Medical Monitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433410 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Medical Monitor Market Size

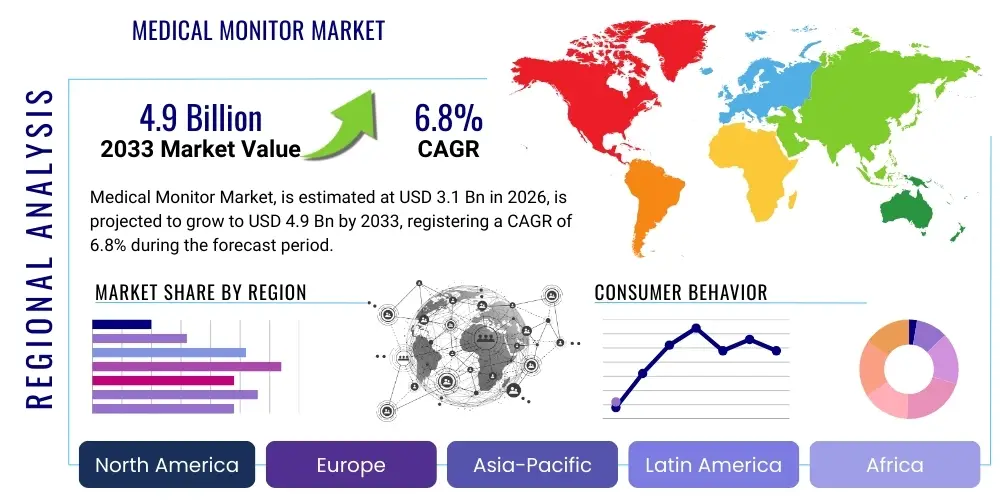

The Medical Monitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the increasing integration of advanced imaging technologies in healthcare settings, including high-resolution 4K and 8K displays essential for complex surgical procedures and diagnostic precision. The continuous global expansion of minimally invasive surgery (MIS) and the rising demand for efficient patient monitoring systems in critical care units further solidify the market's upward trend, emphasizing the critical role of superior visual feedback in modern medical practice.

Medical Monitor Market introduction

The Medical Monitor Market encompasses specialized display solutions designed for clinical environments, offering enhanced clarity, color accuracy, and sterilization capabilities crucial for diagnostic imaging, surgical visualization, and patient data monitoring. These devices range from large surgical displays used in operating rooms (ORs) to compact bedside monitors and high-resolution diagnostic review displays. The inherent need for stringent safety standards, durability, and precise visual performance differentiates these products significantly from standard commercial displays, positioning them as mission-critical components within the healthcare infrastructure. The core function of a medical monitor is to provide accurate and reliable visual information, directly impacting clinical decision-making and patient outcomes across various specialties.

Key applications of medical monitors span radiology, cardiology, endoscopy, ophthalmology, and intensive care units (ICUs). The development of Digital Imaging and Communications in Medicine (DICOM) Part 14 calibration standards ensures consistent gray scale representation, which is vital for accurate interpretation of X-rays, CT scans, and MRIs. Furthermore, the increasing complexity of robotic surgery demands ultra-high-definition (UHD) monitors that can handle real-time video feeds with minimal latency, providing surgeons with the necessary depth perception and detail to perform intricate procedures safely and effectively. The intrinsic benefits include improved diagnostic confidence, enhanced workflow efficiency, reduced procedural errors, and superior patient safety outcomes due to clearer visualization of anatomical structures and vital sign data.

Major driving factors fueling market expansion include the aging global population leading to higher incidence of chronic diseases requiring advanced diagnostics, significant investments in hybrid operating rooms (ORs) and specialized cath labs, and mandatory regulatory shifts towards digital record keeping and picture archiving and communication systems (PACS). The continuous advancement in display technologies, such as OLED and mini-LED integration, offering better contrast ratios and thinner profiles, also contributes to market dynamism. Additionally, the replacement cycle of older cathode ray tube (CRT) and lower-resolution LCD monitors with newer, high-brightness, medically certified displays provides a consistent revenue stream for market players globally.

Medical Monitor Market Executive Summary

The Medical Monitor Market exhibits strong business trends driven by technological convergence, emphasizing superior display resolution (4K and 8K) and seamless connectivity required for integrated OR systems and telemedicine platforms. Strategic trends involve major manufacturers focusing on developing modular monitoring solutions that can adapt to various clinical settings, from emergency departments to remote outpatient facilities. High acquisition costs associated with specialized diagnostic displays remain a constraint, yet the long-term clinical value and regulatory compliance requirements mandate the adoption of these premium products, sustaining high average selling prices. Furthermore, the market is shifting towards infection control-optimized designs, featuring sealed enclosures and anti-microbial coatings, reflecting post-pandemic awareness regarding hospital-acquired infections (HAIs).

Regionally, North America maintains market dominance due to high healthcare expenditure, early adoption of advanced medical technologies, and the strong presence of key technological innovators. However, the Asia Pacific (APAC) region is projected to register the fastest growth, propelled by rapidly improving healthcare infrastructure in countries like China and India, expanding medical tourism, and substantial government initiatives aimed at modernizing public hospitals. European markets exhibit mature growth, characterized by strict regulatory frameworks (MDR) that necessitate continuous product upgrades and replacement, particularly within high-income Western European countries committed to enhancing surgical imaging capabilities and patient monitoring standards.

Segment trends reveal that the diagnostic display segment, particularly those catering to high-precision fields like mammography and primary radiology reading, commands the highest market share due to critical reliance on accurate gray scale calibration and high luminance. The surgical display segment, driven by the expansion of minimally invasive and robotic surgery, is expected to exhibit the highest CAGR, focusing on large-format, ultra-HD, 3D visualization systems. By display color type, color displays dominate due to their necessity in surgical visualization and multi-modal monitoring, while high-contrast monochrome displays remain essential for specific diagnostic needs such as mammography, where subtle gray variations are critical for early disease detection and assessment.

AI Impact Analysis on Medical Monitor Market

Common user questions regarding AI's impact on medical monitors revolve primarily around how artificial intelligence will influence diagnostic workflows, the necessary display specifications needed to handle AI-generated data overlays, and whether AI will reduce the reliance on highly specialized diagnostic monitors. Users are particularly keen on understanding how AI integration, such as computer-aided diagnosis (CAD) systems or real-time predictive analytics, will change the visual interface, demanding monitors capable of rendering complex visualizations, probabilistic heatmaps, and annotated data streams simultaneously. The underlying concern is centered on ensuring that the display infrastructure can support these next-generation cognitive tools without introducing latency or compromising image integrity, thus requiring monitors with enhanced processing power and dedicated AI visualization modes for optimal interpretation.

The integration of AI, machine learning, and advanced computer vision technologies is fundamentally transforming the requirements for medical monitors, shifting them from simple display devices to integrated visualization platforms. AI algorithms are increasingly being used in real-time interpretation of diagnostic images, flagging critical areas, and providing automated measurements. This necessitates monitors with extremely high pixel density and dynamic contrast ratios to effectively display both the raw image data and the intricate graphical overlays generated by AI models, ensuring that the physician can validate the algorithm's suggestions accurately and swiftly. This synergy demands displays with enhanced calibration precision to ensure that AI-driven color coding or highlighting remains consistent across different viewing stations and institutions, thereby standardizing diagnostic review.

Furthermore, AI-driven patient monitoring systems generate massive streams of predictive health data, requiring clinical monitors to display complex time-series data, risk scores, and alerts in an easily digestible format within ICUs and operating theatres. The future iteration of medical monitors will likely incorporate edge computing capabilities or optimized interfaces specifically designed to receive and display AI output efficiently, reducing the computational load on centralized hospital servers and improving response times. This convergence ensures that the monitor acts as the final, critical interface for AI insights, necessitating advanced features like auto-dimming based on clinical environment and personalized viewing preferences based on user profiles and task type (e.g., diagnostic versus review).

- AI requires monitors to support real-time graphical overlays and annotations for CAD systems.

- Increased demand for 8K and high-luminance displays to visualize complex AI outputs (e.g., probabilistic maps).

- Integration of AI visualization modes to optimize display settings for algorithmic data interpretation.

- Medical monitors need enhanced connectivity to securely receive and display cloud-based or edge-processed AI insights.

- AI-driven patient monitoring necessitates multi-modal display capabilities for predictive vital sign analytics.

- Potential for AI algorithms to assist in display calibration and quality assurance processes automatically.

- Development of standardized communication protocols for transmitting AI-generated findings to surgical displays during procedures.

- Demand for displays with high refresh rates and minimal latency crucial for visualization in AI-assisted robotic surgery.

DRO & Impact Forces Of Medical Monitor Market

The Medical Monitor Market is significantly shaped by dynamic forces, where robust drivers meet inherent structural restraints, creating substantial opportunities for innovation. Key drivers include the global push for digitalization in healthcare, substantial growth in minimally invasive surgeries requiring specialized visualization, and the rising prevalence of chronic and lifestyle diseases necessitating continuous and accurate patient monitoring. These drivers collectively amplify the need for high-performance, regulatory-compliant display devices across the healthcare continuum. Conversely, market growth is restrained by the high initial investment cost associated with premium medical-grade monitors, particularly high-resolution diagnostic units, and the complex, time-consuming regulatory approval processes required by bodies like the FDA and EMA for new medical devices, which slow down product launch cycles.

The primary opportunities lie in the expansion of hybrid operating rooms and the increasing adoption of 3D and 4K/8K visualization technologies in surgical settings, which currently represent a high-growth, high-margin niche. Furthermore, the burgeoning field of telemedicine and remote patient monitoring (RPM) offers significant avenues for growth, driving demand for cost-effective, durable, and highly secure display solutions suitable for distributed healthcare models. The untapped potential in emerging economies, coupled with governmental mandates focusing on improving public health infrastructure, provides a long-term growth trajectory. The development of specialized OLED displays and flexible screen technology for medical wearables also presents new market possibilities.

The overall impact forces are strongly positive, favoring market expansion. Technological obsolescence in existing hospital equipment creates a persistent replacement demand, while stringent regulatory requirements concerning image quality ensure that only certified medical monitors, rather than cheaper commercial alternatives, are utilized for critical applications. This regulatory barrier acts as a competitive moat for established players. The confluence of rising patient volumes, technological sophistication in surgical interventions, and the shift towards integrated digital environments solidifies the essential role of high-quality medical monitors in modern healthcare delivery, ensuring steady demand growth despite economic fluctuations.

Segmentation Analysis

The Medical Monitor Market is extensively segmented based on display color type, panel size, resolution, application, and end-user, reflecting the diverse and highly specialized needs across different clinical areas. Understanding these segments is crucial for manufacturers to tailor their product offerings and marketing strategies effectively, addressing specific requirements such as high grayscale accuracy for radiology or wide color gamut and high brightness for surgical visualization. The fundamental divisions highlight the operational distinctions, differentiating between displays used primarily for interpretation (diagnostic) and those used for procedural viewing or vital sign visualization (clinical and surgical), each demanding unique technical specifications regarding luminance, contrast, and response time, as well as adherence to specific DICOM standards.

Analysis by application clearly delineates the most significant growth areas, with operating rooms and ICUs driving demand for large, robust, and highly integrated display systems, whereas diagnostic reading rooms focus primarily on color calibration stability and resolution. Within the end-user segmentation, hospitals and clinics remain the largest consumers, driven by centralized purchasing and the need for large installed bases, though specialty facilities and ambulatory surgical centers (ASCs) are emerging as significant, rapidly growing segments due to the shift towards outpatient care models. Panel size segmentation indicates a trend towards larger displays (27 inches and above) in professional diagnostic and surgical environments, while smaller formats (below 24 inches) remain prevalent in bedside monitoring and basic clinical review stations across the globe.

- By Display Color Type:

- Color Displays

- Monochrome Displays

- By Panel Size:

- Under 22 Inches

- 22 to 27 Inches

- Above 27 Inches

- By Application:

- Diagnostic Imaging (Radiology, Mammography)

- Surgical/Interventional Procedures (ORs, Cath Labs)

- Clinical Review/Patient Monitoring (ICUs, Emergency Wards)

- Others (Telemedicine, Medical Training)

- By Resolution:

- Up to Full HD (1920x1080)

- 4K UHD (3840x2160)

- 8K UHD and above

- By End-User:

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Academic and Research Institutes

Value Chain Analysis For Medical Monitor Market

The value chain for the Medical Monitor Market begins with the sourcing of specialized raw materials and core components, particularly high-performance display panels (LCD, OLED), complex backlighting systems, and advanced connectivity modules. Upstream analysis highlights the critical reliance on highly specialized component suppliers for achieving medical-grade specifications, especially concerning luminance uniformity, DICOM compliance controllers, and robust enclosures designed for disinfection. Key component manufacturers, often based in Asia, play a crucial role in setting baseline performance metrics and managing supply chain resilience. The design and manufacturing phase involve rigorous engineering to meet IEC 60601 electrical safety standards and ISO 13485 quality management systems, adding significant complexity and cost compared to commercial display manufacturing.

Midstream activities involve the primary medical device manufacturers who assemble, calibrate, and certify the final monitor products. Value is added here through proprietary calibration software, integrated processing capabilities, ergonomic design optimized for clinical use, and comprehensive quality assurance testing. Distribution channels are highly specialized, relying heavily on direct sales teams for major hospital contracts, or partnering with specialized medical device distributors (indirect channel) who possess deep clinical expertise and established relationships with hospital procurement managers and IT departments. The indirect distribution channel is particularly vital for reaching smaller clinics and regional diagnostic centers, offering installation support and localized service agreements essential for high-value medical equipment.

Downstream analysis focuses on installation, maintenance, and end-user support. Due to the critical nature of these devices in patient care, ongoing technical support, precise recalibration services, and adherence to replacement cycles are crucial. Direct sales often include bundled service agreements, ensuring ongoing revenue for manufacturers. The primary consumers (hospitals and diagnostic centers) demand long product lifecycles and comprehensive warranties. Efficient management of the service and repair lifecycle is a significant competitive differentiator in this market, impacting customer loyalty and long-term contract renewal rates for both direct and indirect suppliers serving the highly demanding healthcare sector.

Medical Monitor Market Potential Customers

The primary potential customers and end-users of medical monitors are large public and private hospital systems, including tertiary care centers and specialized clinics. These institutions require a vast array of monitor types, ranging from multiple diagnostic reading stations in radiology departments to dozens of bedside monitors in intensive care units (ICUs) and high-specification surgical displays in operating rooms (ORs). Their purchasing decisions are driven by factors such as total cost of ownership (TCO), standardization across different hospital campuses, regulatory compliance, and the ability of the vendor to provide scalable solutions and long-term service support crucial for maintaining accreditation standards and ensuring uninterrupted patient care flow.

A rapidly expanding customer segment includes Ambulatory Surgical Centers (ASCs) and specialty outpatient clinics focusing on specific procedures like endoscopy, ophthalmology, and cardiovascular interventions. ASCs, prioritizing efficiency and cost-effectiveness, seek high-quality, durable, yet sometimes more compact surgical visualization systems. These customers often value monitors that are easy to clean, highly reliable, and integrate seamlessly with existing procedural equipment, favoring vendors who offer bundled solutions including cameras, display systems, and recording capabilities. The increasing shift of complex procedures from inpatient to outpatient settings positions ASCs as a highly attractive growth opportunity for monitor manufacturers.

Furthermore, academic institutions and medical research laboratories represent a stable but specialized customer base. These entities require monitors for medical training, simulation labs, and sophisticated research imaging analysis, often demanding cutting-edge resolutions and specialized features, such as multi-source inputs and extreme color accuracy, for detailed anatomical study or development of new diagnostic techniques. Diagnostic imaging centers, dedicated solely to radiology, mammography, and ultrasound services, represent the most critical segment for high-end diagnostic monitors, where image quality and adherence to DICOM standards are absolute non-negotiables, driving demand for premium, monochrome and high-luminance color displays necessary for accurate clinical interpretation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barco, EIZO, FSN Medical Technologies, Sony Corporation, Quest International, Advantech, LG Electronics, NEC Display Solutions, STERIS, JVC Kenwood, Dell Technologies, Siemens Healthineers, Philips Healthcare, HP Development Company, GE Healthcare, Merivaara, Shenzhen Mindray Bio-Medical Electronics, Axiomtek, Touch Systems, Innolux Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Monitor Market Key Technology Landscape

The Medical Monitor Market is characterized by a rapid evolution in display technologies focusing intensely on image fidelity, operational robustness, and user interaction. The transition from standard LCD (Liquid Crystal Display) backlighting to advanced LED (Light Emitting Diode) backlights has significantly improved luminance uniformity and reduced power consumption, making monitors brighter and more energy efficient for demanding 24/7 hospital environments. A major technological leap involves the widespread adoption of 4K and, increasingly, 8K Ultra High Definition (UHD) resolution, particularly in surgical and interventional settings, where microscopic detail is essential. These UHD technologies facilitate superior visualization for complex procedures, especially robotic surgery, by providing extremely high pixel density and eliminating visual artifacts that could compromise surgical precision.

Another critical technology driver is the implementation of DICOM Part 14 calibration standards, which ensures precise grayscale rendering crucial for accurate diagnostic interpretation of radiological images (CT, MRI, X-ray). Advanced monitors now incorporate integrated calibration sensors and automation software that continuously monitor and adjust the display characteristics to maintain these stringent standards over the monitor’s lifespan, ensuring consistent image quality across different viewing locations and minimizing the need for manual intervention. Furthermore, the rising use of OLED (Organic Light-Emitting Diode) technology is starting to penetrate the high-end segment, offering perfect black levels and superior contrast ratios compared to traditional LCDs, though lifetime and burn-in remain areas of ongoing research and development in the clinical space.

Beyond the display panel itself, connectivity and user interface technologies are gaining prominence. Medical monitors are increasingly featuring robust, sealed, fan-less designs with protective glass (often incorporating projected capacitive touch technology) to allow for easy disinfection, meeting strict infection control protocols. Connectivity advancements include fiber optic input options for long-distance, high-bandwidth signal transmission required in integrated operating rooms, alongside enhanced cybersecurity features to protect sensitive patient data displayed on the screen. The industry is also seeing the proliferation of modular design concepts, allowing monitors to be easily upgraded or adapted with new input modules (e.g., specific SDI or DVI inputs) to ensure compatibility with a wide range of specialized medical imaging equipment.

Regional Highlights

- North America: This region holds the largest market share, driven by sophisticated healthcare infrastructure, high per capita healthcare spending, and rapid adoption of cutting-edge technologies like hybrid operating rooms and advanced robotic surgery systems. The stringent regulatory environment necessitates frequent replacement of non-compliant older equipment with certified medical-grade monitors, ensuring sustained high demand. The U.S., in particular, dominates due to the large presence of specialized diagnostic centers and leading technology manufacturers.

- Europe: Characterized by mature healthcare systems and strong commitments to quality patient care, Europe is a significant market. Growth is particularly robust in Western European countries (Germany, France, UK) driven by government funding for hospital modernization and adherence to strict EU Medical Device Regulations (MDR), which push for high-quality, traceable medical technology. Germany stands out due to its high concentration of large teaching hospitals and medical technology innovation hubs.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing regional market over the forecast period. This exponential growth is fueled by increasing government investments in developing healthcare infrastructure, expanding medical tourism sectors, and the massive population size driving demand for basic and advanced clinical monitoring solutions in emerging economies like China and India. Local manufacturing capabilities are also rapidly expanding, driving price competition in standard clinical review monitors.

- Latin America (LATAM): Growth in LATAM is steady, primarily concentrated in major economies such as Brazil and Mexico. Market expansion here is driven by the gradual modernization of public hospitals, increasing accessibility to private healthcare services, and the rising need for basic patient monitoring solutions. However, procurement decisions are often constrained by budget limitations and economic volatility, favoring high-value, durable products.

- Middle East and Africa (MEA): The MEA market shows potential, largely centered around the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) where significant oil revenues are being invested into building world-class specialized medical cities and highly modern hospitals, stimulating demand for premium surgical and diagnostic visualization systems. Africa remains a nascent market, primarily focused on essential clinical monitors for expanding primary care services and basic imaging needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Monitor Market.- Barco

- EIZO

- FSN Medical Technologies

- Sony Corporation

- Quest International

- Advantech

- LG Electronics

- NEC Display Solutions

- STERIS

- JVC Kenwood

- Dell Technologies

- Siemens Healthineers

- Philips Healthcare

- HP Development Company

- GE Healthcare

- Merivaara

- Shenzhen Mindray Bio-Medical Electronics

- Axiomtek

- Touch Systems

- Innolux Corporation

Frequently Asked Questions

Analyze common user questions about the Medical Monitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a medical monitor and a standard commercial display?

Medical monitors are specialized devices engineered to meet rigorous clinical standards, primarily IEC 60601 for electrical safety and DICOM Part 14 for grayscale accuracy and consistency. Unlike commercial displays, they feature sealed enclosures for liquid resistance and disinfection, utilize high-brightness panels with internal calibration sensors, and are certified for use in critical environments where image fidelity is non-negotiable for patient diagnosis and surgical visualization.

How is the adoption of 4K and 8K resolution impacting the Medical Monitor Market?

The adoption of 4K and 8K UHD resolutions is significantly driving the surgical and diagnostic segments by enabling visualization of extremely fine details necessary for robotic surgery, neurosurgery, and high-resolution diagnostic imaging like digital pathology. These higher resolutions improve clinical accuracy, reduce eye strain during long procedures, and support the integration of multiple imaging modalities onto a single large screen, thereby optimizing the workflow in modern hybrid operating rooms and advanced reading rooms globally.

Which application segment holds the largest share in the Medical Monitor Market?

The Diagnostic Imaging segment holds the largest revenue share in the Medical Monitor Market. This segment requires premium, highly regulated monitors (often high-luminance color or dedicated monochrome displays) used for primary reading of X-rays, CTs, MRIs, and mammograms. The critical reliance on precise DICOM calibration and stringent quality assurance standards ensures sustained demand for these high-value, specialty diagnostic devices necessary for accurate and reliable clinical decision-making across all major healthcare facilities.

What role does the DICOM standard play in the functionality of medical monitors?

The DICOM (Digital Imaging and Communications in Medicine) Part 14 standard is fundamental as it ensures that the grayscale appearance of medical images is consistent across all compliant display devices, regardless of the manufacturer or viewing location. This standard guarantees reliable reproduction of luminance levels, which is vital for the detection of subtle pathological features in images, preventing diagnostic errors caused by display variation and ensuring adherence to international healthcare quality regulations for image archival and communication systems.

What are the key drivers for market growth in the Asia Pacific (APAC) region?

Growth in the APAC region is primarily driven by substantial government investments aimed at rapidly expanding and modernizing public and private healthcare infrastructure, increasing disposable incomes leading to higher private healthcare utilization, and the rising prevalence of chronic diseases requiring advanced monitoring and diagnostic equipment. Favorable policy initiatives and the expansion of medical tourism further accelerate the demand for high-quality, certified medical monitors across major regional economies, including China, India, and Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager