Medical Trolleys Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437252 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Medical Trolleys Market Size

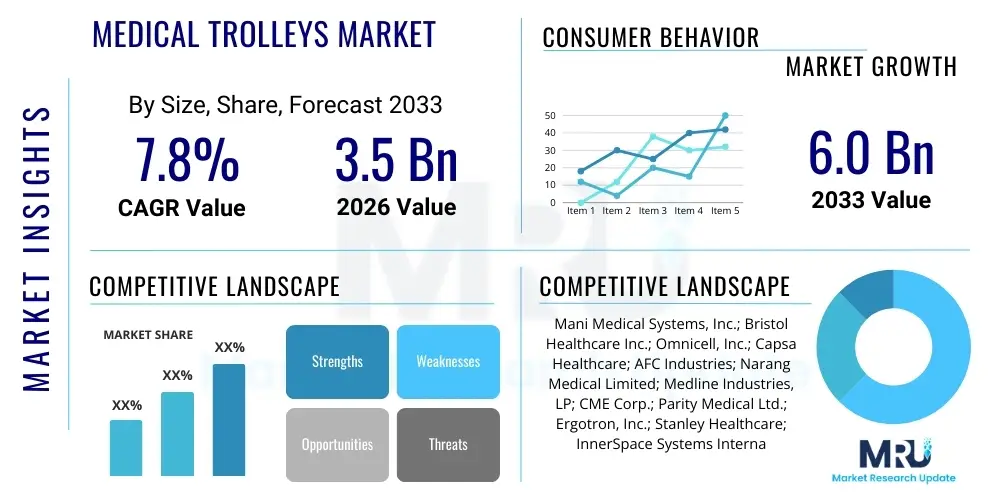

The Medical Trolleys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 billion in 2026 and is projected to reach USD 6.0 billion by the end of the forecast period in 2033.

Medical Trolleys Market introduction

The Medical Trolleys Market encompasses the production and distribution of various mobile units designed to assist healthcare professionals in organizing, transporting, and managing essential medical supplies, instruments, medication, and patient records within clinical settings. These trolleys are fundamental components of modern healthcare infrastructure, enhancing operational efficiency and patient safety across hospitals, clinics, and specialized surgical centers. The core product categories include crash carts, utility trolleys, medication trolleys, anesthesia trolleys, and specialized procedure trolleys, each tailored to specific departmental needs and workflows. Design considerations prioritize ergonomics, infection control features (such as smooth, easy-to-clean surfaces), and integration capabilities for electronic devices and advanced dispensing systems. The demand is intrinsically linked to the global expansion of healthcare facilities, the increasing elderly population necessitating complex care, and the continuous push for higher quality standards in patient management.

Major applications of medical trolleys span virtually all areas of patient care. In emergency departments, crash carts equipped with essential life-saving equipment and medication are critical for rapid response protocols. Operating rooms utilize anesthesia and instrument trolleys to ensure sterile and organized access to surgical tools and monitoring devices. Furthermore, general wards and intensive care units rely heavily on medication dispensing trolleys, often incorporating advanced locking and tracking systems to comply with strict pharmaceutical regulations and minimize errors. The deployment of specialized trolleys supports diverse clinical activities, from minor procedures to complex diagnostic imaging, serving as mobile workstations that bring necessary resources directly to the point of care, thereby optimizing staff time and reducing workflow disruptions.

Key driving factors propelling the market growth include the persistent need for better infection prevention measures, especially post-pandemic, which necessitates replacing outdated equipment with antimicrobial-coated or easy-to-sanitize units. Furthermore, technological integration, such as the incorporation of smart locking mechanisms, biometric access, and computerized inventory management systems (CIMS) into medication trolleys, is increasing the adoption rate, particularly in developed healthcare economies focused on maximizing efficiency and regulatory compliance. The benefits realized by healthcare providers are substantial, encompassing improved inventory control, enhanced nursing efficiency through streamlined workflows, and significantly reduced risk of medication errors, ultimately contributing to better patient outcomes and lower operational costs associated with disorganized or inefficient clinical practices.

Medical Trolleys Market Executive Summary

The Medical Trolleys Market is characterized by robust growth, driven primarily by global investment in healthcare infrastructure expansion and technological advancements aimed at optimizing hospital logistics. Business trends indicate a strong move toward customization and specialization, with manufacturers developing modular trolley systems that can be adapted quickly to varied clinical needs, from mobile workstations supporting telehealth initiatives to specialized isolation trolleys for infectious disease management. Mergers, acquisitions, and strategic partnerships focusing on supply chain resilience and local manufacturing presence are prominent as companies seek to capitalize on regional demand spikes. Furthermore, sustainability is becoming a critical business differentiator, leading to the development of trolleys made from recyclable or lightweight, durable materials, aligning with the broader trend toward green healthcare operations and reducing the environmental footprint of medical equipment.

Regional trends highlight North America and Europe as mature markets demanding high-tech, compliant, and ergonomic products, characterized by strong purchasing power and strict regulatory oversight promoting replacement cycles. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by massive government investment in establishing new hospitals and modernizing existing facilities, particularly in populous nations like China and India. This regional growth is driven by increasing healthcare access and affordability, although price sensitivity remains a factor, leading to higher demand for cost-effective, yet functionally reliable, standardized utility trolleys. Latin America and the Middle East & Africa (MEA) present significant untapped potential, spurred by medical tourism growth and urbanization, necessitating basic and advanced trolley solutions for newly established private healthcare networks.

Segment trends reveal that the product type segment is dominated by crash carts and medication trolleys due to their critical function in daily operations and error prevention, respectively. In terms of material, composite materials are gaining ground over traditional stainless steel due to superior lightweight properties and inherent anti-corrosion and antimicrobial characteristics. The end-user segment is heavily concentrated in hospitals, which represent the largest volume purchasers; however, specialized clinics and ambulatory surgical centers (ASCs) are showing the highest growth trajectory, reflecting the shift toward outpatient care models. Technology integration, specifically smart trolleys equipped with IoT sensors for real-time location tracking and inventory status, is the most influential trend shaping segment demand, providing actionable data for optimized hospital asset management and utilization.

AI Impact Analysis on Medical Trolleys Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Medical Trolleys Market frequently revolve around automation, inventory intelligence, and predictive maintenance. Common questions include whether AI will lead to fully autonomous delivery systems, how AI can prevent medication stockouts on trolleys, and the feasibility of using machine learning algorithms to optimize trolley location based on patient flow and clinical urgency. These inquiries reveal user expectations centered on transforming the trolley from a simple storage and transport unit into an active, intelligent asset within the hospital's digital ecosystem. The key themes summarized are the optimization of workflow through predictive logistics, enhancing security via intelligent access control, and improving patient safety by minimizing human errors related to supply management, all powered by AI-driven analytics integrated into the trolley's operational framework.

- Integration of predictive analytics to forecast supply needs on specialized trolleys (e.g., identifying medication usage patterns).

- Implementation of AI-driven routing and asset tracking systems to optimize the location and movement of mobile trolleys within large hospital campuses.

- Enhancement of medication management trolleys with biometric and AI-based facial recognition access for heightened security and controlled substance dispensing audit trails.

- Development of machine learning models for preventative maintenance, signaling potential mechanical or electronic failures in smart trolleys before they occur, reducing downtime.

- AI-enabled inventory scanning using computer vision and weight sensors to provide real-time, accurate stock counts and automated reordering triggers.

DRO & Impact Forces Of Medical Trolleys Market

The dynamics of the Medical Trolleys Market are shaped by powerful Drivers (D) compelling adoption, significant Restraints (R) hindering expansion, and strategic Opportunities (O) for future growth, all influenced by critical Impact Forces. The primary drivers include the mandatory implementation of rigorous infection control standards globally and the ongoing replacement cycle of older, non-compliant equipment in mature markets. Coupled with this is the demographic pressure from aging populations, which increases the complexity and volume of care required, thereby heightening the need for efficient, mobile medical infrastructure. However, the market faces strong restraints, primarily the high initial procurement cost of advanced, automated, or smart trolleys, which can be prohibitive for smaller or budget-constrained healthcare facilities, particularly in emerging economies. Furthermore, the complexities associated with integrating advanced trolley systems with existing, disparate hospital IT infrastructure (Hospital Information Systems or HIS) often slow down implementation timelines and create adoption resistance among hospital administrators.

Opportunities for market players are abundant, focusing heavily on technological evolution. The transition towards lightweight, high-strength composite materials presents an opportunity to improve ergonomics and maneuverability while lowering freight costs. Furthermore, the burgeoning demand for specialized procedural trolleys tailored for minimally invasive surgery and diagnostics offers manufacturers a high-margin niche. A critical opportunity lies in the development of subscription-based or leasing models for smart trolleys, which could significantly lower the initial financial barrier to entry for end-users, ensuring wider market penetration for high-end products featuring IoT and AI capabilities. Addressing the need for modularity and standardized interfaces that simplify integration across various electronic health record (EHR) systems represents another key area for competitive advantage and market capture.

The impact forces influencing the market trajectory are multifaceted. Regulatory scrutiny is a persistent force, especially in North America and Europe, where strict guidelines related to anti-tipping safety, material antimicrobial properties, and data security standards for networked trolleys dictate design and manufacturing processes. Economic stability and governmental healthcare spending significantly influence purchasing power, acting as a cyclical force affecting large capital investments in new equipment. Finally, the competitive landscape is defined by the impact of globalization, leading to pricing pressure from manufacturers based in low-cost regions, forcing established players in high-cost regions to innovate rapidly, offering superior quality and advanced connectivity features to justify premium pricing.

Segmentation Analysis

The Medical Trolleys Market is segmented based on product type, material, application, and end-user, reflecting the diverse functional needs across the healthcare spectrum. Segmentation provides critical insights into purchasing patterns and technological adoption rates across different clinical environments. The fundamental division exists between basic utility and transport trolleys and highly specialized, procedure-specific units, such as emergency or intensive care trolleys. Analyzing these segments helps stakeholders understand which product lines are driving revenue growth and where customization efforts are most effectively directed, ensuring that manufacturing capacities align with shifting clinical requirements and evolving safety standards.

- By Product Type:

- Emergency Trolleys (Crash Carts)

- Anesthesia Trolleys

- Medication Trolleys (Drug Distribution Carts)

- Utility/General Purpose Trolleys

- Procedure Trolleys (e.g., Dialysis, Endoscopy)

- Instrument Trolleys

- By Material:

- Stainless Steel

- Plastic & Composite Materials (ABS, Polypropylene)

- Aluminum

- By Application:

- Hospital Wards and Patient Rooms

- Surgical and Operating Rooms (OR)

- Emergency Departments and ICUs

- Outpatient Clinics and Diagnostic Centers

- By End-User:

- Hospitals and Health Systems

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (e.g., Rehabilitation Centers)

- Nursing Homes and Long-term Care Facilities

Value Chain Analysis For Medical Trolleys Market

The value chain for the Medical Trolleys Market begins with upstream activities involving raw material procurement, focusing on high-grade medical-grade stainless steel, ABS plastic resins, and increasingly, specialized composite materials that offer antimicrobial properties and enhanced durability. Key upstream suppliers include material processors and specialized component manufacturers responsible for casters, locking mechanisms, and electronic sub-assemblies (e.g., batteries, IoT sensors). Manufacturers strategically focus on securing stable supply contracts and maintaining stringent quality controls over these raw inputs, as material quality directly impacts the trolley’s lifespan, infection control capabilities, and compliance with healthcare regulatory standards regarding fire resistance and load-bearing capacity.

The manufacturing stage involves detailed design, fabrication, assembly, and rigorous testing. This stage is complex, particularly for advanced medication trolleys that require integration of sophisticated software, biometric access control, and electronic dispensing systems compliant with data privacy regulations (like HIPAA or GDPR). Midstream activities heavily involve specialized logistics and warehousing capabilities tailored to handling large, sensitive medical equipment. Competitive advantage at this stage is often secured through Lean manufacturing principles, optimizing production lines to allow for high customization levels (modular design) while maintaining economies of scale for standard utility models. Certification processes by regulatory bodies like the FDA or CE mark institutions are crucial midstream checkpoints.

Downstream analysis focuses on distribution channels and end-user delivery. Distribution is typically bifurcated into direct sales channels, favored for large-scale hospital system contracts requiring customized solutions and extensive after-sales support, and indirect channels relying on established medical equipment distributors and wholesalers. These intermediaries are vital for market penetration, particularly in fragmented regional markets and for reaching smaller clinics or long-term care facilities. Post-sales service, including maintenance, repairs, and software updates for smart trolleys, constitutes a growing part of the value proposition, extending the product lifecycle and building customer loyalty. The increasing prominence of e-commerce platforms and specialized online medical supply portals is subtly disrupting traditional indirect distribution models, offering faster access to standard trolley models.

Medical Trolleys Market Potential Customers

The primary end-users and buyers of medical trolleys are institutional healthcare providers, whose purchasing decisions are driven by factors such as patient volume, specialization requirements, budget constraints, and adherence to accreditation standards. Hospitals, particularly large-scale public and private health systems, constitute the largest volume segment, requiring comprehensive fleets of standard utility trolleys, specialized crash carts for every wing, and high-security medication management systems. Their purchasing cycles are typically managed through centralized procurement departments and often involve complex tenders focused on total cost of ownership (TCO) rather than just initial price, prioritizing durability, service contracts, and technological compatibility.

A rapidly expanding customer base includes Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics. As healthcare shifts away from costly inpatient stays, ASCs are investing heavily in specific procedural trolleys (e.g., endoscopy carts, minor surgery instrument tables) that are compact, highly mobile, and tailored for fast turnaround times between procedures. These buyers often seek mid-range products that balance functionality with space efficiency. Long-term care facilities and nursing homes represent another crucial segment, primarily driving demand for medication dispensing trolleys and smaller, ergonomic utility carts suitable for continuous, daily bedside care. Furthermore, governments and military health organizations are significant customers, often requiring robust, highly durable, and standardized products for field hospitals and large institutional settings, sometimes necessitating specialized certifications for rapid deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 billion |

| Market Forecast in 2033 | USD 6.0 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mani Medical Systems, Inc.; Bristol Healthcare Inc.; Omnicell, Inc.; Capsa Healthcare; AFC Industries; Narang Medical Limited; Medline Industries, LP; CME Corp.; Parity Medical Ltd.; Ergotron, Inc.; Stanley Healthcare; InnerSpace Systems International, Inc.; TouchPoint Medical; Harloff Company; Metro Industries; Midmark Corporation; Steris PLC; Herman Miller Healthcare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Trolleys Market Key Technology Landscape

The technological landscape of the Medical Trolleys Market is rapidly evolving from basic physical transport units to sophisticated, connected medical devices. A paramount technological trend is the adoption of Internet of Things (IoT) connectivity, which enables real-time location tracking (RTLS) of trolleys using RFID or Bluetooth Low Energy (BLE) tags. This technology significantly improves asset utilization rates within large facilities, reduces search time for critical equipment like crash carts, and provides valuable data on workflow bottlenecks. Furthermore, smart trolley platforms integrate advanced sensor technology, such as weight sensors in drawers and cabinets, to accurately monitor consumable levels and trigger automated replenishment alerts, thereby minimizing the incidence of clinical interruptions due to supply shortages. This integration leverages cloud-based systems for centralized monitoring and fleet management across multiple hospital locations, enhancing operational visibility.

Security and dispensing accuracy represent another key technological battleground, predominantly impacting medication trolleys. Biometric security features, including fingerprint scanners and vein pattern recognition, are replacing traditional key locks to restrict access to controlled substances, enhancing compliance and accountability in drug administration. Furthermore, integration with electronic health records (EHR) and computerized physician order entry (CPOE) systems is becoming standard, ensuring that medication dispensed from the trolley matches the patient's prescribed order, thereby dramatically reducing medication administration errors (MAEs). Software sophistication now allows for complex charting and automated documentation directly at the point of care, transforming the trolley into a mobile charting station, significantly improving nursing efficiency and data accuracy.

Material science and engineering contribute substantially to modern trolley design, focusing on ergonomics, durability, and infection control. The use of antimicrobial coatings, often incorporating silver ions or copper, is standard across high-contact surfaces to mitigate healthcare-associated infections (HAIs). Lightweight construction techniques utilizing high-impact polymers and aluminum alloys are improving maneuverability, reducing physical strain on staff, and improving the operational lifecycle of the equipment. Power management technologies, including long-life battery systems and efficient charging docks, are crucial for supporting the array of integrated electronics (monitors, scanners, and computers) that transform the modern medical trolley into a comprehensive, self-contained mobile workstation capable of sustaining extended shifts without interruption.

Regional Highlights

- North America: North America, comprising the United States and Canada, stands as the largest and most technologically advanced market for medical trolleys. The region is characterized by high healthcare expenditure, stringent safety and compliance regulations enforced by bodies like the FDA, and a pervasive emphasis on minimizing medication errors and hospital-acquired infections (HAIs). Demand here is heavily skewed toward high-end, smart trolleys featuring comprehensive IoT integration, biometric security, and robust IT connectivity to interface seamlessly with complex EHR systems. The frequent replacement and upgrade cycles driven by technological obsolescence and continuous attempts to optimize operational efficiency ensure consistent market growth. Furthermore, the strong presence of major market players and early adopters of innovative solutions solidify North America's position as a trendsetter in trolley design and functionality. Investments in ambulatory surgical centers (ASCs) also fuel demand for specialized, compact procedural carts.

- Europe: The European market is mature, exhibiting steady growth propelled by favorable regulatory environments (e.g., MDR compliance) and widespread public healthcare modernization initiatives. Western European countries, particularly Germany, the UK, and France, prioritize ergonomic design, adherence to strict material standards for patient safety, and sustainability, leading to a high demand for trolleys made from recyclable or environmentally friendly composite materials. While cost sensitivity is higher compared to the U.S. in publicly funded systems, the focus on long-term value drives purchasing towards highly durable, modular systems designed for longevity and ease of maintenance. Eastern Europe represents a strong growth pocket due to ongoing infrastructure upgrades and increased private investment, transitioning from basic utility carts to more advanced anesthesia and medication trolleys. Regional procurement decisions often involve centralized tenders, emphasizing conformity to harmonized EU standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to explosive healthcare infrastructure development, rising medical tourism, and improving access to quality care across densely populated economies. Countries like China, India, and Southeast Asian nations are witnessing massive construction of new hospitals and clinics, driving immense volume demand for all types of medical trolleys. Although price sensitivity is higher, leading to strong sales of standardized, cost-effective stainless steel and ABS utility trolleys, there is a burgeoning high-tech segment catering to international standard private hospitals in urban centers, which demand advanced medication dispensing and IT-integrated trolleys. Government spending on public health initiatives, coupled with favorable foreign investment policies, makes this region a critical strategic focus for global manufacturers seeking expansion and localized manufacturing partnerships to navigate regional logistical complexities.

- Latin America (LATAM): The LATAM market, covering countries such as Brazil, Mexico, and Argentina, is characterized by variable economic conditions and fragmented healthcare systems. Growth is moderate but significant, driven mainly by the expansion of private hospitals and the increasing adoption of modern medical standards. Demand centers on basic and mid-range utility and anesthesia trolleys, although smart technology penetration remains limited outside of specialized private medical centers in major metropolitan areas. Currency volatility and reliance on imported goods often influence pricing structures and inventory planning for international suppliers.

- Middle East & Africa (MEA): The MEA market shows substantial potential, particularly within the Gulf Cooperation Council (GCC) nations (Saudi Arabia, UAE), which are investing heavily in world-class medical cities and health tourism infrastructure. These wealthy economies exhibit high demand for premium, technologically advanced trolleys, mirroring the trends seen in North America, focusing on advanced IT integration and luxurious ergonomic design. In contrast, the African segment is dominated by demand for robust, simple, and durable basic trolleys that can withstand challenging logistical environments, supported often by international aid organizations and large-scale public health projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Trolleys Market.- Mani Medical Systems, Inc.

- Bristol Healthcare Inc.

- Omnicell, Inc.

- Capsa Healthcare

- AFC Industries

- Narang Medical Limited

- Medline Industries, LP

- CME Corp.

- Parity Medical Ltd.

- Ergotron, Inc.

- Stanley Healthcare

- InnerSpace Systems International, Inc.

- TouchPoint Medical

- Harloff Company

- Metro Industries

- Midmark Corporation

- Steris PLC

- Herman Miller Healthcare

- Enovate Medical

- InterMetro Industries Corporation

Frequently Asked Questions

Analyze common user questions about the Medical Trolleys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Medical Trolleys Market?

Market growth is primarily driven by the increasing global focus on rigorous infection control standards, mandatory replacement of outdated non-compliant equipment, continuous technological integration of smart features (IoT, AI), and the general expansion of hospital infrastructure globally, particularly in emerging Asia Pacific markets.

How does the integration of smart technology impact the cost and adoption of medical trolleys?

Smart technology integration (e.g., biometric locking, RTLS, automated inventory) significantly increases the initial procurement cost of trolleys. However, it enhances clinical efficiency, reduces medication errors, and improves asset utilization, justifying the higher investment for large health systems focused on long-term operational savings and regulatory compliance.

Which product segment holds the largest share in the Medical Trolleys Market?

The medication trolleys and emergency trolleys (crash carts) segments collectively hold the largest market share due to their indispensable roles in daily clinical operations, patient safety protocols, and the critical need for advanced security and compliance features in drug dispensing.

What are the key materials used in manufacturing modern medical trolleys, and why?

Modern medical trolleys are primarily manufactured using high-grade stainless steel for durability and sanitation, and advanced composite materials (ABS, polymers) and aluminum for their lightweight properties, resistance to chemical cleaning agents, and potential for integrated antimicrobial features vital for reducing HAIs.

Which geographical region is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) owing to large-scale government investments in modernizing and expanding healthcare infrastructure, rising medical tourism, and rapidly increasing patient populations requiring access to standardized medical care equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager