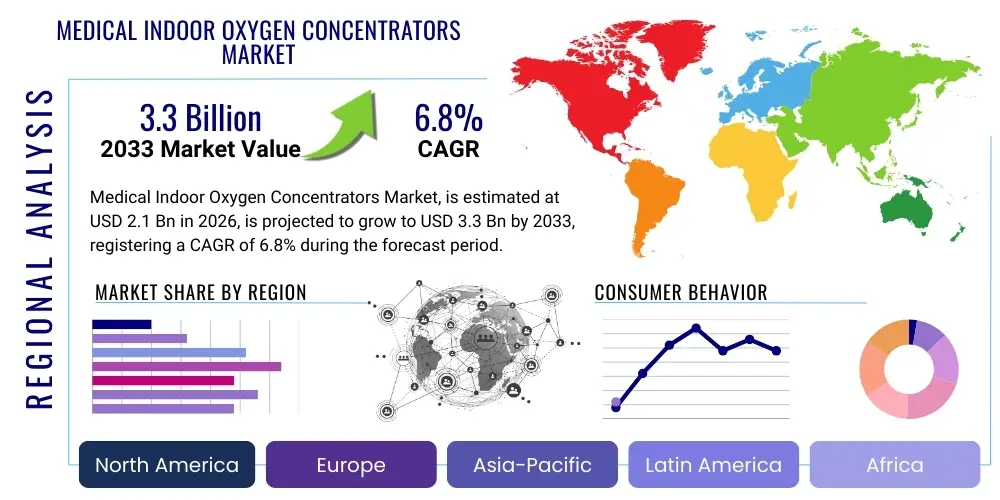

Medical Indoor Oxygen Concentrators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437125 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Medical Indoor Oxygen Concentrators Market Size

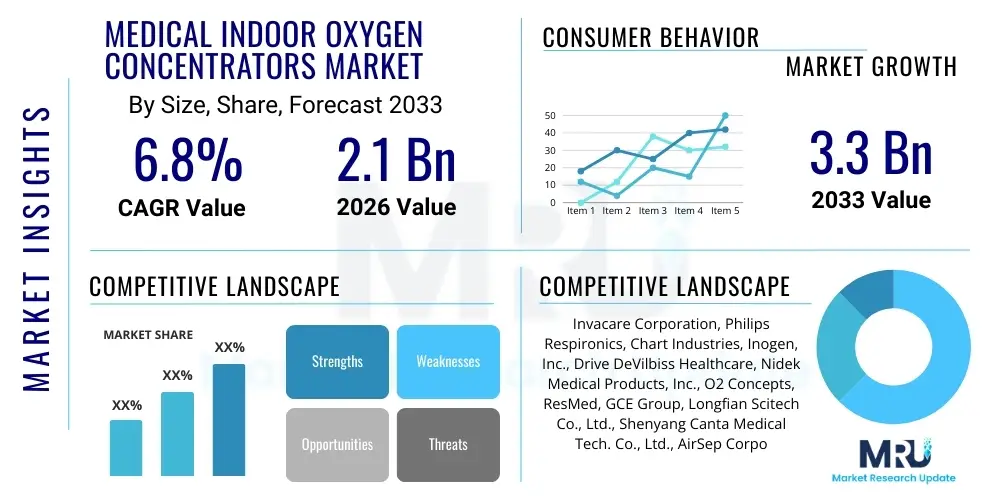

The Medical Indoor Oxygen Concentrators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033.

Medical Indoor Oxygen Concentrators Market introduction

The Medical Indoor Oxygen Concentrators Market encompasses devices designed to provide supplemental oxygen therapy to patients suffering from respiratory conditions such as Chronic Obstructive Pulmonary Disease (COPD), cystic fibrosis, sleep apnea, and heart failure. These stationary units filter nitrogen and other gases from ambient air, delivering high-purity oxygen (>90%) to the user via a nasal cannula or mask. The primary objective of these devices is to improve patient quality of life, reduce hospitalization rates, and manage chronic hypoxemia effectively within homecare settings or institutional environments. Advancements in molecular sieve technology and noise reduction capabilities have significantly improved the user experience, driving widespread adoption.

Product descriptions typically involve continuous flow oxygen delivery, ranging from 1 to 10 liters per minute (LPM), prioritizing reliability and energy efficiency since they often operate 24/7. Major applications are predominantly centered in home respiratory care, reflecting the global trend toward reducing healthcare costs by transitioning chronic care management from hospitals to domestic environments. These concentrators serve as a crucial component of long-term oxygen therapy (LTOT), which is medically necessary for patients whose arterial oxygen partial pressure falls below specified thresholds.

The core benefits include uninterrupted oxygen supply without the logistical complexities or refill requirements associated with traditional oxygen cylinders or liquid oxygen systems, offering enhanced safety and independence for patients. Driving factors for market expansion include the rapidly aging global population, which exhibits higher prevalence rates of debilitating respiratory disorders, coupled with increasing governmental and private insurance coverage for home oxygen therapy equipment. Furthermore, rising air pollution levels in industrialized nations contribute indirectly to the worsening of chronic lung diseases, thereby increasing the patient pool requiring concentrated oxygen solutions.

Medical Indoor Oxygen Concentrators Market Executive Summary

The Medical Indoor Oxygen Concentrators Market exhibits robust growth propelled by favorable business trends focused on miniaturization, enhanced energy efficiency, and integration of smart monitoring features for remote patient management (RPM). Manufacturers are strategically investing in optimizing Pressure Swing Adsorption (PSA) technology to improve oxygen output purity and reduce the noise profile, addressing key concerns of long-term users. Furthermore, shifts in reimbursement policies across major economies, particularly the United States and Western Europe, increasingly favor the rental and long-term lease of oxygen concentrators over outright purchases, creating stable recurring revenue streams for Durable Medical Equipment (DME) providers and manufacturers. This trend encourages innovation geared towards device durability and lower maintenance requirements, positioning technological sophistication as a critical competitive differentiator in this highly regulated medical device space.

Regional trends indicate that North America currently dominates the market, driven by high prevalence of COPD, well-established healthcare infrastructure, and favorable reimbursement structures. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion in APAC is fueled by improving healthcare access, rising awareness of respiratory care management, and significant investments in expanding home healthcare services in populous countries like China and India. European markets maintain stable growth, emphasizing regulatory compliance and the adoption of advanced, integrated devices capable of data logging and telemedicine capabilities, aligning with stringent European Union medical device regulations (MDR).

Segment trends highlight the dominance of continuous flow concentrators, particularly those offering flow rates suitable for severe respiratory impairment, although modular designs offering flexibility in flow settings are gaining traction. In terms of end-use, the homecare setting segment remains the largest and fastest-growing category, reflecting the broader paradigm shift toward decentralized healthcare delivery. Key market strategies revolve around strategic partnerships between device manufacturers and large homecare providers to secure exclusive distribution channels, ensuring widespread market penetration and streamlined supply chain logistics for ongoing maintenance and patient support.

AI Impact Analysis on Medical Indoor Oxygen Concentrators Market

User questions regarding AI's impact on the Medical Indoor Oxygen Concentrators Market primarily focus on how Artificial Intelligence can optimize device performance, enhance patient safety, and streamline oxygen prescription processes. Common concerns revolve around predictive maintenance schedules—whether AI algorithms can forecast component failure (e.g., molecular sieve degradation) before it impacts oxygen purity—and the potential for personalized oxygen delivery, adapting flow rates automatically based on real-time physiological data (like pulse oximetry readings collected wirelessly). Users are keenly interested in AI’s role in diagnostic support, specifically integrating oxygen saturation data with patient medical history to provide early alerts for exacerbations of conditions like COPD, thereby reducing emergency room visits. Furthermore, logistical inquiries frequently touch upon how AI can optimize the inventory and deployment of concentrators across vast geographic areas for DME providers, improving efficiency in device rental fleets.

The integration of AI is transforming indoor oxygen concentrators from simple mechanical devices into intelligent therapeutic systems. Machine learning algorithms are crucial for analyzing vast datasets generated by connected devices (IoT integration), allowing for sophisticated monitoring of device operational parameters, including power consumption, internal temperatures, and molecular sieve efficiency. This advanced monitoring translates directly into higher uptime and enhanced reliability, which are paramount for life-sustaining equipment. For manufacturers, AI-driven simulations and optimization tools are accelerating the design phase, leading to lighter, quieter, and more energy-efficient models, addressing consumer demands for less intrusive healthcare technology within the home environment.

Beyond hardware optimization, AI plays a pivotal role in patient care coordination. Predictive analytics models are being developed to identify patients at high risk of acute respiratory events based on variations in their oxygen usage patterns and ambient environmental data. This proactive approach allows healthcare providers to intervene before a crisis occurs, significantly enhancing the efficacy of long-term oxygen therapy. Regulatory bodies are also paying attention, leading to ongoing standardization efforts regarding data security and the validation protocols for AI-driven clinical decision support systems integrated into these medical devices, ensuring clinical accuracy and patient data privacy.

- AI-driven predictive maintenance scheduling reduces device downtime and ensures optimal oxygen purity.

- Machine learning algorithms enable personalized, adaptive oxygen flow rates based on real-time patient physiological feedback.

- IoT integration combined with AI facilitates sophisticated remote monitoring and compliance tracking by healthcare providers.

- Natural Language Processing (NLP) is used in patient support systems to analyze user feedback and troubleshoot device issues remotely.

- AI optimizes supply chain and inventory management for DME providers, enhancing logistical efficiency in device distribution.

- Advanced data analytics aids in identifying early signs of respiratory exacerbations, enabling timely clinical intervention.

DRO & Impact Forces Of Medical Indoor Oxygen Concentrators Market

The dynamics of the Medical Indoor Oxygen Concentrators Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that influence investment decisions and market penetration globally. The primary market driver is the undeniable demographic shift toward an older population worldwide, coupled with the escalating global burden of chronic respiratory diseases, notably COPD, which requires continuous oxygen supplementation. Alongside this, favorable healthcare policies, particularly in developed nations, that promote homecare settings as a cost-effective alternative to prolonged hospital stays significantly boost the demand for reliable indoor concentrators. Restraints primarily involve the relatively high initial cost of advanced units, which can pose financial hurdles for patients in developing economies, and intense competition from refurbished or low-cost imported units that may not meet stringent quality standards. Furthermore, the inherent technological limitation of continuous noise generation, despite significant improvements, remains a psychological barrier for some users.

Opportunities for market expansion are abundant, particularly through technological leapfrogging in emerging markets where infrastructure for traditional liquid oxygen systems is inadequate, making electric oxygen concentrators a far more viable solution. The rise of telemedicine and integrated healthcare platforms creates a substantial opportunity for manufacturers to embed connectivity features, offering value-added services such as remote diagnostic checks, compliance tracking, and automated inventory management. Moreover, the focus on developing non-invasive ventilation support systems that integrate seamless oxygen concentration capabilities presents a significant product diversification avenue, addressing the needs of patients requiring dual therapeutic approaches.

Impact forces affecting the market include stringent regulatory approval processes (e.g., FDA clearance, CE Marking), which require extensive clinical validation and restrict rapid product iteration, thereby influencing time-to-market. Economic recessions or shifts in government healthcare spending can directly affect reimbursement rates for DME, altering the profitability landscape for providers. Sociocultural factors, such as increased public awareness regarding respiratory health and environmental factors like heightened air quality concerns, indirectly increase the diagnosis rate and subsequent patient uptake of long-term oxygen therapy. These forces necessitate a resilient business model focused on quality, regulatory compliance, and strategic pricing to navigate the fluctuating global healthcare economy effectively.

Segmentation Analysis

The Medical Indoor Oxygen Concentrators Market is meticulously segmented based on product type, technology, application, and end-use, allowing for precise market analysis and targeted strategic planning. Understanding these segments is crucial for manufacturers to tailor their R&D efforts and marketing strategies to specific patient needs and healthcare environments. The segmentation by product type, distinguishing between continuous flow and pulse dose (though indoor units are predominantly continuous flow but often feature continuous/pulse modes), reflects the varied clinical requirements of patients, dependent on the severity and type of respiratory impairment. The technological segmentation, primarily focusing on Pressure Swing Adsorption (PSA), underscores the reliance of the industry on molecular sieve efficiency and air processing capability, driving innovation in component material science and design.

Segmentation by application clarifies the primary usage contexts, highlighting the dominance of the homecare setting segment, which represents the largest volume market due to the nature of chronic respiratory conditions requiring long-term management outside of institutional care. Hospitals and specialized respiratory clinics, while lower in volume, demand higher performance and durability, typically utilizing industrial-grade concentrators for ward use and emergency backup. End-use segmentation, covering adults and pediatrics, reveals specific design constraints, as pediatric units require precise, low-flow capabilities and enhanced safety features compliant with younger patient specifications, representing a high-value niche market focused on clinical accuracy and user-friendly interfaces for caregivers.

These segmentations collectively inform strategic investment decisions. For instance, players targeting the lucrative homecare segment must prioritize ease of use, low maintenance, quiet operation, and energy efficiency to meet consumer expectations and reduce operating costs for DME providers. Conversely, companies focusing on the institutional market emphasize robust construction, high flow rate capacity (e.g., 10 LPM+ units), and compatibility with hospital IT infrastructure for data logging and remote diagnostics. The ongoing trend is toward technological convergence, where newer models offer flexible operation profiles that can effectively serve both high-demand institutional settings and continuous 24/7 home environments.

- Product Type

- Continuous Flow Oxygen Concentrators

- High-Flow Oxygen Concentrators (10 LPM and above)

- Dual Mode Concentrators (Fixed Indoor/Portable Capable Units)

- Technology

- Pressure Swing Adsorption (PSA)

- Membrane Separation (Niche Applications)

- Application

- Homecare Settings

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Long-Term Care Facilities (LTCFs)

- End-Use

- Adult Patients

- Pediatric Patients

Value Chain Analysis For Medical Indoor Oxygen Concentrators Market

The value chain for Medical Indoor Oxygen Concentrators begins with upstream analysis, focusing on the sourcing and manufacturing of critical raw materials and components. Key inputs include molecular sieve material (zeolites, essential for nitrogen absorption), compressors (the core engine of the device, requiring high reliability), specialized plastics for housing, and electronic components for control boards and sensors. The quality and cost of molecular sieves and high-performance, quiet compressors are pivotal determinants of overall product efficiency and manufacturing costs. Suppliers in this upstream segment often specialize in niche industrial gases or high-precision mechanical engineering, requiring strong, long-term relationships with concentrator manufacturers to ensure component quality and consistent supply, particularly amidst global supply chain volatility affecting specialized electronic parts.

The middle segment involves the core manufacturing, assembly, quality control, and testing processes. Manufacturers undertake significant R&D investment to optimize the PSA cycle, reduce power consumption, minimize noise, and integrate digital monitoring capabilities. After manufacturing, the products enter the distribution channel, which is highly specialized. Direct sales are common for large institutional buyers (hospitals), while the predominant channel for homecare devices involves DME providers. DME companies act as intermediaries, handling inventory, patient setup, education, ongoing maintenance, and insurance billing (rental model), making them critical gatekeepers in the market.

Downstream analysis focuses on the end-users—patients and healthcare facilities—and the provision of post-sale services. Indirect distribution, through DME providers, is the dominant model, necessitated by the complexity of insurance reimbursement and the requirement for technical support and maintenance of medical equipment within the patient's home. Direct distribution, although less common for home units, is utilized for high-volume sales to hospital networks or government tenders. Effective service provision, including rapid response to maintenance issues and regular filter changes, significantly impacts patient satisfaction and brand reputation, closing the loop on the value chain and reinforcing the importance of the DME partnership model.

Medical Indoor Oxygen Concentrators Market Potential Customers

The primary potential customers and end-users of Medical Indoor Oxygen Concentrators are individuals diagnosed with chronic respiratory failure who require long-term oxygen therapy (LTOT) at home. This demographic predominantly comprises the elderly population (65 years and older) suffering from advanced stages of Chronic Obstructive Pulmonary Disease (COPD), which includes chronic bronchitis and emphysema. Other significant patient groups include those with severe restrictive lung diseases, interstitial lung disease, cystic fibrosis, and advanced cardiac conditions leading to secondary respiratory compromise. These patients rely on continuous, reliable oxygen supply to maintain adequate blood oxygen levels, especially during rest and sleep, thereby preventing pulmonary hypertension and other severe complications.

Beyond the individual patients, the immediate buyers often include Durable Medical Equipment (DME) providers, who purchase or lease the concentrators in large volumes to manage their rental fleets. These DME providers serve as the commercial conduit between the manufacturer and the patient, driven by reimbursement schedules and the need for durable, low-maintenance equipment. Institutional buyers form another key customer segment, including public and private hospitals, specialized respiratory rehabilitation centers, and long-term care facilities (LTCFs). These institutions typically require robust, high-capacity units capable of continuous 24/7 operation in demanding clinical settings, often prioritizing features like remote monitoring and network compatibility for centralized management.

In certain geopolitical contexts, governmental health agencies and non-governmental organizations (NGOs) focused on public health initiatives also act as significant purchasers, particularly during public health emergencies or for deployment in regions with underdeveloped healthcare infrastructure. The buying decision across all segments is heavily influenced by factors such as device reliability, energy efficiency (critical for home use), noise level, ease of maintenance, and crucially, the established track record and availability of parts and service support. The trend toward purchasing devices with integrated IoT capabilities is strong among institutional and large DME buyers, seeking to leverage data for improved fleet management and patient outcomes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Invacare Corporation, Philips Respironics, Chart Industries, Inogen, Inc., Drive DeVilbiss Healthcare, Nidek Medical Products, Inc., O2 Concepts, ResMed, GCE Group, Longfian Scitech Co., Ltd., Shenyang Canta Medical Tech. Co., Ltd., AirSep Corporation (Caire Inc.), Precision Medical, Inc., Yuwell, Medtronic, SeQual (A Caire Inc. company), Devilbiss Healthcare LLC, Besco Medical Co., Ltd., Foshan Kaiya Medical Equipment Co., Ltd., Owgels. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Indoor Oxygen Concentrators Market Key Technology Landscape

The technological core of the Medical Indoor Oxygen Concentrators Market is the Pressure Swing Adsorption (PSA) process, which leverages the selective adsorption properties of molecular sieve materials, primarily zeolites, to separate nitrogen from ambient air, leaving a highly concentrated stream of oxygen. Recent technological advancements in PSA are centered on optimizing the cycle timing, column design, and adsorption pressure to enhance oxygen concentration levels (maintaining >90% purity) while simultaneously reducing the device's footprint and energy consumption. Modern high-efficiency compressors are integral to this optimization, requiring less power to achieve the necessary pressure cycles, directly addressing the key consumer need for lower electricity bills during continuous operation.

Another significant technological focus is noise reduction and acoustic engineering. Stationary oxygen concentrators, by nature of their continuous mechanical operation, generate noise which can severely impact patient sleep quality and overall compliance. Manufacturers are deploying advanced dampening materials, sophisticated air flow pathways, and magnetic bearing compressors to reduce operational noise to levels below 40 decibels (dBA), making the devices less intrusive in quiet home environments. Furthermore, there is a growing incorporation of diagnostic technologies, utilizing internal sensors to monitor component degradation, particularly the molecular sieve health, providing preemptive alerts to both the user and the service provider, enhancing reliability and reducing unexpected failure rates.

The integration of connectivity and smart features represents the frontier of technological development. Devices increasingly feature embedded wireless modules (Wi-Fi or Bluetooth) to transmit operational and usage data to cloud platforms, enabling remote monitoring by DME providers and physicians. This connectivity facilitates compliance tracking, alerts for low oxygen purity, and software updates. Although Membrane Separation technology exists, offering simpler operation, PSA remains dominant due to its superior oxygen purity output required for long-term medical therapy. Future technological shifts will likely concentrate on solid-state oxygen concentration methods, although these remain largely in the research and development phase and are not yet commercially viable for indoor medical use.

Regional Highlights

North America, spearheaded by the United States, commands the largest share of the Medical Indoor Oxygen Concentrators Market. This dominance is attributed to several factors: a high prevalence rate of COPD and other age-related respiratory diseases, sophisticated healthcare infrastructure, and highly favorable reimbursement policies, especially Medicare coverage for long-term oxygen therapy (LTOT). The region boasts a well-organized network of DME providers and a strong presence of key market players who drive technological innovation and rapid market uptake of advanced, connected devices. Stringent regulatory standards set by the FDA ensure high quality and reliability, fostering consumer trust, although they also contribute to the relatively higher average price points of the devices sold here.

Europe represents a mature market characterized by stable growth, driven by universal healthcare systems and a significant aging population, particularly in Western European nations like Germany, the UK, and France. Regulatory adherence to the EU Medical Device Regulation (MDR) ensures product safety and performance. European demand leans heavily toward energy-efficient and low-noise concentrators due to dense residential living and high energy costs. The market is segmented, with national health services dictating purchasing volumes and often favoring cost-effective, yet reliable, devices for widespread distribution through regional DME partners.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is driven by massive population size, improving access to healthcare services, and increasing disposable income leading to higher demand for advanced medical equipment. While per capita usage remains lower than in North America, the sheer volume of undiagnosed and untreated respiratory patients, particularly in emerging economies like India and China, presents immense untapped potential. Governments in APAC are increasingly prioritizing chronic disease management and promoting homecare, creating a fertile environment for market entry, despite challenges related to varied reimbursement policies and infrastructure gaps, particularly in remote areas.

- North America: Market leader; driven by high COPD prevalence, established reimbursement frameworks (Medicare), and focus on technologically advanced, connected devices.

- Europe: Stable, mature market; characterized by stringent MDR compliance, focus on low noise and high energy efficiency, supported by national health systems procurement.

- Asia Pacific (APAC): Fastest-growing region; fueled by population size, improving healthcare infrastructure, rising air pollution, and increasing government investments in home healthcare infrastructure (especially China and India).

- Latin America (LATAM): Developing market; growth constrained by limited reimbursement and healthcare expenditure, but opportunities exist in private healthcare sectors in Brazil and Mexico.

- Middle East and Africa (MEA): Nascent market; concentrated demand in high-income Gulf Cooperation Council (GCC) countries, driven by modern hospital infrastructure and medical tourism; significant untapped need in Africa, constrained by economic factors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Indoor Oxygen Concentrators Market.- Invacare Corporation

- Philips Respironics

- Chart Industries

- Inogen, Inc.

- Drive DeVilbiss Healthcare

- Nidek Medical Products, Inc.

- O2 Concepts

- ResMed

- GCE Group

- Longfian Scitech Co., Ltd.

- Shenyang Canta Medical Tech. Co., Ltd.

- AirSep Corporation (Caire Inc.)

- Precision Medical, Inc.

- Yuwell

- Medtronic

- SeQual (A Caire Inc. company)

- Devilbiss Healthcare LLC

- Besco Medical Co., Ltd.

- Foshan Kaiya Medical Equipment Co., Ltd.

- Owgels

Frequently Asked Questions

Analyze common user questions about the Medical Indoor Oxygen Concentrators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology used in Medical Indoor Oxygen Concentrators?

The primary technology is Pressure Swing Adsorption (PSA), which uses specialized molecular sieves (zeolites) to filter nitrogen from ambient air, delivering high-purity concentrated oxygen (typically 90-96%) to the patient.

How does the increasing prevalence of COPD drive market growth?

Chronic Obstructive Pulmonary Disease (COPD) is the leading cause requiring Long-Term Oxygen Therapy (LTOT). As the global geriatric population grows and exposure to environmental pollutants increases, the prevalence of COPD rises, directly expanding the patient pool dependent on indoor oxygen concentrators.

What is the key advantage of using a concentrator over traditional oxygen tanks?

The key advantage is continuous, uninterrupted oxygen supply without the need for cylinder refills or exchanges, offering greater convenience, enhanced safety, and lower logistical costs for patients managing chronic conditions at home.

Which geographical region holds the largest market share for these devices?

North America currently holds the largest market share, driven by a high volume of COPD cases, advanced healthcare infrastructure, and well-established, favorable governmental reimbursement policies for Durable Medical Equipment (DME), including oxygen concentrators.

How are manufacturers addressing concerns regarding device noise levels?

Manufacturers are heavily investing in acoustic engineering, utilizing advanced sound dampening materials, and developing magnetic bearing or high-efficiency rotary compressors to minimize operational noise, aiming for levels below 40 dBA to improve patient compliance and quality of life.

What is the role of Durable Medical Equipment (DME) providers in this market?

DME providers are critical intermediaries who manage the rental fleets, handle complex insurance billing and reimbursement, provide patient education on device usage, and ensure essential maintenance and technical support for concentrators deployed in homecare settings.

Are connected or 'smart' oxygen concentrators becoming standardized?

Yes, there is a strong trend towards integration of IoT capabilities, making smart concentrators increasingly standard. These devices transmit real-time data on performance and patient usage to healthcare providers, facilitating remote monitoring, compliance tracking, and predictive maintenance.

What segment of application is experiencing the fastest growth?

The Homecare Settings application segment is experiencing the fastest growth, primarily due to global shifts in healthcare policy promoting decentralized care, aiming to reduce expensive and unnecessary hospitalizations for chronic respiratory management.

What is the potential impact of AI on device efficiency?

AI is used for predictive maintenance, analyzing operational data to forecast component failure (e.g., molecular sieve depletion) before it affects oxygen purity. This optimizes device performance, extends lifespan, and minimizes unexpected downtime, enhancing overall therapeutic reliability.

What are the key differences between adult and pediatric indoor concentrators?

Pediatric indoor concentrators require significantly more precise, low-flow capabilities (often less than 1 LPM) to ensure accurate dosage for infants and children. They also must incorporate enhanced safety features and often simpler interfaces for caregiver use compared to standard adult units.

Which market restraint is most challenging for expansion in emerging economies?

The high initial cost of purchasing advanced, certified indoor oxygen concentrators presents the most challenging restraint in emerging economies, often compounded by limited public health insurance coverage and underdeveloped technical support infrastructure for long-term maintenance.

How do global regulatory standards influence the market?

Strict global regulatory standards (like FDA and EU MDR) ensure device safety and clinical efficacy but impose rigorous testing and documentation requirements, which lengthen the product development cycle and raise the barriers to entry for new manufacturers.

What is the expected CAGR for the Medical Indoor Oxygen Concentrators Market between 2026 and 2033?

The Medical Indoor Oxygen Concentrators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven by chronic disease prevalence and homecare adoption.

What are the primary components sourced in the upstream segment of the value chain?

The primary components sourced upstream include molecular sieve materials (zeolites), high-efficiency compressors, precision electronic control boards, and specialized durable plastics used for the outer casing and internal airflow systems.

Why is energy efficiency a crucial design factor for indoor concentrators?

Energy efficiency is crucial because many patients require their concentrators to run continuously (24/7) for years. Reducing power consumption directly translates to lower operational costs for the patient or the healthcare system, significantly influencing purchasing decisions and patient affordability.

How does reimbursement affect the choice of technology?

Reimbursement policies often dictate the flow capacity and feature requirements deemed medically necessary. Stable reimbursement encourages manufacturers to invest in higher-quality, more feature-rich PSA technology, whereas uncertain reimbursement drives a focus on basic, reliable, and cost-optimized continuous flow models.

What emerging technology might disrupt the PSA market in the long term?

While nascent, solid-state oxygen concentration technology and other advanced separation methods are being researched. If they can achieve comparable purity and flow rates at competitive costs, they could potentially disrupt the current PSA dominance by eliminating moving parts and further reducing noise.

What is the distinction between Fixed Flow and High-Flow segmentations?

Fixed Flow concentrators typically provide standard flows (up to 5 LPM), sufficient for moderate conditions. High-Flow units provide greater output (10 LPM or more), necessary for patients with severe respiratory impairment or those requiring supplementary non-invasive ventilation support in institutional or high-acuity home settings.

How do air quality issues indirectly affect the concentrator market?

Poor air quality and high levels of environmental pollutants exacerbate existing chronic lung conditions like COPD and asthma, leading to faster disease progression and a higher incidence of respiratory failure, thus increasing the clinical necessity and demand for concentrated oxygen therapy.

What is the forecasted market size of the Medical Indoor Oxygen Concentrators Market by 2033?

The market size is projected to reach approximately USD 3.3 Billion by the end of the forecast period in 2033, reflecting steady growth driven by demographic factors and technological advancements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager