Medical Pleated Masks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432088 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Medical Pleated Masks Market Size

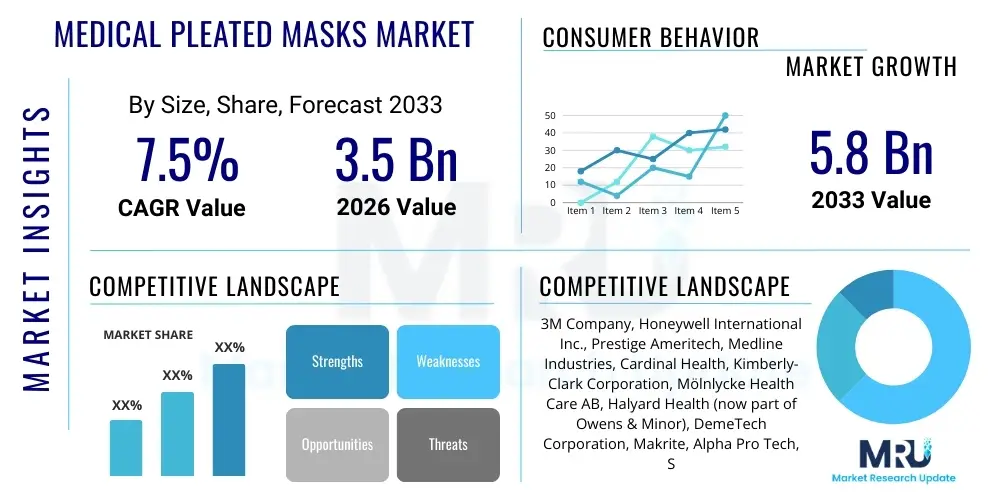

The Medical Pleated Masks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

Medical Pleated Masks Market introduction

The Medical Pleated Masks Market encompasses the global production and distribution of fluid-resistant, disposable face masks primarily used in healthcare settings to protect patients and healthcare workers from the transfer of microorganisms, body fluids, and particulate matter. These masks are characterized by their multi-layered, non-woven fabric construction, typically featuring three or more layers, and distinctive pleated design that allows for expanded coverage over the nose and mouth. The foundational material usually involves polypropylene, with key layers dedicated to filtration efficiency, liquid resistance, and comfort, ensuring compliance with international regulatory standards such as ASTM F2100 or EN 14683, which categorize masks based on Bacterial Filtration Efficiency (BFE) and fluid resistance.

The primary applications of medical pleated masks span across surgical procedures, patient care, isolation procedures, and general hospital environments where contamination control is critical. These masks are indispensable tools in infection prevention protocols, serving as a physical barrier against airborne particulates and droplets generated during coughing, sneezing, or medical interventions. Benefits include high breathability, ease of disposal, and effective barrier protection against pathogens, making them standard consumable items in hospitals, clinics, dental offices, and long-term care facilities globally. The demand for these masks is intricately linked to demographic shifts, increasing awareness regarding healthcare-associated infections (HAIs), and mandated use during epidemics or pandemics.

Driving factors for sustained market growth include the continuously increasing volume of surgical procedures performed worldwide, particularly in emerging economies, coupled with stringent regulatory environments emphasizing worker safety and infection control standards. Furthermore, the global recognition of the importance of personal protective equipment (PPE), cemented by recent public health crises, has established a baseline demand significantly higher than pre-2020 levels. Investment in automated manufacturing technologies and diversification of supply chains also contribute positively to market expansion and stability, ensuring widespread availability across diverse healthcare ecosystems.

Medical Pleated Masks Market Executive Summary

The Medical Pleated Masks Market is experiencing robust expansion driven by structural shifts in global healthcare spending, heightened awareness of infectious disease transmission, and sustained governmental procurement programs aimed at bolstering national strategic reserves of PPE. Business trends indicate a strong focus on advanced material science, particularly the development of meltblown fabrics that offer enhanced filtration efficiency without compromising breathability, leading to premium product offerings. Furthermore, market consolidation is observed as major global players leverage economies of scale and vertical integration to optimize cost structures and control the quality of critical components like filter media, while smaller, regional manufacturers focus on serving specialized local regulatory requirements or specific niche healthcare segments such as dentistry or ambulatory surgery centers.

Regional trends reveal significant differentiation in growth rates and market maturity. North America and Europe, characterized by highly established healthcare infrastructure and stringent regulatory standards (e.g., FDA approval, CE marking), represent high-value markets demanding Type IIR and Level 3 fluid resistance masks. Conversely, the Asia Pacific (APAC) region, particularly China and India, is projected to exhibit the highest CAGR due to rapid expansion of healthcare facilities, increasing disposable income, rising health consciousness among the populace, and the massive domestic manufacturing capacity, which serves both regional and global export needs. Latin America, the Middle East, and Africa (MEA) are emerging markets, heavily reliant on import flows but showing accelerating domestic demand influenced by infrastructure investments and ongoing public health initiatives targeting infectious disease control.

Segmentation trends highlight the dominance of the surgical mask segment, attributed to the high volume of operations requiring sterile environment maintenance. However, the procedure mask segment is rapidly gaining traction due to extensive use in non-surgical patient interactions, visitor screening, and outpatient settings. By material, the non-woven polypropylene segment remains paramount, though there is growing research into biodegradable and sustainable material alternatives in response to environmental concerns. Key strategic initiatives across all segments focus on optimizing filtration layer performance, improving ear loop attachment methods for comfort, and packaging solutions designed for aseptic dispensing in clinical settings, ensuring market resilience and continuous product evolution.

AI Impact Analysis on Medical Pleated Masks Market

Common inquiries from users regarding AI's influence on the Medical Pleated Masks Market often revolve around operational efficiency, quality control, and predictive supply chain management, rather than direct product design modification, as the mask structure is fundamentally straightforward. Key themes include how AI can optimize highly automated mask production lines (e.g., fault detection, material usage minimization), whether AI-driven demand forecasting can prevent future PPE shortages, and the role of machine learning in quality assurance, specifically identifying minuscule defects in meltblown filtration layers or sealing integrity. Users also express interest in AI's application for real-time monitoring of global disease outbreaks to preemptively adjust manufacturing volumes, anticipating regional spikes in demand for basic barrier protection devices.

- AI-driven optimization of manufacturing lines: Machine vision systems utilize AI to monitor production in real-time, detecting defects (e.g., improper pleating, flawed ear loop attachment, material thinning) at high speeds, significantly reducing waste and ensuring product uniformity, crucial for Level 3 surgical masks.

- Predictive demand modeling: Machine learning algorithms analyze historical sales data, geopolitical events, disease outbreak metrics, and public health policies to forecast localized and global demand spikes, allowing manufacturers to strategically allocate raw materials and adjust production schedules, mitigating potential supply chain disruptions.

- Automated quality control (AQC): AI facilitates the rigorous testing of BFE and PFE (Particulate Filtration Efficiency) by analyzing complex microscopic imagery of filter media structure, ensuring consistent compliance with mandated filtration standards (e.g., ASTM Level 1, 2, or 3).

- Supply chain resilience and risk assessment: AI models track raw material availability (polypropylene, elastic bands, nose clips) globally, identifying bottlenecks, assessing vendor reliability scores, and suggesting alternative sourcing strategies to maintain continuous high-volume production.

- Enhanced inventory management: Implementation of AI-powered systems in distribution centers optimizes storage, picking efficiency, and shelf-life management of disposable masks, particularly important for maintaining large national stockpiles effectively.

- Regulatory compliance documentation: AI tools assist in automating the complex documentation required for global market access, generating compliance reports based on manufacturing batches and material traceability data, accelerating time-to-market.

DRO & Impact Forces Of Medical Pleated Masks Market

The Medical Pleated Masks Market is significantly influenced by a dynamic interplay of factors. Key drivers include mandatory regulatory requirements for PPE use in healthcare settings, heightened global awareness and infrastructural preparedness following pandemics, and the continuous increase in surgical procedure volumes globally. Restraints primarily involve raw material price volatility, particularly for specialty meltblown non-woven polypropylene, environmental concerns regarding massive disposable plastic waste generated by these products, and intense price competition, particularly from large-scale manufacturers in Asia, which can squeeze profit margins for smaller producers. Opportunities emerge through innovation in sustainable materials, expansion into non-traditional high-risk occupational settings, and the development of customized masks offering superior comfort and fit (e.g., pediatric or specialized surgical designs). The overall impact forces suggest a high degree of market resilience and sustained growth potential, although margins remain sensitive to operational efficiency and external supply chain shocks.

Drivers are exerting the strongest positive impact. The established legal and clinical mandate for using fluid-resistant masks during invasive medical procedures provides a stable base demand that is independent of public health crises. Additionally, rising global health expenditure, especially in developing economies focusing on modernizing their hospitals and clinics, ensures sustained capital investment in essential medical consumables. The increasing prevalence of chronic diseases requiring surgical intervention further solidifies this demand. Moreover, post-pandemic policies implemented by national governments to maintain robust PPE stockpiles act as a persistent, high-volume demand driver, stabilizing the market against cyclical downturns observed in routine consumables.

However, restraining factors necessitate careful strategic planning. The high reliance on polypropylene, a petrochemical derivative, subjects manufacturing costs to global oil price fluctuations. Furthermore, the environmental backlash against disposable medical plastics is forcing manufacturers to invest heavily in R&D for compostable or recyclable mask alternatives, which currently face challenges in matching the filtration efficiency and fluid resistance of standard materials. The intense global competition, fueled by excess capacity built up during 2020-2022, leads to fierce pricing wars, especially in bulk procurement contracts, requiring producers to focus heavily on automation and vertical integration to maintain cost competitiveness. Addressing these restraints through innovation and supply chain diversification is critical for long-term profitable market participation.

Opportunities for market players are vast, particularly in product diversification and technological advancements. The development of next-generation pleated masks incorporating antimicrobial coatings or novel filter technologies that offer both high efficiency and significantly reduced breathing resistance will capture premium segments. Expanding the application scope beyond traditional hospitals to sectors like pharmaceutical manufacturing cleanrooms, specialized hazardous waste management, and high-density public transport systems in high-risk zones represents an untapped potential. Furthermore, optimizing packaging to reduce material usage, ensure sterility integrity, and facilitate ease of dispensing in clinical environments are crucial aspects of seizing market advantage and contributing to sustainable operational goals.

Segmentation Analysis

The Medical Pleated Masks Market is systematically segmented based on product type, application, material, and distribution channel, providing a granular view of market dynamics and consumer preferences within the healthcare sector. Product segmentation differentiates between procedural, surgical, and specialized masks (e.g., dental masks), reflecting varying levels of filtration, fluid resistance, and regulatory compliance required for specific clinical settings. Application segmentation focuses on where the masks are utilized, predominantly hospitals and clinics, ambulatory surgical centers, and diagnostic laboratories. Material segmentation highlights the critical role of non-woven fabrics, primarily polypropylene, used for the outer, middle (filter), and inner layers. Finally, distribution channels delineate the primary routes to market, including direct sales to large healthcare systems and indirect channels through distributors and e-commerce platforms, offering different strategic points of engagement for manufacturers.

Analyzing these segments reveals important trends. The surgical mask segment, requiring the highest level of BFE (typically 98% or greater) and fluid resistance (ASTM Level 3 or EN Type IIR), commands premium pricing and stable demand due to non-negotiable regulatory requirements for operating room environments. Conversely, procedural masks (ASTM Level 1 or 2) dominate volume sales, driven by their widespread use in general patient interactions, outpatient services, and non-invasive procedures. The continuous push for better infection control practices in all clinical environments supports steady growth across all product types. Geographically, segmentation analysis demonstrates a shift in manufacturing concentration towards Asia Pacific, although high-quality, specialty mask production remains strong in North America and Europe to cater to specific regulatory and quality demands.

Understanding the interplay between material science and application is crucial. Manufacturers are increasingly differentiating their products by optimizing the meltblown layer for maximum efficiency and minimum pressure drop (breathability), targeting specific clinical user comfort requirements during long shifts. The segmentation by distribution channel is vital for market strategy, with large multinational distributors playing a crucial role in managing complex cross-border logistics and providing specialized inventory management services to major hospital networks, while direct procurement gains prominence for governmental reserve purchases and large Group Purchasing Organizations (GPOs).

- By Product Type:

- Surgical Masks (Type IIR, ASTM Level 3)

- Procedure Masks (Type I, II, ASTM Level 1, 2)

- Specialty Masks (e.g., N95 compatible pleated, Anti-fog dental masks)

- By Material:

- Non-woven Polypropylene (Spunbond, Meltblown, and Composites)

- Cellulose and Pulp Composites

- Other Polymers and Materials (e.g., Biodegradable alternatives)

- By Application/End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories and Research Institutions

- Pharmaceutical and Biotechnology Industries (Cleanrooms)

- Dental Clinics

- By Distribution Channel:

- Direct Sales (Government tenders, Large GPOs)

- Indirect Sales

- Medical Distributors

- E-commerce and Online Retail

- Retail Pharmacies

Value Chain Analysis For Medical Pleated Masks Market

The value chain for the Medical Pleated Masks Market is characterized by a high degree of integration for major players, stretching from the sourcing of petrochemical raw materials to the final distribution to healthcare providers. The upstream analysis centers on the procurement and conversion of chemical feedstocks (like propylene) into non-woven fabrics, primarily spunbond and specialized meltblown materials, which constitute the core functional elements of the mask. Quality control at this initial stage is paramount, as the integrity of the meltblown filter media directly determines the mask's Bacterial Filtration Efficiency (BFE) and fluid resistance, making key suppliers of high-grade non-woven fabric crucial gatekeepers in the chain. Manufacturing involves high-speed, automated assembly lines that pleat the material, insert the nose piece, ultrasonically weld the layers, and attach the ear loops, emphasizing capital expenditure on precision automation.

Midstream activities involve the complex process of high-volume, automated production, followed by sterilization (if required for certain surgical applications), and specialized packaging to maintain sterility and ease of dispensing in clinical environments. This stage is highly sensitive to regulatory oversight, requiring adherence to ISO 13485 standards and specific regional medical device regulations (e.g., FDA Class II requirements). Cost efficiency and output volume are the primary competitive factors in the midstream. Downstream analysis focuses on logistics and distribution. Due to the high-volume, low-cost nature of the product, efficient warehousing, bulk packaging, and synchronized regional distribution networks are essential to minimize transportation costs and ensure rapid response capability during demand surges.

Distribution channels in this market are bifurcated into direct and indirect routes. Direct sales are often utilized for massive government tenders, large-scale health system procurement through Group Purchasing Organizations (GPOs), and direct contractual relationships with major hospital networks, offering better pricing control and deeper integration with customer inventory systems. Indirect distribution relies heavily on global and regional medical device distributors who manage the complex logistics, regulatory compliance across multiple jurisdictions, and inventory for smaller clinics, dental offices, and pharmacies. The rapid expansion of specialized B2B e-commerce platforms has also created a hybrid distribution model, allowing smaller players to reach healthcare consumers more efficiently, provided they can navigate the stringent quality assurance checks required by purchasers.

Medical Pleated Masks Market Potential Customers

The primary end-users and buyers of medical pleated masks are entities within the established healthcare infrastructure, ranging from large governmental institutions to individual private practitioners. Hospitals—including teaching, community, and specialty hospitals—represent the single largest customer segment, driven by the constant need for masks across operating rooms, emergency departments, inpatient care units, and outpatient clinics. These institutions typically purchase through centralized procurement departments or via GPOs to leverage bulk pricing, demanding masks that meet high-level standards (ASTM Level 2 or 3) and require specialized packaging formats (e.g., sterile bulk packs or dispensers for high-traffic areas).

Ambulatory Surgical Centers (ASCs) and specialized clinics, such as dental and aesthetic surgery practices, constitute another significant customer base. While these settings might purchase smaller volumes individually compared to major hospitals, the aggregate demand is substantial and characterized by a focus on specific features like anti-fog properties (for dental masks) and enhanced comfort for staff performing lengthy, intricate procedures. These buyers often prioritize reliable delivery through established regional distributors and seek products that easily integrate into their existing infection control protocols, valuing consistency and compliance documentation.

Beyond traditional patient care, governmental public health agencies and national strategic stockpile organizations are crucial buyers. Their purchasing is episodic but massive, focused on ensuring national resilience against future public health crises, requiring long shelf-life products and demanding rapid scalability from suppliers. Furthermore, diagnostic laboratories, research institutions handling biohazards, and pharmaceutical manufacturing cleanrooms also represent vital niche customer segments, requiring masks that often meet dual standards—both medical fluid resistance and particulate control necessary for controlled environments, demonstrating the broad, indispensable nature of medical pleated masks across the clinical and scientific sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Honeywell International Inc., Prestige Ameritech, Medline Industries, Cardinal Health, Kimberly-Clark Corporation, Mölnlycke Health Care AB, Halyard Health (now part of Owens & Minor), DemeTech Corporation, Makrite, Alpha Pro Tech, Shanghai Dasheng Health Products Manufacture Co., Ltd., Winner Medical Group Co., Ltd., Shandong Lihua Medical Technology Co., Ltd., Jiangsu Dasheng Group Co., Ltd., Zhende Medical Co., Ltd., Crosstex International Inc., Gerson Company, R&R Medical Inc., Cantel Medical Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Pleated Masks Market Key Technology Landscape

The technological landscape of the Medical Pleated Masks Market is dominated by advancements in non-woven fabric engineering and high-speed automated manufacturing processes. The cornerstone technology is the meltblown technique, which produces ultra-fine microfibers essential for creating the filtration layer with high Bacterial Filtration Efficiency (BFE) and low pressure drop (improving breathability). Continuous innovation focuses on bi-component fibers and advanced electrostatic charging methods applied to the meltblown layer to enhance particulate capture without increasing material thickness or density. This optimization is crucial for achieving ASTM Level 3 standards while maximizing user comfort during extended wear. Furthermore, ultrasonic welding technology is uniformly adopted across the industry for assembling the multiple layers, securing the nose piece, and attaching ear loops, replacing traditional stitching to ensure sterile integrity and efficiency in high-volume production environments.

In addition to core material science, secondary technologies are enhancing product functionality and manufacturability. Automation and robotics play a central role, with fully integrated assembly lines capable of producing hundreds of masks per minute with minimal human intervention, ensuring consistent quality and cost control. Specialized technologies are also targeting user comfort; this includes anti-fog strips and moisture-wicking inner layers, often achieved through specialized polymer coatings or lamination techniques designed to divert exhaled moisture and maintain clear vision for users wearing glasses or protective eyewear. The integration of quality assurance technologies, particularly high-speed camera systems and AI-powered visual inspection, ensures every mask meets specified geometric and functional standards before packaging.

Furthermore, technology related to sustainability is gaining importance. As environmental regulations tighten, R&D is shifting towards developing materials that maintain filtration efficacy while being compostable or more readily recyclable than traditional polypropylene. This involves exploring polylactic acid (PLA) and other bio-based polymers for the outer and inner layers, though challenges remain in replicating the superior fluid resistance provided by standard synthetic materials. Overall, the technology landscape is highly focused on scalable, efficient production methodologies paired with iterative material enhancements to comply with increasingly stringent performance and environmental criteria.

Regional Highlights

Regional dynamics are critical in defining the competitive landscape of the Medical Pleated Masks Market, heavily influenced by local regulatory frameworks, public health infrastructure maturity, and domestic manufacturing capabilities. North America, led by the United States and Canada, represents a high-value, highly regulated market. Demand here is characterized by a preference for premium, high-fluid-resistant masks (ASTM Level 3) due to stringent surgical safety mandates. The region maintains robust strategic stockpiles, providing stable, long-term contractual demand. Manufacturing in this region focuses heavily on automation, quality control, and vertical integration to mitigate reliance on overseas supply chains, a trend solidified by recent governmental incentives aimed at onshore production resilience and supply stability, ensuring rapid scalability during health emergencies.

Europe, encompassing major markets like Germany, the UK, and France, exhibits similar high-quality demand patterns, strictly adhering to the EN 14683 standard (particularly Type IIR). The market is mature, with sophisticated purchasing mechanisms driven by national health services and large GPOs. A significant regional trend is the growing emphasis on sustainability and traceability, prompting manufacturers to invest in environmentally friendly materials and transparent supply chain documentation. Eastern Europe is emerging as a critical manufacturing hub, benefiting from lower operating costs while maintaining close proximity to Western European quality control standards, facilitating rapid distribution within the EU common market.

The Asia Pacific (APAC) region is the undisputed engine of volume growth and the dominant global manufacturing base, particularly centered in China, South Korea, and India. China holds an unparalleled capacity for non-woven fabric production and automated mask assembly, enabling it to serve both massive domestic demand and a significant share of global exports. Rapid urbanization, increasing access to modern healthcare, and high prevalence of infectious diseases are driving robust internal market growth. India is also developing its domestic manufacturing ecosystem rapidly, supported by governmental initiatives encouraging local production (e.g., "Make in India"). While pricing is highly competitive in APAC, there is a clear rising demand for certified, higher-quality masks in major metropolitan hospitals.

Latin America, the Middle East, and Africa (MEA) remain primarily import-dependent markets, although local manufacturing is slowly increasing, often targeting basic Level 1 procedural masks. Growth in these regions is driven by international aid programs, increasing investment in public health infrastructure, and a growing recognition of infection control necessity, often implemented through global health organization standards. Procurement in MEA is often centralized through governmental ministries or large regional distributors, creating opportunities for suppliers who can manage complex logistics and provide products that meet international standards (e.g., ISO and WHO guidelines) at competitive pricing points.

- North America (USA, Canada): Focus on high-grade, premium ASTM Level 3 masks; strong regulatory oversight; trend towards domestic production resilience and strategic stockpiling.

- Europe (Germany, UK, France): High demand for EN 14683 Type IIR standards; emphasis on environmental sustainability and supply chain transparency; significant procurement via national health services and GPOs.

- Asia Pacific (China, India, South Korea): Dominant global manufacturing center; highest volume consumption and fastest CAGR; driven by expanding healthcare infrastructure and rising health awareness; highly competitive pricing environment.

- Latin America (Brazil, Mexico): Emerging markets relying heavily on imports; governmental investments driving public hospital infrastructure upgrades; increasing adoption of international infection control protocols.

- Middle East and Africa (MEA): Growth influenced by public health spending and international aid; demand focused on balancing cost and compliance with essential safety standards; logistical complexity in distribution is a key challenge.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Pleated Masks Market. These companies are profiled based on their global market share, technological capabilities, product portfolio diversity, strategic acquisitions, distribution network strength, and regulatory compliance history. Key strategies involve vertical integration to secure raw material supply, significant investment in automated production lines, and continuous efforts to meet stringent international certification standards.- 3M Company

- Honeywell International Inc.

- Prestige Ameritech

- Medline Industries

- Cardinal Health

- Kimberly-Clark Corporation

- Mölnlycke Health Care AB

- Halyard Health (now part of Owens & Minor)

- DemeTech Corporation

- Makrite

- Alpha Pro Tech

- Shanghai Dasheng Health Products Manufacture Co., Ltd.

- Winner Medical Group Co., Ltd.

- Shandong Lihua Medical Technology Co., Ltd.

- Jiangsu Dasheng Group Co., Ltd.

- Zhende Medical Co., Ltd.

- Crosstex International Inc.

- Gerson Company

- R&R Medical Inc.

- Cantel Medical Corp.

Frequently Asked Questions

Analyze common user questions about the Medical Pleated Masks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a surgical mask and a procedure mask?

The primary difference lies in the regulatory classification and intended use, particularly fluid resistance. Surgical masks (e.g., ASTM Level 3 or EN Type IIR) must provide high fluid barrier protection (splash resistance) to prevent blood or bodily fluids from reaching the wearer in an operating setting. Procedure masks (Level 1 or 2) offer barrier protection for general patient care but may have lower fluid resistance requirements.

What are the key raw materials used in the manufacturing of medical pleated masks?

The essential raw material is non-woven polypropylene fabric. Typically, masks are constructed using three layers: an outer spunbond layer for fluid resistance, a middle meltblown layer for filtration efficiency (BFE/PFE), and an inner spunbond layer for comfort and moisture absorption. Elastic materials are used for ear loops, and metal or plastic strips form the nose piece.

How are Medical Pleated Masks regulated globally, and which standards are most critical?

Regulation is primarily conducted by governmental bodies like the FDA in the US (Class II medical device) and through the CE marking system in Europe. The most critical performance standards are ASTM F2100 (defining Level 1, 2, and 3 classifications based on BFE, PFE, and fluid resistance) and the European EN 14683 standard (defining Type I, II, and IIR based on similar filtration and splash resistance criteria).

What impact do supply chain constraints, such as polypropylene price volatility, have on the market?

Polypropylene is a petrochemical derivative, making mask manufacturing costs highly susceptible to global oil price fluctuations. Volatility in the meltblown fabric market directly impacts overall production costs and, consequently, procurement pricing for healthcare systems. Manufacturers often mitigate this by engaging in long-term raw material contracts or increasing vertical integration.

Are biodegradable or sustainable medical pleated masks commercially viable yet?

Sustainable alternatives are emerging and gaining traction, driven by environmental mandates, but they currently face challenges in achieving the same high-level filtration (BFE) and fluid resistance as traditional polypropylene masks. While materials like PLA are used, widespread commercial viability hinges on technological breakthroughs that ensure full regulatory compliance without significantly increasing per-unit cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager