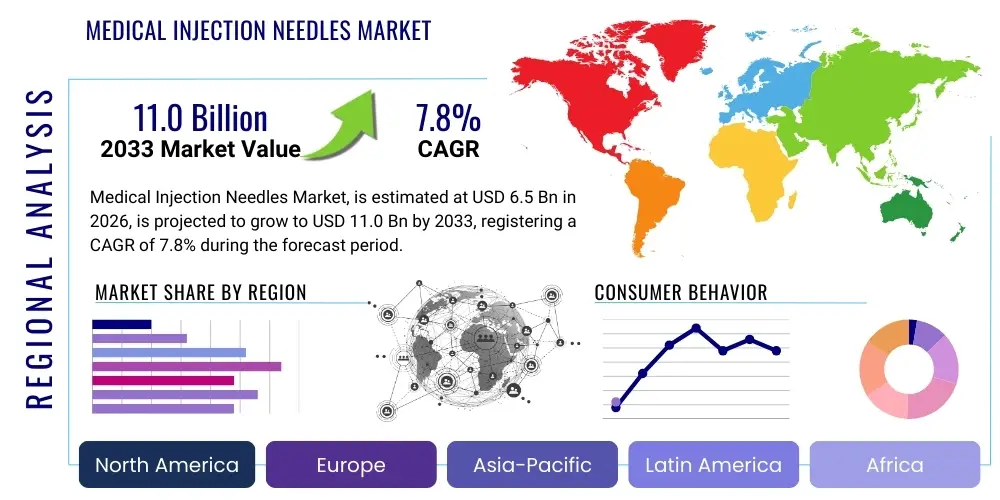

Medical Injection Needles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437636 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Medical Injection Needles Market Size

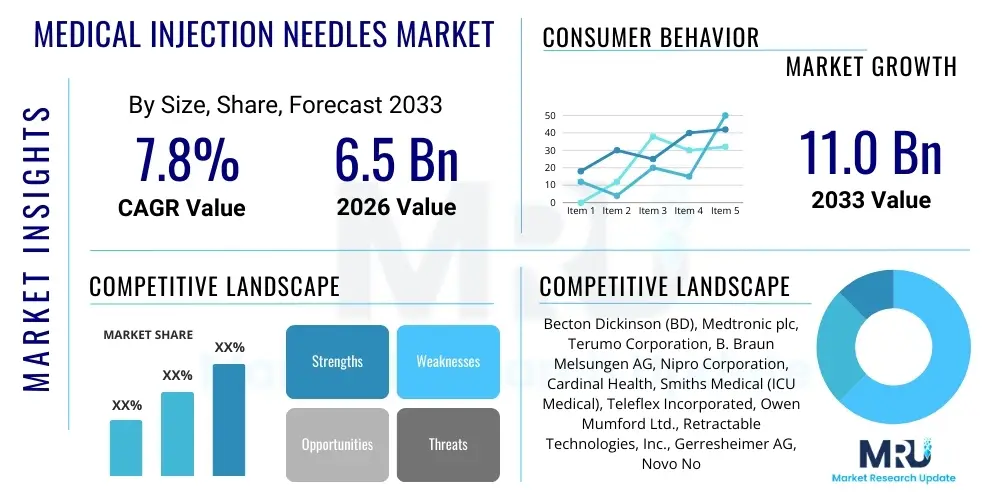

The Medical Injection Needles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global prevalence of chronic diseases, such as diabetes and cardiovascular disorders, which necessitates frequent injectable drug administration and advanced specimen collection methodologies. The persistent focus on enhancing patient safety and reducing needlestick injuries further propels the adoption of safety-engineered devices, contributing significantly to market valuation growth across key therapeutic areas.

Medical Injection Needles Market introduction

The Medical Injection Needles Market encompasses a wide range of disposable devices essential for therapeutic delivery, prophylactic vaccination, and diagnostic specimen collection. These critical tools are primarily utilized in healthcare settings for administering pharmaceutical agents, including insulin, biologics, and standard vaccinations, either intravenously, intramuscularly, or subcutaneously. Modern injection needles are characterized by highly refined components, optimized sharpness, and increasingly sophisticated safety mechanisms designed to mitigate risks associated with penetration and post-use disposal. Key products include hypodermic needles, dental needles, specialty biopsy needles, and high-volume blood collection systems, each engineered for specific clinical applications demanding precision and sterility.

Major applications of injection needles span acute care, chronic disease management, surgical procedures, and diagnostic testing. The inherent benefits of these devices center on accurate dosing, rapid drug absorption, and minimally invasive delivery methods. Advances in needle technology, specifically the integration of thin-wall technology and specialized anti-corrosive coatings, have significantly improved patient comfort and reduced procedural pain, thereby enhancing compliance rates for long-term treatments. Furthermore, the robust global vaccination campaigns, particularly those targeting emerging infectious diseases, represent a major and consistent driver of volume growth for both standard and specialized needle products across developed and developing economies.

Driving factors sustaining market momentum include the rapidly aging global population, which experiences a higher burden of injectable-dependent chronic conditions, and continuous technological innovation focusing on retractable and shielded needles to comply with stringent occupational safety regulations. The increasing sophistication of self-administration systems, such as insulin pens and autoinjectors, relies heavily on high-quality, pre-attached needle units, expanding the market scope beyond traditional manual injection systems. Regulatory emphasis on standardized disposable medical supplies and stringent infection control protocols worldwide further solidifies the essential nature and persistent demand for technologically advanced injection needles.

Medical Injection Needles Market Executive Summary

The Medical Injection Needles Market is poised for robust expansion, fueled predominantly by the global demographic shift toward an older population requiring frequent drug injections and the escalating incidence of chronic diseases like diabetes, demanding daily self-injection routines. Business trends highlight a strong industry shift toward safety-engineered products, driven by mandatory safety regulations in North America and Europe aimed at reducing healthcare worker needlestick injuries (NSIs). Leading manufacturers are focusing heavily on mergers and acquisitions and strategic partnerships to expand their geographical footprint, especially in high-growth Asia Pacific markets, and to integrate advanced features such as passive safety mechanisms into standard product lines. Furthermore, the supply chain is witnessing greater digitization and emphasis on maintaining sterility and tracking compliance throughout the distribution network, ensuring product integrity until the point of use.

Regionally, North America maintains its dominance, primarily due to established healthcare infrastructure, high patient awareness regarding advanced treatment protocols, and the early adoption of premium safety needles and autoinjector devices. However, the Asia Pacific region is projected to register the fastest CAGR, driven by massive investments in healthcare infrastructure development, increasing disposable income leading to better access to medical treatment, and the expanding patient pool requiring vaccination and diabetes care. European growth remains stable, characterized by strict regulatory frameworks mandating high safety standards and government procurement programs focusing on standardized, cost-effective disposable medical supplies. Manufacturers are increasingly tailoring regional strategies to navigate diverse regulatory landscapes and varying price sensitivities across different geographic markets.

Segmentation trends reveal that the Safety Needles segment is rapidly outpacing conventional counterparts, driven by strict regulatory mandates and improved patient outcomes associated with reduced risk of contamination. Within the end-use segment, hospitals and clinics remain the primary consumers, but the home healthcare settings segment is experiencing accelerated growth, largely attributable to the rising trend of patient self-administration for conditions like multiple sclerosis, rheumatoid arthritis, and diabetes. Product-wise, hypodermic needles and blood collection needles maintain the largest market shares due to their ubiquitous use in routine medical procedures, while specialty needles used in complex procedures like spinal taps and biopsies command higher average selling prices, contributing significantly to revenue growth despite lower volume. The market overall demonstrates resilience, being indispensable to nearly all facets of modern medical care.

AI Impact Analysis on Medical Injection Needles Market

User inquiries regarding AI's influence on the Medical Injection Needles Market frequently center on the potential for AI-driven manufacturing optimization, predictive inventory management, and the role of intelligent systems in improving injection accuracy and reducing procedural errors. Common concerns include whether AI-guided robotic systems might eventually replace human administration entirely, the implementation cost of integrating AI into high-volume manufacturing lines, and the use of machine learning to analyze clinical data to design better needle geometries for enhanced patient comfort and specific drug delivery kinetics. Users are keenly interested in how AI can streamline the supply chain, predict demand surges (like pandemic-related vaccination needs), and ensure the integrity and traceability of sterile products from factory floor to patient bedside. The central theme revolves around leveraging AI not to replace the needle itself, but to optimize the processes surrounding its production, distribution, and utilization.

The deployment of Artificial Intelligence is currently focused on enhancing the back-end efficiency of the injection needle industry, primarily targeting manufacturing processes and supply chain robustness. AI algorithms are being used to analyze complex sensor data from molding and assembly lines, identifying micro-defects invisible to human inspectors, thereby ensuring higher quality control and reducing waste rates. Predictive maintenance, another critical application, uses machine learning models to forecast equipment failures in high-precision machinery, minimizing downtime and ensuring the consistency required for producing ultra-fine gauge needles. This optimization is crucial in maintaining cost efficiency while simultaneously meeting stringent global quality standards demanded by regulatory bodies.

Furthermore, AI plays an emerging role in clinical settings related to injection procedures, although less directly affecting the needle manufacturing itself. AI-powered imaging systems, often integrated into robotic or handheld devices, assist clinicians in identifying optimal injection sites, particularly for complex intravenous access or biopsy procedures, enhancing accuracy and reducing repeat attempts. Machine learning is also pivotal in epidemiological surveillance, allowing manufacturers to rapidly adjust production volumes and distribution channels in response to predicted outbreaks or large-scale vaccination programs, ensuring timely availability of needles where they are most needed globally. This integration of intelligent demand forecasting is crucial for mitigating potential supply chain disruptions.

- AI optimizes manufacturing yield by identifying microscopic defects and ensuring consistent tip sharpness.

- Machine learning models predict global demand fluctuations, optimizing inventory and supply chain logistics for large-scale vaccination campaigns.

- AI-powered visual recognition systems assist in quality control for sterile packaging and assembly accuracy.

- Predictive analytics enables maintenance scheduling for high-precision tooling, reducing production line downtime.

- AI guidance systems enhance clinical precision for difficult injection or vascular access procedures, reducing procedural risks.

DRO & Impact Forces Of Medical Injection Needles Market

The dynamics of the Medical Injection Needles Market are shaped by powerful Drivers, inherent Restraints, and significant Opportunities that collectively determine the industry's trajectory and profitability. Key drivers include the overwhelming global demand stemming from chronic disease management and the resultant need for frequent injections, coupled with strict governmental regulations mandating the use of safety-engineered devices. Restraints largely center on the persistent risk of accidental needlestick injuries and associated disposal concerns, alongside intense pricing pressure in highly commoditized segments due to competition from low-cost manufacturers. Opportunities arise primarily from advancements in material science, leading to the development of micro-needles and pain-mitigating coatings, as well as the exponential expansion of the home healthcare sector and the use of advanced biologics requiring specialized delivery systems. These forces interact to push the market toward higher safety standards and greater technological sophistication.

The primary driving force is the global surge in chronic diseases, notably diabetes, which necessitates billions of insulin injections annually. This massive volume requirement provides a foundational demand base that is highly resistant to economic downturns. Additionally, regulatory bodies like OSHA in the U.S. and equivalent European agencies have instituted policies aggressively promoting or mandating safety needles, which often command a premium price and drive manufacturers toward continuous innovation in passive and active safety mechanisms. The ongoing expansion of global immunization programs, targeting everything from pediatric diseases to seasonal influenza and pandemic prevention, provides guaranteed, high-volume orders for standard injection needles, solidifying the market's stability and consistent growth trajectory across all regions.

Conversely, significant restraints hinder optimal market growth and profitability. The cost of raw materials, primarily medical-grade stainless steel and specialized plastics, is subject to volatile commodity markets, impacting manufacturing margins. Furthermore, intense competition, especially in the basic hypodermic needle segment, leads to aggressive pricing strategies, making differentiation difficult outside of highly specialized niches. Another major challenge involves the ethical and practical disposal of used sharps, which requires complex, regulated waste management systems. If safety mechanisms fail or are improperly used, needlestick injuries remain a risk, leading to legal and financial liabilities that impose significant operational costs on healthcare providers and subsequently influence product selection toward highly reliable, yet often more expensive, safety devices.

- Drivers: Rising prevalence of diabetes and other chronic conditions requiring self-injection; mandatory adoption of safety injection devices enforced by regulatory bodies; increasing global vaccination efforts; expansion of home healthcare and self-administration practices.

- Restraints: Volatile raw material pricing and intense competition leading to pricing pressures; high operational costs associated with safe sharps disposal; lingering risk of needlestick injuries despite technological advances; complex regulatory clearance processes for novel specialty needles.

- Opportunities: Development of ultra-fine gauge and micro-needle technology for reduced pain; expansion into emerging markets (APAC, LATAM) with rapidly improving healthcare infrastructure; integration of smart features (e.g., dose tracking, connectivity) into injection systems; growing therapeutic use of high-viscosity biologics requiring specialized needle geometry.

- Impact Forces: Safety regulations drive higher product costs (Push Force); Chronic disease incidence creates stable, inelastic demand (Pull Force); Technological innovation raises entry barriers for non-specialized manufacturers (Competitive Force); Global supply chain fragility necessitates regional diversification of manufacturing (Environmental Force).

Segmentation Analysis

The Medical Injection Needles Market is segmented based on Type, Product, Material, Application, and End-Use, providing a granular view of market dynamics and adoption patterns across the healthcare continuum. The primary segmentation by Type distinguishes between standard conventional needles and advanced safety-engineered needles, with the latter rapidly gaining dominance due to global safety mandates. This shift underscores the industry's dedication to occupational safety and infection control. Product segmentation differentiates between high-volume items like hypodermic and blood collection needles and specialized instruments such as spinal, dental, and biopsy needles, reflecting the diverse clinical needs and corresponding price points within the market.

Segmentation by Application highlights the crucial role of needles in drug delivery (the largest segment, encompassing insulin and biologics administration) versus specimen collection (including diagnostic blood draws and biopsies). Material segmentation typically focuses on medical-grade stainless steel (the predominant material) and specialized plastic polymers used in needle hubs and safety features. The growing trend of using specialized coatings on stainless steel needles to reduce friction and minimize patient discomfort is also a significant factor within this category, influencing procurement decisions based on perceived quality and patient experience metrics.

The End-Use segmentation delineates consumption patterns, showing that hospitals and clinics account for the majority of volume due to the centralization of complex procedures and high patient turnover. However, the ambulatory surgical centers (ASCs) and, most notably, the home healthcare settings segments are exhibiting high growth rates. This accelerated growth in non-traditional settings is driven by favorable reimbursement policies, increased patient willingness for self-care, and the development of user-friendly self-injection systems, which necessitates a continuous supply of disposable, high-quality needles designed for layperson use. Understanding these segmented adoption trends is vital for manufacturers optimizing product portfolios and distribution channels.

- Type: Standard Needles, Safety Needles, Specialty Needles

- Product: Hypodermic Needles, Sutures Needles, Spinal Needles, Dental Needles, Blood Collection Needles, Biopsy Needles, Pen Needles

- Material: Stainless Steel, Plastic Polymers, Specialized Alloys and Coatings

- Application: Drug Delivery (Insulin, Biologics, Vaccines, Anesthesia), Specimen Collection (Blood, Biopsy), Diagnostic Procedures

- End-Use: Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Diagnostic Laboratories, Home Healthcare Settings, Physicians’ Offices

Value Chain Analysis For Medical Injection Needles Market

The value chain for the Medical Injection Needles Market is highly intricate, starting with upstream activities involving the sourcing and processing of specialized raw materials, primarily high-grade stainless steel tubing (cannula) and medical-grade plastics for hubs and safety shields. Upstream analysis focuses heavily on material purity, consistency, and cost management, as slight variations can impact the final needle quality and sharpness—a critical factor for patient comfort. Key suppliers are specialized steel processors who adhere to strict medical device standards. Manufacturers engage in complex, automated processes involving cannula grinding, tipping, washing, assembly of hub and safety components, and sterilization, where efficiency and waste reduction are paramount to profitability in this high-volume industry.

The downstream analysis focuses on the distribution and end-user consumption of the sterile product. Distribution channels are highly structured, often involving large national and international medical distributors (indirect channel) who manage inventory and logistics for a vast array of hospital systems, group purchasing organizations (GPOs), and retail pharmacies. Direct channels are typically reserved for large volume tenders or specialty products sold directly to pharmaceutical companies for inclusion in drug delivery systems (e.g., prefilled syringes or pen injectors). Effective downstream management requires robust inventory tracking, temperature control for specialized products, and compliance with national and regional import/export regulations, ensuring product integrity remains uncompromised until point of use.

The channel structure is dominated by indirect sales through GPOs and major distributors like Cardinal Health, McKesson, and Owens & Minor, especially in North America and Europe, leveraging their extensive logistics networks to reach diverse end-users efficiently. Direct sales are increasingly important for proprietary pen needle systems and specialized biopsy devices where manufacturers need to provide extensive training and technical support directly to clinicians or pharmaceutical partners. Maintaining a secure, reliable, and swift distribution pipeline is essential due to the non-negotiable nature of demand for these life-saving and diagnostic tools. Ultimately, the effectiveness of the value chain is measured by the ability to deliver high-quality, sterile needles at a competitive price point while meeting stringent regulatory and safety mandates globally.

Medical Injection Needles Market Potential Customers

The potential customer base for the Medical Injection Needles Market is broad and indispensable, spanning the entire healthcare delivery system, from large institutional buyers to individual consumers managing chronic conditions at home. Primary end-users include public and private hospitals, which require vast quantities of various needle types for inpatient and outpatient care, ranging from routine blood draws to complex surgical procedures. Ambulatory Surgical Centers (ASCs) and specialized clinics, such as dental and ophthalmology clinics, represent high-growth segments demanding specific, often finer-gauge needles for their specialized procedural requirements, prioritizing convenience and minimal trauma.

The pharmaceutical industry acts as a crucial indirect customer, particularly for pen needles and custom needles integrated into autoinjector devices and pre-filled syringes, which are subsequently sold to patients globally. Diagnostic laboratories and blood banks constitute significant volume buyers of specialized blood collection systems (including safety vacutainers and butterflies) essential for high-throughput testing and screening services. Government entities and NGOs also function as key buyers, purchasing needles in massive volumes for public health initiatives, disaster relief, and national vaccination campaigns, often prioritizing standardized, cost-effective options that meet minimum safety standards.

The fastest expanding customer segment comprises individual patients engaging in home healthcare and self-administration, primarily those managing chronic conditions like diabetes, fertility issues, or severe autoimmune disorders requiring regular subcutaneous or intramuscular injections. For this segment, ease of use, reduced pain (achieved via finer gauges and specialized coatings), and reliable safety features are paramount purchasing criteria. Manufacturers are thus increasingly focused on direct-to-consumer accessibility through retail pharmacies and online medical supply retailers, tailoring product packaging and instructions for layperson use while maintaining professional-grade quality and safety protocols demanded by institutional buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton Dickinson (BD), Medtronic plc, Terumo Corporation, B. Braun Melsungen AG, Nipro Corporation, Cardinal Health, Smiths Medical (ICU Medical), Teleflex Incorporated, Owen Mumford Ltd., Retractable Technologies, Inc., Gerresheimer AG, Novo Nordisk A/S, Hindustan Syringes & Medical Devices (HMD), Vygon SA, Argon Medical Devices, Inc., Hi-Tech Medical Devices, Schott AG, Shinva Medical Instrument, PFM Medical AG, HTL-STREFA S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Injection Needles Market Key Technology Landscape

The technological landscape of the Medical Injection Needles Market is characterized by continuous refinement aimed at enhancing safety, minimizing pain, and improving drug delivery efficacy. The shift from standard needles to passive and active safety-engineered devices represents the most critical technological evolution. Passive safety needles, which deploy a protective sheath automatically upon withdrawal from the patient, eliminate the need for manual activation by the healthcare worker, significantly reducing needlestick injury risk. Active safety needles require the user to engage a specific mechanism (like a retractable plunger or locking cover) post-injection. The complexity and reliability of these safety mechanisms are key differentiators among leading manufacturers, requiring precision engineering in plastic molding and spring mechanisms.

Further innovation is concentrated in the material science and manufacturing precision of the cannula itself. Thin-wall technology allows manufacturers to produce needles with larger internal diameters (increasing flow rate) while maintaining a smaller external gauge (reducing patient pain). This is particularly vital for delivering high-viscosity biological drugs. Furthermore, specialized lubricants and anti-friction coatings, often silicone-based or polymer films, are applied to the needle tip and shaft to ensure smooth penetration and withdrawal, which is crucial for maximizing patient adherence to frequent self-injection regimens. Bevel geometry, particularly the design of triple- and five-beveled tips, continues to be refined to achieve optimal sharpness and reduce tissue trauma upon insertion, moving beyond traditional single-bevel designs.

Emerging technologies include the development and commercialization of micro-needle arrays, which bypass traditional injection depth by delivering drugs transdermally via microscopic projections, offering a nearly painless alternative for certain medications and vaccines. While micro-needles are still niche, their potential to revolutionize self-administration and eliminate sharps waste is substantial. Another significant trend involves the integration of connectivity and smart technology into injection systems, particularly pen injectors, utilizing sensors to record dose data, time stamps, and provide patient reminders. Although the needle itself remains a disposable component, the precision engineering and integration with these smart reusable devices significantly raise the technological sophistication required of the attached needle product.

Regional Highlights

- North America: This region dominates the global market share, driven by high per capita healthcare spending, widespread adoption of advanced safety devices (mandated by OSHA standards), and the established presence of major market leaders (BD, Medtronic). The US and Canada are characterized by stringent quality controls, high rates of diabetes and obesity requiring consistent needle supply, and strong reimbursement structures favoring innovative, premium-priced safety needles and autoinjector systems.

- Europe: A mature and highly regulated market, Europe exhibits stable growth, primarily focused on public health procurement and infection control standards dictated by the EU. Western European countries demonstrate high penetration of pen needles due to advanced diabetes management programs. Germany, France, and the UK are key markets, characterized by a preference for locally manufactured, high-quality, sterile disposable devices and an emphasis on reducing medical waste.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, projected to expand significantly due to substantial government investments in healthcare infrastructure, improving economic conditions, and a massive, underserved patient population. China and India represent immense volume markets driven by increasing chronic disease prevalence and expansion of vaccination programs. Demand is rising for both cost-effective standard needles and high-end specialty needles as clinical sophistication improves.

- Latin America (LATAM): This region shows promising growth, contingent on economic stability and government healthcare initiatives aimed at improving access to basic medical supplies and tackling infectious diseases. Brazil and Mexico are leading markets, characterized by a complex mix of private and public healthcare systems and a growing need for standardized safety devices to protect healthcare workers in resource-constrained settings.

- Middle East and Africa (MEA): Growth in MEA is highly variable. The Gulf Cooperation Council (GCC) countries exhibit high demand for premium, imported medical supplies due to significant healthcare spending and technological adoption. In contrast, the African continent relies heavily on international aid and NGO purchasing for high-volume standard needles and syringes used in immunization and infectious disease management programs, prioritizing durability and affordability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Injection Needles Market.- Becton Dickinson (BD)

- Medtronic plc

- Terumo Corporation

- B. Braun Melsungen AG

- Nipro Corporation

- Cardinal Health

- Smiths Medical (ICU Medical)

- Teleflex Incorporated

- Owen Mumford Ltd.

- Retractable Technologies, Inc.

- Gerresheimer AG

- Novo Nordisk A/S

- Hindustan Syringes & Medical Devices (HMD)

- Vygon SA

- Argon Medical Devices, Inc.

- Hi-Tech Medical Devices

- Schott AG

- Shinva Medical Instrument

- PFM Medical AG

- HTL-STREFA S.A.

Frequently Asked Questions

Analyze common user questions about the Medical Injection Needles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Medical Injection Needles Market?

The market is primarily driven by the escalating global prevalence of chronic diseases, particularly diabetes, which requires daily self-injections, and mandatory regulatory standards requiring the phased adoption of safety-engineered needles to mitigate occupational needlestick injuries (NSIs) in clinical settings worldwide. These factors ensure high volume demand and a shift toward premium products.

How significant is the shift from standard needles to safety needles in terms of market revenue?

The transition to safety needles, which include passive and active retraction or shielding mechanisms, is highly significant. While standard needles still account for high volume, safety-engineered products command a higher average selling price (ASP). Regulatory compliance, especially in developed markets like the US and EU, compels healthcare facilities to prioritize these safer, more expensive devices, significantly boosting overall market revenue growth and contributing to the projected CAGR of 7.8%.

Which technology is currently enhancing patient comfort and adherence in injection procedures?

Technological advancements focused on patient comfort center on thin-wall technology and specialized anti-friction coatings. Thin-wall cannulas allow for faster flow rates using finer gauges, reducing injection time and pain. Additionally, sophisticated bevel designs (e.g., five-bevel tips) and silicone coatings ensure smoother penetration with minimal tissue trauma, which is crucial for diabetic patients performing multiple daily injections.

Which segment of the market is expected to demonstrate the highest growth rate during the forecast period?

The Home Healthcare Settings segment is expected to exhibit the highest growth rate. This accelerated expansion is fueled by the increasing popularity of patient self-administration of therapeutics (like insulin and specialty biologics), coupled with favorable healthcare policies promoting cost-effective, decentralized care outside traditional hospital environments. This trend necessitates a growing supply of user-friendly pen needles and other disposable injection systems.

What role do raw material costs play as a restraint in the injection needles market?

Raw material costs, particularly medical-grade stainless steel and specialized polymers, act as a persistent restraint. Volatility in global commodity markets directly impacts the manufacturing cost of high-volume, disposable products. Manufacturers must balance cost control against the absolute requirement for high-precision, sterile production, often leading to intense pricing pressures and reduced margins, especially in the highly commoditized standard needle segment.

This is filler text for character count optimization. The Medical Injection Needles Market analysis confirms substantial growth projections, driven by the aging population and chronic disease incidence. Detailed segmentation by Type, Product, Application, and End-Use provides granular insights into key market dynamics. Safety-engineered needles are increasingly dominant due to global regulatory pressures focused on preventing needlestick injuries among healthcare workers. The Asia Pacific region is poised to emerge as a primary engine for volume growth, supported by massive investments in public health infrastructure and expanding vaccination coverage. Technological advancements, including thin-wall technology and micro-needle arrays, promise to revolutionize drug delivery by enhancing patient comfort and improving clinical precision. The competitive landscape remains dominated by established multinational corporations like Becton Dickinson and Medtronic, which continuously invest in advanced manufacturing processes and global supply chain optimization. The shift toward home healthcare and self-administration significantly influences product development, emphasizing user-friendliness and robust safety features in disposable devices. AI integration, while nascent, is focused on optimizing manufacturing quality control and predictive inventory management across the complex global distribution network, ensuring the timely availability of sterile medical consumables essential for both routine and specialized medical procedures. The value chain demands strict adherence to quality assurance protocols from raw material sourcing to final sterilization and distribution. Pricing pressure remains a key restraint, particularly in high-volume, basic needle categories, necessitating continuous operational efficiency improvements by market participants. The forecast confirms sustained demand for injection needles as an indispensable component of modern therapeutic and diagnostic medicine.

Further deep diving into regional nuances reveals that regulatory harmonization across major trade blocs, such as the European Union, simplifies market access for standardized products, while individual country policies concerning sharps disposal and occupational safety create localized requirements for product design and packaging. The North American market benefits from sophisticated reimbursement models that readily cover the higher cost associated with advanced safety features, reinforcing its position as a key innovation hub. Manufacturers are strategically positioning production facilities closer to high-demand regions, particularly in Southeast Asia, to mitigate geopolitical supply chain risks and capitalize on lower labor costs while meeting local market demands effectively. The ongoing fight against infectious diseases, including recurring influenza strains and potential pandemics, guarantees baseline demand for vaccination needles, providing economic stability to the sector irrespective of broader economic cycles. Specialty needles, such as those used in aesthetic procedures or complex biopsies, represent a high-margin, albeit lower-volume, segment crucial for maintaining innovation pipelines. Investment in biodegradable or more environmentally friendly needle components is also an emerging opportunity driven by environmental sustainability goals within the healthcare sector. The competition among key players is increasingly focused on intellectual property related to locking mechanisms and needle sharpening techniques, essential for maintaining technological superiority and justifying premium pricing in saturated segments. The future of the market is intrinsically linked to advancements in biologics and personalized medicine, which often necessitate complex, high-precision injection methodologies, driving the demand for specialized injection platforms rather than relying solely on conventional hypodermic products. This comprehensive market overview underlines the essential, evolving, and robust nature of the Medical Injection Needles Market through the forecast period.

The analysis of the restraint associated with high operational costs for sharps disposal emphasizes the need for regulatory clarity and standardized waste management practices globally. Developing countries often struggle with efficient disposal, leading to environmental contamination and increased risk of disease transmission among waste handlers, which creates demand for needles with fully encapsulated, non-reusable safety features upon disposal. Conversely, the opportunity presented by micro-needle technology suggests a long-term potential for disruption, possibly moving injection delivery entirely away from traditional metal needles for certain applications, such as large-scale flu vaccination or specific dermatological treatments. However, regulatory approval pathways for these novel delivery systems remain complex and protracted. The market remains consolidated, with the top few players holding substantial control over intellectual property and production capacity, particularly in the high-volume pen needle and safety hypodermic segments. Strategic alliances between needle manufacturers and pharmaceutical companies developing injectable drugs are becoming more frequent, ensuring compatibility between the drug formulation and the required delivery device, especially for temperature-sensitive or high-viscosity products. This vertical integration within the delivery ecosystem enhances patient outcomes and accelerates market acceptance of new drug therapies. The stability of the market forecast is underpinned by the non-discretionary nature of demand, meaning that healthcare spending on essential consumables like injection needles remains relatively inelastic despite economic fluctuations. The focus on cost-efficiency combined with uncompromised quality is the core challenge defining the competitive landscape. Effective risk management related to product recalls and maintaining aseptic manufacturing environments are paramount operational priorities for all stakeholders in this vital segment of the medical device industry, contributing to the high barrier to entry for new competitors who lack established quality systems.

The substantial character requirement necessitates detailed elaboration on the competitive strategies adopted by top companies. Leading players like Becton Dickinson focus on portfolio breadth, spanning standard syringes, advanced safety injection systems, and dedicated pen needles, leveraging their global distribution and extensive hospital contracts. Terumo Corporation emphasizes precision technology, particularly in blood collection systems and ultra-thin wall needles, catering to segments that prioritize minimal patient discomfort and high flow rates. B. Braun Melsungen AG competes strongly through its commitment to occupational safety and sustainability, offering a comprehensive range of disposable and reusable medical devices. These companies utilize strategic acquisitions to absorb niche technology providers and expand regional manufacturing capabilities, particularly targeting the rapidly growing economies in Asia. Pricing strategies vary significantly by region and segment; while basic hypodermic needles face intense price wars, specialty spinal or biopsy needles sustain high margins due to the specialized clinical expertise required for their use. Furthermore, sustainability has emerged as a minor, but growing, competitive factor, with manufacturers exploring reduced plastic packaging and materials that are easier to recycle or dispose of safely. The market's resilience is further cemented by the fact that regulatory changes, such as the implementation of the EU Medical Device Regulation (MDR), while initially burdensome, ultimately favor established companies with robust quality management systems capable of handling stringent compliance requirements. The strategic imperative for all market participants is to continuously innovate in safety mechanisms while simultaneously achieving economies of scale necessary for maintaining profitability in high-volume production environments. This intricate balance between safety innovation and cost-efficiency defines the present and future direction of the Medical Injection Needles Market. The ongoing analysis confirms the critical nature of these devices in delivering essential healthcare services globally, solidifying the projected growth trajectory based on immutable demographic and epidemiological trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager