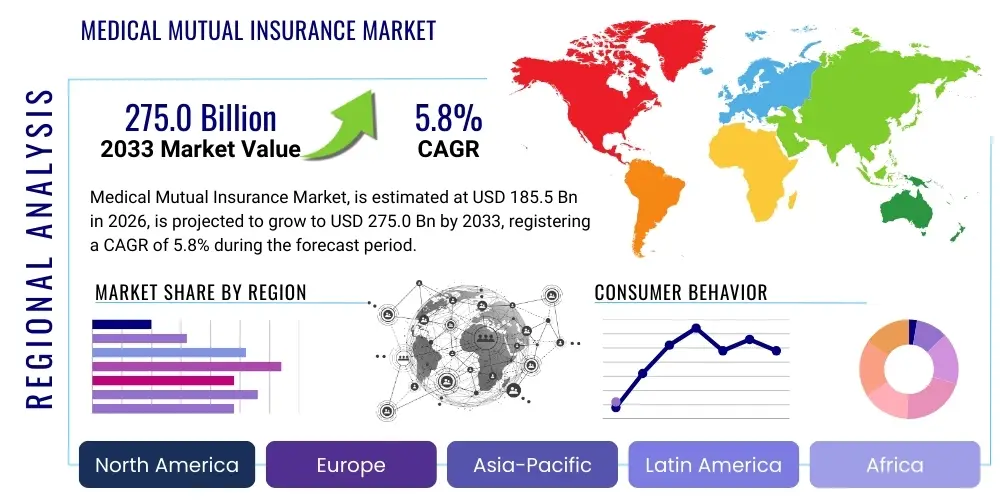

Medical Mutual Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434903 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Medical Mutual Insurance Market Size

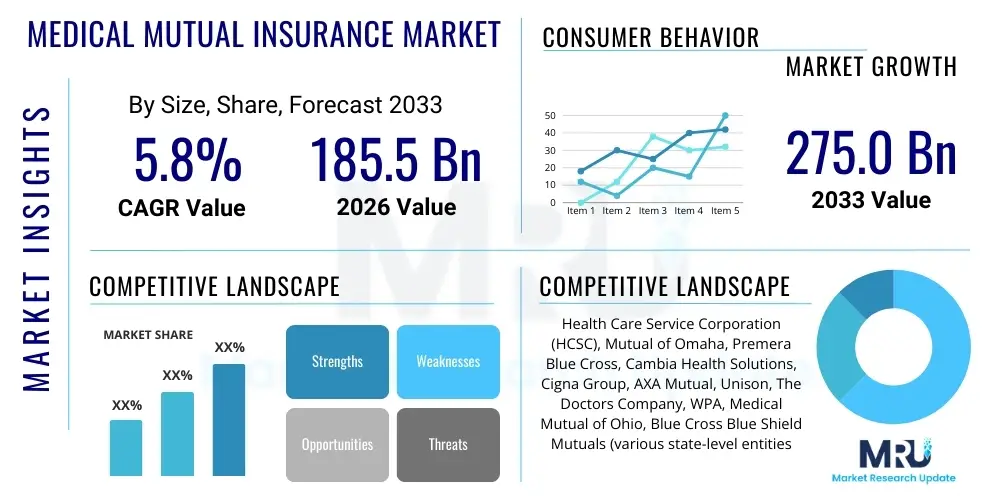

The Medical Mutual Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185.5 Billion in 2026 and is projected to reach USD 275.0 Billion by the end of the forecast period in 2033.

Medical Mutual Insurance Market introduction

The Medical Mutual Insurance Market encompasses organizations that are owned by their policyholders, operating not for profit, but primarily to provide affordable and comprehensive healthcare coverage. These mutual societies emphasize member benefits, stability, and high-quality services over shareholder returns, representing a fundamental alternative to investor-owned health insurance companies. This structure often fosters greater transparency and policyholder engagement, positioning mutual insurers as trusted providers in regions prioritizing collective welfare, particularly across Europe and specific segments of the North American market.

Products offered by medical mutuals range widely, covering basic hospitalization, specialized chronic care management, preventative health programs, and prescription drug benefits. Major applications span individual health coverage, supplementary insurance plans, and large-scale group benefits for employers, unions, and professional associations. The flexibility inherent in the mutual structure allows for the customization of plans tailored to specific demographic needs, such as coverage optimized for retirees or specialized groups facing unique occupational health risks.

Key benefits driving the market include lower administrative costs often translated into reduced premiums or enhanced benefits, greater investment in policyholder services, and strong long-term solvency supported by conservative financial management practices. Driving factors accelerating growth include the rising global demand for comprehensive and affordable healthcare coverage, increasing consumer disillusionment with purely profit-driven insurers, demographic shifts leading to an aging population requiring extensive care, and supportive regulatory frameworks in various jurisdictions that favor non-profit health organizations. The stability offered by mutual insurers is particularly attractive during periods of economic uncertainty, reinforcing their market position.

Medical Mutual Insurance Market Executive Summary

The Medical Mutual Insurance Market demonstrates robust growth driven by favorable legislative environments, a sustained demand for cost-effective healthcare solutions, and an increasing preference among consumers for transparent, policyholder-centric governance models. Business trends show a significant consolidation activity as smaller mutuals merge to achieve greater operational scale and capital reserves, enhancing their competitive posture against large commercial carriers. Furthermore, the market is undergoing intense digitalization, with mutuals investing heavily in robust IT infrastructures to improve claims processing efficiency, personalize member communication, and deploy advanced risk assessment models, moving away from legacy systems.

Regionally, Europe remains the bedrock of the mutual insurance movement, particularly in countries like Germany and France, where mutual organizations are deeply integrated into the national healthcare infrastructure and enjoy regulatory support. However, North America is experiencing renewed interest, especially in supplemental insurance products and specific market niches where mutuals can offer highly specialized coverage. The Asia Pacific (APAC) region is emerging as a critical growth frontier, driven by expanding middle classes, increased penetration of formal insurance products, and governments seeking stable partners for universal health coverage initiatives. This geographic diversification is crucial for mitigating regional regulatory risks and ensuring stable global expansion.

Segment trends indicate strong performance in the Group Coverage segment, fueled by employers recognizing the value of stable, low-churn mutual providers for employee benefits. Concurrently, the increasing complexity of chronic diseases and the push towards preventative care are driving demand for specialized plans that focus on long-term wellness management, often utilizing integrated care networks managed by the mutuals themselves. Technological integration, particularly in utilizing data analytics to tailor pricing and manage population health risk, is becoming a decisive factor across all segments, ensuring that mutuals remain financially viable while upholding their commitment to affordability and comprehensive care.

AI Impact Analysis on Medical Mutual Insurance Market

User inquiries regarding AI's impact on the Medical Mutual Insurance Market primarily revolve around balancing technological innovation with the foundational mutual principle of equitable member service and low-cost operations. Key themes include the ethical implications of using AI algorithms for underwriting and risk profiling—specifically, whether such tools could inadvertently lead to discriminatory practices or violate the non-profit ethos. Users also frequently ask how AI can reduce administrative overhead (e.g., claims processing automation) to benefit policyholders through lower premiums, rather than maximizing profits. Furthermore, there is significant interest in AI's role in proactive health management, such as using predictive analytics to identify high-risk members for early intervention, thereby enhancing the quality of care provided by the mutual organization.

AI adoption is profoundly restructuring operational efficiency within the mutual insurance domain, primarily through automating routine tasks and enhancing decision-making accuracy. Automated claims adjudication systems, powered by Natural Language Processing (NLP) and machine learning, significantly reduce processing times and decrease human error rates, directly contributing to lower operational expenses. This efficiency gain is critical for mutuals, whose competitive advantage often lies in their ability to offer affordable premiums by maintaining exceptionally lean operational structures compared to shareholder-driven competitors. The integration of robotic process automation (RPA) into back-office functions, such as policy renewal notifications and member correspondence management, further streamlines services.

Beyond administrative efficiencies, AI is transforming member engagement and risk stratification. Advanced predictive models analyze vast datasets—including claims history, electronic health records (where permissible), and lifestyle indicators—to forecast future healthcare utilization and costs for specific member cohorts. This capability allows medical mutuals to personalize outreach programs, offering targeted wellness interventions and preventative care guidance, thus improving health outcomes and managing overall population health costs more effectively. The careful deployment of AI, guided by stringent ethical frameworks ensuring algorithmic transparency and fairness, is crucial for maintaining the trust and solidarity that defines the mutual model.

- Enhanced efficiency in claims processing through machine learning and NLP-based automation.

- Improved risk stratification and personalized pricing models via predictive analytics, optimizing reserve allocation.

- Deployment of AI-powered chatbots and virtual assistants for 24/7 member support and inquiry handling.

- Utilization of sophisticated fraud detection algorithms to minimize losses and protect policyholder funds.

- Integration of AI tools for preventative health management, identifying members needing proactive clinical intervention.

- Challenges in data privacy compliance and ensuring algorithmic fairness (avoiding bias in risk assessment).

- Streamlining underwriting processes for specialized group plans, increasing speed and accuracy.

DRO & Impact Forces Of Medical Mutual Insurance Market

The dynamics of the Medical Mutual Insurance Market are shaped by a complex interplay of internal strengths and external pressures, summarized by Drivers (D), Restraints (R), and Opportunities (O). Key drivers include the inherent consumer trust in non-profit, member-owned organizations, particularly following periods of heightened scrutiny on commercial insurers' profitability. Additionally, regulatory frameworks in many European and specific North American markets actively support mutual insurance models, offering tax advantages and operational stability. Restraints often center on the challenges of limited capital access compared to publicly traded companies, which can hinder large-scale technology investments or rapid expansion into highly competitive or capital-intensive emerging markets. Furthermore, the inherent conservatism often associated with mutual governance structures can occasionally delay the adoption of disruptive innovations.

Opportunities for growth are substantial, particularly in penetrating the supplementary health insurance market, catering to aging populations that require specialized, long-term care products, and expanding into developing economies where state-backed health systems seek stable partners. The shift towards value-based care models globally aligns perfectly with the mutual ethos, allowing these organizations to leverage their established focus on preventative health and long-term member wellness rather than simply managing acute episodes. This strategic alignment creates significant avenues for partnerships with healthcare provider networks that also prioritize patient outcomes.

The market is further governed by critical Impact Forces, primarily revolving around regulatory changes and technological disruption. Legislative shifts towards universal healthcare or mandatory insurance coverage significantly expand the addressable market, benefiting stable mutual organizations. Conversely, sudden changes in capital reserve requirements or accounting standards can pose substantial challenges. Technological forces, particularly the integration of AI and big data analytics, serve as both an opportunity (for efficiency) and an impact force (requiring massive investment), compelling mutuals to modernize quickly or risk operational obsolescence against digitally native competitors. These forces necessitate continuous strategic evaluation and robust capital planning to maintain market relevance.

Segmentation Analysis

The Medical Mutual Insurance Market is robustly segmented based on the type of policyholder, the provider network utilized, and the operational model employed by the mutual organization. This granular segmentation is essential for understanding market structure and identifying niche growth areas, as the needs of individual policyholders differ significantly from those of large corporate groups. Furthermore, the varying regulatory landscapes across countries dictate which organizational models (pure mutual vs. hybrid) are prevalent and successful, particularly regarding access to capital and allowed investment strategies.

Segmentation by Type (Individual vs. Group) reflects critical differences in risk pooling and premium setting. The Group segment often presents lower administrative overhead per member and greater stability in risk profiles, making it highly attractive. Conversely, the Individual segment requires sophisticated underwriting and personalized customer service but offers high-margin potential for specialized, supplemental policies. Provider segmentation focuses on whether the mutual primarily contracts with large Hospital systems or smaller independent Clinics, influencing the geographic reach and specialty focus of the coverage offered. Understanding these segment dynamics is paramount for mutual insurers seeking optimal portfolio diversification and strategic regional deployment.

- By Type

- Individual Coverage

- Group Coverage (Employer-Sponsored, Association-Based)

- By Provider Network

- Hospital-Centric Networks

- Clinic and Primary Care Networks

- Specialty Care Networks (e.g., Dental, Vision)

- By Operational Model

- Pure Mutual Societies (100% policyholder-owned)

- Hybrid Models (Mutual Holding Companies)

- By Application

- Basic Health Insurance

- Supplemental/Top-Up Insurance

- Long-Term Care Insurance

Value Chain Analysis For Medical Mutual Insurance Market

The value chain for the Medical Mutual Insurance Market begins with upstream activities focused heavily on underwriting and risk assessment, where accurate data aggregation and actuarial science are paramount. Unlike commercial insurers who may optimize this stage solely for profit maximization, mutuals integrate ethical considerations and long-term member stability into their risk profiling processes. Key upstream inputs include vast datasets related to population health, regulatory compliance software, and sophisticated actuarial modeling platforms. The efficient management of this stage dictates the financial stability and premium affordability of the eventual policies offered.

Midstream activities involve core insurance operations: policy issuance, premium collection, and capital management. Given the mutual structure, capital deployment focuses primarily on prudent investment strategies designed to ensure long-term solvency and benefit policyholders, rather than aggressive, high-return strategies typical of publicly traded firms. Distribution channels form a critical part of this stage, increasingly relying on digital direct-to-consumer platforms, proprietary agents, and strategic partnerships with brokers who understand the unique value proposition of the mutual model. Effective digital channel management is crucial for maintaining low overheads and enhancing member accessibility.

Downstream analysis focuses on service delivery, specifically claims processing and policyholder support. This stage is highly influential in shaping member loyalty and retention. Direct channels, managed by the mutual itself, ensure personalized service aligned with the policyholder-centric mission. Indirect channels often involve relationships with third-party administrators (TPAs) for specialized services, though mutuals strive to retain core oversight. The value chain concludes with preventative health services and wellness programs, which are often integrated directly by mutuals to reduce future claims costs, creating a positive feedback loop of value for the membership.

Medical Mutual Insurance Market Potential Customers

Potential customers for the Medical Mutual Insurance Market are highly diverse but generally share a preference for financial stability, transparency, and a strong sense of community or collective benefit in their healthcare coverage. The primary end-users fall into three distinct categories: individuals seeking stable, non-profit-driven health coverage; employers looking for reliable, cost-effective group benefits; and specific demographic cohorts requiring tailored, long-term care solutions. The mutual model particularly appeals to consumers disillusioned with the perceived predatory pricing or complex policy structures of purely profit-driven insurers.

The largest segment of potential buyers includes mid-sized companies and large professional associations (e.g., teachers, civil servants, unionized workforces). These entities often seek insurance stability and predictable rate changes, attributes consistently delivered by mutual organizations focused on long-term viability rather than quarterly earnings. For these group buyers, the alignment of values—prioritizing employee welfare over shareholder profit—serves as a strong determinant in provider selection. The customization flexibility offered by mutuals for bespoke group plans further enhances their attractiveness in competitive labor markets.

Furthermore, an increasingly crucial customer segment is the aging population and retirees, particularly those requiring comprehensive supplemental insurance to fill gaps left by government programs. Mutual insurers are adept at designing tailored long-term care products and specialty coverages (e.g., chronic disease management) that emphasize ongoing care coordination and wellness maintenance. These customers prioritize the proven long-term financial security and ethical governance of mutual insurers, viewing them as partners in managing their health throughout retirement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Billion |

| Market Forecast in 2033 | USD 275.0 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Health Care Service Corporation (HCSC), Mutual of Omaha, Premera Blue Cross, Cambia Health Solutions, Cigna Group, AXA Mutual, Unison, The Doctors Company, WPA, Medical Mutual of Ohio, Blue Cross Blue Shield Mutuals (various state-level entities), AAA Health Mutual, HBF Health Limited, Nippon Life Insurance Company, and several large European Mutuals (e.g., MGEN, K&H). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Mutual Insurance Market Key Technology Landscape

The Medical Mutual Insurance Market is increasingly reliant on a sophisticated technology landscape focused on data security, operational efficiency, and enhanced member experience. Central to this landscape are robust core administration systems that integrate policy, billing, and claims modules, often replacing fragmented legacy platforms. Cloud computing adoption is accelerating, providing the scalability and resilience necessary to manage massive member databases and peak claims volumes while ensuring compliance with stringent healthcare data regulations like HIPAA and GDPR. Furthermore, investment in cybersecurity infrastructure is critical, given the highly sensitive nature of the Protected Health Information (PHI) managed by these mutuals, demanding continuous monitoring and advanced threat detection capabilities.

A crucial technological area involves the implementation of advanced data analytics and Business Intelligence (BI) tools. These technologies enable mutuals to move beyond basic claims history analysis to detailed risk modeling, personalized member engagement strategies, and precise actuarial forecasting. Predictive modeling, facilitated by machine learning algorithms, allows for proactive identification of health risks within the membership base, supporting the mutual’s mission to invest in preventative care. This technology shift aids in managing population health, which is a key differentiator for mutual organizations aiming to minimize long-term claim liabilities.

Finally, technology related to seamless member interface is a strategic priority. This includes developing user-friendly mobile applications and dedicated member portals that facilitate easy access to policy details, provider directories, and telemedicine services. The implementation of blockchain technology is also being explored cautiously, particularly for streamlining secure data exchange between the mutual and various healthcare providers, potentially enhancing the speed and transparency of claims settlement and reducing administrative friction across the complex healthcare ecosystem. The successful leveraging of these technologies is paramount for mutuals aiming to compete effectively on service quality and efficiency.

Regional Highlights

The global Medical Mutual Insurance Market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced heavily by regulatory structure, healthcare system design, and cultural affinity towards non-profit financial entities.

- Europe: The most established and mature market, characterized by deep integration of mutual societies (Mutuelles) into national health systems (especially France, Germany, and Belgium). Growth is stable, driven by supplemental insurance demand and strong regulatory protection. Focus is on maintaining market share against commercial insurers and investing in digital transformation to improve service delivery speed.

- North America: A highly competitive market where mutual insurers, often state-level Blue Cross Blue Shield entities, hold significant regional market power. The growth here is focused on group benefits, Medicare Advantage plans, and capitalizing on the desire for local, community-focused healthcare management. Market dynamism is heavily influenced by U.S. healthcare policy changes (e.g., Affordable Care Act reforms).

- Asia Pacific (APAC): The fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and governments increasing private insurance penetration to supplement strained public health systems (e.g., China, India, Southeast Asia). Mutual insurers are entering this market by emphasizing long-term stability and trustworthiness, appealing to populations newly accessing formal insurance products.

- Latin America (LATAM): Growth is moderate, constrained by economic volatility and varying regulatory maturity. Opportunities exist in specific urban centers and high-income segments seeking premium, reliable health coverage that transcends basic government provisions. Mutual structures are appealing due to the high sensitivity to corporate trust in the financial sector.

- Middle East and Africa (MEA): Emerging market where growth is concentrated in the Gulf Cooperation Council (GCC) countries driven by mandatory health insurance requirements for expatriates and citizens. Mutual models are less common but are gaining traction as regulators seek stable, policyholder-focused organizations for risk management in rapidly developing insurance sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Mutual Insurance Market.- Health Care Service Corporation (HCSC)

- Mutual of Omaha

- Premera Blue Cross

- Cambia Health Solutions

- Medical Mutual of Ohio

- Cigna Group (operating mutual subsidiaries)

- AXA Mutual (Global Mutual Operations)

- Unison (Ireland)

- The Doctors Company

- WPA (Western Provident Association)

- Blue Cross Blue Shield of Massachusetts

- Blue Shield of California

- HBF Health Limited (Australia)

- Nippon Life Insurance Company (Japan)

- MGEN (Mutuelle Générale de l'Éducation Nationale, France)

- Krankenkasse und Hilfskasse (K&H)

- Security Health Plan

- Highmark Inc.

- UnitedHealthcare (Non-profit segments)

- Kaiser Permanente (Mutual elements)

Frequently Asked Questions

Analyze common user questions about the Medical Mutual Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What fundamentally distinguishes medical mutual insurance companies from commercial, for-profit insurers?

Medical mutual insurance companies are owned entirely by their policyholders, not external shareholders. Their primary objective is maximizing member benefits and ensuring long-term affordability and solvency, meaning profits are reinvested into improving coverage, reducing premiums, or strengthening reserves, rather than being distributed to shareholders. This structure mandates transparency and accountability directly to the membership.

How does the mutual structure influence premium costs and overall affordability for policyholders?

The mutual structure often leads to greater affordability because the absence of shareholder demands removes the necessity to generate high quarterly profits. Operational efficiencies gained through lean management and focused investment in preventative care, coupled with lower administrative overheads compared to large commercial competitors, allow mutuals to typically offer more stable, competitively priced premiums over the long term, directly benefiting members.

What role does governance play in a medical mutual insurance organization?

Governance in a medical mutual is democratic and member-centric. Policyholders often have the right to vote on board members and key strategic decisions. This governance model ensures that organizational priorities remain aligned with the collective interests of the membership, emphasizing community health outcomes, service quality, and financial prudence, which builds high levels of consumer trust and loyalty.

Are medical mutual insurers constrained in their ability to adopt advanced technologies like AI and data analytics?

While historically, mutuals faced capital constraints compared to investor-backed firms, the current market shows strong investment in technology, driven by the need for operational efficiency and enhanced member services. Mutuals are actively adopting AI for claims processing and risk stratification, but they prioritize ethical deployment, ensuring algorithmic fairness and transparency to uphold their commitment to equitable member treatment.

Which geographical region represents the strongest growth opportunity for mutual health insurance currently?

The Asia Pacific (APAC) region currently represents the strongest growth opportunity. Driven by rapid economic expansion, increasing disposable incomes, and governments seeking stable partners to support expanding national health schemes, APAC populations are highly receptive to the stability and trust offered by the mutual insurance model as they transition into formal insurance markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager