Medical Imaging Information Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434229 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Medical Imaging Information Systems Market Size

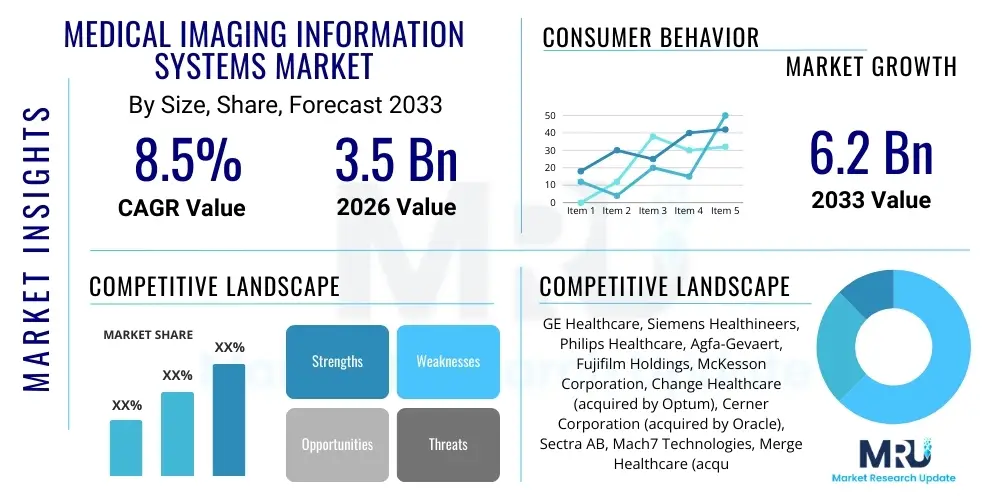

The Medical Imaging Information Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $6.2 Billion by the end of the forecast period in 2033.

Medical Imaging Information Systems Market introduction

The Medical Imaging Information Systems (MIIS) Market encompasses the infrastructure and applications designed to manage, store, distribute, and display medical images and related clinical data across healthcare enterprises. These systems are crucial for streamlining diagnostic workflows, improving patient care coordination, and ensuring regulatory compliance regarding data integrity and privacy. Key components of MIIS include Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), and Vendor Neutral Archives (VNA). The integration of these systems facilitates a comprehensive digital environment, moving healthcare facilities away from traditional film-based imaging processes towards efficient digital workflows that support remote viewing and collaborative diagnosis.

Product descriptions within this domain primarily center on software solutions engineered for high performance and scalability. PACS forms the core, providing universal access to images from various modalities (MRI, CT, X-ray, Ultrasound). RIS manages patient scheduling, tracking, and reporting within the radiology department. The emergence of VNA represents a significant architectural shift, enabling centralized, format-agnostic storage that enhances data longevity and interoperability across disparate systems and institutions. These interconnected technologies support major applications such as advanced visualization, teleradiology, and clinical decision support, making them indispensable in modern healthcare operations.

The driving factors propelling this market are fundamentally rooted in the global trend toward digital transformation in healthcare, coupled with an increasing volume of complex diagnostic procedures. Benefits derived from adopting MIIS include reduced operating costs, faster turnaround times for diagnostic reports, enhanced data security, and improved communication between clinical specialists. Furthermore, the rising prevalence of chronic diseases requiring sophisticated imaging surveillance, alongside government initiatives promoting Electronic Health Record (EHR) adoption, provides a strong foundational impetus for sustained market growth across developed and emerging economies.

Medical Imaging Information Systems Market Executive Summary

The Medical Imaging Information Systems (MIIS) market is experiencing robust expansion driven by the critical need for efficient clinical data management and seamless integration across healthcare ecosystems. Key business trends indicate a definitive shift toward cloud-based deployment models, favored for their superior scalability, reduced capital expenditure, and enhanced accessibility for teleradiology services. Strategic consolidation through mergers and acquisitions is shaping the competitive landscape, with major vendors focusing on offering integrated platforms that combine PACS, RIS, and VNA functionalities into unified enterprise imaging solutions. Furthermore, cybersecurity resilience and compliance with stringent regulations like HIPAA and GDPR remain paramount concerns, driving vendor investment in sophisticated security features and data governance tools.

Regional trends highlight North America as the dominant market, characterized by high adoption rates of advanced medical technologies, substantial healthcare IT budgets, and established digital infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid expansion of healthcare infrastructure, increasing medical tourism, and government initiatives aimed at modernizing hospital systems, particularly in large economies such as China and India. Europe maintains a steady growth trajectory, strongly influenced by regional data interoperability mandates and widespread implementation of universal healthcare IT frameworks designed to improve cross-border patient data exchange.

Segment trends underscore the increasing preference for VNA solutions, which address long-term data archival and vendor lock-in issues, positioning them as essential components of enterprise-wide imaging strategies. While software components consistently dominate the market revenue, the services segment, including implementation, maintenance, and consulting, is expected to grow rapidly as facilities require specialized expertise to manage complex integrated environments. End-user adoption continues to be highest among large hospital systems, but diagnostic imaging centers and specialized clinics are rapidly increasing their MIIS investments to manage growing patient volumes and achieve operational efficiencies comparable to larger institutions.

AI Impact Analysis on Medical Imaging Information Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Medical Imaging Information Systems predominantly revolve around efficiency gains, diagnostic reliability, and workflow integration challenges. Common questions focus on how AI can automate image interpretation tasks, whether AI algorithms are certified for primary diagnosis, and the technical requirements for integrating advanced AI engines with existing PACS and RIS infrastructure. Users are particularly concerned about the accuracy of AI in handling rare diseases, the ethical implications of algorithmic bias, and the necessity of upskilling the existing radiology workforce to effectively leverage these new tools. The collective expectation is that AI will primarily serve as a powerful assistive technology, significantly accelerating throughput and minimizing diagnostic errors, thereby justifying the substantial initial investment required for deployment.

AI’s influence is rapidly transforming the architecture and functional capabilities of MIIS. Integration of AI tools facilitates immediate pre-analysis of images, flagging potentially critical findings before human review, thus drastically improving the efficiency of the triage process. Within PACS, AI algorithms are being employed for enhanced image reconstruction, noise reduction, and quantitative analysis, moving beyond simple storage and retrieval functions to become intelligent processing hubs. This shift necessitates stronger computing capabilities within MIIS infrastructure, increasingly leveraging cloud-based platforms to handle the intensive computational load required for large-scale machine learning models and deep learning applications used in medical imaging.

Furthermore, AI is crucial for optimizing the underlying data management infrastructure. By employing machine learning techniques, VNA and PACS systems can better predict storage needs, automatically archive less frequently accessed data, and improve data retrieval speeds based on predictive clinical context. This intelligent automation alleviates the administrative burden on radiology departments. The continuous evolution of AI algorithms, particularly in areas like computer vision, promises to redefine clinical workflows, shifting the radiologist’s role from primary interpretation to validation and consultation on complex cases, fundamentally enhancing the value proposition of modern Medical Imaging Information Systems.

- AI enhances diagnostic workflow automation and image processing speed.

- Machine learning improves image quality through advanced reconstruction and noise reduction.

- AI-powered tools assist in patient triage by prioritizing critical cases immediately.

- Integration of deep learning models enables quantitative analysis and objective measurements.

- Predictive analytics optimize storage management and data retrieval within VNA systems.

- AI raises requirements for scalable cloud computing and robust data governance within MIIS.

DRO & Impact Forces Of Medical Imaging Information Systems Market

The Medical Imaging Information Systems market is shaped by a strong interplay of growth drivers and mitigating restraints, balanced by emerging opportunities and powerful impact forces that dictate strategic market direction. Key drivers include the exponential growth in global imaging volumes, largely due to an aging population and increased prevalence of chronic diseases requiring longitudinal monitoring. The imperative for centralized patient data management, driven by the global adoption of Electronic Health Records (EHR) and the need for standardized interoperability (DICOM, HL7), further accelerates the demand for robust MIIS solutions. Simultaneously, impactful governmental policies promoting digital health and providing financial incentives for IT adoption significantly lower the barrier to entry for many healthcare organizations.

Restraints, however, pose significant challenges to widespread deployment. The most prominent barrier is the high initial capital investment required for implementing comprehensive MIIS solutions, including the necessary hardware, specialized software licensing, and extensive training for clinical staff. Furthermore, interoperability issues persist, particularly in highly heterogeneous healthcare environments where legacy systems struggle to communicate effectively with modern, cloud-native solutions. Data security and patient privacy concerns represent continuous restraints, as institutions must invest heavily to protect sensitive patient information from increasingly sophisticated cyber threats, ensuring compliance with strict global privacy regulations.

Opportunities for market growth are centered around leveraging advanced technologies and addressing unmet clinical needs. The rapid proliferation of cloud computing and the shift towards Software-as-a-Service (SaaS) models offer scalability and reduce the cost burden for smaller facilities. Moreover, the integration of AI and machine learning for enhanced diagnostic capabilities and personalized medicine presents a massive long-term opportunity, transforming MIIS from mere archiving systems into intelligent analytical platforms. Impact forces such as the ongoing healthcare digitalization wave, coupled with the pressure to reduce medical errors and improve patient outcomes through faster and more accurate diagnostics, compel healthcare providers to prioritize MIIS upgrades and adoption.

Segmentation Analysis

The Medical Imaging Information Systems market is meticulously segmented across various dimensions, including product type, component, deployment model, and end-user, providing a granular view of market dynamics and adoption patterns. The segmentation reflects the diverse technological landscape and the varied needs of healthcare providers, ranging from small private practices to large, integrated delivery networks. Understanding these segments is crucial for vendors to tailor their offerings—whether focusing on cloud infrastructure services for scalability or specialized AI-enabled software for diagnostic accuracy—to target specific customer profiles and maximize market penetration.

- By Product:

- Picture Archiving and Communication Systems (PACS)

- Radiology Information Systems (RIS)

- Vendor Neutral Archives (VNA)

- Clinical Information Systems (CIS)

- By Component:

- Software (Core applications, Visualization, Analytics)

- Hardware (Servers, Storage Devices, Workstations)

- Services (Implementation, Training, Maintenance, Consulting)

- By Deployment Model:

- On-premise

- Cloud-based

- Hybrid

- By End-User:

- Hospitals and Clinics

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Research and Academic Medical Centers

Value Chain Analysis For Medical Imaging Information Systems Market

The Value Chain for the Medical Imaging Information Systems market spans from initial technology development and raw component procurement to final deployment and maintenance within clinical settings. Upstream analysis involves foundational activities such as sophisticated software development, focusing on algorithms for image processing, storage optimization, and user interface design. This stage is dominated by specialized software firms and large technology conglomerates that invest heavily in R&D for AI, interoperability standards (DICOM/HL7), and secure data transmission protocols. Hardware manufacturers, including providers of high-capacity servers and specialized storage arrays (often flash-based for rapid access), form another critical upstream segment, ensuring the physical infrastructure can support massive datasets generated by modern imaging modalities.

The midstream of the value chain is characterized by system integration and customization. Value-Added Resellers (VARs) and specialized IT service providers play a pivotal role here, adapting generic software platforms to meet the specific workflow requirements of individual healthcare organizations. Distribution channels are complex, involving direct sales teams for major enterprise solutions targeting large hospital networks, and indirect channels (distributors and third-party integrators) for reaching smaller clinics and regional diagnostic centers. Effective integration services are critical as MIIS must seamlessly interact with existing EHRs, modality equipment, and billing systems, requiring expert project management and technical proficiency.

Downstream activities focus on the delivery, operational use, and long-term support of the systems. This involves training clinical staff (radiologists, technicians, IT administrators) and providing continuous maintenance and troubleshooting services. End-users—primarily hospitals and diagnostic centers—utilize the MIIS to perform core clinical functions, generating value through faster diagnostics and improved patient outcomes. The indirect value stream is realized through teleradiology service providers who leverage MIIS infrastructure to offer remote diagnostic readings, extending the reach of specialized expertise globally and enhancing system utilization efficiency.

Medical Imaging Information Systems Market Potential Customers

The primary consumers and end-users of Medical Imaging Information Systems are diverse healthcare entities that rely on diagnostic imaging for patient care, research, and institutional management. Hospitals, particularly large integrated delivery networks (IDNs) and academic medical centers, represent the largest segment of buyers due to their high volume of imaging procedures, complex inter-departmental needs, and substantial IT budgets. These institutions require comprehensive, enterprise-wide solutions encompassing fully integrated PACS, RIS, and VNA to manage massive quantities of data generated across multiple modalities and specialties (e.g., cardiology, neurology, general radiology).

Diagnostic Imaging Centers constitute the second major customer base. These facilities, ranging from independent outpatient centers to specialized clinics, prioritize efficiency and rapid turnaround times to maintain competitiveness. Their purchasing decisions are often centered around cloud-based solutions and robust RIS components that streamline patient scheduling, billing, and report generation, ensuring high throughput and optimal resource utilization. They seek cost-effective solutions that can easily scale with patient demand without the heavy upfront infrastructure investment associated with traditional on-premise systems.

Further potential customers include government and military healthcare facilities, which require secure, standardized, and often geographically dispersed MIIS platforms for managing veteran and active duty personnel records. Additionally, research and academic medical institutions are key buyers, demanding highly sophisticated systems with advanced visualization and analytics capabilities to support clinical trials and pioneering medical research. The increasing adoption of MIIS by specialty clinics, such as ophthalmology or dental practices incorporating advanced 3D imaging, also expands the customer base requiring specialized, tailored versions of these information management platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $6.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Siemens Healthineers, Philips Healthcare, Agfa-Gevaert, Fujifilm Holdings, McKesson Corporation, Change Healthcare (acquired by Optum), Cerner Corporation (acquired by Oracle), Sectra AB, Mach7 Technologies, Merge Healthcare (acquired by IBM Watson Health), Hyland Software, Intelerad Medical Systems, Konica Minolta, Novarad Corporation, RamSoft, Visage Imaging, Dedalus Group, Infinitt Healthcare, Epic Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Imaging Information Systems Market Key Technology Landscape

The technology landscape of the Medical Imaging Information Systems market is characterized by rapid evolution toward highly scalable, interoperable, and intelligent systems. Central to this transformation is the widespread adoption of cloud computing, which facilitates the migration of legacy PACS and VNA infrastructure to secure, accessible, and elastic public, private, or hybrid cloud environments. Cloud technology not only drastically reduces the on-premise hardware footprint and associated maintenance costs but also supports the bandwidth demands of teleradiology and provides the necessary processing power for integrating advanced analytics and AI applications. This foundational shift ensures that data storage is compliant, highly available, and resilient against disaster, which is critical for continuous clinical operations.

Further technological advancements are driven by the need for enhanced data sharing and management efficiency. Big Data analytics and machine learning techniques are increasingly embedded within MIIS to analyze vast repositories of image data, correlating them with clinical notes and outcomes to derive actionable insights. Furthermore, adherence to standardized protocols, primarily DICOM (Digital Imaging and Communications in Medicine) and HL7 (Health Level Seven International), remains non-negotiable. DICOM defines the format for medical images and associated data, ensuring seamless exchange between imaging modalities and viewing stations. Modern MIIS solutions must demonstrate robust adherence to these standards while incorporating APIs and modular architectures that enable easy integration with disparate Electronic Health Records (EHRs) and other hospital information systems (HIS), thereby minimizing data silos.

The push for enterprise imaging represents a significant architectural trend, moving beyond department-specific systems (like dedicated Radiology PACS) to holistic platforms that manage all clinical media (images, videos, documents) across the entire healthcare enterprise, including cardiology, pathology, and dermatology. This is often achieved through a core VNA component. Mobile imaging solutions and zero-footprint viewers, utilizing web-based technologies, are also key technologies, allowing clinicians to securely access and review high-resolution images on various devices (tablets, smartphones) from any location. Security technologies, including advanced encryption, tokenization, and multi-factor authentication, are integrated throughout the MIIS architecture to protect highly sensitive patient data in transit and at rest, aligning with strict regulatory mandates.

Regional Highlights

- North America (Dominance and Innovation Hub): North America holds the largest share of the MIIS market, primarily driven by high levels of healthcare IT spending, sophisticated digital infrastructure, and favorable reimbursement policies supporting advanced diagnostic procedures. The U.S. market, in particular, benefits from a high concentration of major technology vendors and rapid adoption of cutting-edge solutions like AI-enabled PACS and large-scale VNA deployments in integrated delivery networks. Mandates promoting EHR adoption and interoperability further solidify the region's market leadership.

- Europe (Standardization and Interoperability Focus): The European market is characterized by strong emphasis on standardization (driven by organizations like EuroPACS) and cross-border data exchange initiatives. Western European countries, particularly Germany, the UK, and France, are major consumers of MIIS, driven by government investments in public health IT modernization and efforts to achieve seamless data flow across national healthcare systems, often favoring hybrid deployment models that balance security with accessibility.

- Asia Pacific (APAC) (Fastest Growth Trajectory): APAC is projected to be the fastest-growing region, fueled by massive government investments in developing healthcare infrastructure, the expansion of private diagnostic center chains, and rising awareness regarding the benefits of digital imaging management. Countries like China, India, and Japan are leading the adoption curve, where MIIS solutions are critical for managing the high volume of patients and enabling teleradiology services to reach remote populations efficiently.

- Latin America (Increasing Digitalization Efforts): The market in Latin America is maturing, marked by increasing government initiatives aimed at modernizing public health services and expanding internet connectivity. While currently smaller, the region presents substantial opportunity for cloud-based MIIS solutions that offer scalability and lower operational costs, particularly in rapidly urbanizing centers in Brazil and Mexico.

- Middle East and Africa (MEA) (Focused Infrastructure Investment): The MEA region, specifically the Gulf Cooperation Council (GCC) countries, shows steady growth driven by substantial government investments in building world-class medical cities and healthcare facilities. Adoption is concentrated in technologically advanced cities (e.g., Dubai, Riyadh) that are actively procuring large, integrated MIIS solutions to support high-quality specialized care, often favoring enterprise imaging systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Imaging Information Systems Market.- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Agfa-Gevaert

- Fujifilm Holdings Corporation

- McKesson Corporation

- Change Healthcare (acquired by Optum)

- Cerner Corporation (acquired by Oracle)

- Sectra AB

- Mach7 Technologies

- Hyland Software (including Lexmark Healthcare)

- Intelerad Medical Systems

- Konica Minolta

- Novarad Corporation

- RamSoft

- Visage Imaging (a subsidiary of Pro Medicus)

- Dedalus Group

- Infinitt Healthcare

- Epic Systems Corporation

- Merge Healthcare (acquired by IBM Watson Health)

Frequently Asked Questions

Analyze common user questions about the Medical Imaging Information Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between PACS, RIS, and VNA?

PACS (Picture Archiving and Communication System) manages the storage and display of medical images. RIS (Radiology Information System) manages workflow, scheduling, and billing within the radiology department. VNA (Vendor Neutral Archive) acts as a centralized, format-agnostic repository for all clinical data across the enterprise, offering greater longevity and interoperability than traditional, departmental PACS archives.

How does cloud computing affect the adoption rate of Medical Imaging Information Systems?

Cloud computing significantly accelerates adoption by reducing high upfront infrastructure costs and maintenance burden associated with on-premise MIIS. Cloud-based solutions offer superior scalability, enhanced data accessibility for teleradiology, and robust disaster recovery mechanisms, making advanced imaging management solutions feasible for smaller and remote healthcare facilities.

What major regulatory standards must Medical Imaging Information Systems adhere to?

MIIS must adhere primarily to DICOM (for image standardization and communication) and HL7 (for clinical and administrative data exchange). Regionally, they must comply with data privacy and security regulations, such as HIPAA in the United States, GDPR in Europe, and similar national data protection frameworks governing sensitive patient information.

What is Enterprise Imaging, and why is it important for healthcare providers?

Enterprise Imaging is a comprehensive strategy for managing all clinical content (including images, videos, and documents from all departments like cardiology and pathology, not just radiology) across a healthcare system using a unified platform, often anchored by a VNA. It is critical for breaking down departmental data silos, improving physician access to complete patient records, and supporting system-wide clinical efficiency.

How is Artificial Intelligence (AI) being integrated into PACS solutions?

AI is integrated into PACS to automate tasks like image prioritization (triage), quantitative image analysis, and quality assurance. These AI modules assist radiologists by performing initial screenings, identifying subtle pathology, and optimizing workflow efficiency, transforming the PACS from a passive archive into an intelligent diagnostic assistant.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager