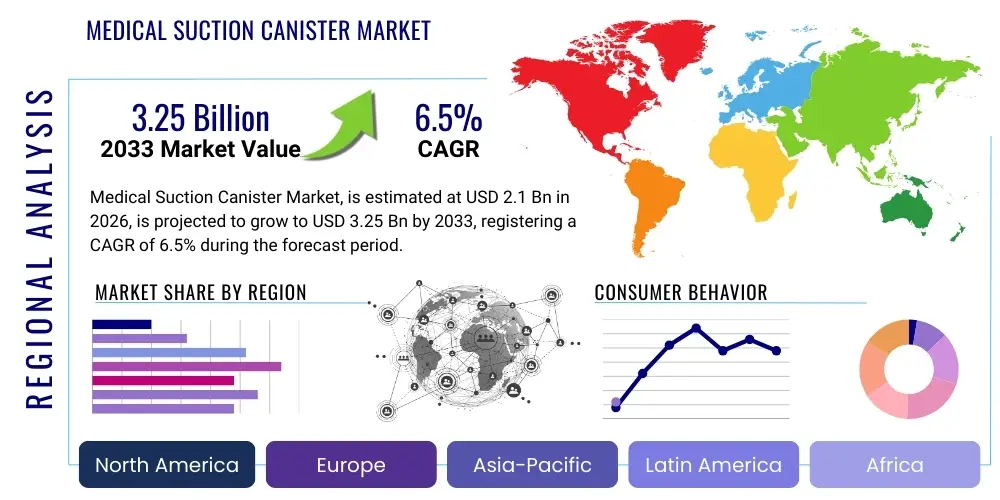

Medical Suction Canister Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436764 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Medical Suction Canister Market Size

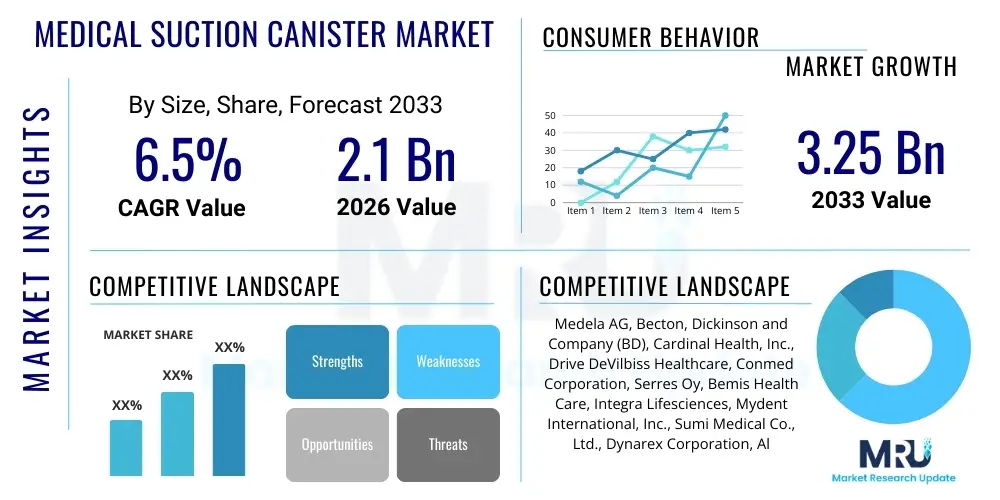

The Medical Suction Canister Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Medical Suction Canister Market introduction

The Medical Suction Canister Market encompasses disposable or reusable containers designed to collect aspirated fluids, secretions, and waste materials during various medical procedures, primarily surgical interventions, emergency care, and critical care settings. These canisters are crucial components of fluid waste management systems, working in conjunction with regulated vacuum sources and tubing to ensure effective patient aspiration while minimizing the risk of contamination for healthcare professionals and the environment. The fundamental function of these devices is maintaining a sterile field and facilitating the safe and efficient disposal of potentially biohazardous materials collected during procedures like liposuction, tracheostomy care, endoscopic procedures, and general operating room operations.

The increasing volume of surgical procedures worldwide, driven by demographic shifts, higher prevalence of chronic diseases, and advancements in minimally invasive techniques, serves as a primary driver for sustained market demand. Furthermore, stringent regulatory guidelines imposed by organizations such as the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO) regarding infection control and occupational safety necessitate the widespread adoption of standardized, high-quality disposable suction canisters. These products offer significant benefits, including reducing the risk of healthcare-associated infections (HAIs), ensuring precise fluid volume measurement, and simplifying the workflow for nurses and clinicians, thereby improving overall operational efficiency in clinical settings.

Major applications span across hospitals, ambulatory surgical centers (ASCs), and long-term care facilities, where efficient fluid collection and containment are paramount. Key benefits include superior containment integrity, incorporation of advanced safety features like overflow protection and hydrophobic filters to prevent backflow into the suction equipment, and ergonomic designs facilitating easy handling and disposal. Driving factors include continuous investments in upgrading healthcare infrastructure, a shift towards disposable systems to mitigate cross-contamination risks, and technological innovations focusing on improved material sciences for enhanced durability and chemical resistance against collected substances.

Medical Suction Canister Market Executive Summary

The Medical Suction Canister Market is characterized by robust growth, primarily fueled by the accelerating global demand for sterile surgical environments and effective infection prevention protocols. Business trends indicate a strong preference for disposable canister systems over reusable alternatives, driven by increasing regulatory scrutiny concerning biohazard management and the operational cost-effectiveness associated with reducing sterilization workload. Key market players are concentrating on product differentiation through enhanced safety features, such as integrated solidification agents, tamper-evident seals, and improved gauge markings for accurate fluid monitoring, responding directly to end-user demands for superior workflow efficiency and safety compliance.

Regional trends highlight North America and Europe as dominant market shareholders, attributed to well-established healthcare systems, high per capita healthcare expenditure, and early adoption of advanced medical devices and strict infection control standards. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth trajectory throughout the forecast period, propelled by expanding healthcare access, significant investments in hospital infrastructure development in emerging economies like China and India, and a rapidly increasing patient base requiring surgical and respiratory care. Competitive dynamics in APAC often revolve around balancing cost efficiency with quality adherence to international standards.

Segmentation trends reveal that disposable canister types, particularly those made from rigid plastics like polypropylene, maintain market leadership due to their convenience and superior infection control properties. Furthermore, the increasing establishment of Ambulatory Surgical Centers (ASCs) globally is driving higher consumption of medium-capacity suction canisters tailored for outpatient procedures. The end-user segment is heavily weighted towards hospitals, though non-hospital settings are rapidly increasing their procurement volumes, driven by the expanding scope of home healthcare services and specialized clinics requiring portable suction equipment.

AI Impact Analysis on Medical Suction Canister Market

User queries regarding the impact of Artificial Intelligence on the Medical Suction Canister Market often center on supply chain optimization, inventory management automation, and predictive needs forecasting within high-volume clinical settings. Users are concerned about how AI can integrate into the procurement and utilization cycle to minimize waste and ensure immediate availability of specific canister types (e.g., 800ml vs 2000ml) across different hospital departments, especially during peak surgical seasons or unforeseen public health crises. Key expectations revolve around using AI for demand sensing based on scheduled surgeries and patient flow, optimizing warehouse logistics for disposable supplies, and potentially integrating usage data from suction pumps into hospital management systems (HMS) for automated reordering, thereby enhancing efficiency and reducing the manual burden on supply chain staff.

- AI-driven predictive demand forecasting minimizes stockouts and reduces inventory holding costs for diverse canister sizes.

- Integration of AI in hospital supply chain management (SCM) optimizes delivery routes and scheduling, ensuring timely replenishment to Operating Rooms (ORs).

- Automated monitoring of suction canister usage rates via smart suction pump integration allows for real-time inventory updates and compliance auditing.

- Machine learning algorithms can analyze historical contamination data to identify high-risk usage scenarios, informing better product design or training protocols.

- AI assists in standardizing procurement processes by identifying cost-effective sourcing options without compromising the quality and safety standards of the suction devices.

DRO & Impact Forces Of Medical Suction Canister Market

The Medical Suction Canister Market is significantly influenced by a complex interplay of clinical demands and operational constraints. Key drivers include the global expansion of surgical procedures, the imperative for stringent infection control following the rise of antibiotic-resistant organisms, and continuous advancements in suction technology integrating enhanced safety features like anti-reflux mechanisms and reliable shut-off valves. These factors collectively push healthcare facilities towards adopting high-quality, disposable collection systems to meet evolving patient safety and occupational health standards. However, the market faces restraints such as the persistent environmental concerns regarding plastic waste generation associated with disposable medical consumables, leading to pressure for more sustainable or biodegradable material options. Additionally, intense price competition, particularly in emerging economies, can suppress average selling prices, challenging manufacturers focused on premium, feature-rich products.

Opportunities in the market are substantial, particularly driven by the shift towards home healthcare settings and the increasing use of portable suction units for managing chronic respiratory conditions and post-operative care outside traditional hospital environments. This shift necessitates the development of smaller, more convenient, and easier-to-handle canisters suitable for non-clinical users. Furthermore, manufacturers have a significant opportunity to innovate in waste treatment solutions, incorporating features like pre-measured gelling agents within the canisters to solidify collected fluids, making disposal safer and compliant with strict biohazard regulations, thus adding tangible value beyond basic fluid collection.

Impact forces govern the market trajectory, with regulatory requirements acting as a primary accelerating force, mandating the use of FDA/CE-approved devices that guarantee leak-proof performance and overflow protection. The competitive intensity is high, characterized by numerous regional and global manufacturers vying for GPO contracts and institutional tender wins, which often requires significant investment in large-scale manufacturing capacity and rigorous quality control. The substitute threat remains moderate, primarily involving reusable systems in specialized settings or older facilities, but the overwhelming focus on infection control strongly favors disposable units, effectively neutralizing this threat in most advanced markets.

Segmentation Analysis

The Medical Suction Canister Market is comprehensively segmented based on product type, material composition, capacity, and end-user application, allowing for a detailed understanding of varying clinical needs and procurement patterns globally. Product type segmentation primarily distinguishes between disposable and reusable canisters, with disposable units dominating due to enhanced safety and compliance benefits, while material analysis focuses predominantly on rigid plastics such as Polycarbonate (PC), Polyethylene (PE), and Polypropylene (PP), chosen for their chemical resistance and durability. Capacity segmentation reflects usage scenarios, ranging from small 300ml canisters for portable or pediatric use to large 3000ml canisters optimized for high-volume procedures in operating theaters and intensive care units.

- By Product Type:

- Disposable Suction Canisters

- Reusable Suction Canisters

- By Material:

- Polycarbonate (PC)

- Polyethylene (PE)

- Polypropylene (PP)

- Other Materials (e.g., PVC alternatives)

- By Capacity:

- 300 ml - 1000 ml (Low/Medium Capacity)

- 1000 ml - 2000 ml (Medium Capacity)

- Above 2000 ml (High Capacity)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Clinics and Long-Term Care Facilities

- Home Healthcare Settings

Value Chain Analysis For Medical Suction Canister Market

The value chain for the Medical Suction Canister Market begins with upstream activities focused on securing high-quality, medical-grade plastic resins, primarily polypropylene and polyethylene, which must meet strict biocompatibility and durability standards. Sourcing these raw materials requires specialized suppliers capable of providing consistent quality, as the integrity of the canister is paramount for preventing leaks and containing biohazardous waste. Manufacturing processes involve complex injection molding and assembly techniques to integrate critical safety components like mechanical shut-off valves, bacterial filters, and anti-foaming agents. Efficiency and scale in manufacturing are crucial for cost competitiveness, especially given the high volume nature of these disposable products.

Midstream activities revolve around the manufacturing and assembly phase, where stringent quality control is applied to ensure compliance with global regulatory standards (ISO 13485, FDA mandates). This phase often includes the sterilization or preparation of the product for clinical use, followed by packaging designed to maintain sterility until the point of use. Downstream activities involve distribution, which is predominantly managed through specialized medical device distributors and large Group Purchasing Organizations (GPOs). GPOs play a pivotal role in the North American and European markets by negotiating bulk purchasing contracts, significantly influencing pricing and market access for manufacturers.

The distribution channel is segmented into direct sales, often used for major high-volume hospital networks where direct negotiation allows for tailored supply agreements, and indirect distribution through third-party logistics providers and regional distributors who manage inventory and delivery to smaller clinics, ASCs, and non-acute care settings. The efficiency of the indirect channel is vital for penetrating geographically dispersed markets and supporting the growing home healthcare segment. Successful navigation of this value chain requires deep strategic partnerships with raw material providers and robust, compliant distribution networks capable of handling sensitive medical consumables efficiently.

Medical Suction Canister Market Potential Customers

The primary customers and end-users of medical suction canisters are institutional healthcare providers that routinely perform invasive or surgical procedures generating biological fluid waste. Hospitals represent the largest segment, encompassing general surgical departments, intensive care units (ICUs), emergency rooms (ERs), and labor and delivery suites, all of which require continuous and reliable fluid aspiration capability. The increasing complexity of patient care and the high throughput of these environments necessitate large, consistent volumes of various canister sizes and types, making hospitals the central procurement focus for manufacturers.

Ambulatory Surgical Centers (ASCs) are rapidly growing consumers, driven by the shift towards performing less complex surgeries and diagnostic procedures in outpatient settings. ASCs prioritize efficiency, quick turnaround times, and cost-effective disposable solutions, often preferring medium-capacity canisters optimized for procedures like endoscopy, plastic surgery, and orthopedic interventions. The streamlined procurement process in ASCs, often bypassing large GPOs, requires manufacturers to maintain strong direct sales relationships and specialized product portfolios tailored to outpatient workflow.

Other significant end-users include specialized clinics, such as dental and cosmetic surgery practices, long-term care facilities, and the rapidly expanding home healthcare sector. The home care segment is particularly attractive for manufacturers, as the demand for portable, compact, and user-friendly suction units and corresponding small-capacity canisters for managing respiratory patients (e.g., tracheostomy care) is escalating. These diverse end-users emphasize different purchase criteria, ranging from volume discounts (hospitals) to portability and ease of use (home care).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medela AG, Becton, Dickinson and Company (BD), Cardinal Health, Inc., Drive DeVilbiss Healthcare, Conmed Corporation, Serres Oy, Bemis Health Care, Integra Lifesciences, Mydent International, Inc., Sumi Medical Co., Ltd., Dynarex Corporation, Allied Healthcare Products, Inc., Precision Medical, Inc., Gentherm Medical, Pennine Healthcare |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Suction Canister Market Key Technology Landscape

The technological landscape of the Medical Suction Canister Market is predominantly driven by innovations aimed at enhancing safety, usability, and environmental sustainability. A crucial technological feature is the integration of advanced mechanical shut-off valves and hydrophobic filters. These components are designed to automatically cease suction flow and prevent overflow and aerosol contamination once the maximum fluid capacity is reached, protecting both the suction equipment from damage and the staff from pathogen exposure. Hydrophobic filters specifically block aerosols and bacteria from passing into the vacuum system, ensuring the air exhausted is clean, which is a critical element in maintaining sterile air quality in operating rooms.

Another significant advancement involves the incorporation of solidification technology directly within the disposable canister. Pre-filled canisters containing gelling agents (superabsorbent polymers) transform collected liquid biohazardous waste into a semi-solid mass upon contact. This technology drastically simplifies the disposal process, minimizes splashing risks during transport, and improves compliance with liquid waste disposal regulations, particularly beneficial in high-volume settings like dialysis centers and operating theaters. Manufacturers are continually refining these polymer formulations to ensure rapid activation and stability across various fluid compositions.

Furthermore, attention is being paid to material innovation to address environmental concerns. While rigid plastics like PP and PE remain standard due to their robustness, research and development efforts are focusing on incorporating recycled plastics or developing canisters from biodegradable or partially plant-based polymers. Although fully bio-based solutions face challenges related to material integrity and cost-effectiveness, partial sustainability measures, such as reducing material usage through structural optimization, are becoming industry standards. The ongoing push for smarter inventory management also necessitates the integration of RFID or barcoding technology on canister labels for seamless tracking and automated procurement within modern hospital management systems.

Regional Highlights

The global Medical Suction Canister Market exhibits distinct regional dynamics reflecting variations in healthcare infrastructure, regulatory environments, and expenditure levels. North America currently dominates the market share due to the highly mature healthcare system, widespread adoption of disposable products to meet stringent infection control standards (e.g., AORN guidelines), and substantial expenditure on advanced surgical equipment and consumables. The presence of major market players and the robust purchasing power of GPOs further solidify this region's leading position, with the U.S. accounting for the majority of regional consumption.

Europe represents the second-largest market, characterized by comprehensive universal healthcare coverage and a strong emphasis on medical waste management regulations, particularly those established by the European Union. Countries such as Germany, the UK, and France show high adoption rates, driven by efforts to standardize clinical practice and enhance patient safety. However, price sensitivity is generally higher in several European countries compared to the US, necessitating competitive pricing strategies from manufacturers.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market. This exponential growth is driven by massive population growth, increasing disposable income leading to higher demand for advanced medical services, and government initiatives to modernize and expand hospital capacity in populous nations like India and China. While cost remains a significant factor in APAC, the increasing awareness of infection control risks is propelling the shift from reusable to disposable canisters, providing immense growth opportunities.

Latin America and the Middle East & Africa (MEA) are emerging markets experiencing moderate growth. Growth in Latin America is tied to improving healthcare accessibility and infrastructure development, while the MEA market is largely driven by health tourism and high healthcare spending in Gulf Cooperation Council (GCC) countries, focusing on establishing world-class medical facilities that mandate the use of high-quality, international-standard medical disposables.

- North America (U.S., Canada): Market dominance driven by established infection control mandates, high surgical volumes, and strong GPO influence in procurement decisions.

- Europe (Germany, UK, France): High penetration of disposable systems, driven by strict EU regulatory frameworks on occupational safety and clinical waste management.

- Asia Pacific (China, India, Japan): Highest growth potential fueled by rapid infrastructure expansion, rising incidence of lifestyle diseases requiring surgical intervention, and increasing focus on HAIs prevention.

- Latin America (Brazil, Mexico): Steady growth linked to increasing government investment in public health systems and expanding access to specialized medical care.

- Middle East & Africa (GCC Countries, South Africa): Growth centered on high-quality medical tourism standards and ongoing large-scale hospital construction projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Suction Canister Market.- Medela AG

- Becton, Dickinson and Company (BD)

- Cardinal Health, Inc.

- Drive DeVilbiss Healthcare

- Conmed Corporation

- Serres Oy

- Bemis Health Care

- Integra Lifesciences

- Mydent International, Inc.

- Sumi Medical Co., Ltd.

- Dynarex Corporation

- Allied Healthcare Products, Inc.

- Precision Medical, Inc.

- Gentherm Medical

- Pennine Healthcare

- Amsino International, Inc.

- Plasti-Products, Inc.

- Olympus Corporation

- Vyaire Medical, Inc.

- Dixie Medical, Inc.

Frequently Asked Questions

Analyze common user questions about the Medical Suction Canister market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for disposable medical suction canisters?

The primary factor driving demand is the critical need for superior infection control and prevention of cross-contamination (Healthcare-Associated Infections or HAIs) in clinical settings, coupled with increasing surgical procedure volumes globally. Disposable canisters minimize manual handling of biohazardous fluids and comply strictly with stringent occupational safety regulations.

How do technological advancements influence the safety features of suction canisters?

Technological advancements focus on integrating critical safety mechanisms, primarily mechanical shut-off valves and hydrophobic bacterial filters. These features prevent fluid overflow into suction pumps, protect equipment integrity, and crucially block aerosols and pathogens from contaminating the environment or staff, thereby enhancing overall clinical safety and workflow efficiency.

Which material is most commonly used for manufacturing high-capacity medical suction canisters?

Polypropylene (PP) and Polyethylene (PE) are the most commonly used rigid plastics. These materials are favored for their excellent chemical resistance, necessary to withstand various collected bodily fluids and sterilizing agents, ensuring structural integrity and preventing leakage throughout the usage and disposal phases.

What role do Ambulatory Surgical Centers (ASCs) play in the growth of the suction canister market?

ASCs are significant growth drivers due to the global shift towards outpatient and minimally invasive procedures. ASCs require high volumes of medium-capacity, cost-effective disposable canisters tailored for quick turnover and simplified waste management, boosting the segment's consumption rate outside traditional hospital environments.

What are the main restraints facing the Medical Suction Canister Market?

The primary restraints include growing environmental concerns regarding the substantial volume of non-biodegradable plastic medical waste generated by disposable systems, leading to increased pressure for sustainable alternatives. Additionally, intense price sensitivity and competition, particularly in emerging economies and GPO-dominated markets, impact profit margins for premium product manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager