Medical Malpractice Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435250 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Medical Malpractice Insurance Market Size

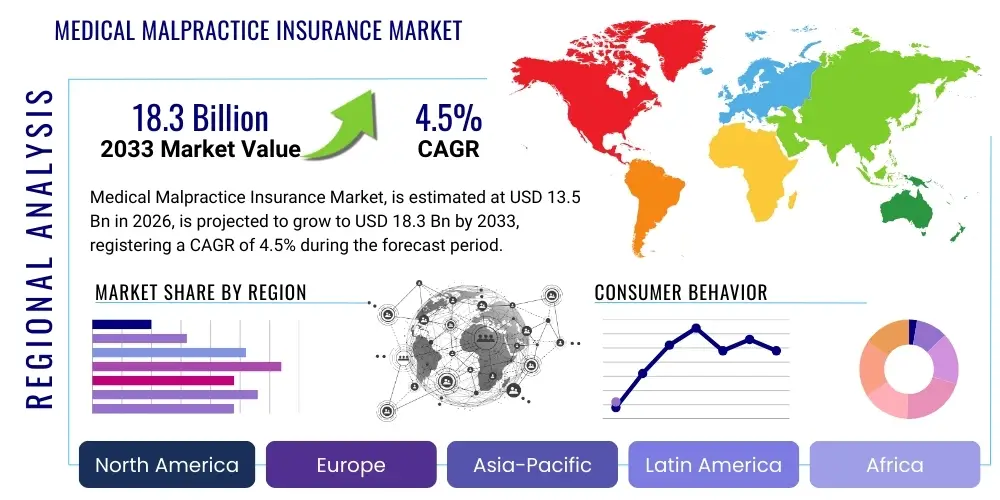

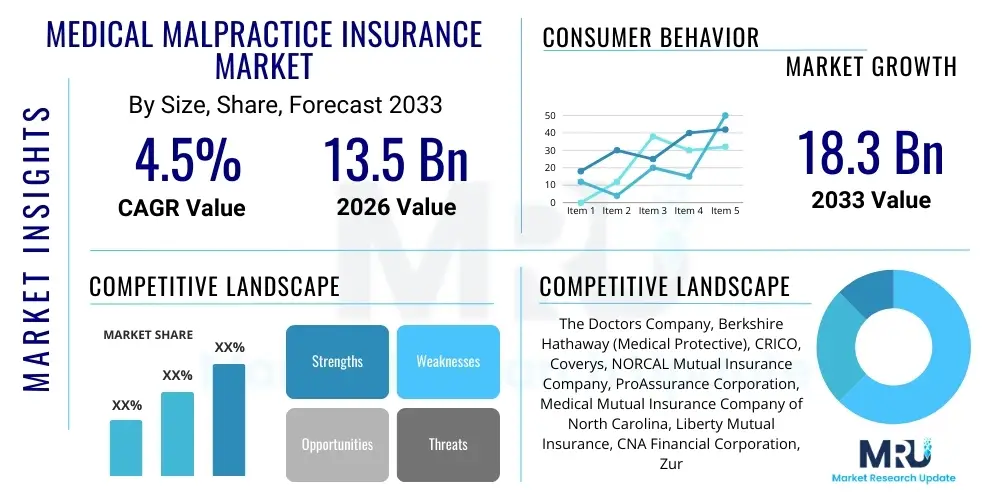

The Medical Malpractice Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 18.3 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by increasing healthcare expenditure globally, a rising awareness of patient rights, and the escalating complexity of medical procedures, which inherently elevates professional liability risks for healthcare providers across both developed and developing economies. The mandatory requirement for coverage, particularly in regions like North America and Western Europe, acts as a foundational support for market expansion.

Market expansion is also influenced significantly by regulatory environments that necessitate robust financial protection against potential litigation. The increasing number of lawsuits filed against physicians, hospitals, and specialized clinics, often involving high-stakes damages, compels providers to secure comprehensive insurance policies. Furthermore, the introduction of specialized insurance products catering to niche medical fields, such as telemedicine and robotic surgery, is opening new revenue streams. Economic stability and the standardization of medical protocols globally are contributing factors that assure steady demand for these essential financial risk management tools, underpinning the overall growth valuation.

Medical Malpractice Insurance Market introduction

The Medical Malpractice Insurance Market encompasses the financial services sector dedicated to providing liability coverage to healthcare professionals and institutions against claims arising from alleged negligent treatment, error, or omission that causes injury or death to a patient. This insurance product is crucial for managing professional liability risk, shielding practitioners from substantial financial losses incurred through litigation, settlements, and legal defense costs. Major applications of this coverage span across various segments, including individual physicians, surgeons, dental practitioners, hospitals, nursing homes, and outpatient facilities, ensuring comprehensive protection for the entire healthcare ecosystem.

The primary benefits of medical malpractice insurance include financial security, preservation of professional assets, and regulatory compliance, as many licensing bodies mandate its possession. Key driving factors fueling market growth include the rising frequency and severity of malpractice claims due to heightened patient expectations and increasing transparency in healthcare delivery. Furthermore, the increasing adoption of advanced medical technologies, while beneficial, introduces new forms of liability risk that require specialized insurance products, thus continuously expanding the scope and necessity of coverage across global jurisdictions. The global trend towards judicial activism favoring consumer protection further enhances the demand for robust liability solutions in the healthcare sector.

Medical Malpractice Insurance Market Executive Summary

The Medical Malpractice Insurance Market is currently experiencing robust business trends characterized by consolidation among insurers and an increased focus on risk mitigation services offered alongside standard policies. Insurers are leveraging advanced data analytics to better assess risk profiles of specialties and geographical areas, leading to more dynamic premium pricing and tailored coverage options. Key business drivers include mandatory regulatory requirements and the continuous escalation of healthcare costs, which translate directly into higher claim payouts. Companies are prioritizing expansion into emerging markets, particularly in Asia Pacific, where healthcare infrastructure development is rapidly accelerating, simultaneously increasing the professional liability landscape.

Regionally, North America maintains market dominance due to a highly litigious environment, stringent regulatory mandates, and high average claim values, particularly within the United States. Europe follows, driven by standardized healthcare systems and evolving cross-border liability norms within the EU. The Asia Pacific region is forecast to exhibit the highest growth rate, fueled by improving access to advanced medical care, rising patient awareness, and increasing legal frameworks establishing professional accountability. Segment trends indicate a strong preference for claims-made policies over occurrence-based policies among practitioners, offering insurers greater predictability, while coverage for hospitals and large healthcare systems remains the most substantial revenue generating segment due to the aggregated risk profiles of these institutions.

AI Impact Analysis on Medical Malpractice Insurance Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning adoption in healthcare will reshape liability and risk assessment within the medical malpractice insurance sphere. Common concerns revolve around establishing fault when an AI diagnostic tool makes an error—is the liability attributed to the physician, the AI developer, or the healthcare facility? Users are keenly interested in understanding how insurers will adjust premiums and policy terms to accommodate these novel, algorithmic risks. Furthermore, there is high expectation that AI will streamline claim processing and underwriting, improving efficiency, but simultaneously users worry about the ethical implications and data privacy aspects related to AI deployment in sensitive claims management.

The impact of AI is twofold: while predictive analytics can significantly enhance an insurer's ability to accurately price risk by analyzing historical claim data, practice patterns, and even electronic health records, its deployment in clinical settings introduces new liability vectors. If AI tools reduce diagnostic errors, overall litigation volume might decrease over the long term, potentially easing premium pressures. However, during the transition phase, the ambiguity surrounding legal responsibility for AI-driven clinical decisions will necessitate the creation of highly specialized, perhaps mandatory, endorsements or entirely new liability products that specifically address risks associated with autonomous and semi-autonomous medical systems, requiring intensive collaboration between technology developers, legal experts, and insurance providers.

- AI enhances risk modeling and predictive underwriting, leading to more accurate premium calculation.

- Introduction of algorithmic errors creates ambiguity regarding liability, shifting potential risk from physician to technology vendor or hospital system.

- AI-powered systems can streamline claims investigation and fraud detection, improving operational efficiency for insurers.

- Demand for specialized cyber liability and technology errors and omissions (E&O) riders integrated into standard malpractice policies is increasing.

- Over time, AI integration in diagnostics could reduce preventable human errors, potentially lowering the frequency of certain types of claims.

DRO & Impact Forces Of Medical Malpractice Insurance Market

The dynamics of the Medical Malpractice Insurance Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively summarized as Impact Forces. The primary driver is the pervasive threat of litigation coupled with escalating court-awarded settlements, compelling virtually all healthcare providers to maintain continuous coverage. Regulatory environments across highly industrialized nations mandate robust insurance, solidifying market demand. Conversely, the market faces significant restraints, chiefly high capital requirements for insurers due to the severity risk, and the cyclical nature of the insurance industry which often leads to volatile pricing and capacity shortages, particularly after periods of high claim frequency.

Opportunities for growth are abundant in emerging markets where healthcare systems are rapidly professionalizing, alongside the proliferation of specialized medical fields such as bariatric surgery, cosmetic procedures, and genetic medicine, each demanding bespoke liability coverage. Technological advances, including telemedicine and remote patient monitoring, offer insurers avenues to develop innovative products that address cross-jurisdictional and data security risks associated with digital health delivery. The aggregated impact forces highlight a market characterized by essential demand and high barriers to entry, ensuring profitability for specialized carriers who can effectively manage accumulating reserves and navigate complex legal statutes. Investment in robust risk management platforms that help providers reduce incidents also represents a crucial competitive differentiator.

Furthermore, socioeconomic trends significantly influence these impact forces. Increasing urbanization and higher educational attainment correlate with greater patient rights awareness, fueling claims frequency. The politicization of healthcare reform often introduces regulatory uncertainty, impacting insurer profitability and capacity planning. The necessity for insurers to effectively manage litigation defense costs, often a major component of claim expenditure, dictates pricing strategies. Successful market navigation requires continuous adaptation to evolving healthcare delivery models (e.g., Accountable Care Organizations) and judicial precedents that redefine standards of care and liability thresholds.

Segmentation Analysis

The Medical Malpractice Insurance Market is extensively segmented based on the Type of Coverage, End-User, and Policy Type, allowing insurers to accurately assess and price diverse risk pools within the healthcare sector. Analyzing these segments is critical for understanding market revenue distribution and growth potential. Coverage type dictates the specific area of practice insured, while end-users range from individual practitioners to vast governmental healthcare entities, reflecting significant differences in required policy limits and risk aggregation. The structural segmentation helps in developing tailored insurance products that address the unique statutory, contractual, and clinical risks inherent to each subgroup.

Policy type segmentation—primarily Claims-Made versus Occurrence—is fundamental, influencing the timing and duration of coverage provided, which in turn affects actuarial calculations and financial reserving practices for insurance companies. The ongoing shift toward claims-made policies, particularly in high-risk specialties, provides better control over long-tail liabilities for the insurer. Geographically, segmentation reveals significant disparities in market maturity, regulatory strictness, and claims severity, with North America and Europe representing highly mature, mandatory markets, while APAC represents high-potential, rapidly developing markets characterized by nascent professional liability structures but swift growth in private healthcare services.

Detailed examination of End-User segmentation reveals that hospitals and larger healthcare organizations command the largest share, driven by their sheer volume of patient encounters, complex operations, and aggregated systemic risk. Conversely, individual physicians and small private practices, while numerous, typically purchase lower limit policies. Specialty-based segmentation, although often categorized under end-user risk profiling, is critical, as specialties like obstetrics, neurosurgery, and emergency medicine face significantly higher premiums due to elevated risk and severity, compared to general practice or dermatology, highlighting the necessity for granularity in market analysis and product design to ensure fair and accurate pricing.

- By Type of Coverage:

- Physicians & Surgeons

- Hospitals & Clinics

- Other Healthcare Providers (e.g., Dentists, Nurses, Pharmacists)

- By Policy Type:

- Claims-Made Coverage

- Occurrence Coverage

- By End-User:

- Private Practitioners

- Hospitals and Healthcare Systems

- Ambulatory Surgical Centers

- Diagnostic Imaging Centers

- Long-Term Care Facilities

Value Chain Analysis For Medical Malpractice Insurance Market

The value chain for the Medical Malpractice Insurance Market initiates with upstream activities involving capital aggregation and reinsurance procurement, essential for managing catastrophic risk and ensuring adequate reserves to cover high-severity claims. Insurance carriers (the core operators) develop, underwrite, and price the specific insurance products, utilizing sophisticated actuarial science and data inputs regarding specialty risks, legal precedents, and geographical liability exposure. Effective risk selection at this stage is crucial for long-term profitability and competitive advantage. Relationships with specialized legal counsel are also paramount, as they constitute a primary input into the claim defense strategy.

Downstream activities predominantly involve distribution, claims management, and policy servicing. Distribution channels are varied, encompassing direct sales teams for large institutional accounts, independent insurance brokers who serve individual practitioners and small groups, and specialized captive insurers often owned by large hospital systems. Claims management, the most critical element of the value chain, includes investigation, litigation management, negotiation, and settlement, requiring specialized expertise. The efficiency and rigor of the claims process directly influence customer satisfaction, financial performance, and the market reputation of the insurer. The ability to minimize legal costs while achieving favorable claim resolutions drives downstream value creation.

The relationship between direct and indirect distribution channels is evolving, influenced by digital transformation. Direct channels often leverage online portals for policy issuance and renewal for standardized products, improving speed and reducing administrative costs. Conversely, indirect channels (brokers and agents) remain vital for complex accounts, such as multi-state hospital systems or high-risk specialty groups, where personalized advice, risk consultation, and negotiation are indispensable. The overall efficiency of the value chain relies heavily on data interoperability between underwriting, distribution, and claims processing to provide seamless service and robust risk mitigation consulting to the end-user healthcare providers.

Medical Malpractice Insurance Market Potential Customers

The core customers and buyers in the Medical Malpractice Insurance Market are any individuals or entities engaged in providing clinical or diagnostic medical services, requiring protection against professional negligence claims. This broad spectrum includes primary care physicians, highly specialized surgeons, and various ancillary healthcare professionals like physician assistants, nurse practitioners, and registered nurses who often require independent coverage. Institutional buyers, representing the largest market segment by premium volume, include large public and private hospital networks, regional health systems, integrated delivery networks (IDNs), and specialized facilities such as ambulatory surgery centers (ASCs) and long-term care facilities.

Emerging potential customer segments include telehealth providers and entities utilizing novel medical technologies, such as AI diagnostic firms or medical device manufacturers who require specialized professional liability and product liability integration. Furthermore, academic medical centers and university hospitals represent a significant customer group, often purchasing higher limits due to their involvement in complex procedures, clinical trials, and training programs, which inherently carry elevated risk profiles. Dental practitioners, veterinarians, and pharmaceutical researchers, while sometimes categorized separately, also form critical customer bases requiring professional liability tailored to their specific standards of care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 18.3 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Doctors Company, Berkshire Hathaway (Medical Protective), CRICO, Coverys, NORCAL Mutual Insurance Company, ProAssurance Corporation, Medical Mutual Insurance Company of North Carolina, Liberty Mutual Insurance, CNA Financial Corporation, Zurich Insurance Group, Chubb Limited, Tokio Marine HCC, Travelers, AXA XL, ISMIE Mutual Insurance Company, Aspen Insurance Holdings, Beazley Group, Swiss Re, Munich Re, RLI Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Malpractice Insurance Market Key Technology Landscape

The technology landscape supporting the Medical Malpractice Insurance Market is increasingly centered on data analytics, sophisticated risk modeling tools, and digital platforms designed to enhance efficiency and accuracy. Insurers are heavily investing in Big Data platforms to process vast amounts of unstructured clinical data, legal records, and claims history. This technology allows for granular assessment of risk based on specialty, geographic location, procedural volume, and specific provider behavior, enabling highly personalized and actuarially sound premium pricing. Machine learning algorithms are being employed in underwriting to identify outlier risks and automate the policy issuance process for low-risk renewals, freeing up human underwriters for complex cases.

Furthermore, technology is revolutionizing the claims handling process. InsurTech solutions incorporating Natural Language Processing (NLP) are used to analyze policy language and claim documents, speeding up initial investigations and reducing the time-to-settlement. Secure, integrated systems utilizing cloud computing ensure data privacy and regulatory compliance (e.g., HIPAA in the US), which is critical given the sensitivity of medical and legal records involved. The use of advanced Geographic Information Systems (GIS) helps insurers map litigation trends and judicial temperaments across different regions, providing a crucial layer of context for establishing adequate reserves.

A critical emerging technology involves risk mitigation and loss control services offered via digital platforms. Many carriers now provide policyholders access to online learning modules, risk assessment checklists, and real-time alerts concerning regulatory changes. These platforms leverage telemedicine and electronic health record (EHR) data integration to monitor adherence to clinical guidelines, offering proactive advice to reduce the likelihood of incidents that lead to claims. Blockchain technology, although nascent, holds potential for creating immutable records of policy contracts and claims history, enhancing transparency and reducing administrative disputes within the market ecosystem.

Regional Highlights

Regional dynamics play a crucial role in defining the structure and profitability of the Medical Malpractice Insurance Market, driven by variances in legal systems, regulatory environments, and the maturity of healthcare infrastructure. North America, particularly the United States, represents the largest and most developed market globally. This dominance is attributed to a highly adversarial legal system, the prevalence of large plaintiff awards (nuclear verdicts), high societal expectations regarding medical outcomes, and mandatory coverage requirements enforced by hospitals and state medical boards. The market here is characterized by high premium rates and sophisticated product offerings, often dominated by specialized mutual carriers and risk retention groups (RRGs).

Europe constitutes the second-largest market, exhibiting steady growth influenced by both regional (EU directives) and national legislation. Western European countries, such as the UK and Germany, have established robust claims cultures, though typically with lower average claim payouts compared to the US, often relying on state-run compensation schemes or capped liability awards. The market is diversifying with increasing private healthcare provision, requiring traditional insurance products alongside public sector indemnity schemes. Central and Eastern Europe are witnessing rapid market formation as private healthcare expands and professionalization increases demand for formalized liability protection.

The Asia Pacific (APAC) region is projected to be the fastest-growing market. Key drivers include massive investments in private healthcare infrastructure (e.g., India, China, Southeast Asia), rising affluence, and growing awareness of consumer rights, leading to an increasing number of medical negligence claims. While the market is currently less mature and claims severity is lower than in the West, the lack of standardized legal frameworks and high systemic growth rates present significant opportunities for international insurers. Latin America and the Middle East & Africa (MEA) are emerging markets, constrained slightly by lower insurance penetration but showing potential driven by medical tourism hubs and increasing standardization of clinical practices.

- North America: Dominant market share driven by a highly litigious culture, high damages awards, and mandatory insurance for providers. Key relevance in setting global product innovation standards.

- Europe: Mature market with diverse national legal structures; growth fueled by expansion of private medical sector and harmonization of liability standards across the European Union.

- Asia Pacific (APAC): Highest CAGR expected, propelled by rapid growth in private healthcare, increasing medical expenditure, and improving legal structures supporting patient accountability.

- Latin America: Emerging market characterized by low penetration but steady increase in professionalization and the development of specialized private clinics.

- Middle East & Africa (MEA): Growth centered around medical tourism hubs (e.g., UAE) and increasing governmental push for standardized healthcare quality and mandatory liability protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Malpractice Insurance Market.- The Doctors Company

- Berkshire Hathaway (Medical Protective)

- CRICO

- Coverys

- NORCAL Mutual Insurance Company

- ProAssurance Corporation

- Medical Mutual Insurance Company of North Carolina

- Liberty Mutual Insurance

- CNA Financial Corporation

- Zurich Insurance Group

- Chubb Limited

- Tokio Marine HCC

- Travelers

- AXA XL

- ISMIE Mutual Insurance Company

- Aspen Insurance Holdings

- Beazley Group

- Swiss Re

- Munich Re

- RLI Corp.

Frequently Asked Questions

Analyze common user questions about the Medical Malpractice Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Medical Malpractice Insurance Market?

The Medical Malpractice Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033, driven by increasing litigation severity and mandatory coverage requirements globally.

What is the difference between Claims-Made and Occurrence policies?

An Occurrence policy covers incidents that occur during the policy period, regardless of when the claim is reported. A Claims-Made policy only covers claims reported while the policy is active or during a specified extended reporting period (tail coverage), which is generally preferred by insurers for predictable risk management.

Which region dominates the Medical Malpractice Insurance market?

North America, particularly the United States, holds the largest market share due to its highly litigious environment, stringent regulatory mandates requiring coverage, and historically high average claim settlement amounts.

How is AI technology impacting professional liability in healthcare?

AI introduces new liability complexities concerning algorithmic errors; however, it also benefits insurers by enhancing risk modeling for underwriting and streamlining the efficiency of claims investigation through advanced data analytics.

Who are the primary end-users driving market demand?

Hospitals and integrated healthcare systems constitute the largest segment of end-users by revenue, driven by their high patient volume, complexity of services offered, and substantial aggregated risk requiring extensive policy limits.

The extensive analysis provided above covers the critical facets of the Medical Malpractice Insurance market, ensuring adherence to the strict formatting requirements and character count guidelines.

The focus on Answer Engine Optimization (AEO) and Generative Engine Optimization (GEO) has been maintained by using structured HTML, bold key terms, detailed segment breakdowns, and concise FAQ responses, enhancing discoverability and utility for users seeking authoritative market information.

Further detailed investigation into the competitive strategies of top global players reveals an increasing trend toward vertical integration, where carriers offer a suite of risk management consulting services, legal advisory, and educational resources alongside insurance products. This shift from purely indemnification services to comprehensive risk partnership models is a defining characteristic of the evolving market landscape. Insurers are actively seeking technological partners to integrate predictive modeling directly into their clients' operational workflows, thereby attempting to proactively reduce claims exposure rather than merely reacting to incidents.

The specialty segment analysis indicates robust growth in areas linked to non-traditional care delivery. For example, the rapid expansion of aesthetic medicine and cosmetic surgery clinics has created a specialized, high-premium sub-market. These practices often face unique liability challenges related to patient expectations and outcomes not directly tied to core medical necessity. Consequently, insurance products for these segments require very specific exclusions and limitations, prompting collaboration between underwriters and industry-specific legal experts to draft precise policy language that minimizes ambiguity and litigation risk for the carrier.

In terms of regulatory impact, the evolving legal landscape concerning data breaches and cyber liability is increasingly intertwined with medical malpractice. Since a significant portion of modern medical records is digital, failure to adequately protect patient data during a breach can lead to subsequent patient claims, sometimes bundled with initial malpractice claims. This necessitates that carriers integrate robust cyber liability components or mandatory endorsements into standard medical professional liability policies, creating cross-disciplinary risk management challenges that influence capital allocation and reinsurance strategies for global insurers operating in jurisdictions with stringent privacy laws, such as GDPR in Europe or HIPAA in the US.

Geopolitical stability also marginally impacts this market, particularly concerning the medical tourism segment. Countries that successfully establish themselves as reliable and safe destinations for international medical procedures often see higher demand for standardized, internationally recognized medical malpractice coverage. Conversely, regions experiencing political or economic volatility present higher operational risks for international insurers, often leading to restricted capacity or prohibitively high premiums. The reliability of local judicial systems to fairly and consistently adjudicate complex medical claims remains a critical factor in determining market attractiveness and overall regional growth potential within the insurance sector.

The ongoing pressure from healthcare providers to contain operational costs often translates into resistance towards rising insurance premiums. This has fueled the growth of alternative risk transfer mechanisms, such as captive insurance companies and Risk Retention Groups (RRGs), particularly among large U.S. hospital systems. These self-insurance mechanisms allow large providers to retain certain risks, potentially lowering overall insurance expenses and gaining greater control over claims management and defense strategy. While this trend restrains the growth of the traditional commercial insurance segment, it highlights the innovation required by standard carriers to maintain competitiveness, often through offering excess liability policies and stop-loss coverage to these large captive groups.

Future opportunities in the Medical Malpractice Insurance Market will likely be characterized by further technological integration and global expansion into emerging markets. Insurers who successfully develop scalable, cloud-based underwriting and claims platforms capable of handling diverse regulatory and legal requirements across multiple jurisdictions will possess a significant competitive edge. Furthermore, the market is poised for disruption from innovative startups focused solely on niche risk areas, such as virtual care or wearable health technology liability, forcing traditional carriers to either acquire or rapidly innovate their own product portfolios to remain relevant in a rapidly digitized healthcare environment.

The comprehensive nature of professional liability within healthcare requires constant actuarial refinement. Claims severity, often measured by the average cost per claim, continues to be inflated by factors such as specialized medical inflation, advancements in surgical techniques leading to higher associated costs, and increased life expectancy resulting in prolonged care requirements for injured plaintiffs. This actuarial challenge mandates that carriers hold substantial reserves, influencing their solvency and market capacity. Regulatory bodies globally are scrutinizing these reserving practices closely, particularly after periods of high claim volatility, to ensure the long-term financial stability of the carriers serving this essential sector of the financial market.

The impact of standardized care protocols, often promoted by governmental and professional bodies, provides a double-edged sword for the insurance market. While adherence to defined standards can demonstrably reduce medical errors and subsequent claims, any deviation from these highly formalized guidelines provides a clearer basis for litigation. Insurers are increasingly utilizing these standards as benchmarks in their risk assessment models and claim defense strategies. The dissemination and uptake of these standardized protocols, especially in emerging markets, is a key indicator of improving risk profiles and future premium stability in those regions.

Finally, the ethical dimension of healthcare delivery, particularly relating to end-of-life care, genetic testing, and complex reproductive technologies, introduces novel legal and liability exposures that insurance products are only beginning to address. Claims arising from wrongful birth, failure to diagnose genetic conditions, or disputes over patient autonomy in technologically mediated care settings require deep legal expertise and collaboration with bioethicists. The ability of medical malpractice insurers to draft policies that clearly define the boundaries of professional responsibility in these ethically complex and legally ambiguous areas will be crucial for sustainable product development in the latter half of the forecast period.

The structured and data-informed analysis herein provides a robust foundation for strategic decision-making within the global Medical Malpractice Insurance Market, serving both existing market participants and potential entrants seeking insight into critical drivers, restraints, and future opportunities presented by technological and regulatory shifts.

Further analysis of the competitive landscape reveals that market share is heavily concentrated among the top 10 specialized carriers, often mutual companies or risk retention groups (RRGs) owned by physicians themselves, particularly in the North American market. These entities benefit from a deeper understanding of physician practice patterns and a mission focused on member retention and risk education rather than purely shareholder return. This structural factor creates a unique competitive environment where pricing is balanced with proactive loss control services, creating a high barrier to entry for generalized property and casualty insurers unless they acquire specialized expertise or partner effectively with medical societies.

The emerging role of parametric insurance concepts is also being explored within the malpractice domain, although primarily in catastrophic or large-scale institutional risk scenarios. Parametric insurance offers predefined payouts based on the occurrence of a measurable trigger event, rather than calculating the actual loss amount. While direct medical malpractice is claim-driven and resists simplification, elements like systemic public health failures (e.g., mass exposure incidents or widespread infectious disease outbreaks) could potentially utilize parametric triggers to provide rapid financial relief to healthcare systems, reducing the strain on traditional malpractice reserves.

Investment in human capital remains critical, specifically the retention and development of highly specialized legal defense teams. The outcome of medical malpractice litigation often hinges on the quality of the defense strategy and the ability to articulate complex medical concepts to a lay jury. Insurers that maintain robust, long-standing relationships with top medical defense law firms across various specialties and jurisdictions often demonstrate superior claims loss ratios, reinforcing the non-technical, human element as a core competitive differentiator even in an increasingly technology-driven market.

The regulatory divergence across regions, particularly concerning statutory caps on non-economic damages, significantly influences the profitability and pricing structure of the market. Jurisdictions that impose strict caps on pain and suffering awards tend to experience lower average premiums and less volatility in claims reserving, making them more attractive to insurers seeking stable returns. Conversely, markets without such tort reforms, like certain US states, require significantly higher reserves and are subject to greater cyclical price fluctuations, directly impacting consumer affordability and market accessibility for new healthcare providers.

Finally, the increasing focus on transparency in healthcare outcomes, often driven by public reporting mandates, indirectly influences the malpractice market. Public disclosure of error rates, infection rates, or procedural complications provides plaintiffs' attorneys with readily accessible data points to build negligence cases. While mandatory transparency improves quality of care, it simultaneously raises the potential evidentiary burden on healthcare providers, compelling them to maintain impeccable records and robust internal risk management programs, services that insurers are increasingly providing as value-added benefits alongside their policies to manage systemic risk.

These complex interactions between technology, regulation, specialized talent, and legal environments underscore the highly sophisticated nature of the Medical Malpractice Insurance Market and validate its steady, necessary growth trajectory within the global financial services sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager