Medical Kits and Trays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433398 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Medical Kits and Trays Market Size

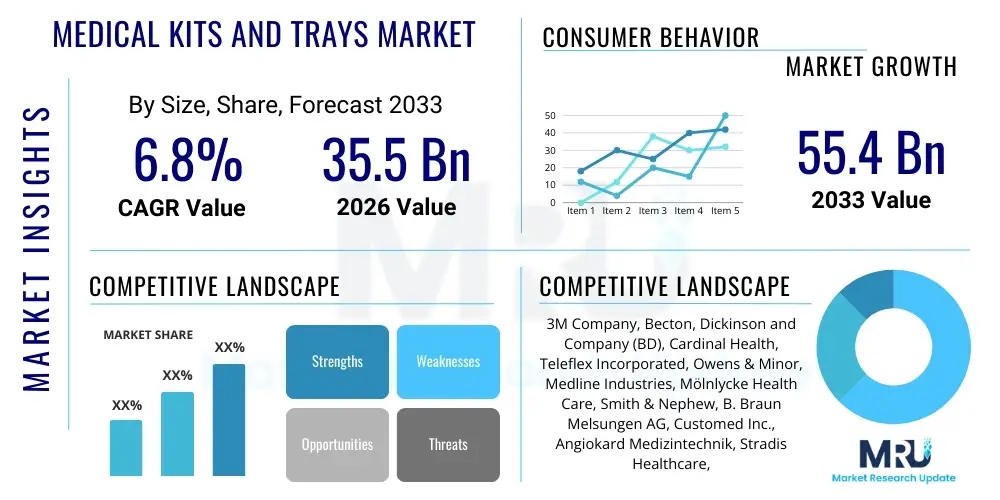

The Medical Kits and Trays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 55.4 Billion by the end of the forecast period in 2033.

Medical Kits and Trays Market introduction

The Medical Kits and Trays Market fundamentally addresses the crucial requirement for standardized, sterilized consumables and instruments utilized across the full spectrum of clinical and surgical environments. These integrated procedural packs are critical components for optimizing hospital workflows, guaranteeing that all necessary supplies—ranging from basic wound dressings and specialized catheters to complex, high-value surgical implants and accompanying instruments—are bundled, sterilized, and readily available at the point of care. The inherent value proposition of these products lies in minimizing the variability in procedural setup, which is directly correlated with a reduction in both human error and the incidence of Healthcare-Associated Infections (HAIs), a pivotal metric for quality care globally. Manufacturers continuously invest in research and development to improve the functional design and ergonomic efficiency of these kits, ensuring they align precisely with modern surgical techniques, including those utilized in minimally invasive and robotic procedures, thereby enhancing overall procedural safety and time efficiency in critical settings.

The primary applications of these market offerings are extremely broad, covering specialties such as orthopedic joint replacement, cardiovascular interventions, ophthalmological cataract surgery, obstetrics, and general emergency medicine. The benefits derived from the adoption of pre-packaged kits are multifaceted; they drastically improve inventory management by converting numerous individual stock-keeping units (SKUs) into a single, traceable unit, simplify procurement logistics, and facilitate accurate cost tracking per procedure. Furthermore, the standardization enabled by these trays plays a vital role in training and maintaining consistent quality standards across multi-facility healthcare systems, which is increasingly important as large hospital groups consolidate and seek uniform operational protocols throughout their networks to achieve large-scale efficiencies and predictable outcomes across diverse geographical locations.

Driving factors propelling this robust market growth include the escalating global volume of surgical procedures, spurred by demographic shifts towards an older population requiring more frequent interventions, alongside technological advancements that make complex surgeries safer and more accessible. Critically, regulatory pressures from bodies such as the FDA and European Medicines Agency (EMA), emphasizing stringent infection control and traceability standards, mandate the use of high-quality, single-use sterile barrier systems inherent in these kits. The trend toward customized procedure trays (CPTs), which are tailored precisely to the preferences of individual surgeons and specific facility protocols, represents a significant growth vector, maximizing clinical utility and waste minimization in high-cost operating environments, while also supporting the financial sustainability of healthcare providers.

Medical Kits and Trays Market Executive Summary

The global Medical Kits and Trays Market demonstrates substantial expansion potential, predicated on the strategic convergence of operational efficiency requirements and heightened demands for patient safety protocols worldwide. Current business trends indicate intense vertical consolidation among key industry players, focused on securing raw material supply chains and integrating specialized sterilization capabilities to maintain quality control and mitigate geopolitical supply risks. A core strategic focus for market leaders is the continued shift toward customized procedure trays (CPTs), leveraging sophisticated data analytics to design kits that perfectly match specific surgical requirements, thereby creating deep, long-term contractual relationships with major healthcare providers. Innovation in sustainable packaging and materials is emerging as a critical competitive edge, particularly in highly regulated Western markets where environmental sustainability is becoming a key procurement consideration alongside cost and quality, driving the adoption of circular economy models within the medical supply chain.

Regionally, the market exhibits a clear divide: North America maintains its dominance, driven by highly sophisticated healthcare infrastructure, high surgical volumes, and early adoption of advanced clinical practices and technologies, including robotic surgery which necessitates specialized kit designs. Europe follows a steady growth path, prioritizing regulatory compliance (EU MDR) and sustainability mandates. However, the Asia Pacific (APAC) region is projected to be the engine of future growth, fueled by rapid healthcare infrastructure development, increasing accessibility to medical insurance, and a substantial, growing patient base needing both basic and specialized surgical care. Investment in localized manufacturing capabilities within APAC is becoming essential for navigating complex regional logistics and regulatory frameworks efficiently and capturing the immense untapped demand from middle-income segments.

Segment trends highlight the overwhelming preference for disposable products due to superior infection control profiles and ease of use, aligning with global efforts to minimize Healthcare-Associated Infections (HAIs). By application, orthopedic and cardiovascular kits command the highest market value, reflecting the high financial weight and clinical complexity of these procedures, demanding premium product quality and reliability. End-user trends show a significant migration of surgical volumes to Ambulatory Surgical Centers (ASCs), fueling disproportionate demand for standardized, cost-optimized procedural kits in these settings. Manufacturers are aggressively tailoring their product portfolios to meet the lean operational models and predictable cost structures prioritized by the rapidly expanding ASC sector, further cementing the segment’s influence on market development and prompting investment in automation for high-volume production lines.

AI Impact Analysis on Medical Kits and Trays Market

Public and clinical stakeholder inquiries concerning Artificial Intelligence (AI) frequently explore its capability to transcend traditional inventory management, moving towards proactive, predictive orchestration of the entire kit lifecycle, from component sourcing to post-procedure documentation. Users are keenly interested in how machine learning models can process vast quantities of patient demographic, historical procedural, and supplier performance data to anticipate demand spikes with granular precision, effectively eliminating the current reliance on static forecasting methods and reducing costly inventory holding times. Furthermore, significant discussion revolves around the implementation of AI-driven visual inspection systems, addressing the critical concern of human fatigue and error during the meticulous, high-volume assembly of complex, multi-component sterile trays, directly enhancing patient safety assurance and supporting stringent ISO quality requirements.

The primary transformative impact of AI and Machine Learning (ML) is concentrated within supply chain resilience and manufacturing quality. AI algorithms analyze nuanced patterns in hospital Electronic Health Records (EHR) and surgical schedules, cross-referenced with epidemiological trends, to generate predictive models that drastically improve the accuracy of demand forecasting for both standardized and highly customized trays. This optimization allows manufacturers to strategically manage raw material procurement and production scheduling, leading to significantly lower obsolescence risk and reduced inventory holding costs for hospitals. By transitioning from reactive stock management to proactive, data-informed supply replenishment, AI ensures the consistent availability of critical supplies, minimizing procedural delays and enhancing the overall clinical operational flow, which provides a profound competitive advantage.

Beyond logistics, AI is fundamentally improving the integrity of the product itself. Advanced computer vision systems, often employing deep learning models, are deployed on assembly lines to conduct real-time, high-speed inspection of every assembled kit. These systems can instantly detect misaligned components, damaged packaging seals, or incorrect instrument inclusion, far exceeding the capability and consistency of manual inspection protocols. This rigorous, AI-enhanced Quality Control (QC) strengthens regulatory compliance, minimizes the chance of sterile breach, and increases brand reliability. Future integration pathways suggest AI could assist in designing ergonomic tray layouts by analyzing robotic surgeon movements and even help train robotic systems used in automated kit packing, continuously learning the optimal arrangement for various procedural requirements and ensuring superior component organization for optimal user experience.

- AI-Driven Demand Forecasting: Utilizes ML to analyze complex data sets (EHRs, historical usage, epidemiology) for ultra-precise inventory prediction, preventing stockouts and overstocking across global distribution points.

- Enhanced Quality Control (QC) via Computer Vision: Implements deep learning algorithms for automated, high-speed visual inspection of assembled kits, verifying component accuracy, placement, and sterile packaging integrity against regulatory standards.

- Optimized Supply Chain Logistics: Predicts potential disruptions, identifies optimal shipping routes, and manages global supply chain risks in real-time using complex network analysis to ensure product sterility is maintained during transit.

- Custom Procedure Tray (CPT) Design Assistance: ML models analyze surgeon feedback and procedural data to recommend optimal component inclusion and ergonomic arrangement for highly customized trays, maximizing clinical efficiency.

- Digital Traceability Integration: Facilitates the use of intelligent identifiers (RFID/NFC) by linking physical kit data to digital twins managed by AI systems for superior lifecycle tracking, immediate usage reporting, and efficient recall management.

DRO & Impact Forces Of Medical Kits and Trays Market

The market’s dynamism is principally powered by compelling drivers rooted in global health safety mandates and economic efficiency objectives, while simultaneously being constrained by formidable environmental and cost-related pressures, yielding complex impact forces. The dominant driver remains the critical requirement for infection prevention; standardized, sterile, single-use kits are internationally recognized as the gold standard for reducing surgical site infections (SSIs) and other HAIs, making their adoption non-negotiable in accredited facilities and driving regulatory demand. Furthermore, the economic driver of reducing labor costs associated with manual kit assembly and sterilization within hospitals pushes procurement decisions toward pre-packaged solutions, directly enhancing clinical staff allocation to patient care. Opportunities arise from expanding market reach into high-growth regions like APAC and LATAM, coupled with the ongoing technological potential inherent in producing sophisticated, smart kits integrated with digital tracking capabilities, providing avenues for competitive differentiation.

Restraints impose structural challenges, most notably the escalating cost of medical-grade raw materials, specifically polymers, and the high capital expenditure required for maintaining cutting-edge cleanroom assembly and validation processes compliant with global certifications. A major and growing restraint is the increasing regulatory focus on environmental sustainability, specifically concerning the immense volume of non-biodegradable plastic waste generated by single-use kits. This forces manufacturers to allocate significant R&D resources toward sourcing eco-friendly alternatives, such as bio-based polymers, and adopting circular economy principles, which often introduces complexities related to maintaining required sterility assurance levels (SALs) with novel materials. Furthermore, the complexity and cost of navigating divergent global regulatory pathways (e.g., FDA 510(k), EU MDR certification) act as substantial barriers to rapid global market expansion and new product introduction.

The prevailing impact forces shaping the competitive landscape include material science innovation and strategic consolidation. The move toward advanced, high-barrier packaging films that allow for alternative sterilization methods (like E-beam) while reducing the overall material footprint is critical for optimizing both logistics and environmental performance. Strategically, market leaders are utilizing mergers and acquisitions to capture smaller, specialized CPT providers, integrating niche expertise into broader portfolios, and achieving massive economies of scale in component sourcing, which provides a buffer against rising component costs. The balancing act between offering highly customized solutions demanded by surgeons and maintaining the manufacturing efficiency required to keep costs competitive defines the core challenge and major force driving innovation in automated assembly and supply chain planning within the sector.

Segmentation Analysis

The robust structure of the Medical Kits and Trays Market allows for detailed segmentation across multiple axes, providing clarity on varying demand profiles and technological maturity levels necessary for strategic market engagement. Segmentation by product type highlights the distinction between high-margin Surgical Kits, which demand complex instruments and specialized components for procedures like neurosurgery or cardiac catheterization, and high-volume, lower-margin Non-Surgical Kits designed for routine hospital activities such as IV starts or basic wound dressing changes. The growing category of Custom Procedure Trays (CPTs) acts as a pivotal differentiator, catering specifically to the nuanced needs of specialized clinical teams and representing the pinnacle of standardization and efficiency, making it the most aggressively targeted segment for market expansion due to its strong correlation with reducing hospital waste and labor costs.

Procedure type segmentation directly correlates with the required complexity, cost, and risk profile. High-complexity procedure kits, used in operating theaters for invasive surgeries, are characterized by stringent quality checks, inclusion of high-value components (e.g., specialized instruments, implants), and consequently drive significant market revenue due to their high average selling price (ASP). Conversely, low-complexity procedural kits, often used in outpatient settings or general wards, prioritize volume manufacturing and cost-effectiveness while still maintaining mandated sterility levels. End-user stratification underscores the shifting landscape of healthcare delivery; while hospitals remain indispensable, the rapid expansion and capital investment into Ambulatory Surgical Centers (ASCs) globally necessitate dedicated product lines that are optimized for rapid turnover, minimal storage footprint, and highly predictable cost structures, solidifying ASCs as a key strategic target segment for manufacturers focusing on procedural standardization and cost optimization.

- By Product Type:

- Surgical Kits and Trays (Orthopedic Procedure Kits, Cardiovascular/Angiography Kits, General Surgery Packs, Neurosurgical Kits, Ophthalmic Kits, Bariatric Kits)

- Non-Surgical Kits and Trays (IV Start Kits, Catheter Insertion Trays, Suture Removal Kits, Central Line Insertion Trays, Minor Laceration Trays, Diagnostic Phlebotomy Kits)

- Custom Procedure Trays (CPTs)

- By Procedure Type:

- High-Complexity Procedures (Requires specialized instruments, significant setup time, and comprehensive component sets for major invasive surgery, driving high ASP)

- Low-Complexity Procedures (Routine interventions, diagnostics, and minor non-invasive treatments, characterized by high volume and focus on cost-efficiency)

- By Sterilization Type:

- Ethylene Oxide (EtO) Sterilized (Dominant for heat-sensitive materials, facing increasing regulatory scrutiny regarding emissions and residuals)

- Gamma Irradiated (Used for higher density materials and high-volume products, known for deep penetration capability)

- E-Beam Sterilized (Faster, increasingly adopted alternative for components compatible with high-energy exposure, improving supply chain speed)

- Autoclave/Steam Sterilized (Limited use for components that are heat-stable and moisture-tolerant)

- By End-User:

- Hospitals (Largest segment, encompassing ORs, ICUs, and Emergency Departments, demanding the widest variety of kits)

- Ambulatory Surgical Centers (ASCs) (Fastest-growing segment focused on high-efficiency, standardized procedures and cost control)

- Specialty Clinics (Dialysis Centers, Cardiac Catheterization Labs, Urology Clinics)

- Outpatient Facilities and Diagnostic Centers (Focus on non-invasive and high-volume diagnostic sampling kits)

Value Chain Analysis For Medical Kits and Trays Market

The value chain begins with a crucial upstream phase involving the sourcing of thousands of specialized raw materials and finished components, a process demanding rigorous adherence to biomedical material standards and robust risk management. Upstream suppliers include specialty plastics manufacturers for sterile barrier systems and trays (compliant with ISO 11607), textile producers for high-performance surgical drapes and gowns, and external suppliers of pre-sterilized instruments (e.g., specialized needles, scalpels, small devices). Establishing secure, long-term relationships with compliant, quality-assured suppliers is critical, as any failure in component quality or sterility directly jeopardizes the marketability and safety of the final kit, necessitating comprehensive supplier audits, robust contractual agreements, and strict adherence to global material compatibility standards (e.g., ISO 10993 for biocompatibility).

The midstream phase, involving assembly and sterilization, represents the core value addition where customization and complexity are managed. This process occurs in highly controlled, certified cleanroom environments (typically ISO Class 7 or 8), where automated or semi-automated lines organize, package, and seal components according to precise, validated formulations specified by the Custom Procedure Tray (CPT) manifest. The selection and execution of the sterilization process (EtO, Gamma, or E-beam) are logistically challenging, requiring specialized facilities, strict regulatory oversight, and highly precise dose or concentration control to achieve the required Sterility Assurance Level (SAL) without degrading material performance or causing chemical residuals above permissible limits. Operational excellence in this stage is paramount for maintaining high throughput, managing configuration complexity, and minimizing per-unit assembly costs, particularly for manufacturers handling thousands of unique CPT configurations simultaneously while responding rapidly to shifting clinical demands.

Downstream market activities focus on distribution, sales, and post-sales support, bridging the product from the cleanroom to the operating table. Distribution channels are complex, involving direct sales to major integrated delivery networks (IDNs) and reliance on specialized medical device distributors and wholesalers for reaching smaller hospitals and international markets. Effective cold chain and logistics management is paramount, ensuring that the sterile barrier integrity is maintained throughout storage and transit until the point of use, requiring specialized temperature-controlled warehousing and validated transport protocols. Direct channels allow for closer customer relationship management, rapid feedback integration for CPT modifications, and superior contract compliance. Indirect channels, while offering broader geographical reach, necessitate robust oversight to ensure that third-party handling and storage practices adhere strictly to the manufacturer's sterility and temperature guidelines, ensuring product safety, efficacy, and prolonged shelf life across diverse and often challenging geographic conditions.

Medical Kits and Trays Market Potential Customers

The customer base for the Medical Kits and Trays Market is centered on entities providing procedural or surgical patient care, with distinct needs based on their operational model, regulatory environment, and procedural complexity. Hospitals, encompassing academic medical centers, large regional systems, and community hospitals, remain the foundational customer segment. These facilities exhibit the highest volume and greatest complexity of demand, requiring everything from generalized minor procedure kits to highly customized, expensive packs for complex cardiothoracic, vascular, and orthopedic procedures. Hospital procurement departments prioritize contracts that offer streamlined logistics, guaranteed sterility, and integrated waste management solutions, often seeking single-source providers capable of handling their entire kit portfolio through large, multi-year, performance-based agreements that reward supply chain reliability and cost savings.

Ambulatory Surgical Centers (ASCs) constitute the most attractive segment in terms of growth trajectory and profitability for standardized kits. ASCs are characterized by lower overheads, rapid patient turnover, and an intense focus on highly standardized, repeatable procedures, typically requiring kits optimized for speed, precision, and cost-efficiency. Manufacturers targeting ASCs emphasize the economic benefits of bulk CPT procurement, which directly supports the ASC model of reducing preparation time and minimizing staffing needs in non-clinical roles. The continuous migration of procedures from inpatient to outpatient settings, driven by favorable reimbursement policies and patient preferences for convenience, ensures that ASCs will remain a primary focus for manufacturers looking for high-volume, standardized contracts with predictable purchasing patterns.

Furthermore, specialized end-users, including Long-Term Care (LTC) facilities, Home Healthcare agencies, and government health services, are expanding their consumption profiles. LTC and home care settings require simple, standardized kits for chronic care management (e.g., tracheostomy care, dialysis preparation, complex wound care) that can be easily used by non-specialized personnel or patients themselves, necessitating enhanced product design focused on user safety, simplicity, and compact storage. Diagnostic imaging centers and cath labs also represent focused, high-value customers for specialized angiography and interventional radiology trays, where procedural accuracy and component quality are non-negotiable requirements, justifying the procurement of premium-priced, high-specification products that are often bundled with specific proprietary devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 55.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Becton, Dickinson and Company (BD), Cardinal Health, Teleflex Incorporated, Owens & Minor, Medline Industries, Mölnlycke Health Care, Smith & Nephew, B. Braun Melsungen AG, Customed Inc., Angiokard Medizintechnik, Stradis Healthcare, Pennine Healthcare, DeRoyal Industries, Medical Action Industries (part of Owens & Minor), Baxter International Inc., Hogy Medical Co., Ltd., Steris plc, Kimal plc, McKesson Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Kits and Trays Market Key Technology Landscape

The technological evolution within the Medical Kits and Trays market is highly concentrated on achieving enhanced sterility assurance, improving supply chain visibility, and developing more sustainable packaging materials without compromising product integrity, driven by stringent regulatory expectations. A significant technological focus is placed on refining sterilization modalities; while traditional Ethylene Oxide (EtO) remains dominant for heat-sensitive instruments, environmental and occupational health regulations are aggressively catalyzing the adoption of alternatives. This includes sophisticated E-beam and gamma irradiation processes, which offer faster turnaround times and eliminate chemical residuals, demanding the parallel development of new polymer formulations for packaging that can withstand higher energy exposure without compromising the sterile barrier or material properties of the enclosed components, thus requiring precise calibration of both the packaging material science and the sterilization cycle parameters to maintain the required Sterility Assurance Level (SAL).

Pioneering advancements are also observed in 'smart packaging' and digital integration, critical for improving supply chain transparency and combating counterfeit medical products, which poses a significant risk globally. The integration of passive tracking technologies such as Radio Frequency Identification (RFID) and Near Field Communication (NFC) chips directly into the kit trays allows for automated, hands-free tracking of inventory consumption, real-time location mapping, and expiration date verification within the operating room environment. This technological layer provides hospitals with unprecedented granular data on usage patterns, enabling AI-driven proactive inventory replenishment and immediate verification of the kit's sterility and compliance history before incision. Such integrated digital solutions represent a step change in fulfilling stringent regulatory requirements, particularly concerning the Unique Device Identification (UDI) and traceability mandates across major global markets.

Furthermore, technology is directly influencing the design and customization of the kits themselves, moving beyond simple bundling. Advanced manufacturing techniques, including high-precision injection molding for specialized plastic components and the utilization of 3D printing for specialized, procedure-unique instruments or ergonomic tray inserts, are being adopted to support the explosion in demand for Custom Procedure Trays (CPTs). Computational modeling and simulation are used extensively to optimize the physical layout of instruments within the tray, ensuring efficient use of packaging space, minimizing material waste, and simultaneously improving the workflow and aseptic presentation for clinical staff. These technological investments are essential for maintaining a competitive edge, allowing manufacturers to offer faster customization lead times, superior product functionality, and reduced overall environmental impact compared to traditional, less precise assembly and packaging methods.

Regional Highlights

North America maintains its dominant position in the global Medical Kits and Trays Market, primarily due to the region's highly sophisticated and capital-intensive healthcare infrastructure, characterized by high per capita healthcare spending and extensive adoption of advanced surgical techniques, including robotic and minimally invasive surgeries. The United States market is the largest contributor, driven by a large volume of elective and non-elective procedures, coupled with powerful market forces favoring standardized, sterile disposables as mandated by institutional protocols aimed at reducing soaring costs associated with HAIs. The rapid proliferation of Ambulatory Surgical Centers (ASCs) across the U.S. has created a specialized, high-demand segment focused exclusively on efficiency and streamlined procedural supply management, securing North America's continued influence on global kit design trends and technological adoption, particularly concerning digital tracking and supply chain optimization through integrated data platforms.

The European market is mature and exhibits stable growth, heavily influenced by strong governmental price controls, universal healthcare coverage mandates, and a significant focus on environmental sustainability, especially in Nordic and Western European nations. The comprehensive implementation of the EU Medical Device Regulation (MDR) has fundamentally raised the compliance bar for all manufacturers operating in the region, demanding exhaustive clinical data, robust quality management systems, and stringent traceability requirements, which tends to favor large, established players with deep regulatory expertise. Growth is sustainably driven by demographic trends, specifically an aging population requiring joint replacement, cardiac interventions, and ophthalmological procedures. Manufacturers here must rigorously balance the requirement for high-quality, clinically effective kits with the pressing need to reduce the environmental footprint, leading to innovative approaches in recyclable packaging and material selection, often positioning Europe as a trendsetter in sustainable medical supply chain practices.

Asia Pacific (APAC) is unequivocally recognized as the fastest-growing region, presenting vast, untapped market potential across populous nations such as China, India, Japan, and South Korea. This explosive growth is underpinned by massive government investment programs aimed at modernizing public health infrastructure, rapidly increasing patient access to surgical care, and the burgeoning medical tourism sector which demands international-standard medical supplies. While regulatory environments are diverse and fragmented across APAC countries, the demand for affordable, yet high-quality, standardized kits is skyrocketing due to increasing surgical backlogs and rising disposable incomes. Market players must strategically localize their manufacturing and distribution networks in key countries like Vietnam and Indonesia to circumvent complex logistics challenges and cater to region-specific procedural preferences, capitalizing aggressively on the increasing prevalence of lifestyle diseases requiring surgical intervention.

Latin America (LATAM) shows promising growth, largely concentrated in industrialized nations like Brazil, Mexico, and Chile. Market expansion is propelled by the growing penetration of private healthcare services and a general increase in disposable income, allowing more citizens access to standardized, high-quality medical procedures that align with international standards. However, the market faces structural challenges including economic volatility, fluctuating currency rates, and underdeveloped regional distribution channels, necessitating manufacturers to adopt flexible pricing models, establish local manufacturing hubs where feasible, and rely on strong local partnerships to effectively manage risk and market penetration. Standardization of clinical protocols remains a key hurdle, although governmental drives toward modernization and investment in hospital infrastructure are gradually improving the adoption rates of pre-packaged kits over ad-hoc assembly, signaling a positive long-term trajectory.

The Middle East and Africa (MEA) market segment is characterized by divergent dynamics. Growth in the Middle East, particularly the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia, Qatar), is robust, fueled by significant government healthcare expenditure aimed at establishing world-class medical cities and regional medical tourism hubs. These high-income markets demand premium, specialized kits compliant with stringent international Western standards. In contrast, the African segment is highly reliant on international aid and public health initiatives, where the demand centers on high-volume, cost-effective kits for basic procedures, emergency care, and maternal/child health programs. This requires manufacturers to develop bifurcated strategies catering to both the high-end specification needs of the GCC countries and essential, affordable public health solutions for the broader African continent, often involving collaborations with NGOs and public sector procurement bodies.

- North America: Market dominance driven by high surgical volumes, sophisticated healthcare systems, and stringent infection control regulations favoring single-use sterile products. Key focus on CPT adoption in ASCs and deep integration of digital tracking technologies (RFID) for supply chain transparency.

- Europe: Mature market emphasizing sustainability, rigorous cost-efficiency via public procurement, and strict adherence to the new EU Medical Device Regulation (MDR). Growth is steady, fueled by orthopedic and cardiovascular procedure modernization and leading research into eco-friendly packaging solutions.

- Asia Pacific (APAC): Fastest-growing region due to expanding healthcare infrastructure, high unmet clinical needs, massive governmental investment in public health, and rapidly increasing surgical volume (China, India, Southeast Asia). Requires highly localized manufacturing and distribution strategies for success.

- Latin America (LATAM): Growth fueled by increasing private sector investment, urbanization, and the need for standardized kits in major economies (Brazil, Mexico). Market faces challenges related to economic volatility and requires robust local presence for effective market management.

- Middle East & Africa (MEA): Dual market strategy required; high-end, premium demand in GCC states driven by medical tourism and capital investment, contrasted by demand for affordable essential kits in broader African markets supported by public health initiatives and international aid.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Kits and Trays Market.- 3M Company

- Becton, Dickinson and Company (BD)

- Cardinal Health

- Teleflex Incorporated

- Owens & Minor

- Medline Industries

- Mölnlycke Health Care

- Smith & Nephew

- B. Braun Melsungen AG

- Customed Inc.

- Angiokard Medizintechnik

- Stradis Healthcare

- Pennine Healthcare

- DeRoyal Industries

- Medical Action Industries (part of Owens & Minor)

- Baxter International Inc.

- Hogy Medical Co., Ltd.

- Steris plc

- Kimal plc

- McKesson Corporation

Frequently Asked Questions

Analyze common user questions about the Medical Kits and Trays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Medical Kits and Trays Market?

The primary growth drivers are the imperative to reduce Healthcare-Associated Infections (HAIs) through standardized sterile products, the global increase in surgical procedures due to aging populations, and the critical need for operational efficiency and labor cost containment in high-volume settings like Ambulatory Surgical Centers (ASCs). Regulatory mandates reinforcing patient safety further accelerate adoption.

How do Custom Procedure Trays (CPTs) benefit healthcare providers?

CPTs significantly benefit providers by standardizing clinical workflows based on surgeon preferences, drastically reducing the time staff spend gathering individual supplies, lowering the incidence of missing or incorrect components during surgery, minimizing costly clinical waste, and ultimately improving inventory management and procedural costs, leading to enhanced safety and profitability.

What is the impact of regulatory changes, such as the EU MDR, on market manufacturers?

The EU Medical Device Regulation (MDR) imposes stringent requirements on manufacturers, necessitating substantial investment in clinical data, enhanced post-market surveillance, and complex regulatory compliance procedures for assembling and marketing kits, particularly CPTs. This drives higher operational costs but ensures elevated product quality and safety standards across European distribution channels.

Which sterilization technologies are predominantly used and why is there an industry shift?

Ethylene Oxide (EtO) and gamma irradiation are the predominant sterilization methods due to their proven efficacy. However, the industry is increasingly shifting towards advanced alternatives like E-beam sterilization and HPHPV primarily due to growing environmental and regulatory concerns regarding EtO emissions and the strong demand for faster processing cycles to optimize supply chain velocity and throughput.

How is AI expected to transform the manufacturing and supply chain processes for medical kits?

AI is set to transform the industry by enabling sophisticated predictive demand forecasting based on clinical data, optimizing inventory management to reduce stockouts and waste, and substantially enhancing quality assurance through automated, high-speed computer vision systems that verify component assembly and sterile packaging integrity, creating a more resilient and cost-effective supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Medical Kits and Trays Market Size Report By Type (Procedure-Specific Kits & Trays, General-Use Kits & Trays), By Application (Hospital & Clinic, Ambulatory Surgical Centers), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Medical Kits And Trays Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Procedure-Specific Disposable Kits & Trays, General-Use Kits & Trays, Custom Procedure Kits & Trays, Benefits of Using Custom Trays, Home Test Kits), By Application (Hospitals, Clnics), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager