Medication Therapy Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434068 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Medication Therapy Management Market Size

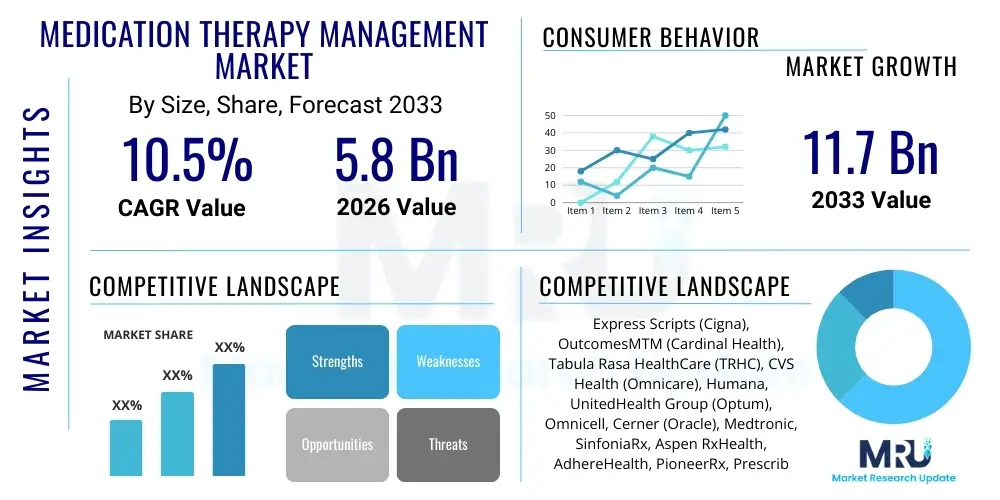

The Medication Therapy Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $11.7 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing burden of chronic diseases, the rise in polypharmacy among the elderly population, and greater regulatory emphasis on improving patient safety and healthcare outcomes through optimized medication usage.

The valuation reflects the critical shift in healthcare delivery models, moving from fee-for-service toward value-based care, where MTM services play a pivotal role in reducing readmission rates and overall healthcare costs. The market size calculation incorporates revenues generated by specialized MTM providers, community pharmacies, managed care organizations, and technology vendors offering software and platforms for MTM delivery and documentation. Future expansion will be heavily influenced by technological advancements, particularly in telemedicine and AI-driven predictive analytics, which enhance the scalability and efficiency of personalized therapy management.

Medication Therapy Management Market introduction

Medication Therapy Management (MTM) is a comprehensive service designed to optimize therapeutic outcomes for individual patients. It involves a systematic review of all medications, including prescription, over-the-counter drugs, and herbal supplements, by a pharmacist or MTM specialist to identify and resolve potential drug-related problems (DRPs). The core product description encompasses comprehensive medication reviews (CMRs), targeted medication reviews (TMRs), medication reconciliation, and patient-specific action planning. Major applications of MTM services include managing complex chronic conditions such as diabetes, hypertension, and heart failure, addressing polypharmacy in geriatric populations, and ensuring safe transitions of care between healthcare settings. Key benefits derived from MTM include improved patient adherence, reduction in adverse drug events (ADEs), lower healthcare expenditures due to avoided hospitalizations, and enhanced patient quality of life. The primary driving factors fueling market growth are the aging population, increasing prevalence of complex chronic illnesses necessitating multiple medications, mandatory MTM coverage under certain Medicare Part D plans, and a growing recognition by payers of MTM’s substantial return on investment in preventative care.

The scope of MTM has broadened significantly beyond traditional pharmacy settings, integrating deeply into accountable care organizations (ACOs) and patient-centered medical homes (PCMHs). This integration ensures that medication management is holistic and coordinated across the entire care continuum. MTM providers leverage advanced software platforms to access electronic health records (EHRs), conduct risk stratification, and communicate findings seamlessly with physicians and other care team members. The market structure is characterized by a mix of large pharmacy benefit managers (PBMs) that offer MTM through their networks, specialized independent MTM companies, and health plans that utilize in-house clinical staff to deliver services.

Technological integration remains a crucial element of MTM market evolution. Telepharmacy and remote patient monitoring (RPM) technologies are enabling the delivery of MTM services to geographically isolated populations, dramatically improving access and convenience. Furthermore, the push for standardization in MTM documentation and data exchange, facilitated by organizations like the American Pharmacists Association (APhA), is enhancing the reliability and comparability of outcomes data, which further strengthens the business case for MTM adoption among cost-conscious payers and providers.

Medication Therapy Management Market Executive Summary

The Medication Therapy Management (MTM) market is characterized by robust business trends centered on technological integration, value-based reimbursement models, and strategic partnerships between payers and MTM providers. Business growth is being accelerated by the expansion of Medicare Advantage plans, which frequently incorporate comprehensive MTM offerings to attract beneficiaries and meet quality metrics such as those defined by the Centers for Medicare & Medicaid Services (CMS) Star Ratings. Key segments trends indicate a strong rise in demand for technology-enabled solutions, particularly sophisticated software for clinical decision support, risk stratification, and efficient documentation of comprehensive medication reviews (CMRs). While chronic disease management remains the largest application segment, personalized medicine, including pharmacogenomics integration into MTM, is emerging as a high-growth niche. Regionally, North America maintains market dominance due to early adoption, favorable reimbursement policies, and a highly structured healthcare system, though Asia Pacific is forecast to exhibit the highest CAGR, driven by increasing healthcare expenditure, rising chronic disease burden, and professionalization of pharmacy services in developing economies.

The market faces concurrent pressures and opportunities. Regulatory mandates, while providing a baseline for MTM services, also introduce complexity regarding eligibility and documentation requirements. The high growth in the volume of prescriptions and complexity of drug regimens globally acts as a foundational driver. Furthermore, the trend toward consolidating pharmaceutical supply chains and vertical integration within healthcare (e.g., PBMs acquiring providers) is shaping the competitive landscape, making scalability and interoperability critical differentiators for technology vendors and service providers. Successful market players are focusing on demonstrating measurable clinical and economic outcomes, crucial for securing long-term contracts with large health plans and government agencies.

AI Impact Analysis on Medication Therapy Management Market

User queries regarding the impact of Artificial Intelligence (AI) on the Medication Therapy Management (MTM) Market frequently revolve around automation of routine tasks, predictive risk modeling for adverse drug events (ADEs), and the ethics of integrating machine-driven recommendations into personalized care. Users seek clarity on how AI can enhance efficiency without diminishing the critical human element of pharmacist-patient consultation. Key themes include the ability of machine learning to identify high-risk patients for targeted medication reviews (TMRs) far more effectively than traditional methods, the potential for Natural Language Processing (NLP) to automate the extraction of crucial medication data from unstructured clinical notes, and the promise of predictive models to forecast patient adherence levels and therapeutic response, thereby transforming MTM from a reactive service into a proactive, preventative intervention. There is high expectation that AI will standardize complex MTM processes and significantly lower operating costs, allowing pharmacists to focus their expertise on high-touch clinical decision-making and patient counseling.

- AI algorithms enable highly accurate patient risk stratification based on demographic data, claims history, and medication profiles, optimizing the selection process for MTM services.

- Natural Language Processing (NLP) accelerates comprehensive medication review (CMR) preparation by quickly extracting relevant clinical data from electronic health records (EHRs) and patient notes.

- Machine learning models predict the likelihood of non-adherence or adverse drug events (ADEs), triggering proactive interventions by MTM providers.

- AI-powered decision support tools provide real-time clinical recommendations for optimizing drug regimens, dosages, and identifying potential drug-drug interactions (DDIs) or drug-disease contraindications.

- Automation of documentation and billing processes through intelligent systems reduces administrative burden, enhancing the scalability and profitability of MTM programs.

- Integration of AI with pharmacogenomics data allows for highly personalized therapy recommendations based on genetic predispositions, improving treatment efficacy.

DRO & Impact Forces Of Medication Therapy Management Market

The MTM market is propelled by structural drivers, including the demographic shift towards an aging population and the escalating complexity of medication regimens for chronic conditions. Restraints primarily involve challenges related to inconsistent and fragmented reimbursement structures across different payer types and jurisdictions, coupled with the slow adoption of interoperable health IT systems necessary for seamless data exchange between prescribers, pharmacies, and MTM providers. Opportunities abound in expanding MTM services into new areas such as specialty pharmacy management, integrating MTM with behavioral health, and leveraging telehealth capabilities to serve remote or underserved communities. These forces, when combined, exert a powerful impact, emphasizing the need for robust evidence demonstrating cost savings and clinical efficacy to overcome economic barriers and secure widespread institutional adoption.

Drivers: The global increase in chronic disease prevalence (e.g., cardiovascular disease, diabetes, respiratory illnesses) directly correlates with increased polypharmacy, making MTM critical for safety and efficacy. Furthermore, regulatory support, particularly mandates under Medicare Part D in the U.S., ensures a foundational market demand. The shift towards value-based care incentivizes healthcare organizations to invest in preventative services like MTM to meet quality metrics and reduce costly acute care events. The proven economic return on investment (ROI) for MTM, demonstrated through reduced hospitalizations and emergency department visits, continues to encourage payer participation.

Restraints: Significant resistance comes from the complexity of achieving consistent reimbursement, as payment models often vary greatly between public and private payers, creating administrative friction for providers. Lack of awareness among both patients and primary care physicians regarding the full scope and benefits of MTM services also acts as a constraint, limiting referrals. Interoperability challenges among disparate electronic health record (EHR) systems impede the comprehensive data sharing required for high-quality, coordinated MTM delivery, increasing the risk of incomplete medication reviews. Furthermore, the current shortage of trained clinical pharmacists specialized in advanced MTM practice limits service expansion capacity in certain regions.

Opportunities: The market offers substantial opportunities in developing sophisticated telehealth platforms that facilitate remote MTM consultations, drastically expanding geographic reach and patient access. Integrating pharmacogenomic testing results into MTM protocols presents an avenue for truly personalized medicine, enhancing treatment optimization. Furthermore, expanding MTM services to specialty medications, which involve high cost and complex handling requirements, represents a burgeoning revenue stream. Developing standardized outcome measures and leveraging predictive analytics provide pathways to optimize service delivery and strengthen the value proposition to risk-bearing entities.

Segmentation Analysis

The Medication Therapy Management (MTM) market is segmented based on Service Type, Application, and End-User. Analyzing these segments provides a granular view of market dynamics and adoption trends. The Service Type segmentation details the specific clinical activities performed, with Comprehensive Medication Reviews (CMRs) being the primary revenue generator due to their mandatory nature for high-risk patients. Application segmentation highlights the therapeutic areas driving demand, where chronic disease management dominates due to high population burden. The End-User analysis focuses on the entities purchasing or providing MTM services, with Health Plans/Payers being the largest segment as they bear the financial risk and mandate MTM coverage for their members.

- Service Type:

- Comprehensive Medication Review (CMR)

- Targeted Medication Review (TMR)

- Personal Medication Record (PMR)

- Medication-Related Action Plan (MAP)

- Intervention and Referral

- Application:

- Chronic Disease Management (Diabetes, Hypertension, COPD, Asthma)

- Polypharmacy Management (Geriatric Care)

- Transitions of Care (Hospital Discharge)

- High-Risk Drug Management

- End-User:

- Retail Pharmacies and Community Settings

- Hospitals and Clinics

- Health Plans/Payers (PBMs and Managed Care Organizations)

- Ambulatory Care Centers

Value Chain Analysis For Medication Therapy Management Market

The value chain for the Medication Therapy Management market begins with upstream activities focused on data acquisition and technology development. This involves technology providers creating secure, interoperable MTM software platforms, AI/ML tools for risk stratification, and patient engagement systems. Key upstream elements also include academic institutions and regulatory bodies defining clinical protocols and training specialized MTM pharmacists. Downstream activities involve the direct delivery of the service to the patient. This is predominantly carried out by licensed clinical pharmacists in various settings, including community pharmacies, telehealth centers, or integrated health systems. The distribution channel is often multi-faceted, involving both direct service provision from payer-owned clinics or PBM subsidiaries (direct channel) and indirect service provision through contracted independent pharmacies or specialized MTM firms (indirect channel). The complexity of the value chain is centered on ensuring high-quality, standardized service delivery while maintaining compliance with privacy and regulatory mandates.

Upstream analysis emphasizes the role of IT and data vendors who supply the foundational technology necessary for MTM execution. These entities are responsible for developing the intelligence layer that integrates claims data, clinical data, and demographic information to identify patients needing intervention. Innovation in this segment focuses on cloud-based solutions and enhancing interoperability standards (like FHIR) to facilitate seamless communication between providers. The cost of acquiring and maintaining these sophisticated software platforms represents a significant portion of upstream expenditure, but is necessary for scalability.

Downstream analysis is dominated by service delivery and patient interaction. The success of MTM highly depends on the clinical expertise and communication skills of the dispensing pharmacist or MTM specialist. Community pharmacies play a crucial role as they offer high accessibility, making them vital distribution points for MTM services, especially CMRs. Health plans often act as the central coordinator in the downstream process, contracting with providers, managing reimbursement, and monitoring quality metrics. The direct channel (e.g., PBM-owned clinics) offers greater control over service quality and adherence to specific protocols, while the indirect channel (independent pharmacies) provides greater geographic coverage and flexibility.

Medication Therapy Management Market Potential Customers

The primary end-users and buyers of Medication Therapy Management services are organizations that bear the financial risk associated with patient health outcomes and those mandated to provide comprehensive coverage. This includes large government programs such as Medicare and Medicaid, which contract MTM coverage, and private Health Plans and Managed Care Organizations (MCOs) who utilize MTM to improve quality metrics (HEDIS/Star Ratings) and control overall expenditures related to preventable adverse drug events. Furthermore, self-insured employers are increasingly recognizing MTM as a tool to reduce healthcare costs for their employees with chronic conditions. Hospitals and integrated delivery networks (IDNs) also constitute significant customers, particularly for MTM services focused on transitions of care, aiming to reduce 30-day readmission penalties imposed by CMS.

Specific customer segments include Pharmacy Benefit Managers (PBMs), who often act as the intermediary, administering MTM programs on behalf of health plans and establishing networks of MTM providers. Independent physician associations (IPAs) and Accountable Care Organizations (ACOs) are rapidly adopting MTM to meet performance benchmarks under value-based payment contracts. These customers require highly measurable results, demanding sophisticated data analytics from MTM service providers that can clearly articulate clinical efficacy and financial return on investment (ROI). The expanding focus on preventative care and personalized medicine means that individuals managing complex, expensive conditions are the ultimate beneficiaries driving institutional demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $11.7 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Express Scripts (Cigna), OutcomesMTM (Cardinal Health), Tabula Rasa HealthCare (TRHC), CVS Health (Omnicare), Humana, UnitedHealth Group (Optum), Omnicell, Cerner (Oracle), Medtronic, SinfoniaRx, Aspen RxHealth, AdhereHealth, PioneerRx, PrescribeWellness, McKesson Corporation, Change Healthcare, Surescripts, MTM Services LLC, Genoa Healthcare, Enliven Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medication Therapy Management Market Key Technology Landscape

The technological backbone of the Medication Therapy Management market is characterized by sophisticated software solutions designed to enhance efficiency, data integration, and clinical decision support. Key technologies include advanced MTM documentation platforms that comply with rigorous regulatory standards, such as those set by the Centers for Medicare & Medicaid Services (CMS). Interoperability solutions, utilizing standards like HL7 and FHIR, are essential for seamless communication between electronic health records (EHRs), claims processing systems, and MTM delivery platforms. Furthermore, the increasing adoption of telehealth and video conferencing tools facilitates remote MTM consultations, significantly broadening patient access. The application of Artificial Intelligence (AI) and Machine Learning (ML) is transforming the landscape by enabling predictive analytics for risk stratification and automated identification of potential drug therapy problems (DTPs), moving the industry toward a highly proactive care model.

The technology utilized extends into patient engagement tools, including mobile applications and secure patient portals, which facilitate adherence tracking, medication reminders, and direct asynchronous communication with MTM providers. Data security and compliance technology, particularly cloud-based solutions adhering to HIPAA and GDPR requirements, are foundational, given the sensitive nature of patient health information (PHI) involved in MTM reviews. Specialized software for managing pharmacogenomics data is also emerging, allowing MTM pharmacists to incorporate genetic testing results into their therapeutic recommendations, leading to more precise and effective treatment plans. This high degree of technological integration is essential for MTM providers to handle large patient volumes efficiently while maintaining high standards of clinical quality and documentation.

Regional Highlights

- North America: North America, particularly the United States, holds the dominant share of the MTM market, largely due to mandatory MTM provisions under Medicare Part D, a highly structured healthcare reimbursement system, and the presence of major key players (PBMs, large health plans) who actively utilize MTM services. High rates of chronic disease and high expenditure on prescription drugs further solidify its lead. Technological infrastructure, including widespread EHR adoption and advanced telehealth capabilities, supports efficient service delivery.

- Europe: The European MTM market is characterized by varying levels of adoption across member states. The UK, Nordic countries, and Germany show relatively mature MTM initiatives, often integrated within primary care settings. Growth is slower than in North America due to fragmented national healthcare systems and differing reimbursement models, but the emphasis on patient safety and quality management, driven by increasing polypharmacy among aging populations, is accelerating acceptance and piloting MTM programs.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market. This growth is fueled by rising healthcare expenditure, rapid expansion of pharmaceutical markets, increasing prevalence of lifestyle-related chronic diseases (especially diabetes in countries like India and China), and the professionalization of pharmacy services. While starting from a smaller base, investments in digital health infrastructure and government initiatives aimed at improving primary care quality offer significant long-term expansion opportunities.

- Latin America (LATAM): The LATAM market is nascent, facing challenges related to healthcare access, infrastructure variability, and economic instability. However, increasing urbanization and the resulting rise in chronic illnesses are creating demand. Adoption is primarily concentrated in private health systems and larger economies like Brazil and Mexico, focusing initially on managing high-cost specialty medications and optimizing polypharmacy in high-income demographics.

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven primarily by Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) which have strong governmental backing for modernizing healthcare systems. High prevalence of chronic conditions and increasing investment in establishing specialized clinical pharmacy services are key drivers. The African continent, excluding South Africa, sees limited MTM adoption, confined mainly to pilot programs in major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medication Therapy Management Market.- Express Scripts (Cigna Corporation)

- OutcomesMTM (Cardinal Health)

- Tabula Rasa HealthCare (TRHC)

- CVS Health (Omnicare)

- Humana

- UnitedHealth Group (OptumRx)

- Omnicell

- Cerner (Oracle)

- Medtronic

- SinfoniaRx

- Aspen RxHealth

- AdhereHealth

- PioneerRx

- PrescribeWellness

- McKesson Corporation

- Change Healthcare

- Surescripts

- MTM Services LLC

- Genoa Healthcare

- Enliven Health

Frequently Asked Questions

Analyze common user questions about the Medication Therapy Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Medication Therapy Management (MTM) Market?

The primary drivers include the escalating prevalence of chronic diseases globally, the subsequent rise in polypharmacy among geriatric populations, and the mandatory MTM provisions integrated into Medicare Part D plans in the US. The transition to value-based care models, which emphasize outcome-based reimbursement and cost reduction, also significantly drives market demand.

How does MTM reduce overall healthcare costs for payers and patients?

MTM reduces costs by preventing adverse drug events (ADEs), minimizing unnecessary prescriptions, and significantly improving medication adherence. This proactive approach leads to fewer hospitalizations, reduced emergency room visits, and optimized utilization of costly medications, offering a substantial return on investment (ROI) for health plans.

Which technology is most crucial for the future scalability of MTM services?

Artificial Intelligence (AI) and telehealth platforms are most crucial. AI enables efficient risk stratification and clinical decision support, automating routine data analysis. Telehealth facilitates remote, high-quality consultations, ensuring MTM services are accessible to a wider geographic patient base, thus enhancing scalability and reach.

What is the difference between a Comprehensive Medication Review (CMR) and a Targeted Medication Review (TMR)?

A Comprehensive Medication Review (CMR) is a face-to-face or telehealth consultation involving a systematic review of all a patient's medications to develop an action plan. A Targeted Medication Review (TMR) is a focused, intermittent review performed by a pharmacist to address specific, identified drug therapy problems (DTPs, such as high dosage or non-adherence) without necessarily requiring direct patient contact.

Which region is expected to show the fastest growth rate for MTM adoption through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly increasing healthcare expenditure, rising chronic disease burden in populous countries like China and India, and significant government investment in establishing modern clinical pharmacy services and digital health infrastructure.

Regional Market Deep Dive: North America

North America, led by the United States, represents the largest and most mature market for Medication Therapy Management (MTM). The market strength here is fundamentally rooted in the structure of the American healthcare system, specifically the integration of MTM into federal programs. The Centers for Medicare & Medicaid Services (CMS) mandate that Medicare Part D plans offer MTM services to eligible beneficiaries, ensuring a continuous and substantial demand base. This regulatory framework, coupled with the high prevalence of complex, chronic conditions requiring multiple prescriptions, has fostered an environment where MTM is essential for quality assurance and cost control. Major Pharmacy Benefit Managers (PBMs) and large integrated delivery systems have heavily invested in MTM technologies and specialized clinical staff to manage risk and meet performance metrics like Star Ratings.

The technological adoption in North America is highly advanced, driving efficiency gains in service delivery. Widespread use of electronic health records (EHRs) and sophisticated claims data analysis tools allows providers to accurately identify patients who will benefit most from MTM intervention. Furthermore, the rapid expansion and regulatory acceptance of telehealth services, particularly following recent public health crises, has normalized remote MTM consultations, significantly increasing patient accessibility, particularly in rural and underserved areas. The intense competition among health plans to attract and retain members also spurs innovation in MTM offerings, leading to specialized programs tailored for specific high-risk populations, such as those with end-stage renal disease or complex behavioral health needs.

However, the North American market faces challenges related to inconsistent state-level reimbursement for non-Medicare beneficiaries and ongoing interoperability issues despite advances. Efforts are continuously focused on demonstrating the long-term cost-effectiveness of MTM, moving beyond short-term savings to showcase reductions in total cost of care over several years. Strategic alliances between MTM technology vendors and large pharmacy chains are defining the competitive edge, enabling rapid deployment of services across expansive retail footprints. The future trajectory for North America involves deeper integration of personalized medicine, including widespread incorporation of pharmacogenomics into MTM decision-making processes.

- Dominant Market Share: Highest revenue generation due to regulatory mandate (Medicare Part D) and high prescription drug utilization.

- Advanced Technology Adoption: Leadership in AI-driven risk stratification, predictive analytics, and sophisticated MTM software platforms.

- Value-Based Care Emphasis: Strong alignment between MTM outcomes and financial incentives under ACOs and Managed Care Organizations.

- Key Players Concentration: Presence and significant influence of global PBMs and major integrated healthcare providers.

Regional Market Deep Dive: Asia Pacific (APAC)

The Asia Pacific region is poised for explosive growth, emerging as the fastest-expanding market segment globally for Medication Therapy Management. This acceleration is predominantly fueled by transformative demographic and socioeconomic shifts. Rapid urbanization, coupled with significant increases in disposable income across key economies like China, India, and Southeast Asian nations, is leading to a dramatic rise in lifestyle-related chronic conditions, including diabetes and cardiovascular diseases. This demographic shift necessitates sophisticated medication management solutions, moving beyond basic dispensing services offered by traditional pharmacy models. Governments across the region are increasingly investing in healthcare infrastructure and quality initiatives, recognizing the critical need to control escalating costs associated with poorly managed chronic conditions.

The APAC market, while currently smaller than North America or Europe, benefits from a "leapfrog" effect in technology adoption. Many developing economies are bypassing older infrastructural challenges by directly implementing modern, mobile-first digital health platforms, which are highly conducive to remote MTM delivery. Japan, South Korea, and Australia represent the mature segment of the APAC market, boasting established professional pharmacy roles and early MTM adoption programs supported by national health insurance schemes. In contrast, emerging markets like India and China are witnessing rapid growth driven by private sector initiatives and a large, aging patient base transitioning to complex drug regimens, creating immense potential for MTM service providers to enter and scale quickly.

Challenges in APAC include the heterogeneity of regulatory environments, linguistic diversity, and substantial variations in healthcare access between urban and rural areas. Successful market penetration requires localized strategies, often involving partnerships with regional healthcare providers and adapting MTM services to existing public health priorities. The focus is shifting toward establishing robust standards for clinical pharmacy practice and leveraging technology to bridge geographical gaps. This regional market is expected to attract significant international investment as global MTM players seek to capitalize on the vast, untapped patient pool and improving reimbursement landscapes.

- Highest CAGR Forecast: Driven by substantial increases in healthcare spending and chronic disease incidence.

- Favorable Demographic Trends: Large and rapidly aging populations in major economies requiring polypharmacy management.

- Digital Health Leapfrogging: Rapid adoption of mobile and cloud-based solutions for remote MTM delivery.

- Government Quality Initiatives: Increasing focus on improving primary care quality and reducing medication-related harm through national health programs.

Regional Market Deep Dive: Europe

The European Medication Therapy Management market is characterized by moderate, steady growth, primarily driven by national efforts to enhance patient safety and efficiency within centralized healthcare systems. Countries across Western Europe, particularly the UK, Germany, and the Nordic nations, have established robust primary care pharmacy services and are incorporating elements of MTM, often termed medication review services, into their standard clinical protocols. The impetus for MTM adoption stems from high levels of geriatric polypharmacy and a commitment across the European Union to reduce adverse drug reactions (ADRs), which represent a significant burden on hospital resources and budgets. Standardization and quality frameworks, often mandated by national health agencies, are key features of the European MTM landscape, ensuring high standards of clinical delivery.

A key distinguishing feature of the European market is the diverse structure of funding and delivery mechanisms. Unlike the US, where PBMs play a dominant role, European MTM often involves direct collaboration between community pharmacies and general practitioners (GPs), funded either through capitation payments or specific service fees from national health insurance bodies. This requires MTM providers to integrate services seamlessly within existing primary care networks. Technology adoption, while strong in core Western countries, is primarily focused on achieving interoperability between various national patient record systems and improving medication reconciliation during transitions of care, rather than aggressive AI adoption seen in North America.

Market expansion in Europe faces hurdles related to fragmentation among national healthcare policies and slower regulatory movement compared to the US. While the economic argument for MTM is compelling—reducing expensive hospital stays—securing pan-European alignment on reimbursement coding and service standards remains a persistent challenge. Opportunities lie in scaling successful pilot programs nationally, specifically targeting high-risk patient groups such as those recently discharged from hospitals or managing multiple complex conditions. Eastern European countries, while currently lagging in comprehensive MTM implementation, present significant long-term growth potential as their healthcare systems continue to mature and modernize, increasing their focus on preventative pharmaceutical care.

- Steady Growth Rate: Driven by national safety priorities and reduction of adverse drug reactions (ADRs).

- Integrated Primary Care Focus: MTM services are often delivered via collaboration between community pharmacists and general practitioners.

- Regulatory Fragmentation: Variations in reimbursement and service definitions across different national health systems.

- Core Focus Areas: High emphasis on transitions of care and optimizing geriatric polypharmacy protocols.

Technology Integration and Future Outlook in MTM

The future of Medication Therapy Management is inextricably linked to technological innovation, transforming it from a resource-intensive, largely manual process into a highly efficient, data-driven service. The core technology shift centers on leveraging data analytics to move from reactive interventions—responding to drug-related problems (DRPs)—to proactive, predictive care models. Integration platforms that combine real-time electronic health record (EHR) data, claims information, wearable device data, and behavioral health metrics are foundational. These comprehensive datasets, when processed through advanced machine learning algorithms, enable the identification of patients at imminent risk of non-adherence or adverse events with unprecedented accuracy, allowing pharmacists to intervene precisely when and where it is needed most, optimizing resource utilization and enhancing clinical impact.

Furthermore, the widespread adoption of standardized interoperability frameworks, such as Fast Healthcare Interoperability Resources (FHIR), is critical for unlocking the full potential of MTM. Current challenges often stem from disparate systems that cannot easily share medication histories or clinical notes, forcing pharmacists to manually reconcile information—a time-consuming and error-prone process. FHIR-enabled platforms facilitate instantaneous, secure data exchange between PBMs, pharmacies, hospitals, and primary care physicians, ensuring that the MTM provider has a complete, up-to-date picture of the patient's therapeutic regimen. This technical harmonization not only improves clinical outcomes but also streamlines administrative workflows, making MTM programs more financially viable across diverse healthcare settings.

Looking forward, the incorporation of personalized medicine, especially pharmacogenomics, represents the next major technological evolution in MTM. Integrating genetic information allows pharmacists to anticipate how a patient will metabolize and respond to specific medications before they are prescribed, moving MTM beyond addressing current DRPs to preventing future ones. This level of personalized therapeutic optimization, combined with sophisticated virtual care tools (tele-MTM), will establish MTM as a crucial, indispensable component of patient-centered primary care, driving continuous market growth and solidifying its role as a key contributor to value-based healthcare delivery globally.

- FHIR Interoperability: Essential for seamless data exchange between EHRs, claims systems, and MTM platforms, reducing manual reconciliation efforts.

- Tele-MTM Expansion: Utilization of high-definition video conferencing and secure messaging to deliver consultations remotely, improving accessibility and reducing overhead costs.

- Pharmacogenomics Integration: Tools for incorporating genetic test results into MTM planning to optimize drug selection and dosage based on patient metabolism.

- Blockchain Technology: Emerging use case for enhancing the security and immutability of shared patient data across multiple MTM stakeholders.

The market's sustained growth is also dependent on overcoming workforce constraints through automation. Automated systems are increasingly handling routine tasks such as prior authorization checks, basic eligibility screening, and generating medication reconciliation reports. This strategic automation frees up highly trained clinical pharmacists to focus their time on complex clinical reasoning, patient education, and collaborative practice agreements with prescribers. The optimization of human capital through intelligent technology is a core strategic objective for MTM providers seeking market leadership and long-term sustainability in a resource-scarce environment. The investment in robust cybersecurity measures is paramount, given the sensitive nature of the longitudinal health data managed by MTM technology platforms.

The evolution towards predictive MTM is significantly enhancing the value proposition to payers. By accurately forecasting which patients are most likely to incur high healthcare costs due to medication mismanagement, MTM programs can be hyper-targeted, ensuring that resources are allocated efficiently. This data-driven approach strengthens the argument for MTM as an investment, not an expense. Furthermore, the development of standardized quality metrics and robust reporting capabilities, often driven by software solutions, allows MTM providers to consistently demonstrate their impact on metrics such as adherence rates, hospital readmission rates, and Star Ratings improvement, which are critical performance indicators for health plans and government regulators.

In summary, the key technology landscape for MTM is rapidly shifting from basic documentation software to integrated, intelligent clinical platforms. Success hinges on a provider's ability to effectively integrate AI, cloud computing, and advanced connectivity tools to manage complex patient populations proactively. The synergy between high-touch clinical expertise and high-tech efficiency will ultimately determine market differentiation and long-term success in the competitive Medication Therapy Management ecosystem, cementing technology as the primary driver of market scalability and clinical excellence throughout the forecast period.

The market intelligence suggests a strong convergence of pharmaceutical supply chain management technologies with MTM service delivery. For instance, integration with specialty pharmacy tracking systems allows MTM providers to monitor adherence for high-cost, high-complexity drugs more closely. This intersection creates new opportunities for specialized MTM services focused solely on costly therapeutic areas like oncology, rheumatology, and HIV management, where adherence and proper utilization are paramount to both clinical success and financial stewardship. The technical ability to track and influence patient behavior through integrated systems provides a measurable edge.

Furthermore, digital therapeutics and companion diagnostics are beginning to integrate within the MTM framework. MTM specialists are expanding their roles to help patients utilize digital tools prescribed alongside their medications, ensuring seamless execution of the overall therapeutic plan. This requires MTM platforms to be able to ingest and interpret data generated by these external digital tools. The move towards holistic patient management means MTM technology must be flexible enough to accommodate data inputs ranging from blood glucose levels recorded via an app to sleep patterns tracked by a wearable device, providing the pharmacist with a truly comprehensive view of the patient's health determinants beyond just the prescription list.

The final significant technological consideration is the ongoing refinement of user experience (UX) and user interface (UI) for MTM software. As the service demands increase, clinical systems must be intuitive and efficient to minimize time spent on documentation and maximize time spent on high-value patient interaction. Mobile optimization is critical, allowing pharmacists and care team members to access and update patient records securely from various points of care, including patient homes or clinic exam rooms. Technology vendors who prioritize clinician workflow efficiency alongside robust analytical capabilities will maintain a competitive advantage in providing essential tools for the evolving MTM practice.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager