, is crucial for hospitals, ambulatory surgical centers, and specialized clinics requiring stringent adherence to safety and functional standards, such as NFPA 99 and ISO 7396-1. Major applications span high-acuity areas like ICUs, Critical Care Units (CCUs), Emergency Rooms (ERs), and neonatal units, where multiple simultaneous connections for monitoring and life support are mandatory. The equipment belts are designed for robustness, ease of installation, and modularity, allowing customization based on the complexity of patient needs and architectural specifications of the facility. Advanced models now incorporate infection control features, such as smooth surfaces and antimicrobial coatings, responding to heightened awareness of Healthcare-Associated Infections (HAIs).

Driving factors for market expansion include the global increase in hospital infrastructure development, particularly in emerging economies, coupled with significant investment in upgrading existing healthcare facilities in developed nations to meet modern safety and operational standards. The aging global population, which necessitates more sophisticated and critical care infrastructure, further fuels demand. Furthermore, the inherent benefits—such as enhanced organization, reduced clutter, improved clinical response times, and compliance with strict regulatory frameworks regarding medical gas management—make these equipment belts indispensable components of modern healthcare facility planning and construction.

Medical Gas Equipment Belt Market Executive Summary

The Medical Gas Equipment Belt Market is characterized by steady growth driven predominantly by escalating global healthcare infrastructure spending, stringent regulatory requirements mandating standardized gas delivery systems, and the ongoing modernization of existing hospitals. Key business trends include a strategic shift towards modular and customizable solutions, enabling facilities to tailor equipment belts precisely to specific unit needs (e.g., higher complexity in ICUs versus standard rooms). Manufacturers are increasingly focusing on incorporating smart features, such as integrated sensors for gas pressure monitoring and digital connectivity for remote diagnostics, positioning the products as central hubs within the connected hospital ecosystem. Consolidation among smaller regional players by large international corporations seeking to expand geographical reach and product portfolios is also a notable market activity.

Regional dynamics highlight North America and Europe as established markets dominated by strict adherence to safety codes and high expenditure on critical care infrastructure upgrades. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily due to massive government and private investment in healthcare expansion in populous countries like China, India, and Southeast Asian nations aiming to bridge the gap in available hospital beds and critical care capacity. Latin America and the Middle East & Africa (MEA) are also showing promising potential, stimulated by medical tourism initiatives and oil-revenue-backed healthcare development projects, although political and economic instability can occasionally restrain market potential in certain sub-regions.

Segmentation trends indicate that Critical Care Units (CCUs) and Intensive Care Units (ICUs) remain the leading application segments, commanding the largest share due to the required complexity and density of integrated services. Material segmentation favors aluminum alloy and stainless steel due to their durability, ease of sterilization, and compliance with fire safety regulations. Furthermore, electrically powered equipment belts, which offer seamless integration of data and power alongside medical gases, are rapidly gaining traction over purely mechanical or gas-specific systems, reflecting the increasing technological complexity of patient monitoring and life support apparatus.

AI Impact Analysis on Medical Gas Equipment Belt Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Medical Gas Equipment Belt Market primarily revolve around how AI can enhance safety, predictive maintenance, and operational efficiency of these systems. Users are keen to understand if AI can predict potential gas leaks or pressure failures, optimize gas inventory management based on real-time usage patterns, and streamline the installation and maintenance processes through augmented reality (AR) tools integrated with AI diagnostics. The central theme is the transition of the equipment belt from a passive utility fixture to a smart, integrated data node within the hospital's Internet of Medical Things (IoMT) infrastructure, using AI algorithms to ensure continuous reliability and proactive fault detection, thereby minimizing risk in critical patient care environments.

While AI does not directly alter the fundamental physical structure or function of the gas outlets themselves, its influence is profound in the peripheral management and efficiency layers. AI algorithms, when applied to data collected by smart sensors embedded within the belts (monitoring flow rates, pressure fluctuations, and electrical loads), can establish baseline operational metrics. Any significant deviation from these metrics triggers an immediate alert, enabling predictive maintenance before a component failure impacts patient care. This transformation moves facility management from reactive repair to proactive, condition-based maintenance schedules, maximizing uptime and lifespan of the entire system.

Moreover, AI contributes significantly to capacity planning and inventory optimization. By analyzing historical and real-time gas consumption data linked to patient acuity levels and unit occupancy (information routed through the equipment belt's data ports), AI models can accurately forecast medical gas requirements. This ensures that the bulk supply systems (e.g., cryogenic tanks or manifold systems) are managed optimally, reducing wastage, lowering logistical costs, and crucially, preventing shortages during peak demand periods or emergencies. This data-driven approach, facilitated by smart equipment belts, elevates the overall resilience and financial viability of hospital operations.

- AI-driven Predictive Maintenance: Forecasts component failure (e.g., solenoid valves, pressure regulators) based on sensor data, minimizing unplanned downtime.

- Real-time Usage Optimization: Monitors gas flow and consumption patterns to optimize inventory and supply chain logistics.

- Integrated Safety Monitoring: Utilizes machine learning to detect anomalous pressure readings or electrical spikes, immediately alerting facility management to potential hazards.

- Clinical Workflow Enhancement: AI analyzes data connectivity through the belt to optimize placement of monitoring equipment, improving clinical efficiency.

- Automated Compliance Reporting: Generates AI-verified reports on gas usage and system integrity, aiding adherence to regulatory standards (NFPA, ISO).

DRO & Impact Forces Of Medical Gas Equipment Belt Market

The Medical Gas Equipment Belt Market is significantly influenced by a dynamic set of Drivers, Restraints, and Opportunities (DRO). The primary driver remains the pervasive global trend towards enhancing patient safety standards in acute care settings, which necessitates the use of standardized, organized, and compliant utility delivery systems like equipment belts. This is strongly supported by non-negotiable regulatory frameworks, especially those enforced by organizations such as the Joint Commission International (JCI) and national safety codes, which mandate segregated and clearly identifiable medical gas outlets. These regulatory forces compel healthcare providers globally to install or upgrade to sophisticated equipment belts during new construction or renovation cycles. Furthermore, the inherent organizational advantage that these belts provide, consolidating disparate utilities into a single aesthetic and functional unit, significantly improves the efficiency of clinical staff, thereby acting as a continuous market stimulant.

However, several restraints impede faster market penetration. The most significant is the substantial initial capital expenditure required for installing these integrated systems, especially in older facilities where extensive structural modifications are often necessary to accommodate new piping, conduit runs, and specialized wall reinforcement. This high upfront cost can be a major deterrent for smaller private clinics or hospitals in economically constrained regions. Additionally, the complexity involved in adhering to diverse national and regional installation codes (which vary significantly regarding gas color coding, outlet threading, and electrical isolation standards) creates logistical challenges for multinational manufacturers. Another constraint is the long replacement cycle typical of hospital infrastructure components; once installed, equipment belts generally remain in place for 15-20 years, limiting repetitive sales in established facilities.

Opportunities for growth are concentrated in the rapid technological evolution and geographical expansion. The move towards modular, infection-resistant (antimicrobial materials), and smart equipment belts—integrating IoMT capabilities and digital patient interfaces—represents a high-value opportunity. Geographically, untapped potential lies in the massive healthcare expansion projects across APAC and MEA, driven by public health policy goals and rising middle-class demand for quality care. The increasing demand for prefabricated modular hospitals and temporary healthcare facilities also opens new avenues for lightweight, rapidly deployable equipment belt solutions. The imperative to manage costs while maintaining high compliance standards creates an opportunity for manufacturers offering life-cycle maintenance contracts and robust, easily serviceable products.

The impact forces shaping this market include regulatory pressure (high), technological innovation (medium-to-high), and macroeconomic conditions influencing healthcare capital spending (variable). Regulatory adherence acts as a strong positive driver that overrides most cost restraints in critical environments. Technological advancements are focused on product differentiation and improving clinical utility, rather than core function changes. Economic stability determines the speed and scale of hospital construction, directly impacting market volume. Overall, the structural necessity of medical gas delivery systems in modern medicine makes the market highly resilient to external shocks, placing regulatory mandates as the dominant impact force.

Segmentation Analysis

The Medical Gas Equipment Belt Market is broadly segmented based on Product Type, Installation Type, Material Type, Application, and End-User. Analyzing these segments provides a clear view of where growth capital is being directed within the healthcare infrastructure sector. Product segmentation is crucial, differentiating between horizontal, vertical, and specialized ceiling-mounted units, reflecting diverse architectural and clinical requirements. Installation and material types define the durability, aesthetic compatibility, and cost profile of the systems, with aluminum and stainless steel dominating due to hygiene and structural integrity requirements.

Application segmentation reveals the intensity of demand across various hospital units. Critical care environments, requiring the highest concentration of integrated utilities, consistently lead market demand, followed by standard patient rooms and operating theaters. End-user analysis clarifies the procurement landscape, highlighting that large public and private hospitals remain the primary buyers, although specialized centers like ambulatory surgery centers (ASCs) are rapidly emerging as key consumers for streamlined, low-profile systems. The increasing focus on infection control and ergonomic design is driving growth in premium, seamless units across all segments.

- By Product Type:

- Horizontal Equipment Belts

- Vertical Equipment Belts (often used in pediatric or specialized units)

- Ceiling-Mounted Equipment Delivery Systems (booms/pendants)

- By Installation Type:

- Surface Mounted

- Recessed/Flush Mounted

- By Material Type:

- Aluminum Alloy

- Stainless Steel

- Other Composites and Plastics

- By Application:

- Intensive Care Units (ICU)

- Critical Care Units (CCU)

- General Patient Rooms

- Operating Rooms (OR) and Recovery Rooms

- Emergency Rooms (ER)

- Neonatal Intensive Care Units (NICU)

- By End-User:

- Hospitals (Public and Private)

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics and Medical Centers

Value Chain Analysis For Medical Gas Equipment Belt Market

The Value Chain for the Medical Gas Equipment Belt Market begins with the upstream procurement of raw materials, primarily high-grade aluminum, stainless steel, copper tubing (for gas lines), and electrical components (sockets, wiring). Key upstream activities involve sourcing compliant materials that meet rigorous medical standards for corrosion resistance, fire safety, and hygiene. Manufacturers engage specialized suppliers for precision engineering of gas outlets, regulators, electrical conduits, and lighting fixtures. Cost management at this stage, particularly minimizing the volatility associated with metal prices and ensuring robust quality control of outsourced electronic components, is critical to maintaining profitability and product reliability.

The core manufacturing and assembly stage involves high-precision fabrication of the metal casings, integration of complex piping systems, and installation of electrical wiring systems, all done under strict quality assurance protocols compliant with global medical device standards (e.g., ISO 13485). Customization, design consultation, and engineering services form a significant part of the value added here, as most equipment belts are tailored to specific architectural blueprints. Downstream activities involve distribution, which is predominantly executed through specialized medical equipment distributors, system integrators, and direct sales teams targeting large hospital construction projects. These distributors often provide localized installation support, technical training, and after-sales maintenance services, which are crucial due to the complexity and life-critical nature of the equipment.

Direct sales are often preferred for major governmental or private hospital tenders, ensuring closer control over project specifications and installation compliance. Indirect channels rely heavily on system integrators who bundle the equipment belts with broader hospital fit-outs (HVAC, medical vacuum systems, central gas supply). The final stage, encompassing installation, commissioning, and long-term maintenance, requires certified technicians who understand both electrical and medical gas system requirements. The longevity of the product means that maintenance and parts replacement, facilitated by the established distribution network, represent a stable, recurring revenue stream throughout the product lifecycle, strongly connecting the manufacturer to the end-user long after the initial sale.

Medical Gas Equipment Belt Market Potential Customers

The primary potential customers and end-users of Medical Gas Equipment Belts are institutions that provide acute or critical care services requiring centralized and highly regulated access to utilities. Hospitals constitute the largest customer segment, encompassing both large public healthcare systems (often procurement driven by centralized governmental tenders) and private healthcare corporations (focused on premium aesthetics and advanced functionality). Within hospitals, procurement is typically driven by facilities management, biomedical engineering departments, and capital planning committees during major construction, renovation, or expansion phases.

Beyond traditional hospitals, the market is expanding significantly into specialized healthcare environments. Ambulatory Surgical Centers (ASCs), though requiring less complex systems than ICUs, represent a growing market due to the shift towards outpatient procedures requiring standardized recovery areas. Furthermore, specialized long-term care facilities, trauma centers, military field hospitals, and large university medical teaching facilities are significant buyers, often prioritizing durability, redundancy, and compliance with the highest available international standards. The decision to purchase is heavily influenced by certifications, compliance with local building codes, and proven track records of system reliability and low maintenance requirements, making technical specifications paramount over marginal cost savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,030 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Draegerwerk AG & Co. KGaA, Hill-Rom Holdings (Baxter International), Amico Corporation, Allied Healthcare Products, Inc., Medline Industries, Heyer Medical AG, Precision Medical, Inc., BeaconMedaes (Atlas Copco), Powerex, Inc., Ohmeda Medical (GE Healthcare), Egemin Automation (Konecranes), Tedisel Medical, Covalence Medical, Starkstrom, Novair Medical, Penlon Ltd., Shanghai Zhenghua Medical Equipment Co. Ltd., Nanjing Tianlun Medical Equipment Co. Ltd., BPR Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Gas Equipment Belt Market Key Technology Landscape

The technological landscape of the Medical Gas Equipment Belt Market is evolving from basic utility conveyance systems toward highly integrated, data-enabled solutions. Historically, the primary technology focus was on the reliability and separation of conduits—ensuring strict segregation between medical gases, vacuum lines, and electrical wiring as mandated by standards like NFPA 99. The materials science aspect is continuously refined, with a focus on high-strength, non-corrosive metals (anodized aluminum or 304/316 stainless steel) and specialized seals and valves that guarantee leak integrity and longevity, essential for life-critical applications. Advanced manufacturing techniques, such as modular prefabrication and clean-room assembly, reduce installation time and enhance system quality control before deployment.

The contemporary shift is dominated by digitalization and connectivity. Key technological advancements include the integration of sophisticated monitoring systems, such as digital pressure gauges with network connectivity that provide real-time status updates to the hospital's central building management system (BMS) or alarm panels. These smart belts feature integrated data ports (Ethernet, fiber optic) and specialized conduits designed to shield sensitive data lines from electromagnetic interference generated by adjacent power lines. Furthermore, manufacturers are developing highly ergonomic designs, including self-cleaning surfaces, seamless construction to eliminate microbial harboring crevices, and low-profile installation options that minimize physical obstruction and enhance aesthetic integration into modern hospital architecture.

A crucial emerging technology involves the modularity and customization facilitated by advanced computer-aided design (CAD) and manufacturing (CAM). This allows belts to be engineered rapidly for unique room specifications (e.g., bariatric rooms, isolation units) and future-proofed with expandable raceway capacity. Additionally, significant innovation is seen in ancillary features: high-efficiency, indirect LED lighting systems integrated into the belts to reduce patient glare while providing adequate illumination for clinical tasks, and sophisticated nurse call integration systems that utilize touchscreen interfaces and wireless data transmission protocols, turning the equipment belt into a consolidated patient interface and communication hub within the clinical environment.

Regional Highlights

- North America: Market Maturity and Regulatory Compliance

- Europe: Standardization, Aging Infrastructure, and Healthcare Reform

- Asia Pacific (APAC): Rapid Infrastructure Expansion and Volume Growth

- Latin America (LATAM): Economic Volatility and Public Sector Dominance

- Middle East & Africa (MEA): High-Value Projects and Critical Care Focus

North America, particularly the United States, holds a dominant position in terms of market value, driven by high healthcare expenditure, established critical care standards (NFPA 99 compliance), and continuous modernization of hospital facilities. The market here is highly mature, characterized by demand for premium, customized, and technologically advanced equipment belts featuring IoMT capabilities and integration with sophisticated Electronic Health Record (EHR) systems. Procurement decisions are heavily influenced by life-cycle cost analysis and stringent safety regulations. The presence of major global players and robust standardization ensures consistent quality, although the growth rate is steadier compared to emerging markets, focusing primarily on high-value upgrades and replacement cycles rather than new facility volume.

The Canadian market mirrors the U.S. in terms of quality standards but operates under a predominantly public healthcare procurement model. Key trends involve the adoption of recessed equipment belts to maximize space and improve aesthetics, especially in patient rooms, and an increasing preference for anti-microbial coatings. Strict regulatory enforcement regarding color-coding and outlet type mandates (preventing cross-connection of gases) ensures a continuous demand for compliant systems, bolstering the market's stability and technical specification requirements.

The European market is robust, largely governed by the strict medical device regulations (MDR) and standardized gas system requirements (ISO 7396-1). Western European nations (Germany, UK, France) represent significant markets due to the necessity of replacing aging hospital infrastructure built in the mid-to-late 20th century. High labor and installation costs drive demand for pre-engineered, modular solutions that minimize on-site complexity and fitting time. Focus areas include maximizing energy efficiency (through integrated LED lighting) and ensuring seamless integration with existing historical building architectures, presenting unique engineering challenges.

Eastern Europe is experiencing accelerated growth fueled by EU structural funds and national health initiatives aimed at modernizing care standards to align with Western European benchmarks. This often involves large-scale, greenfield hospital projects, translating into substantial bulk orders for equipment belts. The diversity in national procurement processes, however, necessitates manufacturers to maintain flexible distribution strategies and ensure rapid localization of product specifications (e.g., differing electrical socket standards). Sustainability and the use of eco-friendly, recyclable materials are becoming increasingly important drivers in Scandinavian countries and Germany.

APAC is the fastest-growing regional market, characterized by massive investments in healthcare infrastructure driven by urbanization, rising disposable incomes, and government initiatives aimed at expanding public health access. Countries like China and India are constructing hundreds of new hospitals annually, creating an enormous volume-driven demand for medical gas equipment belts. While cost-sensitivity remains a factor, particularly in tier-2 and tier-3 cities, the simultaneous rise of high-end private hospitals targets premium, technologically advanced solutions, mirroring Western specifications.

Southeast Asian countries (e.g., Indonesia, Vietnam, Thailand) are leveraging medical tourism, which necessitates world-class facility standards. Manufacturers focusing on the APAC market must prioritize ease of installation, robust after-sales support due to varied infrastructural quality, and the ability to scale production quickly to meet high-volume demands. The increasing adoption of international standards (ISO) in newly constructed facilities is progressively replacing older local or proprietary standards, facilitating market entry for global suppliers.

The LATAM market shows strong underlying potential, particularly in Brazil, Mexico, and Chile, yet growth is often hindered by economic instability and currency fluctuations. The public sector dominates procurement in many nations, often relying on large, infrequent tenders, leading to market volatility. Demand is primarily centered on fundamental, highly durable, and cost-effective equipment belts that meet minimum safety requirements. Opportunities exist in private sector expansion, which is often focused in major urban centers, offering higher specification requirements and better pricing flexibility for advanced products.

Chile and Mexico, with relatively stable economies, show higher adoption rates for imported, standards-compliant systems. Manufacturers must navigate complex import duties and localized certification processes. The need for robust systems capable of operating reliably in often challenging environmental conditions (e.g., high humidity, variable power supply) is a key customer requirement across the region.

The Middle East (GCC nations like UAE, Saudi Arabia, Qatar) represents a high-value, quality-sensitive market segment. These countries invest heavily in luxurious, state-of-the-art hospitals, often driven by government health visions and medical tourism goals. Procurement in this region prioritizes premium features, advanced connectivity, aesthetic customization, and adherence to top international standards (U.S./European). The demand is particularly high for Critical Care Unit (CCU) and OR systems, often utilizing ceiling-mounted pendants rather than wall belts for maximum flexibility.

The African market is highly heterogeneous. South Africa maintains a relatively developed healthcare system with significant demand for robust equipment belts. Sub-Saharan African countries, however, largely rely on donor funding or highly constrained government budgets, resulting in demand for highly durable, low-maintenance, and cost-effective basic systems. The primary growth driver is the expansion of specialized clinics and regional hospitals, aiming to establish foundational infrastructure for acute care services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Gas Equipment Belt Market. These companies are pivotal in driving innovation, setting industry standards, and influencing global supply chain dynamics across various regional markets.- Draegerwerk AG & Co. KGaA

- Hill-Rom Holdings (Baxter International)

- Amico Corporation

- Allied Healthcare Products, Inc.

- BeaconMedaes (Atlas Copco)

- Powerex, Inc.

- Medline Industries

- Heyer Medical AG

- Precision Medical, Inc.

- Ohmeda Medical (GE Healthcare)

- Egemin Automation (Konecranes)

- Tedisel Medical

- Covalence Medical

- Starkstrom

- Novair Medical

- Penlon Ltd.

- Shanghai Zhenghua Medical Equipment Co. Ltd.

- Nanjing Tianlun Medical Equipment Co. Ltd.

- BPR Medical

- Ohio Medical Corporation

Frequently Asked Questions

Analyze common user questions about the Medical Gas Equipment Belt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety standards governing Medical Gas Equipment Belts globally?

The primary global safety standards include NFPA 99 (Health Care Facilities Code) in North America, which strictly mandates performance criteria for medical gas systems, and ISO 7396-1 (Piping systems for compressed medical gases and vacuum), widely adopted in Europe and Asia. These standards cover mandatory color coding, outlet type segregation, pressure requirements, and robust electrical isolation to prevent critical service cross-connection.

How does the integration of IoMT technologies affect the functionality of a standard equipment belt?

IoMT integration transforms the equipment belt from a passive fixture into a smart data hub. It allows for the integration of sensors for real-time monitoring of gas pressure and flow rates, network connectivity for nurse call systems, and digital integration for automated asset tracking and predictive maintenance alerts. This enhances system reliability and clinical efficiency.

What is the typical lifespan and maintenance requirement for Medical Gas Equipment Belts?

A well-installed Medical Gas Equipment Belt typically has a structural lifespan of 15 to 25 years, aligning with general hospital renovation cycles. Routine maintenance primarily involves quarterly or semi-annual checks of gas outlet integrity, valve sealing mechanisms, electrical wiring compliance, and ensuring the functionality of critical alarm systems, often mandated by regulatory bodies like JCI.

Which application segment provides the highest growth potential in the short term?

The Intensive Care Unit (ICU) and Critical Care Unit (CCU) segments offer the highest short-term value growth potential globally. This is driven by the post-pandemic necessity to expand and modernize critical care capacity, demanding complex, highly customized, and redundant equipment belts with superior connectivity and a dense concentration of gas and electrical outlets.

Is there a significant difference in demand between surface-mounted and recessed equipment belts?

Yes, recessed or flush-mounted equipment belts are experiencing rising demand, particularly in new hospital construction and premium patient rooms, due to their aesthetic appeal, easier cleaning (infection control), and maximization of usable floor space. However, surface-mounted systems remain dominant in quick renovations or older facilities where structural modifications for recessing are cost-prohibitive or architecturally complex.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager