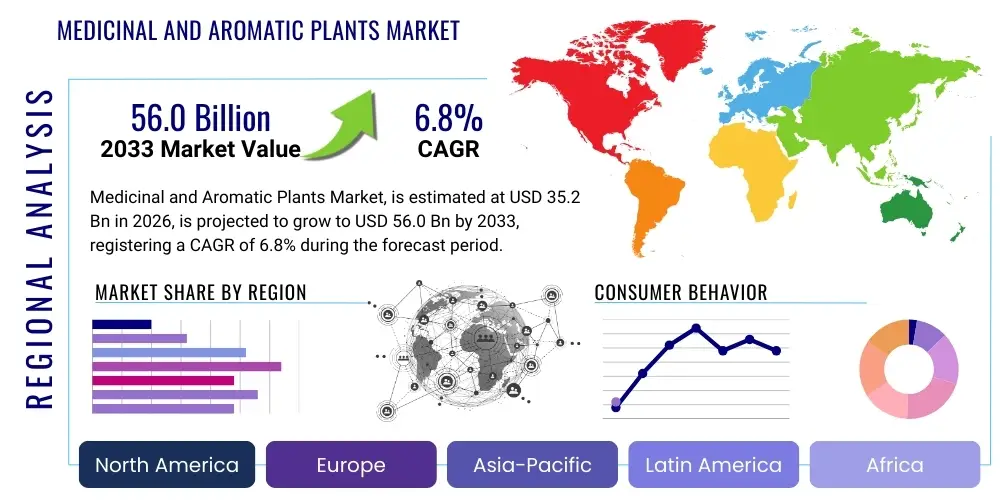

Medicinal and Aromatic Plants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438169 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Medicinal and Aromatic Plants Market Size

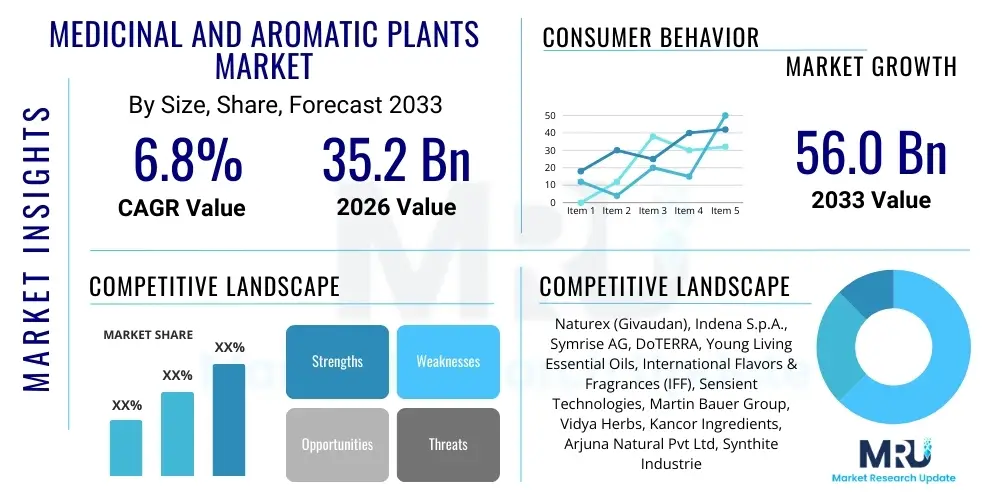

The Medicinal and Aromatic Plants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.2 Billion in 2026 and is projected to reach USD 56.0 Billion by the end of the forecast period in 2033.

Medicinal and Aromatic Plants Market introduction

The Medicinal and Aromatic Plants (MAPs) market encompasses a vast array of plant species utilized for their therapeutic, flavoring, and fragrant properties. These plants, including herbs, spices, essential oil-bearing crops, and various botanical extracts, serve as critical raw materials across several high-growth industries, notably pharmaceuticals, nutraceuticals, cosmetics, and the food and beverage sector. The fundamental driver of this market is the global shift toward preventive healthcare, natural ingredients, and traditional remedies, fueled by increasing consumer dissatisfaction with synthetic chemicals and a preference for holistic wellness solutions. The market involves sophisticated cultivation, harvesting, processing, and extraction techniques necessary to ensure the purity, potency, and standardization of active compounds, which is crucial for regulatory approval and consumer trust.

MAPs are fundamentally defined by the presence of bioactive secondary metabolites—such as alkaloids, flavonoids, terpenes, and polyphenols—which confer their medicinal or aromatic qualities. In the pharmaceutical sector, these plants are often sources for isolated single molecules, such as artemisinin or taxol, or standardized herbal extracts used in traditional medicine systems like Ayurveda and Traditional Chinese Medicine (TCM). Major applications span dietary supplements (nutraceuticals), functional foods aimed at improving health outcomes, sophisticated cosmetic formulations leveraging antioxidant and anti-inflammatory properties, and natural flavorings and fragrances used extensively in the beverage and personal care industries. The diversity of applications ensures the market's resilience against specific sectoral downturns.

The primary benefits driving market expansion include the perceived safety profile of natural ingredients, the long history of efficacy established through traditional use, and the complexity of chemical structures found in plants that often prove challenging for synthetic replication. Key driving factors include rigorous scientific validation of traditional remedies, advancements in extraction technology (like supercritical fluid extraction), and supportive regulatory frameworks in developing economies promoting sustainable cultivation and ethical sourcing practices. Furthermore, the growing global population suffering from chronic lifestyle diseases is actively seeking plant-based alternatives to manage symptoms and improve quality of life, cementing MAPs as indispensable components of the modern wellness industry.

Medicinal and Aromatic Plants Market Executive Summary

The Medicinal and Aromatic Plants (MAPs) market is experiencing robust growth, primarily propelled by favorable consumer trends emphasizing natural, organic, and plant-derived products, coupled with significant technological advancements in genetic breeding and extraction standardization. Business trends indicate a strong move toward vertical integration among key players, securing raw material supply chains and enforcing stringent quality control measures, particularly concerning pesticide residues and heavy metal contamination, which remain high-priority concerns for global regulatory bodies like the FDA and EFSA. Furthermore, strategic partnerships between large pharmaceutical and cosmetic companies and smaller, specialized herb suppliers are accelerating the development and commercialization of new, scientifically validated botanical extracts.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, driven by its rich biodiversity, large-scale traditional medicine markets (India and China), and low-cost cultivation bases. However, regulatory harmonization efforts across the European Union (EU) and increasing demand for certified organic and sustainably sourced MAPs in North America (NA) are fostering market maturity in these Western regions, focusing heavily on nutraceutical and cosmeceutical applications. The Middle East and Africa (MEA) are emerging as growth frontiers, primarily due to increasing interest in indigenous aromatic oils and traditional herbal remedies, alongside government initiatives promoting local cultivation to reduce import reliance.

Segment trends reveal that the essential oils segment, particularly lavender, peppermint, and tea tree oil, maintains a high market share due to their broad use in aromatherapy and personal care products, benefiting from highly efficient extraction technologies and strong consumer acceptance. Conversely, the herbal extracts segment, crucial for the nutraceutical industry, is witnessing the fastest growth, driven by the demand for highly concentrated and standardized phytochemicals, such as curcumin, ginkgo biloba, and adaptogens. The pharmaceutical application segment, though slower in growth due to rigorous clinical trials and lengthy approval processes, represents the highest value per unit volume, focusing on targeted drug discovery derived from rare or endangered plant species.

AI Impact Analysis on Medicinal and Aromatic Plants Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Medicinal and Aromatic Plants market frequently center on three core themes: accelerated drug discovery, optimization of sustainable agricultural practices, and enhanced quality assurance throughout the complex supply chain. Users are keen to understand how machine learning (ML) models can predict the efficacy and toxicity of novel plant compounds derived from large biological datasets, dramatically reducing the time and cost associated with preclinical research. A significant concern revolves around the implementation cost of such high-tech solutions in traditional farming communities and how AI can aid in managing the biodiversity crisis by identifying high-value, threatened plant species suitable for controlled cultivation. The general expectation is that AI will revolutionize the standardization process, ensuring batch-to-batch consistency and meeting rigorous regulatory criteria globally.

AI is fundamentally transforming the R&D pipeline in the MAPs sector by enabling high-throughput screening of massive phytochemical libraries against various disease targets. Using deep learning algorithms, researchers can predict the biological activity of thousands of plant-derived molecules much faster than traditional laboratory methods, thereby prioritizing promising candidates for anti-cancer, anti-inflammatory, or antimicrobial agents. This computational approach allows for the discovery of synergistic effects in complex plant extracts, moving beyond single-molecule pharmacology toward a more holistic, systems biology perspective inherent in traditional medicine. Furthermore, predictive modeling is being deployed to understand how environmental factors, such as soil chemistry, climate variation, and harvesting time, influence the concentration of active compounds, enabling precision formulation.

Beyond drug discovery, AI provides critical support for sustainable sourcing and supply chain integrity. Machine learning applications are being developed for advanced remote sensing, utilizing satellite and drone imagery to monitor the health and optimal harvesting time of MAPs crops, improving yield prediction, and minimizing pre-harvest losses. In processing, AI-powered image recognition and spectroscopic analysis ensure real-time quality control, verifying the authenticity and purity of botanical raw materials, thereby combating the pervasive issue of adulteration and misidentification in the herbal trade. This enhanced traceability and automated quality gating bolster consumer confidence and help companies comply with stringent international standards, ultimately reducing the risk associated with complex global sourcing networks.

- AI accelerates natural compound drug discovery by predicting efficacy and toxicity through deep learning analysis of chemical structures.

- Machine Learning (ML) optimizes precision agriculture for MAPs, forecasting ideal growing conditions and harvesting schedules to maximize active ingredient yields.

- Predictive modeling assists in conservation efforts by identifying vulnerable plant populations and guiding sustainable wild collection strategies.

- AI-driven spectroscopy enhances quality control, enabling rapid, non-destructive authentication of raw materials and detection of adulterants in extracts.

- Supply chain transparency is improved through blockchain integration and AI analytics, ensuring traceability from farm to finished product.

- Robotics and automation, guided by AI, are being implemented for high-precision harvesting and post-harvest processing, minimizing human error and contamination.

- Chatbots and AI platforms provide personalized dosage recommendations and usage information for nutraceutical products based on consumer health data.

DRO & Impact Forces Of Medicinal and Aromatic Plants Market

The Medicinal and Aromatic Plants (MAPs) market is profoundly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces. The market's central driver is the escalating global health consciousness and the sustained consumer demand for natural, clean-label ingredients across the food, cosmetic, and pharmaceutical industries. This demand is reinforced by strong scientific evidence validating the efficacy of specific botanical extracts, which shifts consumer perception from traditional folklore to scientifically supported treatment modalities. Crucially, advancements in extraction and standardization technologies (such as chromatography and mass spectrometry) enable manufacturers to offer highly potent, standardized extracts that meet pharmaceutical-grade quality requirements, overcoming historical issues of variable product quality. The increasing integration of nutraceuticals into mainstream healthcare practices further solidifies this market growth.

Despite significant growth potential, the MAPs market faces substantial restraints, primarily rooted in regulatory complexity, standardization challenges, and sustainability concerns. The lack of harmonized global regulatory frameworks for botanical supplements, particularly regarding health claims and dosage guidelines, creates significant market entry barriers and risks for international trade. Furthermore, inherent biological variability—the concentration of active compounds often fluctuates based on geographic location, climate, and harvesting methods—makes consistent quality assurance difficult and expensive, hindering mass production scalability. Sustainability remains a critical challenge, as over-harvesting of wild plants, habitat destruction, and climate change threaten the biodiversity and consistent supply of key raw materials, necessitating costly investment in cultivation infrastructure and ethical sourcing compliance.

These challenges, however, also translate into key opportunities. The pressing need for sustainable sourcing is driving innovations in controlled environment agriculture (CEA), including vertical farming and hydroponics, allowing for predictable, high-purity production regardless of external climate variability. There is a massive opportunity in the R&D space to explore underexplored indigenous flora, utilizing modern genomics and metabolomics to discover novel bioactive compounds with significant pharmaceutical potential, particularly in antibiotic resistance and chronic disease management. Furthermore, the rising demand for organic and Fair Trade certified products provides a premiumization opportunity, allowing companies to command higher margins by investing in ethical and transparent supply chains. These impact forces collectively dictate investment decisions, regulatory focus, and technological innovation within the entire ecosystem.

Segmentation Analysis

The Medicinal and Aromatic Plants market is broadly segmented based on the type of product derived, the primary application area, and the source of the raw material. This structure allows for granular analysis of market dynamics, identifying high-growth niches within the broader ecosystem. The segmentation by product type—including essential oils, herbal extracts, and whole herbs/spices—reflects the diverse methods of processing and utilization, with extracts generally commanding higher value due to their concentration and standardization. Application segmentation highlights the key end-use industries, demonstrating the massive cross-sectoral appeal of MAPs, ranging from high-value pharmaceuticals to mass-market food and beverage applications.

The crucial growth metrics are often observed within the segments catering to consumer health and wellness, driven by increasing disposable income and preventative healthcare spending. The food and beverage sector utilizes MAPs primarily for natural flavoring, coloring, and functional enrichment, aligning with the clean-label movement. The nutraceutical segment, encompassing dietary supplements and functional foods, is witnessing explosive growth as consumers actively seek natural ingredients (like adaptogens and antioxidants) to boost immunity and manage stress. Understanding these segmentation nuances is vital for stakeholders, as it dictates investment in specific processing technologies, compliance requirements (e.g., food safety vs. pharmaceutical GMP), and regional sourcing strategies.

- Product Type:

- Essential Oils (Lavender, Peppermint, Citrus Oils, Eucalyptus, Tea Tree)

- Herbal Extracts (Standardized Extracts, Tinctures, Powders, Resinoids)

- Whole Herbs/Spices (Dried Roots, Leaves, Flowers, Seeds)

- Floral Extracts (Rose, Chamomile, Calendula)

- Source:

- Cultivated (Controlled Environment, Traditional Farming)

- Wild/Forest Collected (Sustainable Wildcrafting, Unsustainable Harvesting)

- Application:

- Pharmaceuticals (Drug Development, Traditional Herbal Medicines)

- Nutraceuticals (Dietary Supplements, Functional Foods, Medical Foods)

- Cosmetics and Personal Care (Aromatherapy, Skincare, Haircare)

- Food and Beverages (Flavorings, Preservatives, Natural Colorants)

- Perfumery and Aromatherapy (Fragrance Components, Wellness Products)

Value Chain Analysis For Medicinal and Aromatic Plants Market

The value chain of the Medicinal and Aromatic Plants market is inherently complex, starting from diverse upstream sourcing methods (cultivation and wild collection) and progressing through multiple layers of processing, standardization, and distribution before reaching the end-use sectors. The upstream analysis is dominated by farmers, wild collectors, and specialized agricultural producers, where ensuring genetic identity, sustainable harvesting practices, and initial drying/storage protocols are critical for determining the final quality and value of the raw material. High fragmentation characterizes this initial stage, often involving smallholder farmers, necessitating robust quality management systems and fair-trade initiatives to ensure traceability and social responsibility.

Midstream activities involve sophisticated processing and manufacturing, transforming raw botanicals into marketable ingredients such as essential oils, standardized extracts, and isolated active compounds. This stage requires significant investment in advanced technology, including supercritical fluid extraction (SFE), sophisticated distillation units, and chromatographic separation equipment, adhering strictly to current Good Manufacturing Practices (cGMP). Quality control laboratories play a crucial role here, utilizing analytical techniques like High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS) to authenticate materials and quantify active ingredients, thereby mitigating risks related to adulteration and ensuring product consistency demanded by pharmaceutical and nutraceutical buyers.

The distribution channel facilitates the journey of finished ingredients to downstream users. Direct channels involve large integrated players selling standardized extracts directly to major pharmaceutical or cosmetic manufacturers, ensuring high control over specification and supply security. Indirect distribution relies heavily on regional traders, specialized ingredient distributors, and brokers, particularly for bulk spices and essential oils, providing market access for smaller producers but potentially adding complexity to traceability. End-users (e.g., pharmaceutical companies, large food processors) act as the final demand generators, heavily scrutinizing quality certifications (e.g., organic, non-GMO, cGMP) and sustainability credentials before procurement, thereby influencing the entire value chain back to the source.

Medicinal and Aromatic Plants Market Potential Customers

The potential customer base for Medicinal and Aromatic Plants (MAPs) is highly diversified, reflecting the ubiquitous use of natural ingredients across consumer product sectors. The largest and most value-intensive customer segment is the global pharmaceutical industry, which purchases highly purified botanical derivatives for drug formulation, either as isolated compounds or validated herbal drug preparations. These buyers require stringent quality assurance, clinical data, and compliance with pharmacopeial standards (USP, EP, IP), driving demand for premium, scientifically standardized extracts.

The fastest-growing segment consists of nutraceutical and dietary supplement manufacturers. These customers cater to the proactive health and wellness market, demanding large volumes of botanicals rich in antioxidants, vitamins, and adaptogens (like ashwagandha or ginseng). Their purchasing decisions are primarily influenced by consumer trends, scientific backing (evidence-based nutrition), and marketing narratives emphasizing natural and clean-label sourcing, making sustainability and transparency key requirements.

Additionally, the cosmetics and personal care industry represents a significant end-user, utilizing MAPs for their aromatic, skin-soothing, and anti-aging properties. Essential oils, floral waters, and plant-based active ingredients are incorporated into high-end skincare, fragrance, and hair care lines. Lastly, the food and beverage industry remains a foundational customer, relying on spices and culinary herbs for flavoring, and increasingly utilizing natural plant extracts as functional ingredients (e.g., natural preservatives, colorants) in response to the massive industry shift away from artificial additives. These diverse buyer needs dictate the product form, required certification, and scale of production within the MAPs supply network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.2 Billion |

| Market Forecast in 2033 | USD 56.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Naturex (Givaudan), Indena S.p.A., Symrise AG, DoTERRA, Young Living Essential Oils, International Flavors & Fragrances (IFF), Sensient Technologies, Martin Bauer Group, Vidya Herbs, Kancor Ingredients, Arjuna Natural Pvt Ltd, Synthite Industries, Organic India, Nutra Green Biotechnology, Shaanxi Huike Botanical Development Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medicinal and Aromatic Plants Market Key Technology Landscape

The technological landscape in the Medicinal and Aromatic Plants (MAPs) market is focused intensely on improving efficiency, increasing the purity and concentration of active compounds, and ensuring the sustainability and traceability of raw materials. Core processing technologies include advanced extraction methods designed to minimize thermal degradation and maximize yield. Supercritical Fluid Extraction (SFE), primarily using CO2, is gaining significant traction because it allows for solvent-free, highly selective separation of heat-sensitive compounds, yielding cleaner and more potent extracts preferred by the nutraceutical and cosmetic industries. Traditional steam distillation remains crucial for essential oils, but modern vacuum and hydro-distillation techniques are being refined to preserve volatile aromatic profiles better. Furthermore, membrane filtration and chromatographic separation (like flash chromatography) are essential downstream technologies for isolating specific high-value phytochemicals (e.g., cannabinoids, specific polyphenols) at high purity scales required by pharmaceutical companies.

Beyond extraction, analytical and quality assurance technologies form the backbone of market credibility. High-Performance Liquid Chromatography (HPLC), Gas Chromatography-Mass Spectrometry (GC-MS), and Nuclear Magnetic Resonance (NMR) spectroscopy are standard tools used for chemical fingerprinting, quantification, and authentication of botanical materials. These technologies are crucial for verifying that the product matches the intended botanical species and ensuring compliance with purity standards regarding heavy metals, pesticides, and microbial contamination. The integration of high-throughput screening and genomics/metabolomics platforms is revolutionizing the early-stage research, allowing researchers to quickly analyze the complex chemical composition of plant extracts and correlate specific compound profiles with biological activities, leading to the rapid development of standardized formulations and IP protection.

Emerging technologies also significantly impact cultivation and supply chain management. Precision agriculture tools, including sensor networks, IoT devices, and Geographic Information Systems (GIS), are deployed to monitor soil quality, nutrient levels, and plant health in real-time, optimizing resource use and maximizing the consistency of active ingredient production in the field. Crucially, the increasing adoption of blockchain technology is addressing the inherent complexity and lack of transparency in global sourcing networks. Blockchain enables immutable record-keeping of every transaction, from the farmer's field through extraction and final bottling, providing unparalleled traceability and combating fraud, thereby satisfying the rigorous transparency demands of modern consumers and regulators. This holistic technological approach ensures both product quality and supply chain integrity, driving market trust and sustained growth.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the MAPs market, characterized by its vast biodiversity, low-cost cultivation centers (especially China, India, and Indonesia), and deeply entrenched traditional medicine systems (TCM and Ayurveda). The region is a massive consumer and exporter of raw and processed botanicals, particularly functional herbs like ginseng, turmeric, and ashwagandha. The growth here is driven by government support for traditional medicine integration into mainstream healthcare and significant investment in large-scale contract farming operations to meet global extract demand.

- Europe: Europe represents a mature, high-value market characterized by stringent quality regulations (e.g., EMA guidelines for herbal medicinal products) and strong consumer demand for certified organic, ethically sourced, and high-purity essential oils and functional extracts. Germany, France, and the UK are key markets, with a strong focus on aromatherapy, cosmeceuticals, and advanced nutraceutical formulations. The market is defined by leading processing and flavoring houses that invest heavily in R&D to standardize botanical drugs and extracts.

- North America (NA): North America, particularly the U.S. and Canada, is dominated by the dietary supplements and functional food sectors, driven by proactive health management and high rates of self-medication. The NA market is highly receptive to innovative ingredients, such as adaptogens, medicinal mushrooms, and plant proteins. Key drivers include robust marketing efforts, rapid product launch cycles, and a general consumer preference for non-GMO and clean-label products, although the regulatory landscape for supplements (FDA scrutiny) remains a continuous factor influencing market behavior.

- Latin America (LATAM): LATAM is rich in unique flora, offering significant potential for sourcing high-value ingredients such as specialized essential oils (e.g., from Brazil and Mexico) and regional superfoods (e.g., maca, acai). The region is characterized by emerging local industries focusing on cosmetic and food applications, leveraging indigenous knowledge and biodiversity. Challenges include infrastructural limitations and achieving global quality certifications, but increasing international investment is facilitating technology transfer and formalized export channels.

- Middle East and Africa (MEA): The MEA region is witnessing growth driven by increased awareness of herbal remedies and the potential for cultivating regional aromatic plants, such as frankincense, myrrh, and various medicinal herbs adapted to arid climates. The domestic demand is focused on traditional remedies and cosmetics. Economic diversification efforts in the Gulf Cooperation Council (GCC) countries, focusing on establishing local pharmaceutical manufacturing bases, provide a foundational opportunity for local MAPs processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medicinal and Aromatic Plants Market.- Naturex (Part of Givaudan)

- Indena S.p.A.

- Symrise AG

- International Flavors & Fragrances (IFF)

- Sensient Technologies Corporation

- DoTERRA International LLC

- Young Living Essential Oils

- Martin Bauer Group

- Vidya Herbs Pvt. Ltd.

- Kancor Ingredients Ltd.

- Arjuna Natural Pvt Ltd

- Synthite Industries Ltd.

- Organic India Pvt. Ltd.

- Nutra Green Biotechnology Co., Ltd.

- Shaanxi Huike Botanical Development Co., Ltd.

- Lala Jagat Narayan & Sons (L.J.N.)

- Plant Extracts International Inc. (PEI)

- Blue Sky Botanics

- Biolandes S.A.

- Sabinsa Corporation

Frequently Asked Questions

Analyze common user questions about the Medicinal and Aromatic Plants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Medicinal and Aromatic Plants (MAPs) market?

The primary driver is the pervasive global shift in consumer preference toward natural, plant-derived products for prophylactic and therapeutic applications, coupled with increased consumer awareness of the side effects associated with synthetic chemical ingredients across pharmaceuticals, nutraceuticals, and cosmetics.

Which application segment holds the highest growth potential in the MAPs market forecast period?

The Nutraceuticals segment, encompassing functional foods and dietary supplements, exhibits the highest growth potential. This growth is fueled by increasing geriatric populations, rising prevalence of lifestyle diseases, and sustained demand for immunity-boosting and stress-relieving botanical extracts like adaptogens and antioxidants.

What are the main regulatory challenges faced by MAPs suppliers?

Suppliers primarily face challenges related to the lack of globally harmonized regulatory standards for herbal products, particularly concerning clinical evidence requirements, permissible health claims, and the control of contaminants such as pesticide residues, which necessitate high investment in certification and analytical validation.

How is technology being utilized to improve the sustainability of MAPs sourcing?

Technology supports sustainability through advanced techniques like Supercritical Fluid Extraction (SFE) for efficient processing, genomics for optimizing plant breeding, and the implementation of precision agriculture (IoT and GIS) to monitor crop health and yield, reducing reliance on unsustainable wild harvesting.

Why is the Asia Pacific region dominant in the global Medicinal and Aromatic Plants Market?

APAC dominates due to its immense indigenous biodiversity, serving as the historical and current hub for traditional medicine systems (TCM, Ayurveda), coupled with robust cultivation capabilities, competitive labor costs, and strong domestic consumption of herbal products in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager