Medical Tray Sealing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437444 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Medical Tray Sealing Market Size

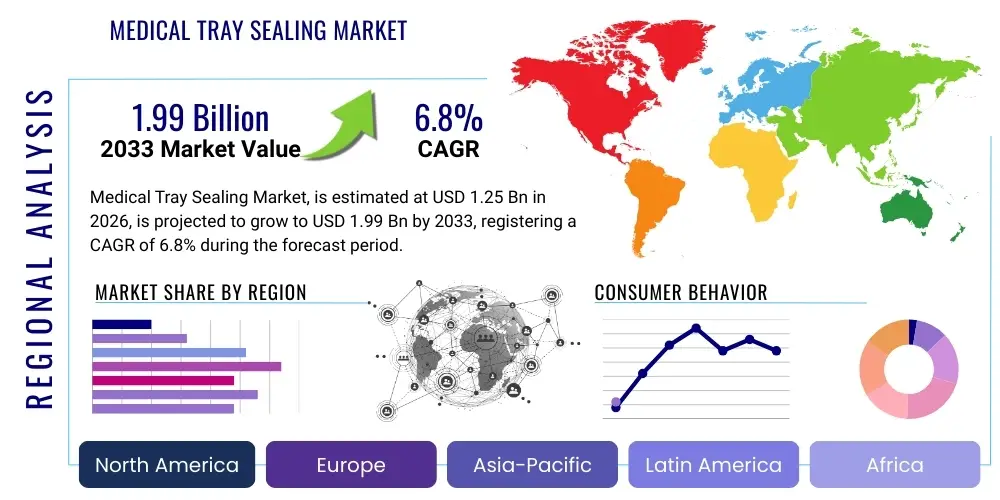

The Medical Tray Sealing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating demand for sterile, single-use medical devices, coupled with increasingly stringent global regulatory standards requiring validated packaging processes to ensure patient safety.

Medical Tray Sealing Market introduction

The Medical Tray Sealing Market encompasses equipment, materials, and services dedicated to creating sterile barrier systems (SBS) for medical devices, pharmaceuticals, and diagnostics. Tray sealing involves utilizing specialized machinery to bond a sterile lid material (such as Tyvek, medical-grade paper, or foil) to a rigid tray (typically PVC, PETG, or HDPE) under controlled conditions, ensuring the integrity of the enclosed product until the point of use. These sealing processes are critical components of the medical manufacturing workflow, designed to maintain sterility through transportation, storage, and handling, adhering strictly to global standards like ISO 11607.

Major applications of medical tray sealing include the packaging of complex surgical instruments, implantable devices (e.g., orthopedic components, pacemakers), diagnostic kits, and high-volume disposable supplies like catheters and syringes. The primary benefits derived from advanced tray sealing technologies include enhanced product protection against contamination, extended shelf life, clear visual validation of seal integrity, and optimized packaging speeds crucial for mass production environments. Furthermore, modern sealers often incorporate automated handling and vision inspection systems, minimizing human error and ensuring consistent quality output in highly regulated cleanroom settings.

Driving factors propelling market expansion involve several converging trends: the global aging population requiring more complex surgeries and medical interventions, the rapid proliferation of minimally invasive devices necessitating specialized sterile packaging, and the ongoing shift towards automated, high-throughput manufacturing lines in response to supply chain pressures. Regulatory mandates, particularly those enforced by the FDA and European Commission, emphasizing process validation and material compatibility, further necessitate investment in advanced, reliable tray sealing systems capable of precise temperature and pressure control, thus solidifying the market’s foundation for sustained growth over the next decade.

Medical Tray Sealing Market Executive Summary

The Medical Tray Sealing Market is characterized by intense technological competition focused on increasing automation, improving seal strength validation, and ensuring material compatibility with various sterilization methods (EtO, Gamma, E-beam). Business trends indicate a strong move toward integrated packaging solutions, where tray sealing equipment is seamlessly connected with upstream filling and downstream inspection and serialization systems, catering to the industry’s need for fully validated, end-to-end automated lines. Key regional trends show North America maintaining dominance due to the presence of major medical device manufacturers and stringent regulatory infrastructure, while the Asia Pacific region exhibits the highest growth potential, fueled by increasing healthcare investment, expanding medical device manufacturing hubs in countries like China and India, and rising demand for domestically manufactured sterile products.

Segment trends reveal that rotary and semi-automatic tray sealers currently hold substantial market share, particularly among smaller and medium-sized manufacturers requiring flexibility, while fully automatic inline sealers are gaining significant traction among large OEMs driven by the imperative to maximize throughput and minimize labor costs. Material segmentation highlights the increasing adoption of PETG trays and DuPont Tyvek lids due to their superior barrier properties, durability during transit, and established compatibility with sterilization cycles. Furthermore, customization and quick changeover capabilities are critical purchasing criteria, compelling manufacturers to invest in modular sealing platforms that can handle diverse product geometries and volumes efficiently without compromising sterile integrity.

AI Impact Analysis on Medical Tray Sealing Market

User queries regarding AI’s influence on the Medical Tray Sealing Market frequently revolve around predictive maintenance, quality control automation, and process optimization. Users are keen to understand how machine learning models can predict equipment failure before downtime occurs, how advanced computer vision systems powered by AI can replace manual or traditional automated seal inspection, and whether AI can dynamically adjust sealing parameters (temperature, dwell time, pressure) in real-time based on material variations or ambient environmental changes. The core expectation is that AI integration will significantly reduce packaging defects, eliminate unscheduled maintenance, and lower operational costs while enhancing overall compliance and validated sterility assurance levels.

- AI-Powered Vision Inspection Systems: Utilizing deep learning for rapid, highly accurate defect detection (e.g., minor wrinkles, incomplete seals, particulate contamination) that surpasses traditional inspection methods.

- Predictive Maintenance: Machine learning algorithms analyze sensor data (temperature logs, pressure fluctuations, motor current) to forecast component failure, drastically reducing downtime and improving OEE (Overall Equipment Effectiveness).

- Process Optimization and Control: AI models dynamically adjust sealing parameters based on historical validation data and real-time environmental input, ensuring optimal seal integrity under varying operational conditions.

- Supply Chain Visibility: Integration of AI with serialization data to track packaging integrity from the cleanroom to the end-user, enhancing compliance and traceability.

- Automated Robotics Integration: AI optimizes the path planning and gripping mechanics for robotic arms loading and unloading trays, maximizing throughput in automated sealing lines.

DRO & Impact Forces Of Medical Tray Sealing Market

The market dynamics of the Medical Tray Sealing Market are governed by a complex interplay of stringent regulatory requirements, technological advancement, and cost pressures inherent in the medical device industry. Drivers prominently include the relentless increase in healthcare expenditure globally, the demand for single-use sterilized instruments, and mandatory compliance with ISO 11607 for sterile barrier systems. Restraints predominantly center on the high initial capital investment required for automated, validated sealing machinery, the complexity of material compatibility testing necessary for sterilization processes, and the significant operational costs associated with maintaining Class 7 or Class 8 cleanroom environments necessary for packaging operations. Opportunities reside in developing intelligent, flexible packaging machines capable of handling biodegradable and sustainable materials, addressing the growing environmental concerns of medical device manufacturers, and expanding market presence in emerging economies undergoing rapid healthcare infrastructure development.

The impact forces within this market are heavily weighted towards regulatory adherence and patient safety. The mandatory requirement for validated sealing processes—where consistency and repeatability are non-negotiable—compels manufacturers to adopt high-precision, automated systems. This regulatory pull acts as a major driver, constantly forcing the retirement of older, less reliable equipment. Furthermore, the rising adoption of specialized and complex devices, such as customized implants, requires tray sealers capable of accommodating low-volume, high-mix production runs with rapid changeover capabilities, pushing technological development towards modular and flexible platforms. The balance between maintaining absolute sterility assurance and achieving cost-effective, high-speed production dictates the competitive landscape, where efficiency gains derived from automation significantly influence market share.

Consequently, the market experiences persistent pressure to innovate in two key areas: enhanced seal integrity monitoring (often via vision systems or force monitoring) and improved energy efficiency. Companies that offer integrated validation protocols and comprehensive post-sale service support gain a substantial advantage. The shift from manual or semi-automatic sealing towards fully automatic, integrated lines represents a primary force reshaping manufacturing floors. This shift is not merely about speed but about achieving validated quality at scale, addressing the dual challenge of regulatory compliance and escalating production demand in the global medical device sector. The convergence of these factors solidifies the critical nature of reliable tray sealing technology in the overall medical device value chain.

Segmentation Analysis

The Medical Tray Sealing Market is comprehensively segmented based on technology type, level of automation, end-user applications, and sealing materials, allowing for a granular understanding of purchasing behaviors and technological adoption across various industry subsectors. Technological segmentation differentiates between thermal conductive sealing, often used for standard processes, and impulse sealing, which offers advantages in specific material pairings. Automation level—ranging from manual desktop units to fully integrated, robotic inline systems—directly correlates with the throughput requirements and capital expenditure capacity of the end-user. Detailed analysis of these segments highlights the divergence in needs between large multinational OEMs prioritizing high-speed automation and small contract manufacturers requiring flexible, multi-purpose machinery.

- By Automation Type:

- Manual Tray Sealing Machines

- Semi-Automatic Tray Sealing Machines

- Automatic and High-Speed Inline Tray Sealing Machines

- By Technology:

- Thermal Sealing

- Impulse Sealing

- Cold Sealing

- By Packaging Material:

- Trays (PETG, PVC, HDPE, PS)

- Lids (Tyvek, Medical Grade Paper, Foils, Film Laminates)

- By End User:

- Medical Device Manufacturers (Orthopedics, Cardiovascular, Diagnostics)

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Hospitals and Clinics (Sterilization Departments)

Value Chain Analysis For Medical Tray Sealing Market

The value chain for the Medical Tray Sealing Market begins with upstream suppliers providing critical raw materials, notably high-purity polymers for trays (PETG, PVC) and specialized barrier materials for lidding (e.g., coated Tyvek and laminates). These materials must meet stringent biocompatibility and sterilization compatibility standards, creating high barriers to entry for raw material suppliers. Equipment manufacturers then design, assemble, and validate the complex sealing machinery, focusing heavily on precision engineering, software controls, and integration with quality assurance systems. This stage is characterized by significant R&D investment to comply with evolving automation and regulatory demands, making specialized knowledge in thermodynamics and robotics essential for market leaders.

Midstream activities involve the distribution channel, which utilizes both direct sales teams (especially for highly customized automatic systems sold to large OEMs) and indirect channels through specialized packaging equipment distributors and authorized agents, particularly targeting smaller and geographically diverse customers. After-sales service, including maintenance contracts, calibration, and provision of validated tooling, forms a critical and high-margin component of the midstream value proposition, as medical manufacturers rely heavily on minimal downtime. Downstream, the key stakeholders are the medical device manufacturers and Contract Manufacturing Organizations (CMOs) who utilize these systems in controlled cleanroom environments for final packaging before sterilization and distribution to healthcare providers.

The increasing prominence of CMOs acts as a significant disruptor, as they consolidate packaging operations and demand highly versatile, reliable equipment that can handle multiple product lines efficiently. The value chain is fundamentally driven by compliance; thus, equipment providers must offer extensive documentation and validation support to enable end-users to meet regulatory audits. Direct relationships between equipment manufacturers and large, global medical device companies are crucial for co-developing customized high-speed solutions, whereas indirect distribution networks serve the broader, fragmented base of smaller end-users and regional markets, ensuring wide market penetration and continuous revenue streams from consumables (spare parts and sealing tools).

Medical Tray Sealing Market Potential Customers

Potential customers for medical tray sealing equipment and materials primarily comprise entities responsible for the manufacturing, sterilization, and distribution of regulated healthcare products. The largest segment of buyers consists of multinational Medical Device Manufacturers (MDMs) across therapeutic areas such as orthopedics (implants, joint replacements), cardiology (stents, catheters), and disposable surgical kits. These large corporations prioritize fully automated, high-throughput inline sealers integrated with robotic handling and sophisticated inspection systems, often requiring custom tooling and extensive validation support to meet massive global demand and stringent quality control standards.

Contract Manufacturing Organizations (CMOs) and Contract Packaging Organizations (CPOs) represent a rapidly growing segment of buyers. These organizations require flexible, modular sealing platforms capable of rapid changeovers to accommodate the diverse product specifications and smaller batch sizes typical of contract work. Their purchasing decisions are heavily influenced by equipment versatility, reliability, and low total cost of ownership (TCO). Furthermore, certain large hospitals and independent sterilization centers, particularly those in developed economies, purchase smaller semi-automatic sealers for in-house sterilization and re-packaging of reusable surgical instruments, focusing on user-friendliness and adherence to local regulatory guidelines for sterile processing departments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Multivac, Kiefel, Klockner Pentaplast, SencorpWhite, Sonoco Products, Tishma Technologies, Sealpac, Alcoa Corporation, Oliver Healthcare Packaging, Tray-Pak Corporation, Starview Packaging Machinery, Ecobliss, Bosch Packaging Technology (Syntegon), Amcor, Nelipak Healthcare Packaging, TOSS Packaging Systems, Hawo, PMS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Tray Sealing Market Key Technology Landscape

The technological landscape of the Medical Tray Sealing Market is continually evolving, driven by the need for enhanced sterile integrity, faster throughput, and reduced energy consumption. Core technologies include precision thermal sealing, utilizing highly controlled heat and pressure to create a homogeneous bond between the lid and tray material. Advanced thermal systems employ precise temperature profiling across the sealing die to prevent localized overheating or cold spots, which are crucial for maintaining seal strength consistency and minimizing material degradation, especially with temperature-sensitive barrier materials like Tyvek. Another significant technology is impulse sealing, which uses rapid, high-intensity bursts of heat followed by immediate cooling, offering advantages in sealing thicker materials or non-traditional polymer combinations, often utilized in high-barrier pharmaceutical packaging.

Recent innovations focus heavily on quality assurance and process validation integration. Key developments include the widespread adoption of non-destructive Seal Strength Testing (SST) and Seal Integrity Monitoring (SIM) systems, often incorporating advanced pressure decay or vacuum testing immediately post-sealing to ensure every package meets the regulatory standards before leaving the production line. Furthermore, the development of modular tooling systems allows manufacturers to perform rapid changeovers between different tray sizes and materials with minimal manual intervention, drastically improving Operational Equipment Effectiveness (OEE). This modularity is facilitated by sophisticated automated tooling recognition and recipe management systems that automatically adjust sealing parameters based on the tool loaded, virtually eliminating setup errors.

Automation and robotic integration represent the future technological cornerstone. Fully automated inline systems now feature high-speed pick-and-place robots for loading products into trays and transferring sealed packages for sterilization preparation, reducing contamination risks associated with human handling. These systems are often paired with sophisticated Human-Machine Interfaces (HMIs) providing real-time data logging and diagnostic capabilities, essential for meeting the demands of FDA 21 CFR Part 11 electronic recordkeeping. Future technology adoption will increasingly focus on sustainable packaging solutions, necessitating the development of sealing systems compatible with compostable or easily recyclable polymer trays and films without sacrificing required barrier properties.

Regional Highlights

- North America: North America, particularly the United States, commands the largest market share due to its well-established, highly regulated medical device manufacturing industry. The region is home to numerous large pharmaceutical and medical device OEMs who are early adopters of advanced, high-speed automated tray sealing solutions. Strict adherence to FDA validation guidelines (e.g., ISO 11607 standards) necessitates continuous investment in high-precision sealing equipment with integrated quality control features, driving premium pricing and technological demand. Significant R&D investment in implantable devices and complex diagnostic kits further fuels the need for specialized, customized sterile packaging solutions.

- Europe: Europe represents a mature market characterized by robust regulatory oversight from the European Medicines Agency (EMA) and compliance with CE marking requirements. Germany, the UK, and Switzerland are key manufacturing hubs, focusing on precision-engineered packaging machinery and sustainable material integration. The region is a leader in adopting energy-efficient and modular sealing equipment, driven by strong corporate social responsibility mandates and environmental directives focusing on reducing packaging waste.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by expanding healthcare access, government initiatives promoting local manufacturing (e.g., 'Make in India'), and the relocation of manufacturing operations by Western OEMs to reduce labor costs. Countries like China, India, and Japan are rapidly modernizing their pharmaceutical and medical device manufacturing infrastructure, leading to high demand for both semi-automatic sealers (for emerging local players) and fully automatic lines (for multinational subsidiaries). Regulatory harmonization efforts across the region are also boosting the need for internationally compliant packaging solutions.

- Latin America (LATAM): The LATAM market is growing steadily, primarily centered in Brazil and Mexico. Demand is concentrated in imported technology, often semi-automatic systems that balance investment costs with required sterile packaging quality. Growth is constrained somewhat by economic volatility but is supported by increasing public and private investment in healthcare infrastructure, driving localized production of basic medical supplies.

- Middle East and Africa (MEA): The MEA market is nascent but shows potential, particularly in the Gulf Cooperation Council (GCC) countries, which are investing heavily in world-class healthcare facilities and local pharmaceutical production capabilities. The focus remains largely on importing high-quality, reliable sealing machinery to ensure compliance with global standards necessary for future export ambitions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Tray Sealing Market.- Multivac Sepp Haggenmüller SE & Co. KG

- Kiefel GmbH

- Klockner Pentaplast Group

- SencorpWhite (Packaging Division)

- Sonoco Products Company

- Tishma Technologies Inc.

- Sealpac International

- Oliver Healthcare Packaging

- Tray-Pak Corporation

- Starview Packaging Machinery, Inc.

- Ecobliss Global B.V.

- Syntegon Technology GmbH (formerly Bosch Packaging Technology)

- Amcor plc

- Nelipak Healthcare Packaging

- TOSS Packaging Systems, Inc.

- Hawo GmbH

- PMS (Packaging Machinery Services)

- ULMA Packaging S. Coop.

- Thermo King (via specialized packaging solutions)

- 3M (Packaging Solutions Division)

Frequently Asked Questions

Analyze common user questions about the Medical Tray Sealing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of medical tray sealing in device manufacturing?

The primary function of medical tray sealing is to create a Sterile Barrier System (SBS) around medical devices, protecting them from physical damage and microbial contamination during transit and storage, thereby maintaining product sterility until the point of use as mandated by ISO 11607.

Which regulatory standard governs sterile barrier systems in this market?

The key governing regulatory standard is ISO 11607, which defines the requirements for materials, sterile barrier systems, and packaging systems for terminally sterilized medical devices. Compliance with ISO 11607 is mandatory for obtaining regulatory clearance in most major global markets.

How does automation impact the cost structure of medical tray sealing operations?

While automated tray sealing machines require high initial capital investment, they significantly reduce long-term operational costs by increasing throughput, minimizing labor dependence, reducing packaging defects, and providing integrated, auditable data essential for regulatory compliance and process validation.

What are the most common materials used for medical trays and lids?

Common tray materials include PETG (Polyethylene terephthalate glycol) and PVC (Polyvinyl chloride) due to their rigidity and thermoformability. The most widely used lidding material for breathable sterile packaging is DuPont Tyvek, valued for its superior microbial barrier properties and compatibility with various sterilization methods like EtO and Gamma irradiation.

What technological trends are driving innovation in seal integrity monitoring?

Innovation is driven by the integration of AI-powered vision systems and advanced non-destructive testing methods, such as force monitoring, ultrasonic measurement, and vacuum decay testing. These technologies provide real-time, objective data on seal strength and consistency, moving quality control from batch sampling to 100% inline inspection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager