Medical NIRF Imaging System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432603 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Medical NIRF Imaging System Market Size

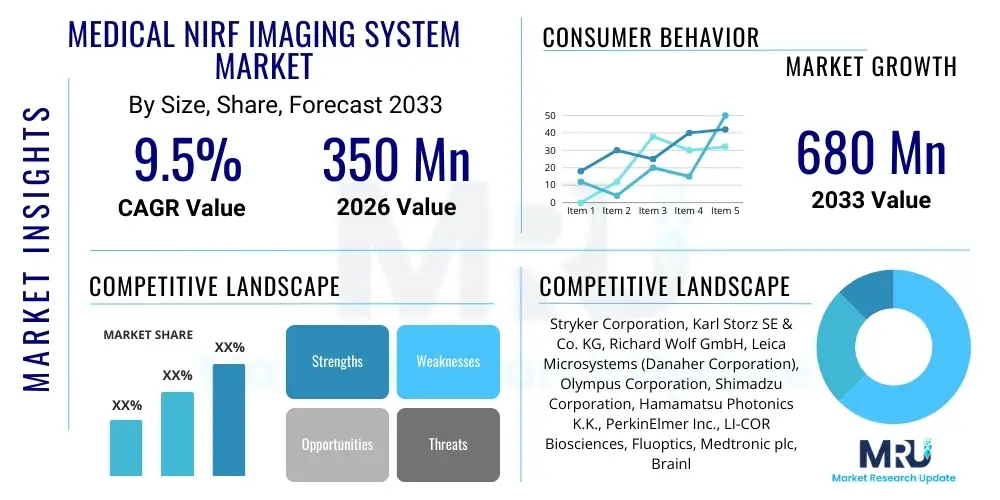

The Medical NIRF Imaging System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $680 Million USD by the end of the forecast period in 2033.

Medical NIRF Imaging System Market introduction

The Medical Near-Infrared Fluorescence (NIRF) Imaging System Market encompasses advanced diagnostic and surgical visualization technologies that utilize near-infrared light (typically 700 nm to 900 nm wavelength) in conjunction with specific fluorescent contrast agents, such as Indocyanine Green (ICG) or sophisticated molecular probes. These systems provide real-time, high-contrast visualization of physiological processes, anatomical structures, and cellular activity deep within tissues, overcoming the scattering and absorption limitations associated with visible light imaging. The core utility of NIRF imaging lies in its ability to enhance image-guided surgery (IGS), enabling surgeons to precisely delineate tumors, identify sentinel lymph nodes, assess tissue perfusion, and visualize vascular structures during minimally invasive procedures. This non-ionizing, highly sensitive modality is rapidly replacing or supplementing traditional visualization techniques across various surgical specialties, fundamentally improving procedural safety and therapeutic outcomes.

The increasing clinical adoption of NIRF imaging is strongly correlated with the global shift towards minimally invasive surgery (MIS) and the growing demand for precision medicine. These systems offer distinct advantages, including improved depth penetration, reduced background auto-fluorescence, and compatibility with existing surgical platforms, such as laparoscopes and robotic systems. Key applications span oncology, where they are crucial for tumor margin assessment; cardiovascular surgery, particularly for coronary artery bypass graft patency checks; and reconstructive surgery for flap viability assessment. The market growth is also propelled by continuous innovation in fluorescent probes, which are becoming more targeted and disease-specific, moving beyond generic perfusion indicators to agents that specifically bind to cancer biomarkers or inflammation markers, thereby increasing the specificity and diagnostic value of the imaging data.

Major driving factors influencing market dynamics include substantial investments in healthcare infrastructure in developing economies, favorable regulatory approvals for new fluorescence probes, and the robust clinical evidence supporting the use of NIRF technology in improving resection completeness and reducing reoperation rates. Furthermore, the integration of NIRF technology with artificial intelligence (AI) is beginning to unlock new capabilities, such as automated image analysis and predictive modeling, which further cement its role as an indispensable tool in modern surgical suites. As healthcare providers seek technologies that enhance efficiency and patient safety simultaneously, the demand for sophisticated NIRF imaging platforms is expected to witness accelerated growth over the forecast period.

- Product Description: Non-ionizing imaging systems utilizing near-infrared light and exogenous fluorescent probes for real-time visualization of anatomical and functional biological features.

- Major Applications: Oncology (tumor margin detection), Lymphatic Mapping, Cardiovascular Assessment (perfusion/patency), Plastic and Reconstructive Surgery.

- Benefits: Real-time visualization, increased depth penetration, improved surgical precision, reduced operative time, and lower reoperation rates.

- Driving factors: Rise in minimally invasive surgical procedures, development of novel targeted fluorescent agents, and increasing incidence of cancer requiring precise surgical intervention.

Medical NIRF Imaging System Market Executive Summary

The Medical NIRF Imaging System Market is undergoing rapid expansion, primarily driven by its indispensable role in enhancing surgical precision across critical specialties, notably oncology and complex reconstructive surgery. Market penetration is accelerating due to the successful integration of NIRF cameras into existing surgical modalities, including robotic platforms and specialized endoscopic systems, making the technology highly accessible. A central business trend involves strategic mergers and acquisitions, where large medical device companies acquire specialized NIRF innovators to consolidate technological expertise and expand patent portfolios related to both imaging hardware and proprietary fluorescent dyes. Furthermore, increasing clinical trials validating the utility of molecular imaging agents are paving the way for broader FDA and CE mark approvals, thereby expanding the addressable market.

Regionally, North America maintains the dominant market share, attributed to high healthcare expenditure, sophisticated technological adoption rates, and robust reimbursement policies that favor advanced image-guided procedures. Europe follows, propelled by strong academic research initiatives focusing on personalized medicine and early adoption in key surgical centers in countries like Germany and the UK. Asia Pacific (APAC), however, represents the fastest-growing region, fueled by rising awareness regarding early cancer detection, improving healthcare access, and significant government investments in upgrading surgical infrastructure, particularly in China, Japan, and India. The regional diversity in technological readiness necessitates customized market entry strategies focusing on either high-end integration (North America/Europe) or cost-effective, standalone systems (APAC).

In terms of segment trends, the Reagents segment, specifically comprising targeted fluorescent probes, is anticipated to exhibit a higher growth rate than the hardware segment, although the Systems segment currently holds the larger market share by value. This growth acceleration in reagents is due to the continuous discovery and commercialization of new molecular fluorophores designed to visualize specific biological pathways (e.g., folate receptors, PSMA), which are highly specific to certain disease states. Among end-users, Hospitals and Ambulatory Surgical Centers (ASCs) are the primary consumers, with ASCs increasingly investing in compact, portable NIRF systems to facilitate specialized same-day surgeries. Overall, the market remains highly competitive, demanding continuous innovation in resolution, integration capability, and the concurrent development of targeted contrast agents to maintain a competitive edge.

AI Impact Analysis on Medical NIRF Imaging System Market

Common user questions regarding AI's impact on Medical NIRF imaging often center on its ability to overcome human interpretation limitations, standardize surgical decision-making, and reduce procedural variability. Users frequently ask if AI can accurately segment tumors automatically, if it can predict tissue viability better than visual inspection, and how AI integration affects existing surgical workflows and regulatory compliance. There is significant interest in algorithms that can compensate for motion artifacts or poor illumination in real-time, thereby improving image quality. Users also seek clarity on the development timeline for AI-driven diagnostic tools that utilize complex NIRF spectral data to differentiate between benign and malignant tissues with higher specificity than current methods. The key expectation is that AI will transform NIRF imaging from a visual aid into a quantifiable, objective surgical guidance system, ensuring consistency and enhancing surgical education through automated feedback and assessment.

The primary influence of AI on the Medical NIRF Imaging System Market is manifested through enhanced image processing and automation. AI algorithms, particularly deep learning models, are being trained on vast datasets of fluorescence images to perform critical functions such as noise reduction, contrast enhancement, and artifact removal in real-time. This significantly improves the clarity and reliability of intraoperative feedback, especially when using complex, multi-spectral imaging approaches that generate voluminous data. Furthermore, AI is crucial in automating the complex task of quantifying fluorescence signals, moving beyond qualitative visual assessment to provide objective metrics, such as fluorescent intensity ratios, which are essential for precise tumor demarcation or measuring lymphatic drainage efficiency. This move toward quantitative fluorescence imaging (QFI) is critical for clinical validation and standardization.

Beyond image processing, AI is profoundly impacting surgical workflow and decision support. Machine learning models are being developed to instantly analyze NIRF images, identify structures of interest (like specific vasculature or metastatic lymph nodes), and provide overlay guidance directly onto the surgeon’s view. For instance, in oncology, AI can potentially delineate the positive tumor margins based on the uptake pattern of the fluorescent agent, minimizing the chances of incomplete resection. This level of automation not only speeds up the procedure but also standardizes the interpretation of subtle fluorescence signals, which are often operator-dependent. The application of predictive analytics using NIRF data can also help forecast therapeutic response or risk of complications, further embedding the technology into the core of precision surgical care.

- AI-driven real-time image enhancement and noise reduction, optimizing intraoperative visualization clarity.

- Automated quantitative fluorescence imaging (QFI) provides objective measurement of contrast agent uptake and distribution, standardizing analysis.

- Deep learning models for instantaneous tumor margin detection and precise lymph node identification, increasing resection completeness.

- Workflow integration through automated anatomical segmentation and overlay generation on 3D surgical maps.

- Development of predictive algorithms using spectral NIRF data to differentiate tissue types (e.g., malignant vs. benign) with high accuracy.

DRO & Impact Forces Of Medical NIRF Imaging System Market

The Medical NIRF Imaging System Market dynamics are governed by a robust confluence of technological drivers, structural restraints, and expanding clinical opportunities. A major driving force is the global paradigm shift toward minimally invasive and robotic surgical procedures, where high-definition, real-time visualization systems like NIRF are essential for navigating complex anatomy and confirming critical tissue boundaries without tactile feedback. Technological advancements in both the hardware (miniaturized cameras, multispectral systems) and the software (AI-driven image fusion) significantly enhance the utility and adoption rate. However, the market faces significant restraints, primarily related to the high initial capital expenditure associated with purchasing sophisticated imaging systems and the cost of proprietary fluorescent probes. Regulatory hurdles, particularly for novel, targeted molecular probes, also slow down commercialization and widespread clinical access, acting as a frictional force against rapid market expansion.

Opportunities in the market primarily reside in the development of next-generation, disease-specific fluorescent agents and the expansion of NIRF applications beyond oncology and vascular surgery into neurosurgery, gastroenterology, and infectious disease diagnostics. Companies investing in research and development to create cost-effective, portable, and disposable NIRF camera modules suitable for point-of-care settings or low-resource healthcare environments stand to gain substantial market share, particularly in emerging markets. Furthermore, strategic partnerships between pharmaceutical companies (developing probes) and medical device manufacturers (developing systems) are essential to create integrated diagnostic-therapeutic platforms, maximizing the clinical impact of both components. The ability to offer comprehensive training and long-term service contracts also provides a significant opportunity for market differentiation.

The impact forces influencing the trajectory of the market include the growing elderly population requiring complex surgical interventions, necessitating improved visualization tools to minimize complications. Increased funding for cancer research and therapeutic development globally accelerates the demand for accurate tumor detection and staging technologies. Socio-economic forces, such as improving global insurance coverage and the demonstrated health economic value of NIRF—by reducing hospital stays and reoperation rates—further drive procurement decisions. Competitive intensity remains high among established surgical visualization companies and emerging niche imaging firms, fostering rapid innovation cycles focused on enhancing image resolution, reducing system footprint, and improving spectral selectivity. Regulatory harmonization across major geographies will also act as a positive force, streamlining the approval process for global market entry.

Segmentation Analysis

The Medical NIRF Imaging System Market is meticulously segmented based on product type, application, and end-user, reflecting the diverse clinical needs and technological implementations across the healthcare spectrum. Segmentation by product distinguishes between the capital equipment (Systems) and the consumable agents (Reagents), which have fundamentally different market dynamics—systems represent high initial investment but long-term use, whereas reagents drive recurring revenue and innovation cycles. Application segmentation highlights the critical clinical areas benefiting most from real-time fluorescence guidance, with oncology currently dominating due to the immense benefit in visualizing tumor margins and lymph node status, followed closely by cardiovascular assessment.

Analyzing the market by end-user provides insight into procurement patterns and infrastructural requirements. Hospitals, particularly large university and teaching hospitals, remain the largest segment due to their capacity for complex surgeries, high patient volume, and dedicated budgets for advanced surgical technologies. However, the fastest growth is anticipated in Ambulatory Surgical Centers (ASCs), which are increasingly specializing in minimally invasive procedures and require compact, integrated, and efficient imaging solutions. Furthermore, the segmentation analysis confirms the essential role of specialized contrast agents; the development of targeted fluorescent molecular probes is the key differentiator in the overall market, shifting focus from generic ICG use to high-specificity visualization tools that address unmet clinical needs in disease diagnostics and staging.

The systematic breakdown of the market allows stakeholders to identify high-growth niches. For example, within the oncology segment, specific applications such as breast reconstruction (perfusion assessment) and colorectal cancer surgery (anastomotic perfusion) are exhibiting strong upward trends. Geographically, the segmentation of the market reveals that while mature markets focus on replacing older generation systems and integrating high-end robotic NIRF solutions, emerging markets prioritize fundamental standalone systems capable of utilizing widely available contrast agents like ICG for cost-effective surgical enhancement. This granular view is crucial for developing targeted marketing and sales strategies.

- By Product Type:

- Systems (Standalone, Integrated, Handheld)

- Reagents (Indocyanine Green (ICG), Targeted Molecular Probes, Other Proprietary Dyes)

- By Application:

- Oncology (Tumor Mapping, Margin Assessment, Sentinel Lymph Node Biopsy)

- Cardiovascular Surgery (Coronary Artery Bypass Graft (CABG) Patency, Perfusion Assessment)

- Gastrointestinal Surgery

- Plastic, Reconstructive, and Aesthetic Surgery (Flap Viability)

- Neurosurgery

- Other Applications

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories and Research Institutes

Value Chain Analysis For Medical NIRF Imaging System Market

The value chain for the Medical NIRF Imaging System Market is complex, involving the convergence of chemical synthesis, advanced optics manufacturing, software development, and specialized clinical distribution. Upstream analysis focuses on the supply of raw materials, primarily high-quality optical components (lenses, detectors, filters, light sources) and the specialty chemicals required for synthesizing fluorescent probes. Key suppliers include specialized materials science companies and pharmaceutical intermediates manufacturers. The intellectual property rights associated with novel fluorophore molecules and advanced NIR camera sensors represent significant value capture points upstream. Manufacturing often involves cleanroom assembly of highly sensitive components, demanding stringent quality control and regulatory adherence, particularly concerning ISO standards for medical devices.

Midstream activities are dominated by original equipment manufacturers (OEMs) who integrate these components into functional, clinical-grade imaging systems. This stage involves significant R&D investment in optics, software algorithms for real-time image processing, and ensuring seamless compatibility with existing surgical hardware (e.g., robotic arms or standard laparoscopes). Value is added through sophisticated system design, user interface development, and clinical validation studies. Distribution channels are critical downstream and typically involve a mix of direct sales forces for large, established markets, where technical support and ongoing training are crucial, and indirect distribution through specialized medical device distributors in smaller or emerging markets.

Downstream activities include installation, comprehensive training for surgical teams, and post-sale maintenance services. The role of direct and indirect channels varies significantly; direct sales (used by major players like Stryker or Olympus) allow for greater control over pricing, service quality, and relationship building with key opinion leaders, facilitating quicker adoption of new technology versions. Indirect channels, conversely, offer wider geographical reach and efficient logistics, particularly for reagent distribution. The end value delivered to the customer is the integrated system and consumable reagent bundle that enhances surgical outcomes and operational efficiency, thereby justifying the high capital investment. Strong linkages between manufacturers and key academic medical centers (KOLs) are vital for generating clinical evidence and accelerating market acceptance.

Medical NIRF Imaging System Market Potential Customers

The primary purchasers and users of Medical NIRF Imaging Systems are institutional healthcare providers specializing in complex surgical procedures that benefit immensely from real-time visualization, precision guidance, and perfusion assessment. The largest customer segment consists of large acute care hospitals and academic medical centers. These institutions manage diverse patient populations, perform a high volume of complex oncology, cardiovascular, and reconstructive surgeries, and possess the necessary capital budget and infrastructure to support advanced imaging equipment. Their purchasing decisions are often driven by the need to attract top surgical talent, enhance their reputation for high-quality outcomes, and integrate multi-modal imaging technologies into hybrid operating rooms.

A rapidly expanding customer base includes Ambulatory Surgical Centers (ASCs), which are increasingly performing specialized, high-reimbursement procedures, such as laparoscopic cholecystectomy, hernia repair, and specialized plastic surgery procedures. ASCs prioritize systems that are compact, easy to operate, quick to set up, and provide immediate economic returns by reducing procedure time and complications. Their demand is shifting towards portable or trolley-based NIRF systems rather than fully integrated robotic systems. The procurement cycle in ASCs is often shorter than in large hospitals, focusing heavily on proven cost-effectiveness and minimal maintenance requirements to maximize operational efficiency.

A third significant segment comprises specialized diagnostic laboratories, pathology labs, and major biomedical research institutes. These entities utilize high-resolution NIRF systems, often benchtop or microscope-integrated versions, for non-clinical applications such as preclinical drug development, pharmacological research, and molecular biology studies focused on disease mechanisms. While they do not purchase surgical systems, their demand for advanced, quantitative fluorescence imaging capability drives innovation in both hardware sensitivity and targeted probe development, influencing the overall market trajectory. Furthermore, collaborations between manufacturers and these research institutions are crucial for validating the next generation of fluorescent agents before clinical translation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $680 Million USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Karl Storz SE & Co. KG, Richard Wolf GmbH, Leica Microsystems (Danaher Corporation), Olympus Corporation, Shimadzu Corporation, Hamamatsu Photonics K.K., PerkinElmer Inc., LI-COR Biosciences, Fluoptics, Medtronic plc, Brainlab AG, Mizuho OSI, Quest Medical, Novadaq Technologies Inc. (Stryker subsidiary), Intuitive Surgical, Photon Control Inc., SurgiQuest, OnLume Surgical, Carl Zeiss Meditec AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical NIRF Imaging System Market Key Technology Landscape

The technological landscape of the Medical NIRF Imaging System Market is rapidly advancing, focusing primarily on enhancing image quality, improving integration capabilities, and developing highly sophisticated multi-spectral imaging approaches. Current systems leverage high-sensitivity CCD or CMOS sensors optimized for NIR wavelengths, coupled with precision optical filters and powerful solid-state light sources to minimize phototoxicity while maximizing fluorescence excitation. A significant technological shift involves the transition from simple ICG-based visualization to molecular imaging, requiring systems capable of distinguishing between multiple fluorophores simultaneously. This multi-spectral imaging capability allows surgeons to visualize various biological processes or structures independently in real-time, greatly increasing the information density and clinical utility derived from a single imaging session.

Integration and miniaturization represent another critical area of innovation. Manufacturers are increasingly focused on embedding NIRF functionality directly into existing surgical tools, such as robotic endoscopes and laparoscopic towers, rather than offering cumbersome standalone units. This integration ensures a streamlined surgical workflow and wider adoption, particularly in operating rooms where space is limited. Furthermore, advancements in software are crucial; modern NIRF systems utilize sophisticated algorithms for image fusion, overlaying real-time fluorescence data onto preoperative CT or MRI scans or white-light endoscopic views. This capability provides enhanced anatomical context, translating the invisible NIRF signal into actionable, context-aware surgical guidance, which is essential for complex procedures like neurosurgery or deep abdominal interventions.

The development of targeted fluorescent probes is inextricably linked to hardware innovation. Next-generation technology focuses on probes with optimized pharmacokinetic profiles, higher quantum yield, and improved specificity towards disease biomarkers (e.g., pH indicators, enzyme-activatable probes, or antibodies conjugated to fluorophores). Alongside chemical innovation, technological efforts are directed at creating benchtop or handheld devices that allow for quantitative fluorescence imaging (QFI). QFI aims to standardize measurements by compensating for tissue depth and light attenuation, moving the technology beyond qualitative visualization to a true quantitative diagnostic tool, crucial for predicting treatment response and ensuring reproducibility across different surgical settings. This push toward objectivity necessitates constant interplay between advanced hardware and sophisticated calibration algorithms.

Regional Highlights

- North America (United States, Canada, Mexico): Dominates the global market share due to high penetration rates of advanced surgical technologies, favorable reimbursement policies for image-guided procedures, and the presence of leading NIRF system manufacturers and early-stage molecular probe developers. The U.S. remains the central hub for clinical trials validating new NIRF agents and adopting high-end robotic integrated systems, driven by high healthcare expenditure and a strong focus on precision oncology.

- Europe (Germany, United Kingdom, France, Italy, Spain): Holds the second-largest market share, supported by robust governmental funding for cancer research and early clinical adoption in highly advanced healthcare systems like Germany. Key growth drivers include the integration of NIRF imaging into standard laparoscopic procedures and strong academic collaboration focusing on novel applications in vascular and gastrointestinal surgery. Regulatory pathways (EMA) for new fluorescent tracers are actively being streamlined, accelerating product access.

- Asia Pacific (APAC) (China, Japan, India, South Korea): Fastest-growing region, characterized by rapidly developing healthcare infrastructure, increasing awareness of advanced surgical techniques, and large patient pools, particularly for oncology. Japan and South Korea are leaders in technological adoption and R&D for next-generation systems, while China and India offer massive growth potential driven by increasing healthcare access and investments in high-tech hospitals. The focus here is often on cost-effective, high-quality systems that can utilize established dyes like ICG.

- Latin America (Brazil, Argentina, Colombia): Emerging market where adoption is gradual but steady, concentrated primarily in private hospital groups in major metropolitan centers. Market growth is stimulated by the introduction of localized manufacturing or distribution partnerships, focusing initially on standard ICG applications for critical surgeries, gradually expanding as regulatory and reimbursement frameworks mature.

- Middle East and Africa (MEA) (GCC Countries, South Africa): Growth is prominent in the Gulf Cooperation Council (GCC) states due to substantial government investment in world-class medical facilities and medical tourism initiatives. These regions prioritize sophisticated, high-end equipment procurement. South Africa leads the adoption in the African continent, focusing on essential applications such as trauma and critical care perfusion assessment, although overall market penetration remains lower than in other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical NIRF Imaging System Market.- Stryker Corporation

- Karl Storz SE & Co. KG

- Richard Wolf GmbH

- Leica Microsystems (Danaher Corporation)

- Olympus Corporation

- Shimadzu Corporation

- Hamamatsu Photonics K.K.

- PerkinElmer Inc.

- LI-COR Biosciences

- Fluoptics

- Medtronic plc

- Brainlab AG

- Mizuho OSI

- Quest Medical

- Novadaq Technologies Inc. (Stryker subsidiary)

- Intuitive Surgical, Inc.

- Photon Control Inc.

- SurgiQuest (ConMed Corporation)

- OnLume Surgical

- Carl Zeiss Meditec AG

Frequently Asked Questions

What are the primary clinical advantages of using NIRF imaging systems in surgery?

NIRF imaging systems provide surgeons with real-time, high-definition visualization of tissue perfusion, vascularity, and critical structures that are otherwise invisible under white light. Key advantages include precise identification of tumor margins in oncology, real-time assessment of graft patency in cardiovascular surgery, and confirmation of tissue viability in reconstructive procedures, leading to reduced complications and improved patient outcomes.

How do Indocyanine Green (ICG) and targeted molecular probes differ in NIRF applications?

ICG is a non-specific, widely used fluorescent dye primarily indicating perfusion and vessel blood flow, offering broad utility. Targeted molecular probes, conversely, are designed to bind specifically to disease biomarkers, such as cancer receptors or enzymes, offering superior specificity for detailed visualization of cellular or pathological processes, thereby enhancing diagnostic accuracy beyond general flow assessment.

Which application segment holds the largest market share for Medical NIRF Imaging Systems?

The Oncology application segment currently holds the largest market share. NIRF technology, particularly when used for sentinel lymph node mapping and definitive tumor margin assessment during complex cancer resections (such as breast, colorectal, and hepatobiliary cancers), provides critical guidance necessary for minimizing recurrence rates and maximizing the completeness of the surgical procedure.

What regulatory challenges impact the commercialization of new fluorescent probes?

Novel fluorescent probes, categorized as drugs or biological agents, face rigorous regulatory pathways (FDA, EMA) requiring extensive preclinical toxicology studies, multiple phases of human clinical trials, and strict manufacturing standards. Proving the safety, efficacy, and clinical superiority over existing agents, alongside system compatibility, constitutes the primary challenge, leading to lengthy and capital-intensive commercialization timelines.

How is Artificial Intelligence (AI) enhancing the functionality of modern NIRF imaging platforms?

AI integration is optimizing NIRF platforms by enabling real-time image correction (noise reduction, artifact removal), automating the quantitative analysis of fluorescence signals (Quantitative Fluorescence Imaging or QFI), and providing automated segmentation and overlay of critical structures onto surgical navigation screens, transforming qualitative visualization into objective, precise surgical guidance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager