Medical Isotopes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434555 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Medical Isotopes Market Size

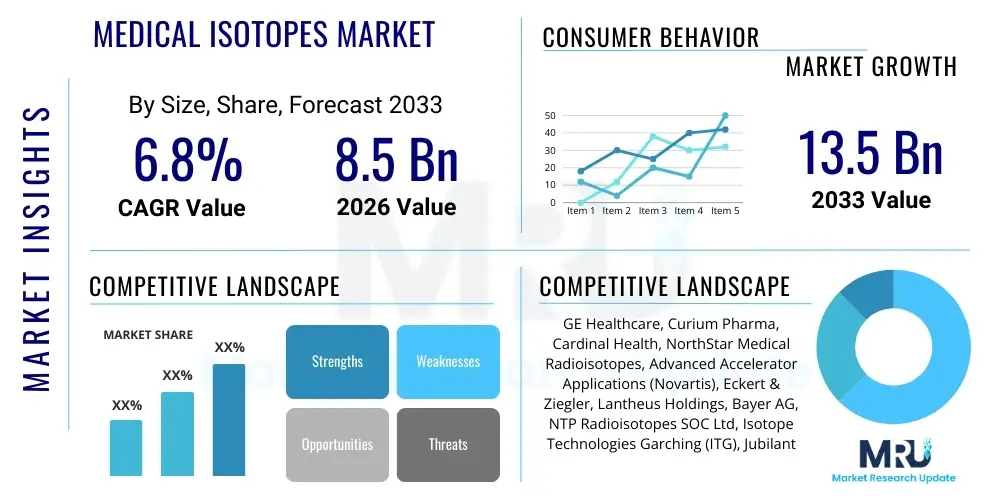

The Medical Isotopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Medical Isotopes Market introduction

The Medical Isotopes Market encompasses the production, distribution, and utilization of radioactive materials, known as radioisotopes, specifically engineered for diagnostic and therapeutic applications within the healthcare sector. These isotopes, integral to the field of nuclear medicine, play a critical role in procedures such as Positron Emission Tomography (PET) and Single-Photon Emission Computed Tomography (SPECT), enabling precise imaging of organ function and disease progression. Key products dominating this landscape include Technetium-99m (derived from Molybdenum-99), Iodine-131, Fluorine-18, and emerging therapeutic isotopes like Lutetium-177 and Actinium-225, which are fundamentally transforming oncology treatment paradigms.

The primary applications of medical isotopes are stratified into diagnostics, focusing largely on cardiology, oncology, and neurology, and therapeutics, concentrating on highly targeted treatment modalities for various cancers and thyroid disorders. The market's robust expansion is intrinsically linked to the escalating global prevalence of chronic diseases, particularly cardiovascular ailments and cancer, which necessitate early and accurate diagnostic tools. Furthermore, the increasing adoption of personalized medicine approaches, particularly in theranostics—the coupling of a diagnostic radioisotope with a therapeutic radioisotope targeting the same biological pathway—is significantly contributing to market valuation and innovation.

Driving factors propelling market growth include substantial investments in research and development leading to the commercialization of novel radioisotopes with superior pharmacological profiles, alongside technological advancements in non-reactor-based production methods, such as cyclotrons and linear accelerators. The rising demand for minimally invasive diagnostic procedures and highly effective, targeted radiation therapies is creating sustained market momentum. However, persistent challenges related to the stability of the global supply chain for key isotopes, regulatory stringency, and the high capital expenditure required for production facilities remain critical determinants of future market trajectory.

- Product Description: Radioactive materials (radioisotopes) utilized for imaging (SPECT, PET) and targeted therapy (radiopharmaceuticals).

- Major Applications: Oncology, Cardiology, Neurology, and Thyroid Treatment.

- Key Benefits: Non-invasive diagnosis, high detection sensitivity, targeted therapeutic effectiveness, and personalized medicine implementation.

- Driving Factors: Rising cancer and cardiovascular disease incidence, advancements in theranostics, and technological innovations in radioisotope generation.

Medical Isotopes Market Executive Summary

The Medical Isotopes Market is experiencing a pivotal transition driven by technological diversification and a heightened focus on ensuring supply chain resiliency. Business trends indicate a significant shift away from over-reliance on a few aging nuclear research reactors for the production of Molybdenum-99 (Mo-99). Market players are aggressively investing in non-fission-based production methodologies, notably accelerator-based and liquid-metal reactor technologies, to mitigate historical supply volatility. Furthermore, mergers, acquisitions, and strategic collaborations, particularly between pharmaceutical companies and cyclotron operators, are becoming commonplace, aimed at integrating discovery, production, and distribution to capture maximum value in the rapidly growing theranostics segment, especially those involving Lutetium-177 and Yttrium-90.

Regional trends highlight North America and Europe as historically dominant markets, fueled by mature healthcare infrastructures, high reimbursement rates, and pioneering research activities. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate during the forecast period. This accelerated growth is primarily attributed to expanding access to nuclear medicine facilities, increasing healthcare expenditure across developing economies like China and India, and a burgeoning patient pool requiring sophisticated diagnostic and therapeutic interventions. Investment in nuclear medicine infrastructure and the relaxation of regulatory hurdles in several APAC countries are key elements supporting this robust regional expansion.

Segmental analysis reveals that diagnostic isotopes, particularly those utilized in SPECT procedures, maintain the largest market share due to their widespread use and relatively lower cost of infrastructure required compared to PET facilities. However, the therapeutic isotopes segment is poised for the most rapid expansion, propelled by the success of targeted alpha and beta emitter therapies in oncology. Within applications, oncology remains the primary end-use sector, absorbing the largest volume of medical isotopes, driven by the increasing application of advanced imaging for staging and monitoring, and the advent of highly effective radiopharmaceutical treatments. The trend toward personalized treatment plans is fundamentally reshaping demand across all key segments.

- Business Trends: Increased investment in non-fission Mo-99 production, strategic partnerships focusing on theranostics development, and vertical integration across the supply chain.

- Regional Trends: Dominance of North America and Europe shifting towards rapid expansion and infrastructure development in the APAC region.

- Segments Trends: Rapid growth in therapeutic isotopes (e.g., Lu-177, Ac-225) driven by oncology, while diagnostics (Tc-99m) maintain volume dominance.

AI Impact Analysis on Medical Isotopes Market

Users frequently inquire about how Artificial Intelligence (AI) will enhance the efficiency and efficacy of nuclear medicine, particularly concerning image analysis, dose optimization, and supply chain management. Key concerns revolve around the potential for AI to standardize interpretation, reducing inter-operator variability in PET and SPECT scans, and whether AI algorithms can predict optimal radioisotope delivery and effective therapeutic outcomes. Users also seek information on AI's role in addressing the historical fragility of the isotope supply chain, focusing on predictive maintenance for complex production facilities and optimizing the highly time-sensitive logistics of short-lived isotopes.

AI is set to revolutionize several core aspects of the Medical Isotopes Market, moving beyond traditional image processing. In diagnostics, deep learning algorithms are being trained on vast datasets of nuclear medicine images to automatically segment tumors, quantify radiotracer uptake, and provide highly accurate prognostic markers, significantly speeding up diagnosis and supporting treatment decision-making. For therapeutic applications, AI algorithms are crucial for sophisticated dosimetry planning, allowing clinicians to calculate the absorbed radiation dose in target tissues and critical organs with unprecedented precision, thereby maximizing efficacy while minimizing patient toxicity in personalized radiopharmaceutical therapy.

Furthermore, the integration of AI extends critically into the operational sphere, addressing longstanding industry challenges related to production stability and distribution. Machine learning models are being deployed to monitor the operational parameters of nuclear reactors and cyclotrons in real-time, predicting potential component failures before they occur, thus ensuring high uptime for critical isotope production. In logistics, AI optimizes complex scheduling and routing for radioisotope deliveries, which are constrained by short half-lives, significantly reducing waste and improving global distribution efficiency, thereby contributing substantially to mitigating market supply shocks.

- Enhancement of Diagnostic Accuracy: AI utilizes deep learning for automated segmentation, quantitative analysis, and rapid interpretation of PET/SPECT images.

- Personalized Dosimetry: Machine learning algorithms optimize radiation dose calculations for targeted radiopharmaceutical therapies, ensuring maximum therapeutic index.

- Supply Chain Optimization: Predictive maintenance models increase the reliability and uptime of isotope production facilities (reactors, cyclotrons).

- Radiopharmaceutical Discovery: AI assists in screening potential targets and optimizing molecular design for novel diagnostic and therapeutic radiotracers.

- Clinical Workflow Efficiency: Automation of pre- and post-processing steps in nuclear medicine departments, reducing manual errors and preparation time.

DRO & Impact Forces Of Medical Isotopes Market

The dynamics of the Medical Isotopes Market are defined by a complex interplay of robust demand drivers and inherent structural restraints, balanced by transformative opportunities arising from scientific breakthroughs and technological maturity. The primary drivers fueling market expansion include the global increase in chronic disease incidence, particularly cancer, which mandates advanced diagnostic and therapeutic tools. This demand is further amplified by the successful clinical translation of theranostics, creating a virtuous cycle where precise diagnosis leads directly to targeted, effective treatment, thereby raising the perceived value of radioisotopes in modern healthcare. These forces collectively maintain persistent upward pressure on market growth.

However, the market faces significant structural restraints that impede seamless growth and stability. The most critical restraint remains the volatile and often fragile global supply chain for vital isotopes, particularly Mo-99, which is derived primarily from a limited number of aging nuclear research reactors with unpredictable downtime. Furthermore, the high initial capital expenditure required for building and operating advanced production facilities, such as cyclotrons and dedicated reactors, combined with stringent regulatory requirements and the necessity for specialized handling and transportation infrastructure, pose substantial barriers to entry and expansion. The relatively short half-lives of many isotopes also introduce significant logistical complexities and inherent product wastage.

Counterbalancing these restraints are significant opportunities, chiefly stemming from the ongoing paradigm shift towards accelerator-based production techniques that offer a non-fission pathway for Tc-99m, enhancing supply stability and environmental safety. Moreover, the increasing research focus on novel therapeutic isotopes, such as alpha emitters (e.g., Actinium-225) which offer high cytotoxicity with short range for highly localized tumor destruction, represents a major avenue for future revenue generation. The continuous expansion of clinical applications beyond traditional oncology and cardiology, penetrating fields like neurology and infectious disease imaging, broadens the addressable market and ensures long-term sustained growth for specialized radiopharmaceutical companies. The impact forces are currently skewed toward market growth due to unmet medical needs and technological solutions addressing supply constraints.

- Drivers: Rising global prevalence of cancer and cardiovascular diseases; increasing adoption of theranostics; high efficiency of targeted radiotherapies; advancements in molecular imaging techniques.

- Restraints: Fragility of Mo-99 supply chain; high capital and operational costs; stringent regulatory landscape for handling and disposal; short half-life requiring complex logistics.

- Opportunities: Development of non-reactor production methods; emergence of novel therapeutic isotopes (Alpha emitters); expansion into new clinical indications (e.g., neuroendocrine tumors); strategic governmental investment in nuclear medicine infrastructure.

- Impact forces: Currently high demand impact due to chronic disease burden and high technological impact from theranostics innovations.

Segmentation Analysis

The Medical Isotopes Market is meticulously segmented based on several critical parameters: the type of isotope, the application area, the production method, and the end-user. This segmentation allows for precise market analysis, reflecting the diversity and complexity of the nuclear medicine sector. By type, the market is broadly divided into diagnostic and therapeutic radioisotopes, with each category comprising distinct nuclides characterized by specific decay properties suitable for either imaging or targeted destruction. Diagnostic isotopes, led by Technetium-99m and Fluorine-18, account for the majority of the procedural volume, while therapeutic isotopes like Lutetium-177, Iodine-131, and Yttrium-90 are driving significant value growth due to premium pricing associated with highly effective cancer treatments.

Segmentation by application highlights the dominant role of Oncology, which utilizes isotopes for both early detection (staging) and targeted treatment (radiopharmaceutical therapy). Cardiology is another major segment, relying heavily on SPECT agents for myocardial perfusion imaging. Production methodology provides another layer of distinction, differentiating between reactor-produced isotopes, which utilize fission products, and accelerator-produced isotopes (primarily cyclotrons), which are growing rapidly due to localized production capabilities and enhanced stability. The shift towards cyclotron and accelerator technologies is a key trend influencing segment valuation and geographical market structure.

Finally, end-user segmentation focuses on the primary consumption points for these specialized products. Hospitals and specialized diagnostic centers represent the largest segments, acting as the final point of administration for most procedures. Furthermore, research institutes and pharmaceutical companies constitute a vital, albeit smaller, segment focused on developing and validating new radiopharmaceuticals. Understanding the segmentation allows stakeholders to target specific high-growth areas, particularly the niche segments focusing on specific therapeutic radiopharmaceuticals that promise high clinical efficacy and favorable patient outcomes.

- Type:

- Diagnostic Isotopes (e.g., Technetium-99m, Fluorine-18, Iodine-123, Thallium-201)

- Therapeutic Isotopes (e.g., Lutetium-177, Iodine-131, Yttrium-90, Samarium-153, Actinium-225)

- Application:

- Oncology (Cancer Diagnosis and Treatment)

- Cardiology (Myocardial Perfusion Imaging)

- Neurology (Dopamine Transporter Scans, Brain Imaging)

- Thyroid Management

- Others (Infection, Inflammation, Bone Palliatives)

- Production Method:

- Reactor-based Production

- Cyclotron-based Production

- Accelerator-based Production

- Generator-based Production

- End-User:

- Hospitals and Clinics

- Diagnostic Centers

- Research and Academic Institutions

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Medical Isotopes Market

The value chain for medical isotopes is inherently complex and highly specialized, beginning with the upstream analysis involving the sourcing of enriched uranium or stable precursor materials. The initial stage necessitates highly specialized nuclear infrastructure, typically involving nuclear research reactors or high-energy particle accelerators (cyclotrons). Upstream activities involve ensuring the consistent and safe supply of target materials (e.g., Mo targets for Mo-99 production or stable isotopes for neutron activation). Regulatory compliance, safety protocols, and waste management are paramount at this foundational stage, demanding significant capital investment and adherence to international nuclear safety standards, particularly concerning safeguards and non-proliferation.

Midstream activities focus on the actual processing, purification, and manufacturing of the raw radioisotopes into generator systems or final compounded radiopharmaceuticals ready for clinical administration. This includes the complex process of chemical separation, quality control (QC), and packaging of short-lived isotopes. The logistics associated with the midstream are critical, as the limited shelf life of these products dictates rapid processing and efficient distribution planning. Companies often specialize in generator technology (e.g., Mo-99/Tc-99m generators) which allows for on-site elution and preparation at the point of use, optimizing the utility of the parent isotope.

Downstream analysis centers on the distribution channels and the final end-user delivery. Due to the radioactive nature and short half-lives, distribution relies heavily on specialized logistics providers certified for handling dangerous goods, often utilizing dedicated air and ground transportation networks operating on non-stop schedules. The channel structure typically includes direct distribution from manufacturers/producers to large hospital networks or indirect distribution via radiopharmacies, which compound the final unit doses and deliver them to surrounding clinical sites. Direct channels offer greater control over quality and timing, while indirect channels through radiopharmacies enable wider reach and specialized dosage preparation tailored to immediate patient needs. The necessity of maintaining cold chain logistics and specialized shielding significantly adds to the cost and complexity of the entire value chain.

Medical Isotopes Market Potential Customers

Potential customers for medical isotopes encompass a defined spectrum of healthcare providers and research organizations that rely on nuclear medicine technologies for patient care and scientific advancement. The largest segment of end-users consists of hospitals and integrated healthcare systems that maintain dedicated nuclear medicine departments equipped with SPECT and PET scanners. These institutional buyers are the primary consumers of diagnostic radioisotopes, utilizing them for routine procedures in oncology staging, cardiac function assessment, and neurological disorder diagnosis. Their demand profile is characterized by large, consistent volume requirements for common isotopes like Tc-99m and F-18, often procured through long-term supply agreements to ensure procedural continuity.

Specialized independent diagnostic imaging centers and outpatient clinics constitute another significant customer base. These facilities, often focusing exclusively on advanced imaging services, typically require flexible, just-in-time delivery of unit doses from centralized radiopharmacies. The growth of these centers is often driven by shifts in healthcare economics favoring outpatient care, particularly in areas like PET imaging which requires the rapid delivery of short-lived radioisotopes. Their purchasing decisions are heavily influenced by the reliability of supply, competitive pricing, and the ability of suppliers to customize dose preparation and logistics.

Furthermore, major pharmaceutical companies, biotechnology firms, and academic research institutions represent high-value, albeit smaller volume, customers. These entities primarily utilize medical isotopes for drug discovery, clinical trials, and basic research, particularly in the rapidly evolving fields of novel radioligand design and theranostics development. Their demand is highly specialized, often requiring rare, experimental isotopes (such as Actinium-225 or Zirconium-89) in research quantities. These customers prioritize supplier capability in producing research-grade materials under strict regulatory compliance and often engage in collaborative partnerships to secure access to novel radioisotope production capacity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Curium Pharma, Cardinal Health, NorthStar Medical Radioisotopes, Advanced Accelerator Applications (Novartis), Eckert & Ziegler, Lantheus Holdings, Bayer AG, NTP Radioisotopes SOC Ltd, Isotope Technologies Garching (ITG), Jubilant DraxImage, Shine Technologies, IRE ELiT, Fusion Pharmaceuticals, BWXT Medical, Siemens Healthineers, TRIUMF, JSC Isotope, Capintec, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Isotopes Market Key Technology Landscape

The technological landscape of the Medical Isotopes Market is characterized by a significant transition away from legacy production methods towards more sustainable, resilient, and specialized techniques. Historically, the market was dominated by high-flux nuclear research reactors utilizing highly enriched uranium targets for the fission-based production of key isotopes, particularly Molybdenum-99. While reactors remain crucial, the industry is heavily investing in reactor modernization and, more importantly, in developing alternative, non-fission production routes. This technological shift is fundamentally driven by the need to ensure domestic supply and eliminate reliance on proliferation-sensitive materials, aligning with global security initiatives.

The most impactful technological evolution is the proliferation of accelerator-based production methods, primarily using cyclotrons. Cyclotrons are increasingly being utilized to produce Fluorine-18 (for PET scans) and are now being adapted for the large-scale, non-fission production of Technetium-99m, often through the Mo-100(p,2n)Tc-99m pathway. These technologies offer localized, decentralized production capabilities, significantly mitigating the logistical risks associated with international shipping of short-lived precursors. Furthermore, advanced processing technologies, such as plasma separation techniques and novel chromatographic columns, are essential for efficiently purifying and concentrating radioisotopes from both reactor and accelerator sources, maintaining the high pharmaceutical quality required for human injection.

Another crucial technological development lies within the therapeutic segment, focusing on the sophisticated targeting and conjugation of radioisotopes. This includes the development of novel chelating agents that securely bind the radioisotope (e.g., Lutetium-177 or Actinium-225) to a specific targeting molecule (such as a peptide or antibody), ensuring precise delivery to cancer cells. The transition towards high linear energy transfer (LET) isotopes, such as alpha emitters, which require specialized handling and production techniques, marks the cutting edge of therapeutic radiopharmaceutical innovation. These advancements necessitate continuous R&D investment in radiochemistry, molecular biology, and advanced particle physics infrastructure to sustain the pipeline of novel nuclear medicine products.

Regional Highlights

North America maintains a commanding position in the Medical Isotopes Market, primarily due to the presence of mature and highly sophisticated healthcare infrastructure, high rates of adoption for advanced diagnostic and therapeutic modalities, and robust reimbursement frameworks. The United States, in particular, drives significant demand, bolstered by substantial R&D spending and the early adoption of high-value theranostic agents like those based on Lutetium-177. Recent domestic investments in accelerator technology, particularly in cyclotron facilities for non-fission Mo-99 production, are aimed at strengthening supply chain independence and maintaining regional market leadership. High patient awareness and the prevalence of chronic diseases further solidify North America's status as a dominant revenue contributor.

Europe represents the second-largest market, characterized by strong governmental support for nuclear medicine research, particularly in countries like Germany, France, and the UK. The European market benefits from a well-established network of nuclear research facilities and a high degree of integration between academic research and pharmaceutical commercialization. However, the region faces challenges related to consolidating reactor capacity and managing aging infrastructure. The market trend here is focused on optimizing distribution logistics across borders and accelerating the clinical translation of advanced PET tracers and novel therapeutic radiopharmaceuticals, often through pan-European collaborations.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, driven by massive investments in healthcare infrastructure expansion, rapidly increasing affordability of nuclear medicine technologies, and a vast, underserved patient population. Countries such as China, Japan, and India are expanding their capacity for both isotope production and clinical application. Specifically, China is heavily investing in building new domestic cyclotron facilities and research centers to reduce reliance on imported radioisotopes, reflecting a strategic shift towards self-sufficiency. This region’s growth trajectory is dependent on regulatory harmonization and the successful training of specialized nuclear medicine professionals to meet the burgeoning demand.

- North America: Market dominance due to robust healthcare spending, high adoption of personalized medicine (theranostics), and strategic investment in domestic, non-fission production technologies.

- Europe: Strong R&D environment, established nuclear medicine facilities, focus on cross-border logistics optimization, and high usage rates for standard diagnostic procedures.

- Asia Pacific (APAC): Highest growth potential driven by healthcare infrastructure expansion, favorable government initiatives in major economies (China, India), and a rapid increase in the prevalence of cancer and related disorders.

- Latin America and MEA: Emerging markets characterized by increasing urbanization, moderate investments in nuclear medicine centers, and high reliance on imported radioisotopes, presenting opportunities for established global distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Isotopes Market.- GE Healthcare

- Curium Pharma

- Cardinal Health

- NorthStar Medical Radioisotopes

- Advanced Accelerator Applications (A major subsidiary of Novartis)

- Eckert & Ziegler

- Lantheus Holdings

- Bayer AG

- NTP Radioisotopes SOC Ltd

- Isotope Technologies Garching (ITG)

- Jubilant DraxImage

- Shine Technologies

- IRE ELiT (A subsidiary of IRE)

- BWXT Medical

- TRIUMF (Research institution with production capabilities)

- Siemens Healthineers

- JSC Isotope

- CNL (Canadian Nuclear Laboratories)

- Fluorine-18 research focused companies

- Fusion Pharmaceuticals

Frequently Asked Questions

What are the primary applications driving the demand for therapeutic medical isotopes?

The primary applications driving demand for therapeutic medical isotopes center on oncology, specifically in treating neuroendocrine tumors (NETs) and prostate-specific membrane antigen (PSMA) positive prostate cancer, leveraging highly targeted radiopharmaceuticals like Lutetium-177 DOTATATE/PSMA. These isotopes offer targeted radiation delivery, minimizing systemic toxicity and improving overall survival rates in refractory cancers, making them essential tools in precision medicine.

How is the market addressing the historical supply volatility of Molybdenum-99?

The market is addressing Molybdenum-99 (Mo-99) supply volatility through substantial diversification of production technologies. Key strategies include heavy investment in non-fission-based methods, such as utilizing cyclotrons and accelerators to produce Technetium-99m directly or producing Mo-99 without highly enriched uranium (HEU). Furthermore, the commissioning of new, dedicated commercial production facilities aims to create redundant, globally dispersed sources, reducing reliance on aging research reactors.

What is theranostics, and how is it impacting the Medical Isotopes Market?

Theranostics is an emerging field combining diagnostics and therapeutics using similar or paired radioisotopes targeting the same biological pathway (e.g., diagnostic Gallium-68 paired with therapeutic Lutetium-177). This approach allows for precise patient selection, dose optimization, and targeted treatment. Theranostics is profoundly impacting the market by accelerating the demand for therapeutic isotopes and fostering strong R&D pipelines focused on developing highly specific radioligands, driving significant segment growth.

Which production method is expected to see the fastest growth over the forecast period?

Cyclotron-based and accelerator-based production methods are expected to exhibit the fastest growth over the forecast period. This accelerated growth is primarily attributed to the increasing adoption of non-fission technologies for producing critical isotopes like Technetium-99m and Fluorine-18, offering inherent advantages in localized manufacturing, enhanced supply reliability, shorter logistical chains, and reduced reliance on geopolitical factors affecting nuclear reactor operations.

What are the main regulatory challenges faced by medical isotope manufacturers?

Medical isotope manufacturers face significant regulatory challenges including stringent requirements from nuclear regulatory bodies (related to handling, shielding, and disposal of radioactive waste), complex approval processes for novel radiopharmaceuticals by health agencies (like the FDA and EMA), and compliance with transport regulations for hazardous materials. Ensuring consistent Good Manufacturing Practices (GMP) and maintaining highly secure supply chains add substantial layers of regulatory complexity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager