Medical Ultrasound Probe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436267 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Medical Ultrasound Probe Market Size

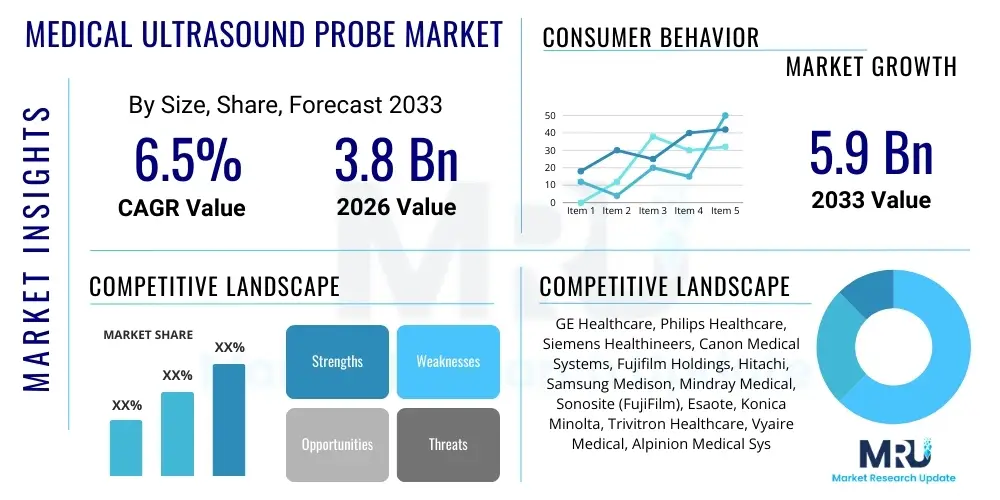

The Medical Ultrasound Probe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $3.8 Billion in 2026 and is projected to reach $5.9 Billion by the end of the forecast period in 2033.

Medical Ultrasound Probe Market introduction

The Medical Ultrasound Probe Market encompasses highly sophisticated transducer devices essential for generating and receiving high-frequency sound waves utilized in diagnostic medical imaging. These probes, often referred to as transducers, convert electrical energy into acoustic energy and vice versa, allowing for the visualization of internal body structures, including organs, tissues, and blood flow. The primary applications of these devices span across cardiology, obstetrics/gynecology (OB/GYN), radiology, and general imaging, facilitating non-invasive, real-time diagnostic procedures. The design complexity varies significantly, ranging from standard convex and linear probes to specialized transesophageal (TEE) and intracavitary probes, each optimized for specific clinical depth and resolution requirements. The continuous evolution toward miniaturization, enhanced image quality through crystal technology (e.g., single-crystal), and improved ergonomic design are central themes defining this market landscape.

Product diversity is a key characteristic of the market, driven by the expanding scope of ultrasound applications beyond traditional radiology settings into point-of-care (POC) environments, emergency medicine, and anesthesiology. The inherent benefits of ultrasound technology, such as its non-ionizing nature (unlike X-rays or CT scans), portability, and cost-effectiveness compared to MRI, ensure its sustained adoption globally. Furthermore, the increasing prevalence of chronic diseases, particularly cardiovascular disorders and cancers requiring early detection and monitoring, significantly amplifies the demand for reliable and high-performance ultrasound probes. The versatility of modern probes, which often support multiple imaging modes like B-mode, Doppler, and elastography, positions them as indispensable tools in comprehensive clinical diagnostics.

Key driving factors accelerating market expansion include significant advancements in transducer manufacturing, such as the transition from ceramic piezoelectric materials to micro-electro-mechanical systems (MEMS) technology, which improves bandwidth and sensitivity. The growing geriatric population, which necessitates frequent diagnostic imaging, coupled with aggressive campaigns in emerging economies to enhance healthcare infrastructure, further fuels market growth. Moreover, the integration of advanced signal processing and image reconstruction software within ultrasound systems necessitates corresponding high-fidelity probes capable of transmitting and receiving complex data streams accurately, thereby pushing continuous innovation in probe design and material science.

Medical Ultrasound Probe Market Executive Summary

The Medical Ultrasound Probe Market is characterized by robust growth, primarily propelled by the integration of advanced materials, increasing demand for portable imaging solutions, and the shift towards specialized applications such such as surgical guidance and minimally invasive procedures. Business trends indicate strong consolidation among major original equipment manufacturers (OEMs), alongside intense competition focused on technological differentiation, particularly in developing single-crystal and matrix array probes that offer superior image resolution and penetration depth. Manufacturers are increasingly focusing on strategic partnerships with software developers to enhance probes with AI-driven image optimization features, improving workflow efficiency and diagnostic accuracy across various clinical environments. Furthermore, supply chain resilience and cost optimization remain critical strategic imperatives for sustaining competitive advantage in the highly regulated medical device sector.

Regional dynamics highlight North America and Europe as established leaders, commanding significant market share due to sophisticated healthcare systems, high per-capita healthcare spending, and rapid adoption of cutting-edge diagnostic technologies. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by vast untapped populations, rising awareness of early disease diagnosis, and substantial governmental investments aimed at modernizing public health infrastructure. Countries like China and India are experiencing a surge in demand for affordable, yet reliable, ultrasound systems and probes, prompting localized manufacturing and distribution efforts. The expansion in these regions is also fueled by the increasing establishment of smaller clinics and diagnostic centers favoring compact, versatile ultrasound equipment.

Segment trends underscore the dominance of the Convex Array Probes segment due to their widespread use in general abdominal and OB/GYN imaging, offering a good balance between penetration and field of view. However, the Linear Array Probes segment is demonstrating accelerated growth, supported by their essential role in vascular imaging, musculoskeletal assessment, and superficial structure visualization, areas seeing increased diagnostic complexity. From an application perspective, Cardiology remains the largest segment, driven by the high global incidence of heart diseases and the necessity for real-time cardiac assessment using phased array and TEE probes. Conversely, the Point-of-Care Testing (POCT) segment, utilizing compact and handheld probes, is poised for explosive expansion, fundamentally altering traditional diagnostic workflows by bringing imaging capabilities directly to the patient bedside, especially in emergency and remote settings.

AI Impact Analysis on Medical Ultrasound Probe Market

Common user questions regarding AI's impact on the Medical Ultrasound Probe Market predominantly revolve around how artificial intelligence enhances image acquisition, improves diagnostic reliability, and affects probe design requirements. Users frequently inquire about the integration of machine learning algorithms for automated image segmentation, quantification of measurements (e.g., ejection fraction, fetal biometry), and automated artifact reduction. There is also keen interest in how AI systems interact with high-fidelity probes to manage complex data streams generated by 3D/4D imaging and elastography. Key concerns center on data privacy, the validation of AI-assisted diagnoses, and whether AI integration will lead to the obsolescence of current probe technologies or necessitate new hardware standards focused on seamless data transfer and processing power at the probe-system interface. Overall, users anticipate that AI will transition ultrasound from a highly operator-dependent modality to a standardized, automated diagnostic platform.

- AI enables real-time image enhancement and noise reduction, optimizing the performance of existing probe technologies.

- Automated image analysis driven by AI reduces operator variability and standardizes diagnostic measurements, increasing clinical consistency.

- Machine learning algorithms guide the user on optimal probe positioning and scanning protocols (AI-guided acquisition), decreasing training requirements.

- AI integration necessitates probes with higher bandwidth and superior signal-to-noise ratio (SNR) to feed clean, high-resolution data for processing.

- Development of smart probes incorporating miniature processing units for edge computing and immediate data compression before transmission.

- AI supports advanced quantitative ultrasound techniques, such as automated shear wave elastography and strain analysis, requiring specialized probe precision.

- Predictive maintenance and quality control of probes through AI monitoring of acoustic element degradation and cable wear.

- Enhanced utilization of 3D and 4D datasets through AI-powered reconstruction and rendering, optimizing volume probe usage.

- Acceleration of workflow in point-of-care settings by automating routine tasks like labeling and reporting, maximizing portable probe utility.

- AI helps in the detection of subtle pathological features that might be missed by the human eye, thus amplifying the diagnostic value derived from complex array probes.

- Facilitation of telesonography and remote diagnostics by using AI to compress and interpret data transmitted from remote handheld probes.

- Optimization of energy transmission and focus depth adjustments dynamically based on tissue characteristics analyzed in real time by AI.

- Customized imaging presets dynamically adjusted by AI for different patient demographics, maximizing the diagnostic efficiency of multi-frequency probes.

DRO & Impact Forces Of Medical Ultrasound Probe Market

The market dynamics of Medical Ultrasound Probes are dictated by a confluence of powerful drivers (D), significant restraints (R), and compelling opportunities (O), creating distinct impact forces that shape investment and technological direction. Key drivers include the overwhelming global preference for non-invasive diagnostic modalities, the substantial increase in the aging population requiring frequent cardiac and cancer screenings, and the aggressive push towards establishing robust point-of-care ultrasound (POCUS) capabilities in diverse clinical settings. The enhanced image quality achieved through advanced piezoelectric materials, such as single crystals and 2D matrix arrays, also acts as a primary catalyst for market growth, encouraging replacement cycles of older equipment. These driving forces collectively generate a strong positive market impact, continuously expanding the installed base and accelerating technological innovation.

Conversely, the market faces notable restraints that temper its potential expansion. High regulatory hurdles, particularly in major markets like North America and Europe, significantly delay product launch and market entry, escalating development costs for manufacturers. Furthermore, the persistent challenge of adequate probe sterilization and reprocessing, crucial for preventing hospital-acquired infections (HAIs), remains a complex logistical and technical constraint. The high initial capital expenditure associated with purchasing advanced ultrasound systems, especially specialized 3D/4D probes and TEE probes, restricts adoption in resource-limited healthcare facilities. Moreover, the dependence on highly skilled professionals to operate and interpret complex ultrasound scans in specialized areas, often leading to variability in results, limits the widespread clinical utility without integrated AI assistance.

Notwithstanding the restraints, the market is rich with transformative opportunities centered on addressing unmet clinical needs. The rapid proliferation of handheld and wireless ultrasound probes, powered by miniaturization technology and cloud connectivity, opens massive market opportunities in primary care, sports medicine, and remote diagnostics. Strategic opportunities also exist in developing probes optimized for therapeutic applications, such as high-intensity focused ultrasound (HIFU) guidance and targeted drug delivery monitoring. The ongoing migration towards standardized manufacturing processes, coupled with the rising availability of cost-effective refurbished probes in developing regions, presents avenues for expanding market penetration. These opportunities, underpinned by technological leaps and evolving care models, collectively exert a forward-looking, transformative impact force on the industry structure.

Segmentation Analysis

The Medical Ultrasound Probe Market is segmented based on critical technical and application parameters to provide a detailed view of its operational dynamics and growth trajectories. Primary segmentation is conducted based on Probe Type (e.g., Convex, Linear, Phased Array, Endocavitary), Technology (e.g., 2D, 3D/4D, Doppler), Application (e.g., Radiology, Cardiology, OB/GYN, Urology), and End-User (e.g., Hospitals, Diagnostic Centers, Ambulatory Surgical Centers). This structural breakdown allows market participants to tailor their research and development efforts to high-growth segments, such as 3D/4D Probes and specialty applications like oncology and musculoskeletal imaging, which are experiencing robust adoption rates due to enhanced diagnostic capabilities and superior volumetric data acquisition.

- By Probe Type:

- Convex Array Probes

- Linear Array Probes

- Phased Array Probes

- Endocavitary Probes (Transvaginal, Transrectal)

- Volume (3D/4D) Probes

- Specialty Probes (TEE, Pencil Probes, Surgical Probes)

- By Technology:

- 2D Ultrasound

- 3D/4D Ultrasound

- Doppler Ultrasound

- Elastography

- Single-Crystal Technology Probes

- By Application:

- Radiology/General Imaging

- Cardiology

- Obstetrics/Gynecology (OB/GYN)

- Vascular Imaging

- Urology

- Emergency Medicine and Point-of-Care (POC)

- Oncology

- Musculoskeletal (MSK)

- By End-User:

- Hospitals and Clinics

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Research and Academic Institutes

Value Chain Analysis For Medical Ultrasound Probe Market

The value chain for the Medical Ultrasound Probe Market begins with the highly specialized Upstream Analysis stage, dominated by raw material procurement and component manufacturing. This stage is critical and involves securing high-grade piezoelectric ceramics (PZT), increasingly advanced single-crystal materials (PMN-PT), acoustic matching layers, backing materials, and complex micro-electronic circuitry necessary for transducer fabrication. Key suppliers in this phase are often specialized material science companies and component providers who adhere to rigorous quality standards required for medical devices. Challenges here include minimizing material defects and ensuring precise acoustic impedance matching, which directly dictates the image quality and frequency bandwidth of the final probe. The subsequent manufacturing process involves intricate assembly, acoustic tuning, and housing design, requiring specialized cleanroom facilities and sophisticated automation.

The Midstream and Distribution Channel analysis focuses on the journey from the manufacturer to the end-user. Major Original Equipment Manufacturers (OEMs) primarily utilize a hybrid distribution model, involving both Direct and Indirect channels. Direct sales channels are typically employed for large institutional clients, major hospital networks, and government contracts, allowing for tighter control over pricing, installation, and service agreements. The Indirect channel relies on a global network of authorized distributors, independent representatives, and third-party logistics providers, crucial for market penetration in geographically diverse or resource-constrained regions. Effective inventory management and specialized logistics for sensitive medical equipment are paramount in this phase, ensuring timely delivery and minimal damage during transit.

The Downstream analysis involves the final installation, maintenance, and post-sale support provided to end-users like hospitals and diagnostic centers. This stage is heavily influenced by the service contracts offered by OEMs and the availability of specialized probe repair services, both authorized and independent. The longevity and reliability of ultrasound probes are significantly enhanced through rigorous preventative maintenance and prompt repair of cable damage or crystal failure, which are common issues impacting operational uptime. Customer satisfaction in the downstream phase is also increasingly tied to software updates, training programs, and integration capabilities of the probes with the hospital's Picture Archiving and Communication Systems (PACS) and electronic health records (EHR), emphasizing the growing convergence of hardware and digital infrastructure.

Medical Ultrasound Probe Market Potential Customers

The primary customers and end-users of Medical Ultrasound Probes are diverse healthcare entities that utilize diagnostic imaging as a core component of patient care and management. Hospitals, encompassing both public and private institutions, represent the largest customer base due to their high patient volumes, comprehensive range of specialties (Cardiology, Radiology, OB/GYN, Critical Care), and significant capital budgets allocated for advanced medical equipment. Within hospitals, specialized departments, such as cardiac catheterization labs and emergency rooms, drive demand for high-end, specialized probes like Transesophageal Echocardiography (TEE) probes and high-frequency linear probes for procedural guidance. The focus of these large institutions is often on purchasing full ultrasound systems with multiple interchangeable probes to ensure maximum versatility across clinical applications.

Secondary, yet rapidly expanding, customer segments include dedicated diagnostic imaging centers and specialty clinics, particularly those focused on areas such as women’s health, vascular diagnostics, and musculoskeletal injuries. Diagnostic centers often invest in a specific range of high-performance probes tailored to their area of expertise, prioritizing throughput and image fidelity over broad general versatility. Furthermore, the burgeoning trend of Ambulatory Surgical Centers (ASCs) and Point-of-Care (POC) settings, including physician offices and remote medical camps, constitutes a key growth area for manufacturers offering compact, ruggedized, and affordable handheld or wireless probes. These end-users prioritize ease of use, portability, and quick diagnostic turnaround, fundamentally altering the traditional market for large, cart-based systems and driving innovation toward miniature transducer technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.8 Billion |

| Market Forecast in 2033 | $5.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, Fujifilm Holdings, Hitachi, Samsung Medison, Mindray Medical, Sonosite (FujiFilm), Esaote, Konica Minolta, Trivitron Healthcare, Vyaire Medical, Alpinion Medical Systems, BK Medical (Analogic), Telemed, SonoScape. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Ultrasound Probe Market Key Technology Landscape

The technological landscape of the Medical Ultrasound Probe Market is defined by a relentless pursuit of higher resolution, greater penetration depth, and enhanced portability, fundamentally relying on advancements in piezoelectric material science and miniaturized electronics. The most significant shift involves the migration from traditional PZT ceramic composites to single-crystal materials, primarily PMN-PT (Lead Magnesium Niobate-Lead Titanate). Single-crystal probes offer superior acoustic properties, including higher electro-mechanical coupling and broader frequency bandwidths, which translates directly into images with vastly improved clarity and contrast resolution, especially beneficial for deep tissue imaging and specialized applications like cardiac analysis. Furthermore, manufacturers are focusing heavily on developing matrix array technology, moving beyond one-dimensional linear arrays to two-dimensional arrays, enabling real-time 3D and 4D imaging capabilities, crucial for volumetric measurements and procedural guidance in surgery and OB/GYN.

Miniaturization and wireless connectivity represent another critical technological pillar reshaping the market. The development of Application-Specific Integrated Circuits (ASICs) tailored for ultrasound beamforming and signal processing allows for the shrinking of electronic components, making handheld and pocket-sized probes viable for clinical use. These highly portable devices often leverage wireless data transmission protocols (Wi-Fi, Bluetooth) to connect to smartphones or tablets, democratizing access to ultrasound imaging outside traditional hospital settings. This technological convergence is central to the explosive growth in the Point-of-Care Ultrasound (POCUS) market, offering immediate diagnostic capabilities in emergency and remote areas where cart-based systems are impractical. The robustness and battery life of these wireless probes are constantly being improved to meet the demands of demanding clinical environments.

Further innovation is concentrated on enhancing functional capabilities through advanced software and sensor integration. Technology such as high-frequency probes (up to 70 MHz) is being developed for specialized dermatological and small-animal research applications, offering microscopic resolution previously unattainable. Moreover, technological advancements in Doppler functionality, including sophisticated flow analysis algorithms and power Doppler modes, continue to improve the visualization and quantification of blood flow, which is crucial for vascular and cardiology diagnostics. The adoption of acoustic lens technologies and complex acoustic matching layers is optimized using simulation tools to maximize sound transmission efficiency and minimize acoustic reflection, ensuring that the next generation of probes provides superior diagnostic confidence across the entire depth range.

Regional Highlights

North America maintains its dominant position in the Medical Ultrasound Probe Market, characterized by early adoption of advanced imaging technologies, robust healthcare expenditure, and the presence of leading market players and research institutions. The high prevalence of chronic conditions, particularly cardiovascular diseases, necessitates continuous investment in high-fidelity ultrasound systems, driving the demand for specialized phased array and TEE probes. Favorable reimbursement policies and standardized regulatory frameworks also facilitate the rapid commercialization and adoption of innovative probes, particularly those integrated with AI capabilities for enhanced workflow efficiency. The United States, in particular, leads in the adoption of POCUS systems, fueled by its expansive emergency medical services and decentralized healthcare delivery models, ensuring sustained market maturity and growth.

Europe represents a mature market showing steady growth, driven by government initiatives focused on improving diagnostic screening programs and the increasing installation base of advanced ultrasound systems across major economies like Germany, the UK, and France. Emphasis in this region is often placed on standardized quality control and rigorous reprocessing standards for probes, influencing design toward more durable and easily sterilizable materials. Eastern European nations are increasingly modernizing their diagnostic infrastructure, creating new opportunities for mid-range and refurbished ultrasound equipment and associated probes. The rising awareness regarding the benefits of non-ionizing imaging modalities further supports the uptake of ultrasound probes across various clinical specialties, including maternity care and musculoskeletal imaging.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily attributable to significant investments in healthcare infrastructure development, particularly in China and India, aimed at serving large and rapidly urbanizing populations. Economic development has increased access to private healthcare, where demand for advanced diagnostic equipment is rising. Furthermore, manufacturers are strategically targeting APAC by developing region-specific, cost-effective solutions and portable ultrasound devices suitable for rural and resource-limited settings. The burgeoning medical tourism sector in countries like Thailand and Singapore also fuels the demand for high-end, technologically superior probes, positioning APAC as the engine of future market growth.

- North America: Dominant market share; driven by high technological adoption, favorable reimbursement, high prevalence of chronic diseases, and established POCUS usage.

- Europe: Steady growth; strong focus on regulatory compliance, demand for specialized cardiovascular and OB/GYN probes, modernization of Eastern European medical facilities.

- Asia Pacific (APAC): Fastest growing region; high healthcare infrastructure investment, rising disposable incomes, large patient pool, strong demand for affordable and portable systems in emerging economies.

- Latin America (LATAM): Moderate growth; expansion of private healthcare facilities, improving access to diagnostic services, potential for refurbished equipment market.

- Middle East and Africa (MEA): Emerging market; driven by investments in high-tech hospitals in the GCC states (Saudi Arabia, UAE) and humanitarian aid driving basic ultrasound penetration in Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Ultrasound Probe Market.- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Hitachi, Ltd.

- Samsung Medison Co., Ltd.

- Mindray Medical International Limited

- Esaote S.p.A.

- Konica Minolta, Inc.

- Trivitron Healthcare

- Vyaire Medical, Inc.

- Alpinion Medical Systems Co., Ltd.

- BK Medical (Analogic Corporation)

- Telemed UAB

- SonoScape Medical Corp.

- Chison Medical Imaging Co., Ltd.

- Wellspring MedTech (Formerly Analogic’s BK Medical)

- Clarius Mobile Health

- Butterfly Network, Inc.

Frequently Asked Questions

Analyze common user questions about the Medical Ultrasound Probe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Medical Ultrasound Probe Market?

The market growth is primarily driven by the increasing global geriatric population, resulting in higher demand for diagnostic screening; continuous advancements in transducer technology, such as single-crystal probes for enhanced image quality; and the widespread adoption of Point-of-Care Ultrasound (POCUS) due to the convenience of portable and handheld devices.

How is technological innovation affecting the design of modern ultrasound probes?

Technological innovation is shifting probe design towards smaller, lighter, and more complex structures, incorporating single-crystal materials for superior bandwidth, developing two-dimensional matrix arrays for 3D/4D imaging, and integrating wireless connectivity and miniature processors to support handheld, AI-enabled diagnostic platforms.

Which probe type holds the largest market share by revenue, and why?

Convex Array Probes typically hold the largest market share due to their broad utility in general abdominal and obstetric/gynecological (OB/GYN) imaging, offering a wide field of view and sufficient penetration depth, making them essential workhorses in most clinical settings globally.

What is the most significant restraint affecting market expansion for medical ultrasound probes?

A key restraint is the complexity and cost associated with rigorous probe reprocessing and sterilization protocols, which are vital for preventing cross-contamination and hospital-acquired infections (HAIs), alongside the substantial initial capital investment required for high-end ultrasound systems and specialized probes.

In which application segment is the adoption of new probe technology expected to accelerate the fastest?

The Emergency Medicine and Point-of-Care (POC) segment is expected to see the fastest acceleration in adoption, driven by the increasing availability of affordable, highly portable, and wireless probes that enable rapid, bedside diagnostic assessment, significantly improving patient triage and management outside traditional radiology departments.

What role does the integration of Artificial Intelligence (AI) play in the future of ultrasound probes?

AI integration is crucial for the future, enabling automated image optimization, real-time quantification of clinical parameters (e.g., cardiac function), and guided scanning protocols. This enhances the diagnostic reliability, reduces operator dependence, and optimizes the complex data output from high-fidelity probes.

Which geographical region is anticipated to demonstrate the highest growth rate during the forecast period?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is forecast to exhibit the highest CAGR. This growth is spurred by significant government investment in healthcare infrastructure, expanding middle-class access to diagnostic services, and rising awareness of preventative health measures.

What are the key differences between Phased Array and Linear Array probes?

Phased Array probes are designed with a small footprint to produce a sector-shaped image, making them ideal for cardiac imaging (allowing scanning between ribs) and deep abdominal scanning. Linear Array probes produce a rectangular image, offering high resolution in the near field, making them suitable for superficial structures, vascular access, and musculoskeletal imaging.

How does the value chain analysis highlight the importance of upstream suppliers in this market?

The upstream segment is critical because it involves specialized material science companies providing high-performance piezoelectric crystals (like PMN-PT). The quality and acoustic properties of these raw materials directly determine the sensitivity, bandwidth, and ultimately the diagnostic image quality of the final probe, making supplier relationships highly strategic.

What impact do stringent regulatory standards have on manufacturers operating in the Medical Ultrasound Probe market?

Stringent regulatory standards (e.g., FDA, CE Mark) necessitate extensive clinical trials, detailed documentation, and adherence to quality management systems (QMS), significantly increasing research and development costs, extending time-to-market, and acting as a barrier to entry for smaller or newer market participants.

Are there growing market opportunities for probes used in therapeutic rather than purely diagnostic applications?

Yes, there are increasing opportunities for specialized probes used in image-guided therapeutics, such as monitoring High-Intensity Focused Ultrasound (HIFU) ablation procedures, guiding targeted biopsies, and supporting minimally invasive surgical interventions, requiring unique design specifications for stability and thermal management.

What defines a "specialty probe" and where are they most commonly used?

Specialty probes are transducers designed for highly specific anatomical access or functional requirements, such as Transesophageal Echocardiography (TEE) probes for detailed cardiac viewing via the esophagus, or intraoperative surgical probes used directly on exposed organs. They are predominantly used in high-acuity hospital settings and specialized surgical centers.

How does the shift toward 3D/4D technology influence the demand for volume probes?

The demand for volume probes (which use 2D matrix arrays) is growing rapidly because 3D/4D technology allows for volumetric data acquisition and real-time visualization, particularly valuable in obstetrics for fetal monitoring and in cardiology for complex structural analysis, enabling more comprehensive and accurate diagnostic assessments.

What is the current trend regarding the end-users purchasing ultrasound probes?

While hospitals remain the largest purchasers, the trend is shifting towards increased purchases by diagnostic imaging centers and, most significantly, by Ambulatory Surgical Centers (ASCs) and private physician offices, which favor portable and specialized probes for efficient, localized diagnostics and procedural guidance.

How do manufacturers address the high cost of advanced probe technologies for emerging markets?

Manufacturers often utilize several strategies, including offering mid-range, feature-optimized systems, focusing on robust and cost-effective refurbished equipment sales, and establishing localized manufacturing or assembly processes to reduce import duties and production overhead, thereby making technology more accessible.

What is the significance of single-crystal technology in ultrasound probes?

Single-crystal technology (like PMN-PT) significantly improves image quality by offering a wider frequency bandwidth and higher electromechanical coupling compared to traditional ceramics. This results in better penetration depth and superior spatial and contrast resolution, crucial for demanding clinical applications such as deep abdominal and cardiac imaging.

How is connectivity, particularly wireless capability, changing the use of ultrasound probes?

Wireless connectivity, driven by miniaturization, allows probes to transmit images to standard smart devices, enabling POCUS (Point-of-Care Ultrasound) in previously inaccessible environments like remote clinics, ambulances, or private practice offices, greatly enhancing portability and immediate diagnostic access.

What are the primary challenges related to the longevity and maintenance of ultrasound probes?

The main challenges are damage to the delicate acoustic lens, frequent cable wear and tear due to high usage and environmental stress, and the risk of crystal degradation over time. Proper handling and adherence to strict maintenance protocols are necessary to mitigate these common issues and ensure functional longevity.

Describe the role of elastography in driving demand for specific probe features.

Elastography, which measures tissue stiffness, requires probes capable of applying and sensing subtle mechanical forces (shear waves or compression). This drives demand for high-precision, robust probes with excellent sensitivity and consistent acoustic output to accurately quantify tissue properties, crucial for liver fibrosis staging and tumor characterization.

Why is the cardiology application segment consistently a dominant revenue contributor?

Cardiology is a dominant segment due to the high global incidence of heart diseases, the necessity for frequent non-invasive monitoring (echocardiography), and the continuous innovation in specialized probes (Phased Array and TEE) that provide detailed, real-time assessment of cardiac structure and function, essential for critical patient management.

How does the shift from 2D to 3D ultrasound affect the market for peripheral accessories?

The transition to 3D ultrasound increases the complexity and requirement for advanced peripheral accessories, including specialized probe holders, tracking sensors for accurate volumetric reconstruction, and high-speed data processing units to handle the larger datasets generated by volume transducers.

What is meant by the "acoustic footprint" of a probe, and why is it important?

The acoustic footprint refers to the physical area of the probe face that contacts the patient's skin and transmits the acoustic energy. It is crucial because a small footprint (like phased arrays) is necessary for scanning through confined spaces (e.g., between ribs), while a large footprint (like convex arrays) provides a broader field of view for general organ imaging.

Are refurbished ultrasound probes a significant factor in the market, and if so, where?

Yes, refurbished ultrasound probes are a significant market factor, particularly in emerging economies (LATAM, MEA, and parts of APAC) and smaller private practices globally. They offer a cost-effective alternative, allowing healthcare providers with constrained budgets to access reliable, albeit older-generation, imaging technology.

How are manufacturers ensuring the durability and longevity of high-use linear probes?

Manufacturers are enhancing the durability of linear probes by utilizing robust housing materials, implementing stress-relieving cable designs (strain reliefs), improving sealing against harsh cleaning chemicals, and incorporating flexible matrix materials for the acoustic lens to withstand frequent physical contact and minor impacts.

In what way is the demand for dedicated urology probes increasing?

Demand is increasing for dedicated urology probes, specifically bi-plane and end-fire transrectal probes, driven by the rising need for prostate cancer screening, guided biopsies, and targeted radiation therapy planning. These applications require high-frequency, high-resolution transducers capable of precise visualization of the prostate and surrounding structures.

What are the key technical challenges in mass-producing high-quality single-crystal probes?

The key technical challenges involve the complex and high-cost growth process of PMN-PT crystals, precise dicing of the crystal into individual elements without inducing mechanical damage, and maintaining uniform acoustic impedance across the entire array for optimal beamforming and image consistency.

How has the COVID-19 pandemic permanently influenced the market for portable probes?

The COVID-19 pandemic permanently accelerated the adoption of portable and handheld probes, as they allowed for rapid lung and cardiac assessment directly at the patient’s bedside without transporting the patient to the radiology department, minimizing infection risk and demonstrating the clinical value of POCUS.

What are the future opportunities for probes designed for veterinary medicine?

Future opportunities exist in developing specialized, ruggedized, and high-frequency probes tailored for veterinary applications, focusing on small animal diagnostics (requiring very high frequency) and equine/large animal reproductive imaging, catering to an increasingly sophisticated veterinary industry.

How does the need for standardized reprocessing affect probe design?

The need for standardized reprocessing requires probe designs that are fully immersible, feature robust sealing to prevent fluid ingress, are resistant to common chemical disinfectants (such as high-level disinfectants), and have smooth, easily cleanable surfaces, often leading to higher initial manufacturing costs.

What is the primary competitive strategy adopted by leading manufacturers in the probe market?

Leading manufacturers primarily compete through technological differentiation, focusing on integrating proprietary software enhancements (including AI), developing superior crystal technology (single-crystal), ensuring seamless integration of probes across their entire system portfolio, and establishing comprehensive global service and repair networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager