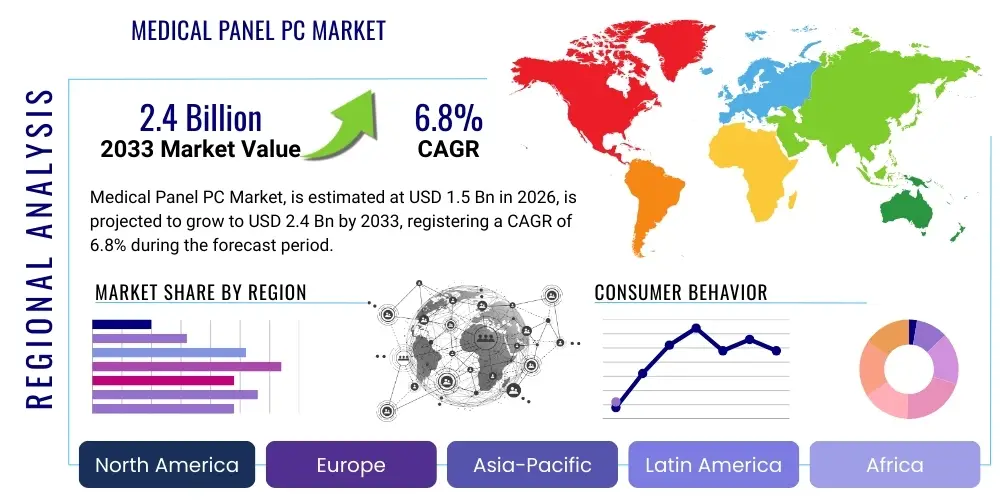

Medical Panel PC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438946 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Medical Panel PC Market Size

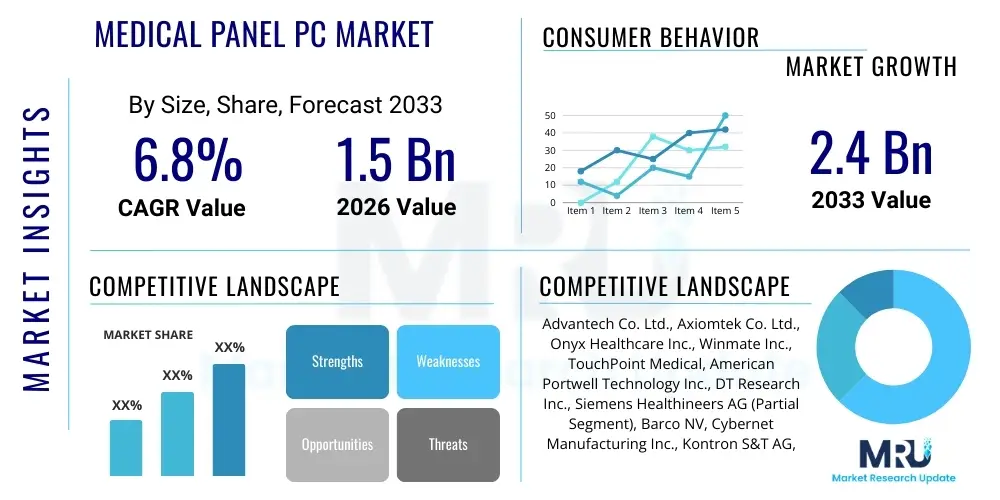

The Medical Panel PC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating digitalization of healthcare infrastructure globally, coupled with stringent regulatory requirements demanding certified, hygienic computing solutions within clinical environments.

Medical Panel PC Market introduction

Medical Panel PCs (MPPCs) represent specialized, highly reliable, and certified computer systems designed specifically for use in clinical settings, including operating rooms, intensive care units, diagnostic imaging centers, and patient monitoring stations. These devices are fundamentally characterized by features such as fanless operation, ensuring noise reduction and preventing the circulation of pathogens; high-brightness, medical-grade displays for accurate visualization of clinical data; and antimicrobial housing, crucial for infection control in sensitive areas. The primary functions of MPPCs revolve around facilitating Electronic Health Record (EHR) access, supporting Picture Archiving and Communication Systems (PACS) viewing, enabling real-time vital sign monitoring, and acting as central hubs for complex surgical navigation systems.

The core utility of MPPCs lies in their ability to offer robust computing power combined with stringent safety and hygiene standards mandated by regulatory bodies like the FDA and CE. Their seamless integration into hospital workflows streamlines administrative tasks, reduces errors associated with manual data entry, and significantly improves the speed and accuracy of clinical decision-making. Furthermore, the robust, durable design—often featuring IP65 rated dust and liquid protection—ensures long operational lifecycles despite constant cleaning with harsh disinfectants, making them economically viable investments for healthcare institutions striving for efficiency and compliance.

Major applications span across diverse healthcare segments, ranging from bedside infotainment systems providing patient education to high-performance surgical monitors necessary for minimally invasive procedures. The driving factors behind market expansion include the global shift towards value-based care, the rapid adoption of telehealth and remote patient monitoring solutions, and the increasing geriatric population requiring frequent medical interventions. These factors necessitate sophisticated, integrated computing platforms that can handle large volumes of sensitive patient data securely and reliably, positioning MPPCs as essential components of the modern smart hospital ecosystem.

Medical Panel PC Market Executive Summary

The Medical Panel PC market is currently defined by significant technological convergence, focusing predominantly on enhancing interoperability, computational speed, and ease of disinfection. Key business trends include the rising demand for higher resolution displays (4K and 8K) specifically for surgical and diagnostic imaging applications, as well as a strong market pivot towards highly modular designs that allow for easy upgrades and customization of peripherals, such as integrated RFID readers, biometric sensors, and specialized medical cameras. Furthermore, strategic partnerships between hardware manufacturers and Electronic Health Record (EHR) software providers are becoming critical, ensuring out-of-the-box compatibility and optimizing user experience within clinical workflows, thus driving enterprise adoption across large hospital networks seeking standardized IT solutions.

Regionally, the market dynamics are characterized by mature market saturation and replacement cycles in North America and Europe, which nonetheless remain the largest revenue contributors due to high healthcare expenditure and established infrastructure. Conversely, the Asia Pacific (APAC) region is demonstrating the most aggressive growth rate, driven by massive government investments in modernizing public healthcare facilities, expanding access to healthcare services in populous nations like China and India, and the burgeoning trend of medical tourism which necessitates world-class technological standards. This regional shift is compelling manufacturers to establish localized production and distribution capabilities to meet diverse regulatory and pricing requirements.

Segmentation trends highlight a pronounced shift in demand towards smaller, highly portable medical tablets for nursing and point-of-care applications, complementing the established segment of large fixed panel PCs used in operating theatres. By application, the demand for devices used in clinical documentation and CPOE (Computerized Physician Order Entry) systems continues to dominate, although growth is fastest in areas related to telemedicine and remote diagnostics. Financially, the market is witnessing increased competition leading to optimized pricing strategies, although the specialized nature of certification (e.g., IEC 60601-1) acts as a high barrier to entry, maintaining relatively healthy profit margins for established, specialized vendors capable of meeting rigorous medical compliance standards.

AI Impact Analysis on Medical Panel PC Market

User queries regarding the impact of Artificial Intelligence on the Medical Panel PC Market frequently center on computational requirements, data processing capacity at the edge, and how MPPCs will serve as reliable interfaces for AI-driven diagnostic tools. Common concerns relate to ensuring that the hardware is powerful enough to run sophisticated machine learning algorithms locally (Edge AI) for real-time applications, such as automated image analysis or predictive patient deterioration models, without relying entirely on cloud connectivity, which can introduce latency and security risks. Users also extensively inquire about the necessity for dedicated AI accelerators (like specialized GPUs or TPUs) within standard MPPC configurations and how system integration must evolve to maintain regulatory compliance (such as GDPR or HIPAA) when handling large, sensitive datasets processed by AI.

The integration of AI is transforming the functional requirements of Medical Panel PCs, shifting them from simple data visualization terminals to sophisticated diagnostic assistance platforms. This necessitates higher specifications concerning processing power, demanding the adoption of industrial-grade CPUs and often incorporating specialized AI modules to handle complex inference tasks required by applications such as computer-aided diagnosis (CAD) in radiology or complex pattern recognition in pathology. AI algorithms deployed on MPPCs enable clinicians to receive immediate, evidence-based suggestions, thereby improving throughput and reducing diagnostic timelines, particularly in high-volume settings like emergency departments or screening facilities, fundamentally enhancing the efficiency of clinical workflows and patient outcomes.

Furthermore, AI significantly influences the data capture and presentation capabilities of MPPCs. Advanced AI-powered interfaces are being developed to optimize the display of complex data streams—like multi-modal physiological parameters—making them easier for clinicians to interpret under high-stress conditions. The predictive maintenance capabilities derived from AI are also being applied internally, allowing MPPCs to self-monitor component health and predict potential hardware failures, thus maximizing uptime in critical care environments. This evolution mandates that MPPC manufacturers prioritize not just processing capability, but also robust network connectivity and enhanced security features designed to protect the integrity and privacy of the massive data volumes utilized by AI models, making compliance with global data privacy standards a fundamental design consideration.

- AI enhances diagnostic accuracy by integrating machine learning models directly into MPPC workflow interfaces.

- Increased demand for edge computing capabilities requires MPPCs with integrated AI accelerators (e.g., specialized GPUs).

- AI-driven predictive analytics utilize MPPCs for real-time monitoring of patient vital signs and anomaly detection in critical care.

- Improved data visualization techniques, powered by AI, help simplify complex patient data representation for faster clinical decisions.

- AI is instrumental in developing intelligent, context-aware user interfaces that adapt to the specific clinical environment or user role.

- Automated data processing and categorization streamline EHR updates and reduce the manual workload for nurses and physicians.

- MPPCs serve as secure collection points for training datasets used in hospital-specific AI model refinement.

DRO & Impact Forces Of Medical Panel PC Market

The Medical Panel PC Market is significantly propelled by the widespread global adoption of Electronic Health Records (EHR) and the corresponding mandate for hospitals to transition towards paperless operations, which fundamentally requires reliable, accessible computing terminals at every point of care. Furthermore, the increasing prevalence of chronic diseases and the aging population demographic are driving the need for sophisticated continuous patient monitoring systems, especially in intensive care units and long-term care facilities, where certified, fanless MPPCs are indispensable for preventing cross-contamination and ensuring 24/7 reliability. These forces are amplified by technological advancements leading to lighter, more powerful, and cost-effective processors, making high-performance medical computing more accessible to a broader range of healthcare providers, from large tertiary hospitals to small community clinics, reinforcing the market’s steady demand profile.

However, the market expansion faces notable restraints, primarily stemming from the significant initial capital investment required for procurement and installation of certified medical-grade hardware, which can be prohibitive for smaller healthcare facilities or those in developing regions. Crucially, the stringent and complex regulatory certification process (such as IEC 60601-1 compliance for electrical safety and EMC testing) imposes high development costs and long time-to-market cycles for manufacturers, acting as a natural barrier to entry. Another operational challenge involves the integration complexities arising from the need for MPPCs to interoperate seamlessly with diverse legacy hospital information systems (HIS) and proprietary medical devices, often requiring extensive customization and ongoing IT support, which increases the total cost of ownership (TCO).

Significant opportunities lie in the accelerating trend of Telemedicine and Remote Patient Monitoring (RPM), which is creating a massive demand for medical-grade tablets and compact panel PCs that can function reliably outside traditional hospital walls, in home healthcare settings or remote clinics. Furthermore, the integration of Internet of Medical Things (IoMT) components into MPPCs—allowing them to act as central data gateways for wearables and medical sensors—represents a key area for future innovation and market capture, offering enhanced real-time data aggregation and analysis capabilities. The ongoing transition towards smart operating rooms (ORs) and digital surgical environments, requiring high-resolution, multi-display support and advanced streaming capabilities, also opens niche, high-value opportunities for vendors specializing in high-performance, ruggedized MPPC solutions capable of managing simultaneous inputs from multiple imaging modalities during complex surgical procedures, demanding specialized processing power and reliability.

Segmentation Analysis

The Medical Panel PC market is meticulously segmented across various dimensions to reflect the specialized nature of clinical requirements and technological diversity. The primary segmentation metrics focus on key functional characteristics such as screen size, which dictates application suitability; processor type, governing computational intensity for tasks like imaging or simple documentation; and the specific end-use environment, ranging from mobile cart integration to fixed wall-mount installations in sterile environments. Understanding these segmentations is critical for manufacturers to tailor product specifications—such as antimicrobial rating, brightness levels, and peripheral connectivity options—to meet the precise operational demands and compliance standards of different healthcare verticals, ensuring optimized product positioning and penetration across the complex healthcare ecosystem.

Segmentation by application remains highly significant, distinguishing between the high-specification demands of surgical theaters, which require extreme clarity and multi-display functionality, and the high-volume, standard requirements for clinical documentation and nursing stations. Devices designed for diagnostic imaging (PACS/RIS viewing) command premium pricing due to the necessity for high-color accuracy and calibrated displays, whereas patient infotainment systems prioritize durability and intuitive touch interfaces. This differentiation drives distinct research and development priorities, separating vendors focused on performance in critical care from those prioritizing ruggedness and cost-effectiveness in general ward use.

Finally, end-user segmentation provides crucial insight into procurement patterns and budget cycles, classifying buyers into large hospital networks, specialized clinics (e.g., dental, oncology), diagnostic laboratories, and ambulatory surgical centers. The purchasing criteria vary significantly; large integrated delivery networks (IDNs) often prioritize scalability, centralized management features, and standardization across hundreds of units, while smaller clinics focus more on ease of use, space constraints, and initial affordability. Recognizing these distinct purchasing behaviors allows vendors to develop targeted sales strategies, offering comprehensive service contracts and customized financing options appropriate for the budgetary constraints and operational scale of each defined customer category within the healthcare landscape.

- By Screen Size:

- Up to 15 Inches (Primarily for bedside monitoring and mobile cart applications)

- 15 Inches to 21 Inches (Standard size for nursing stations and general ward documentation)

- Above 21 Inches (Critical care, surgical displays, and advanced diagnostic viewing)

- By Application:

- Clinical Documentation & EMR Access

- Operating Room (OR) & Surgical Navigation

- Diagnostic Imaging (PACS/RIS Workstations)

- Telehealth & Remote Monitoring

- Patient Monitoring & ICU

- Patient Infotainment Systems

- By End User:

- Hospitals & Clinics (Largest segment)

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers & Laboratories

- Pharmaceutical & Biotechnology Companies (R&D use)

- By Operating System:

- Windows-Based MPPCs

- Linux-Based MPPCs

- Android-Based MPPCs (Primarily for tablets and infotainment)

- By Deployment Type:

- Fixed Mount (Wall-mount or desktop)

- Mobile Cart Integration (Powered and non-powered carts)

Value Chain Analysis For Medical Panel PC Market

The value chain for Medical Panel PCs begins with the upstream segment, which is dominated by the sourcing of highly specialized and standardized electronic components. This phase includes the procurement of industrial-grade processors (CPUs and sometimes GPUs), durable memory modules, and specialized medical-grade displays (often requiring high brightness and viewing angles). A crucial upstream component is the medical power supply unit (PSU), which must adhere to stringent IEC 60601-1 safety standards for leakage current, ensuring patient and operator safety, distinguishing it significantly from commercial IT hardware supply chains. Key suppliers in this phase include global semiconductor giants and specialized enclosure manufacturers providing antimicrobial plastics and robust, fanless chassis designs, where quality control and long-term component availability are paramount concerns for vendors.

The midstream phase involves the core manufacturing, assembly, and rigorous testing process. Manufacturers specializing in MPPCs focus heavily on achieving medical certifications and ensuring compliance with quality management systems like ISO 13485. This stage involves complex integration of software (often customized OS images optimized for clinical use) and hardware, followed by comprehensive verification testing for electromagnetic compatibility (EMC), ingress protection (IP ratings), and thermal management (especially critical for fanless designs). Successful players maintain agile production capabilities to customize peripheral integrations (e.g., smart card readers, specialized imaging inputs) while optimizing bill of materials (BOM) costs without compromising the reliability required for critical care environments, focusing on lean manufacturing principles tailored for low-volume, high-specification production runs.

The downstream segment, focusing on distribution and post-sales support, utilizes both direct and indirect channels. Direct sales are preferred for large hospital networks and government contracts, allowing manufacturers to offer bespoke configurations, negotiate bulk pricing, and provide specialized integration services tailored to specific hospital IT infrastructures. Indirect distribution, leveraging specialized medical technology distributors and value-added resellers (VARs), is vital for reaching smaller clinics, regional markets, and international customers who require localized technical support, financing, and installation expertise. Crucially, the long-term profitability of MPPCs is heavily reliant on robust after-sales support, including extended warranties, easy access to spare parts, and managed services for software updates and security patching, due to the high regulatory requirements governing device longevity in clinical use.

Medical Panel PC Market Potential Customers

The primary and largest segment of end-users for Medical Panel PCs comprises large integrated Hospital Networks and Academic Medical Centers. These institutions require robust, scalable IT infrastructure to manage vast patient populations, complex diagnostic workflows, and high-stakes surgical procedures. Procurement decisions in this sector are driven by total cost of ownership (TCO), standardization capabilities across multiple facilities, compatibility with leading EHR systems (such as Epic or Cerner), and the vendor's ability to provide extensive, enterprise-level technical support and security compliance assurance. MPPCs are deployed ubiquitously within these settings, from the nursing station (clinical documentation) to the operating theater (surgical display and navigation), necessitating a diverse portfolio of screen sizes and processing specifications tailored to various departmental needs, making volume purchasers the most critical revenue source for market vendors.

Another significant customer segment includes Specialized Clinics, such as oncology centers, cardiology groups, and diagnostic imaging centers. These users often require high-performance MPPCs for niche applications, particularly those involving high-resolution viewing of complex images like MRI, CT scans, and digital pathology slides, demanding superior display calibration and graphical processing capabilities compared to general ward use devices. For these specialized environments, the focus shifts slightly from sheer volume to technical fidelity and the ability to integrate seamlessly with proprietary diagnostic equipment and modality workstations. Ambulatory Surgical Centers (ASCs) also fall into this category, prioritizing space-saving, reliable computing solutions that can withstand frequent sterilization while supporting real-time patient monitoring during procedures, often requiring compact, VESA-mountable designs.

Emerging customer categories driving future market demand include long-term care facilities, home healthcare providers, and pharmaceutical or biotechnology research labs. Long-term care centers are increasingly adopting MPPCs for resident monitoring and medication administration, favoring durable, easy-to-use systems. Home healthcare utilizes medical tablets and highly mobile panel PCs for remote consultations and data collection, driven by the expansion of telemedicine services. Pharmaceutical companies use MPPCs in controlled laboratory settings for data collection, analysis, and clinical trial management, where the ruggedized, industrial, and hygienic specifications of MPPCs are preferred over standard commercial computers, ensuring data integrity and compliance within stringent cleanroom environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Advantech Co. Ltd., Axiomtek Co. Ltd., Onyx Healthcare Inc., Winmate Inc., TouchPoint Medical, American Portwell Technology Inc., DT Research Inc., Siemens Healthineers AG (Partial Segment), Barco NV, Cybernet Manufacturing Inc., Kontron S&T AG, Arbor Technology Corp., TEK-SYSTEMS, HP Development Company, Dell Technologies Inc. (Specialized offerings), Avalue Technology Inc., Datalux Corporation, Medical Computers International (MCI), ADLINK Technology Inc., Getac Technology Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Panel PC Market Key Technology Landscape

The core technological foundation of the Medical Panel PC market revolves around achieving a balance between high performance, stringent electrical safety, and superior hygiene. The fanless design is the single most critical technological feature, utilizing passive cooling techniques such as advanced heatsinks and specialized thermal piping to dissipate heat without relying on internal fans, thereby eliminating the risk of spreading airborne contaminants and ensuring silent operation crucial for patient comfort. This design imperative is intrinsically linked to the demand for certified antimicrobial enclosures, often made from specialized plastic polymers or aluminum alloys treated with silver ions or similar agents, which actively inhibit bacterial growth, significantly reducing the surface transmission risk of hospital-acquired infections (HAIs), making the material science an essential part of the MPPC technology profile.

Regarding user interface technology, Projective Capacitive (P-Cap) touchscreens have become the industry standard, replacing older resistive technologies. P-Cap offers high sensitivity, multi-touch capabilities compatible with gloved hands (a necessity in clinical environments), and a completely flat, seamless surface that is easy to clean and sanitize without compromising the integrity of the IP rating. Furthermore, the display technology itself is crucial, with emphasis placed on high-brightness panels with wide viewing angles, full HD or higher resolution capabilities, and sophisticated calibration software to meet DICOM Part 14 standards for grayscale accuracy, particularly vital for diagnostic imaging workstations to ensure reliable visualization of subtle clinical details.

Connectivity and integration technologies are also rapidly advancing. Modern MPPCs are designed to be powerful IoMT gateways, incorporating multiple specialized I/O ports (such as isolated serial ports) to connect safely and reliably with diverse medical devices (e.g., infusion pumps, ventilators, physiological monitors) without introducing ground loop issues or electrical interference. Furthermore, advanced wireless connectivity, including medical-grade Wi-Fi 6 and increasingly 5G capabilities, supports high-bandwidth data transfer necessary for streaming high-definition video during surgical procedures and facilitating robust telehealth services. Security features, including integrated TPM modules, biometric authentication (fingerprint or RFID/NFC readers), and instant login capabilities, complete the technological package, ensuring quick, secure access to protected health information (PHI) in compliance with stringent regulatory frameworks like HIPAA and GDPR.

Regional Highlights

- North America (United States and Canada): This region dominates the global Medical Panel PC market in terms of market value and technological maturity. The adoption is driven by high healthcare expenditure, established regulatory mandates promoting EHR adoption, and the widespread presence of leading integrated delivery networks (IDNs). Demand is strong for high-end, specialized products such as surgical displays and sophisticated AI-ready workstations. The focus is increasingly on replacement cycles for existing IT infrastructure and the deployment of advanced mobile cart solutions across acute care settings.

- Europe (Germany, UK, France, Italy, Spain): Europe is characterized by strict regulatory oversight, particularly concerning data privacy (GDPR) and medical device certification (MDR/IVDR). This necessitates manufacturers to adhere to high standards of compliance and security, favoring specialized vendors. Germany, with its robust manufacturing base and emphasis on high-quality medical equipment, serves as a significant market driver. The regional growth is propelled by public sector modernization initiatives aimed at integrating regional healthcare systems and expanding remote diagnostic capabilities.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development and substantial government investments aimed at improving public health access and modernizing hospitals. While Japan and South Korea represent technologically mature markets focusing on cutting-edge integration (e.g., smart hospitals), emerging economies like China and India are driving volume demand, emphasizing cost-effectiveness, durability, and scalability in their procurement of general ward and telehealth MPPCs.

- Latin America (LATAM): The LATAM region presents significant market opportunities, primarily in major urban centers and private healthcare systems seeking to bridge the technology gap with developed economies. Market adoption is constrained by fluctuating economic conditions and decentralized healthcare spending. However, the increasing focus on digitalizing patient records and implementing basic point-of-care documentation systems provides a foundational demand for entry-level and mid-range Medical Panel PCs, often procured through international tenders and focused development bank financing.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, driven by ambitious state-led healthcare diversification projects and the construction of numerous world-class private hospitals. These projects prioritize best-in-class technology, creating niche demand for premium surgical and diagnostic MPPCs. The African sub-region, while characterized by lower adoption, shows potential in specialized clinics and mobile health initiatives where ruggedized and battery-powered medical tablets are essential for outreach programs and remote data collection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Panel PC Market.- Advantech Co. Ltd.

- Axiomtek Co. Ltd.

- Onyx Healthcare Inc.

- Winmate Inc.

- TouchPoint Medical

- American Portwell Technology Inc.

- DT Research Inc.

- Siemens Healthineers AG (Through specialized embedded systems)

- Barco NV

- Cybernet Manufacturing Inc.

- Kontron S&T AG

- Arbor Technology Corp.

- TEK-SYSTEMS

- HP Development Company (Specialized medical computing line)

- Dell Technologies Inc. (Healthcare division)

- Avalue Technology Inc.

- Datalux Corporation

- Medical Computers International (MCI)

- ADLINK Technology Inc.

- Getac Technology Corporation (Focusing on rugged medical tablets)

Frequently Asked Questions

Analyze common user questions about the Medical Panel PC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a standard commercial PC and a Medical Panel PC?

The critical difference lies in certification and design features essential for patient safety and infection control. Medical Panel PCs (MPPCs) adhere to IEC 60601-1 electrical safety standards, ensuring minimal leakage current, crucial for patient proximity. They feature fanless, antimicrobial housings (often IP-rated) for easy disinfection and prevention of airborne pathogen spread, features absent in standard commercial units.

How significant is the IEC 60601-1 certification for Medical Panel PCs?

The IEC 60601-1 certification is mandatory for any electrical equipment used in close proximity to patients, representing the baseline for market entry and regulatory compliance. This standard dictates strict requirements for electrical safety, fire protection, mechanical robustness, and electromagnetic compatibility (EMC), ensuring the device operates safely in a complex clinical environment without posing risks to patients or interfering with life-support equipment.

What are the key drivers of demand for Medical Panel PCs in the telehealth sector?

Telehealth drives demand for highly mobile, battery-powered medical tablets and compact panel PCs that maintain medical-grade certification. These devices facilitate secure, remote patient monitoring and consultation, requiring integrated cameras, robust wireless connectivity, and antimicrobial surfaces suitable for non-traditional clinical settings like home care or remote clinics, accelerating their adoption in distributed healthcare models.

What role does fanless design play in critical care environments?

Fanless design is paramount in critical care units (ICU, ORs). It ensures silent operation, which is vital for reducing noise stress on patients, and prevents the internal circulation of air, which eliminates the potential for the device to draw in or expel contaminants and pathogens, directly supporting hospital infection control protocols and maximizing device uptime due to fewer moving parts.

How is Edge AI affecting the required specifications for new Medical Panel PCs?

Edge AI necessitates a significant increase in onboard processing power, demanding higher-end CPUs and, increasingly, dedicated AI accelerators (GPUs/TPUs) integrated into MPPCs. This enables real-time execution of complex diagnostic algorithms locally, reducing reliance on cloud latency, enhancing data security, and ensuring immediate clinical decision support directly at the point of care for applications like real-time image analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Medical Panel PC Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (< 15 Inch, 15-17 Inch, 17-21 Inch, 21-24 Inch), By Application (Hospitals, Clinics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- All-in-one medical panel PC Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (24-inch, 22-inch, 21-inch, 17-inch, 15-inch, Others), By Application (Hospital, Thermes Marins, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager