Medical Walkers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438715 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Medical Walkers Market Size

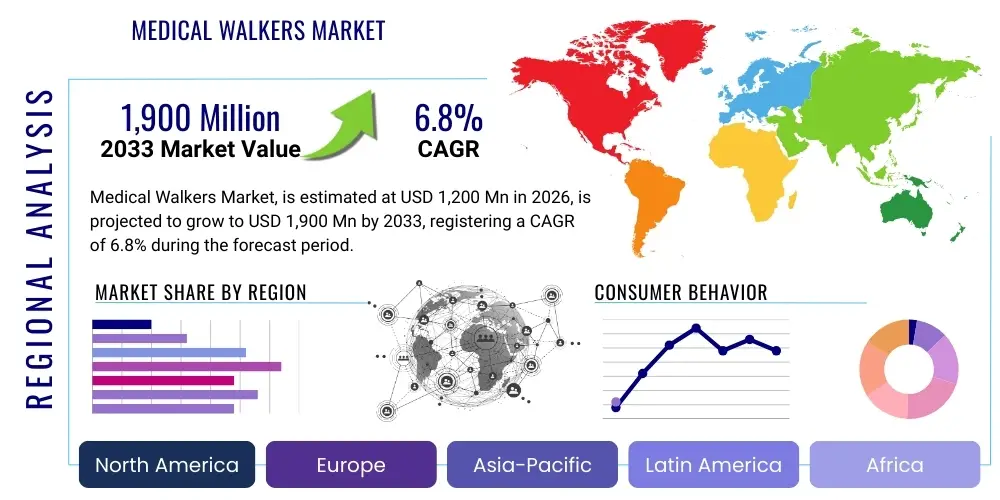

The Medical Walkers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.9 Billion by the end of the forecast period in 2033.

Medical Walkers Market introduction

The Medical Walkers Market encompasses the manufacturing and distribution of mobility assistance devices designed to aid individuals with limited mobility, balance issues, or those recovering from injury or surgery. These devices, primarily categorized as standard walkers, rollators (wheeled walkers), and specialty walkers (such as knee walkers and hemi walkers), are crucial for ensuring patient independence, preventing falls, and facilitating rehabilitation. Modern medical walkers have evolved significantly from basic aluminum frames, now incorporating advanced materials, ergonomic designs, and increasingly, smart technology features.

Major applications of medical walkers span across institutional settings, including hospitals, rehabilitation centers, and nursing homes, as well as the rapidly growing homecare sector. The core benefit of these products lies in enhancing quality of life for the elderly and disabled population, offering stability, weight support, and reducing reliance on caregivers. Furthermore, advancements in walker design, particularly the introduction of lightweight carbon fiber models and enhanced braking systems in rollators, continue to boost user adoption by addressing issues related to bulkiness and maneuverability.

The primary driving factors sustaining market growth include the dramatic demographic shift towards an aging global population, which correlates directly with a higher incidence of age-related mobility impairments like osteoarthritis and chronic neurological disorders. Coupled with rising healthcare expenditures in developed nations and increasing awareness regarding the importance of assistive devices for post-operative recovery, the demand trajectory for medical walkers remains robust throughout the forecast period.

Medical Walkers Market Executive Summary

The Medical Walkers Market is characterized by steady expansion driven primarily by global demographic shifts and technological integration, particularly in high-income regions. Key business trends indicate a strong shift toward rollators, especially four-wheeled models with integrated seating and storage, due to their versatility and enhanced user convenience compared to traditional standard walkers. Furthermore, consolidation among major medical device manufacturers is leading to strategic acquisitions aimed at expanding product portfolios and securing broader distribution networks, particularly targeting the lucrative home healthcare segment.

Regionally, North America maintains market dominance due to high healthcare spending, favorable reimbursement policies for mobility aids, and the presence of established key players focused on innovation. However, the Asia Pacific region is projected to register the highest growth rate, fueled by rapid expansion of healthcare infrastructure in countries like China and India, increasing disposable incomes, and the sheer volume of their aging populations. Regulatory standards concerning device safety and efficacy are becoming increasingly stringent across all major geographies, influencing product development cycles and market entry strategies.

Segmentation analysis highlights the increasing preference for advanced materials, with lightweight aluminum and nascent carbon fiber segments experiencing accelerated adoption rates, especially in the premium market tiers. In terms of end-use, the homecare setting represents the fastest-growing segment, largely attributable to the global trend of aging in place and the cost-effectiveness of managing chronic mobility issues outside clinical environments. Innovation is focused heavily on improving user safety through advanced braking mechanisms and incorporating basic digital features to monitor usage and enhance ergonomic design.

AI Impact Analysis on Medical Walkers Market

User inquiries regarding AI's influence on the Medical Walkers Market primarily revolve around the integration of smart features for enhanced safety and personalized mobility support. Common questions include whether AI can prevent falls before they occur, how data generated by smart walkers will be used, and if these advanced devices will be affordable and accessible to the general elderly population. Concerns center on data privacy, the reliability of complex electronic systems in mobility aids, and the necessity of specialized training for both users and caregivers to maximize the benefits of AI-enhanced devices.

The key thematic expectation is the transition from passive mobility aids to active, intelligent assistive devices. Users anticipate AI algorithms capable of real-time gait analysis, detecting subtle deviations in walking patterns that signal impending fatigue or risk of falling, thereby triggering immediate alerts or physical adjustments within the walker structure (e.g., locking wheels). This proactive intervention capability is seen as the next frontier in minimizing accident risks among the elderly and those undergoing rehabilitation.

Furthermore, AI is expected to revolutionize rehabilitation tracking. By continuously monitoring metrics such as distance walked, speed, weight distribution, and usage duration, AI systems can provide rehabilitation specialists and physical therapists with objective, granular data previously unavailable. This data enables highly personalized treatment plans, optimizing recovery schedules and demonstrating functional improvements more clearly to patients and insurers, ultimately driving better patient outcomes and justifying the cost of these sophisticated devices.

- Predictive Fall Prevention: AI algorithms analyze sensor data (pressure, gyroscope, accelerometer) to predict instability and potential falls 3–5 seconds in advance, engaging stabilizing mechanisms or issuing alerts.

- Personalized Gait Assistance: Real-time modification of walking support parameters based on the user's fatigue level and specific mobility needs, optimizing posture and efficiency.

- Remote Monitoring and Telehealth Integration: AI processes usage data (distance, frequency) for remote healthcare providers, facilitating timely interventions and virtual consultations.

- Cognitive Support and Navigation: Integration of GPS and basic navigational AI to guide users through complex environments and prevent wandering in cognitively impaired patients.

- Optimized Maintenance Scheduling: Machine learning identifies unusual wear patterns in mechanical components (wheels, brakes), scheduling preventative maintenance before failure occurs.

DRO & Impact Forces Of Medical Walkers Market

The dynamics of the Medical Walkers Market are significantly shaped by a combination of strong demographic drivers, stringent regulatory oversight, and continuous technological advancement. Drivers, such as the rapidly expanding geriatric population worldwide and the increasing prevalence of chronic conditions like Parkinson's disease, arthritis, and orthopedic injuries, ensure a sustained baseline demand for mobility aids. Opportunities are opening up in the realm of smart mobility solutions, integrating IoT and AI features to enhance safety and user experience, which commands higher price points and generates new revenue streams for manufacturers.

However, market growth is constrained by several factors. High initial purchase costs associated with advanced, feature-rich rollators and smart walkers can be a significant barrier to adoption, especially in low- and middle-income countries. Additionally, fragmented and inconsistent reimbursement policies across different national healthcare systems create uncertainty for consumers and inhibit widespread adoption of premium products. Regulatory hurdles, while necessary for safety, sometimes slow down the introduction of genuinely innovative technologies due to lengthy testing and approval processes.

The overall impact forces are strongly positive, driven by the societal imperative to maintain independence for an aging population. Technological innovation serves as a multiplier, transforming basic aluminum frames into sophisticated assistive healthcare tools. The key impact force is the shift in healthcare focus toward preventative care and at-home rehabilitation, which naturally elevates the necessity and utility of high-quality, reliable medical walkers, making them essential components of modern geriatric care rather than luxury items.

- Drivers:

- Accelerating global geriatric population growth and associated mobility impairments.

- Increasing incidence of musculoskeletal and neurological disorders requiring walking support.

- Rising patient preference for home-based care (aging in place).

- Growing awareness and demand for ergonomic and lightweight walker designs.

- Restraints:

- High cost and limited reimbursement coverage for advanced and smart walker models in certain regions.

- Potential for user injuries due to improper usage or device failure (leading to increased liability for manufacturers).

- Availability of substitute mobility aids (e.g., wheelchairs, mobility scooters).

- Opportunities:

- Development and commercialization of smart walkers integrated with monitoring sensors and AI.

- Market penetration in emerging economies through partnerships and localized manufacturing.

- Use of novel materials (e.g., aerospace-grade aluminum, composites) to reduce weight and increase durability.

- Impact Forces:

- Strong positive impact from favorable demographic trends.

- Moderate negative impact from stringent regulatory approval timelines.

- High positive impact from continuous material and safety technology innovations.

Segmentation Analysis

The Medical Walkers Market is extensively segmented across dimensions including product type, material, end-use setting, and distribution channel, providing a granular view of user preferences and market dynamics. The product type segmentation reveals a clear trend favoring rollators over traditional standard walkers, owing to the former's superior mobility and integrated features like seats and brakes, which are highly valued by active senior users. Material segmentation highlights a move towards lightweight yet durable options, essential for ease of use, while the end-use market confirms the dominance and projected rapid expansion of the homecare segment globally.

Understanding these segments is crucial for strategic planning. Manufacturers often tailor their product development to meet the specific safety and maneuverability requirements of different end-users—for example, focusing on robustness for hospital use versus compactness and aesthetic appeal for home use. The distribution channel breakdown underscores the strategic importance of e-commerce platforms, which offer greater product variety and convenience for consumers looking to purchase devices directly, circumventing traditional durable medical equipment (DME) retailers.

- By Product Type:

- Standard Walkers (Folding, Non-Folding)

- Rollators (2-wheeled, 3-wheeled, 4-wheeled)

- Hemi Walkers

- Knee Walkers/Scooters

- By Material:

- Aluminum

- Steel

- Carbon Fiber & Composites

- By End-Use:

- Hospitals & Clinics

- Rehabilitation Centers

- Homecare Settings

- Nursing Homes

- By Distribution Channel:

- Retail Pharmacies and Medical Supply Stores

- E-commerce/Online Platforms

- Direct Sales (Institutional Procurement)

Value Chain Analysis For Medical Walkers Market

The Medical Walkers Market value chain begins with raw material sourcing, predominantly aluminum, steel, and increasingly, specialized plastics and carbon fiber composites. Upstream analysis involves suppliers providing these bulk materials, often characterized by volatile commodity pricing, necessitating strong procurement strategies to maintain cost efficiency. Manufacturers then focus on design, fabrication, assembly, and quality control, ensuring compliance with strict international safety standards (e.g., ISO and FDA regulations). Advanced design capabilities, including ergonomics and material engineering, are critical at this stage to differentiate products.

Midstream activities involve large-scale manufacturing and consolidation, where major players leverage automation and lean processes to produce high volumes efficiently. The distribution channel is bifurcated into direct and indirect routes. Direct distribution targets large institutional buyers like hospital systems and government health agencies, emphasizing bulk purchasing agreements and sustained supply chain reliability. Indirect distribution utilizes wholesalers, DME retailers, and specialized e-commerce platforms to reach the vast and fragmented individual consumer market, particularly the burgeoning homecare sector.

Downstream analysis focuses on post-sales service, including warranties, maintenance, and consumer education, which are vital for customer retention and brand reputation, especially given the health-critical nature of the product. E-commerce platforms have fundamentally altered the downstream landscape by providing consumers with direct access to product comparisons, user reviews, and comprehensive product information, demanding greater transparency and responsiveness from manufacturers. Successfully navigating this value chain requires seamless integration from material specification to end-user support, balancing cost control with rigorous quality assurance.

Medical Walkers Market Potential Customers

Potential customers for medical walkers represent a broad spectrum of the population with temporary or permanent mobility challenges. The primary end-users are geriatric individuals aged 65 and above, who frequently require mobility assistance due to age-related conditions such as reduced muscle strength, balance impairment, and chronic diseases like osteoarthritis. This demographic constitutes the largest and most consistent demand pool for both basic standard walkers and premium rollators designed for long-term use and comfort.

A significant secondary customer base includes patients undergoing post-operative recovery, particularly those recovering from orthopedic surgeries (e.g., knee or hip replacements), spinal procedures, or recovering from severe injuries. These users typically require walkers for temporary support during the rehabilitation phase. Rehabilitation centers and hospitals procure walkers in bulk to facilitate early mobilization and physical therapy exercises, often prioritizing durability and ease of cleaning.

Finally, institutional buyers, such as long-term care facilities, nursing homes, and home healthcare agencies, represent a critical customer segment. These organizations prioritize models that offer high safety standards, low maintenance requirements, and are compliant with institutional infection control protocols. Growth in home healthcare services means that individuals using insurance or government assistance for at-home care are increasingly significant buyers, often relying on recommendations from physical therapists and physicians for procurement decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,200 Million |

| Market Forecast in 2033 | $1,900 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Invacare Corporation, Drive DeVilbiss Healthcare, Sunrise Medical, Medline Industries LP, Karman Healthcare, Inc., Nova Medical Products, Graham-Field Health Products, Apex Medical Corp., GF Health Products, Cardinal Health, Ergoactives, Hugo Mobility, Thuasne Group, PDI, LLC, Tarsus Medical, Evolution Technologies, Trionic Sverige, AMG Medical Inc., McKesson Corporation, Pride Mobility Products Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medical Walkers Market Key Technology Landscape

The technological evolution within the Medical Walkers Market is focused primarily on enhancing user safety, improving ergonomic design, and integrating digital monitoring capabilities. Material science plays a vital role, with a sustained shift towards lightweight, high-strength alloys like aircraft-grade aluminum and, increasingly, carbon fiber composites. These materials significantly reduce the physical effort required to maneuver the devices, making them more suitable for weaker users. Ergonomic design advancements include anatomically designed handgrips that reduce pressure points, adjustable height mechanisms with quick-release features, and enhanced folding mechanisms for portability and storage.

Crucially, the integration of safety technology is driving premium product development. Modern rollators feature sophisticated braking systems, including loop-lock brakes for manual control and pressure-activated brakes that automatically engage when weight is applied, providing immediate stability. Furthermore, advancements in wheel design, utilizing durable, non-marking materials and shock absorption features, contribute to smoother movement across various surfaces, minimizing trip hazards and vibration impact on the user's joints.

The most transformative technology involves the introduction of "smart walkers." These devices incorporate IoT sensors (accelerometers, gyroscopes, load cells) to collect real-time data on gait parameters, posture, and potential instability. This data connectivity allows for remote monitoring by caregivers and healthcare providers, triggering alerts for falls or deviations from normal mobility patterns. Although still nascent, the development of basic robotic assistance or guidance systems within walkers—using motors to offer minor directional correction or propulsion assistance on inclines—represents the future trajectory of high-end mobility aid technology, merging traditional medical devices with consumer electronics standards.

Regional Highlights

Regional dynamics are critical in defining the growth trajectory of the Medical Walkers Market, with significant variations in market maturity, healthcare expenditure, and demographic pressures across continents. North America, encompassing the United States and Canada, remains the largest and most mature market, characterized by high disposable income, established reimbursement systems for durable medical equipment, and a strong preference for technologically advanced products, particularly premium rollators and specialized knee walkers. Innovation adoption is rapid here, driven by competitive market forces among key manufacturers and a large elderly population demanding independent living solutions.

Europe represents the second-largest market, with countries like Germany, the UK, and France leading the adoption. The European market is heavily influenced by stringent quality and safety regulations (e.g., MDR compliance) and strong social welfare systems that often subsidize mobility aids. The focus is balanced between institutional procurement for national health services and consumer sales, with a notable emphasis on aesthetic design and functionality suitable for urban and indoor environments. The aging populations in Western Europe ensure continued, stable demand.

The Asia Pacific (APAC) region is poised to exhibit the fastest growth over the forecast period. This acceleration is attributed to rapidly improving healthcare infrastructure, increasing awareness of mobility aids, and, most importantly, the unprecedented scale of the aging populations in countries such as Japan, China, and South Korea. While historically dominated by basic and low-cost standard walkers, rising disposable incomes are fueling a transition towards higher-quality, imported, or locally manufactured rollators. Market opportunities are abundant in establishing robust distribution networks and addressing the unique physical and cultural requirements of diverse user bases within the region.

- North America: Dominant market share due to high healthcare expenditure, favorable insurance coverage for DME, and rapid integration of smart technology; high demand for specialized walkers and 4-wheeled rollators.

- Europe: Mature market sustained by robust social security and healthcare systems; focus on compliance with strict CE marking and Medical Device Regulation (MDR); high per capita spending on quality mobility aids.

- Asia Pacific (APAC): Highest CAGR expected, driven by significant demographic aging (especially in East Asia), infrastructural improvements, and increasing medical tourism; market entry challenges related to price sensitivity and diverse regulatory landscapes.

- Latin America (LATAM): Emerging market segment with growth concentrated in urban centers (Brazil, Mexico); market penetration hindered by inconsistent reimbursement and lower awareness, but potential is high due to increasing middle-class income.

- Middle East and Africa (MEA): Smallest market share, characterized by high demand in GCC states linked to specialized medical facilities and expatriate populations; growth constrained by political instability and limited healthcare access in many African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medical Walkers Market.- Invacare Corporation

- Drive DeVilbiss Healthcare

- Sunrise Medical

- Medline Industries LP

- Karman Healthcare, Inc.

- Nova Medical Products

- Graham-Field Health Products

- Apex Medical Corp.

- GF Health Products

- Cardinal Health

- Ergoactives

- Hugo Mobility

- Thuasne Group

- PDI, LLC

- Tarsus Medical

- Evolution Technologies

- Trionic Sverige

- AMG Medical Inc.

- McKesson Corporation

- Pride Mobility Products Corp.

Frequently Asked Questions

Analyze common user questions about the Medical Walkers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between a standard walker and a rollator?

The fundamental distinction lies in mobility and features. A standard walker typically features four non-wheeled tips (or two front wheels and two tips) that must be lifted to move, prioritizing stability for users with significant balance issues. Conversely, a rollator (wheeled walker) utilizes three or four large wheels, allowing the user to push it continuously without lifting. Rollators invariably include hand brakes and often incorporate seats, making them suitable for more active users who need less support but value convenience and portability over maximum stability. The preference for rollators is a key growth driver in the market due to enhanced user independence.

How is the aging global population impacting the demand for medical walkers?

The demographic trend of the global population aging is the single most powerful driver of demand in the Medical Walkers Market. As individuals age, the incidence of chronic mobility-limiting conditions such as arthritis, osteoporosis, and neurological disorders rises substantially. Since medical walkers are essential for maintaining independence and preventing costly falls in the geriatric demographic, the increasing life expectancy worldwide translates directly into a sustained and expanding demand for all types of walkers, particularly those designed for long-term use in homecare settings, driving segment growth in premium and ergonomic devices.

What role does technology play in the development of next-generation medical walkers?

Technology is transitioning walkers from passive aids to active, intelligent devices. Key technological advancements include the integration of lightweight, durable materials like carbon fiber; sophisticated, multi-functional braking systems; and, most significantly, the advent of "smart walkers." Smart walkers incorporate IoT sensors and potentially AI algorithms to monitor user gait, detect real-time instability, and provide alerts or physical assistance to prevent falls. This focus on digital health integration enhances safety, facilitates remote monitoring by caregivers, and optimizes rehabilitation protocols, positioning these advanced products at the high-growth end of the market.

Which regional market offers the highest growth potential for medical walker manufacturers?

The Asia Pacific (APAC) region is universally identified as offering the highest growth potential (CAGR) for medical walker manufacturers over the forecast period. While North America holds the largest current market value, APAC is experiencing rapid expansion due to its accelerating aging population, particularly in high-density markets like China and India, coupled with significant ongoing investments in healthcare infrastructure. Manufacturers are adapting strategies to address the large, increasingly affluent population in this region by offering a wider range of products, from affordable basic models to advanced rollators, capitalizing on the increasing consumer awareness regarding quality mobility assistance.

Are smart medical walkers covered by insurance or reimbursement policies?

Reimbursement coverage for medical walkers varies significantly by geography and product sophistication. Basic standard walkers and traditional rollators are typically classified as Durable Medical Equipment (DME) and are often covered by government programs (like Medicare in the U.S.) or private insurance, provided they are deemed medically necessary and prescribed by a physician. However, coverage for advanced "smart walkers" featuring integrated AI, IoT connectivity, and enhanced safety mechanisms is currently more inconsistent. While some cutting-edge features might be classified as non-reimbursable enhancements, manufacturers are actively working with regulatory bodies to secure better reimbursement status, positioning these technologies as essential preventative health tools that reduce long-term healthcare costs associated with falls.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager